Asia Pacific Vape Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5693

November 2024

88

About the Report

Asia Pacific Vape Market Overview

- The Asia Pacific Vape Market is currently valued at USD 6 billion, based on a five-year historical analysis, driven by the rising adoption of e-cigarettes and vaping devices as alternatives to traditional tobacco products. Key drivers for this growth include increased consumer awareness regarding health risks associated with smoking, advancements in vaping technologies, and a shift toward lifestyle-driven preferences.

- In the Asia Pacific region, China and Japan are the dominant markets for vaping products due to their large consumer base, established manufacturing facilities, and significant investments in vaping technologies. Chinas established presence in e-cigarette manufacturing, coupled with robust export channels, makes it a central player, while Japans preference for innovative nicotine delivery systems drives its market leadership.

- Asia-Pacific vaping regulations vary, with Japan and South Korea adopting harm-reduction approaches, while countries like Singapore and Thailand impose strict bans. In 2024, Singapores Ministry of Health increased penalties on illegal vape imports, reinforcing the regulatory challenges within the region. South Korea, however, has introduced regulatory frameworks for vape devices to ensure consumer safety, reflecting diverse regulatory landscapes across Asia.

Asia Pacific Vape Market Segmentation

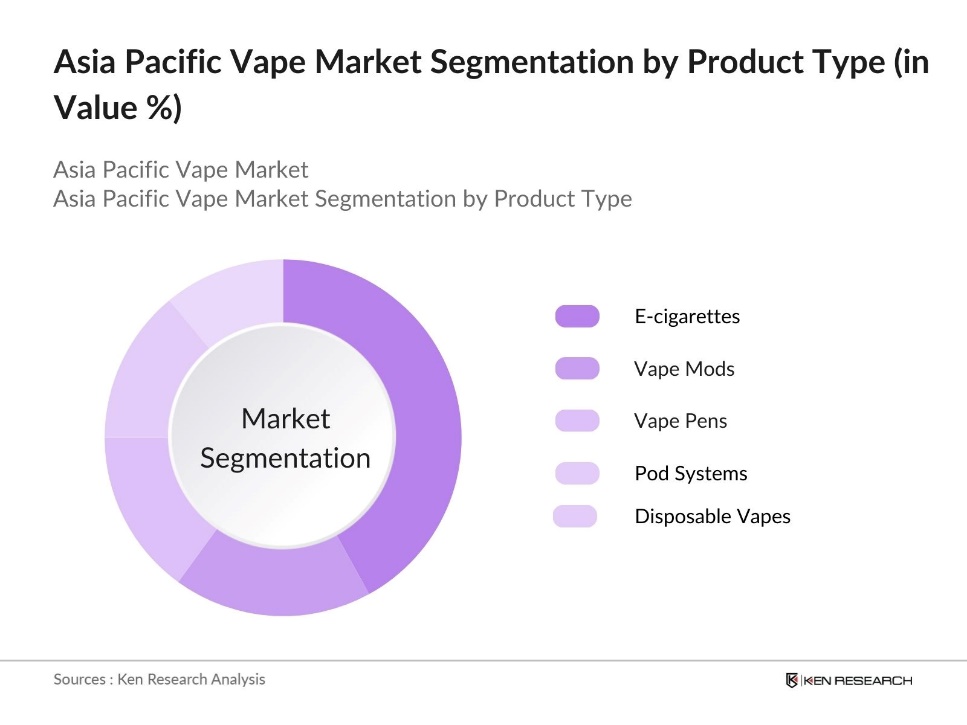

By Product Type: The market is segmented by product type into E-cigarettes, Vape Mods, Vape Pens, Pod Systems, and Disposable Vapes. Recently, E-cigarettes have emerged with a dominant market share under the segmentation by product type. This is due to their widespread popularity as a preferred alternative to smoking traditional cigarettes, supported by various customization options for nicotine levels and flavors. Additionally, E-cigarettes have benefitted from favorable consumer perception as a reduced-risk alternative, contributing to their market dominance.

