Asia Pacific Warehouse Automation Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD2901

November 2024

90

About the Report

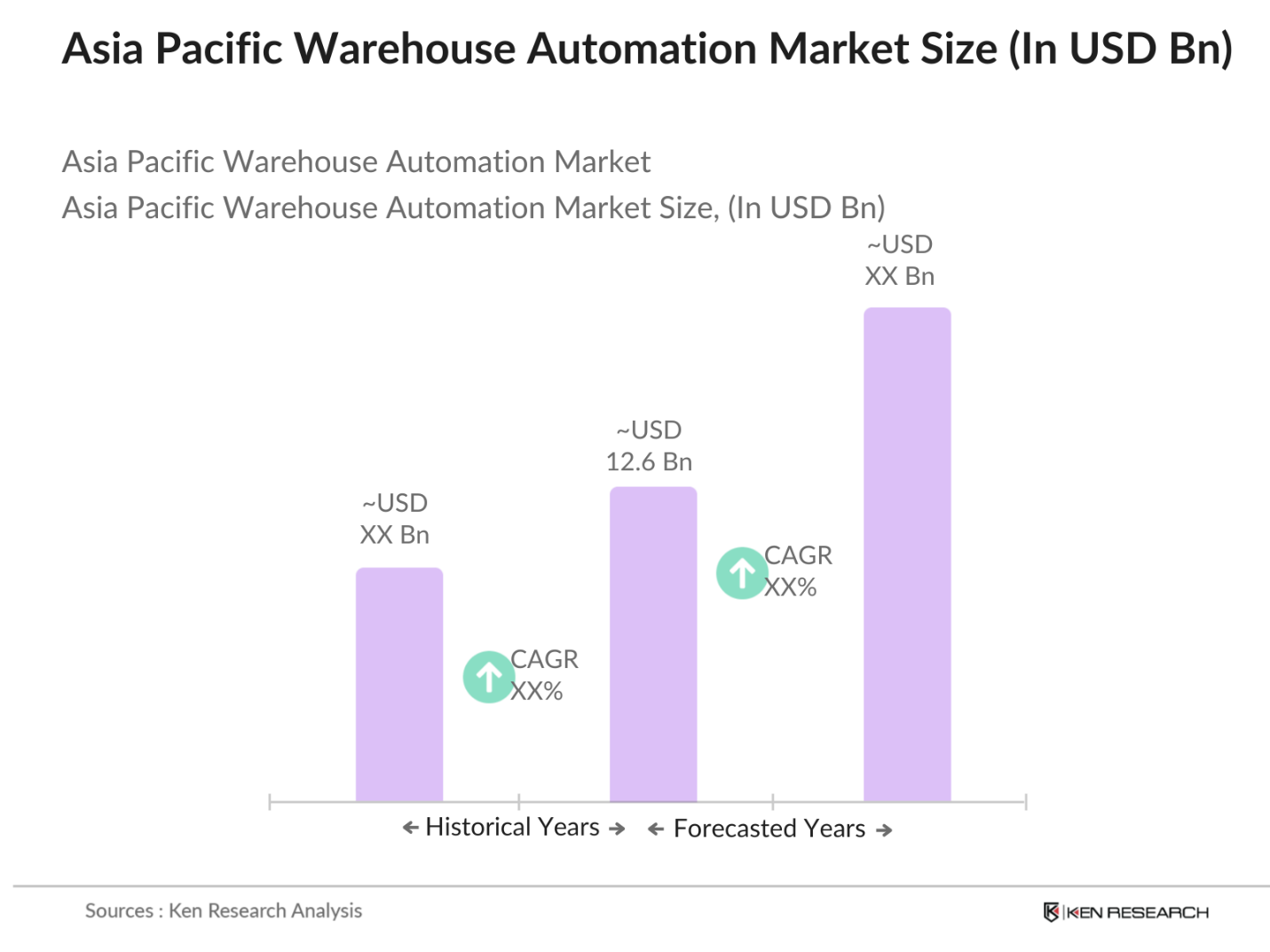

Asia Pacific Warehouse Automation Market Overview

- The Asia Pacific Warehouse Automation Market is valued at USD 12.6 billion, based on a five-year historical analysis. This market's growth is largely driven by rapid industrialization, expansion of e-commerce, and the need to streamline operations within distribution centers. The adoption of advanced automation technologies, including robotic process automation (RPA) and artificial intelligence (AI), has become essential for enhancing efficiency, reducing human error, and meeting rising consumer demand. Additionally, investments from both public and private sectors are supporting the deployment of cutting-edge automation systems across the region.

