Asia Pacific Surfing Equipment Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7630

November 2024

83

About the Report

Asia Pacific Surfing Equipment Market Overview

- The Asia Pacific surfing equipment market is valued at USD 2 billion, based on a five-year historical analysis. This growth is driven by the increasing popularity of surfing as both a recreational activity and a competitive sport, particularly among millennials and adventure enthusiasts. The surge in interest has led to higher demand for surfboards, apparel, and accessories, contributing to the market's expansion.

- Australia and Indonesia are the dominant countries in the Asia Pacific surfing equipment market. Australia's extensive coastline and well-established surfing culture make it a significant market, while Indonesia's renowned surf spots attract both local and international surfers, boosting equipment sales. These factors position both countries as key players in the region's surfing equipment industry.

- Governments in the Asia Pacific region are implementing stringent safety standards for surfing equipment to ensure user safety. For instance, On June 22, 2022, the ACCC implemented mandatory safety and information standards for products containing button batteries. These standards aim to prevent children from accessing button batteries and to ensure that consumers are adequately warned about their dangers.

Asia Pacific Surfing Equipment Market Segmentation

By Product Type: The market is segmented by product type into surfboards, apparel & accessories, and surf gear. Recently, surfboards have a dominant market share under this segmentation. This dominance is due to the essential nature of surfboards in the sport, with continuous innovations in materials and designs enhancing performance and durability, thereby attracting a larger consumer base.

By Distribution Channel: The market is segmented by distribution channel into online and offline channels. The offline segment, comprising specialty surf shops and sporting goods stores, holds a dominant market share. This is attributed to consumers' preference for physically assessing equipment before purchase and the personalized customer service offered in these stores, which enhances the buying experience.

Asia Pacific Surfing Equipment Market Competitive Landscape

The Asia Pacific surfing equipment market is characterized by the presence of both global and regional players, contributing to a competitive environment. Key companies focus on product innovation, quality enhancement, and expanding their distribution networks to maintain market share.

Asia Pacific Surfing Equipment Industry Analysis

Growth Drivers

- Rising Popularity of Surfing as a Recreational Activity: The Asia Pacific region has witnessed a significant surge in surfing participation, with countries like Australia. This increase is attributed to the region's extensive coastlines and favorable climatic conditions, making surfing an accessible and appealing activity for both locals and tourists. In the financial year 2022-23, total tourism consumption in Australia reachedAUD 164.5 billion, marking a72% increasefrom the previous year.

- Increasing Disposable Income and Urbanization: Rising disposable incomes and urbanization in Asia Pacific countries have led to increased spending on recreational activities, including surfing. The region's urban population grew, leading to higher demand for leisure activities. In China, for example, the average disposable income per capita reached 39,218 yuan (about 5,511 U.S. dollars) in 2023, enabling more individuals to invest in surfing equipment and related activities.

- Technological Advancements in Surfing Equipment: Innovations in surfing equipment are boosting performance and safety, attracting more enthusiasts to the sport. Eco-friendly surfboards made from sustainable materials are gaining popularity, reflecting a shift toward environmental responsibility. Additionally, digital integrations, such as GPS-enabled surf watches, enhance the surfing experience by allowing real-time tracking and wave monitoring, which improves both enjoyment and safety for surfers.

Market Challenges

- High Cost of High-Quality Surfing Equipment: The expense of premium surfing equipment presents a significant barrier for many potential surfers in the Asia Pacific region. High-quality surfboards and related gear are often priced beyond the reach of individuals with limited disposable income, making surfing less accessible. This challenge is especially pronounced in developing countries, where such costs are harder to justify for recreational activities.

- Environmental Concerns and Regulations: Environmental degradation, including issues like coral reef damage and coastal erosion, poses challenges for surfing destinations across the Asia Pacific. In response, governments have enacted regulations to protect these ecosystems, which can limit access to certain popular surfing spots. These restrictions aim to balance recreational use with environmental preservation, impacting both surfers and the market overall.

Asia Pacific Surfing Equipment Market Future Outlook

Over the next five years, the Asia Pacific surfing equipment market is expected to show significant growth driven by continuous government support, advancements in surfing technology, and increasing consumer demand for eco-friendly equipment. The rising popularity of surfing as a lifestyle sport, coupled with the expansion of surf tourism in the region, is anticipated to further propel market growth.

Market Opportunities

- Emerging Markets with Growing Surfing Cultures: Countries like Vietnam and the Philippines are experiencing a surge in interest in surfing, creating new opportunities within the market. This increased popularity in surf tourism signals a growing demand for surfing equipment and services, indicating a promising future for surfing culture in these emerging destinations.

