Asia-Pacific Textile Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD3280

November 2024

99

About the Report

Asia-Pacific Textile Market Overview

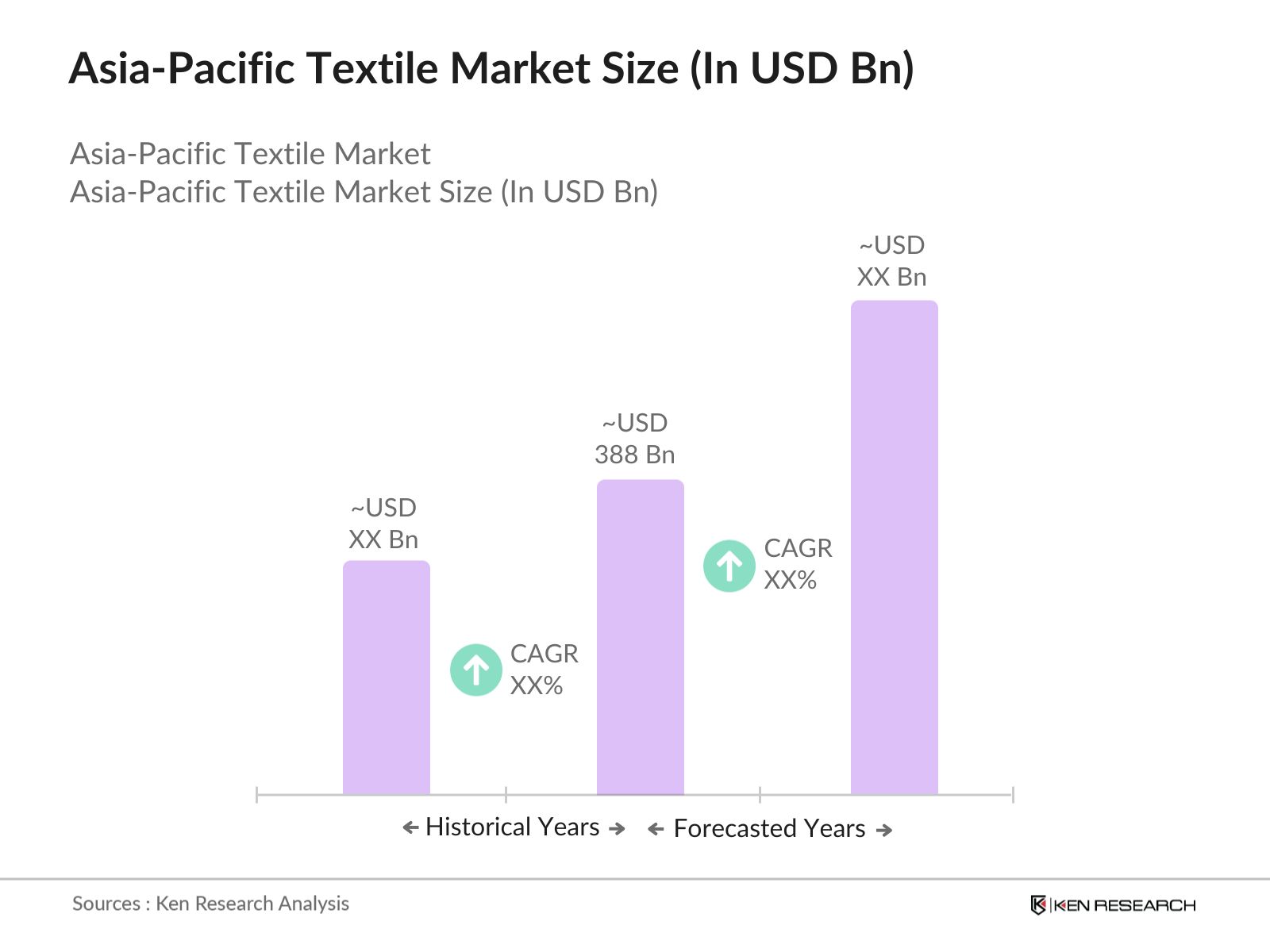

- The Asia-Pacific Textile Market is valued at USD 388 billion, based on a five-year historical analysis. This market is driven by increasing consumer demand for sustainable and innovative fabrics, coupled with the rising influence of e-commerce. The growing fashion industry and advancements in textile manufacturing technology, especially in countries like China and India, have boosted the demand for functional and performance textiles. Further, government initiatives supporting textile production and export across major countries in this region have contributed to steady growth.