- China, Japan, and India lead the Asia Pacific Warehouse Automation Market due to their robust industrial bases and significant advancements in automation technology. China's dominance stems from its extensive manufacturing infrastructure and governmental support for industrial automation, while Japan excels due to its technological expertise and commitment to robotics. India is catching up with strong e-commerce growth and government initiatives promoting Make in India, which encourage automation adoption in logistics and warehousing.

- Several Asia-Pacific governments are offering subsidies to encourage automation. In Singapore, for example, the government provides up to $3 million in grants under the Productivity Solutions Grant to support automation in warehousing and logistics. These subsidies reduce the financial burden on companies, enabling more SMEs to adopt automated technologies. Such government support is crucial for accelerating warehouse automation in the region.

Asia Pacific Warehouse Automation Market Segmentation

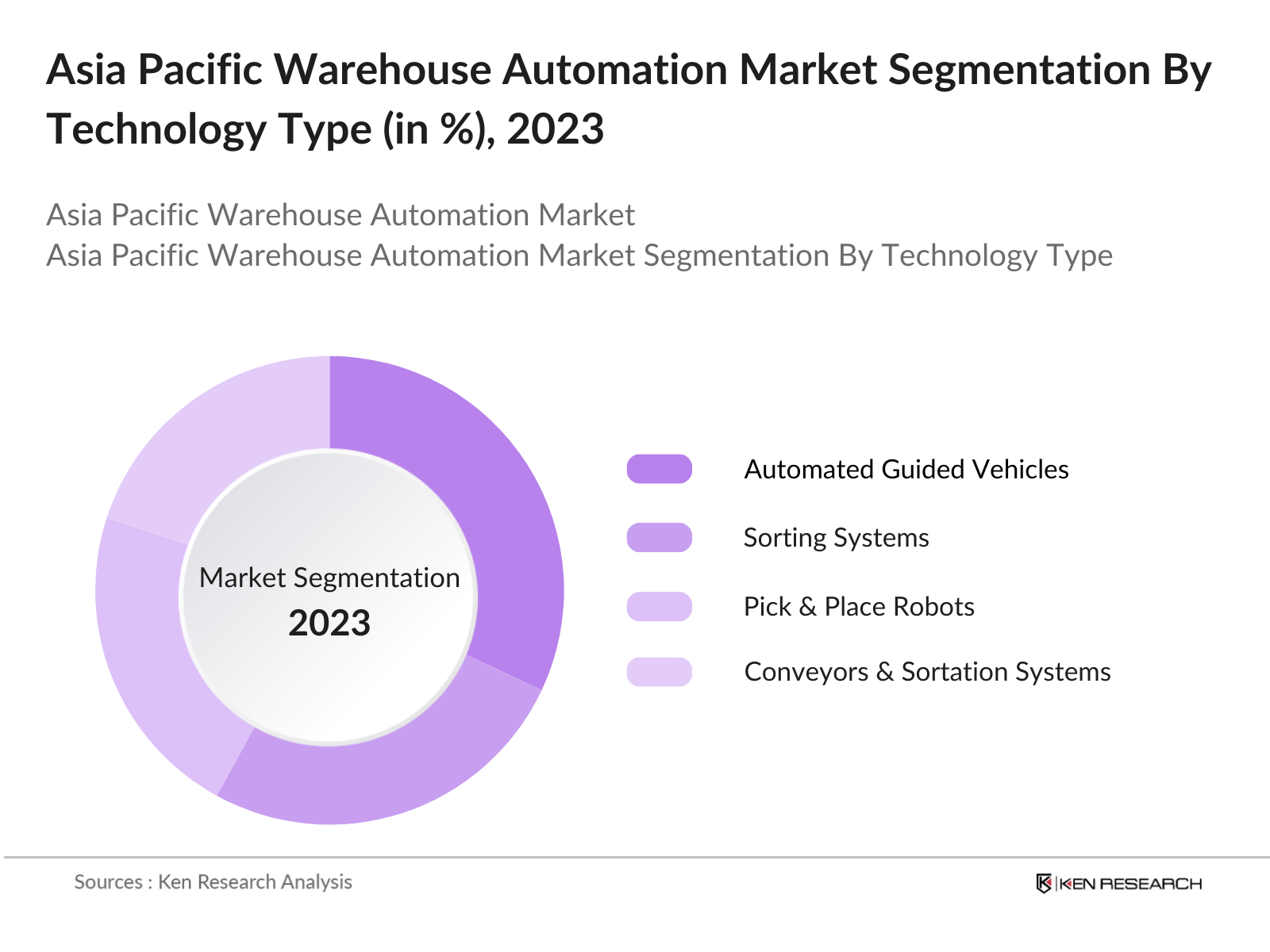

By Technology: The Asia Pacific Warehouse Automation market is segmented by technology into Automated Guided Vehicles (AGVs), Sorting Systems, Pick & Place Robots, Conveyors & Sortation Systems, and Warehouse Management Software (WMS). Automated Guided Vehicles dominate this segment due to their ability to increase productivity by transporting goods autonomously within warehouses, thereby reducing reliance on manual labor. Major players have invested in AGV development, which has also led to cost reductions, making these solutions accessible for businesses of various sizes.

