Asia Pacific Thermal Imaging Systems Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD5456

November 2024

84

About the Report

Asia Pacific Thermal Imaging Systems Market Overview

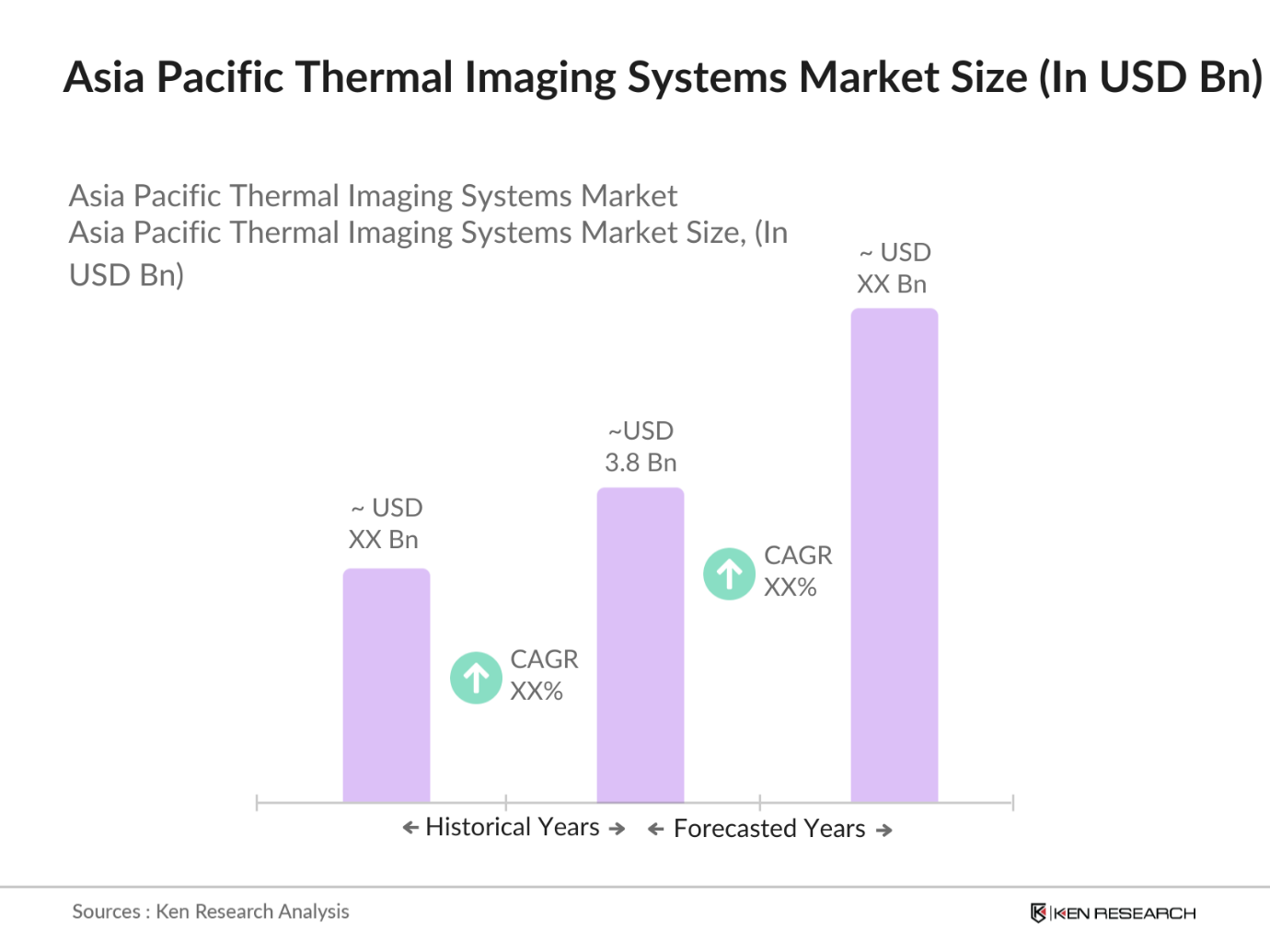

- The Asia Pacific Thermal Imaging Systems market is valued at USD 3.8 billion, based on a historical five-year analysis. This valuation is largely driven by the surging demand for security and surveillance applications in both military and civilian domains. The market's expansion is fueled by advancements in thermal imaging technologies, which are increasingly adopted in critical sectors such as defense, infrastructure, healthcare, and manufacturing. Key growth drivers include heightened government spending on defense, rising demand for predictive maintenance in industrial sectors, and increasing applications in healthcare for non-contact temperature measurements.

