Asia Pacific TPU (Thermoplastic Polyurethane) Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD4062

November 2024

98

About the Report

Asia Pacific Thermoplastic Polyurethane Market Overview

- The Asia Pacific TPU market is valued at USD 2.5 billion, driven by strong demand across multiple industries such as automotive, footwear, and electronics. The growing preference for lightweight materials in manufacturing, especially in the automotive sector, coupled with the expanding demand for durable footwear, has played a pivotal role in boosting TPU consumption.

- Countries such as China, Japan, and South Korea dominate the market due to their large-scale automotive and electronics manufacturing capabilities. China's rapid industrialization and its leadership in footwear production, coupled with Japan and South Koreas high demand for advanced electronics and automotive parts, have made these countries the powerhouses in TPU consumption.

- The Chinese government, under its "Made in China 2025" initiative, is pushing for advanced manufacturing, with a focus on high-tech materials like TPU. This initiative, backed by a $300 billion investment plan, aims to reduce dependency on imports and promote domestic production of high-performance materials, including TPU. This support is boosting local TPU production capacity and innovation.

Asia Pacific Thermoplastic Polyurethane Market Segmentation

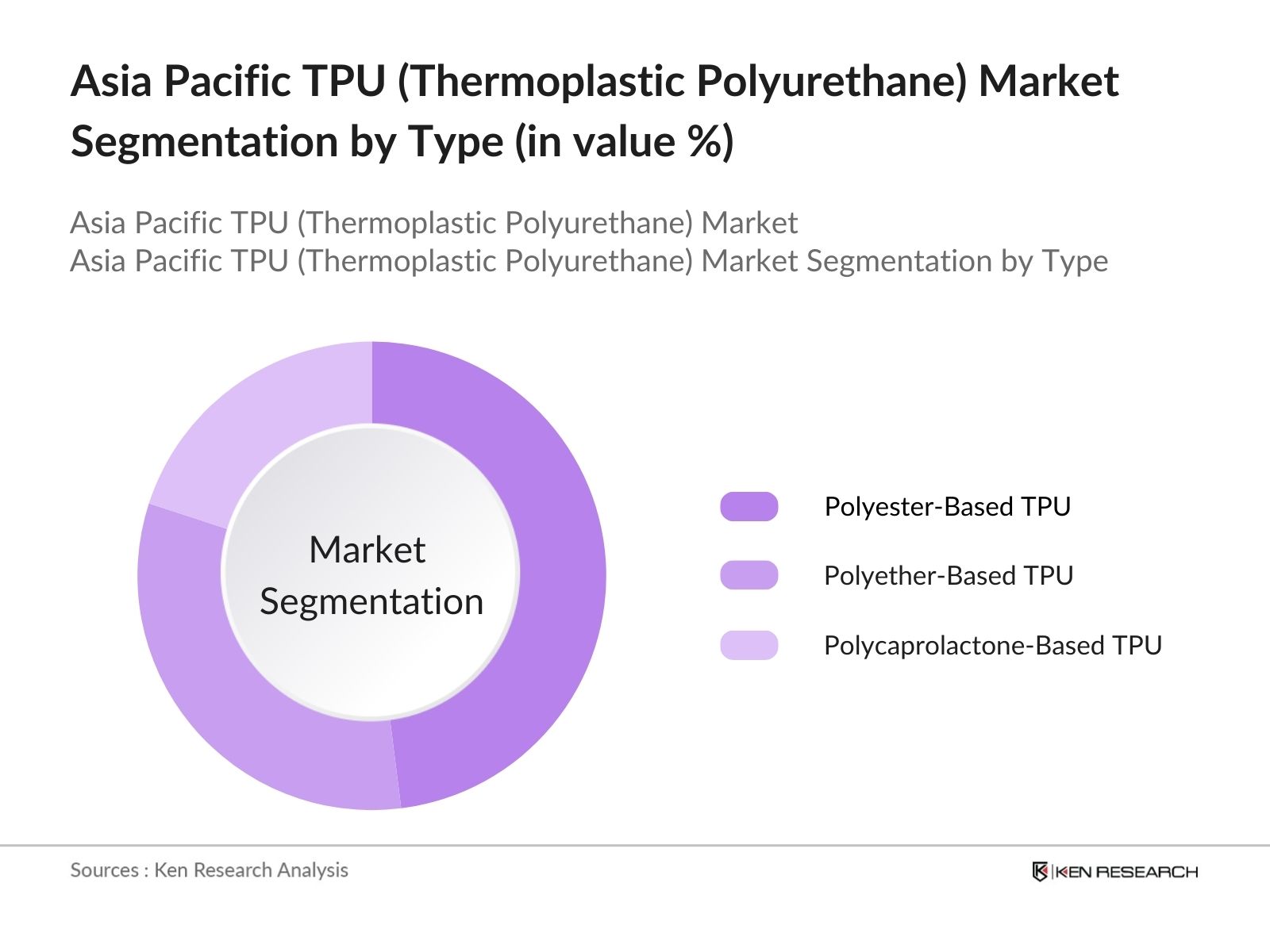

By Type: The market is segmented by type into polyester-based TPU, polyether-based TPU, and polycaprolactone-based TPU. Polyester-based TPU holds the dominant market share due to its superior mechanical properties such as abrasion resistance and flexibility, which make it suitable for high-performance applications like automotive and footwear. Additionally, polyester-based TPUs cost-effectiveness and compatibility with various manufacturing processes like injection molding and extrusion contribute to its widespread adoption across industries.

