Asia Pacific Vertical Farming Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD6541

December 2024

85

About the Report

Asia Pacific Vertical Farming Market Overview

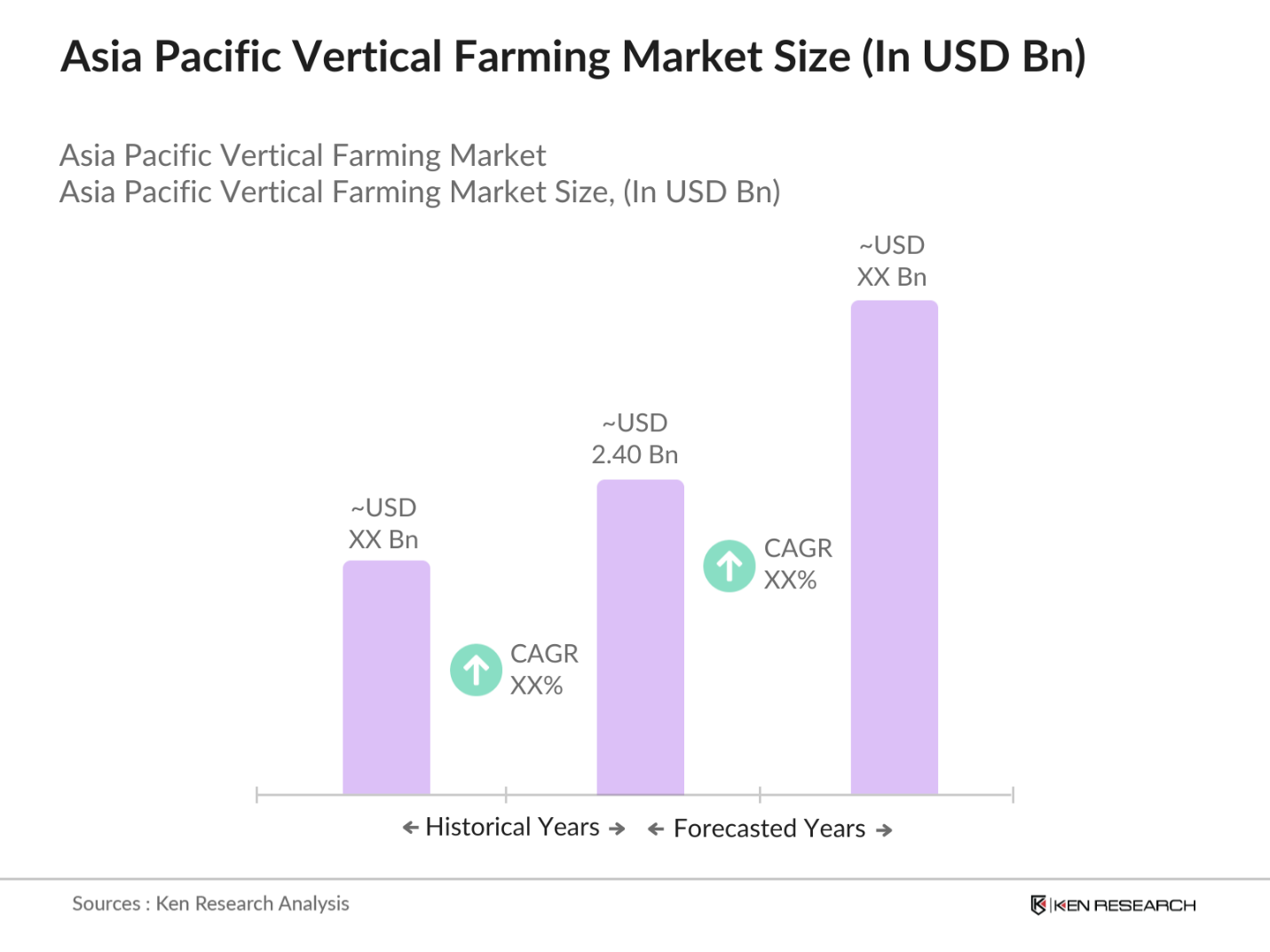

- The Asia Pacific vertical farming market is valued at USD 2.40 billion, driven primarily by increasing urbanization and the need for sustainable agricultural practices. This market has grown as a response to the demand for local food production in densely populated cities, where traditional farming methods face land and water constraints. Vertical farming, with its efficient use of space and water, has become a preferred method, particularly in urban areas. Government support in the form of subsidies for smart farming technologies further accelerates this growth.