- China, Japan, and South Korea dominate the Asia Pacific thermal imaging systems market due to their robust industrial and technological ecosystems. China's dominance stems from its extensive defense budget and the presence of major manufacturing hubs, which drive demand for advanced surveillance and quality control technologies. Japan and South Korea benefit from strong investments in R&D, advanced manufacturing capabilities, and a high degree of technology adoption across industries like automotive, electronics, and healthcare.

- Asia Pacific governments are actively formulating policies to standardize security protocols involving thermal imaging, especially in defense. Chinas National Security Law mandates the use of advanced surveillance for military facilities, with similar mandates expanding across the region. These regulations promote structured deployment of thermal imaging systems, driving the demand in defense applications.

Asia Pacific Thermal Imaging Systems Market Segmentation

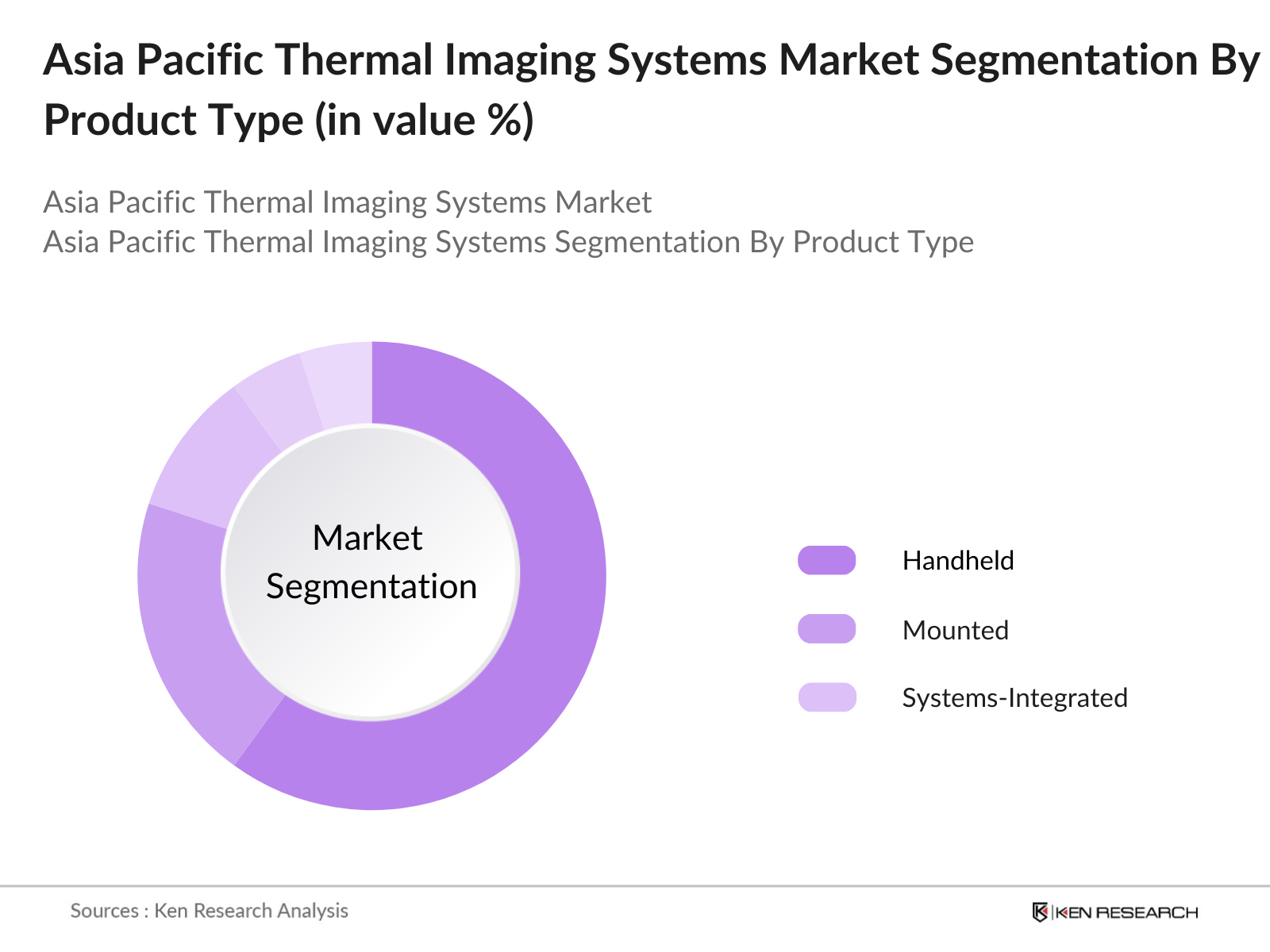

By Product Type: The Asia Pacific Thermal Imaging Systems market is segmented by product type into handheld, mounted, and systems-integrated devices. Handheld devices hold a dominant market share due to their portability, flexibility, and growing applications in industrial maintenance and medical screenings. Industries rely on handheld thermal cameras for on-site inspections, troubleshooting, and maintenance as they allow operators to quickly assess machinery without physical contact. The ease of operation and affordability of handheld devices contribute significantly to their market share in the Asia Pacific region.

