Asia Pacific Supercapacitor Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD6499

December 2024

89

About the Report

Asia Pacific Supercapacitor Market Overview

- The Asia Pacific Supercapacitor market is valued at USD 1.5 billion, based on a five-year historical analysis. The market has been driven by the increasing adoption of supercapacitors across various industries such as automotive, consumer electronics, and renewable energy. The rapid shift toward electric vehicles (EVs) in countries like China and South Korea, alongside a significant push for renewable energy storage solutions, has bolstered the demand for supercapacitors. The integration of supercapacitors in consumer electronics, particularly in wearables and smartphones, has further fueled market expansion. Technological advancements in materials like graphene have also supported growth by enhancing supercapacitor efficiency.

- China, Japan, and South Korea dominate the Asia Pacific Supercapacitor market, owing to their strong manufacturing infrastructure and technological capabilities. China leads due to its massive EV production and strong government support for energy storage innovations, especially under its energy transformation initiatives. Japan and South Korea maintain dominance through their advanced electronics industries and research investments in cutting-edge capacitor technologies. These countries benefit from robust supply chains and government incentives that push innovation and production.

- Governments across the Asia-Pacific region have been proactive in supporting clean energy technologies, including supercapacitors, through subsidies and grants. In 2023, the Indian government allocated $1.2 billion for energy storage projects, with a portion specifically aimed at promoting supercapacitor development. These subsidies are part of broader clean energy initiatives aimed at reducing carbon emissions and enhancing energy efficiency. Such government incentives significantly contribute to the growing adoption of supercapacitors in renewable energy storage systems.

