Asia Pacific Transformers Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6752

December 2024

92

About the Report

Asia Pacific Transformers Market Overview

- The Asia Pacific Transformers Market, valued at USD 22 billion based on a five-year historical analysis, is driven by increasing industrial electrification, urbanization, and the push for renewable energy. The rapid expansion of urban infrastructure and electrification projects, particularly in developing economies, has heightened demand for power grid development and, consequently, transformers. Moreover, technological advancements in smart grid systems and energy efficiency initiatives further fuel the market.

- China and India dominate the market due to large-scale power generation projects, renewable energy investments, and extensive urbanization programs. China's Belt and Road Initiative (BRI) and India's Smart Cities Mission are key drivers. Additionally, the substantial industrial base, coupled with aggressive government policies aimed at reducing carbon footprints through renewable energy sources, underpins their dominance in the market.

- The Asia Pacific region is gradually moving toward environmentally friendly transformers, particularly those that use biodegradable insulation oils. Countries like Japan and South Korea are at the forefront of this shift. In 2022, Japan introduced new regulations that promote the use of eco-friendly transformers to reduce the environmental impact of electricity infrastructure. Additionally, China is increasing its production of green transformers as part of its environmental protection policies, mandating that over 10% of new transformers be eco-friendly by 2025.

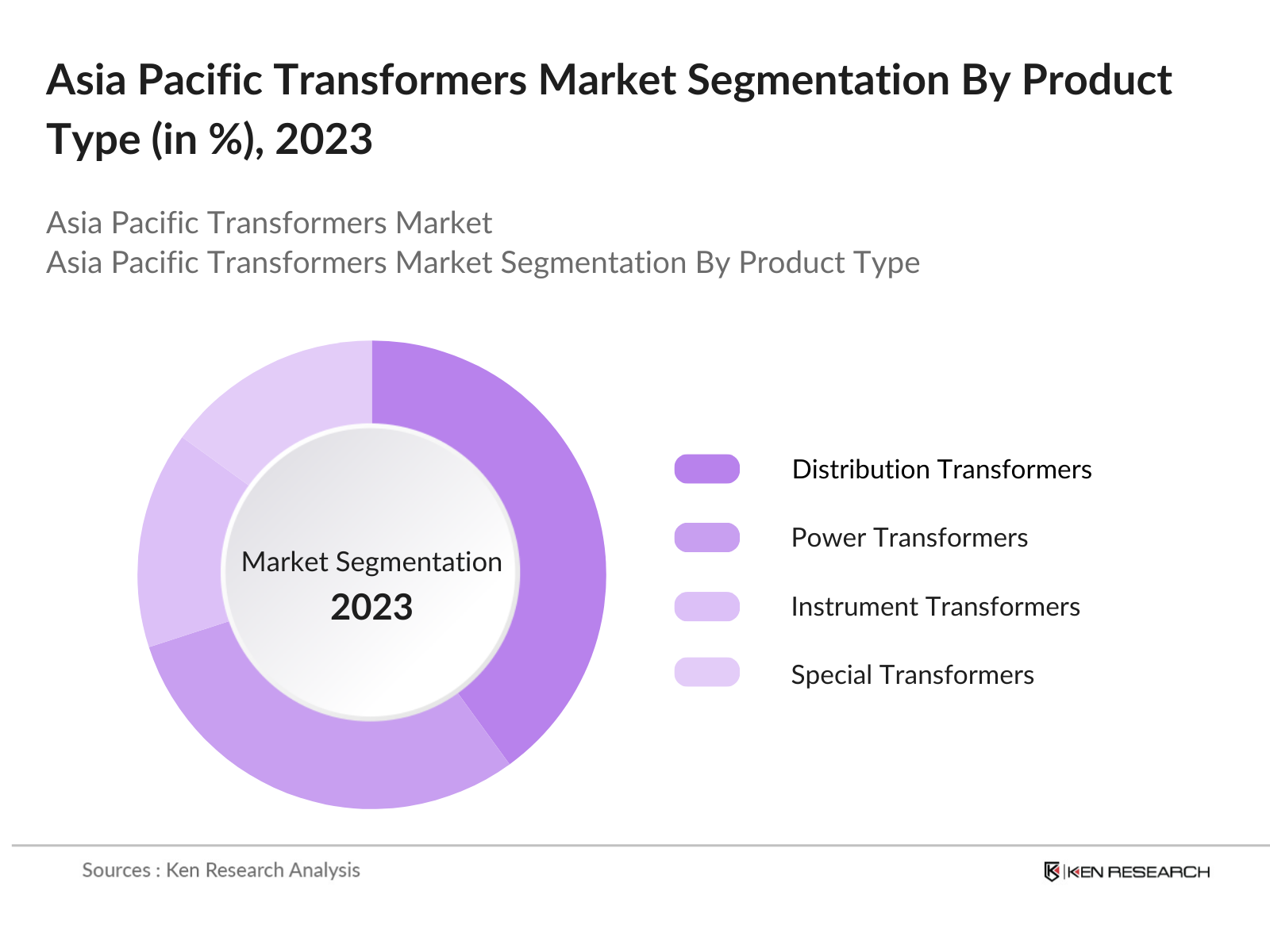

Asia Pacific Transformers Market Segmentation

By Product Type: The Asia Pacific Transformers Market is segmented by product type into distribution transformers, power transformers, instrument transformers, and special transformers. Distribution transformers hold a dominant market share due to their essential role in converting high-voltage electricity to lower voltage levels suitable for domestic and commercial usage. Their widespread application across residential and commercial sectors, coupled with increasing urbanization and rural electrification projects in countries like India and Indonesia, has maintained the significant demand for distribution transformers.

