Asia Pacific Tuna Fish Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD8607

December 2024

92

About the Report

Asia Pacific Tuna Fish Market Overview

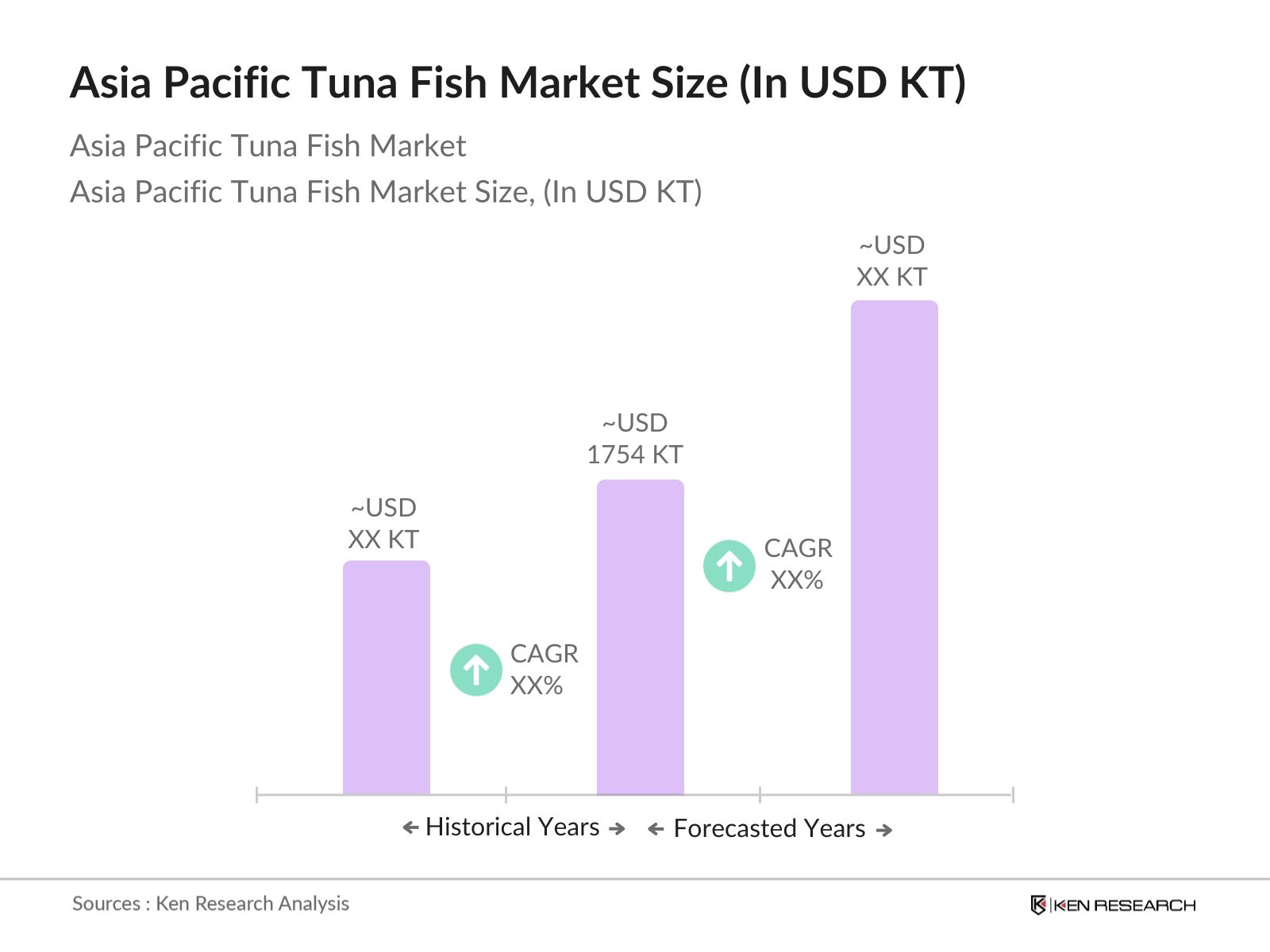

- The Asia Pacific Tuna Fish Market, estimated to be valued at 1754 killo tonnes, reflects robust demand primarily driven by the increasing consumer preference for protein-rich diets, especially in Japan, China, and Southeast Asia. The expansion of sustainable fishing practices and advancements in aquaculture have further supported this growth. With growing urban populations and the influence of health-focused dietary trends, tuna remains a staple source of protein, supported by advancements in fishing and processing technology.

