Asia-Pacific Tile Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD7981

November 2024

99

About the Report

Asia-Pacific Tile Market Overview

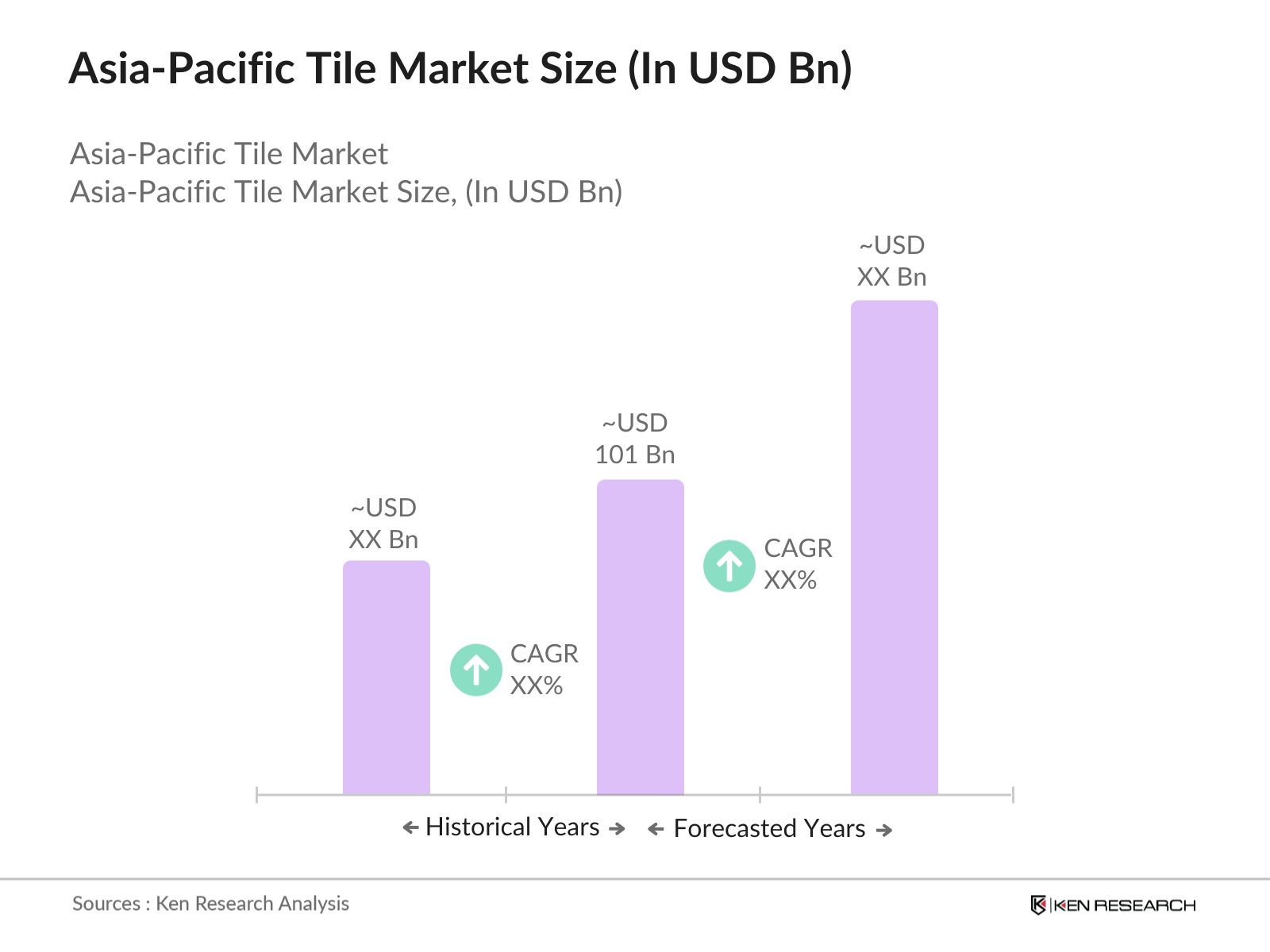

- The Asia-Pacific Tile Market has grown significantly, reaching a market valuation of USD 101 billion based on a five-year historical analysis. This growth is driven primarily by the rapid expansion of construction activities across the region, particularly in residential and commercial sectors. The demand for tiles is primarily fueled by the rising number of infrastructure development projects and increasing renovation activities in key markets such as China and India. Additionally, the growing preference for aesthetically appealing and durable flooring solutions has accelerated market expansion.