- Countries like China, India, and Bangladesh dominate the market due to their large-scale manufacturing capacities, availability of raw materials, and favorable government policies. China is a leader in textile exports globally, while India has gained prominence in cotton production and technical textiles. Bangladeshs competitive labor costs and robust export policies have made it a dominant player in apparel manufacturing, catering primarily to fast fashion brands worldwide.

- Countries like India, China, and Indonesia have introduced several export incentives to boost their textile industries. Indias Rebate of State and Central Taxes and Levies (RoSCTL) scheme has provided nearly USD 1 billion in rebates to textile exporters in 2023, aiming to improve global competitiveness. Similarly, Chinas tax rebate policy for textile exports helped companies reclaim USD 6.5 billion in 2022. Indonesias new Free Trade Agreements (FTAs) with key markets like the EU are expected to further enhance export potential, providing duty-free access to textiles.

Asia-Pacific Textile Market Segmentation

The Asia-Pacific Textile Market is segmented by ownership, service type, speciality type, bed capacity, and geographical region.

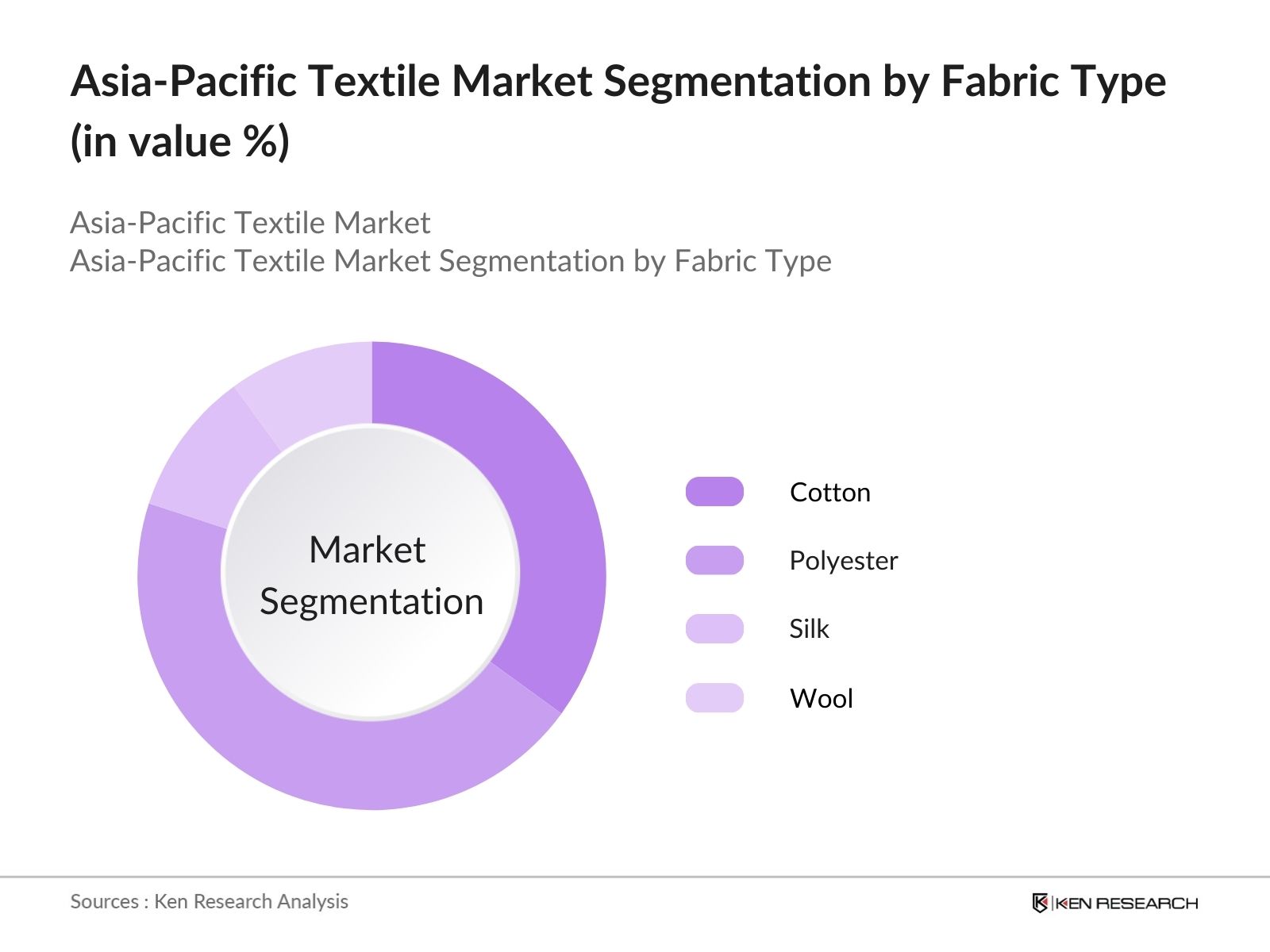

By Fabric Type: The Asia-Pacific Textile market is segmented by fabric type into cotton, polyester, silk, and wool. Recently, polyester has maintained a dominant market share within the fabric type segment, primarily due to its durability, cost-effectiveness, and widespread application in various industries, including fashion and home textiles. Polyester fabrics are lightweight, resistant to shrinking and wrinkling, and have higher moisture-wicking properties, making them preferred for performance wear and active apparel. Additionally, advancements in recycling polyester have boosted its sustainability appeal, further contributing to its dominance.

