Asia Pacific Toothpaste Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD3299

November 2024

89

About the Report

Asia Pacific Toothpaste Market Overview

- The Asia Pacific toothpaste market, valued at USD 10 billion, is driven by the rising focus on oral hygiene across the region. This growth is supported by increasing awareness among consumers regarding the benefits of oral health and the rise in demand for toothpaste with specialized features such as whitening, sensitivity reduction, and natural ingredients. The shift in consumer preferences towards organic and herbal products has also played a significant role in driving the market growth, alongside expanding urbanization and disposable incomes across emerging economies.

- Countries like China, India, and Japan dominate the Asia-Pacific toothpaste market due to their large populations, high consumer demand for advanced oral care products, and significant urbanization rates. China's dominance is bolstered by the growing middle class and its rising preference for premium and natural toothpaste products. India follows with its demand for both mass-market and herbal toothpaste, driven by increasing awareness and government oral health campaigns. Japan, with its aging population, flavoured toothpaste products that cater to specific needs such as dental sensitivity.

- Fluoride usage in toothpaste is strictly regulated across Asia Pacific markets. Countries like Japan and South Korea have established limits on the concentration of fluoride in toothpaste. In 2024, the Japanese government mandated that fluoride levels must not exceed 0.8 mg/litre to prevent adverse health effects. Similar regulations are in place in Australia, where the Therapeutic Goods Administration oversees fluoride content and safety labelling requirements, ensuring consumer protection from excessive fluoride intake.