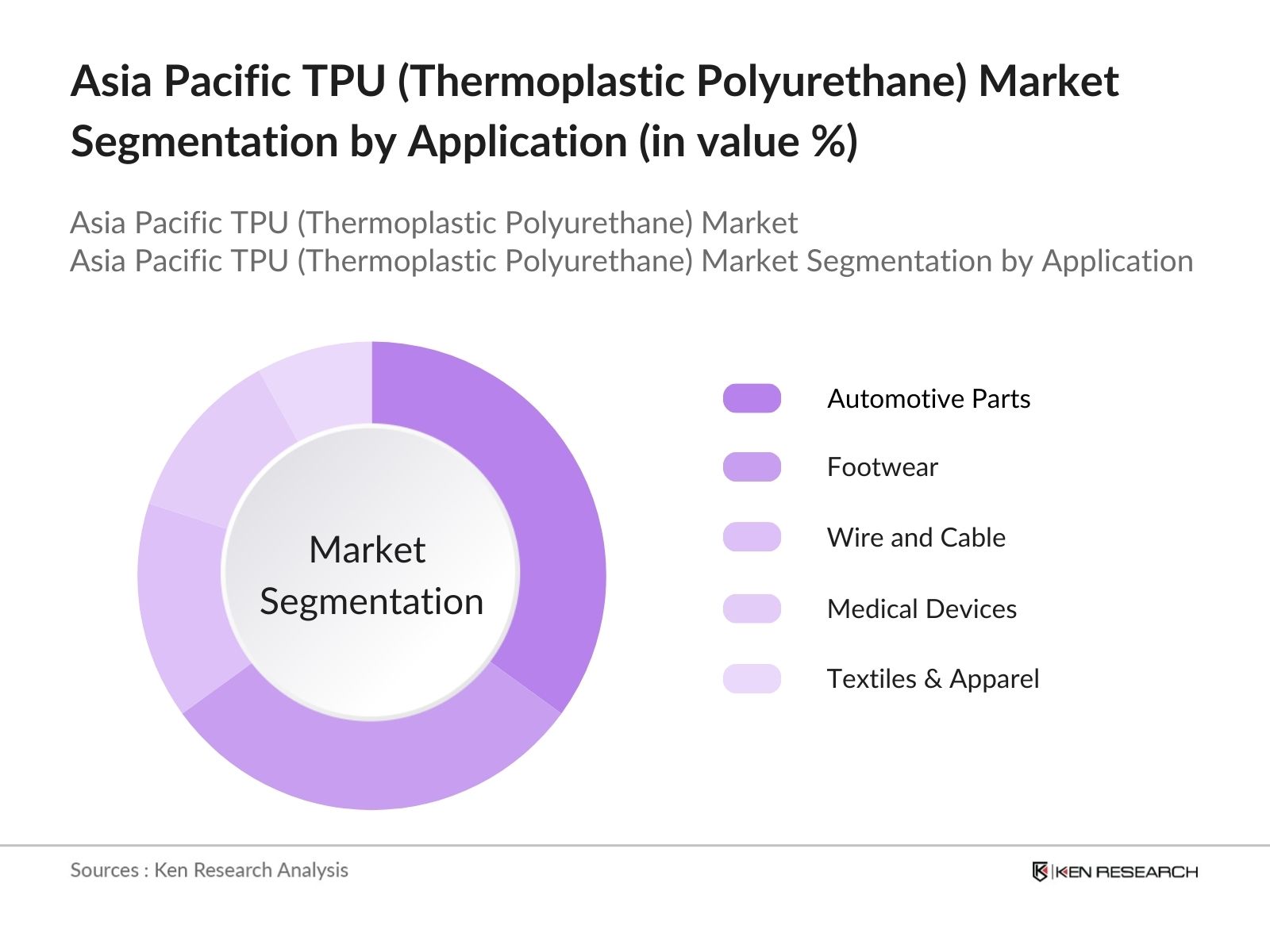

By Application: The market is segmented by application into automotive parts, footwear, wire and cable, medical devices, and textiles & apparel. The automotive parts segment dominates the market due to the rising demand for lightweight, durable materials that improve fuel efficiency and reduce emissions. TPUs flexibility, toughness, and resistance to oils and greases make it ideal for various automotive applications such as instrument panels, door panels, and seals.

Asia Pacific Thermoplastic Polyurethane Market Competitive Landscape

The market is dominated by a mix of global and regional players, leveraging their strong manufacturing capabilities and extensive distribution networks. These companies have established long-term partnerships with industries such as automotive, footwear, and electronics, contributing to their market dominance.

|

Company |

Establishment Year |

Headquarters |

Production Capacity (Tons/Year) |

R&D Investment (USD Mn) |

No. of Patents Held |

Revenue (USD Bn) |

Global Presence |

|

BASF SE |

1865 |

Germany |

|||||

|

Covestro AG |

2015 |

Germany |

|||||

|

Lubrizol Corporation |

1928 |

United States |

|||||

|

Huntsman Corporation |

1970 |

United States |

|||||

|

Wanhua Chemical Group Co. |

1998 |

China |

Asia Pacific Thermoplastic Polyurethane Market Analysis

Market Growth Drivers

- Automotive Industry Expansion in Asia Pacific: The demand for TPU in automotive applications, such as interior parts, cables, and exterior components, is rising due to the region's strong automotive production base. In 2023, Asia Pacific produced over 40 million vehicles, accounting for more than 60% of global automotive production. Countries like China, India, and South Korea are key contributors. Thermoplastic Polyurethane is highly preferred due to its durability, flexibility, and abrasion resistance, driving demand for TPU in the automotive sector.