- Cities like Tokyo, Singapore, and Hong Kong dominate the vertical farming market in Asia Pacific. The dominance of these cities can be attributed to the high levels of urbanization and limited availability of arable land, forcing the adoption of innovative agricultural methods. Additionally, these cities have the technological infrastructure and investment capabilities to implement vertical farming on a large scale, supported by both private and public sector initiatives that prioritize food security and sustainability.

- Several governments in the Asia Pacific region, including Singapore and South Korea, are providing financial assistance to support the growth of vertical farming. Singapores government, for example, has allocated over $30 million in grants in 2022 to encourage the development of high-tech urban farms as part of its 30 by 30 initiative. These subsidies are aimed at reducing the financial burden associated with setting up vertical farms and driving innovation in the sector. These programs are vital for fostering the growth of the vertical farming market, particularly in countries where space is limited.

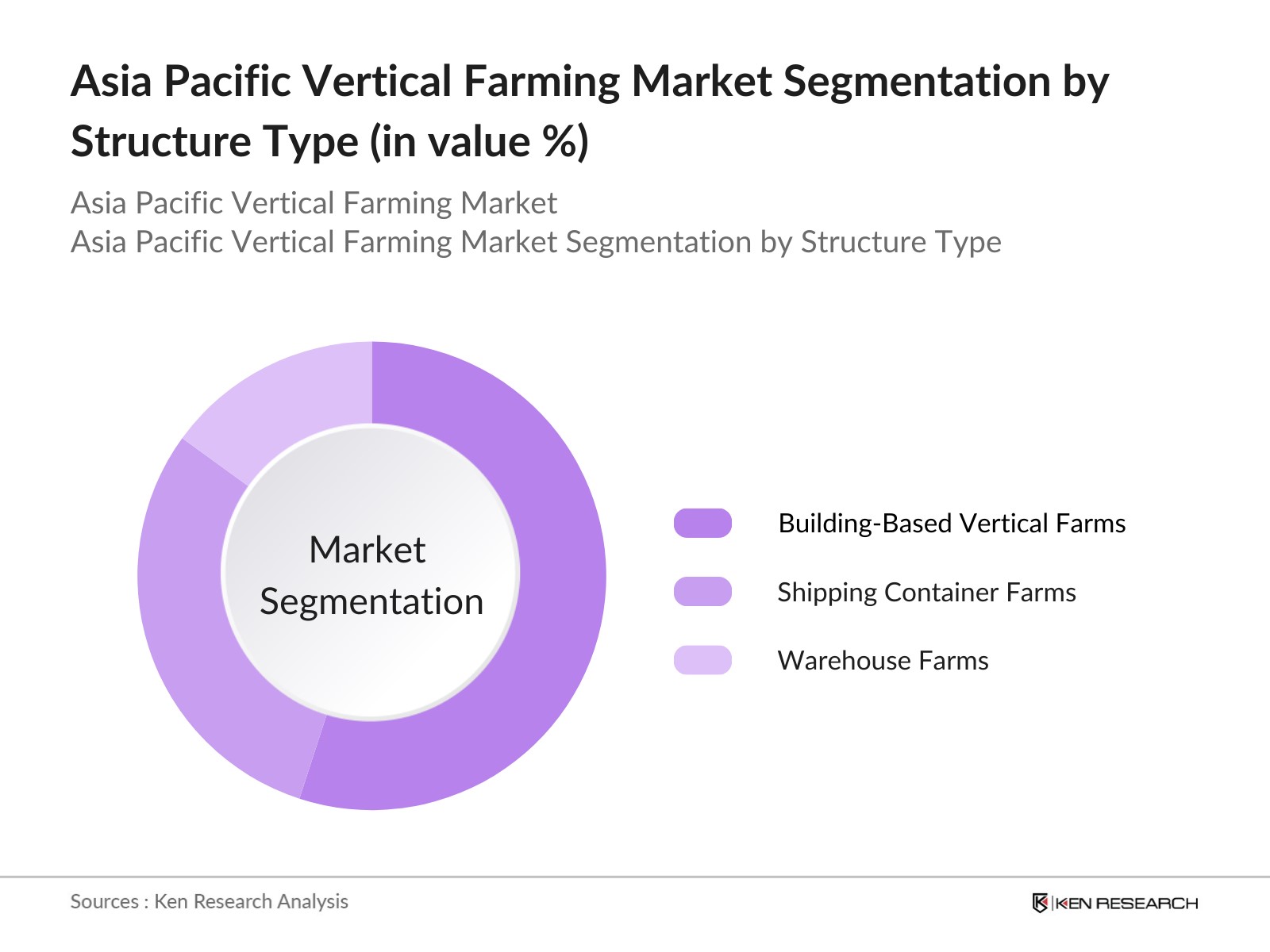

Asia Pacific Vertical Farming Market Segmentation

By Structure Type: The market is segmented by structure type into building-based vertical farms, shipping container farms, and warehouse farms. Building-based vertical farms are dominant in this segment due to their widespread adoption in urban centers where high-rise buildings provide ample vertical space for farming. These farms maximize the use of real estate, particularly in cities like Tokyo and Singapore, where land prices are extremely high. As a result, this structure type has attracted significant investments and government subsidies to promote sustainable urban agriculture.

By Growing Method: The market is segmented by growing method into hydroponics, aeroponics, and aquaponics. Hydroponics dominates the segment due to its ability to optimize water usage and grow crops faster in a controlled environment. This method is favored in regions with water scarcity issues, such as Australia, as it uses 90% less water compared to traditional farming. Additionally, the scalability of hydroponics has made it a preferred option for commercial vertical farms across the Asia Pacific.

Asia Pacific Vertical Farming Market Competitive Landscape

The Asia Pacific vertical farming market is characterized by a mix of global and local players, with companies focusing on innovation and technological partnerships to expand their reach. Several firms are working on developing sustainable solutions for food production, integrating advanced technologies like IoT, AI, and smart sensors to optimize crop yields. The Asia Pacific vertical farming market is dominated by a few major players, including established companies like Plenty Inc. and AeroFarms, as well as regional players such as Sky Greens in Singapore.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Product Range |

R&D Investment |

Key Partnerships |