- Key regions such as Japan, Thailand, and the Philippines dominate the Asia Pacific Tuna Fish Market due to their well-established fishing infrastructures, access to rich marine resources, and expertise in both fishing and processing technologies. Japan's tuna consumption is particularly high due to cultural dietary preferences, while Thailand leads in canned tuna processing for export. These factors enable these countries to maintain a strong presence in the tuna market within the region.

- National fisheries policies across the Asia Pacific are increasingly stringent, with initiatives in Japan and Australia supporting regulated tuna catch volumes to curb overfishing. Australia's fisheries regulatory body enforces annual quotas for tuna, impacting domestic supply and ensuring environmental sustainability.

Asia Pacific Tuna Fish Market Segmentation

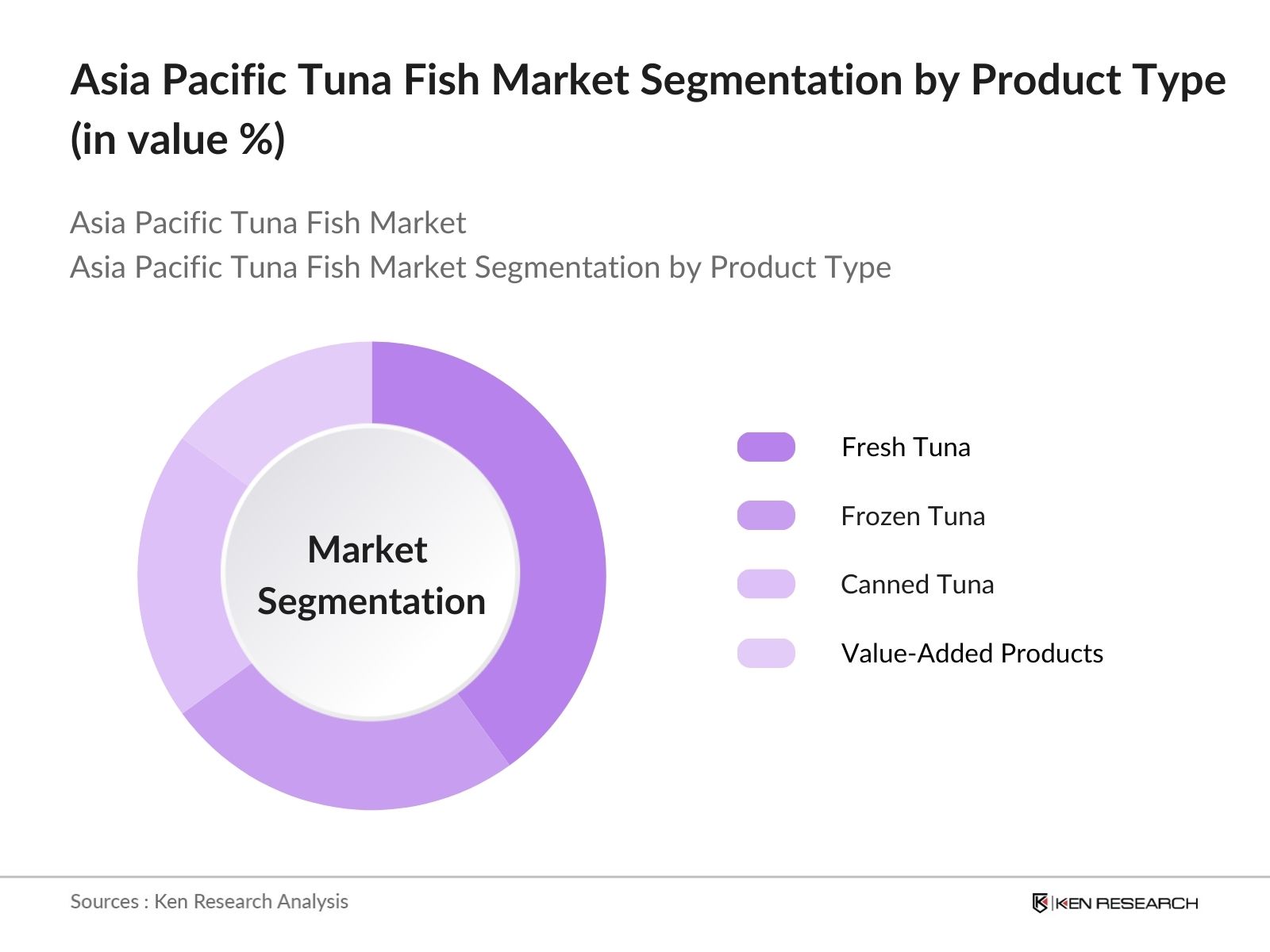

- By Product Type: The Asia Pacific Tuna Fish Market is segmented by product type into fresh tuna, frozen tuna, canned tuna, and value-added tuna products. Recently, fresh tuna has a market share within this segmentation, largely due to the high demand for sashimi-grade fish in Japan and increasingly in China. The popularity of fresh tuna in these regions is linked to dietary habits that favor high-quality, unprocessed seafood, supported by advanced cold chain logistics ensuring freshness.

- By Tuna Species: In terms of tuna species, the market includes yellowfin, skipjack, albacore, and bigeye tuna. Skipjack tuna holds the largest market share in the Asia Pacific region due to its high catch rates and widespread use in canned products. The species' lower cost and mild taste make it favorable for canned tuna, which is in demand globally. Moreover, skipjack tuna is highly preferred by canneries, particularly in Thailand and the Philippines, where large-scale production meets domestic and export demand.

Asia Pacific Tuna Fish Market Competitive Landscape

