Asia Pacific Vehicle Scanner Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7950

November 2024

82

About the Report

Asia Pacific Vehicle Scanner Market Overview

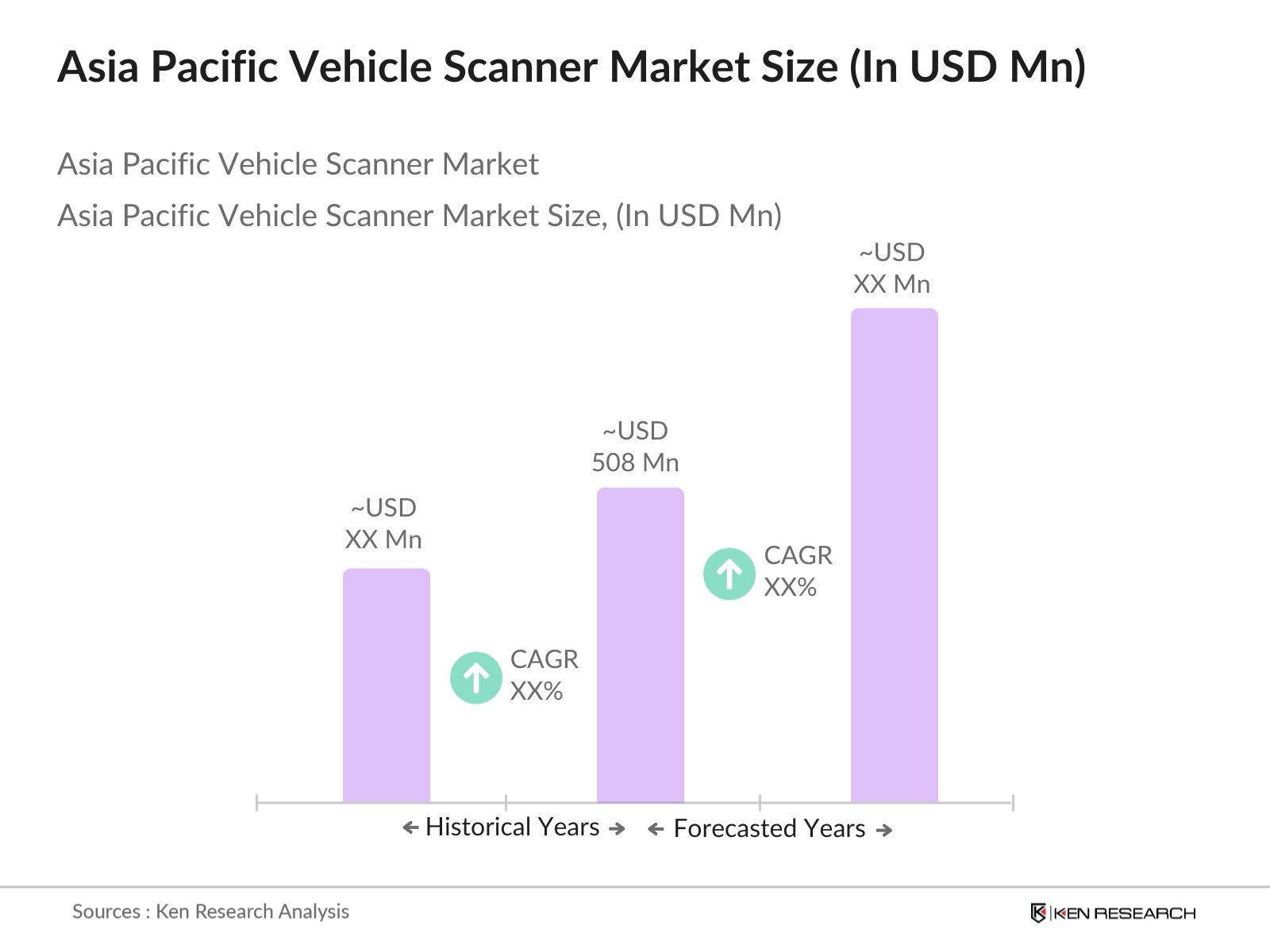

- The Asia Pacific Vehicle Scanner Market is valued at USD 508 million, based on a five-year historical analysis. The market is primarily driven by the increasing need for high-end security solutions at border checkpoints, airports, and other critical infrastructures. As global trade volumes rise and security concerns grow, the demand for advanced vehicle scanning technologies has surged. Governments across the region, particularly in China and India, are focusing on upgrading their border control systems, which has significantly boosted market growth.

