Asia Pacific Vegan Food Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD10972

November 2024

99

About the Report

Asia Pacific Vegan Food Market Overview

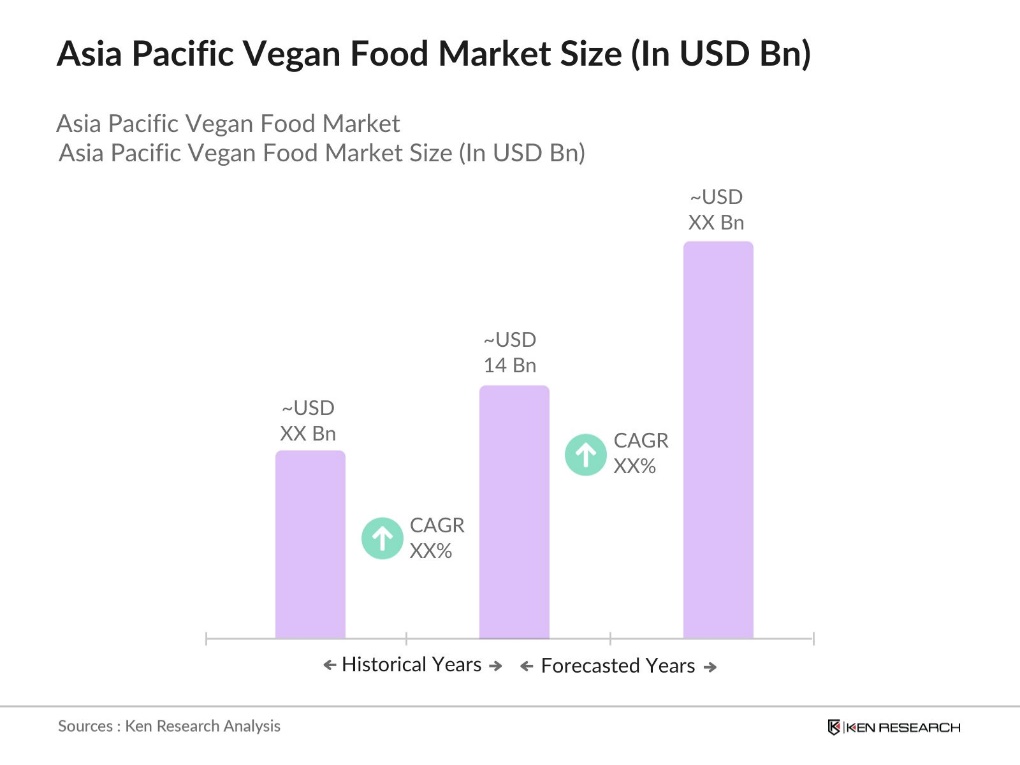

- The Asia Pacific Vegan Food Market has reached a valuation of USD 14 billion, propelled by growing health awareness, environmental concerns, and dietary changes. The surge in veganism has notably impacted product offerings, especially as consumers shift towards plant-based diets for health benefits and sustainability. As dietary trends evolve, increased investments in plant-based food innovations have also contributed to market growth.

- Within the Asia Pacific region, China, India, and Australia lead the market due to diverse factors. Chinas dominance is driven by its robust demand for plant-based alternatives and innovations in food technology. India has a growing consumer base inclined towards dairy-free diets due to lactose intolerance and cultural preferences.

- Labeling regulations for vegan foods are being formalized in several Asia Pacific countries to ensure transparency and consumer trust. The Indian government, through FSSAI, implemented mandatory vegan labeling guidelines in 2023 to distinguish vegan products from others. These regulations aim to aid consumers in making informed choices and to promote the domestic vegan food industry, particularly among urban populations.