Asia Pacific Supercapacitor Market Segmentation

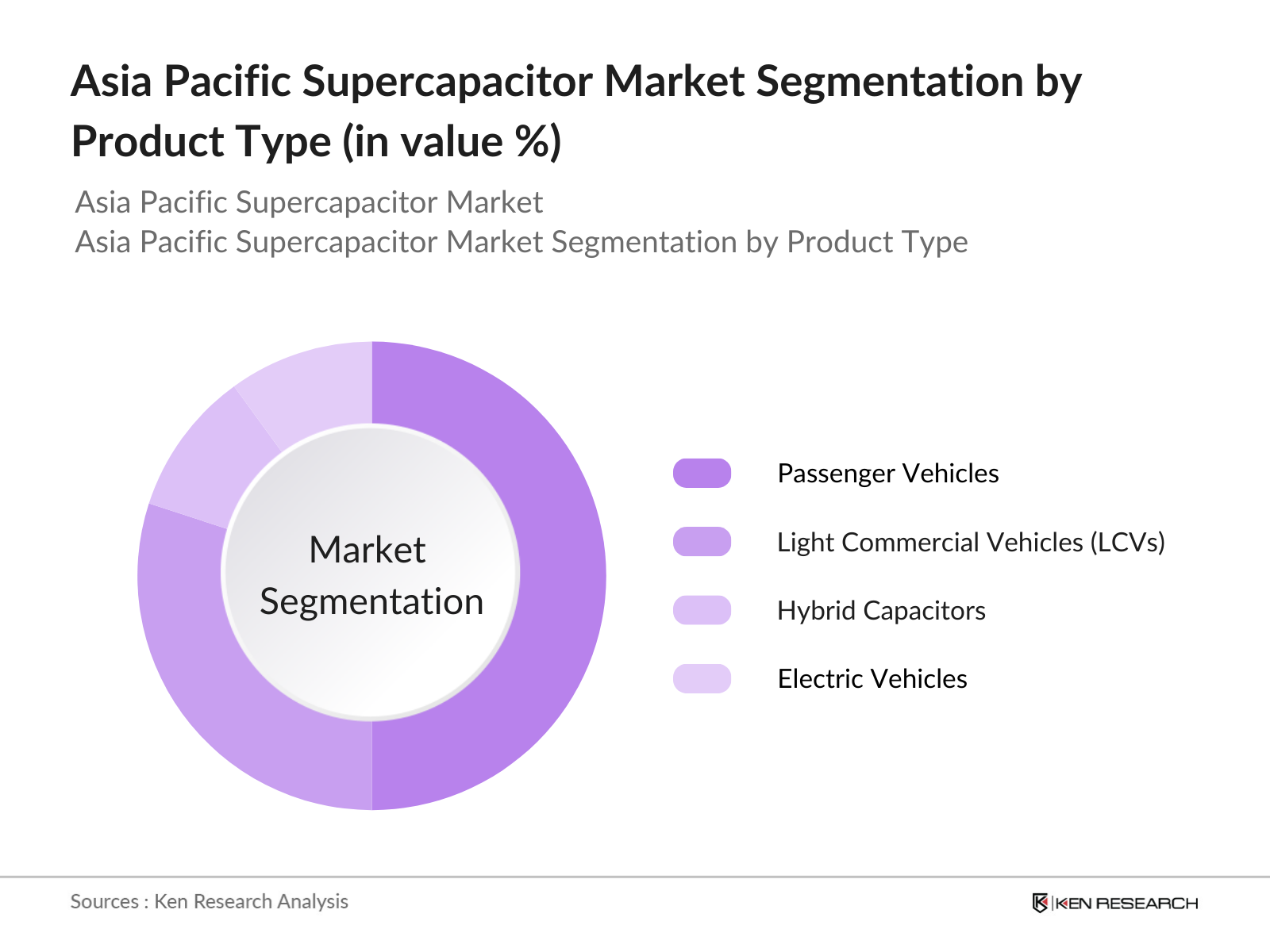

By Product Type: The market is segmented by product type into Double Layer Capacitors, Pseudocapacitors, Hybrid Capacitors, and Symmetric Capacitors. Recently, Double Layer Capacitors hold a dominant market share under this segmentation. The widespread use of double-layer capacitors is due to their lower costs and high-power density, which make them suitable for applications in EVs, energy grids, and industrial machines. Their durability and ability to discharge power quickly also enhance their appeal for a range of energy storage solutions in renewable energy setups and emergency power systems.