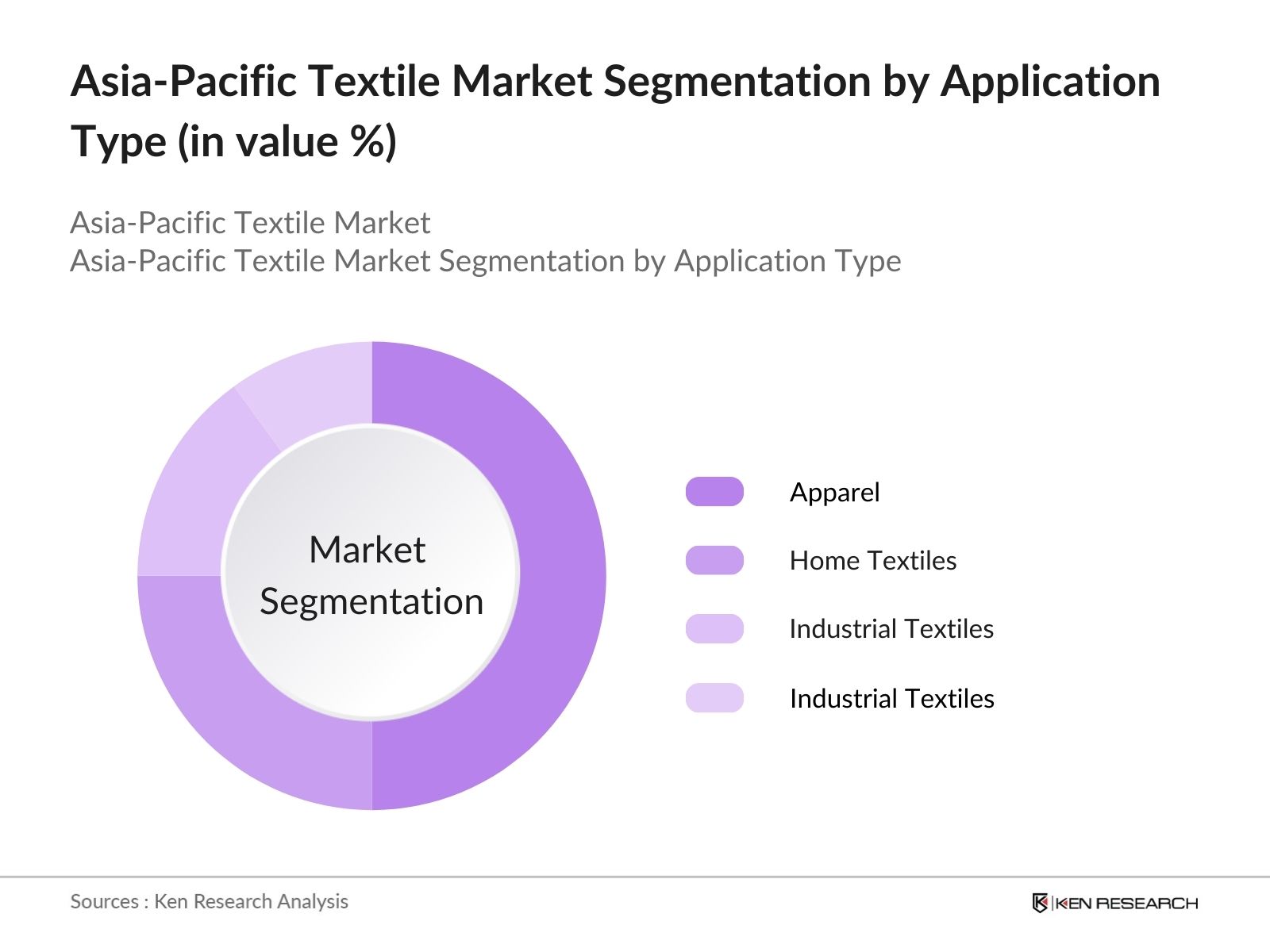

By Application: The Asia-Pacific Textile market is also segmented by application into apparel, home textiles, industrial textiles, and technical textiles. Apparel holds a dominant share in the application segment due to the large consumer base and the regions role as a global hub for fashion production. Major global fashion brands source their products from countries like China, India, and Vietnam, which have developed comprehensive supply chains and competitive labor markets. Additionally, the rise of fast fashion trends and e-commerce platforms has fueled the demand for apparel textiles across the region.

Asia-Pacific Textile Market Competitive Landscape

The market features a mix of local giants and multinational corporations, including Shenzhou International and Toray Industries, which lead the industry in terms of production volume and technological innovation. The focus on sustainability and recycling in textiles is also giving rise to new market entrants aiming for eco-friendly solutions. The competitive landscape remains robust, with the top companies focusing on R&D and expansion into emerging markets.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

No. of Employees |

Fabric Production Capacity |

Key Product |

Sustainability Certifications |

|

Shenzhou International Group |

1989 |

Ningbo, China |

- |

- |

- |

- |

- |

|

PT Sri Rejeki Isman Tbk |

1966 |

Indonesia |

- |

- |

- |

- |

- |

|

Arvind Limited |

1931 |

India |

- |

- |

- |

- |

- |

|

Toray Industries |

1926 |

Japan |

- |

- |

- |

- |

- |

|

Vardhman Textiles |

1965 |

India |

- |

- |

- |

- |

- |

Asia-Pacific Textile Market Analysis

Asia-Pacific Textile Market Growth Drivers:

