Asia Pacific Utility Pole Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD4219

December 2024

89

About the Report

Asia Pacific Utility Pole Market Overview

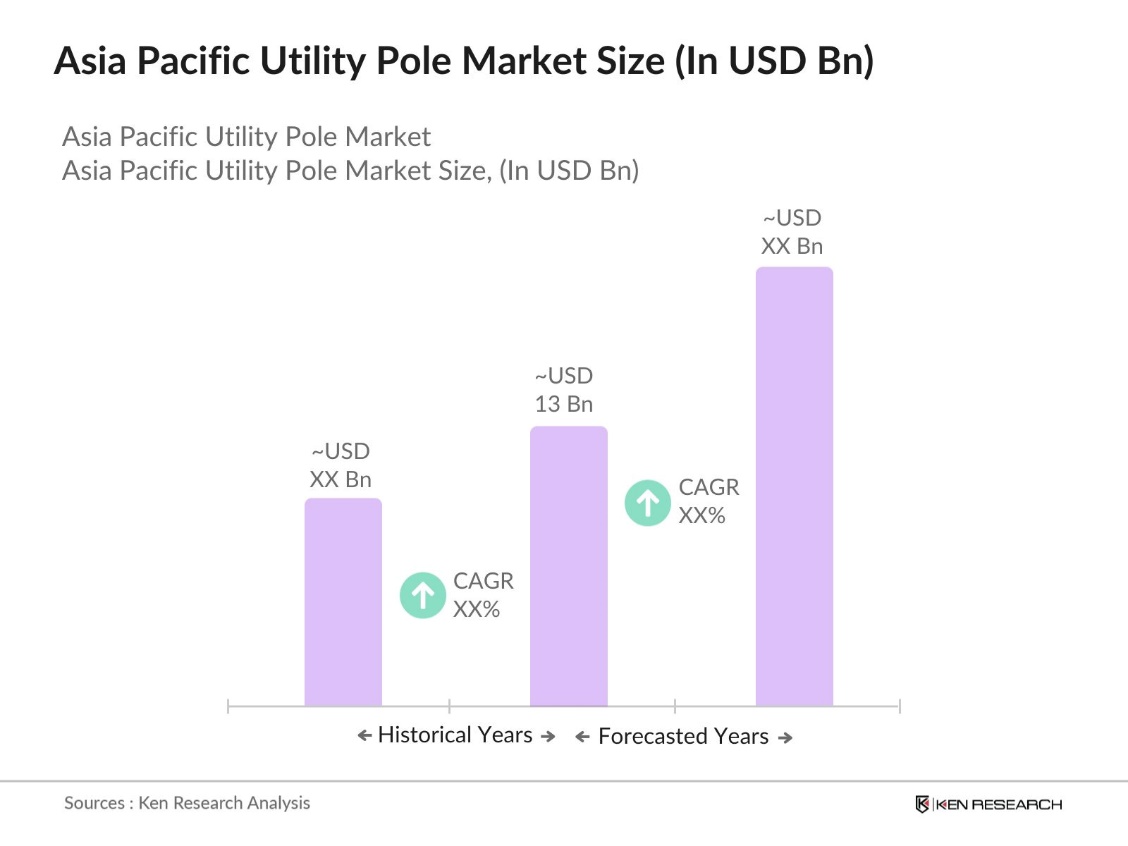

- The Asia Pacific Utility Pole Market is valued at USD 13 billion based on a comprehensive analysis of the past five years. This market is driven by the rapid urbanization and infrastructure development occurring in major economies like China and India. Increasing investments in power distribution networks and rural electrification have also fueled the demand for utility poles across the region.

- China and India dominate the Asia Pacific Utility Pole Market due to their large-scale infrastructure projects and governmental policies aimed at expanding electrification and telecommunications access. Chinas ongoing urbanization and its commitment to expanding its power grid infrastructure have cemented its leadership position. India, driven by its rural electrification programs and rapid telecom growth, is also a key market player.

