Asia Pacific Wallpaper Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD7795

December 2024

84

About the Report

Asia Pacific Wallpaper Market Overview

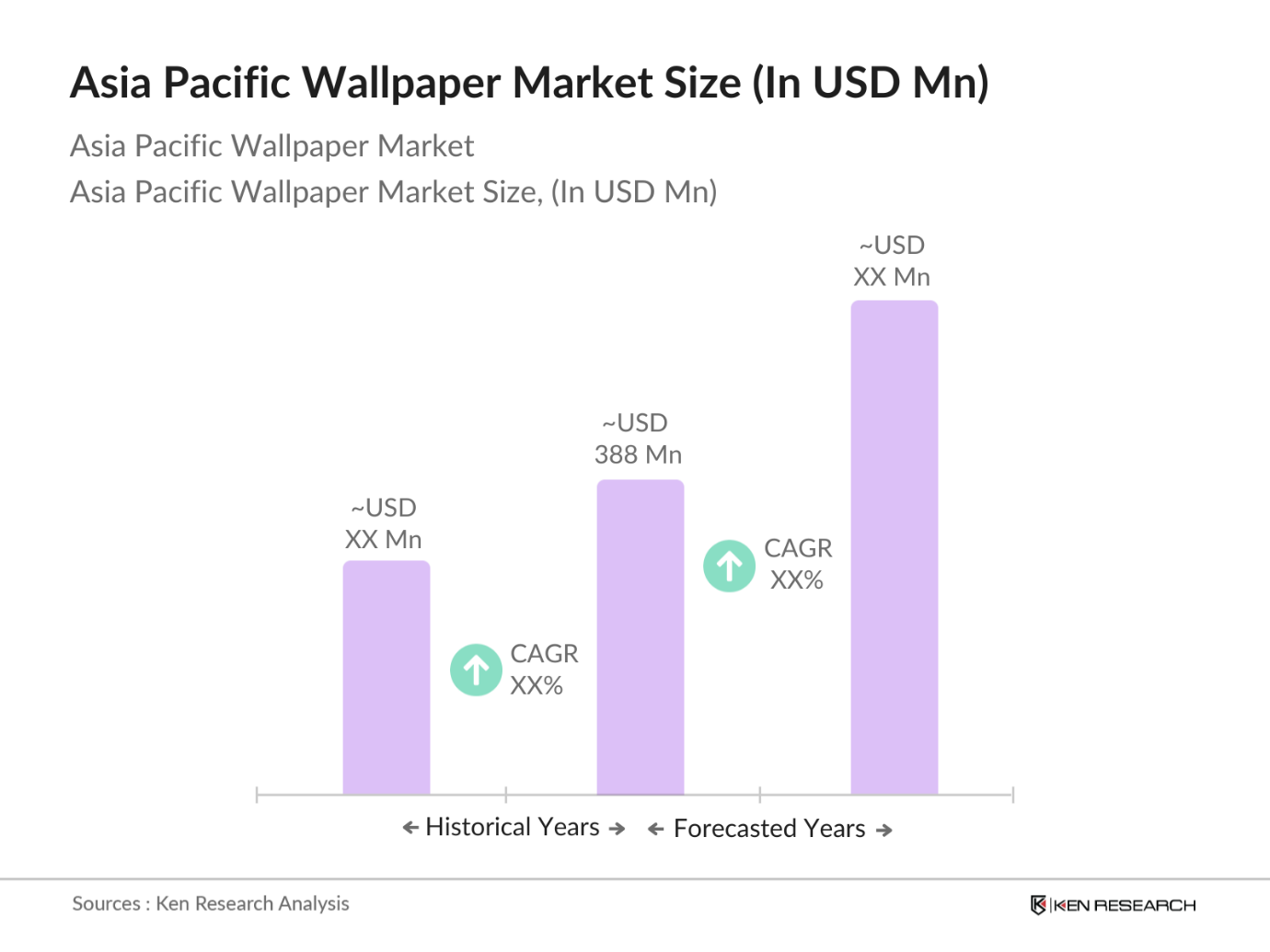

- The Asia Pacific Wallpaper Market is valued at USD 388 million, based on a five-year historical analysis. The market is driven by several factors, including increasing urbanization, a growing preference for aesthetically pleasing home and commercial interiors, and the expanding construction sector. As more people focus on interior design, the demand for wallpapers, particularly customizable and eco-friendly options, has surged. Additionally, technological advancements in production, such as digital printing, have made wallpaper products more affordable and accessible, further driving the market.