- China and India are the dominant countries in the Asia Pacific Vehicle Scanner Market, largely due to their massive investments in infrastructure and security systems. Chinas leading position is attributed to its heavy government investments in border security technologies, alongside its rapid advancements in artificial intelligence and scanning technology. India, with its strategic importance in the region and growing cross-border trade, has increasingly invested in vehicle scanning technologies, particularly at high-traffic border crossings.

- Compliance with international standards like ISO 9001 and ASTM F792-88 is mandatory for vehicle scanners across the Asia Pacific. Japans National Institute of Advanced Industrial Science and Technology implemented stricter compliance checks in 2023 to ensure that all vehicle scanners at border points adhere to these international safety and performance standards. Such regulations are designed to ensure consistency and reliability in vehicle scanning systems, enhancing their effectiveness in both public safety and border security applications.

Asia Pacific Vehicle Scanner Market Segmentation

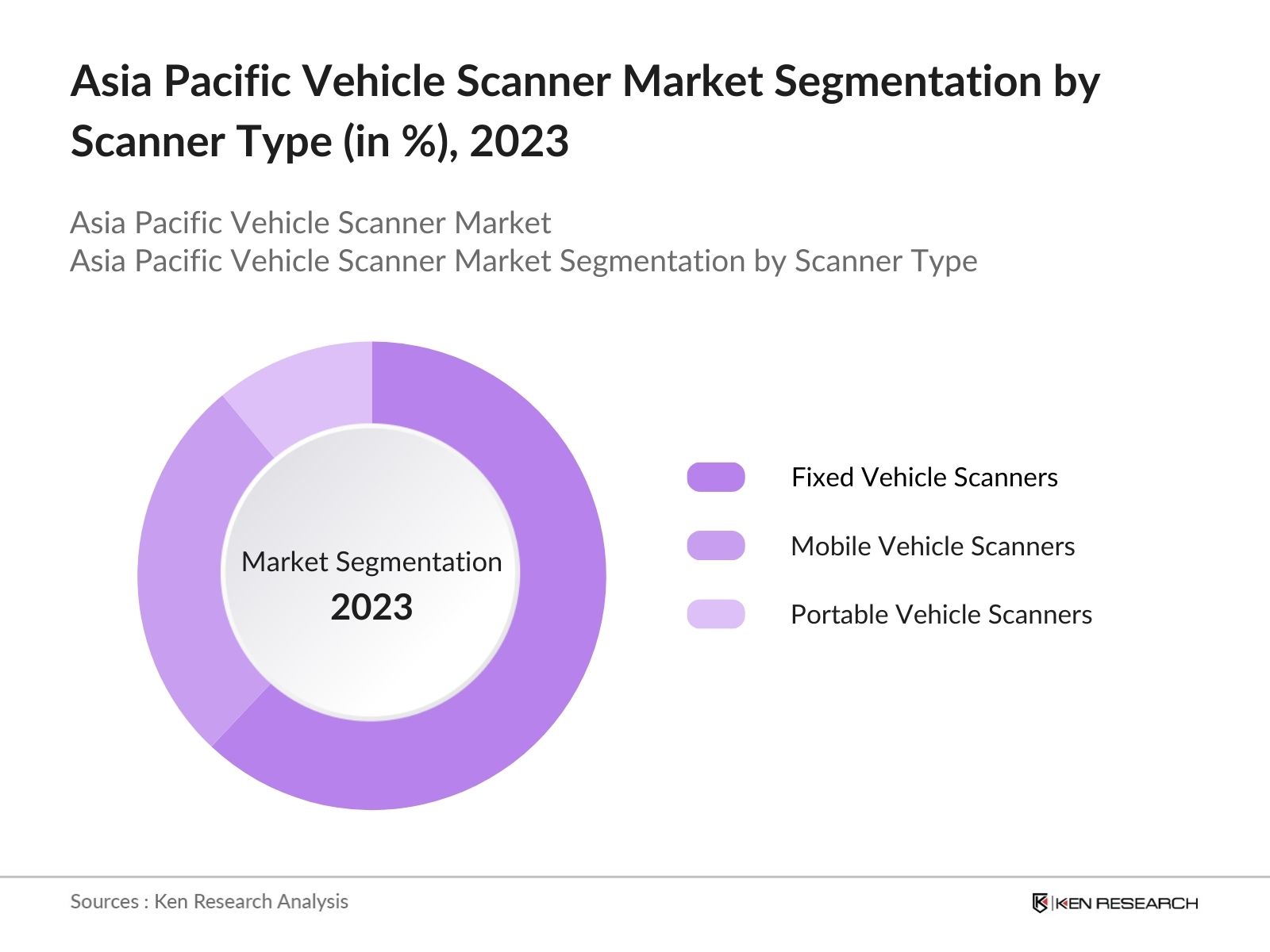

By Scanner Type: The Asia Pacific Vehicle Scanner Market is segmented by scanner type into fixed vehicle scanners, mobile vehicle scanners, and portable vehicle scanners. Fixed vehicle scanners dominate the market under this segmentation, primarily due to their widespread deployment at high-traffic facilities such as border crossings, airports, and seaports.