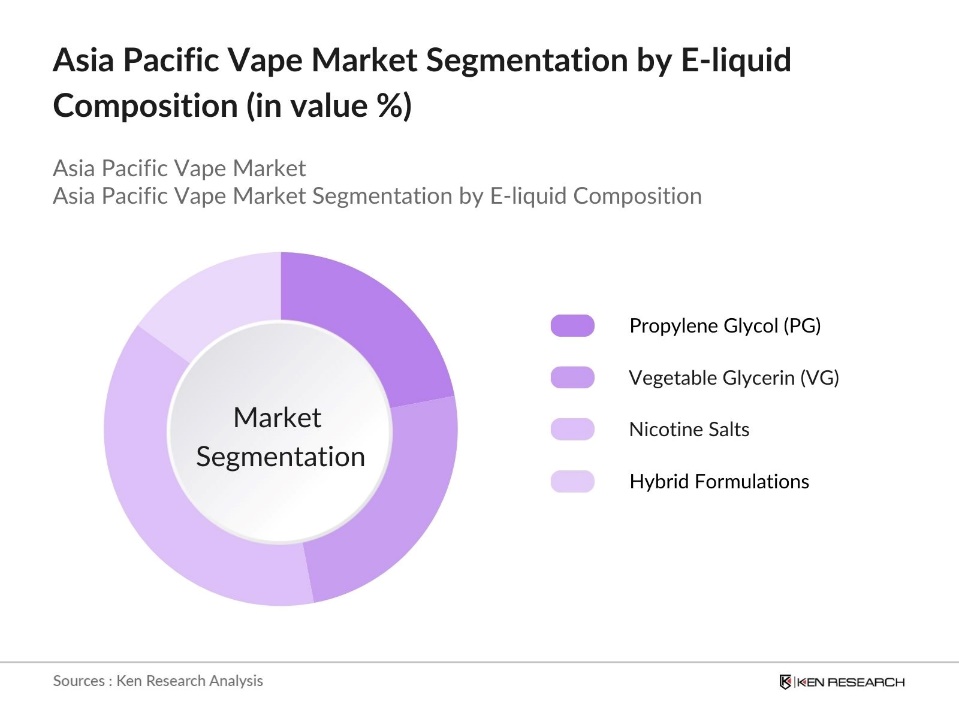

By E-liquid Composition: The market is segmented by E-liquid composition into Propylene Glycol (PG), Vegetable Glycerin (VG), Nicotine Salts, and Hybrid Formulations. Within this segmentation, Nicotine Salts hold a significant market share due to their ability to deliver higher nicotine content with a smoother throat hit, catering to consumers seeking a more intense experience. Nicotine salts have seen widespread adoption, especially in pod systems, due to their efficiency in nicotine delivery and increasing consumer preference for higher satisfaction in vaping.

Asia Pacific Vape Market Competitive Landscape

The Asia Pacific Vape Market is dominated by a select group of major players that wield considerable influence due to their strong brand positioning, broad product portfolios, and effective marketing strategies. Notably, companies such as RELX Technology and JUUL Labs lead the market, benefitting from innovation in product design and robust distribution channels. These companies have established a significant foothold in the market through their expansive reach and investment in consumer engagement strategies.

Asia Pacific Vape Industry Analysis

Growth Drivers

- Increasing Awareness of Harm Reduction: Harm reduction efforts in countries like Japan and South Korea have increased vape adoption as a smoking alternative. For instance, For instance, the WHO indicates that the South-East Asian Region has the highest percentage of tobacco users at 26.5% of the population. This awareness shift has directly contributed to the growth of the vaping market across the region.

- Rising Disposable Income: Rising disposable income levels across Asia-Pacific have bolstered consumer spending on lifestyle products, including vaping devices. South Korea's GDP per capita reached approximately USD 35,569.90 in December 2023. Higher disposable income correlates with an increase in non-essential expenditures, which benefits markets like vaping. The growing middle class in countries such as Vietnam and Thailand also reflects increased purchasing power for alternative lifestyle products, supporting vape market expansion.

