Asia-Pacific VR Gaming Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5482

December 2024

92

About the Report

Asia-Pacific VR Gaming Market Overview

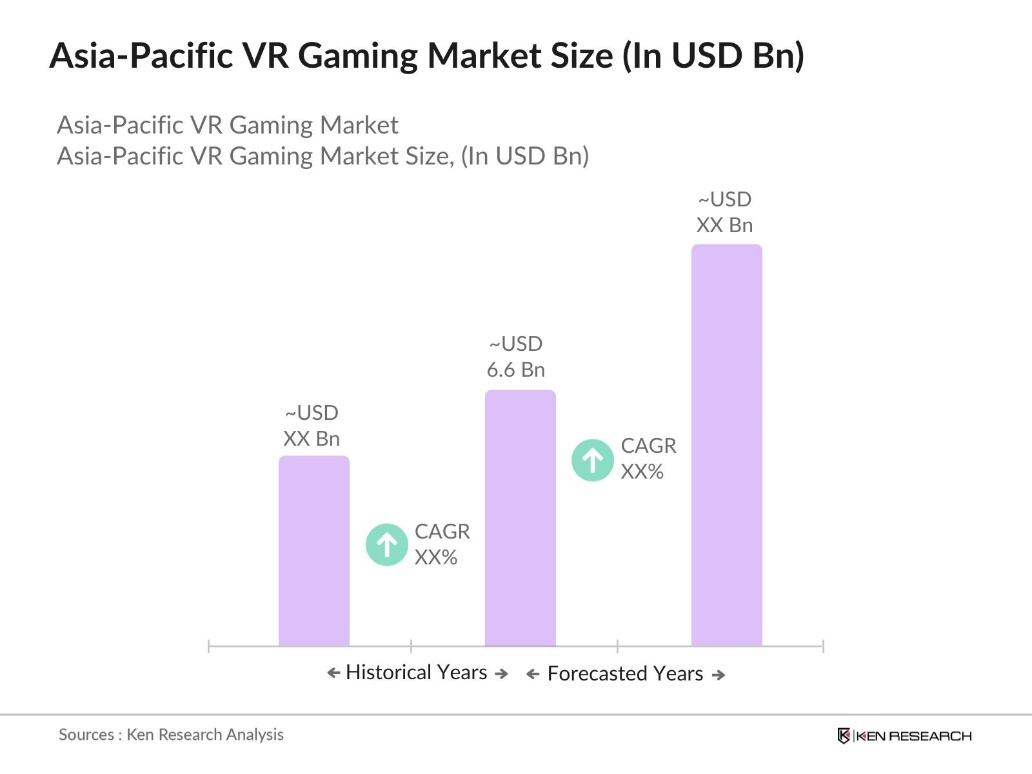

- The Asia-Pacific VR Gaming Market, based on a comprehensive analysis of the last five years, is currently valued at USD 6.6 billion. The market is primarily driven by the regions increasing adoption of cutting-edge gaming technologies, expanding high-speed internet infrastructure, and the rising demand for immersive gaming experiences. Government initiatives supporting tech-driven growth and an increasing interest in e-sports have further fueled the market's expansion, particularly in countries like China, Japan, and South Korea.

- China, Japan, and South Korea dominate the Asia-Pacific VR gaming market. This dominance is attributed to the region's strong technological infrastructure, growing investment in gaming innovation, and a large consumer base eager to adopt new technologies. Moreover, these countries have well-established gaming industries, a thriving e-sports community, and partnerships between VR hardware manufacturers and gaming developers, which further strengthen their position in the market.

- In 2023, Chinas Ministry of Industry and Information Technology (MIIT) introduced a Three-Year Action Plan for the Industrial Innovation and Development of the Metaverse (2023-2025). This initiative includes significant investments aimed at enhancing the VR industry, with a focus on developing metaverse technologies and applications. The plan outlines goals such as cultivating "three to five metaverse-related companies with global influence" and establishing industrial clusters to drive innovation in sectors like gaming and beyond.