The Asia Pacific Tuna Fish Market is dominated by a select group of major companies, benefiting from well-established supply chains, access to technology, and extensive distribution networks. The competition is intense due to high demand, and major players focus on sustainable sourcing and certification to appeal to environmentally conscious consumers.

Asia Pacific Tuna Fish Market Analysis

Market Growth Drivers

- Rising Demand for Sustainable Seafood: The Asia Pacific region has seen a notable increase in sustainable seafood demand, driven by consumer awareness. According to the World Bank, seafood constitutes over 60 million tons of total animal protein consumption in the region, with sustainable seafood alternatives contributing to this growth. Nations like Japan and Australia report over 50% of consumers now opt for sustainably sourced seafood, indicating a strong shift in consumption patterns. Sustainable seafood is becoming mainstream, supported by policy frameworks and green certifications.

- Expansion of Aquaculture Operations: Aquaculture in the Asia Pacific, particularly in countries like Indonesia and Vietnam, has shown a surge in growth, accounting for over 50 million tons of fish production in 2023 as per FAO. This boost in production capacity, facilitated by technological advances, supports increased tuna output, addressing supply-side pressures. Vietnam alone has allocated $1 billion to enhance aquaculture capacities, with a focus on tuna, to sustain domestic and export demand.

- Health Awareness and Protein Demand: The health-driven demand for protein-rich diets is a critical factor, with Asia Pacific nations consuming over 20 grams of fish protein daily per capita, as reported by the World Health Organization. Tuna, rich in omega-3 and essential nutrients, aligns with consumer preferences for high-protein diets, particularly in urban centers where awareness campaigns have heightened.