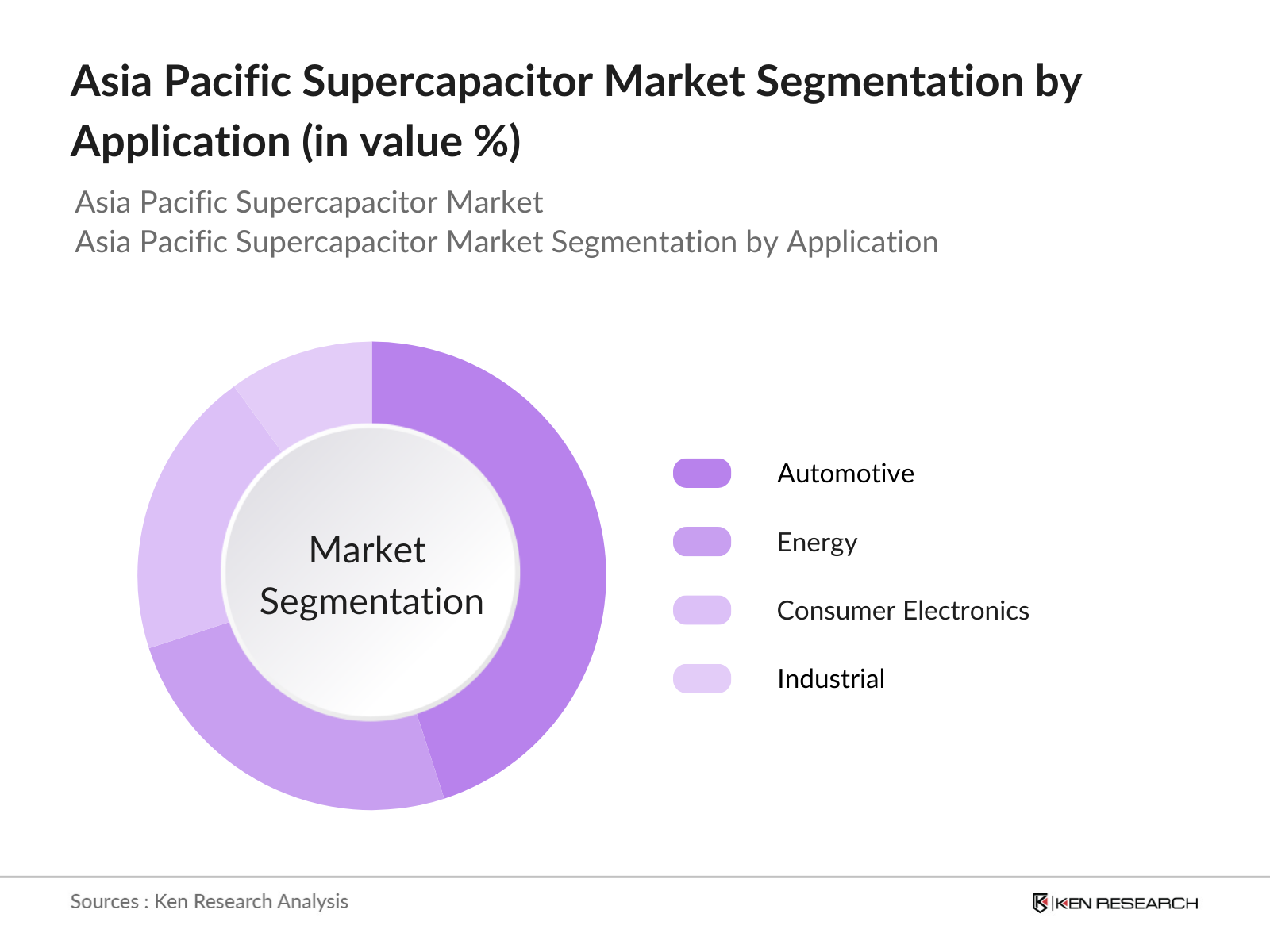

By Application: The market is segmented by application into Automotive (EVs, Hybrid Vehicles), Energy (Grid Energy Storage, Renewable Integration), Consumer Electronics (Wearables, Smartphones, Laptops), and Industrial (Power Tools, Emergency Backup Systems). The Automotive segment dominates the market share due to the ongoing transition towards electric mobility, with EVs becoming more common across major Asian economies like China, Japan, and South Korea. Supercapacitors are increasingly integrated into EVs for functions such as regenerative braking and power assist, making them crucial for the development of energy-efficient automotive solutions.

Asia Pacific Supercapacitor Market Competitive Landscape

The Asia Pacific Supercapacitor market is characterized by a consolidation of key global and regional players. Companies in this sector are focusing on technological innovation, expanding manufacturing capacities, and strategic collaborations to maintain competitive advantages. The Asia Pacific Supercapacitor market is dominated by major players, including Maxwell Technologies (Tesla), Panasonic Corporation, and Skeleton Technologies. These companies have established strong positions due to their extensive product portfolios, advanced R&D capabilities, and strategic partnerships with automotive and electronics manufacturers.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investments |