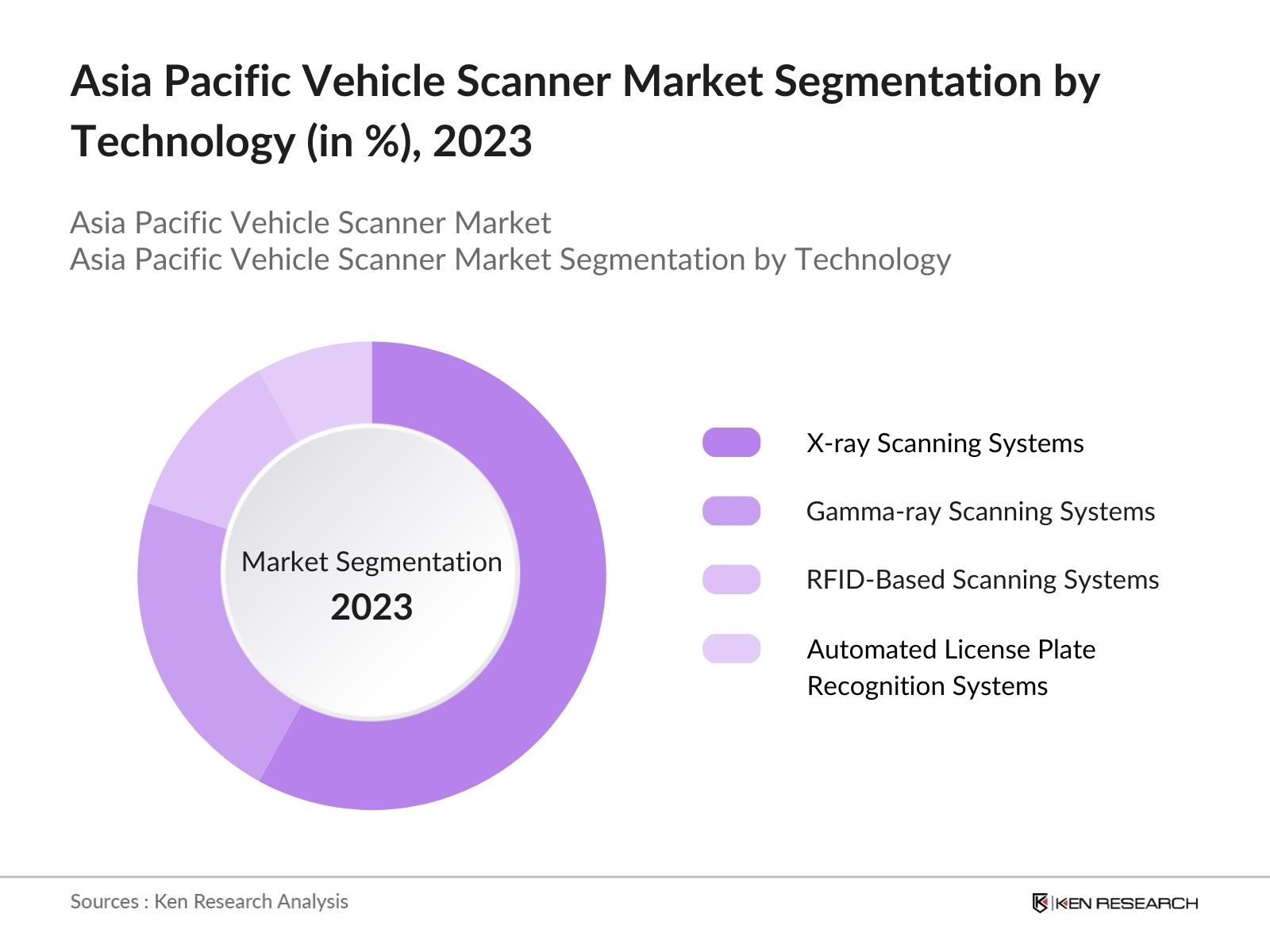

By Technology: The market is also segmented by technology into X-ray scanning systems, gamma-ray scanning systems, RFID-based scanning systems, and automated license plate recognition systems. X-ray scanning systems hold a dominant share in this market segment. These systems provide high-resolution images that enable accurate identification of hidden contraband and threats within vehicles, which is crucial for security at border control and large public venues.

Asia Pacific Vehicle Scanner Market Competitive Landscape

The Asia Pacific Vehicle Scanner Market is dominated by a few major players who contribute significantly to market innovations and security technology advancements. The competitive landscape highlights the consolidation of major industry players who focus on providing advanced, high-accuracy scanning solutions. The Asia Pacific vehicle scanner market is highly consolidated, with key players like Leidos, Rapiscan Systems, and Nuctech leading the technological innovations and supply chain advancements in the sector.

Asia Pacific Vehicle Scanner Industry Analysis

Growth Drivers

- Increasing Cross-Border Trade and Security Concerns: The Asia Pacific region is home to some of the world's busiest borders, particularly between countries like China and India, with trade amounting to over USD 100 billion in 2022. These high trade volumes, combined with growing geopolitical tensions, have led governments to enhance border security measures. According to the World Bank, China's trade surplus was USD 877 billion in 2023, necessitating stringent security protocols, including vehicle scanners at entry points to safeguard against smuggling and terrorism.