- Rising Footwear Manufacturing Asia Pacific, particularly China and Vietnam, leads the global footwear market, producing around 8.9 billion pairs of shoes in 2023. TPU is increasingly used in shoe manufacturing due to its lightweight nature, high resilience, and ability to improve comfort and performance. This growth in footwear manufacturing significantly boosts the TPU market. Major footwear brands are increasingly outsourcing production to Asia, driving the demand for TPU materials in footwear.

- Growth in the Electronics Industry: The region is a major hub for electronics production, with countries like China, Japan, and South Korea contributing heavily to global electronics output, valued at over $1 trillion in 2024. TPU is widely used in protective coatings and flexible electronics components such as smartphone cases and wearable devices. The durability and flexibility of TPU make it a preferred material in the booming consumer electronics sector, enhancing its demand in the region.

Market Challenges

- Environmental Regulations: Governments across Asia Pacific are tightening environmental regulations concerning the production and disposal of plastic-based materials. Countries like China and India have introduced stricter pollution control measures in 2023, targeting industries using polyurethane. TPU producers face increased regulatory pressures to adopt sustainable practices, including the use of bio-based alternatives or improving recycling processes, which can raise production costs and limit market expansion.

- Competition from Alternative Materials: The TPU market faces competition from alternative materials like polyvinyl chloride (PVC) and silicone, which are also used in similar applications such as automotive parts, footwear, and electronics. In 2023, these materials accounted for a significant portion of the market share in various industries. PVC, for example, is more cost-effective in some applications, presenting a challenge for TPU manufacturers to justify the higher cost of TPU.

Asia Pacific Thermoplastic Polyurethane Market Future Outlook

Over the next five years, the Asia Pacific TPU industry is expected to experience growth driven by the rising demand for durable, flexible, and lightweight materials across various sectors. Government regulations promoting eco-friendly products, coupled with advancements in TPU processing technologies, will further propel market growth.