Asia-Pacific VR Gaming Market Segmentation

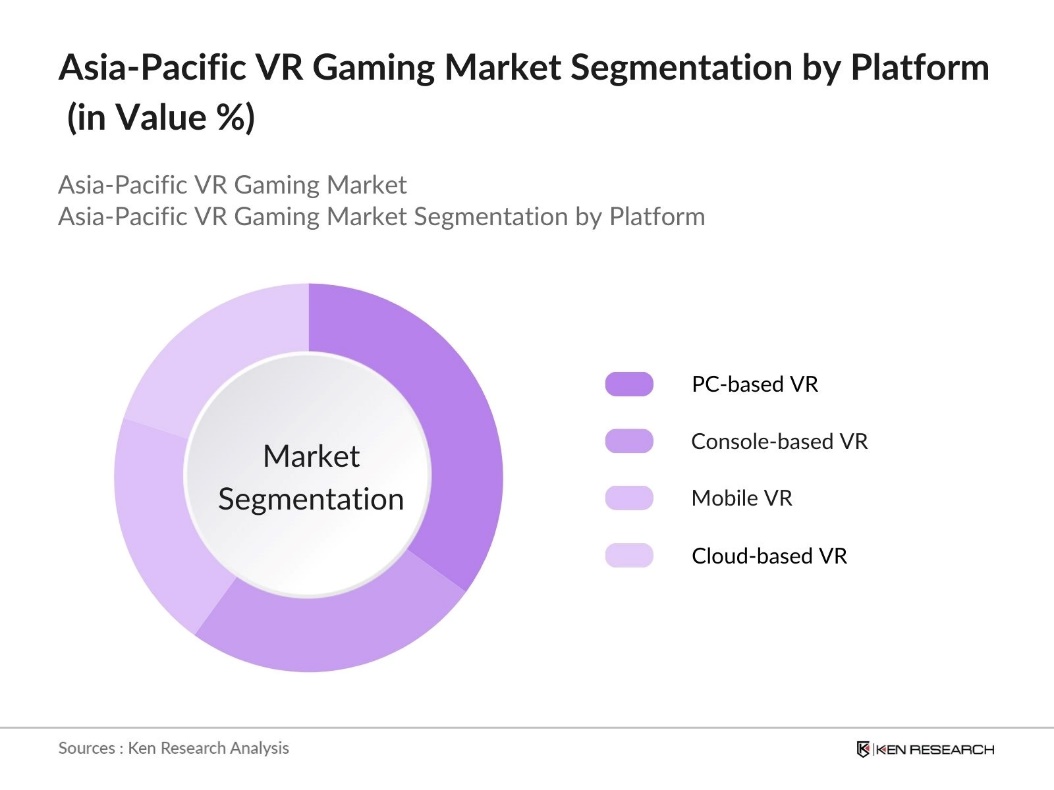

By Platform: The Asia-Pacific VR gaming market is segmented by platform into PC-based VR, console-based VR, mobile VR, and cloud-based VR. Among these, PC-based VR holds a dominant market share due to its superior graphics, immersive gameplay, and integration with powerful hardware systems. PC-based VR games appeal to both hardcore gamers and tech enthusiasts, who prefer the high-quality experience offered by this platform. PC gaming's entrenched ecosystem, strong hardware brands, and comprehensive VR support from leading developers like Valve and Oculus have further cemented its dominance in the region.