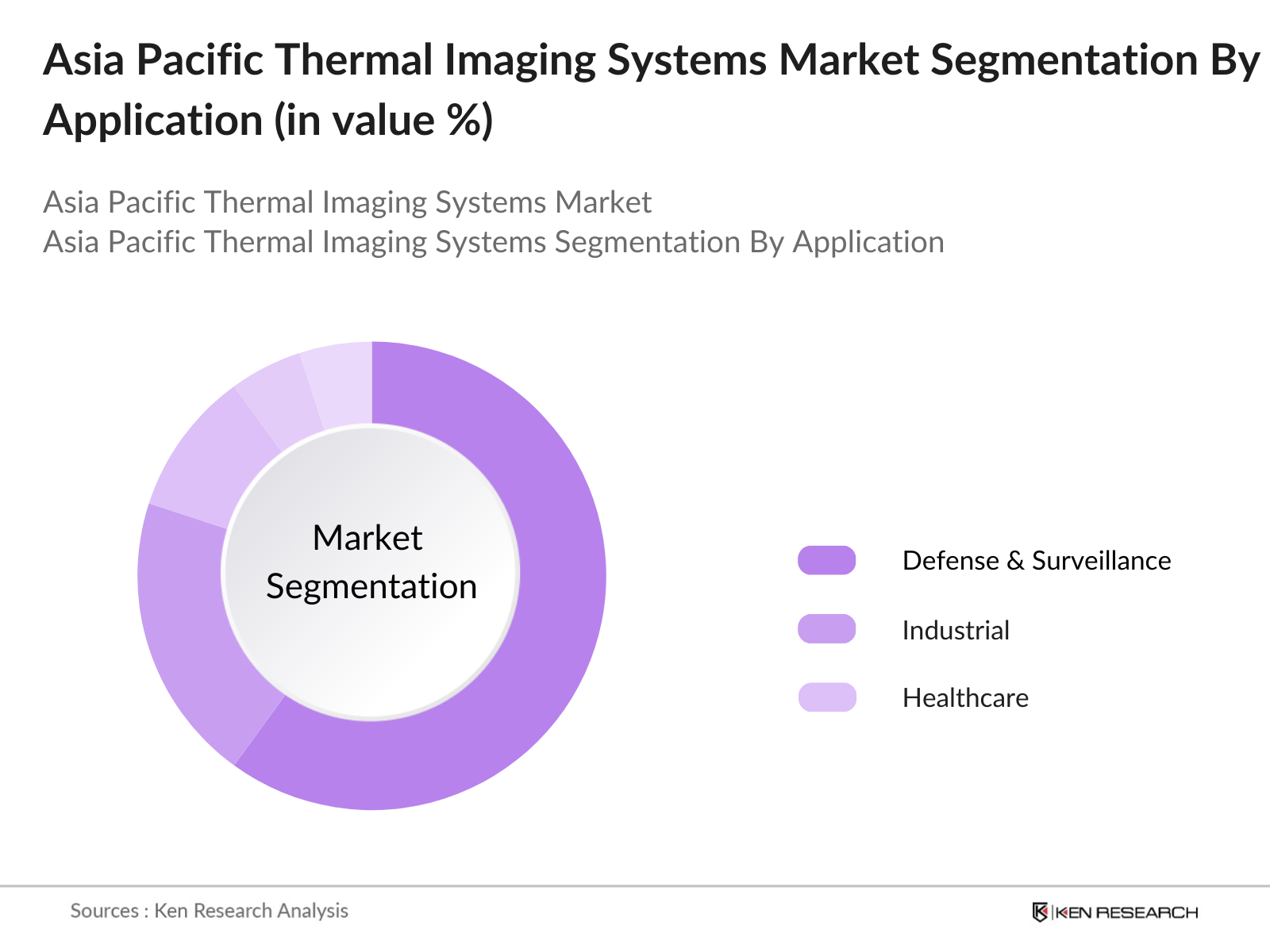

By Application: The market is further segmented by application into defense & surveillance, industrial, and healthcare. Defense & surveillance applications dominate due to the increasing investments in security infrastructure and military equipment modernization programs. The strategic importance of thermal imaging in security, enabling surveillance in low-light or obscured environments, is a crucial factor for dominance in defense applications. In the Asia Pacific region, particularly in countries like China and India, government funding supports the integration of thermal imaging solutions across defense operations.

Asia Pacific Thermal Imaging Systems Market Competitive Landscape

The Asia Pacific Thermal Imaging Systems market is dominated by several key players, each distinguished by their technological advancements and industry experience. Notable players include: The competitive landscape reflects the significant influence of these companies as they continue to innovate and expand their product offerings in response to the evolving demands of the market.

Asia Pacific Thermal Imaging Systems Market Analysis

Growth Drivers

- Rise in Defense Spending: Increased government expenditure in the Asia Pacific region for defense has supported the expansion of thermal imaging systems, with China allocating $224 billion to its military budget in 2024. Indias defense budget is also on the rise, set at $73 billion. This spending is a response to heightened security concerns, driving demand for advanced surveillance tools, including thermal imaging systems to support border security and intelligence.

- Infrastructure Development and Security Enhancements Asia Pacific countries have been enhancing infrastructure security, with projects in China, India, and Japan increasing. Japan is investing $55 billion annually in infrastructure upgrades, including systems that incorporate thermal imaging for safety monitoring. Governmental projects focus on critical infrastructure security, boosting demand for thermal imaging in new installations.

- Adoption in Industrial Applications: Industrial sectors in Asia Pacific, such as manufacturing and oil and gas, are increasingly implementing thermal imaging for equipment diagnostics. In 2024, the Indian manufacturing sector alone employed thermal imaging in over 3,000 facilities to monitor heat signatures in machinery, a preventive measure against equipment failures and accidents, showing strong industrial adaptation.

Challenges

- High Initial Costs for Installation: The cost of thermal imaging systems remains high, with installations ranging between $10,000 to $100,000 depending on complexity. Such initial investments pose a barrier, especially for small and medium-sized enterprises in countries like Vietnam and the Philippines. The equipments premium cost limits accessibility, despite its utility, slowing adoption in less affluent regions.

