Asia Pacific Surfactants Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD4408

November 2024

99

About the Report

Asia Pacific Surfactants Market Overview

- The Asia Pacific Surfactants market is valued at USD 22 billion, driven by the rising demand from end-use industries such as personal care, household cleaning products, and industrial applications. Surfactants are essential in formulations for cleaning, emulsifying, and dispersing properties, which are increasingly being used in the manufacturing of products like shampoos, soaps, and detergents. This market is further supported by population growth, rapid urbanization, and increasing consumer spending, particularly in emerging economies like China and India.

- China and India are dominant markets in the region due to their large population bases and fast-growing industrial sectors. Chinas robust manufacturing infrastructure and Indias expanding personal care and cleaning industries have positioned these countries as key players. Additionally, the demand for bio-based surfactants in Southeast Asia, driven by increased environmental consciousness and government regulations promoting green chemicals, is contributing to market expansion in these regions.

- The REACH regulations, implemented in Europe, are influencing similar frameworks in Asia Pacific. In 2024, South Koreas K-REACH regulations were strengthened, requiring manufacturers to provide comprehensive safety data on chemicals used in surfactants. Additionally, China has established a similar regulatory framework under its New Chemical Substance Notification System (NCSN), which mandates stricter controls on chemical imports and manufacturing.

Asia Pacific Surfactants Market Segmentation

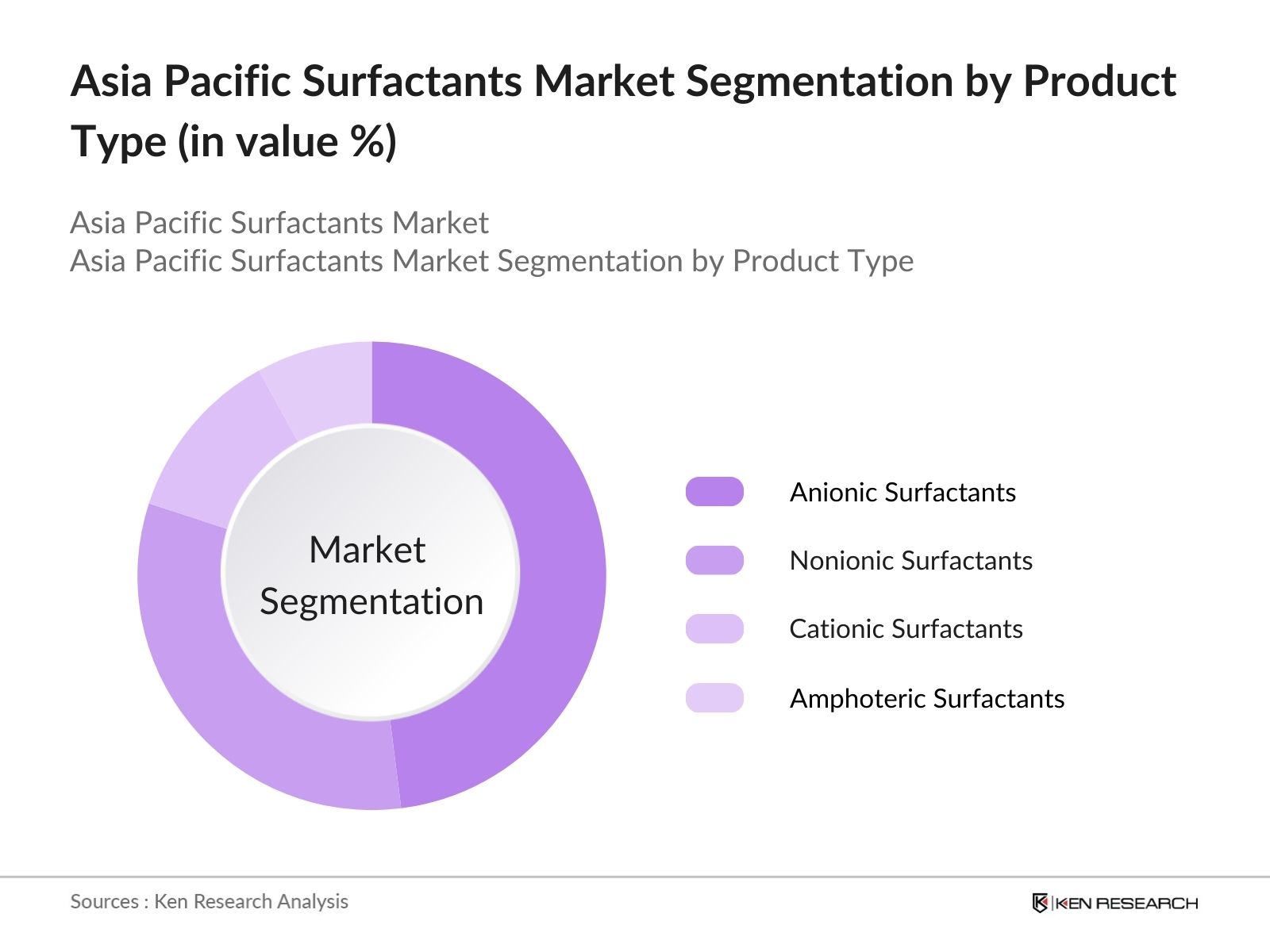

By Product Type: The Asia Pacific Surfactants market is segmented by product type into anionic, nonionic, cationic, and amphoteric surfactants. Among these, anionic surfactants dominate the market due to their widespread use in household cleaning products and personal care items like shampoos and body washes. Their affordability and strong cleaning properties have made them a preferred choice for both manufacturers and consumers, driving their dominance in the market.