Market Reach |

Strategic Partnerships |

Manufacturing Capacity |

Revenue Growth |

ESG Commitments |

|

Maxwell Technologies |

1965 |

San Diego, USA |

|||||||

|

Panasonic Corporation |

1918 |

Osaka, Japan |

|||||||

|

Skeleton Technologies |

2009 |

Tallinn, Estonia |

|||||||

|

Nippon Chemi-Con Corporation |

1931 |

Tokyo, Japan |

|||||||

|

Yunasko |

2010 |

Kyiv, Ukraine |

Asia Pacific Supercapacitor Industry Analysis

Growth Drivers

- Expansion of Renewable Energy: The Asia-Pacific region is rapidly expanding its renewable energy capacity, with countries like China and India leading in solar and wind energy production. In 2023, Chinas installed renewable energy capacity reached 1,200 GW, driven by significant investments in grid-level integration to store surplus energy. Supercapacitors play a crucial role in stabilizing energy fluctuations in renewable grids. According to the International Energy Agency (IEA), China's grid-related investments exceeded $100 billion in 2023, with supercapacitors integrated into energy storage systems for enhanced reliability and efficiency.

- Electric Vehicle (EV) Adoption: The Asia-Pacific region witnessed an exponential growth in electric vehicle (EV) adoption, particularly in China and Japan, where over 7 million EVs were registered by 2023. This surge in EVs has intensified the demand for energy storage solutions, such as supercapacitors, which complement battery systems in EVs. The Chinese government allocated $5 billion for EV charging infrastructure in 2023 to improve energy storage capabilities. Supercapacitors are increasingly utilized in fast-charging stations for peak power delivery, offering a boost to charging infrastructure.

- Increased Demand in Consumer Electronics: Asia-Pacific's consumer electronics market, particularly in South Korea, China, and Japan, has seen a notable increase in the demand for wearable devices and portable power supplies. By mid-2024, South Korea alone had shipped 15 million wearable devices, necessitating highly efficient energy storage. Supercapacitors are favored for their quick charge-discharge capabilities in such devices. Chinas electronics sector accounted for 25% of global consumer electronics production in 2023, fueling the need for advanced energy storage solutions like supercapacitors.

Market Challenges

- High Manufacturing Costs: Manufacturing supercapacitors in the Asia-Pacific region remains costly due to high raw material costs, including activated carbon and graphene, essential for producing high-performance capacitors. In 2023, graphene production costs hovered around $100 per gram, making large-scale production challenging. The cost of research and development (R&D) has also escalated, with South Korea's energy storage sector spending nearly $1 billion on R&D in 2023 alone. These high manufacturing costs slow down the widespread adoption of supercapacitors despite their efficiency advantages.

- Competition from Lithium-Ion Batteries: Lithium-ion batteries dominate the energy storage market, especially in electric vehicles and consumer electronics, where their energy density and cost-efficiency present significant competition to supercapacitors. In 2023, the price per kilowatt-hour (kWh) for lithium-ion batteries decreased to approximately $130, compared to supercapacitors, which remain costlier in terms of energy storage per kWh. This price difference, coupled with the established manufacturing infrastructure for lithium-ion batteries, presents a major challenge for supercapacitor adoption in the Asia-Pacific market.

Asia Pacific Supercapacitor Market Future Outlook

Over the next five years, the Asia Pacific Supercapacitor market is expected to show robust growth driven by advancements in material science, particularly the commercialization of graphene-based capacitors. These innovations are expected to improve energy density, making supercapacitors a more viable option for long-term energy storage solutions. The growth will also be fueled by continuous government support in countries like China and South Korea, particularly in the context of EV development and renewable energy adoption. Furthermore, as consumer electronics continue to evolve with new functionalities, the demand for energy-efficient and high-performing capacitors will rise.

Future Market Opportunities

- IoT and Smart Cities Integration: The rapid development of smart cities in Asia-Pacific, particularly in China and India, has created a new demand for energy-efficient technologies. By 2024, China had developed over 500 smart cities, with supercapacitors increasingly being used in sensor networks and low-power systems. The integration of supercapacitors into IoT networks enhances the lifespan and efficiency of these systems, particularly in data collection and transmission. The Asia-Pacific IoT market, valued at over $300 billion in 2023, presents significant growth potential for supercapacitor manufacturers.