Future Market Opportunities

- Increased Demand for Sustainable TPU: Over the next five years, Asia Pacific will see a shift towards sustainable TPU, driven by governmental regulations and consumer demand for eco-friendly materials. The bio-based TPU market is expected to witness a growth in applications, particularly in automotive and electronics, where environmental concerns are paramount. By 2028, nearly 1.5 million metric tons of bio-based TPU is projected to be consumed annually in the region.

- Growth in Electric Vehicle Applications: The demand for TPU in electric vehicles (EVs) will grow exponentially as countries like China, India, and South Korea aim for substantial EV adoption by 2028. The Asia Pacific region is forecasted to produce over 10 million EVs annually by 2027. TPU will play a critical role in manufacturing lightweight, durable components, especially in battery protection and cable insulation, contributing to enhanced vehicle performance.

Scope of the Report

|

By Type |

Polyester-Based TPU Polyether-Based TPU Polycaprolactone-Based TPU |

|

By Application |

Automotive Parts Footwear Wire and Cable Medical Devices Textiles & Apparel |

|

By End-Use Industry |

Automotive Construction Healthcare Consumer Goods Industrial Manufacturing |

|

By Technology |

Extrusion Injection Molding Blown Film Adhesive Coating |

|

By Region |

China India Japan South Korea Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Footwear Manufacturers

Electronics Manufacturers

Wire and Cable Producers

Medical Device Companies

Government and Regulatory Bodies (Ministry of Industry and Information Technology, Japan Ministry of Economy, Trade, and Industry)

Investments and Venture Capitalist Firms

Polymer Research and Development Institutions

Companies

Players Mentioned in the Report:

BASF SE

Covestro AG

Lubrizol Corporation

Huntsman Corporation

Wanhua Chemical Group Co., Ltd.

Coim Group

Epaflex Polyurethanes

Polyone Corporation

Miracll Chemicals Co., Ltd.

Hexpol AB

Avient Corporation

Kuraray Co., Ltd.

Asahi Kasei Corporation

Huafon Group

Tosoh Corporation

Table of Contents

1. Asia Pacific TPU Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Market Value Growth)

1.4. Market Segmentation Overview (Type, Application, End-Use Industry, Region, Technology)

2. Asia Pacific TPU Market Size (In USD Bn)

2.1. Historical Market Size (Value and Volume)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Production Capacities, New Plant Setups, Key Partnerships)

3. Asia Pacific TPU Market Analysis

3.1. Growth Drivers

3.1.1. Growth in Automotive Sector (Increased demand for lightweight and durable materials)

3.1.2. Rising Demand in Footwear and Apparel (Expansion of sports and leisurewear)

3.1.3. Advancements in TPU Processing Technologies (Additive Manufacturing, Extrusion, Injection Molding)

3.1.4. Increasing Adoption in Electronics (Wearables, Flexible Devices)

3.1.5. Government Regulations Promoting Sustainable Polymers (Circular Economy Initiatives)

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices (Fluctuation in the price of polyols and diisocyanates)

3.2.2. Limited Recycling Infrastructure (Challenges in TPU recycling and reuse)

3.2.3. Intense Competition from Substitutes (Silicone, Rubber, and Other Elastomers)

3.2.4. High Processing Costs (Energy consumption in TPU production)

3.3. Opportunities

3.3.1. Increased Focus on Biodegradable TPUs (Sustainability Goals)

3.3.2. Growing Automotive Electrification (Need for TPU in EV battery housing, cable insulation)

3.3.3. Expansion in Emerging Markets (Southeast Asia, South Asia growth potential)

3.3.4. Strategic Collaborations with OEMs (Long-term supply contracts with automotive and footwear OEMs)

3.4. Trends

3.4.1. TPU in 3D Printing (Expansion in rapid prototyping)

3.4.2. Customization of TPU Grades (Specialty TPUs for niche applications like medical devices)

3.4.3. Shift Towards Bio-based TPUs (Development in eco-friendly TPU manufacturing)

3.4.4. TPU in Smart Fabrics and Wearables (Integration into IoT-driven apparel)

3.5. Government Regulations

3.5.1. Environmental Policies on Plastics (Asia-Pacific regional policies)

3.5.2. Sustainable Manufacturing Initiatives (Government support for bio-based TPU development)

3.5.3. Automotive Emission Standards (Impact on automotive material choice)

3.5.4. Import/Export Tariffs on Polymers (Impact of trade policies on TPU market)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Raw Material Suppliers, TPU Manufacturers, Distributors, End-Users)