- In terms of regional dominance, China and India lead the Asia-Pacific Tile Market due to their massive construction sectors and robust manufacturing capabilities. China, with its highly developed manufacturing ecosystem, not only serves as a significant consumer but also as a top producer of tiles. India, on the other hand, is experiencing a construction boom, driven by urbanization and government initiatives such as affordable housing programs, contributing to the country's growing consumption of tiles. These factors explain why these countries are pivotal to the Asia-Pacific Tile Market.

- The Indian governments Smart Cities Mission, with over 100 cities slated for development by 2025, is driving tile demand for new public infrastructure projects such as airports, metro stations, and public housing. In 2024, the mission resulted in a surge in demand for ceramic tiles in government projects worth over INR 50 billion.

Asia-Pacific Tile Market Segmentation

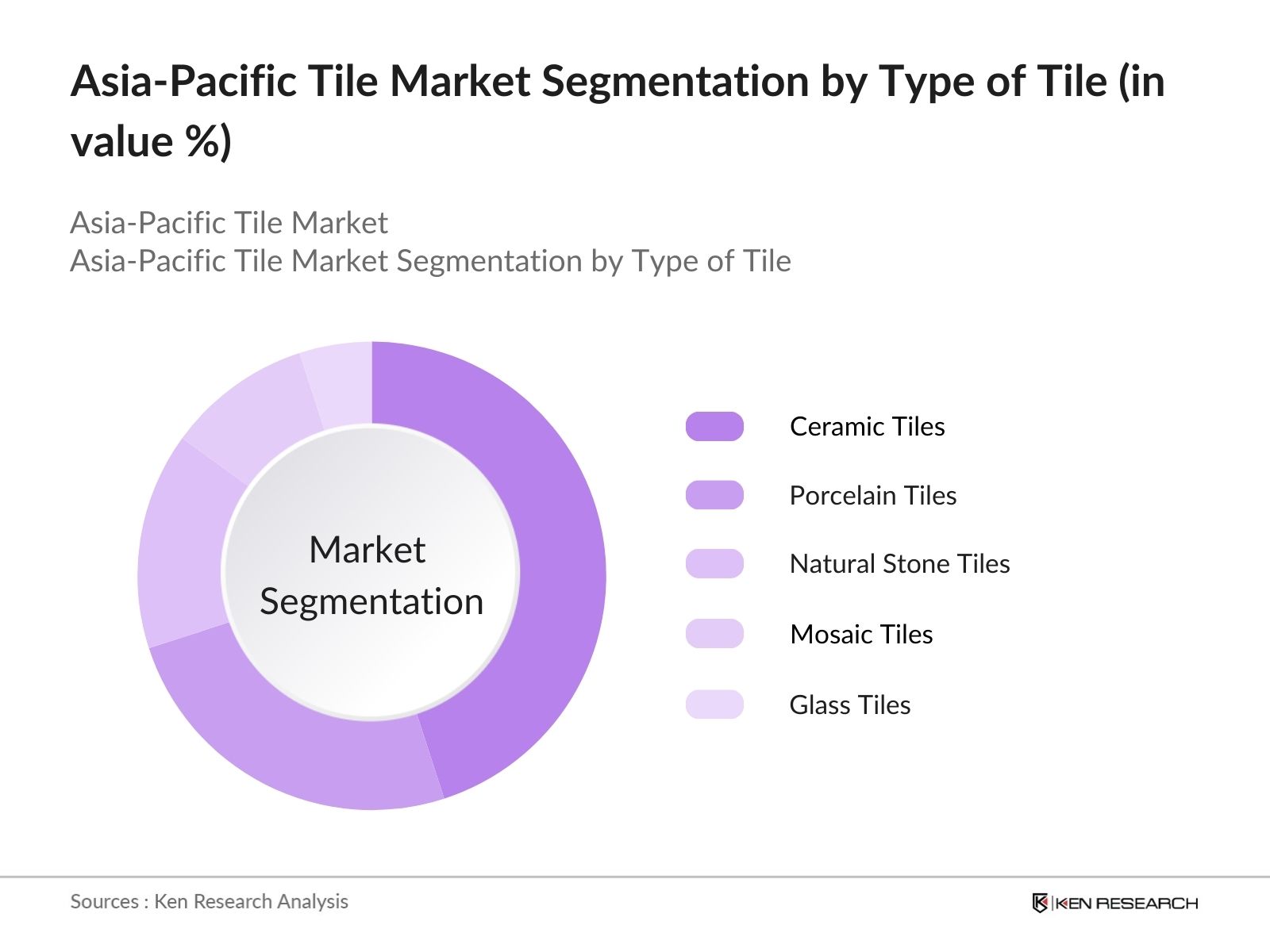

By Type of Tile:

The Asia-Pacific Tile Market is segmented by type of tile into ceramic tiles, porcelain tiles, natural stone tiles, mosaic tiles, and glass tiles. Ceramic tiles hold a dominant market share under this segmentation. This is primarily due to their affordability and widespread availability. Ceramic tiles have become the go-to solution for residential applications, where cost-effectiveness is a critical factor. Furthermore, the variety of designs and easy installation options contribute to their popularity in both new construction and renovation projects.