Revenue (USD) |

Sustainability Initiatives |

Expansion Strategy |

|

AeroFarms |

2004 |

USA |

|||||||

|

Sky Greens |

2011 |

Singapore |

|||||||

|

Plenty Inc. |

2014 |

USA |

|||||||

|

Spread Co. |

2007 |

Japan |

|||||||

|

Gotham Greens |

2009 |

USA |

500 |

Leafy Greens |

High |

Retail Chains |

150 Mn |

Renewable Energy Usage |

Global |

Asia Pacific Vertical Farming Industry Analysis

Growth Drivers

- Urban Population Growth: The Asia Pacific region is experiencing rapid urbanization, with 2.4 billion people living in urban areas in 2023, up from 2.2 billion in 2020. This increase in urban population has led to a rise in demand for fresh, locally produced food to reduce dependence on long supply chains. In cities like Tokyo and Shanghai, vertical farming addresses the growing need for food security and supply close to urban centers, where space is constrained. The World Banks 2022 report highlights the significance of this population trend, projecting continued urban growth in this region, driving demand for local food production.

- Technological Advancements: Technological innovations in vertical farming, such as LED lighting and hydroponics, are enhancing productivity and efficiency. LED lights have drastically improved energy use in farming, while hydroponics systems reduce water consumption by 90% compared to traditional agriculture, according to FAO's 2022 report. In Asia Pacific, countries like Japan are leading in vertical farming innovation, with more than 200 operational facilities using these technologies to maximize yield in smaller spaces. This integration of advanced technologies not only increases output but also supports sustainable farming practices in urban environments.

- Environmental Sustainability; Vertical farming is a key solution for sustainable agriculture, particularly in regions like Asia Pacific that face water scarcity and land depletion. According to the United Nations Environment Programme (UNEP), vertical farming consumes only 10% of the water used in traditional agriculture. Countries such as Singapore are adopting these practices to ensure food security while minimizing environmental impact. In a study by the FAO in 2022, the reduced land use in vertical farmingnearly 80% less than conventional methodswas highlighted as a crucial factor in addressing food demand without exacerbating environmental degradation.

Market Challenges

- Limited Crop Variety: One of the limitations of vertical farming is the narrow range of crops that can be produced effectively. In the Asia Pacific region, vertical farms primarily focus on leafy greens and herbs, which have faster growth cycles and require less space. According to a report from FAO in 2023, only around 15-20 types of crops are typically grown in vertical farms, limiting the potential for producing staple crops like wheat or rice. This limited crop variety constrains the market's ability to fully meet the food demands of urban populations, posing a significant challenge to market expansion.