- Growing Adoption of Advanced Security Technologies: The adoption of advanced security technologies like AI-integrated scanners has seen significant growth in Asia Pacific. For instance, South Korea's investment in AI-based border surveillance rose by USD 1.6 billion in 2023, according to the South Korean Ministry of Trade, Industry, and Energy. The rise of smart technologies in vehicle scanners ensures the quick and efficient detection of threats.

- Rising Investments in Smart Infrastructure and Border Control: Countries in the Asia Pacific are heavily investing in smart infrastructure, including vehicle scanners, to bolster national security. According to Indias Ministry of Finance, the Indian government allocated USD 8 billion for border infrastructure in 2023. This investment includes upgrades to smart surveillance systems, which utilize advanced vehicle scanners at high-traffic border checkpoints. Similar investments in Australia and China have further enhanced their border control mechanisms.

Market Challenges

- High Installation and Maintenance Costs: The cost of installing advanced vehicle scanners is a significant challenge for many countries in Asia Pacific. According to the Australian Department of Home Affairs, the installation of a single advanced vehicle scanner can exceed USD 1.5 million, with additional annual maintenance costs reaching USD 300,000. These high expenses can deter small and medium-sized economies from fully integrating vehicle scanning technologies at their borders, limiting market growth in less affluent countries.