Asia Pacific Vegan Food Market Segmentation

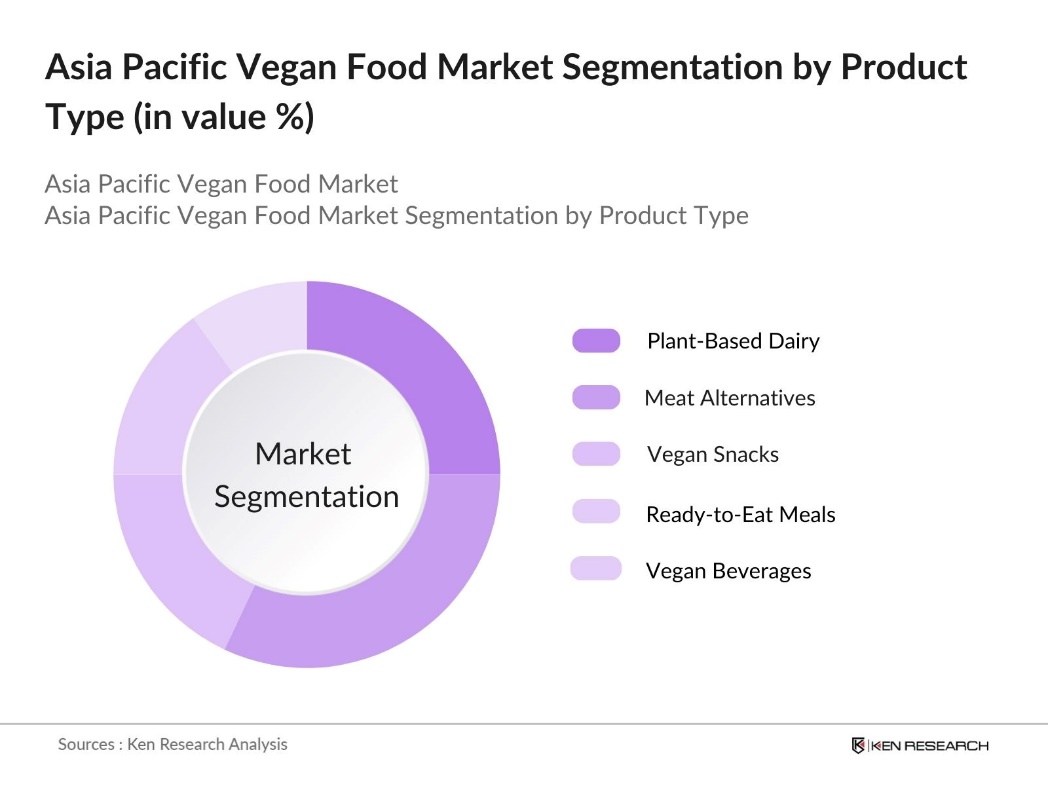

By Product Type: The market is segmented by product type into plant-based dairy, meat alternatives, vegan snacks and confectionery, ready-to-eat vegan meals, and vegan beverages. Among these, meat alternatives dominate due to consumer inclination towards high-protein options and ethical food sourcing. The popularity of brands like Beyond Meat and Impossible Foods, coupled with local innovators, has reinforced the markets growth. Companies have successfully captured consumer interest through taste improvements and competitive pricing.

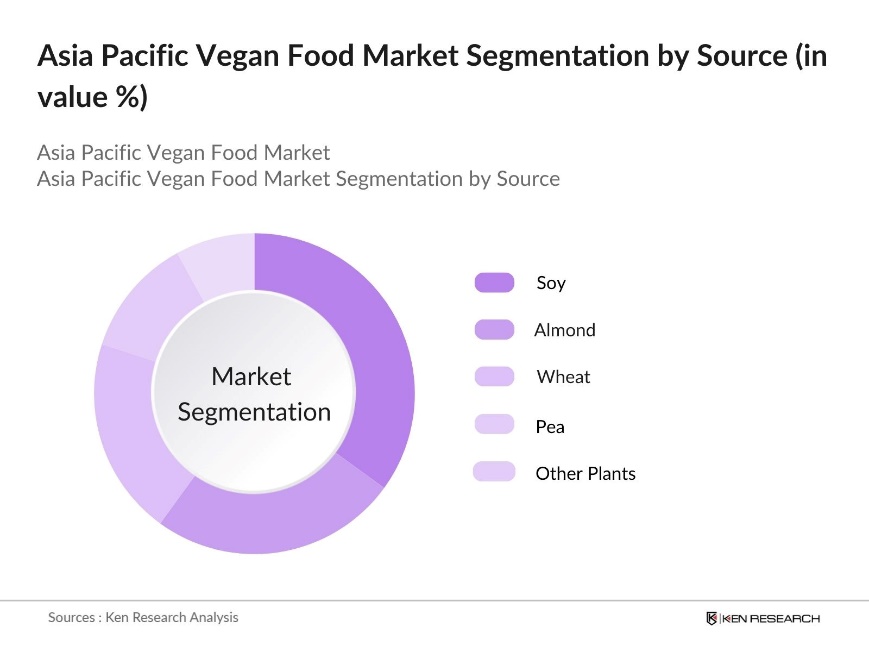

By Source: The market is segmented by source into soy, almond, wheat, pea, and other plant sources. Soy-based products dominate, driven by cost efficiency, nutritional benefits, and versatile applications in dairy and meat substitutes. Soys established agricultural infrastructure in regions like China and India has enabled cost-effective and large-scale production, sustaining its dominance in vegan product formulations.

Asia Pacific Vegan Food Market Competitive Landscape

The Asia Pacific Vegan Food Market is dominated by prominent global and regional players, with notable influences from local brands that cater to region-specific tastes and preferences. This competitive landscape is marked by constant innovation in taste, texture, and nutritional value to satisfy a broad consumer base.