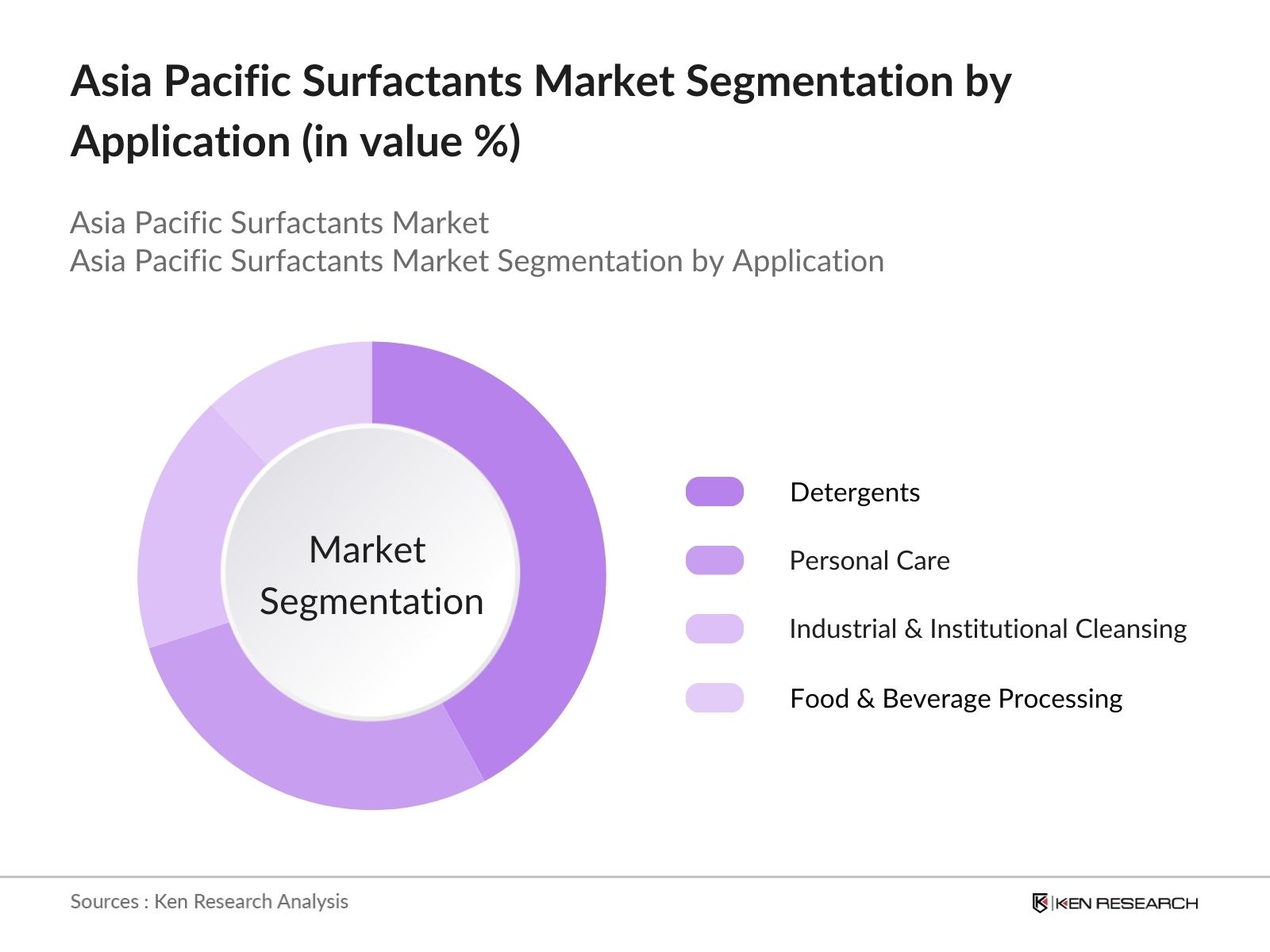

By Application: The market is also segmented by application into detergents, personal care, industrial & institutional cleaning, and food & beverage processing. The detergents segment holds the largest market share, driven by high consumption in household and industrial cleaning applications. The constant demand for cleaning agents and disinfectants across domestic and commercial environments has sustained the growth of this segment.

Asia Pacific Surfactants Market Competitive Landscape

The Asia Pacific Surfactants market is dominated by a few key players that have established a strong presence in the region through extensive R&D efforts and strategic partnerships. Companies like BASF SE, Dow Inc., and Evonik Industries AG lead the market with a focus on innovation, sustainability, and expansion into bio-based surfactants. This concentration of major players highlights the competitive nature of the market, where continuous product development and adherence to environmental standards are critical for maintaining market leadership.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

R&D Expenditure |

Product Portfolio |

Sustainability Initiatives |

Strategic Partnerships |

Market Penetration |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

- |

- |

- |

- |

- |

- |

- |

|

Dow Inc. |

1897 |

Midland, USA |

- |

- |

- |

- |

- |

- |

- |

|

Evonik Industries AG |

2007 |

Essen, Germany |

- |

- |

- |

- |

- |

- |

- |

|

Croda International |

1925 |

Goole, UK |

- |

- |

- |

- |

- |

- |

- |

|

Clariant AG |

1995 |

Muttenz, Switzerland |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Surfactants Market Analysis

Growth Drivers

- Increasing Demand in Detergents & Personal Care Products: The Asia Pacific region is witnessing robust demand for surfactants, particularly driven by the growing consumption of detergents and personal care products. In 2024, the population of China and India, the two largest markets in the region, reached 1.43 billion and 1.44 billion, respectively, accounting for a significant portion of the global population. This demographic expansion has increased the demand for cleaning agents and personal hygiene products, which are key applications of surfactants.