- China's 2024-2027 action plan focuses on advancing renewable energy and improving grid flexibility. Key initiatives include the development of large-scale renewable energy bases, particularly in desert regions, and increasing the transmission of renewable energy across provincial corridors. The plan targets the construction of a clean, efficient power system, with renewable projects expected to reach 455 GW by 2030. These actions support China's carbon neutrality goals, aiming to address grid challenges and boost the share of renewables in the energy mix.

Asia Pacific Utility Pole Market Segmentation

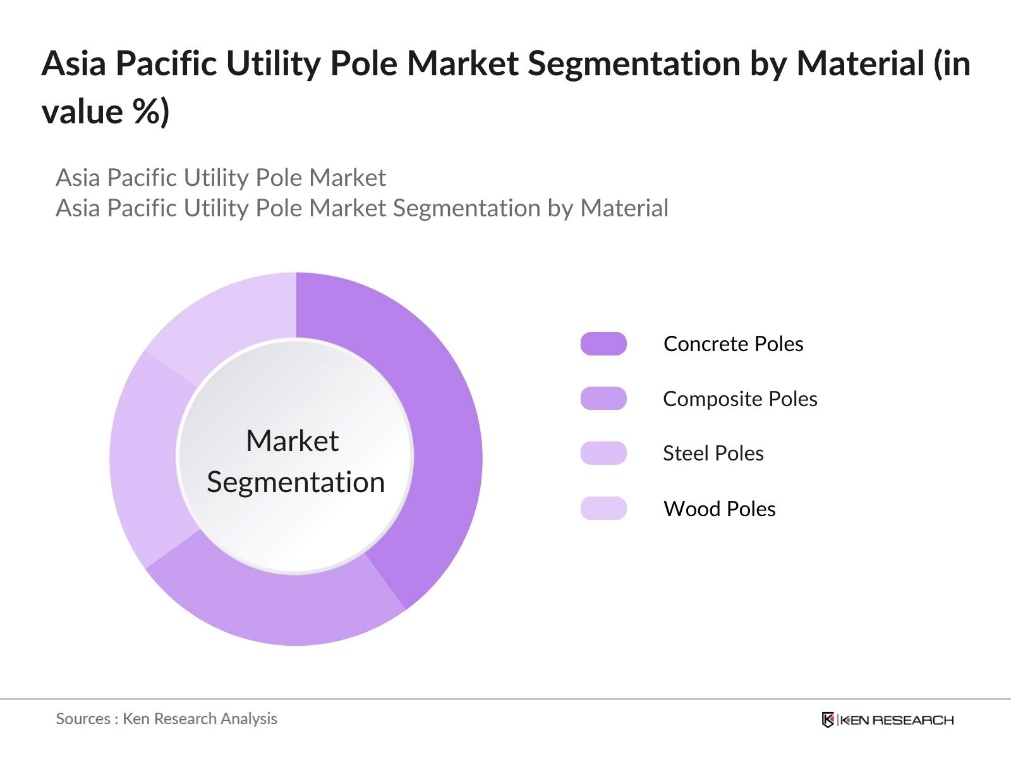

By Material: The Asia Pacific Utility Pole Market is segmented by material into wood poles, steel poles, concrete poles, and composite poles. Concrete poles dominate the market, primarily because they offer high durability and resistance to environmental factors like moisture, corrosion, and termite infestation. The growing infrastructure projects, especially in developing regions, prefer concrete poles due to their long life span and ability to support heavy electrical lines and telecommunication equipment. Steel poles are also gaining traction in urban areas due to their sleek design and adaptability for use in smart cities.