Asia Pacific Vegan Food Industry Analysis

Growth Drivers

- Rising Health Consciousness: Consumer health awareness in Asia Pacific is fueling vegan food market growth as populations become more health-conscious due to lifestyle diseases. In 2024, diabetes and heart disease rates remain high, with countries like India and China having over 70 million diagnosed diabetes cases combined, as per WHO data. The rising prevalence of these conditions is prompting consumers to adopt plant-based diets, noted for their low-fat and high-fiber content, reducing risks of such illnesses. Additionally, in countries like Japan, health-focused spending in households has reached substantial levels, reinforcing demand for vegan foods.

- Growth in Flexitarian and Vegan Population: Flexitarian and vegan populations are expanding in the Asia Pacific region, driven by shifting dietary preferences. In New Zealand, a recent study showed that while 93% of Kiwis still consume meat, many are lowering their intake due to cost and health concerns, rather than climate issues. This demographic shift has catalyzed growth in vegan options, particularly in urban centers where vegan alternatives are more accessible.

- Innovation in Vegan Product Offerings: Product innovation in plant-based alternatives, particularly in meat and dairy, is a major driver of the vegan food market in Asia Pacific. With increasing R&D support and industry collaborations, diverse and improved vegan products are becoming more available and appealing to mainstream consumers. This push toward variety and accessibility aligns with growing dietary preferences and demand for plant-based foods across the region.

Market Challenges

- High Product Costs: The high cost of vegan products remains a barrier to growth in Asia Pacific, largely due to the expense of raw materials and processing. This pricing differential, especially in comparison to traditional food products, poses a challenge in terms of affordability for consumers, particularly in emerging economies. As a result, premium pricing continues to limit accessibility and widespread adoption across the region.

- Limited Supply Chain Infrastructure: Inadequate supply chain infrastructure restricts the availability of vegan products in many Asia Pacific countries. Logistical challenges, especially in cold-chain facilities, complicate the transportation of fresh and processed vegan foods. This infrastructure gap impacts distribution efficiency and limits accessibility, particularly in rural and remote areas where demand for vegan options is gradually increasing.

Asia Pacific Vegan Food Market Future Outlook

Over the next five years, the Asia Pacific Vegan Food Market is anticipated to grow significantly, driven by increasing awareness of plant-based diets, strong government support for sustainable food production, and advancements in vegan food technology. A rise in health-conscious consumers and initiatives for reducing carbon footprints is expected to sustain the markets upward trend.

Market Opportunities

- Expansion in Emerging Economies: Emerging economies such as Vietnam, Thailand, and the Philippines are witnessing a growing adoption of vegan diets. Urban consumers are showing increased interest in plant-based options, with government-backed initiatives in some countries encouraging this dietary shift to support health and environmental goals. This expanding consumer base in these regions presents promising opportunities for vegan food manufacturers to enter and thrive in these emerging markets.

- Digital Transformation in Food Distribution: Digital transformation in food distribution is opening new growth opportunities for vegan products in Asia Pacific. The rapid development of e-commerce platforms specializing in niche dietary needs has made it easier for vegan brands to reach a wider audience. Supported by government efforts, this shift to online channels is becoming a critical pathway for expanding the availability and popularity of vegan foods across the region.

Scope of the Report

|

Product Type |

Plant-Based Dairy Meat Alternatives Vegan Snacks and Confectionery Ready-To-Eat Meals Vegan Beverages |

|

Source |

Soy Almond Wheat Pea Other Plant Sources |

|

Distribution Channel |

Supermarkets and Hypermarkets Online Retail Specialty Stores Foodservice Convenience Stores |

|

Application |

Household Commercial Industrial |

|

Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience

Plant-Based Food Manufacturers

Health and Wellness Companies

Food and Beverage Industry

E-commerce Platforms

Government and Regulatory Bodies (Ministry of Health, Food Safety and Standards Authorities)

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Impossible Foods Inc.

Beyond Meat Inc.

Otsuka Holdings Co. Ltd.

Vitasoy International Holdings Ltd.

Nestl S.A.

The Tofurky Company

Blue Diamond Growers

Danone S.A.

The Hain Celestial Group

SunOpta Inc.