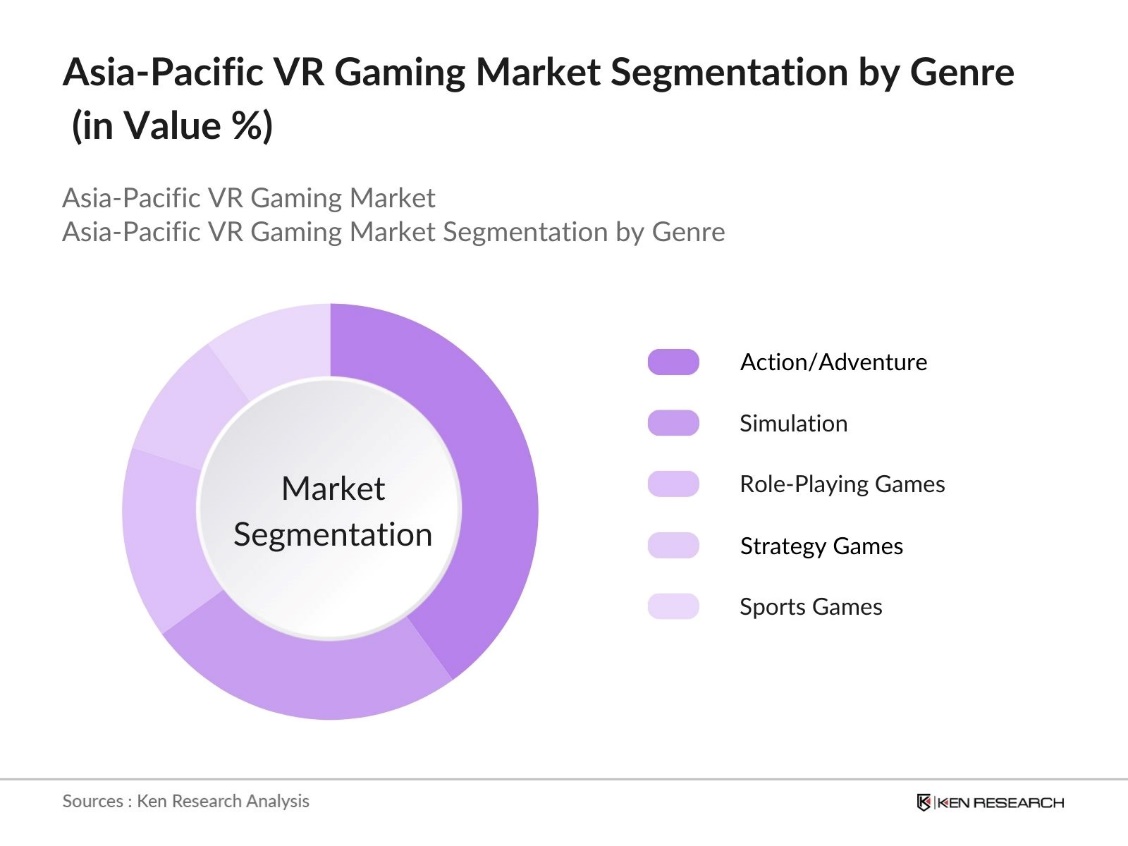

By Genre: The Asia-Pacific VR gaming market is segmented by genre into action/adventure, simulation, role-playing games (RPG), strategy games, and sports games. Action/adventure games lead the market share due to their widespread appeal, offering intense gameplay, immersive narratives, and advanced VR mechanics. Popular franchises like Half-Life: Alyx and Beat Saber have driven massive engagement from users, contributing to the genre's dominance. The fast-paced, adrenaline-pumping experience of action games in VR has made them a top choice for gamers seeking intense and visually immersive gameplay.

Asia-Pacific VR Gaming Market Competitive Landscape

The market is highly competitive, dominated by both local players and global tech giants. Companies are focusing on providing a seamless user experience by introducing advanced VR technologies, expanding their gaming portfolios, and forming partnerships to strengthen their market presence. Key players like Sony Interactive Entertainment, Oculus (Meta Platforms), and HTC Corporation have shaped the landscape with innovative hardware and immersive gaming platforms.

|

Company |

Establishment Year |

Headquarters |

Platform Reach |

R&D Investment |

Global VR Presence |

APAC Market Revenue |

VR Hardware Portfolio |

Partnerships with Developers |

|

Sony Interactive Entertainment |

1993 |

Tokyo, Japan |

||||||

|

Oculus (Meta Platforms) |

2012 |

California, USA |

||||||

|

HTC Corporation |

1997 |

Taipei, Taiwan |

||||||

|

Valve Corporation |

1996 |

Bellevue, USA |

||||||

|

Samsung Electronics Co., Ltd. |

1969 |

Seoul, South Korea |

Asia-Pacific VR Gaming Industry Analysis

Growth Drivers

- Increasing Adoption of Advanced Gaming Technologies: The Asia-Pacific region has witnessed a rise in the adoption of virtual reality (VR) technologies in gaming, driven by advancements in hardware and software. The overall number of active gamers in Japan reached 55.5 million, which includes various platforms such as mobile, console gaming and also VR game. This rise in adoption is further supported by strong tech manufacturing hubs in these nations.

- Expansion of High-Speed Internet Infrastructure: The growth of high-speed internet infrastructure in Asia-Pacific has been a significant enabler for VR gaming, requiring low-latency networks for an optimal experience. In South Korea, the rate of Internet accessibility is truly remarkable. With a staggering 100% household Internet access rate, all 21.36 million households across the economy are connected, enhancing the VR gaming experience. These infrastructural improvements are crucial for the immersive nature of VR gaming.

- Rising Consumer Demand for Immersive Gaming Experiences: The demand for immersive and interactive gaming experiences has significantly boosted VR gaming adoption in Asia-Pacific. Countries in the region, particularly those with a younger, tech-savvy population, are experiencing growing interest in VR gaming as part of their rapidly evolving digital culture. The rise of esports, combined with the availability of VR gaming arcades in countries like Japan, Malaysia, and China, is further fueling consumer engagement.