- Countries like China, Japan, and India dominate the Asia Pacific wallpaper market due to their large population, rapid urbanization, and investments in real estate development. China, in particular, benefits from a booming construction industry and increasing consumer spending on home decoration. Japan's dominance is driven by its advanced technological capabilities, especially in producing high-quality and durable wallpaper materials. India is emerging as a key player due to the growing middle-class population and increased demand for home renovation projects.

- Governments in the Asia Pacific region is implementing strict regulations to limit volatile organic compound (VOC) emissions in interior products like wallpaper. In 2023, China introduced updated VOC emission standards that restrict the use of harmful chemicals in construction materials, including wall coverings. These regulations are part of the countrys broader effort to reduce indoor air pollution, requiring manufacturers to comply with stringent emission thresholds to market their products. This has led to increased production of low-VOC and eco-friendly wallpapers across the region.

Asia Pacific Wallpaper Market Segmentation

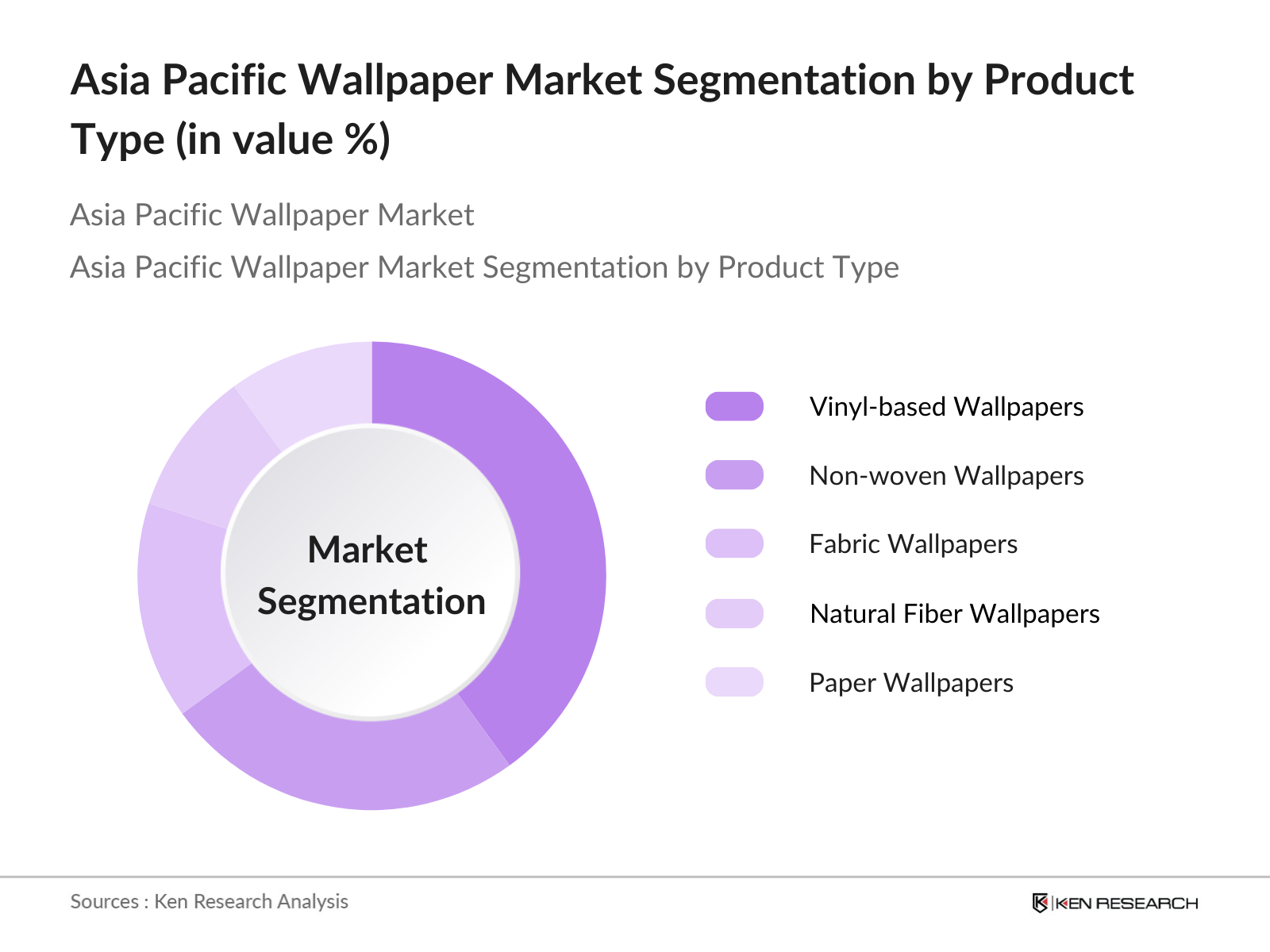

- By Product Type: The Asia Pacific wallpaper market is segmented by product type into vinyl-based wallpapers, non-woven wallpapers, fabric wallpapers, natural fiber wallpapers, and paper wallpapers. Recently, vinyl-based wallpapers have emerged as the dominant segment due to their durability, ease of maintenance, and affordability. Vinyl wallpapers are preferred in both residential and commercial spaces for their resistance to moisture, making them ideal for areas like kitchens and bathrooms. This product type is widely favored by interior designers and homeowners due to its extensive range of designs and patterns.