- Energy Consumption: Energy consumption remains a major challenge in vertical farming, particularly for large-scale operations. In vertical farms, artificial lighting, climate control, and water systems consume significant energy. According to the International Energy Agency (IEA), a medium-sized vertical farm uses around 15,000 to 20,000 kilowatt-hours of energy per month. This level of energy usage increases operational costs, especially in regions like Southeast Asia where energy prices are relatively high. As a result, energy costs can account for nearly 40% of operational expenses in vertical farming, making scalability challenging without further advancements in energy efficiency.

Asia Pacific Vertical Farming Market Future Outlook

The Asia Pacific vertical farming market is expected to continue its upward trajectory, driven by several factors, including increased demand for fresh and organic produce, growing urban populations, and the need for sustainable farming practices. Additionally, government support through subsidies and research funding is expected to fuel innovation in the sector, allowing vertical farms to scale up operations and increase their crop variety. The rise of smart farming technologies and integration with IoT will enable vertical farms to become more efficient in water and energy usage, making them a viable solution to food security concerns in the region.

Future Market Opportunities

- Expansion into Emerging Markets: Rapid urbanization in emerging markets presents a substantial opportunity for vertical farming in the Asia Pacific region. Countries like India and Vietnam, where urban population density is increasing, are seeing a rise in demand for locally grown food due to space constraints. According to the World Bank, Indias urban population is expected to exceed 600 million by 2025, significantly increasing the demand for innovative farming solutions like vertical farming in densely populated urban areas. This urban growth is creating a market ripe for vertical farming expansion to meet the food needs of space-constrained cities.

- Integration with Smart Agriculture: The integration of smart agriculture technologies such as IoT and AI-powered monitoring systems offers significant opportunities for improving the efficiency and scalability of vertical farms. According to the Asian Development Bank's 2022 report, IoT-based solutions can reduce operational inefficiencies by up to 25% by optimizing water usage, lighting, and climate control in real time. AI-powered systems are also increasingly used to monitor plant health, detect diseases early, and enhance overall crop yield. These technologies are especially attractive in the Asia Pacific region, where urban farming efficiency is critical for meeting food demand.

Scope of the Report

|

Structure Type |

Building-Based Vertical Farms Shipping Container Farms Warehouse Farms |

|

Growing Method |

Hydroponics Aeroponics Aquaponics |

|

Crop Type |

Leafy Greens Microgreens Herbs Fruits and Vegetables |

|

Technology |

LED Lighting Climate Control Systems Sensors and Monitoring Systems |

|

Region |

China Japan South Korea Australia Rest of Asia Pacific |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Agriculture, Agricultural Research Organizations)

Technology Providers (AI, IoT, Climate Control)

Urban Farming Startups

Sustainable Agriculture NGOs

Vertical Farm Operators

Real Estate Developers

Agri-Tech Investors

Companies

Major Players

AeroFarms

Plenty Inc.

BrightFarms

Bowery Farming

Freight Farms

Green Sense Farms

Sky Greens

Iron Ox

Mirai Co. Ltd.

Gotham Greens

Spread Co.

AgriCool

Metropolis Farms

PlantLab

InFarm

Table of Contents

1. Asia Pacific Vertical Farming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Vertical Farming Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Vertical Farming Market Analysis

3.1. Growth Drivers

3.1.1. Urban Population Growth (increased demand for local food)

3.1.2. Technological Advancements (LED, hydroponics, aeroponics, aquaponics)

3.1.3. Environmental Sustainability (reduced water and land use)

3.1.4. Government Support (subsidies, agricultural reforms)

3.2. Market Challenges

3.2.1. High Initial Capital Investment (infrastructure and technology costs)

3.2.2. Limited Crop Variety (focus on leafy greens and herbs)

3.2.3. Energy Consumption (costly for large-scale operations)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (urbanizing regions, space-constrained areas)

3.3.2. Integration with Smart Agriculture (IoT, AI-powered monitoring systems)

3.3.3. Consumer Demand for Organic Produce (focus on quality, local sourcing)

3.4. Trends

3.4.1. Increase in Vertical Farming as a Service (B2B and B2C models)

3.4.2. Partnerships Between Technology Firms and Agricultural Producers

3.4.3. Growth in Indoor Vertical Farming Operations (urban warehouses, unused industrial spaces)

3.5. Government Regulations

3.5.1. Agricultural Policy Support (food security initiatives)

3.5.2. Subsidies and Grants (financial assistance for innovation and expansion)

3.5.3. Carbon Footprint Reduction Incentives (sustainability standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (agricultural technology providers, distributors, urban planners)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Asia Pacific Vertical Farming Market Segmentation