- Integration Issues with Legacy Systems: Many countries in Asia Pacific face challenges in integrating new vehicle scanners with outdated security infrastructure. For example, a report from India's Border Management Department in 2022 indicated that 35% of border security systems are more than 15 years old, making the adoption of modern vehicle scanners difficult without substantial upgrades. This integration challenge is compounded by varying technology standards across the region, leading to delays in full-scale deployment of advanced scanning systems.

Asia Pacific Vehicle Scanner Market Future Outlook

Over the next five years, the Asia Pacific Vehicle Scanner Market is expected to exhibit substantial growth, driven by the increasing need for enhanced security at critical infrastructures such as airports, borders, and ports. Government initiatives aimed at upgrading border security, coupled with growing investments in smart city projects, will create a surge in demand for advanced scanning technologies.

Market Opportunities

- Advancements in Artificial Intelligence and Machine Learning: The application of AI and machine learning in vehicle scanners presents a significant opportunity for growth in the Asia Pacific market. In 2023, Japan's Ministry of Economy, Trade, and Industry launched an initiative with USD 2 billion funding to develop AI-powered threat detection systems. These advancements enable real-time detection of concealed threats, enhancing security at border crossings.

- Expansion into Developing Markets: Developing markets in Southeast Asia, such as Vietnam and Indonesia, present lucrative opportunities for the vehicle scanner market. According to the Asian Development Bank, Indonesias infrastructure budget surpassed USD 28 billion in 2023, with a focus on improving border security and urban transit systems. These markets are rapidly expanding their investment in vehicle scanning technologies as part of broader infrastructure development projects, offering significant opportunities for manufacturers and service providers in the region.

Scope of the Report

|

By Scanner Type |

Fixed Vehicle Scanners Mobile Vehicle Scanners Portable Vehicle Scanners |

|

By Technology |

X-ray Scanning Systems Gamma-Ray Scanning Systems RFID-Based Systems Automated License Plate Recognition Systems |

|

By Application |

Border Control Commercial Facilities Military Facilities Government Buildings |

|

By Component |

Hardware (Detectors, Sensors, Cameras) Software (Analytics Platforms, Imaging Software), Services (Installation, Maintenance, Support) |

|

By Region |

China Japan South Korea India Australia |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Transport, National Security Agencies, Border Control Authorities)

Vehicle Scanning Solution Providers

Border Control and Immigration Authorities

Airports and Seaports Operators

Commercial Facility Owners (Logistics Centers, Warehouses)

Investors and Venture Capitalist Firms

Security and Defense Organizations

Public Safety and Homeland Security Agencies

Companies

Players Mentioned in the Report

Leidos

Rapiscan Systems

Nuctech Company Limited

Smiths Detection

OSI Systems

Astrophysics Inc.

Teledyne ICM

VMI Security

Secunet Security Networks

ADANI Systems

Table of Contents

1. Asia Pacific Vehicle Scanner Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Vehicle Scanner Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Vehicle Scanner Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Cross-Border Trade and Security Concerns

3.1.2. Growing Adoption of Advanced Security Technologies

3.1.3. Rising Investments in Smart Infrastructure and Border Control

3.1.4. Government Mandates for Public Safety

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs

3.2.2. Integration Issues with Legacy Systems

3.2.3. Technical Barriers in Harsh Environments

3.3. Opportunities

3.3.1. Advancements in Artificial Intelligence and Machine Learning

3.3.2. Expansion into Developing Markets

3.3.3. Public-Private Partnerships for Enhanced Security Solutions

3.4. Trends

3.4.1. Adoption of Automated and Contactless Scanning Systems

3.4.2. Integration with Smart City and Intelligent Traffic Management Systems

3.4.3. Increasing Use of AI-Powered Threat Detection

3.5. Government Regulation

3.5.1. Vehicle Scanning Compliance Standards (ISO, ASTM)

3.5.2. Import-Export Regulatory Guidelines

3.5.3. Homeland Security and Border Control Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Service Providers

3.7.3. Government Bodies

3.7.4. Technology Providers

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Vehicle Scanner Market Segmentation