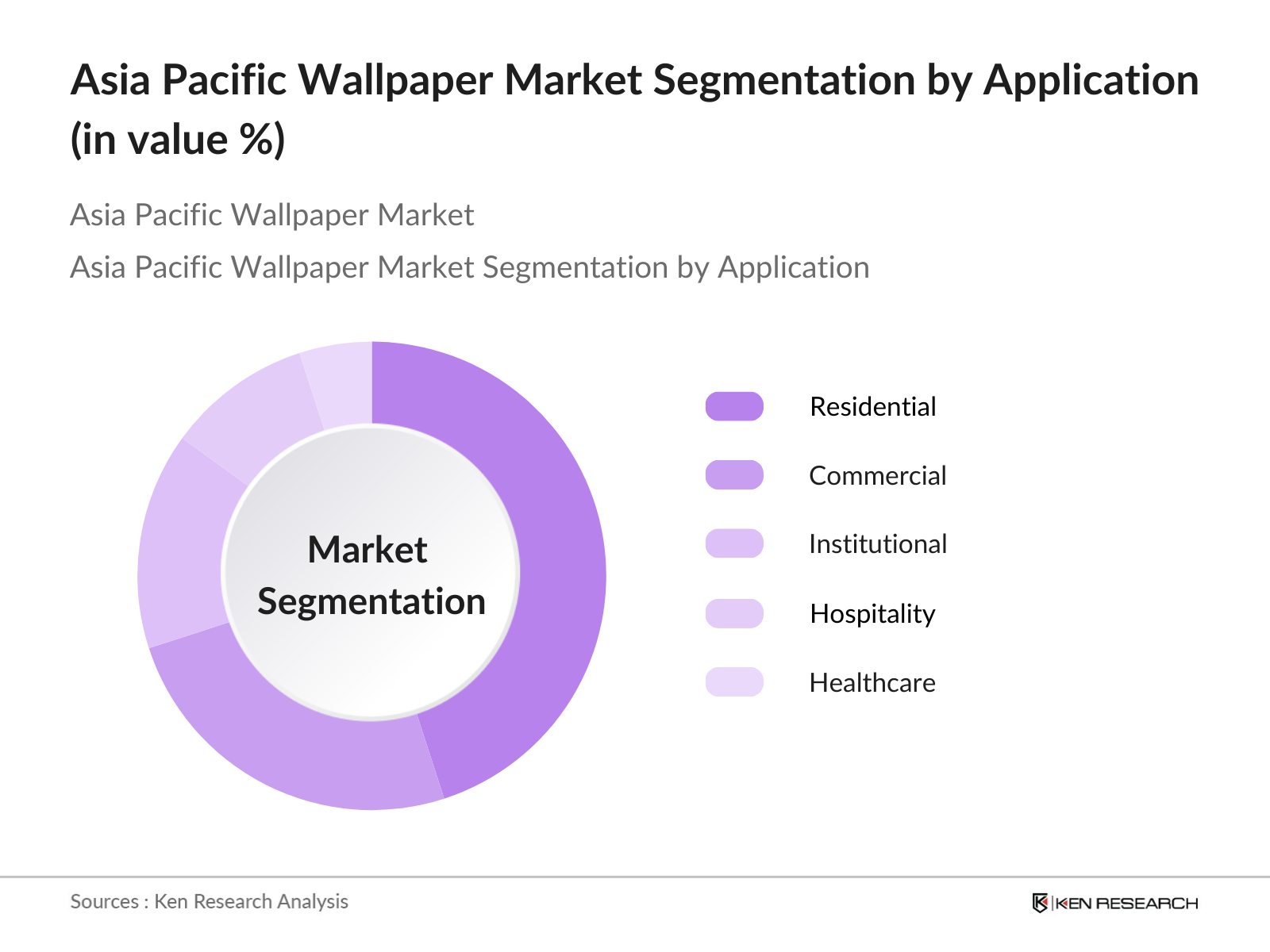

- By Application: The market is also segmented by application into residential, commercial, institutional, hospitality, and healthcare sectors. The residential segment holds the largest share, driven by increasing consumer demand for personalized interior dcor and the trend towards home improvement projects. Wallpapers in residential applications are particularly favoured for their ability to enhance aesthetics without extensive renovations. In addition, the growing availability of DIY wallpaper products has encouraged homeowners to experiment with wallpapers, driving further growth in this segment.