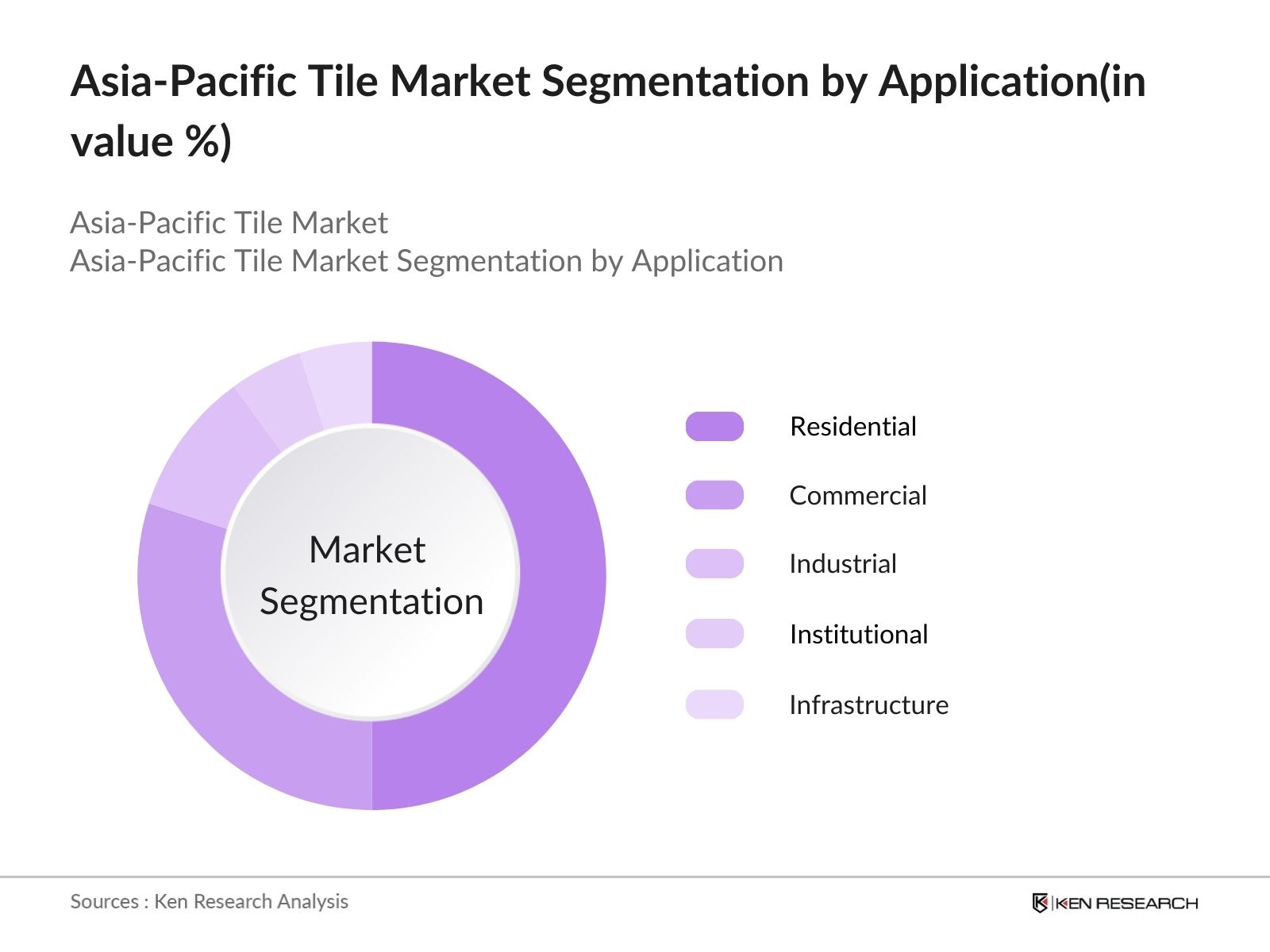

By Application:

The Asia-Pacific Tile Market is segmented by application into residential, commercial, industrial, institutional, and infrastructure. The residential segment dominates the market due to the regions booming housing sector. Countries like China, India, and Southeast Asian nations have seen increased residential construction due to growing urbanization and government-led affordable housing programs. The demand for aesthetically pleasing and cost-effective flooring solutions, particularly for kitchens and bathrooms, has propelled the dominance of this segment.

Asia-Pacific Tile Market Competitive Landscape

The Asia-Pacific Tile Market is dominated by both regional players and multinational companies that have established a strong foothold in the region. The market remains competitive due to the high demand for construction materials, particularly tiles. Some of the major players include Kajaria Ceramics, RAK Ceramics, and Mohawk Industries. These companies have built a robust supply chain and manufacturing capabilities to cater to the rising demand. The consolidation within the market indicates a clear concentration of power among these key players.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Tile Output Capacity |

Geographic Footprint |

Product Portfolio |

R&D Investment |

Market Position |

|---|---|---|---|---|---|---|---|---|

|

Kajaria Ceramics |

1985 |

India |

- |

- |

- |

- |

- |

- |

|

RAK Ceramics |

1989 |

United Arab Emirates |

- |

- |

- |

- |

- |

- |

|

Mohawk Industries |

1878 |

United States |

- |

- |

- |

- |

- |

- |

|

SCG Ceramics |

1913 |

Thailand |

- |

- |

- |

- |

- |

- |

|

Asian Granito India Ltd. |

2000 |

India |

- |

- |

- |

- |

- |

- |

Asia-Pacific Tile Market Analysis