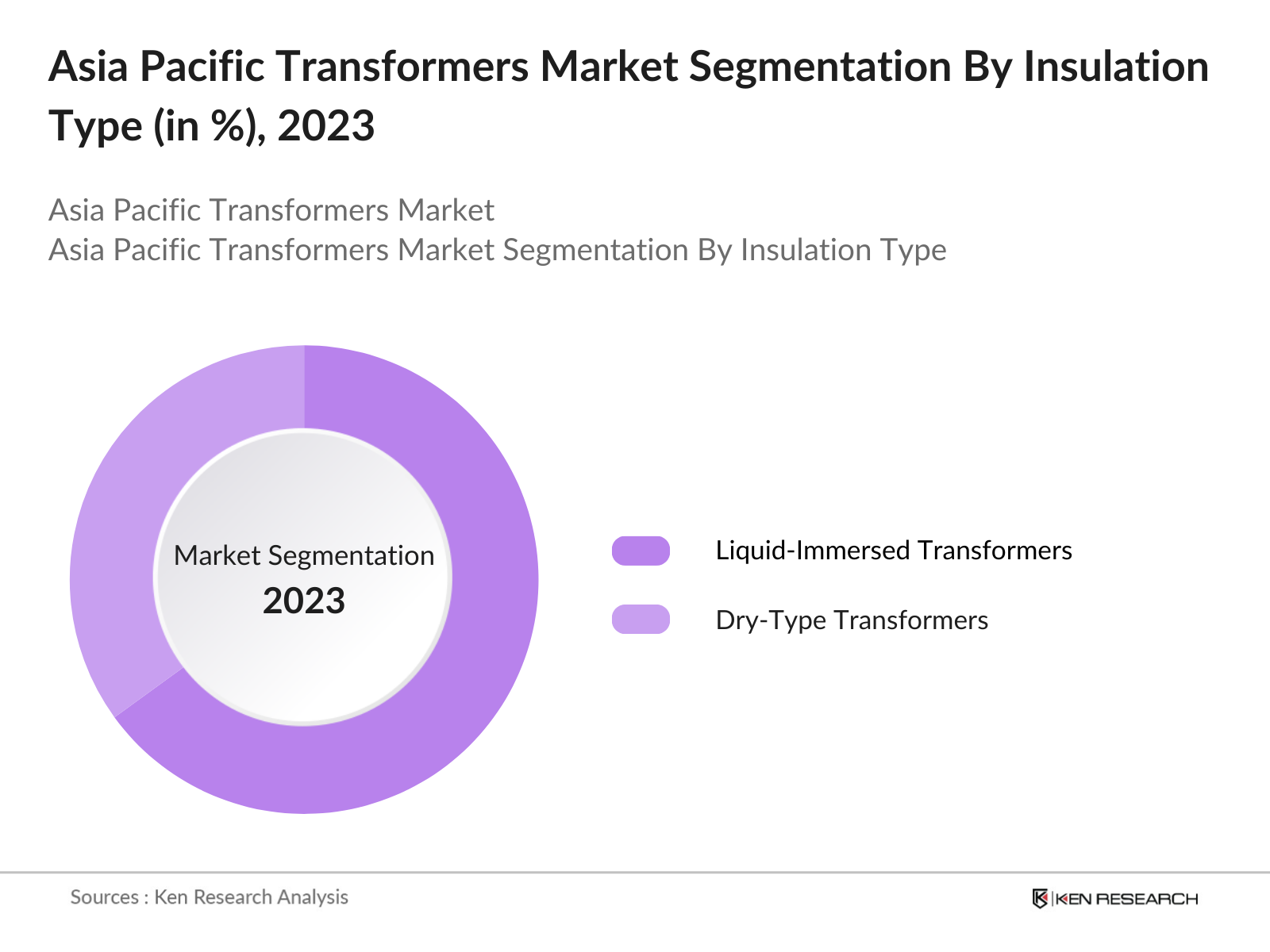

By Insulation Type: The market is further segmented by insulation type into liquid-immersed transformers and dry-type transformers. Liquid-immersed transformers lead the market due to their higher efficiency and cooling capabilities, which make them ideal for heavy-duty industrial applications. Moreover, liquid-immersed transformers are more suited for high-voltage applications, which are in demand as countries in the Asia Pacific region continue to invest in power grid expansions and renewable energy integration.

Asia Pacific Transformers Market Competitive Landscape

The Asia Pacific Transformers Market is dominated by a few major players, including both international giants and prominent local manufacturers. Companies like ABB Ltd., Siemens AG, and Schneider Electric SE have strong presences due to their comprehensive product portfolios and vast distribution networks. Local companies such as Bharat Heavy Electricals Limited (BHEL) benefit from government contracts and local expertise. The competition is marked by technological innovation, with smart transformers and eco-friendly solutions gaining traction.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Global Market Presence |

Patents Held |

Production Capacity |

Number of Employees |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

_ |

_ |

_ |

_ |

_ |

|

Siemens AG |

1847 |

Munich, Germany |

_ |

_ |

_ |

_ |

_ |

|

Schneider Electric SE |

1836 |

Rueil-Malmaison, France |

_ |

_ |

_ |

_ |

_ |

|

Bharat Heavy Electricals Limited |

1964 |

New Delhi, India |

_ |

_ |

_ |

_ |

_ |

|

Mitsubishi Electric Corporation |

1921 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

Asia Pacific Transformers Industry Analysis

Growth Drivers

- Industrial Electrification: The Asia Pacific region is witnessing a surge in industrial electrification, especially within countries like India, China, and Vietnam, driven by the expansion of manufacturing activities. China, the region's largest manufacturing hub, accounted for nearly 30% of global manufacturing output in 2022, leading to substantial transformer demand in heavy industries. India is also ramping up manufacturing under the Make in India initiative, contributing to increased energy consumption and infrastructure needs. The growth of high-energy consumption industries, like steel and chemical processing, is demanding advanced transformer solutions.