Asia Pacific Toothpaste Market Segmentation

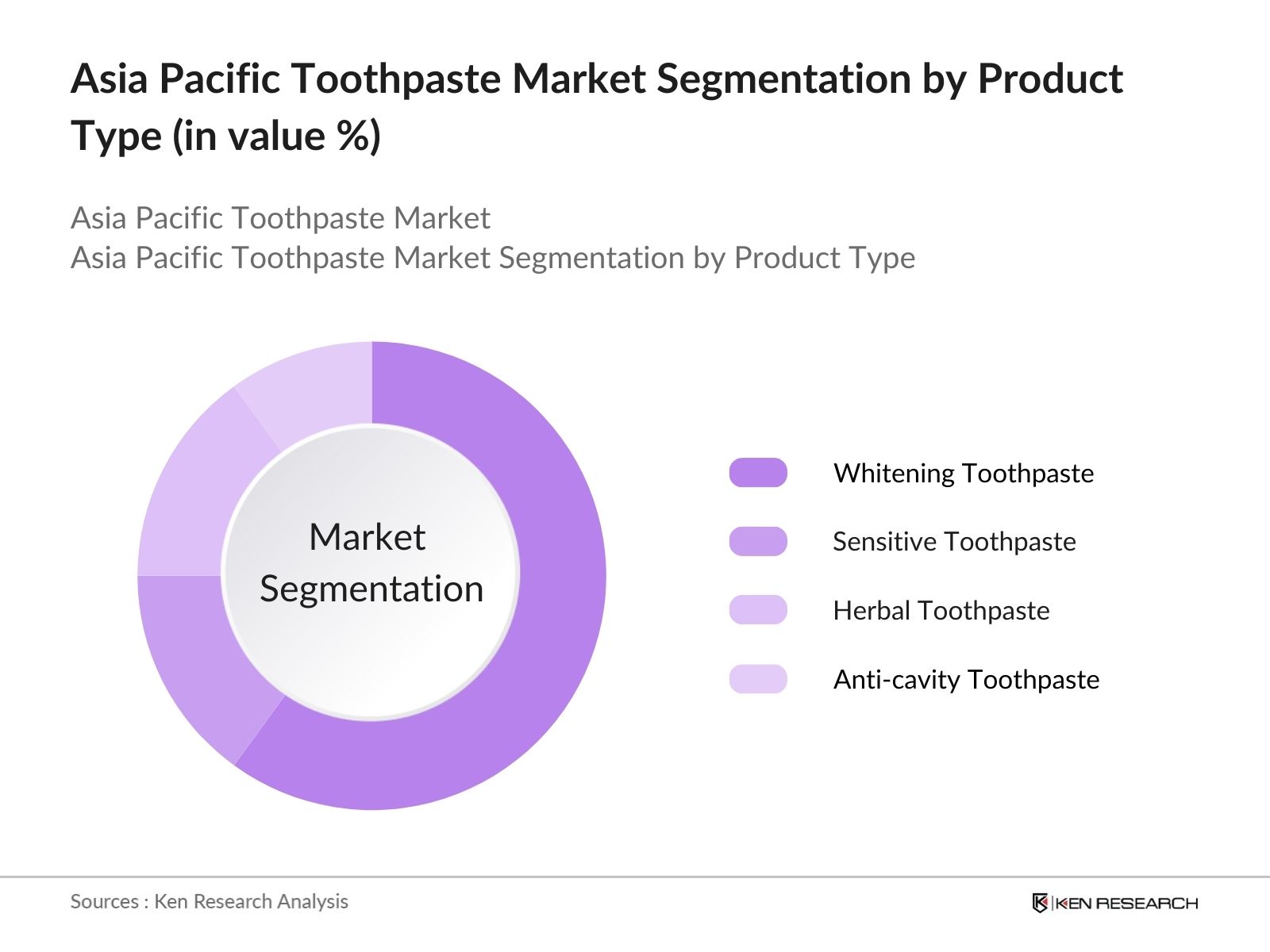

By Product Type: The Asia Pacific toothpaste market is segmented by product type into whitening toothpaste, sensitive toothpaste, herbal toothpaste, and anti-cavity toothpaste. Whitening toothpaste holds the dominant share in the market, largely due to the growing consumer interest in improving the aesthetics of their teeth. The influence of beauty standards and the increasing focus on cosmetic dental care in countries like China and South Korea have further amplified the demand for whitening toothpaste. Brands offering advanced formulations for enhanced whitening effects are contributing to this segment's growth.

By Application: The market is segmented by application into adults and children. Adult toothpaste products dominate the market with majority of market share due to the high demand for specialized oral care products such as sensitivity, whitening, and gum care toothpaste. In regions like Japan and Australia, the aging population seeks toothpaste that addresses sensitivity and gum health, further driving the dominance of the adult segment. Childrens toothpaste remains a niche segment but shows steady growth due to increasing oral hygiene awareness among parents and pediatric oral care initiatives.

Asia Pacific Toothpaste Market Competitive Landscape

The Asia Pacific toothpaste market is highly competitive, with several global and regional players competing for market dominance. Key players are focusing on innovation, product diversification, and expanding their distribution channels to reach a wider consumer base. The market is led by global giants like Colgate-Palmolive and Procter & Gamble, alongside regional players such as Dabur and Lion Corporation. This competitive landscape is characterized by the constant introduction of new products that cater to evolving consumer preferences, such as herbal and organic toothpaste, as well as premium offerings for specific oral health needs.

Table: Major Players in the Asia Pacific Toothpaste Market

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Geographical Reach |

Revenue (USD Bn) |

R&D Investment |

Market Strategy |

Distribution Network |

Customer Segments |

|

Colgate-Palmolive |

1806 |

New York, USA |

|||||||

|

Procter & Gamble |

1837 |

Cincinnati, USA |

|||||||

|

Unilever |

1929 |

London, UK |

|||||||

|

Dabur India Ltd. |

1884 |

Ghaziabad, India |

|||||||

|

Lion Corporation |

1891 |

Tokyo, Japan |

Asia Pacific Toothpaste Market Analysis

Growth Drivers

- Rising Oral Health Awareness: In the Asia Pacific region, increased health awareness is driving the toothpaste market, particularly in developing countries like India, Indonesia, and the Philippines. According to the World Health Organization (WHO), over 60% of children aged 619 experience dental caries, fueling demand for preventive dental care products like toothpaste. Governments are promoting national oral hygiene campaigns, such as Indias National Oral Health Program, which aims to reduce dental diseases through education and access to affordable care. Additionally, Japan's Ministry of Health has initiated policies encouraging regular dental check-ups and the use of fluoride toothpaste.

- Increasing Demand for Whitening Toothpaste: The demand for whitening toothpaste is expanding in urban areas of the Asia Pacific, where consumers are highly influenced by aesthetic concerns. In 2024, whitening toothpaste sales have surged, especially in China and South Korea, where personal appearance holds cultural significance. The China National Health Commission reports that 48% of urban households regularly use whitening toothpaste. Increased dental care and aesthetic concerns contribute to this demand, supported by consumer spending growth across major economies, with Chinas per capita expenditure on personal care products reaching $432 in 2024.

- Growth in Natural and Herbal Products: Consumers in the Asia Pacific region are increasingly favoring natural and herbal toothpaste formulations over synthetic ones due to rising concerns about chemical additives. According to Indias Ministry of Commerce, the demand for herbal toothpaste containing neem and clove extracts has seen significant growth. The global movement toward organic products, supported by governmental regulations like India's Organic Certification System, is driving this market segment. In 2024, India's export of herbal oral care products reached over $120 million, demonstrating both local and international demand for natural formulations.