- Rising Focus on Bio-based Surfactants: With increasing environmental awareness and regulatory pressure, the Asia Pacific market is witnessing a rising focus on bio-based surfactants. The Japan Climate Initiative (JCI), a network of companies, local governments, and NGOs, is committed to realizing a decarbonized society by 2050 through promoting energy efficiency and expanding renewable energy. This focus on sustainable chemicals, along with governmental support for green technologies, is propelling the demand for bio-based surfactants in the region.

- Urbanization & Population Growth in Emerging Markets: Rapid urbanization in Asia Pacific countries, especially in India, China, and Southeast Asia, is driving the demand for surfactants in household and industrial cleaning. According to the United Nations, in 2024, 52.9% of the population in Southeast Asia lives in urban areas, a significant increase from 2015's 49%. The urban shift is fueling the demand for cleaning products, which are a major application of surfactants. Additionally, the population of the ASEAN region, with over 680 million people, is driving the surge in demand for surfactants in personal and household care products.

Challenges

- Fluctuating Raw Material Prices: The Asia Pacific surfactants market faces challenges due to fluctuating raw material prices. Crude oil, a primary source of petrochemical surfactants, saw prices vary between $83 per barrel in 2023. These fluctuations have a direct impact on production costs. Additionally, the price of palm oil, a key natural oil used in bio-based surfactants, has been volatile, with Malaysia's palm oil prices averaging $850 per metric ton in 2023, These price volatilities increase uncertainty and margin pressure for surfactant manufacturers.