Market Challenges

- High Initial Costs of VR Gaming Equipment: Despite the growing interest in VR gaming, the high cost of VR gaming hardware remains a notable barrier in the Asia-Pacific region. The prices of high-end VR headsets make them inaccessible to many consumers, particularly in emerging markets. This challenge is further compounded by the limited availability of affordable VR alternatives, which restricts widespread adoption, especially in price-sensitive countries. The lack of initiatives to reduce equipment costs, such as subsidies or affordable payment plans, continues to hinder the growth of the market in less economically advanced regions.

- Limited Consumer Awareness in Emerging Markets: Consumer awareness of VR gaming remains relatively low in several emerging markets across the Asia-Pacific region. In countries like Vietnam, the Philippines, and Thailand, the exposure to VR gaming products is still minimal, and fewer retail options exist to encourage adoption. This lack of awareness poses a challenge to market growth, as potential users are less informed about the availability and benefits of VR gaming. However, this also presents an opportunity for gaming companies to focus on increasing brand awareness and implementing localized marketing strategies to penetrate these untapped markets.

Asia-Pacific VR Gaming Market Future Outlook

The Asia-Pacific VR gaming market is poised to experience strong growth in the coming years, driven by rapid advancements in VR technologies, increasing consumer demand for immersive experiences, and growing government support for digital infrastructure. The emergence of cloud gaming and mobile VR is expected to open new avenues for growth, especially in emerging economies within the region. Additionally, the integration of artificial intelligence (AI) into VR gaming and the growing popularity of multiplayer VR games will fuel market expansion.

Market Opportunities

- Expanding E-Sports Integration with VR Gaming: The rising popularity of e-sports in the Asia-Pacific region is creating opportunities to integrate virtual reality into competitive gaming. As the e-sports industry continues to grow, VR is increasingly being experimented with in competitive gaming environments. Governments and gaming organizations in various countries are promoting VR-based e-sports, launching initiatives and infrastructure to support this development. The combination of VR technology with e-sports offers a more immersive gaming experience, driving higher engagement and unlocking new potential for growth in both the e-sports and VR sectors.

- VR Gaming for Education and Training: Virtual reality gaming is expanding its reach beyond entertainment into education and training sectors. Schools and institutions are adopting VR technologies for immersive learning experiences, allowing students to engage with content in more interactive ways. VR is also being integrated into vocational training programs, where it is particularly useful in fields such as healthcare and engineering. This growing trend opens new avenues for VR developers to collaborate with educational and training organizations, creating innovative platforms that enhance learning through immersive, interactive experiences.

Scope of the Report

|

Platform |

PC-Based VR Console-Based VR Mobile VR Cloud-Based VR |

|

Genre |

Action/Adventure Simulation RPG Strategy Sports Games |

|

Hardware |

VR Headsets Haptic Feedback Devices VR Motion Controllers VR Treadmills |

|

End-User |

Residential/Individual Commercial Gaming Centers E-Sports Organizers Educational Institutes |

|

Region |

China Japan South Korea Australia Southeast Asia |

Products

Key Target Audience

VR Hardware Manufacturers

Entertainment and Media Companies

Consumer Electronics Companies

Telecommunications Companies

Government and Regulatory Bodies (Ministry of Communication and Information Technology, National IT Development Authority)

Investor and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Sony Interactive Entertainment

Oculus (Meta Platforms)

HTC Corporation

Samsung Electronics Co., Ltd.

Valve Corporation

Google LLC

Microsoft Corporation

Lenovo Group Ltd.

Huawei Technologies Co., Ltd.

Magic Leap, Inc.

Pimax Technology Co., Ltd.

FOVE, Inc.

Virtuix Inc.

Nintendo Co., Ltd.

Infinadeck

Table of Contents

1. Asia-Pacific VR Gaming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific VR Gaming Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific VR Gaming Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Advanced Gaming Technologies

3.1.2. Rising Consumer Demand for Immersive Gaming Experiences

3.1.3. Expansion of High-Speed Internet Infrastructure

3.1.4. Government Support for Digital and Tech Innovation

3.2. Market Challenges

3.2.1. High Initial Costs of VR Gaming Equipment

3.2.2. Limited Consumer Awareness in Emerging Markets

3.2.3. Technical Issues Related to Latency and Compatibility

3.3. Opportunities

3.3.1. Expanding E-Sports Integration with VR Gaming

3.3.2. VR Gaming for Education and Training

3.3.3. Cross-Industry Collaborations and Partnerships

3.4. Trends

3.4.1. Growth of Multiplayer VR Gaming Platforms

3.4.2. Mobile VR and Cloud Gaming Integration

3.4.3. Increased Use of Haptic Feedback in VR Accessories

3.5. Government Regulation

3.5.1. Digital Infrastructure Development Policies

3.5.2. Regulations for Data Privacy in VR Gaming

3.5.3. E-Sports and Gaming Legislation

3.5.4. VR Gaming Inclusion in National Gaming Development Programs

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia-Pacific VR Gaming Market Segmentation