4.1. By Scanner Type (In Value %)

4.1.1. Fixed Vehicle Scanners

4.1.2. Mobile Vehicle Scanners

4.1.3. Portable Vehicle Scanners

4.2. By Technology (In Value %)

4.2.1. X-ray Scanning Systems

4.2.2. Gamma-Ray Scanning Systems

4.2.3. RFID-Based Scanning Systems

4.2.4. Automated License Plate Recognition Systems

4.3. By Application (In Value %)

4.3.1. Border Control

4.3.2. Commercial Facilities (Airports, Ports, and Warehouses)

4.3.3. Military Facilities

4.3.4. Government Buildings

4.4. By Component (In Value %)

4.4.1. Hardware (Detectors, Sensors, Cameras)

4.4.2. Software (Analytics Platforms, Imaging Software)

4.4.3. Services (Installation, Maintenance, and Support)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. Australia

5. Asia Pacific Vehicle Scanner Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Leidos

5.1.2. Rapiscan Systems

5.1.3. Nuctech Company Limited

5.1.4. Smiths Detection

5.1.5. Astrophysics Inc.

5.1.6. OSI Systems

5.1.7. Teledyne ICM

5.1.8. VMI Security

5.1.9. Secunet Security Networks

5.1.10. ADANI Systems

5.1.11. Gilardoni S.p.A

5.1.12. Autoclear LLC

5.1.13. Uveye

5.1.14. Gatekeeper Security

5.1.15. VMI Sistemas de Segurana

5.2. Cross Comparison Parameters (Revenue, Employees, Product Portfolio, Geographic Presence, Installed Base, Product Innovation, Market Share, Technology Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Vehicle Scanner Market Regulatory Framework

6.1. Security Standards and Certifications (ASTM, ISO)

6.2. Industry Compliance Requirements

6.3. Certification Processes (Country-Specific Regulations)

7. Asia Pacific Vehicle Scanner Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Vehicle Scanner Future Market Segmentation

8.1. By Scanner Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Vehicle Scanner Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage focuses on identifying the key drivers, challenges, and technological advancements in the Asia Pacific Vehicle Scanner Market. This involves an extensive review of market reports, patents, regulatory databases, and government publications to gather industry-level insights.

Step 2: Market Analysis and Construction

At this stage, historical market data, including sales volume and value, were collected and analyzed. The research also incorporated various statistical tools to ensure accurate market forecasts, with the integration of data from proprietary databases to refine the assessment of growth patterns and competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

A series of expert consultations were conducted via telephonic interviews to validate key market hypotheses. Industry experts from vehicle scanning solution providers, government agencies, and border control authorities provided direct insights into technological adoption trends, customer preferences, and emerging challenges in the market.

Step 4: Research Synthesis and Final Output

Finally, the research output was consolidated and cross-verified with top market players in the vehicle scanning industry. A comprehensive analysis of market shares, emerging trends, and technological disruptions was presented to provide an accurate and validated outlook of the Asia Pacific Vehicle Scanner Market.

Frequently Asked Questions

01. How big is the Asia Pacific Vehicle Scanner Market?

The Asia Pacific Vehicle Scanner Market is valued at USD 508 million, based on a five-year historical analysis. The market is primarily driven by the increasing need for high-end security solutions at border checkpoints, airports, and other critical infrastructures.

02. What are the challenges in the Asia Pacific Vehicle Scanner Market?

Challenges include the high cost of installation and maintenance, integration issues with legacy systems, and the complexity of operating in extreme weather conditions, which can limit the adoption of vehicle scanners in certain regions.

03. Who are the major players in the Asia Pacific Vehicle Scanner Market?

Key players in the market include Leidos, Rapiscan Systems, Nuctech Company Limited, Smiths Detection, and OSI Systems, who dominate the market due to their advanced technological solutions and strong government contracts.

04. What are the growth drivers of the Asia Pacific Vehicle Scanner Market?

The growth of the market is propelled by increasing cross-border trade, rising security concerns at critical infrastructures, and the adoption of AI and machine learning in vehicle scanning systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.