- Urbanization: Asia Pacific's urbanization rate is accelerating, with countries such as China, Indonesia, and India experiencing rapid growth in urban populations. Chinas urban population stood at over 900 million in 2023, and Indias urban growth rate is 2.3% annually, driving the demand for urban infrastructure like metro networks and housing. The need for energy to support these developments is pushing utilities to upgrade and expand power grids, which directly increases demand for transformers in urban infrastructure projects like smart cities and electrified transportation systems.

- Government Initiatives: Governments across Asia Pacific are implementing electrification programs and renewable energy targets that directly boost transformer demand. Indias National Electricity Plan aims for 24/7 power supply by 2024, requiring extensive grid expansions, particularly in rural areas. Indonesias government allocated over $5 billion in 2023 to enhance its electricity infrastructure as part of its electrification roadmap. The adoption of renewable energy targets, such as South Koreas goal to derive 20% of its energy from renewable sources by 2025, requires upgraded transformers compatible with fluctuating energy outputs.

Market Challenges

- High Initial Investment Costs: Advanced transformers, particularly those required for smart grids and renewable energy integration, come with high upfront investment costs. For instance, digital transformers, which include IoT capabilities, can be up to 30% more expensive than conventional units. In Japan, the upgrade to smart grid transformers has led to a notable increase in capital expenditures for utility companies, with a projected $5 billion allocated for grid modernization in 2023. Such high costs create barriers for smaller utility companies and industries in emerging economies.