|

Technology |

Market Share (2023) |

|

Automated Guided Vehicles |

32% |

|

Sorting Systems |

26% |

|

Pick & Place Robots |

22% |

|

Conveyors & Sortation Systems |

20% |

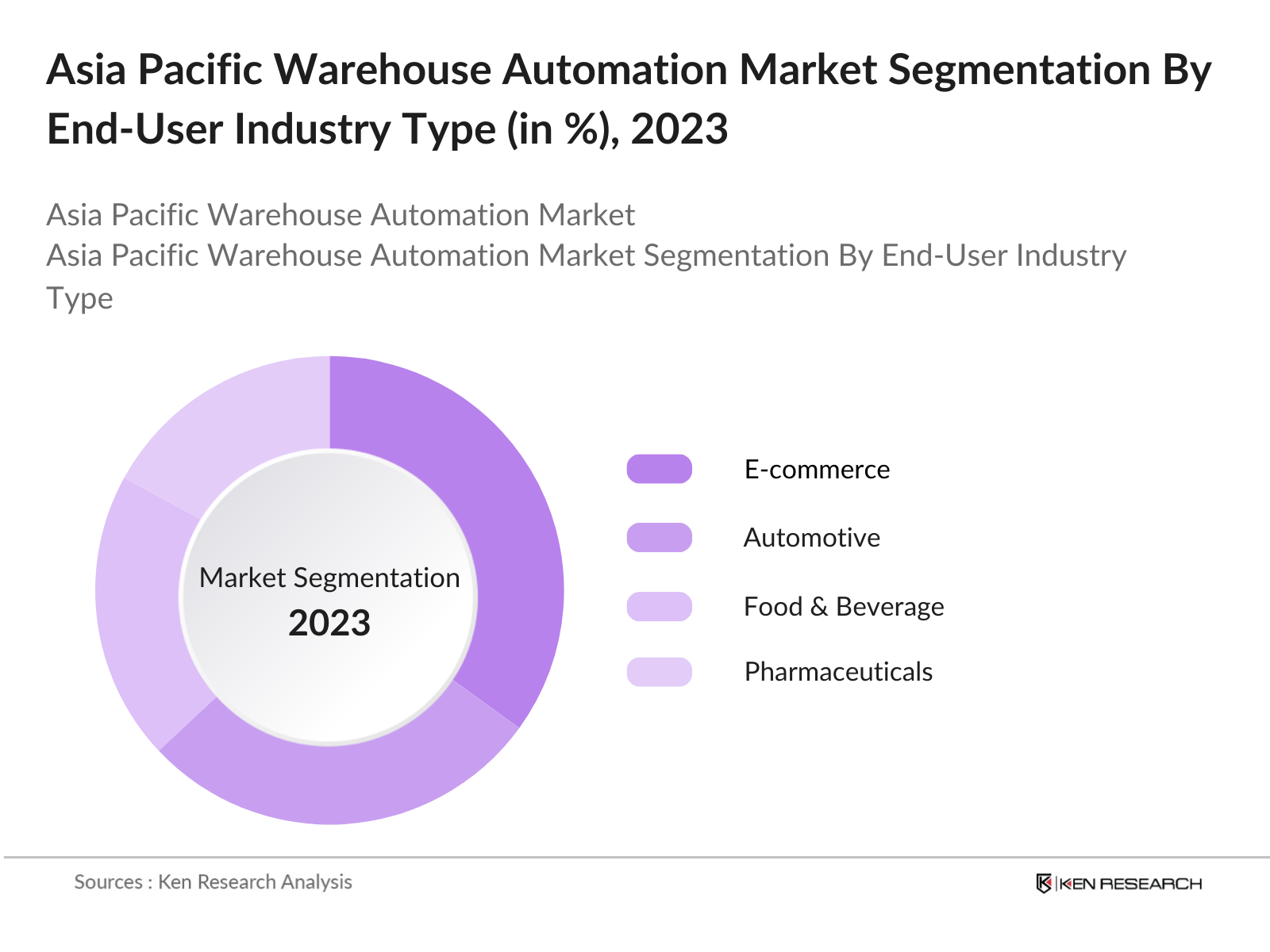

By End-User Industry: The Asia Pacific Warehouse Automation market is segmented by end-user industry into E-commerce, Automotive, Food & Beverage, Pharmaceuticals, and Retail. The e-commerce sector holds a dominant position, primarily due to the increasing consumer preference for online shopping. This sector relies heavily on warehouse automation to manage high order volumes, reduce delivery times, and minimize operational costs. Companies like Amazon and Alibaba have been instrumental in the advancement of automated warehouses, setting new benchmarks for operational efficiency in e-commerce.

|

End-User Industry |

Market Share (2023) |

|

E-commerce |

35% |

|

Automotive |

28% |

|

Food & Beverage |

20% |

|

Pharmaceuticals |

17% |

Asia Pacific Warehouse Automation Competitive Landscape

The Asia Pacific Warehouse Automation market is dominated by a few key players who lead in innovation and large-scale deployment. This competitive landscape includes firms that specialize in automated warehousing solutions, with significant investments in R&D and a focus on strategic partnerships.

Asia Pacific Warehouse Automation Industry Analysis

Growth Drivers