Growth Drivers

- Increase in Residential Construction: The growing demand for residential housing across major Asia-Pacific nations like India and China has significantly boosted the tile market. By 2024, it is estimated that India alone will see construction of over 25 million residential units, driving demand for ceramic and vitrified tiles in both rural and urban regions. This trend is driven by government housing schemes such as India's Pradhan Mantri Awas Yojana, which aims to provide housing for all, encouraging higher tile consumption in new projects.

- Growth in Real Estate Development in Key Markets: Real estate developments, especially in urban centers, are pushing demand for high-quality tiles in both residential and commercial projects. The Chinese government is implementing measures such as expanding a "whitelist" program to facilitate financing for troubled developers, with expectations that total loans for these projects could reach around4 trillion yuan(approximately$561.8 billion) by the end of 2024

- Rise in Commercial and Retail Spaces: With increased foreign direct investment in retail and commercial infrastructure, nations like Australia, Japan, and South Korea are witnessing an uptick in the construction of shopping malls, offices, and retail outlets. In 2024, Japans retail space development expanded by 500,000 square meters across metropolitan regions, driving tile demand in flooring and wall applications.

Market Challenges

- High Raw Material Costs: The cost of essential raw materials such as clay and silica has increased in 2024 due to supply chain disruptions and inflation. In India, the average cost of clay rose to INR 3,000 per ton, significantly impacting the profitability of tile manufacturers who rely on consistent material supplies for large-scale production.