- Limited Awareness in Emerging Markets: Thermal imaging technology faces challenges in emerging markets across Southeast Asia due to limited awareness. In Indonesia, for example, only 1 in 10 industries actively use thermal imaging, highlighting the need for awareness campaigns and training. These gaps in knowledge and technical familiarity hamper market expansion in regions that lack exposure to advanced security technology.

Asia Pacific Thermal Imaging Systems Future Outlook

Over the next five years, the Asia Pacific Thermal Imaging Systems market is expected to experience significant growth, driven by technological advancements and expanded applications in various sectors. Factors such as increased government spending in defense, rising industrial automation, and growing awareness of the benefits of non-invasive imaging in healthcare are anticipated to propel market demand. Emerging applications in environmental monitoring and autonomous vehicles are also set to contribute to the market's expansion, solidifying the strategic importance of thermal imaging systems across industries.

Market Opportunities

- Expansion into Commercial Real Estate Security: Thermal imaging is seeing expanded use in commercial real estate for security applications, with Asia Pacific commercial complexes investing in such systems. In China, over 2,500 commercial buildings are integrating thermal systems to detect unauthorized access, illustrating the growth potential within urban commercial developments as security demands increase.

- Integration with IoT and AI Technologies: Thermal imaging systems are increasingly integrated with IoT and AI technologies for enhanced data analysis. Japans IoT-enabled surveillance systems, employed across 800 facilities in 2024, utilize thermal imaging paired with AI to streamline security monitoring. Such integration shows promise for further market penetration as IoT adoption grows in security solutions.

Scope of the Report

|

Segment |

Sub-Segments |

|

Application |

Defense and Military |

|

Technology |

Uncooled Thermal Imaging |

|

Component |

Cameras |

|

End-User |

Government |

|

Region |

China |

Major Players

- FLIR Systems

- Infrared Cameras Inc.

- Seek Thermal

- Hanwha Techwin

- Guide Infrared

- Hikvision

- Teledyne Technologies

- L3Harris Technologies

- Lockheed Martin Corporation

- Axis Communications

- Opgal Optronic Industries

- Thermoteknix Systems Ltd.

- BAE Systems

- Raytheon Technologies

- Bosch Security Systems

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Defence, Bureau of Industry and Security)

Thermal Imaging Manufacturers

Industrial Automation Companies

Security and Surveillance Agencies

Healthcare Equipment Distributors

Infrastructure and Construction Firms

Defense Contractors

1. Asia Pacific Thermal Imaging Systems Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Thermal Imaging Systems Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Thermal Imaging Systems Market Analysis

3.1 Growth Drivers (Key Metrics)

3.1.1 Rise in Defense Spending (USD in Investments)

3.1.2 Infrastructure Development and Security Enhancements (Project Count)

3.1.3 Adoption in Industrial Applications (Units of Equipment Used)

3.1.4 Technological Advancements in Sensor Accuracy (Innovation Count)

3.2 Market Challenges (Key Barriers)

3.2.1 High Initial Costs for Installation (Investment Range)

3.2.2 Limited Awareness in Emerging Markets (Market Penetration Rate)

3.2.3 Technical Limitations in Specific Applications (R&D Limitations)

3.3 Opportunities (Current Market Scope)

3.3.1 Expansion into Commercial Real Estate Security (Facility Adoption Rate)

3.3.2 Integration with IoT and AI Technologies (Adoption Projects)

3.3.3 Strategic Partnerships with Government Bodies (Agreements Signed)

3.4 Trends (Key Indicators)

3.4.1 Increased Demand in Automotive Safety (Market Initiatives)

3.4.2 Integration in Health Monitoring Systems (Product Launch Count)

3.4.3 Development of Lightweight Portable Systems (Product Innovation Rate)

3.5 Government Regulation (Policy and Compliance)

3.5.1 Defense and Security Initiatives (Budget Allocation)

3.5.2 Safety Standards for Public Infrastructure (Compliance Guidelines)

3.5.3 Trade Regulations on Thermal Equipment (Regulatory Imports)

3.5.4 Certification Protocols for Industrial Use (Regulatory Standards)

3.6 SWOT Analysis (Market-specific Factors)

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Thermal Imaging Systems Market Segmentation