- Regulatory Constraints: Stringent environmental regulations across the Asia Pacific region have imposed compliance costs on surfactant manufacturers. In 2024, China implemented tighter environmental standards through its Ecological and Environmental Protection Plan, requiring industries to reduce the use of non-biodegradable surfactants. Additionally, India's Environment Protection Act demands industries to limit the use of hazardous chemicals. Compliance with such regulations has increased operational costs for manufacturers and slowed the production of certain types of surfactants.

Asia Pacific Surfactants Future Market Outlook

Over the next five years, the Asia Pacific Surfactants market is expected to experience substantial growth driven by the rising demand for eco-friendly and bio-based surfactants. Government regulations across several countries in the region are encouraging the use of sustainable products, pushing manufacturers to adopt greener alternatives. Increasing awareness among consumers regarding the environmental impact of traditional surfactants will also contribute to the expansion of bio-based options.

Market Opportunities

- Increasing Penetration in Niche Applications: Surfactants are increasingly finding applications in niche markets such as food processing and agrochemicals. In 2024, China's agrochemical industry, valued at $53 billion, has been expanding its use of surfactants in pesticide formulations to enhance the efficacy of crop protection products. These niche applications represent a significant opportunity for surfactant manufacturers to diversify their product portfolios.

- Collaboration with Emerging Markets: Collaborating with emerging markets in the Asia Pacific region is an opportunity for surfactant manufacturers. The Regional Comprehensive Economic Partnership (RCEP), implemented in 2022, has facilitated trade among 15 Asia Pacific countries, including China and Southeast Asia, reducing tariffs and increasing market access for surfactant products. In 2024, ASEAN economies are expected to grow by 4.6%, according to the IMF, providing an avenue for surfactant manufacturers to tap into these expanding markets.

Scope of the Report

|

Segment |

Sub-Segment |

|

Product Type |

- Anionic Surfactants |

|

- Nonionic Surfactants |

|

|

- Cationic Surfactants |

|

|

- Amphoteric Surfactants |

|

|

- Others (Specialty Surfactants) |

|

|

Raw Material |

- Petrochemical-based Surfactants |

|

- Bio-based Surfactants |

|

|

- Synthetic Surfactants |

|

|

Application |

- Detergents |

|

- Personal Care |

|

|

- Industrial & Institutional Cleaning |

|

|

- Food & Beverage Processing |

|

|

- Oilfield Chemicals |

|

|

End-User |

- Household |

|

- Industrial |

|

|

- Agriculture |

|

|

- Pharmaceuticals |

|

|

- Others |

|

|

Region |

- China |

|

- India |

|

|

- Japan |

|

|

- Southeast Asia |

|

|

- Australia & New Zealand |

Products

Key Target Audience

Manufacturers of household and industrial cleaning products

Personal care product manufacturers

Oilfield chemical companies

Agriculture chemical producers

Logistics & Supply Chain Companies

Paints & Coatings Manufacturers

Investors and venture capitalist firms

Government and regulatory bodies (REACH, Asian Chemical Compliance Agencies)

Companies

Major Players in the Market

BASF SE

Dow Inc.

Evonik Industries AG

Croda International Plc

Clariant AG

Solvay S.A.

Stepan Company

Galaxy Surfactants Ltd.

Kao Corporation

Aarti Industries Ltd.

Huntsman Corporation

Sasol Limited

Reliance Industries Ltd.

Lion Corporation

AkzoNobel N.V.

Table of Contents

1. Asia Pacific Surfactants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Volume Growth, Revenue Growth)

1.4. Market Segmentation Overview (Product Type, Application, Raw Material, End-User, Region)

2. Asia Pacific Surfactants Market Size (In USD Bn)

2.1. Historical Market Size (Value, Volume)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Surfactants Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Detergents & Personal Care Products

3.1.2. Growing Industrial Applications

3.1.3. Rising Focus on Bio-based Surfactants

3.1.4. Urbanization & Population Growth in Emerging Markets

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices (Petrochemicals, Natural Oils)

3.2.2. Regulatory Constraints (Environmental Regulations, Compliance Costs)

3.2.3. Competitive Pricing Pressure

3.3. Opportunities

3.3.1. Expansion of Green and Bio-based Surfactants

3.3.2. Increasing Penetration in Niche Applications (Food Processing, Agrochemicals)

3.3.3. Collaboration with Emerging Markets (China, India, Southeast Asia)

3.4. Trends

3.4.1. Shift Towards Sustainable and Eco-friendly Surfactants

3.4.2. Innovation in High-Performance Surfactants (Amphoteric, Cationic, Nonionic Surfactants)

3.4.3. Expansion in Industrial and Household Cleaning Markets

3.5. Regulatory Landscape

3.5.1. REACH (Europe) and Asian Equivalents

3.5.2. Certification Standards for Bio-based Surfactants

3.5.3. Government Initiatives for Green Chemistry

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, End-Users)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Surfactants Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Anionic Surfactants