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of Substitutes

3.8.4. Threat of New Entrants

3.8.5. Industry Rivalry

3.9. Competition Ecosystem (Key Players, Market Positioning, New Product Launches)

4. Asia Pacific TPU Market Segmentation

4.1. By Type (In Value and Volume %)

4.1.1. Polyester-Based TPU

4.1.2. Polyether-Based TPU

4.1.3. Polycaprolactone-Based TPU

4.2. By Application (In Value and Volume %)

4.2.1. Automotive Parts

4.2.2. Footwear

4.2.3. Wire and Cable

4.2.4. Medical Devices

4.2.5. Textiles & Apparel

4.3. By End-Use Industry (In Value and Volume %)

4.3.1. Automotive

4.3.2. Construction

4.3.3. Healthcare

4.3.4. Consumer Goods

4.3.5. Industrial Manufacturing

4.4. By Technology (In Value and Volume %)

4.4.1. Extrusion

4.4.2. Injection Molding

4.4.3. Blown Film

4.4.4. Adhesive Coating

4.5. By Region (In Value and Volume %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

4.5.6. Rest of APAC

5. Asia Pacific TPU Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Covestro AG

5.1.3. Lubrizol Corporation

5.1.4. Huntsman Corporation

5.1.5. Wanhua Chemical Group Co., Ltd.

5.1.6. Coim Group

5.1.7. Epaflex Polyurethanes

5.1.8. Polyone Corporation

5.1.9. Miracll Chemicals Co., Ltd.

5.1.10. Hexpol AB

5.1.11. Avient Corporation

5.1.12. Kuraray Co., Ltd.

5.1.13. Asahi Kasei Corporation

5.1.14. Huafon Group

5.1.15. Tosoh Corporation

5.2 Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Production Capacity

5.2.6. R&D Investment

5.2.7. Patents Held

5.2.8. Global Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Products, Partnerships, Joint Ventures)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific TPU Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific TPU Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific TPU Future Market Segmentation

8.1. By Type

8.2. By Application

8.3. By End-Use Industry

8.4. By Technology

8.5. By Region

9. Asia Pacific TPU Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map encompassing all major stakeholders in the Asia Pacific TPU Market. Through extensive desk research and proprietary databases, we identify critical variables that shape the market, including material demand, supply chain structures, and end-user industries.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data on TPU demand and supply across key applications like automotive, footwear, and electronics. We assess market penetration and product pricing dynamics, compiling insights on revenue generation and capacity utilization.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, we engage with industry experts from TPU manufacturers and end-user industries. This consultation process includes structured interviews and surveys to obtain real-time insights into market dynamics.

Step 4: Research Synthesis and Final Output

In this final phase, we integrate data from both desk research and expert consultations to construct a robust market model. This approach ensures accurate forecasts of future TPU market trends, capacity expansions, and opportunities.

Frequently Asked Questions

01. How big is the Asia Pacific TPU Market?

The Asia Pacific TPU market is valued at USD 2.5 billion, driven by increasing demand from automotive, footwear, and electronics sectors. The market benefits from a strong manufacturing infrastructure across major countries like China, Japan, and South Korea.

02. What are the challenges in the Asia Pacific TPU Market?

The Asia Pacific TPU market faces challenges such as volatile raw material prices and limited recycling infrastructure. Competition from other flexible materials like silicone and elastomers further intensifies market dynamics.

03. Who are the major players in the Asia Pacific TPU Market?

Key players in the Asia Pacific TPU market include BASF SE, Covestro AG, Lubrizol Corporation, Huntsman Corporation, and Wanhua Chemical Group Co., Ltd. These companies dominate through their extensive production capacities and strong R&D initiatives.

04. What are the growth drivers of the Asia Pacific TPU Market?

Growth drivers in the Asia Pacific TPU market include increasing demand for lightweight and durable materials in the automotive sector, advancements in TPU processing technologies, and expanding applications in footwear and electronics industries.

05. What are the dominant countries in the Asia Pacific TPU Market?

China, Japan, and South Korea dominate the Asia Pacific TPU market due to their well-established manufacturing sectors and large-scale production of automotive parts, footwear, and electronics, which are key end-use industries for TPU.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.