Market Challenges

- Stringent Regulations on Ingredient Usage: Asia Pacific governments are tightening regulations on ingredients used in toothpaste formulations, specifically concerning fluoride content and chemical preservatives. In 2024, Indias Central Drugs Standard Control Organization issued stricter regulations on permissible levels of parabens in oral care products. Similarly, Japan's Ministry of Health limits the fluoride concentration to 0.8 mg/liter in over-the-counter toothpastes. These regulations challenge toothpaste manufacturers to reformulate products, increasing production costs and time to market, especially for multinational brands operating across multiple regulatory environments.

- High Brand Loyalty Among Consumers: Brand loyalty presents a significant challenge for new entrants into the Asia Pacific toothpaste market. In established markets like Japan and Australia, leading brands such as Colgate and Crest dominate, with over 70% of consumers regularly repurchasing the same brand, according to the Australia Bureau of Statistics. This loyalty is particularly strong in developed nations where consumers are less likely to experiment with new products. The challenge for smaller or newer brands is to break through these loyalty barriers by offering unique value propositions

Asia Pacific Toothpaste Market Future Outlook

Over the next five years, the Asia Pacific toothpaste market is expected to witness strong growth, driven by increasing consumer awareness about oral health, the rising preference for premium and natural products, and expanding e-commerce channels. The market will benefit from the growing middle-class population across emerging economies, particularly in China and India, where consumers are shifting towards specialized toothpaste products. Innovations in toothpaste formulations, such as those targeting dental sensitivity and natural ingredients, will continue to shape the market's future.

Market Opportunities

- Innovations in Toothpaste Formulations: Innovations in toothpaste formulations, such as the inclusion of probiotics for oral health and fluoride alternatives, are creating new growth opportunities. South Korea, renowned for its advancements in biotechnology, has seen the introduction of toothpaste that incorporates probiotic strains to promote oral flora balance. By 2024, South Korean manufacturers are exporting over 50 million units of these advanced oral care products to neighboring Asian countries. These innovations cater to health-conscious consumers seeking functional benefits beyond traditional toothpastes. Source.

- Untapped Rural Market Potential:; There is substantial growth potential in rural areas of India and Southeast Asia, where oral hygiene products are still underutilized. As of 2024, the World Bank reports that over 40% of Indias rural population lacks regular access to basic oral care products like toothpaste. Government programs, such as Indias Ayushman Bharat healthcare initiative, aim to improve access to healthcare products in these regions. Toothpaste companies can capitalize on this by offering affordable, accessible products targeted at rural consumers.

Scope of the Report

|

Segment |

Sub-segments |

|

By Product Type |

Whitening Toothpaste Sensitive Toothpaste Herbal Toothpaste Anti-cavity Toothpaste |

|

By Application |

Adults Children |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores, Pharmacies E-commerce |

|

By Ingredient Type |

Fluoride Toothpaste Charcoal Toothpaste Baking Soda Toothpaste Probiotic Toothpaste |

|

By Region |

China India Japan Australia South Korea |

Products

Key Target Audience

Toothpaste Manufacturers

Oral Care Product Distributors

Pharmacies and Supermarkets

Dental Clinics and Hospitals

Retail and E-commerce Channels

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food and Drug Administration, Ministry of Health)

Packaging and Raw Material Suppliers

Companies

Players mentioned in the report

Colgate-Palmolive

Procter & Gamble

Unilever

GlaxoSmithKline (GSK)

Lion Corporation

Dabur India Ltd.

Himalaya Herbal Healthcare

Patanjali Ayurved

Johnson & Johnson

Amway

Table of Contents

1. Asia Pacific Toothpaste Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Toothpaste Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Toothpaste Market Analysis