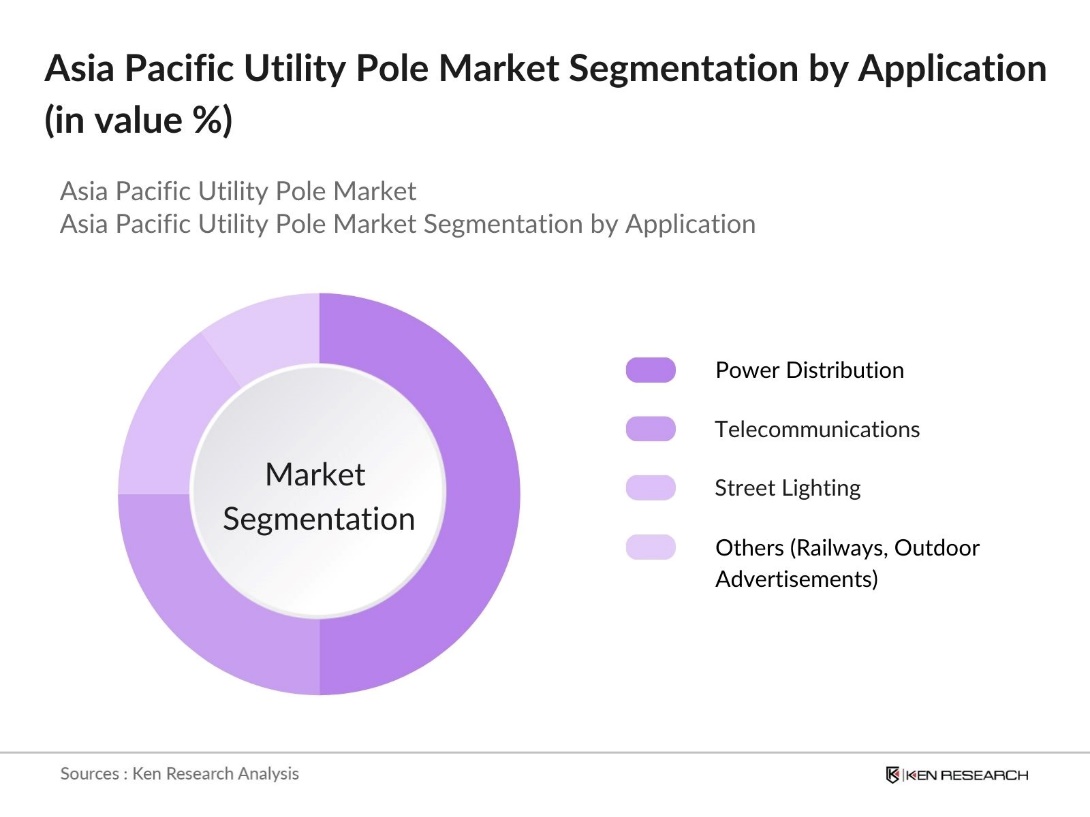

By Application: The Asia Pacific Utility Pole Market is segmented by application into power distribution, telecommunications, street lighting, and others (railways, outdoor advertisements). Power distribution holds the largest market share, driven by the increased demand for reliable electricity access across both urban and rural regions. Governments across the Asia Pacific region have undertaken large-scale electrification projects, particularly in India and Southeast Asia, to ensure that even remote areas have access to the power grid. Telecommunications applications are rapidly growing, particularly with the advent of 5G technology and increased demand for better connectivity infrastructure.

Asia Pacific Utility Pole Market Competitive Landscape

The market is dominated by both regional and international players. Companies with extensive expertise in durable materials, long-lasting pole designs, and strategic partnerships with utility companies lead the market. The integration of smart pole technologies is also a growing focus among market leaders. For instance, many companies are investing in IoT-enabled utility poles to support smart grid infrastructure.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD Mn) |

Production Capacity |

R&D Investments |

Regional Presence |

Key Clients |

|

Valmont Industries, Inc. |

1946 |

Omaha, USA |

||||||

|

Nippon Concrete Industries |

1955 |

Tokyo, Japan |

||||||

|

Skipper Limited |

1981 |

Kolkata, India |

||||||

|

RS Technologies Inc. |

2003 |

Alberta, Canada |

||||||

|

Creative Pultrusions, Inc. |

1973 |

Pennsylvania, USA |

Asia Pacific Utility Pole Industry Analysis

Growth Drivers

- Urbanization and Infrastructure: Urbanization across the Asia-Pacific region has led to a surge in demand for utility poles, especially in rapidly developing countries like China and India. In 2022, urban population reached 56.9%, with the growth of the population going down to 1.55%, driving the need for robust power and telecommunications infrastructure. These developments push the demand for both power and telecommunications poles to ensure connectivity and reliable energy supply.