Asia Pacific Wallpaper Market Competitive Landscape

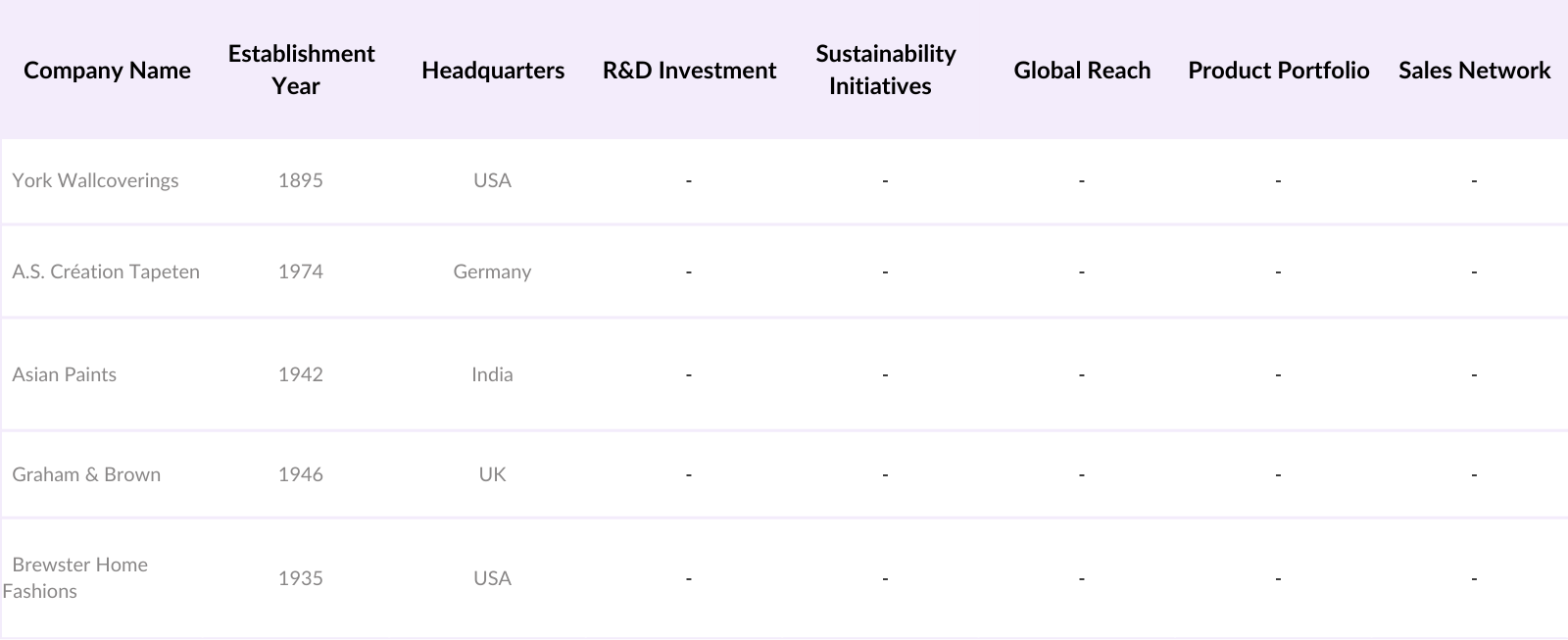

The Asia Pacific wallpaper market is dominated by several key players that have established a strong market presence through innovation, distribution networks, and product diversity. Companies are focusing on sustainability and digital printing technologies to remain competitive. The competitive landscape reflects both local and international players vying for market share.

Asia Pacific Wallpaper Market Analysis

Asia Pacific Wallpaper Market Growth Drivers

- Urbanization in Developing Economies: The Asia Pacific region is experiencing rapid urbanization, particularly in countries like India, Indonesia, and Vietnam. According to the World Bank, over 460 million people moved into urban areas between 2010 and 2023, increasing demand for residential and commercial spaces. This urban migration has accelerated construction activity, driving the demand for wallpaper as a preferred interior design option in new homes and office spaces. Additionally, cities like Bangalore, Ho Chi Minh City, and Jakarta are expected to see a further influx of over 25 million urban residents by 2025, bolstering the market's growth.

- Rise in Interior Design Trends: The growing influence of Western and Korean design aesthetics across the Asia Pacific region has driven an increased interest in wallpapers, particularly among the middle and upper-middle classes. The global trend of home improvement post-pandemic has led to an uptick in interior decoration investments. In 2022, the interior design industry in India alone was valued at $23 billion, with wallpaper usage constituting a major portion of this. Countries such as Japan and Australia are also witnessing similar trends, fueled by rising disposable incomes and increased awareness about home aesthetics.

- Eco-friendly and Sustainable Designs: The growing emphasis on sustainability is reshaping the Asia Pacific wallpaper market, with eco-conscious consumers increasingly opting for eco-friendly products. As part of its green initiatives, Japan passed legislation in 2022 to reduce carbon emissions in construction materials, driving a surge in demand for wallpapers made from recycled or biodegradable materials. Furthermore, Australias government has incentivized green building practices, with the construction of green-certified buildings doubling from 2020 to 2023, further boosting demand for sustainable wallpaper solutions. Source: Japan Ministry of the Environment.