4.1. By Platform (In Value %)

4.1.1. PC-Based VR

4.1.2. Console-Based VR

4.1.3. Mobile VR

4.1.4. Cloud-Based VR

4.2. By Genre (In Value %)

4.2.1. Action/Adventure

4.2.2. Simulation

4.2.3. Role-Playing Games (RPG)

4.2.4. Strategy Games

4.2.5. Sports Games

4.3. By Hardware (In Value %)

4.3.1. VR Headsets

4.3.2. Haptic Feedback Devices

4.3.3. VR Motion Controllers

4.3.4. VR Treadmills

4.4. By End-User (In Value %)

4.4.1. Residential/Individual

4.4.2. Commercial Gaming Centers

4.4.3. E-Sports and Tournament Organizers

4.4.4. Educational Institutes

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia-Pacific VR Gaming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sony Interactive Entertainment

5.1.2. Oculus (Meta Platforms)

5.1.3. HTC Corporation

5.1.4. Samsung Electronics Co., Ltd.

5.1.5. Google LLC

5.1.6. Valve Corporation

5.1.7. Nintendo Co., Ltd.

5.1.8. Microsoft Corporation

5.1.9. Lenovo Group Ltd.

5.1.10. Huawei Technologies Co., Ltd.

5.1.11. Magic Leap, Inc.

5.1.12. Pimax Technology Co., Ltd.

5.1.13. FOVE, Inc.

5.1.14. Virtuix Inc.

5.1.15. Infinadeck

5.2. Cross Comparison Parameters (Platform Reach, R&D Investment, Global VR Gaming Market Presence, Revenue from APAC VR Gaming)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific VR Gaming Market Regulatory Framework

6.1. Consumer Data Protection Laws

6.2. Age-Appropriate Gaming Content Regulations

6.3. Cross-Border Gaming Regulations

6.4. Compliance Standards for VR Hardware

7. Asia-Pacific VR Gaming Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific VR Gaming Future Market Segmentation

8.1. By Platform (In Value %)

8.2. By Genre (In Value %)

8.3. By Hardware (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific VR Gaming Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Demographic Analysis

9.3. Competitive Benchmarking

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase entails constructing an ecosystem map of all major stakeholders within the Asia-Pacific VR gaming market. Extensive desk research is conducted using secondary and proprietary databases to gather industry-level data. The goal is to identify and define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This step involves compiling historical data on the market's development, including the ratio of hardware platforms to service providers and the resulting revenue generation. An assessment of service quality statistics ensures the accuracy of these estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market are validated through expert consultations, conducted via computer-assisted telephone interviews (CATIs) with industry professionals. These insights will refine the market estimates.

Step 4: Research Synthesis and Final Output

The final step involves direct engagement with VR hardware manufacturers to gather detailed insights on product segments, sales performance, and consumer preferences, which will be integrated into the final report.

Frequently Asked Questions

01. How big is the Asia-Pacific VR Gaming Market?

The Asia-Pacific VR Gaming Market is valued at USD 6.6 billion, driven by the growing adoption of immersive technologies, robust e-sports communities, and increasing investments in high-speed internet infrastructure.

02. What are the challenges in the Asia-Pacific VR Gaming Market?

The major challenges in Asia-Pacific VR Gaming Market include the high initial cost of VR equipment, technical issues related to latency and compatibility, and limited consumer awareness in emerging markets, which may hamper widespread adoption.

03. Who are the major players in the Asia-Pacific VR Gaming Market?

The Asia-Pacific VR Gaming Market includes prominent players such as Sony Interactive Entertainment, Oculus (Meta Platforms), HTC Corporation, Valve Corporation, and Samsung Electronics Co., Ltd., all of whom are shaping the future of VR gaming through innovative hardware and software solutions.

04. What are the growth drivers of the Asia-Pacific VR Gaming Market?

Key growth drivers in Asia-Pacific VR Gaming Market include the increasing consumer demand for immersive experiences, advancements in VR technology, and the integration of VR gaming with the rapidly expanding e-sports industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.