- Electrification of Rural Areas: The electrification of rural areas continues to be a priority for many governments across the region. For instance, the Philippine government is also focusing on integrating renewable energy sources into its energy mix, aiming for 35% renewable energy by 2030 and 50% by 2040, which further emphasizes the need for robust electrical infrastructure, including utility poles and about 52 GW of additional power capacity will be required by 2045.

- Technological Advancements: Smart poles equipped with IoT technology are increasingly being adopted in urban centers across the Asia-Pacific region. These poles integrate advanced features such as environmental monitoring, traffic control, and energy management systems, enhancing the functionality of urban infrastructure. Countries like Japan and South Korea are at the forefront of this trend, incorporating smart poles to improve public safety and optimize energy usage. The rise of smart cities is accelerating the demand for IoT-enabled utility poles, as they play a critical role in supporting more efficient and connected urban environments.

Market Challenges

- Rising Raw Material Costs: The rising costs of essential raw materials like wood, steel, and concrete pose a significant challenge for utility pole manufacturers in the Asia-Pacific region. These price increases result in higher production expenses, making it more difficult for manufacturers to maintain affordable pricing. The impact is particularly felt in developing countries where infrastructure expansion is critical, and budget constraints can hinder the ability to accommodate these cost surges. As a result, infrastructure projects that rely heavily on utility poles may experience delays or cost overruns.

- Regulatory Compliance and Environmental Standards: Stricter environmental regulations surrounding the use of wood for utility poles are creating additional challenges for manufacturers in the Asia-Pacific region. Countries are implementing more stringent standards to ensure that wood used for poles is sourced sustainably, which can drive up costs and complicate production. Balancing environmental sustainability with cost-effectiveness is becoming increasingly difficult, as manufacturers must adhere to these regulations while maintaining competitive pricing.

Asia Pacific Utility Pole Market Future Outlook

Over the next five years, the Asia Pacific Utility Pole Market is expected to show steady growth driven by increasing investments in renewable energy projects, telecommunications infrastructure expansion, and the adoption of smart city initiatives. Governments across the region are focusing on enhancing both rural and urban infrastructure to support growing populations and industrial demand. Additionally, the rise of smart utility poles, which integrate advanced technologies like sensors and IoT, will create new opportunities for market players looking to enhance their portfolios.

Market Opportunities

- Demand for Smart Poles in Urban Areas: The adoption of smart poles is growing rapidly in urban areas, particularly in response to smart city initiatives. These poles, which integrate cameras, sensors, and IoT technologies, are being utilized to enhance urban management systems such as traffic control, energy monitoring, and public safety. The increasing focus on building more connected and efficient cities presents significant opportunities for utility pole manufacturers to tap into the evolving demand for this advanced technology in urban infrastructure.

- Growth in Telecommunication Infrastructure: The expansion of 5G networks across the Asia-Pacific region is driving a notable increase in demand for utility pole installations. As countries enhance their telecommunications infrastructure to support the high-speed connectivity of 5G, the need for extensive pole networks becomes crucial. This growing demand presents a valuable opportunity for utility pole manufacturers, particularly as nations like India, Japan, and South Korea continue to expand their 5G networks, requiring reliable pole infrastructure to support the rollout of next-generation technology.

Scope of the Report

|

By Material |

Wood Poles Steel Poles Concrete Poles Composite Poles |

|

By Application |

Power Distribution Telecommunications Street Lighting, Others |

|

By Pole Height |

Below 10 Meters 10-20 Meters Above 20 Meters |

|

By Utility Type |

Transmission Poles Distribution Poles |

|

By Region |

China India Japan South Korea Southeast Asia Australia and New Zealand |

Products

Key Target Audience

Utility Companies

Telecommunication Companies

Construction and Infrastructure Companies

Electric Power Generation and Transmission Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Energy, Ministry of Telecommunications)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Valmont Industries, Inc.