Asia Pacific Wallpaper Market Challenges

- Fluctuating Raw Material Costs: The wallpaper industry heavily relies on raw materials like PVC, paper, and fabric, whose prices have been highly volatile in recent years. For example, the global price of PVC, a key component, has risen by nearly 40% from 2020 to 2023 due to supply chain disruptions and rising oil prices. This volatility puts pressure on wallpaper manufacturers in countries like China and India, where price-sensitive consumers dominate the market. Rising material costs also reduce the profit margins of manufacturers and limit the ability to offer competitively priced products.

- Competition from Paint Alternatives: The availability of high-quality, cost-effective paint alternatives, particularly in developing countries, poses a challenge for wallpaper adoption. In 2023, the paint industry in India recorded a growth rate of 6% in the construction and home renovation sectors, with a large segment of consumers still opting for paint due to its affordability and ease of application. This trend is prevalent in other Asia Pacific countries, where the relatively higher costs of wallpaper, combined with lower awareness, hinder its wider adoption.

Asia Pacific Wallpaper Market Future Outlook

The Asia Pacific wallpaper market is expected to see growth in the coming years, driven by the rising demand for sustainable and customizable wallpapers. Increasing investments in the construction industry, coupled with growing consumer interest in interior design and renovation projects, are expected to propel market expansion. Additionally, technological innovations such as digital printing and the development of eco-friendly wallpapers will create new opportunities for manufacturers and suppliers in the region.

Asia Pacific Wallpaper Market Opportunities

- Rising Demand for Digital and Customizable Wallpapers: The demand for digitally printed and customizable wallpapers is growing rapidly across Asia Pacific, especially in urban centers like Tokyo and Sydney. The technological advancement in digital printing has made it possible to offer bespoke designs at competitive prices, appealing to a growing segment of style-conscious consumers. In 2023, China reported a 15% increase in demand for digital wallpapers for residential and commercial projects, driven by rising disposable incomes and consumer desire for personalized interiors. This trend is further supported by the increasing number of home renovation projects across the region.

- Technological Advancements in Wallpaper Materials: New technologies are enhancing the durability and functionality of wallpaper materials, making them more attractive to consumers. The development of antimicrobial and self-cleaning wallpapers, for instance, has gained popularity in high-demand markets such as Singapore and South Korea. In 2023, over 35% of new commercial spaces in Singapore were designed using advanced wallpaper materials due to their enhanced features, including stain resistance and ease of maintenance. These advancements are opening up new market segments, particularly in healthcare and hospitality industries.

Scope of the Report

Product Type | Vinyl-based Non-woven Fabric Natural Fiber Paper |

Application | Residential Commercial Institutional Hospitality Healthcare |

Distribution Channel | Online Retail Offline Retail Specialty Stores Interior Design Studios |

End-Use Sector | Construction Renovation DIY Home Projects |

Country | China India Japan South Korea Australia |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, China)

Interior Designers and Architects

Banks and Financial Institutions

Home Improvement Retailers

Real Estate Developers

Construction Companies

Wallpaper Manufacturers

Hospitality Industry Operators

Companies

Players Mentioned in the Report

York Wallcoverings

A.S. Cration Tapeten

Asian Paints

Graham & Brown

Brewster Home Fashions

Len-Tex Corporation

J. Josephson Inc.

Grandeco Wallfashion

Sanderson Design Group

Arte-International

Table of Contents

1. Asia Pacific Wallpaper Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Wallpaper Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Wallpaper Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization in Developing Economies

3.1.2. Rise in Interior Design Trends

3.1.3. Government Incentives for Construction Sector

3.1.4. Eco-friendly and Sustainable Designs

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Costs

3.2.2. Competition from Paint Alternatives

3.2.3. Import Tariffs and Trade Restrictions

3.3. Opportunities

3.3.1. Rising Demand for Digital and Customizable Wallpapers

3.3.2. Technological Advancements in Wallpaper Materials

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Increased Adoption of Peel-and-Stick Wallpapers