- Collaboration with Automotive OEMs: Supercapacitors offer unique advantages in hybrid powertrains and peak power delivery systems, areas where automotive original equipment manufacturers (OEMs) in the Asia-Pacific region are focusing. In 2023, Toyota announced a partnership with DENSO to develop supercapacitor-based power systems for its next-generation hybrid vehicles. The quick-charging capabilities of supercapacitors make them ideal for applications that require high power bursts. This collaboration reflects the growing trend of integrating supercapacitors with traditional battery systems to optimize power management in hybrid and electric vehicles.

Scope of the Report

|

Product Type |

Electrochemical Double-Layer Capacitors (EDLC) Pseudocapacitors Hybrid Capacitors |

|

Application |

Automotive Energy & Power Consumer Electronics Industrial Aerospace & Defense |

|

Technology |

Activated Carbon Carbon Nanotubes (CNTs) Graphene Metal Oxides |

|

End-Use Industry |

Automotive Telecommunications Aerospace Manufacturing |

|

Region |

China India Japan South Korea Australia & New Zealand |

Products

Key Target Audience

Automotive OEMs (China Automotive Technology and Research Center)

Energy Storage Providers (China National Energy Administration)

Consumer Electronics Manufacturers (Japan Electronics and Information Technology Industries Association)

Industrial Power Solution Providers (Korea Electric Power Corporation)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (National Development and Reform Commission, Ministry of Industry and Information Technology)

R&D Institutes (Chinese Academy of Sciences)

Renewable Energy Providers (Asia-Pacific Economic Cooperation Energy Working Group)

Companies

Major Players

Maxwell Technologies (Tesla)

Panasonic Corporation

Skeleton Technologies

Nippon Chemi-Con Corporation

Yunasko

CAP-XX Limited

Nesscap Co. Ltd.

Evans Capacitor Company

Ioxus Inc.

LS Mtron

Samwha Capacitor Group

AVX Corporation

Supreme Power Solutions

Tokin Corporation

Vina Tech

Table of Contents

1. Asia Pacific Supercapacitor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Demand Surge, Industrial Applications, Technological Innovation)

1.4. Market Segmentation Overview (Product Types, Application Areas, Technology, End-Use Industry, Region)

2. Asia Pacific Supercapacitor Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Installed Capacity Growth, Energy Storage Demand)

2.3. Key Market Developments and Milestones

3. Asia Pacific Supercapacitor Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Renewable Energy (Grid-Level Integration, Energy Storage Needs)

3.1.2. Electric Vehicle (EV) Adoption (EV Charging Infrastructure, Battery Systems)

3.1.3. Increased Demand in Consumer Electronics (Wearable Devices, Portable Power Supplies)

3.1.4. Government Policies and Incentives (Subsidies for Energy-Efficient Technologies)

3.2. Market Challenges

3.2.1. High Manufacturing Costs (Raw Materials, R&D Costs)

3.2.2. Competition from Lithium-Ion Batteries (Efficiency, Cost-Competitiveness)

3.2.3. Technical Barriers (Energy Density, Performance Metrics)

3.3. Opportunities

3.3.1. Emerging Applications in Aerospace (Backup Power, Peak Power Management)

3.3.2. IoT and Smart Cities Integration (Sensor Networks, Power Systems)

3.3.3. Collaboration with Automotive OEMs (Hybrid Powertrains, Power Delivery Systems)

3.4. Trends

3.4.1. Miniaturization of Supercapacitors (Micro-Supercapacitors, Flexible Devices)

3.4.2. Hybrid Energy Storage Solutions (Battery-Supercapacitor Integration)

3.4.3. Investment in Graphene-Based Supercapacitors (Material Science Advancements)

3.5. Government Regulation

3.5.1. Subsidies and Grants for Clean Energy Initiatives

3.5.2. Emission Reduction Targets for Industrial Sectors

3.5.3. Mandatory Efficiency Standards for Consumer Electronics

3.5.4. Smart Grid Development Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces (Bargaining Power of Suppliers, Threat of New Entrants, Competitive Rivalry)