Nippon Concrete Industries Co., Ltd.

Skipper Limited

FUCHS Europoles GmbH

Stella-Jones Inc.

KEC International

Omega Concrete Poles Australia

Creative Pultrusions, Inc.

RS Technologies Inc.

Duratel LLC

StressCrete Group

Qingdao Wuxiao Group Co., Ltd.

Pelco Products, Inc.

Sabre Industries, Inc.

McWane Poles

Table of Contents

1. Asia Pacific Utility Pole Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Poles Installed, Replacement Rates, New Infrastructure)

1.4. Market Segmentation Overview

2. Asia Pacific Utility Pole Market Size (In USD Bn)

2.1. Historical Market Size (Volume of Poles Installed, Replacement Rates)

2.2. Year-On-Year Growth Analysis (New Installations vs. Replacement)

2.3. Key Market Developments and Milestones (Expansion of Power Grids, Telecommunications Projects)

3. Asia Pacific Utility Pole Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Infrastructure Development (Increased Demand for Power and Telecommunications Poles)

3.1.2. Electrification of Rural Areas (New Utility Pole Installation)

3.1.3. Technological Advancements (Smart Poles, IoT-Enabled Utility Poles)

3.1.4. Government Infrastructure Projects (Power Grid Expansion, 5G Rollout)

3.2. Market Challenges

3.2.1. Rising Raw Material Costs (Wood, Steel, Concrete)

3.2.2. Regulatory Compliance and Environmental Standards (Sustainability of Wood Poles)

3.2.3. Competition from Alternative Technologies (Underground Power Lines, Wireless Solutions)

3.2.4. Maintenance and Replacement Costs

3.3. Opportunities

3.3.1. Demand for Smart Poles in Urban Areas (Integration of Cameras, Sensors, IoT)

3.3.2. Growth in Telecommunication Infrastructure (5G Network Expansion)

3.3.3. Expansion into Emerging Markets (Rural Electrification in Developing Countries)

3.3.4. Public-Private Partnerships in Infrastructure Projects

3.4. Trends

3.4.1. Adoption of Composite Poles (Longer Lifespan, Less Maintenance)

3.4.2. Integration of IoT with Utility Poles (Smart Grids, Remote Monitoring)

3.4.3. Sustainability and Eco-Friendly Materials (Demand for Recycled and Sustainable Utility Poles)

3.4.4. Development of Multi-Purpose Poles (Power, Telecommunications, Street Lighting)

3.5. Government Regulations

3.5.1. National Infrastructure Development Plans

3.5.2. Environmental Regulations on Pole Materials (Sustainable Wood, Reduction of Concrete Usage)

3.5.3. Safety Standards for Utility Poles (High Wind, Earthquake Resistance Standards)

3.5.4. Incentives for Renewable Energy-Enabled Poles (Poles with Solar Panels)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Contractors, Governments)