- Increasing Demand for Sustainable Textiles: The Asia-Pacific region is witnessing a surge in demand for sustainable textiles due to rising environmental concerns and consumer awareness. According to the World Bank, textile manufacturing is responsible for 20% of global wastewater, prompting brands to seek eco-friendly alternatives. In 2023, China, India, and Bangladesh reported an increase in the production of organic cotton, with China producing over 220,000 metric tons of organic cotton.

- Urbanization and Changing Consumer Preferences: Urbanization continues to reshape consumer behavior in the Asia-Pacific region, with more than 60% of the population expected to live in urban areas by 2025, according to the IMF. This rapid urbanization is leading to shifts in fashion consumption patterns, with consumers opting for premium, fashionable, and innovative textiles.

- Technological Advancements in Fabric Production: Technological innovations are revolutionizing fabric production in the Asia-Pacific textile industry. Advanced weaving and dyeing technologies have reduced production time by nearly 30%, according to reports by the Japan Textile Federation. Furthermore, the region is seeing the integration of automation and AI in fabric production, boosting efficiency.

Asia-Pacific Textile Market Challenges:

- Volatile Raw Material Prices: The Asia-Pacific textile industry is heavily reliant on raw materials like cotton, wool, and synthetic fibers, whose prices have been volatile due to fluctuating demand and supply. In 2023, the global cotton price reached USD 1.28 per kilogram, a notable increase from previous years. This price fluctuation is particularly challenging for countries like India and Bangladesh, where the cost of imported synthetic fibers has also risen due to global supply chain disruptions. As per data from the World Bank, synthetic fiber prices increased by nearly 15% in 2022, exacerbating the cost pressures on textile manufacturers.