- Development of Eco-Friendly and Sustainable Equipment: Consumer interest in environmentally sustainable products is rising across the Asia Pacific region. Manufacturers are responding by creating eco-friendly surfing equipment, including biodegradable surf wax and boards made from recycled materials. This shift toward sustainability aligns with evolving consumer values and presents an opportunity for brands focusing on eco-conscious innovations.

Scope of the Report

|

Product Type |

Surfboards Apparel & Accessories Surf Gear |

|

Application |

Recreational Surfing Professional Surfing Competitions Surf Schools and Training Centers Surf Tourism |

|

Distribution Channel |

Online (E-commerce Platforms, Brand Websites) Offline (Specialty Surf Shops, Sporting Goods Stores, Department Stores) |

|

End-User |

Men Women Kids |

|

Country |

Australia New Zealand Japan Indonesia Thailand Rest of Asia Pacific |

Products

Key Target Audience

Surfing Equipment Manufacturers

Surfing Equipment Distributors and Retailers

Surf Schools and Training Centers

Surf Tourism Operators

Sports and Adventure Clubs

Government and Regulatory Bodies (e.g., Australian Sports Commission)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

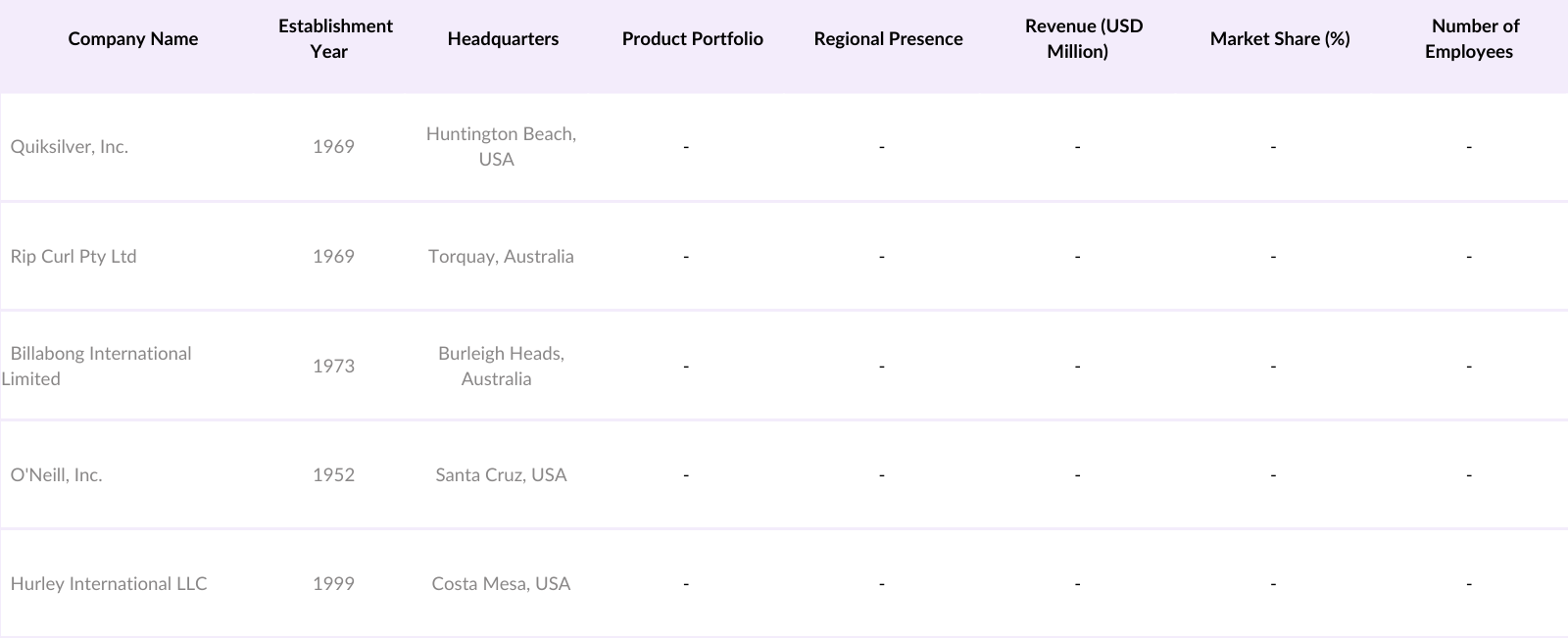

Quiksilver, Inc.

Rip Curl Pty Ltd

Billabong International Limited

O'Neill, Inc.