Market Challenges

- Overfishing and Environmental Concerns: Overfishing in the Asia Pacific is impacting tuna stocks, with an estimated 33% of tuna populations being exploited beyond sustainable limits, according to FAO 2023 data. Government and international agency efforts aim to mitigate these impacts, but enforcement remains challenging across smaller fisheries, particularly in Southeast Asia. This sustainability constraint places pressure on the tuna industry to adopt stricter practices.

- Variability in Tuna Prices: Price volatility due to fluctuating supply levels and varying demand is a challenge for stakeholders. For example, Japan has observed tuna price fluctuations across seasons, affecting profit margins and supply chains. The IMF reports that market dynamics for essential exports, like tuna, are impacted by trade policies and production capacities.

Asia Pacific Tuna Fish Market Future Outlook

The Asia Pacific Tuna Fish Market is poised for steady growth, driven by increasing consumer preference for high-quality seafood, expanding demand for value-added tuna products, and growing awareness of sustainable fishing practices. Initiatives to support sustainable sourcing and adoption of advanced processing technologies will likely enhance the market's appeal, particularly in regions where environmental concerns are rising among consumers.

Market Opportunities

- Growth in Tuna Processing Technologies: Advancements in tuna processing, especially with automated filleting and canning, have increased efficiency. Japan and China have invested over $300 million collectively in tuna processing technologies in 2023, as reported by the World Bank. Such investments enhance processing rates and meet growing consumer demands for high-quality products.

- Increasing Investment in Cold Chain Infrastructure: Countries in Asia Pacific are investing heavily in cold chain infrastructure to maintain tuna freshness for export, with an investment surge of over $400 million in 2023, led by South Korea and Singapore. This infrastructure supports maintaining tuna quality from harvest to consumer markets, which the ADB reports as crucial to sustaining market competitiveness.

Scope of the Report

Product Type | Fresh Tuna Frozen Tuna Canned Tuna Value-Added Tuna Products |

Application | Food Service Retail Pharmaceuticals Animal Feed |

Tuna Species | Yellowfin Tuna Skipjack Tuna Albacore Tuna Bigeye Tuna |

Distribution Channel | Supermarkets and Hypermarkets Specialty Stores Online Channels Direct Sales |

Region | Japan China Australia Southeast Asia Rest of Asia Pacific |

Products

Key Target Audience

Tuna Fish Processors

Distribution and Logistics Companies

Retailers (Supermarkets, Hypermarkets)

Food Service Operators

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Asia Pacific Fishery Commission, Ministry of Marine Affairs and Fisheries)

Environmental NGOs

Banks and Financial Institutions

Cold Chain Infrastructure Providers

Companies

Players Mentioned in the Report

Thai Union Group

Dongwon Industries

Bumble Bee Foods

Maruha Nichiro Corporation

FCF Fishery Company Ltd.

Ocean Brands GP

StarKist Co.

Tri Marine International

Alliance Select Foods

Mitsui & Co. Ltd.

Table of Contents

1. Asia Pacific Tuna Fish Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Tuna Fish Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Tuna Fish Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Sustainable Seafood (Demand Trends)

3.1.2 Expansion of Aquaculture Operations (Production Capacity)

3.1.3 Favorable Government Policies and Subsidies (Regulatory Support)

3.1.4 Health Awareness and Protein Demand (Consumer Preference Shifts)

3.2 Market Challenges

3.2.1 Overfishing and Environmental Concerns (Sustainability Constraints)

3.2.2 Variability in Tuna Prices (Market Volatility)

3.2.3 Stringent Import Regulations (Trade Compliance)

3.3 Opportunities

3.3.1 Growth in Tuna Processing Technologies (Technological Advances)

3.3.2 Increasing Investment in Cold Chain Infrastructure (Supply Chain Efficiency)

3.3.3 Expansion of Premium Product Offerings (Value-Added Products)

3.4 Trends

3.4.1 Adoption of Traceability and Certifications (Sustainable Labeling)

3.4.2 Growing Popularity of Fresh and Frozen Tuna (Product Diversification)

3.4.3 Rise in Direct-to-Consumer Channels (Digital Commerce Expansion)

3.5 Government Regulation

3.5.1 National Fisheries Policies (Regulation Framework)

3.5.2 Export Restrictions and Quotas (Trade Limitations)

3.5.3 Subsidies for Sustainable Fishing Practices (Policy Incentives)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Landscape Overview