- Environmental Regulations and Compliance: Stringent environmental regulations are becoming a major challenge for textile manufacturers in the Asia-Pacific region. Countries like China and India have implemented strict wastewater management standards, pushing textile manufacturers to adopt costly eco-friendly technologies. According to the Ministry of Ecology and Environment of China, over 45% of textile factories were found non-compliant with environmental regulations in 2023, leading to heavy fines and operational delays. This is coupled with global certifications such as OEKO-TEX and GOTS becoming mandatory for manufacturers seeking to export to European and North American markets.

Asia-Pacific Textile Future Market Outlook

Over the next five years, the Asia-Pacific Textile Market is expected to show growth, driven by increasing consumer demand for sustainable and functional fabrics, coupled with continued investments in advanced textile manufacturing technologies. As brands shift toward eco-friendly production processes, the adoption of recycled materials and circular fashion models will be prominent trends. Additionally, the growth of e-commerce platforms and digital retailing will continue to push the demand for ready-to-wear apparel, particularly in emerging economies within the region.

Asia-Pacific Textile Market Opportunities:

- Growing Demand for Functional and Performance Fabrics: Functional and performance fabrics, such as moisture-wicking and antimicrobial textiles, are experiencing rising demand in the Asia-Pacific region, particularly in activewear and outdoor apparel markets. Japan, South Korea, and China are leading this trend, with Japans textile exports of functional fabrics exceeding USD 2 billion in 2023. Increased participation in sports and fitness activities, along with growing health consciousness, are key drivers behind this demand. Additionally, local manufacturers are investing in R&D to produce high-quality performance textiles, presenting opportunities for growth shortly.

- Digitalization in the Textile Supply Chain: Digitalization is transforming the textile supply chain in the Asia-Pacific region, particularly in automation and smart textile production. Automation has reduced fabric production times by 20-30%, enhancing efficiency across supply chains. According to the Asian Development Bank (ADB), the integration of digital technologies such as blockchain for transparency and smart textiles for functionality is on the rise, particularly in countries like South Korea and Japan. These innovations are expected to improve traceability, reduce operational costs, and support sustainability initiatives within the textile sector.

Scope of the Report

|

By Fabric Type |

Cotton Polyester Wool Silk |

|

By Application |

Apparel Home Textiles Industrial Textiles Technical Textiles |

|

By Distribution Channel |

Online Offline (Retail, Wholesale) |

|

By End-Use |

Fashion Industry Healthcare Textiles Automotive Textiles Protective Clothing |

|

By Region |

China India Vietnam Japan Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Apparel Manufacturers

Textile Machinery Providers

Home Textile Companies

Technical Textile Producers

Automotive Industry (Technical Textiles)

Companies

Players Mentioned in the Report:

Shenzhou International Group

PT Sri Rejeki Isman Tbk

Arvind Limited

Toray Industries

Vardhman Textiles

Pacific Textiles Holdings

Parkdale Mills

Weiqiao Textile Company

Reliance Industries (Textile Division)

Nitto Boseki Co., Ltd.

Luthai Textile

Welspun India

Tainan Enterprises

Kyungbang Limited

Teijin Frontier

Table of Contents

1. Asia-Pacific Textile Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Textile Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Textile Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Sustainable Textiles

3.1.2. Urbanization and Changing Consumer Preferences

3.1.3. Government Initiatives Supporting Textile Manufacturing (Regional Initiatives: India, China, Vietnam)

3.1.4. Technological Advancements in Fabric Production

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. Environmental Regulations and Compliance

3.2.3. Skilled Labor Shortage in Emerging Markets

3.3. Opportunities

3.3.1. Growing Demand for Functional and Performance Fabrics

3.3.2. Expansion in the E-Commerce Sector

3.3.3. Digitalization in the Textile Supply Chain (Automation, Smart Textiles)

3.4. Trends

3.4.1. Increasing Use of Recycled Materials

3.4.2. Adoption of Circular Fashion Model

3.4.3. Growth of Fast Fashion in Emerging Markets

3.5. Government Regulations

3.5.1. Textile & Apparel Export Incentives (Country-specific: India, China, Indonesia)

3.5.2. Environmental Sustainability Standards (OEKO-TEX, GOTS)

3.5.3. Import Duties and Trade Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Raw Material Suppliers

3.7.2. Manufacturers

3.7.3. Retailers

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia-Pacific Textile Market Segmentation