- Technological Innovations: Technological advancements in battery life, coil efficiency, and compact designs have made vaping devices more attractive to consumers. The rise of heat-not-burn (HnB) technology, especially popular in Japan, provides an alternative to traditional smoking. These innovations meet consumer demands for efficient, reduced-risk nicotine options, contributing to the growing adoption of vaping technology across the Asia-Pacific region.

Market Challenges

- Regulatory Restrictions: Vaping in Asia-Pacific faces various regulatory restrictions, with countries like Singapore enforcing stringent bans on vape sales and imports. In contrast, Australia requires prescriptions for nicotine-based vape products. In India, a nationwide vape ban restricts access and stifles market growth. These regulatory hurdles create fragmented markets within Asia-Pacific, limiting cross-border supply chains. Government measures are expected to shape the vape markets legal landscape in the coming years, significantly impacting product accessibility.

- Product Quality Control Issues: Product quality and counterfeit items present ongoing challenges in the vape market. Variability in product standards and the prevalence of unregulated products undermine consumer trust and pose safety risks. Many of these items lack essential safety certifications, leading to increased scrutiny from regulatory bodies. While efforts to enforce quality standards are growing, counterfeit products remain a persistent concern within the market.

Asia Pacific Vape Market Future Outlook

Over the next five years, the Asia Pacific Vape Market is expected to witness substantial growth, driven by shifting consumer preferences, increased government support for smoking cessation initiatives, and the continuous introduction of innovative products tailored to varying consumer preferences. As regulations around traditional tobacco products tighten, vaping is likely to gain further acceptance as a reduced-risk alternative, potentially expanding market opportunities. Additionally, advancements in battery technology and flavor formulation are set to elevate the user experience and drive consumer adoption.

Market Opportunities

- Expansion of E-commerce Platforms: The growth of e-commerce platforms in Asia-Pacific presents a major opportunity for the vape market by enhancing accessibility to vape products. Direct-to-consumer online channels allow easier, more private access to a variety of vaping options, particularly appealing in markets like Indonesia and Vietnam. The convenience and anonymity of online shopping have helped drive consumer interest, supporting further market expansion across the region.

- Diversification in Vape Flavors: The demand for a wider range of vape flavors continues to grow, as consumers increasingly seek variety beyond traditional tobacco flavors. Popular options like fruit and menthol cater to diverse tastes, offering companies opportunities to differentiate their products. This diversification aligns with shifting consumer preferences, allowing brands to appeal to a broader, flavor-conscious audience within the vape market.

Scope of the Report

|

Product Type |

E-cigarettes Vape Mods Vape Pens Pod Systems Disposable Vapes |

|

E-liquid Composition |

Propylene Glycol (PG) Vegetable Glycerin (VG) Nicotine Salts Hybrid Formulations |

|

Distribution Channel |

Online Retail Vape Shops Convenience Stores Specialty Stores |

|

User Demographics |

Adult Smokers Young Adults Recreational Users |

|

Region |

China Japan South Korea Southeast Asia Australia and New Zealand |

Products

Key Target Audience

Vaping Device Manufacturers

Brick-and-Mortar Vape Industry

Healthcare and Wellness Industry

Vape Marketing and Advertising Agencies

Government and Regulatory Bodies (e.g., Ministry of Health, Asia Pacific Tobacco Control Program)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

RELX Technology

JUUL Labs

SMOK

VAPORESSO

Innokin Technology

GeekVape

KangerTech

Eleaf Electronics

Philip Morris International (IQOS)

Altria Group, Inc.