3.1. Growth Drivers (Consumer Preferences, Health Awareness, Demand for Natural Ingredients, Oral Hygiene Initiatives)

3.1.1. Rising Oral Health Awareness

3.1.2. Increasing Demand for Whitening Toothpaste

3.1.3. Growth in Natural and Herbal Products

3.1.4. Expanding Middle-Class Population

3.2. Market Challenges (Regulatory Compliance, Rising Raw Material Costs, Brand Loyalty, Supply Chain Disruptions)

3.2.1. Stringent Regulations on Ingredient Usage

3.2.2. High Brand Loyalty Among Consumers

3.2.3. Rising Costs of Natural Ingredients

3.3. Opportunities (Technological Innovations, Expansion into Rural Markets, Growing E-commerce Channels)

3.3.1. Innovations in Toothpaste Formulations

3.3.2. Untapped Rural Market Potential

3.3.3. Expansion of Online Retailing for Toothpaste

3.4. Trends (Sustainability Focus, Demand for Multibenefit Toothpaste, Personalization in Oral Care Products)

3.4.1. Sustainability and Eco-friendly Packaging

3.4.2. Demand for Toothpaste with Multibenefits

3.4.3. Personalization of Toothpaste Products

3.5. Government Regulations (Ingredient Safety Regulations, Advertising Standards, Health Labeling Requirements)

3.5.1. Regulations on Fluoride Usage

3.5.2. Advertising Standards for Oral Care Products

3.5.3. Government Health Initiatives for Oral Hygiene

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Toothpaste Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Whitening Toothpaste

4.1.2. Sensitive Toothpaste

4.1.3. Herbal Toothpaste

4.1.4. Anti-cavity Toothpaste

4.2. By Application (In Value %)

4.2.1. Adults

4.2.2. Children

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Pharmacies

4.3.4. E-commerce

4.4. By Ingredient Type (In Value %)

4.4.1. Fluoride Toothpaste

4.4.2. Charcoal Toothpaste

4.4.3. Baking Soda Toothpaste

4.4.4. Probiotic Toothpaste

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

5. Asia Pacific Toothpaste Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Colgate-Palmolive

5.1.2. Procter & Gamble

5.1.3. Unilever

5.1.4. GlaxoSmithKline (GSK)

5.1.5. Lion Corporation

5.1.6. Johnson & Johnson

5.1.7. Henkel

5.1.8. Kao Corporation

5.1.9. Amway

5.1.10. Dabur India Ltd.

5.1.11. Himalaya Herbal Healthcare

5.1.12. Patanjali Ayurved

5.1.13. Church & Dwight Co., Inc.

5.1.14. Sunstar Group

5.1.15. Shiseido Co. Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Product Portfolio, Revenue, Market Share, Geographical Reach, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Toothpaste Market Regulatory Framework

6.1. Ingredient Safety Standards

6.2. Compliance and Certification Processes

6.3. Advertising and Labeling Regulations

7. Asia Pacific Toothpaste Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Toothpaste Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Toothpaste Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key stakeholders within the Asia Pacific Toothpaste Market ecosystem. Extensive desk research is conducted using secondary databases and proprietary information sources. The objective is to define the key variables, including consumer preferences, distribution channels, and competitive dynamics that influence the market.

Step 2: Market Analysis and Construction

This phase focuses on gathering historical data related to the toothpaste market, including market penetration rates, revenue generated from each product segment, and consumer behavior. This data is essential for understanding market trends and building accurate forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the gathered data and then validated through expert interviews with key market participants. These interviews provide real-world insights into product development, competitive strategies, and consumer demand, helping to refine and verify the market data.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the data into a comprehensive report. This includes detailed segmentation, competitive analysis, and future market forecasts, ensuring that the data is accurate and reliable.

Frequently Asked Questions

01. How big is the Asia Pacific Toothpaste Market?

The Asia Pacific toothpaste market is valued at USD 10 billion, driven by growing oral health awareness and the rising demand for premium and natural products across the region.

02. What are the challenges in the Asia Pacific Toothpaste Market?

Challenges in Asia Pacific toothpaste market include high competition among well-established brands, rising raw material costs for natural ingredients, and the need for companies to comply with stringent regulatory requirements regarding toothpaste formulations.

03. Who are the major players in the Asia Pacific Toothpaste Market?

Key players in Asia Pacific toothpaste market include Colgate-Palmolive, Procter & Gamble, Unilever, GlaxoSmithKline (GSK), and Lion Corporation. These companies dominate due to their strong brand presence, extensive distribution networks, and continuous product innovation.

04. What are the growth drivers of the Asia Pacific Toothpaste Market?

The Asia Pacific toothpaste market is propelled by factors such as increasing oral hygiene awareness, rising disposable incomes, demand for herbal and natural toothpaste, and the expansion of e-commerce channels in emerging markets like India and China.

05. What is the dominant product type in the Asia Pacific Toothpaste Market?

Whitening toothpaste dominates the Asia Pacific toothpaste market, primarily driven by consumer demand for aesthetically pleasing dental care products across countries like China and South Korea.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.