4.1. By Fabric Type (In Value %)

4.1.1. Cotton

4.1.2. Polyester

4.1.3. Wool

4.1.4. Silk

4.2. By Application (In Value %)

4.2.1. Apparel

4.2.2. Home Textiles

4.2.3. Industrial Textiles

4.2.4. Technical Textiles

4.3. By Distribution Channel (In Value %)

4.3.1. Online

4.3.2. Offline (Retail, Wholesale)

4.4. By End-Use (In Value %)

4.4.1. Fashion Industry

4.4.2. Healthcare Textiles

4.4.3. Automotive Textiles

4.4.4. Protective Clothing

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Vietnam

4.5.4. Japan

4.5.5. Rest of APAC

5. Asia-Pacific Textile Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Shenzhou International Group

5.1.2. PT Sri Rejeki Isman Tbk (Sritex)

5.1.3. Arvind Limited

5.1.4. Toray Industries

5.1.5. Vardhman Textiles

5.1.6. Pacific Textiles Holdings

5.1.7. Parkdale Mills

5.1.8. Weiqiao Textile Company

5.1.9. Reliance Industries (Textile Division)

5.1.10. Nitto Boseki Co., Ltd.

5.1.11. Luthai Textile

5.1.12. Welspun India

5.1.13. Tainan Enterprises

5.1.14. Kyungbang Limited

5.1.15. Teijin Frontier

5.2. Cross Comparison Parameters (Revenue, Fabric Production Capacity, Regional Presence, Sustainability Certifications, R&D Spending, Employee Count, Product Portfolio, Digital Transformation Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Government Grants and Subsidies

6. Asia-Pacific Textile Market Regulatory Framework

6.1. Environmental and Sustainability Standards (GOTS, OEKO-TEX Certification)

6.2. Compliance with Trade Agreements (ASEAN, RCEP)

6.3. Certification Processes for Export

7. Asia-Pacific Textile Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Textile Future Market Segmentation

8.1. By Fabric Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-Use (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Textile Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Investment Opportunities

9.3. Strategic Market Entry Recommendations

9.4. Product Diversification and Innovation Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying key variables that influence the Asia-Pacific Textile Market, with a focus on primary stakeholders, including manufacturers, retailers, and raw material suppliers. Comprehensive desk research was conducted using proprietary databases to gather industry insights.

Step 2: Market Analysis and Construction

We compiled historical data from textile manufacturers across the Asia-Pacific region, including penetration rates and fabric production capacity. This data was evaluated to generate revenue estimates and market share figures.

Step 3: Hypothesis Validation and Expert Consultation

The research team conducted interviews with industry experts and company representatives to validate market data and trends. These consultations provided valuable insights into the production and sales performance of key market players.

Step 4: Research Synthesis and Final Output

The final output includes validated data on market size, segmentation, and competitive landscape, synthesized from both top-down and bottom-up approaches. This ensures accuracy and comprehensiveness in the report.

Frequently Asked Questions

01. How big is the Asia-Pacific Textile Market?

The Asia-Pacific Textile Market is valued at USD 388 billion, driven by the increasing demand for sustainable fabrics and advancements in manufacturing technologies.

02. What are the challenges in the Asia-Pacific Textile Market?

The Asia-Pacific Textile market challenges include environmental regulations, fluctuating raw material prices, and labor shortages in key textile manufacturing countries like China and India.

03. Who are the major players in the Asia-Pacific Textile Market?

The Asia-Pacific Textile market key players include Shenzhou International Group, Arvind Limited, Toray Industries, PT Sri Rejeki Isman Tbk, and Vardhman Textiles.

04. What are the growth drivers of the Asia-Pacific Textile Market?

The Asia-Pacific Textile market growth drivers include the expansion of e-commerce platforms, government support for textile exports, and rising consumer demand for sustainable and functional textiles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.