- Supply Chain Disruptions: Supply chain disruptions are a persistent challenge in the Asia Pacific transformer market, particularly due to raw material shortages. The availability of key materials like steel, copper, and insulation oil faced bottlenecks in 2023, primarily due to global supply chain disruptions. China, the largest supplier of raw materials, faced a slowdown in exports of electrical steel by 15% in 2022, further straining transformer manufacturers across the region. Additionally, COVID-19-related disruptions continue to affect logistics, leading to delayed delivery times for transformer components.

Asia Pacific Transformers Market Future Outlook

Over the next five years, the Asia Pacific Transformers Market is expected to show significant growth, driven by continuous investments in power infrastructure, advancements in transformer technology, and increasing integration of renewable energy sources. The rise in smart city initiatives and the growing need for efficient energy transmission are also likely to spur demand for both traditional and digital transformers. Furthermore, governments across the region are encouraging investments in energy-efficient equipment, further boosting market growth.

Market Opportunities

- Expanding Power Grid Infrastructure: Several developing countries in the Asia Pacific region are significantly expanding their power grid infrastructure to increase energy access. Indonesia, for example, is extending its electricity network to reach the countrys eastern regions, which currently experience low energy coverage, with only 68% electrification in some areas. In 2023, the Indonesian government allocated over $5 billion for this grid expansion. Similarly, Bangladesh is investing in grid modernization projects, with a $2 billion investment in 2022, providing a growing opportunity for transformer manufacturers.

- Renewable Energy Integration: Asia Pacific is at the forefront of renewable energy adoption, particularly in solar and wind energy. In 2023, India added over 15 GW of solar power capacity, contributing to the need for specialized transformers capable of handling variable renewable energy output. Japan is also investing in offshore wind projects, with plans to develop 10 GW of wind power capacity by 2025. These developments provide significant opportunities for manufacturers of renewable energy transformers designed to handle fluctuating energy loads and ensure grid stability.

Scope of the Report

|

Product Type |

Distribution Transformers Power Transformers Instrument Transformers Isolation Transformers Special Transformers |

|

Insulation Type |

Liquid-Immersed Transformers Dry-Type Transformers |

|

Voltage Level |

Low Voltage (Up to 1kV) Medium Voltage (1kV to 36kV) High Voltage (Above 36kV) |

|

Application |

Power Utility Industrial Commercial Residential |

|

Region |

China India Japan Southeast Asia Australia & New Zealand |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

Transformer Manufacturing Compnaies

Power Utility Companies

Renewable Energy Industries

Government and Regulatory Bodies (Ministry of Power, Bureau of Energy Efficiency)

Industrial Equipment Companies

Smart Grid Solution Industries

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

ABB Ltd.

Siemens AG

Schneider Electric SE

General Electric

Mitsubishi Electric Corporation

Bharat Heavy Electricals Limited (BHEL)

Toshiba Corporation

Hyundai Heavy Industries

CG Power and Industrial Solutions

Hyosung Heavy Industries

SPX Transformer Solutions

TBEA Co., Ltd.

Eaton Corporation

Fuji Electric Co., Ltd.

Hammond Power Solutions

Table of Contents

1. Asia Pacific Transformers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Transformers Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Transformers Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Electrification (High demand from manufacturing sectors)

3.1.2. Urbanization (Increase in urban infrastructure projects)

3.1.3. Government Initiatives (Electrification programs, renewable energy targets)

3.1.4. Technological Advancements (Smart grid solutions)

3.2. Market Challenges

3.2.1. High Initial Investment Costs (Cost associated with advanced transformers)

3.2.2. Supply Chain Disruptions (Raw material shortages and logistics challenges)

3.2.3. Regulatory Compliance (Stringent energy-efficiency regulations)

3.2.4. Dependency on Imports (High reliance on transformer components)

3.3. Opportunities

3.3.1. Expanding Power Grid Infrastructure (Increased energy access in developing regions)

3.3.2. Renewable Energy Integration (High potential for transformer demand in solar and wind energy)

3.3.3. Digitalization of Power Systems (Opportunities for digital transformers with real-time monitoring)

3.4. Trends

3.4.1. Shift to Green Transformers (Eco-friendly, biodegradable insulation oil-based transformers)

3.4.2. Emergence of Smart Transformers (IoT-enabled transformers for smart grid integration)

3.4.3. Use of Artificial Intelligence in Predictive Maintenance (AI in transformer performance analysis)

3.4.4. Compact Substations (Demand for smaller and more efficient transformers)

3.5. Government Regulation

3.5.1. Energy Efficiency Standards (Government mandates on transformer energy efficiency)

3.5.2. National Electrification Plans (Expansion plans in emerging economies)

3.5.3. Environmental Standards (Regulations on emissions and sustainable material use)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Utilities, Industrial Users, Manufacturers, Regulators)