4.1 By Application (Units or Value USD)

4.1.1 Defense and Military

4.1.2 Surveillance and Security

4.1.3 Automotive and Transportation

4.1.4 Healthcare and Medical Use

4.1.5 Industrial Monitoring

4.2 By Technology (USD Value)

4.2.1 Uncooled Thermal Imaging

4.2.2 Cooled Thermal Imaging

4.3 By Component (Market Shares by Segment)

4.3.1 Cameras

4.3.2 Modules

4.3.3 Software Solutions

4.4 By End-User (Revenue Split)

4.4.1 Government

4.4.2 Commercial

4.4.3 Residential

4.5 By Region (Geographic Demand)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 South Korea

5. Asia Pacific Thermal Imaging Systems Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 FLIR Systems

5.1.2 Fluke Corporation

5.1.3 Axis Communications

5.1.4 L3Harris Technologies

5.1.5 Opgal Optronic Industries

5.1.6 Leonardo S.p.A.

5.1.7 Testo SE & Co. KGaA

5.1.8 Raytheon Technologies

5.1.9 BAE Systems

5.1.10 Lockheed Martin

5.1.11 Hikvision Digital Technology

5.1.12 Guide Infrared

5.1.13 ULIS Infrared Sensors

5.1.14 NEC Corporation

5.1.15 Honeywell International

5.2 Cross Comparison Parameters (Revenue, Technology Focus, Key Markets, R&D Expenditure, Employee Strength, Product Portfolio, Market Strategy, Key Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Investments and Innovations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Thermal Imaging Systems Market Regulatory Framework

6.1 Compliance Requirements for Defense Applications

6.2 Certification Standards for Industrial Use

6.3 Safety Protocols and Installation Guidelines

7. Asia Pacific Thermal Imaging Systems Future Market Size (Projected USD)

7.1 Market Size Projections

7.2 Key Factors Driving Market Growth

8. Asia Pacific Thermal Imaging Systems Future Market Segmentation

8.1 By Application

8.2 By Technology

8.3 By Component

8.4 By End-User

8.5 By Region

9. Asia Pacific Thermal Imaging Systems Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Table of Contents

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, a comprehensive ecosystem map of the Asia Pacific Thermal Imaging Systems market was constructed. Extensive desk research involving secondary and proprietary databases was conducted to collect industry-level information and identify critical market variables.

Step 2: Market Analysis and Construction

Historical data for the Asia Pacific market was analyzed, covering market penetration and revenue generation metrics across various applications and product types. Service quality metrics were evaluated to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through expert consultations. Industry experts representing key companies provided insights into financial and operational factors, allowing for a more refined market analysis.

Step 4: Research Synthesis and Final Output

In the final phase, interviews were conducted with thermal imaging manufacturers to acquire specific data on product segments, sales trends, and consumer preferences. These inputs were cross-referenced with a bottom-up analysis to produce a validated report for the Asia Pacific Thermal Imaging Systems market.

Frequently Asked Questions

-

How big is the Asia Pacific Thermal Imaging Systems Market?

The Asia Pacific Thermal Imaging Systems Market is valued at USD 3.8 billion, driven by rising demand in defense, healthcare, and industrial applications. -

What are the challenges in the Asia Pacific Thermal Imaging Systems Market?

Key challenges include high production costs, stringent government regulations, and the limited technical expertise required for system integration. -

Who are the major players in the Asia Pacific Thermal Imaging Systems Market?

Major players include FLIR Systems, Infrared Cameras Inc., Seek Thermal, Hanwha Techwin, and Guide Infrared, known for their extensive product range and market reach. -

What drives the growth of the Asia Pacific Thermal Imaging Systems Market?

Growth is propelled by technological advancements, government spending on defense, and increased applications in healthcare and industrial automation. -

What applications are prominent in the Asia Pacific Thermal Imaging Systems Market?

Prominent applications include defense & surveillance, industrial automation, and healthcare, each benefiting from the non-invasive, reliable imaging solutions offered by thermal technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.