Hurley International LLC

Volcom LLC

Channel Islands Surfboards

Firewire Surfboards, LLC

Rusty Surfboards

JS Industries

Table of Contents

1. Asia Pacific Surfing Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Surfing Equipment Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Surfing Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Rising Popularity of Surfing as a Recreational Activity

3.1.2 Expansion of Surf Tourism in Coastal Regions

3.1.3 Technological Advancements in Surfing Equipment

3.1.4 Increasing Disposable Income and Urbanization

3.2 Market Challenges

3.2.1 High Cost of High-Quality Surfing Equipment

3.2.2 Environmental Concerns and Regulations

3.2.3 Seasonal Nature of Surfing Activities

3.3 Opportunities

3.3.1 Emerging Markets with Growing Surfing Cultures

3.3.2 Development of Eco-Friendly and Sustainable Equipment

3.3.3 Integration of Digital Technologies in Surfing Gear

3.4 Trends

3.4.1 Adoption of Lightweight and Durable Materials

3.4.2 Customization and Personalization of Surfing Gear

3.4.3 Growth of Female Participation in Surfing

3.5 Government Regulations

3.5.1 Safety Standards for Surfing Equipment

3.5.2 Environmental Protection Policies Affecting Surfing Areas

3.5.3 Supportive Policies for Adventure Tourism

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific Surfing Equipment Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Surfboards

4.1.1.1 Shortboards

4.1.1.2 Longboards

4.1.1.3 Fish Boards

4.1.1.4 Funboards

4.1.2 Apparel & Accessories

4.1.2.1 Wetsuits

4.1.2.2 Rash Guards

4.1.2.3 Surf Leashes

4.1.2.4 Surfboard Fins

4.1.2.5 Traction Pads

4.1.3 Surf Gear

4.1.3.1 Surfboard Bags

4.1.3.2 Surfboard Wax

4.1.3.3 Repair Kits

4.2 By Application (In Value %)

4.2.1 Recreational Surfing

4.2.2 Professional Surfing Competitions

4.2.3 Surf Schools and Training Centers

4.2.4 Surf Tourism

4.3 By Distribution Channel (In Value %)

4.3.1 Online

4.3.1.1 E-commerce Platforms

4.3.1.2 Brand Websites

4.3.2 Offline

4.3.2.1 Specialty Surf Shops

4.3.2.2 Sporting Goods Stores

4.3.2.3 Department Stores

4.4 By End-User (In Value %)

4.4.1 Men

4.4.2 Women

4.4.3 Kids

4.5 By Country (In Value %)

4.5.1 Australia

4.5.2 New Zealand

4.5.3 Japan

4.5.4 Indonesia

4.5.5 Thailand

4.5.6 Rest of Asia Pacific

5. Asia Pacific Surfing Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Quiksilver, Inc.

5.1.2 Rip Curl Pty Ltd

5.1.3 Billabong International Limited

5.1.4 O'Neill, Inc.

5.1.5 Hurley International LLC

5.1.6 Volcom LLC

5.1.7 Channel Islands Surfboards

5.1.8 Firewire Surfboards, LLC

5.1.9 Rusty Surfboards

5.1.10 JS Industries

5.1.11 Lost Enterprises

5.1.12 Patagonia, Inc.

5.1.13 Surftech, LLC

5.1.14 FCS (Fin Control Systems)

5.1.15 Dakine, Inc.

5.2 Cross Comparison Parameters (Product Portfolio, Regional Presence, Market Share, Revenue)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Asia Pacific Surfing Equipment Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Surfing Equipment Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Surfing Equipment Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-User (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific Surfing Equipment Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Serviceable Available Market (SAM) Analysis

9.3 Serviceable Obtainable Market (SOM) Analysis

9.4 Customer Cohort Analysis

9.5 Marketing Initiatives

9.6 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Surfing Equipment Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Surfing Equipment Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple surfing equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Surfing Equipment market. This rigorous methodology enables precise estimations and actionable insights for industry stakeholders.

Frequently Asked Questions

01 How big is the Asia Pacific Surfing Equipment Market?

The Asia Pacific surfing equipment market was valued at USD 2 billion, driven by increasing interest in surfing across the region, advancements in product technology, and an expanding surf tourism industry.

02 What are the main challenges in the Asia Pacific Surfing Equipment Market?

Challenges in Asia Pacific surfing equipment market include the high cost of premium equipment, seasonal demand fluctuations, and environmental concerns related to production. Regulatory standards for environmental sustainability also present obstacles for manufacturers.

03 Who are the leading players in the Asia Pacific Surfing Equipment Market?

Key players in Asia Pacific surfing equipment market include Quiksilver, Rip Curl, Billabong, O'Neill, and Hurley. These companies lead due to strong brand recognition, extensive product lines, and established distribution channels across the region.

04 What factors are driving the growth of the Asia Pacific Surfing Equipment Market?

The Asia Pacific surfing equipment market is driven by a surge in surfing popularity, product innovations that enhance performance, and increasing disposable income among consumers, particularly in Australia and Indonesia.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.