Table of Contents

1. Asia Pacific Vape Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Vape Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Vape Market Analysis

3.1. Growth Drivers (e.g., Increasing Awareness of Harm Reduction, Rising Disposable Income, Technological Innovations, Changing Social Norms)

3.2. Market Challenges (e.g., Regulatory Restrictions, Health Concerns, Product Quality Control Issues, Supply Chain Constraints)

3.3. Opportunities (e.g., Expansion of E-commerce Platforms, Diversification in Vape Flavors, Product Innovations)

3.4. Trends (e.g., Shift Toward Organic Vape Liquids, Popularity of Closed Pod Systems, Introduction of Nicotine Salts)

3.5. Government Regulations (e.g., Regional Policies, Import and Sales Restrictions, Tax Policies)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (e.g., Manufacturers, Distributors, Retailers, Regulatory Bodies)

3.8. Porters Five Forces

3.9. Competition Landscape

4. Asia Pacific Vape Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. E-cigarettes

4.1.2. Vape Mods

4.1.3. Vape Pens

4.1.4. Pod Systems

4.1.5. Disposable Vapes

4.2. By E-liquid Composition (In Value %)

4.2.1. Propylene Glycol (PG)

4.2.2. Vegetable Glycerin (VG)

4.2.3. Nicotine Salts

4.2.4. Hybrid Formulations

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Vape Shops

4.3.3. Convenience Stores

4.3.4. Specialty Stores

4.4. By User Demographics (In Value %)

4.4.1. Adult Smokers

4.4.2. Young Adults

4.4.3. Recreational Users

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Southeast Asia

4.5.5. Australia and New Zealand

5. Asia Pacific Vape Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. RELX Technology

5.1.2. JUUL Labs

5.1.3. VAPORESSO

5.1.4. SMOK

5.1.5. Innokin Technology

5.1.6. Joyetech Group

5.1.7. GeekVape

5.1.8. KangerTech

5.1.9. Eleaf Electronics

5.1.10. Philip Morris International (IQOS)

5.1.11. Altria Group, Inc.

5.1.12. British American Tobacco (Vuse)

5.1.13. Japan Tobacco Inc.

5.1.14. China Tobacco International

5.1.15. Imperial Brands (Blu)

5.2. Cross Comparison Parameters (Product Portfolio Diversity, Regional Market Share, Sales Revenue, Product Innovation Rate, Customer Engagement, Brand Positioning, Market Penetration Rate, Expansion Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Vape Market Regulatory Framework

6.1. Regulatory Landscape by Country

6.2. Compliance and Certification Standards

6.3. Product Import and Export Regulations

6.4. Advertising and Marketing Restrictions

7. Asia Pacific Vape Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Vape Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By E-liquid Composition (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By User Demographics (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Vape Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Market Penetration Strategies

9.4. Emerging Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase focuses on mapping the Asia Pacific Vape Market's ecosystem, identifying key stakeholders and their roles. This involves in-depth desk research using both proprietary and public databases to construct a comprehensive framework and pinpoint influential variables that drive the market.

Step 2: Market Analysis and Construction

Historical data related to market penetration, revenue generation, and consumer trends is collected and analyzed to construct a robust market analysis model. This phase includes a comparative study of vape product adoption across various consumer demographics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through in-depth interviews with industry experts, utilizing CATI (Computer-Assisted Telephone Interviews). Insights gained from these discussions provide clarity on operational strategies and the financial health of market participants.

Step 4: Research Synthesis and Final Output

The final phase involves validating data through direct consultation with vaping device manufacturers, consolidating feedback on product trends, sales performance, and consumer preferences. This ensures an accurate, validated, and holistic view of the Asia Pacific Vape Market.

Frequently Asked Questions

01. How big is the Asia Pacific Vape Market?

The Asia Pacific Vape Market is currently valued at USD 6 billion, driven by rising consumer interest in alternatives to traditional tobacco, technological advancements, and changing regulatory landscapes across the region.

02. What challenges exist in the Asia Pacific Vape Market?

Challenges include regulatory uncertainties, health concerns, and supply chain issues that impact product availability and pricing, as well as increasing scrutiny on marketing practices targeting younger consumers.

03. Who are the major players in the Asia Pacific Vape Market?

Key players include RELX Technology, JUUL Labs, SMOK, VAPORESSO, and Innokin Technology. These companies dominate due to extensive product portfolios, strong brand positioning, and wide distribution networks.

04. What are the growth drivers of the Asia Pacific Vape Market?

Growth is driven by rising awareness of smoking cessation, technological innovations in vaping devices, expanding online retail channels, and the launch of new flavors and formulations catering to consumer preferences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.