4. Asia Pacific Tuna Fish Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fresh Tuna

4.1.2 Frozen Tuna

4.1.3 Canned Tuna

4.1.4 Value-Added Tuna Products

4.2 By Application (In Value %)

4.2.1 Food Service

4.2.2 Retail

4.2.3 Pharmaceuticals

4.2.4 Animal Feed

4.3 By Tuna Species (In Value %)

4.3.1 Yellowfin Tuna

4.3.2 Skipjack Tuna

4.3.3 Albacore Tuna

4.3.4 Bigeye Tuna

4.4 By Distribution Channel (In Value %)

4.4.1 Supermarkets and Hypermarkets

4.4.2 Specialty Stores

4.4.3 Online Channels

4.4.4 Direct Sales

4.5 By Region (In Value %)

4.5.1 Japan

4.5.2 China

4.5.3 Australia

4.5.4 Southeast Asia

4.5.5 Rest of Asia Pacific

5. Asia Pacific Tuna Fish Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Thai Union Group

5.1.2 Dongwon Industries

5.1.3 Bumble Bee Foods

5.1.4 StarKist Co.

5.1.5 Maruha Nichiro Corporation

5.1.6 FCF Fishery Company Ltd.

5.1.7 Ocean Brands GP

5.1.8 Hagoromo Foods Corporation

5.1.9 Bolina Holding Co.

5.1.10 Tri Marine International

5.1.11 Alliance Select Foods

5.1.12 Mitsui & Co. Ltd.

5.1.13 Century Pacific Food Inc.

5.1.14 Pacific Tuna Corporation

5.1.15 Cooks Global Foods

5.2 Cross Comparison Parameters

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Tuna Fish Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Tuna Fish Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Tuna Fish Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Tuna Species (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Tuna Fish Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping critical market players and analyzing stakeholder influence within the Asia Pacific Tuna Fish Market. Desk research integrates data from reliable industry sources and proprietary databases to determine market trends and growth factors.

Step 2: Market Analysis and Construction

This phase compiles historical data on market size, consumption rates, and supply chain logistics. Assessment of the geographic and species distribution helps in providing accurate revenue figures and processing capacities.

Step 3: Hypothesis Validation and Expert Consultation

Key industry assumptions are verified through consultations with industry experts and stakeholders. These insights support detailed analysis on pricing trends, sustainability certifications, and export logistics.

Step 4: Research Synthesis and Final Output

Direct engagement with major tuna processors provides insights into species sourcing, processing efficiency, and market trends, ensuring a comprehensive, validated output for the Asia Pacific Tuna Fish Market report.

Frequently Asked Questions

How big is the Asia Pacific Tuna Fish Market?

The Asia Pacific Tuna Fish Market was valued at 1754 killo tonnes, driven by high consumer demand for protein sources and growth in sustainable fishing practices across the region.

What are the challenges in the Asia Pacific Tuna Fish Market?

Key challenges include overfishing, strict export regulations, and environmental sustainability issues, all of which impact supply and drive up production costs.

Who are the major players in the Asia Pacific Tuna Fish Market?

Leading players include Thai Union Group, Dongwon Industries, Bumble Bee Foods, Maruha Nichiro Corporation, and FCF Fishery Company, each known for extensive processing capacity and global reach.

What drives the demand in the Asia Pacific Tuna Fish Market?

Consumer demand for high-protein diets, the popularity of tuna-based products, and advancements in tuna processing technologies drive the markets growth, particularly in Japan and China.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.