4.1.2. Nonionic Surfactants

4.1.3. Cationic Surfactants

4.1.4. Amphoteric Surfactants

4.1.5. Others (Specialty Surfactants)

4.2. By Raw Material (In Value %)

4.2.1. Petrochemical-based Surfactants

4.2.2. Bio-based Surfactants

4.2.3. Synthetic Surfactants

4.3. By Application (In Value %)

4.3.1. Detergents

4.3.2. Personal Care

4.3.3. Industrial & Institutional Cleaning

4.3.4. Food & Beverage Processing

4.3.5. Oilfield Chemicals

4.4. By End-User (In Value %)

4.4.1. Household

4.4.2. Industrial

4.4.3. Agriculture

4.4.4. Pharmaceuticals

4.4.5. Others

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Southeast Asia

4.5.5. Australia & New Zealand

5. Asia Pacific Surfactants Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. BASF SE

5.1.2. AkzoNobel N.V.

5.1.3. Croda International Plc

5.1.4. Dow Inc.

5.1.5. Evonik Industries AG

5.1.6. Clariant AG

5.1.7. Solvay S.A.

5.1.8. Stepan Company

5.1.9. Huntsman Corporation

5.1.10. Aarti Industries Ltd.

5.1.11. Galaxy Surfactants Ltd.

5.1.12. Kao Corporation

5.1.13. Lion Corporation

5.1.14. Reliance Industries Ltd.

5.1.15. Sasol Limited

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Market Share, Technology Adoption, Product Diversification, Innovation, Sustainability Initiatives, Regional Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Mergers & Acquisitions)

5.5. Investment Analysis (Private Equity, Venture Capital, M&A)

5.6. R&D Focus and Innovation Roadmap

5.7. Emerging Competitors and Market Disruptors

6. Asia Pacific Surfactants Market Regulatory Framework

6.1. Environmental and Safety Standards

6.2. Certification and Labeling Requirements

6.3. Import/Export Regulations

6.4. Government Incentives for Bio-based Surfactants

7. Asia Pacific Surfactants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Drivers for Future Growth

8. Asia Pacific Surfactants Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Raw Material (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Surfactants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunities

9.3. Pricing Strategies

9.4. Customer Segmentation Insights

9.5. Product Differentiation Strategies

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying key stakeholders, including manufacturers, distributors, and end-users. Extensive desk research is conducted to gather industry-level data and to define the critical factors driving the Asia Pacific Surfactants Market, such as the demand for sustainable alternatives.

Step 2: Market Analysis and Construction

Historical data on market size, volume, and value is compiled and analyzed. This analysis includes assessing key performance metrics of various sub-segments, including product and application types, and their relative revenue contributions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts from leading surfactant manufacturing companies. These insights are combined with the statistical analysis of key market dynamics to ensure robust market forecasts.

Step 4: Research Synthesis and Final Output

In the final stage, insights from primary and secondary sources are synthesized to generate a comprehensive market report, ensuring accuracy through bottom-up and top-down approaches. This includes verifying data with surfactant manufacturers and market participants.

Frequently Asked Questions

01. How big is the Asia Pacific Surfactants Market?

The Asia Pacific Surfactants market was valued at USD 22 billion, driven by growing demand from industries such as personal care, household cleaning, and industrial applications.

02. What are the challenges in the Asia Pacific Surfactants Market?

Key challenges include fluctuating raw material prices, particularly for petrochemical-based surfactants, and stringent environmental regulations, which require companies to adopt greener alternatives.

03. Who are the major players in the Asia Pacific Surfactants Market?

Major players include BASF SE, Dow Inc., Evonik Industries AG, Croda International Plc, and Clariant AG. These companies lead due to their strong R&D investments and innovative product portfolios.

04. What are the growth drivers of the Asia Pacific Surfactants Market?

Growth drivers include increasing demand for personal care products, expanding applications in industrial cleaning, and the shift towards bio-based surfactants due to environmental concerns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.