3.9. Competition Ecosystem

4. Asia Pacific Supercapacitor Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electrochemical Double-Layer Capacitors (EDLC)

4.1.2. Pseudocapacitors

4.1.3. Hybrid Capacitors

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Energy & Power

4.2.3. Consumer Electronics

4.2.4. Industrial

4.2.5. Aerospace & Defense

4.3. By Technology (In Value %)

4.3.1. Activated Carbon

4.3.2. Carbon Nanotubes (CNTs)

4.3.3. Graphene

4.3.4. Metal Oxides

4.4. By End-Use Industry (In Value %)

4.4.1. Automotive

4.4.2. Telecommunications

4.4.3. Aerospace

4.4.4. Manufacturing

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia & New Zealand

5. Asia Pacific Supercapacitor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Maxwell Technologies

5.1.2. Nippon Chemi-Con Corporation

5.1.3. Panasonic Corporation

5.1.4. CAP-XX Limited

5.1.5. LS Mtron

5.1.6. Ioxus Inc.

5.1.7. Skeleton Technologies

5.1.8. VINATech Co., Ltd.

5.1.9. Nesscap Energy Inc.

5.1.10. ELNA Co., Ltd.

5.1.11. Murata Manufacturing Co., Ltd.

5.1.12. Yunasko Ltd.

5.1.13. Samwha Capacitor Group

5.1.14. Tokyo Electron Ltd.

5.1.15. Supreme Power Solutions Co., Ltd.

5.2. Cross Comparison Parameters (No. of Employees, R&D Expenditure, Headquarters, Market Presence, Manufacturing Capacity, Strategic Partnerships, Revenue, Production Facilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Funding

5.8. Venture Capital & Private Equity Funding

6. Asia Pacific Supercapacitor Market Regulatory Framework

6.1. Regional Standards for Energy Storage Systems

6.2. Compliance with Safety Certifications (UL, CE)

6.3. Import/Export Regulations for Capacitor Components

6.4. Tax Incentives for R&D in Energy Storage

7. Asia Pacific Supercapacitor Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Supercapacitor Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Supercapacitor Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Electric Vehicle Manufacturers, Energy Grid Operators, Consumer Electronics Companies, Aerospace and Defense)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Supercapacitor Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Supercapacitor Market. This includes assessing market penetration, revenue generation, and the ratio of manufacturers to service providers. An evaluation of production and supply chain statistics is conducted to ensure the reliability and accuracy of market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts representing major stakeholders. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with supercapacitor manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from a bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Supercapacitor market.

Frequently Asked Questions

01. How big is the Asia Pacific Supercapacitor Market?

The Asia Pacific Supercapacitor Market is valued at USD 1.5 billion, driven by increasing demand for energy storage in electric vehicles and renewable energy sectors.

02. What are the challenges in the Asia Pacific Supercapacitor Market?

Challenges in the Asia Pacific Supercapacitor Market include high costs associated with advanced materials like graphene, limited energy density compared to batteries, and the need for technological innovation to extend lifecycle and performance.

03. Who are the major players in the Asia Pacific Supercapacitor Market?

Key players in the Asia Pacific Supercapacitor Market include Maxwell Technologies, Panasonic Corporation, Skeleton Technologies, Nippon Chemi-Con Corporation, and Yunasko. These companies dominate through technological innovation, strategic partnerships, and extensive product portfolios.

04. What are the growth drivers of the Asia Pacific Supercapacitor Market?

Growth in the Asia Pacific Supercapacitor Market is driven by increased adoption of electric vehicles, expanding grid infrastructure, technological advancements in material science, and government support for energy-efficient technologies.

05. What are the emerging trends in the Asia Pacific Supercapacitor Market?

Emerging trends in the Asia Pacific Supercapacitor Market include the integration of supercapacitors in renewable energy grids, the development of hybrid capacitors, and the increasing use of graphene to improve capacitor efficiency and energy density.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.