3.8. Porters Five Forces (Competitive Rivalry, Supplier Power, Buyer Power, Threat of New Entrants, Substitutes)

3.9. Competitive Ecosystem (Market Structure, Competition Levels)

4. Asia Pacific Transformers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Distribution Transformers

4.1.2. Power Transformers

4.1.3. Instrument Transformers

4.1.4. Isolation Transformers

4.1.5. Special Transformers

4.2. By Insulation Type (In Value %)

4.2.1. Liquid-Immersed Transformers

4.2.2. Dry-Type Transformers

4.3. By Voltage Level (In Value %)

4.3.1. Low Voltage (Up to 1kV)

4.3.2. Medium Voltage (1kV to 36kV)

4.3.3. High Voltage (Above 36kV)

4.4. By Application (In Value %)

4.4.1. Power Utility

4.4.2. Industrial

4.4.3. Commercial

4.4.4. Residential

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Southeast Asia

4.5.5. Australia and New Zealand

5. Asia Pacific Transformers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. Schneider Electric SE

5.1.4. General Electric

5.1.5. Mitsubishi Electric Corporation

5.1.6. Toshiba Corporation

5.1.7. Hyundai Heavy Industries

5.1.8. Bharat Heavy Electricals Limited (BHEL)

5.1.9. CG Power and Industrial Solutions

5.1.10. Eaton Corporation

5.1.11. Hyosung Heavy Industries

5.1.12. TBEA Co., Ltd.

5.1.13. SPX Transformer Solutions

5.1.14. Hammond Power Solutions

5.1.15. Fuji Electric Co., Ltd.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, R&D Investment, Product Portfolio, Global Market Presence, Patent Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Development, Market Expansion, Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. Asia Pacific Transformers Market Regulatory Framework

6.1. National Energy Policies

6.2. Compliance Requirements (Energy Efficiency, Safety Standards)

6.3. Certification Processes

7. Asia Pacific Transformers Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Transformers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Insulation Type (In Value %)

8.3. By Voltage Level (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Transformers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first step, we created an ecosystem map covering the Asia Pacific Transformers Market stakeholders, including manufacturers, distributors, and end-users. Comprehensive desk research was carried out using secondary and proprietary databases to pinpoint the critical variables driving the market.

Step 2: Market Analysis and Construction

Historical data on the market, including sales and production capacity for the key players, were collected and analyzed. This included assessing the penetration of transformers across different sectors, including utilities and renewable energy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through telephonic interviews with industry experts from top companies in the transformers sector. These consultations provided insights on operational challenges, growth drivers, and financial data that helped refine the analysis.

Step 4: Research Synthesis and Final Output

The final stage involved direct engagement with manufacturers and end-users to gather detailed data on product performance, consumer demand, and emerging market trends. This information was integrated to deliver a comprehensive, validated report on the Asia Pacific Transformers Market.

Frequently Asked Questions

1. How big is the Asia Pacific Transformers Market?

The Asia Pacific Transformers Market is valued at USD 22 billion, driven by increased industrialization and expanding energy infrastructure across the region.

2. What are the challenges in the Asia Pacific Transformers Market?

Challenges include high initial investment costs, supply chain disruptions, and stringent regulatory compliance for energy efficiency and environmental standards.

3. Who are the major players in the Asia Pacific Transformers Market?

Major players include ABB Ltd., Siemens AG, Schneider Electric SE, General Electric, and Bharat Heavy Electricals Limited, among others, dominating due to their expansive portfolios and technological innovations.

4. What are the growth drivers of the Asia Pacific Transformers Market?

Growth is driven by urbanization, rising demand for renewable energy integration, and technological advancements such as the adoption of smart transformers and digitalization of energy grids.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.