- Regulatory Compliance for Quality Standards: Countries in the Asia-Pacific region face stringent regulatory frameworks concerning tile quality. In 2024, nations like Australia enforced compliance with AS 4459 standards for ceramic tiles, leading to additional costs for manufacturers to meet local and international standards, thereby challenging smaller manufacturers.

Asia-Pacific Tile Market Future Outlook

Over the next five years, the Asia-Pacific Tile Market is expected to witness robust growth, driven by sustained demand in residential construction and infrastructure projects. Governments in countries like India, Indonesia, and Vietnam are investing heavily in infrastructure development, boosting the demand for tiles. The shift towards eco-friendly and energy-efficient building materials is also expected to shape the future of the tile market, with manufacturers increasingly adopting sustainable production methods.

Market Opportunities

- Digital Printing and Customization: Advances in digital printing technology allow manufacturers to create customized tile designs, appealing to both commercial and residential customers. In 2024, over 75% of newly manufactured tiles in China used digital printing methods, significantly enhancing design options and boosting market competitiveness.

- Expansion into Eco-Friendly Tiles: There is a growing demand for eco-friendly tiles that use sustainable or recycled materials. For instance, in 2024, Japan and Australia witnessed a surge in demand for tiles made from recycled materials, such as glass and plastics, due to their government mandates on sustainable construction. The market for these tiles is estimated to be worth over $300 million across the region.

Scope of the Report

|

By Type of Tile |

Ceramic Tiles Porcelain Tiles Natural Stone Tiles Mosaic Tiles Glass Tiles |

|

By Application |

Residential Commercial Industria Institutional Infrastructure |

|

By Installation Type |

Floor Tiles Wall Tiles Roof Tiles Ceiling Tiles Facade Tiles |

|

By Distribution Channel |

Offline Online |

|

By Region |

China India Australia Southeast Asia Rest of Asia-Pacific |

Products

Key Target Audience

Tile Manufacturers

Raw Material Suppliers (Clay, Silica, Pigments)

Construction Companies

Real Estate Developers

Government and Regulatory Bodies (Ministry of Housing and Urban Affairs, National Building Organization)

Investors and Venture Capitalist Firms

Architects and Interior Designers

Infrastructure Development Agencies (Asia Infrastructure Investment Bank)

Companies

Players Mentioned in the Report:

Kajaria Ceramics

RAK Ceramics

Mohawk Industries

SCG Ceramics

Somany Ceramics

Asian Granito India Ltd.

China Ceramics Co., Ltd.

Pamesa Cermica

Grupo Lamosa

Dongpeng Holdings

Table of Contents

1. Asia-Pacific Tile Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Tile Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Tile Market Analysis

3.1. Growth Drivers (Consumer Demand, Real Estate Development, Export Market

3. Expansion, Government Infrastructure Projects)

3.1.1. Increase in Residential Construction

3.1.2. Growth in Urbanization in Key Markets

3.1.3. Rise in Commercial and Retail Spaces

3.1.4. Export Opportunities from Asia-Pacific to Emerging Markets

3.2. Market Challenges (Cost Structure, Raw Material Price Fluctuations, Regulatory Hurdles, Import Dependency)

3.2.1. High Raw Material Costs (Clay, Silica, etc.)

3.2.2. Regulatory Compliance for Quality Standards

3.2.3. Impact of Trade Tariffs and Import Restrictions

3.2.4. Logistics and Distribution Challenges

3.3. Opportunities (Innovation in Product Design, Green Building Initiatives, Digital Tile Printing Technology, Expansion of Online Retail)