3.4.2. Integration of Anti-bacterial and Self-cleaning Features

3.4.3. Rise in the Use of Wallpapers in Commercial Spaces

3.5. Government Regulations (Regional Market Compliance)

3.5.1. VOC Emission Regulations

3.5.2. Standards for Eco-friendly Products

3.5.3. Tariff and Import Duty Structures

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Designers)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia Pacific Wallpaper Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vinyl-based Wallpapers

4.1.2. Non-woven Wallpapers

4.1.3. Fabric Wallpapers

4.1.4. Natural Fiber Wallpapers

4.1.5. Paper Wallpapers

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Institutional

4.2.4. Hospitality

4.2.5. Healthcare

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail

4.3.3. Specialty Stores

4.3.4. Interior Design Studios

4.4. By End-Use Sector (In Value %)

4.4.1. Construction

4.4.2. Renovation

4.4.3. DIY Home Projects

4.5. By Country (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Wallpaper Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. York Wallcoverings

5.1.2. Brewster Home Fashions

5.1.3. A.S. Cration Tapeten

5.1.4. Sanderson Design Group

5.1.5. Graham & Brown

5.1.6. Asian Paints

5.1.7. Len-Tex Corporation

5.1.8. J. Josephson Inc.

5.1.9. Grandeco Wallfashion

5.1.10. F. Schumacher & Co.

5.1.11. Wallquest Inc.

5.1.12. Arte-International

5.1.13. Eijffinger BV

5.1.14. Cole & Son

5.1.15. Fine Dcor Wallcoverings Ltd.

5.2. Cross Comparison Parameters (Product Portfolio, R&D Investment, Global Reach, Manufacturing Capacity, Sustainability Initiatives, Marketing Strategy, Pricing Strategy, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product Launches, Expansions)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Asia Pacific Wallpaper Market Regulatory Framework

6.1. Product Safety Standards

6.2. Environmental Compliance Regulations

6.3. Certification Processes for Eco-Friendly Products

7. Asia Pacific Wallpaper Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Wallpaper Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-Use Sector (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Wallpaper Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on identifying critical variables in the Asia Pacific wallpaper market, including major stakeholders and industry trends. It includes in-depth desk research, using proprietary databases to assess industry-level data, and understanding key market drivers and restraints.

Step 2: Market Analysis and Construction

Historical data for market penetration, revenue generation, and consumer preferences are collected. This step also involves evaluating market segmentation by product type and application to estimate the market shares of each sub-segment and their contribution to overall revenue.

Step 3: Hypothesis Validation and Expert Consultation

The initial hypotheses about market growth and challenges are validated through interviews with industry experts. These consultations offer insights into operational strategies, market dynamics, and product developments, refining the market estimates.

Step 4: Research Synthesis and Final Output

All data is consolidated and verified through cross-referencing with leading wallpaper manufacturers and distributors in the Asia Pacific region. The final analysis incorporates both top-down and bottom-up approaches, ensuring the accuracy and reliability of the findings.

Frequently Asked Questions

01. How big is the Asia Pacific Wallpaper Market?

The Asia Pacific wallpaper market is valued at USD 388 million, driven by a rise in consumer spending on interior dcor and home renovation projects across the region.

02. What are the challenges in the Asia Pacific Wallpaper Market?

Challenges in the Asia Pacific wallpaper market include fluctuating raw material costs, competition from alternative products like paint, and the impact of import tariffs on pricing and product availability.

03. Who are the major players in the Asia Pacific Wallpaper Market?

Key players in the Asia Pacific wallpaper market include York Wallcoverings, A.S. Cration Tapeten, Asian Paints, and Graham & Brown. These companies dominate due to their strong global presence, extensive product portfolios, and innovative designs.

04. What are the growth drivers of the Asia Pacific Wallpaper Market?

The Asia Pacific wallpaper market is propelled by rising urbanization, increasing demand for aesthetic home dcor, and advancements in wallpaper production technologies such as digital printing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.