3.8. Porters Five Forces Analysis (Raw Material Suppliers, New Entrants, Substitutes, Competition)

3.9. Competition Ecosystem (Technology Integration, Geographical Dominance)

4. Asia Pacific Utility Pole Market Segmentation

4.1. By Material (In Value %):

4.1.1. Wood Poles

4.1.2. Steel Poles

4.1.3. Concrete Poles

4.1.4. Composite Poles

4.2. By Application (In Value %):

4.2.1. Power Distribution

4.2.2. Telecommunications

4.2.3. Street Lighting

4.2.4. Others (Railways, Outdoor Advertisements)

4.3. By Pole Height (In Value %):

4.3.1. Below 10 Meters

4.3.2. 10-20 Meters

4.3.3. Above 20 Meters

4.4. By Utility Type (In Value %):

4.4.1. Transmission Poles

4.4.2. Distribution Poles

4.5. By Region (In Value %):

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Southeast Asia

4.5.6. Australia and New Zealand

5. Asia Pacific Utility Pole Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Valmont Industries, Inc.

5.1.2. Nippon Concrete Industries Co., Ltd.

5.1.3. Skipper Limited

5.1.4. FUCHS Europoles GmbH

5.1.5. Stella-Jones Inc.

5.1.6. KEC International

5.1.7. Omega Concrete Poles Australia

5.1.8. Creative Pultrusions, Inc.

5.1.9. RS Technologies Inc.

5.1.10. Duratel LLC

5.1.11. StressCrete Group

5.1.12. Qingdao Wuxiao Group Co., Ltd.

5.1.13. Pelco Products, Inc.

5.1.14. Sabre Industries, Inc.

5.1.15. McWane Poles

5.2. Cross Comparison Parameters (No. of Employees, Production Capacity, Revenue, Manufacturing Plants, Inception Year, Regional Presence, Key Partnerships, Technology Adoption)

5.3. Market Share Analysis (Top 10 Players by Revenue)

5.4. Strategic Initiatives (Expansion, Joint Ventures, R&D Investments)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (New Production Facilities, Modernization of Existing Plants)

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies for Green Poles

6. Asia Pacific Utility Pole Market Regulatory Framework

6.1. Industry Standards (ISO, National Standards)

6.2. Compliance Requirements (Safety, Durability)

6.3. Certification Processes (Sustainable Pole Manufacturing, Fire Resistance Standards)

7. Asia Pacific Utility Pole Future Market Size (In USD Bn)

7.1. Future Market Size Projections (New Installations, Replacement Rates)

7.2. Key Factors Driving Future Market Growth (Urbanization, Telecommunication Expansion, Smart Grid Developments)

8. Asia Pacific Utility Pole Future Market Segmentation

8.1. By Material (In Value %)

8.2. By Application (In Value %)

8.3. By Pole Height (In Value %)

8.4. By Utility Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Utility Pole Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Utility Companies, Contractors, Municipalities)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis (New Regions, Technological Innovations)

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out the key stakeholders in the Asia Pacific Utility Pole Market. This was achieved by conducting in-depth desk research using proprietary databases and reports, with a focus on identifying material use trends, regional power projects, and growth in telecommunications infrastructure.

Step 2: Market Analysis and Construction

Historical data was compiled to evaluate market performance, including the number of utility poles installed across various regions, demand for renewable energy projects, and advancements in smart pole technology. Additionally, a comprehensive analysis of service and product offerings by market leaders was conducted.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses related to market growth, technological innovation, and governmental regulations were validated through interviews with industry experts from both utility and telecommunications sectors. These consultations provided crucial insights into the operational challenges and future trends influencing the market.

Step 4: Research Synthesis and Final Output

The final phase of the research involved synthesizing the gathered data and insights, ensuring the accuracy and reliability of the market statistics. This was further supported by engaging with manufacturing firms to validate production capacities and future technology adoption.

Frequently Asked Questions

01. How big is the Asia Pacific Utility Pole Market?

The Asia Pacific Utility Pole Market is valued at USD 13 billion, driven by infrastructure investments, government initiatives in electrification, and the growth of telecommunications networks across the region.

02. What are the challenges in the Asia Pacific Utility Pole Market?

Key challenges in Asia Pacific Utility Pole Market include the rising costs of raw materials such as wood and steel, regulatory compliance related to environmental concerns, and competition from alternative technologies like underground power lines.

03. Who are the major players in the Asia Pacific Utility Pole Market?

Major players in Asia Pacific Utility Pole Market include Valmont Industries, Inc., Nippon Concrete Industries, Skipper Limited, RS Technologies Inc., and Stella-Jones Inc. These companies lead the market due to their strong production capacities and partnerships with utility companies.

04. What are the growth drivers of the Asia Pacific Utility Pole Market?

Growth drivers in Asia Pacific Utility Pole Market include increasing government investments in rural electrification, the expansion of 5G networks, and the modernization of urban infrastructure through smart city projects, which require advanced utility pole solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.