Table of Contents

1. Asia Pacific Vegan Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Growth Rate and Trends

1.5. Vegan Food Landscape in Asia Pacific

2. Asia Pacific Vegan Food Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Sales Channel Overview

3. Asia Pacific Vegan Food Market Analysis

3.1. Growth Drivers (Consumer Behavior, Dietary Shifts, Product Innovation)

3.1.1. Rising Health Consciousness

3.1.2. Growth in Flexitarian and Vegan Population

3.1.3. Innovation in Vegan Product Offerings

3.1.4. Expansion of Distribution Channels

3.2. Market Challenges (Product Perception, Supply Chain Limitations, Cost Implications)

3.2.1. High Product Costs

3.2.2. Limited Supply Chain Infrastructure

3.2.3. Regulatory Constraints

3.3. Opportunities (Market Penetration, Consumer Education, E-commerce Growth)

3.3.1. Expansion in Emerging Economies

3.3.2. Digital Transformation in Food Distribution

3.3.3. Collaboration with E-commerce Platforms

3.4. Trends (Alternative Protein Innovation, Sustainable Packaging, Localized Branding)

3.4.1. Growth in Plant-Based Meat Alternatives

3.4.2. Sustainable Product Packaging

3.4.3. Increasing Use of Digital Marketing and Social Media

3.5. Government Regulations and Standards (Labeling, Certifications, Import Policies)

3.5.1. Vegan Labeling Regulations

3.5.2. Organic and Non-GMO Certifications

3.5.3. Import Tariffs and Restrictions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Market Competitor Landscape

4. Asia Pacific Vegan Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Plant-Based Dairy

4.1.2. Meat Alternatives

4.1.3. Vegan Snacks and Confectionery

4.1.4. Ready-To-Eat Vegan Meals

4.1.5. Vegan Beverages

4.2. By Source (In Value %)

4.2.1. Soy

4.2.2. Almond

4.2.3. Wheat

4.2.4. Pea

4.2.5. Other Plant Sources

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Online Retail

4.3.3. Specialty Stores

4.3.4. Foodservice

4.3.5. Convenience Stores

4.4. By Application (In Value %)

4.4.1. Household

4.4.2. Commercial (Foodservice and Retail)

4.4.3. Industrial

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. South Korea

4.5.4. Japan

4.5.5. Australia

4.5.6. Rest of APAC

5. Asia Pacific Vegan Food Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Impossible Foods Inc.

5.1.2. Beyond Meat Inc.

5.1.3. Otsuka Holdings Co. Ltd.

5.1.4. Vitasoy International Holdings Ltd.

5.1.5. Blue Diamond Growers

5.1.6. Danone S.A.

5.1.7. Nestl S.A.

5.1.8. The Tofurky Company

5.1.9. Unilever

5.1.10. Campbell Soup Company

5.1.11. The Hain Celestial Group

5.1.12. Conagra Brands, Inc.

5.1.13. Archer Daniels Midland Company

5.1.14. Daiya Foods Inc.

5.1.15. SunOpta Inc.

5.2. Cross Comparison Parameters (Market Share, Headquarters, Manufacturing Facilities, Product Portfolio, Sustainability Initiatives, Expansion Strategies, Market Reach, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Funding

5.8. Product Launch Analysis

5.9. R&D and Innovation Investments

6. Asia Pacific Vegan Food Market Regulatory Framework

6.1. Food Safety and Labeling Standards

6.2. Certification Processes (Vegan, Non-GMO, Organic)

6.3. Compliance and Regulatory Requirements

6.4. Import and Export Regulations

6.5. Subsidies and Support Programs for Plant-Based Innovation

7. Asia Pacific Vegan Food Future Market Size (in USD Mn)

7.1. Projected Market Size and Growth Rate

7.2. Key Factors Influencing Future Market Growth

8. Asia Pacific Vegan Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Vegan Food Market Analysts Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Key Customer Segments and Profiles

9.3. Marketing and Distribution Initiatives

9.4. Strategic White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping key stakeholders across the Asia Pacific Vegan Food Market. Extensive desk research is employed to extract industry-specific insights, identifying variables influencing consumer behavior and market dynamics.

Step 2: Market Analysis and Construction

Historical data and market penetration rates are compiled to analyze the influence of vegan food adoption across consumer segments, ensuring accurate estimates of market growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market growth and consumer preferences are refined through consultations with industry experts using CATIs, gathering operational insights from top players in the vegan food segment.

Step 4: Research Synthesis and Final Output

This stage consolidates insights through direct engagement with vegan food manufacturers, ensuring that segment-specific data and market drivers are accurately represented for a holistic market analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Vegan Food Market?

The Asia Pacific Vegan Food Market is valued at USD 14 billion, driven by consumer shifts towards plant-based diets and sustainability awareness, according to a historical analysis of market trends.

02. What challenges does the Asia Pacific Vegan Food Market face?

Challenges in Asia Pacific Vegan Food Market include high production costs, limited infrastructure for plant-based manufacturing, and consumer price sensitivity, impacting product affordability and accessibility.

03. Who are the major players in the Asia Pacific Vegan Food Market?

Key players in Asia Pacific Vegan Food Market include Impossible Foods, Beyond Meat, and Vitasoy International, which dominate due to strong product innovation, extensive distribution networks, and growing brand recognition.

04. What drives growth in the Asia Pacific Vegan Food Market?

The Asia Pacific Vegan Food Market growth is propelled by rising health consciousness, increased environmental awareness, and dietary shifts towards ethical consumption, contributing to the demand for vegan alternatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.