3.3.1. Digital Printing and Customization

3.3.2. Expansion into Eco-Friendly Tiles

3.3.3. Opportunities in Sustainable and Recycled Materials

3.3.4. Increase in E-Commerce Channels for Distribution

3.4. Trends (Customization, Environmentally Friendly Products, Large Format Tiles, Increased Focus on Aesthetics)

3.4.1. Preference for Large-Sized Tiles in Residential Construction

3.4.2. Growth in Sustainable and Recycled Tiles

3.4.3. Rise in Demand for Customizable and Digitally Printed Tiles

3.4.4. Aesthetic Trends Influencing Product Innovation

3.5. Government Regulation (Building Codes, Trade Regulations, Environmental Regulations, Safety Standards)

3.5.1. Building Code Requirements for Tile Usage

3.5.2. Import Regulations on Raw Materials

3.5.3. Environmental Sustainability Policies for Manufacturers

3.5.4. Safety and Quality Compliance for Exports

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape Overview

4. Asia-Pacific Tile Market Segmentation

4.1. By Type of Tile (In Value %)

4.1.1. Ceramic Tiles

4.1.2. Porcelain Tiles

4.1.3. Natural Stone Tiles

4.1.4. Mosaic Tiles

4.1.5. Glass Tiles

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Institutional

4.2.5. Infrastructure

4.3. By Installation Type (In Value %)

4.3.1. Floor Tiles

4.3.2. Wall Tiles

4.3.3. Roof Tiles

4.3.4. Ceiling Tiles

4.3.5. Facade Tiles

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Retailers, Distributors, Contractors)

4.4.2. Online (E-commerce Platforms, Direct Sales)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Australia

4.5.4. Southeast Asia

4.5.5. Rest of Asia-Pacific

5. Asia-Pacific Tile Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Kajaria Ceramics

5.1.2. RAK Ceramics

5.1.3. SCG Ceramics

5.1.4. Somany Ceramics

5.1.5. Mohawk Industries

5.1.6. Pamesa Cermica

5.1.7. Grupo Lamosa

5.1.8. Victoria PLC

5.1.9. Johnson Tiles

5.1.10. Dongpeng Holdings

5.1.11. Asian Granito India Ltd.

5.1.12. China Ceramics Co., Ltd.

5.1.13. Marazzi Group

5.1.14. Florida Tile

5.1.15. Nitco Ltd.

5.2. Cross Comparison Parameters (Revenue, Tile Output Capacity, Geographic Footprint, Product Portfolio, Certifications, Distribution Networks, R&D Investment, Market Position)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Asia-Pacific Tile Market Regulatory Framework

6.1. Building and Construction Codes

6.2. Environmental Compliance for Tile Manufacturing

6.3. Import and Export Regulations

6.4. Certification and Quality Standards

7. Asia-Pacific Tile Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Tile Market Future Segmentation

8.1. By Type of Tile (In Value %)

8.2. By Application (In Value %)

8.3. By Installation Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Tile Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involved developing a comprehensive ecosystem map of the Asia-Pacific Tile Market. Secondary research was employed to identify critical variables affecting market dynamics, including manufacturing processes, supply chains, and distribution networks.

Step 2: Market Analysis and Construction

We gathered historical data on market size and growth drivers by assessing revenue generation, market penetration, and regional demand trends. Key market milestones were identified to evaluate the competitive landscape and strategic movements of leading players.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we conducted telephonic interviews with industry experts, including senior executives from tile manufacturing companies. Their insights were instrumental in validating hypotheses and refining market forecasts.

Step 4: Research Synthesis and Final Output

The final stage focused on synthesizing the data gathered from both primary and secondary research. Key trends, such as the shift towards large format tiles and eco-friendly materials, were highlighted, ensuring an accurate and comprehensive market analysis.

Frequently Asked Questions

01. How big is the Asia-Pacific Tile Market?

The Asia-Pacific Tile Market is valued at USD 101 billion, driven by rising residential and commercial construction activities across key markets like China, India, and Southeast Asia.

02. What are the challenges in the Asia-Pacific Tile Market?

Challenges include fluctuating raw material prices, compliance with environmental regulations, and high competition from local manufacturers. Additionally, import dependency on specific raw materials poses logistical issues.

03. Who are the major players in the Asia-Pacific Tile Market?

Key players in the Asia-Pacific Tile Market include Kajaria Ceramics, RAK Ceramics, Mohawk Industries, SCG Ceramics, and Asian Granito India Ltd., which dominate due to their extensive manufacturing capabilities and distribution networks.

04. What are the growth drivers of the Asia-Pacific Tile Market?

The Asia-Pacific Tile market is propelled by the region's rapid urbanization, increasing residential construction projects, and growing demand for aesthetically appealing, durable tiles in both residential and commercial sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.