4.1. By Structure Type (In Value %)

4.1.1. Building-Based Vertical Farms

4.1.2. Shipping Container Farms

4.1.3. Warehouse Farms

4.2. By Growing Method (In Value %)

4.2.1. Hydroponics

4.2.2. Aeroponics

4.2.3. Aquaponics

4.3. By Crop Type (In Value %)

4.3.1. Leafy Greens

4.3.2. Microgreens

4.3.3. Herbs

4.3.4. Fruits and Vegetables

4.4. By Technology (In Value %)

4.4.1. LED Lighting

4.4.2. Climate Control Systems

4.4.3. Sensors and Monitoring Systems

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. Rest of Asia Pacific

5. Asia Pacific Vertical Farming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AeroFarms

5.1.2. Plenty Inc.

5.1.3. BrightFarms

5.1.4. Bowery Farming

5.1.5. Freight Farms

5.1.6. Green Sense Farms

5.1.7. Sky Greens

5.1.8. Iron Ox

5.1.9. Mirai Co. Ltd.

5.1.10. Gotham Greens

5.1.11. Spread Co.

5.1.12. AgriCool

5.1.13. Metropolis Farms

5.1.14. PlantLab

5.1.15. InFarm

5.2. Cross Comparison Parameters (Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Vertical Farming Technology Used, Expansion Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Asia Pacific Vertical Farming Market Regulatory Framework

6.1. Agricultural Standards and Compliance

6.2. Certification Processes (GAP, organic certifications)

6.3. Sustainable Agriculture Requirements

7. Asia Pacific Vertical Farming Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Vertical Farming Future Market Segmentation

8.1. By Structure Type (In Value %)

8.2. By Growing Method (In Value %)

8.3. By Crop Type (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Vertical Farming Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research process involves mapping the entire vertical farming ecosystem within the Asia Pacific market. This step involves extensive desk research to gather data on major players, government regulations, and consumer demand patterns. Proprietary databases and secondary sources are leveraged to identify critical market variables, including technology adoption rates and environmental sustainability metrics.

Step 2: Market Analysis and Construction

The next phase involves gathering historical data related to market penetration, revenue generation, and crop yields from key vertical farming sites in the region. This step also includes an evaluation of partnerships between agricultural producers and technology companies to understand the flow of investment in the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the Asia Pacific vertical farming market, such as trends in smart agriculture and urban farming, are developed. These hypotheses are validated through CATI interviews with industry professionals, including vertical farm operators and agricultural technology providers. The interviews provide operational insights that help refine market estimates.

Step 4: Research Synthesis and Final Output

In the final phase, vertical farm operators across key cities in the Asia Pacific are consulted to gather data on consumer preferences, crop varieties, and production scalability. This data is used to validate initial findings and ensure that the final market analysis reflects real-world market dynamics. The report is compiled, ensuring that the data is both comprehensive and validated.

Frequently Asked Questions

01 How big is the Asia Pacific Vertical Farming Market?

The Asia Pacific vertical farming market is valued at USD 2.40 billion, driven by growing urbanization and the need for sustainable agricultural solutions. This market has seen a surge in demand for locally sourced, fresh produce.

02 What are the challenges in the Asia Pacific Vertical Farming Market?

Challenges in the Asia Pacific vertical farming market include high capital investment costs for infrastructure and energy consumption. Additionally, limited crop variety and technological adoption hurdles slow down widespread implementation.

03 Who are the major players in the Asia Pacific Vertical Farming Market?

Key players in the Asia Pacific vertical farming market include AeroFarms, Sky Greens, Plenty Inc., Spread Co., and Gotham Greens. These companies lead the market due to their technological advancements and strategic partnerships.

04 What are the growth drivers of the Asia Pacific Vertical Farming Market?

The Asia Pacific vertical farming market is driven by factors such as the increasing demand for sustainable agriculture, rapid urbanization, and government incentives for smart farming technologies. The need for food security and locally sourced produce also plays a significant role.

05 What technologies are commonly used in the Asia Pacific Vertical Farming Market?

Key technologies in the Asia Pacific vertical farming market include hydroponics, aeroponics, LED lighting systems, and climate control mechanisms. IoT-based monitoring systems are increasingly being adopted to enhance farm efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.