- Increasing E-commerce Demand: The Asia-Pacific regions booming e-commerce sector has significantly impacted warehouse automation. As of 2024, approximately 2 billion consumers across Asia-Pacific have engaged in online shopping, driving up demand for efficient, high-speed warehousing solutions. Countries like China and India see heavy traffic in cross-border online retail, with China processing nearly 60 million packages daily in 2023 alone. This surge in e-commerce activity has necessitated automation to meet the logistical challenges and enhance efficiency in order processing, warehousing, and distribution.

- Labor Shortage Solutions: Labor shortages in Asia-Pacific, especially for roles requiring physical endurance in logistics, have prompted investments in warehouse automation. In Japan, for example, the population of workers aged 20-39 in logistics is projected to decline by over 15 million by 2025, intensifying the demand for automation as a viable solution. Automation technologies, such as automated guided vehicles (AGVs) and robotic sorting systems, help address these shortages by increasing throughput with minimal human intervention, particularly in economies like Japan and South Korea, where aging populations impact the labor force significantly.

- Advancements in AI and Robotics: Advances in artificial intelligence (AI) and robotics have enhanced automation in warehouses, allowing for improved accuracy, speed, and safety in handling and processing orders. By 2024, nearly 20,000 AI-equipped robots are actively used in Asia-Pacific warehouses, with Japan leading in robotic density in logistics. These technologies allow for real-time data analysis and predictive maintenance, helping warehouses operate efficiently and with fewer disruptions, particularly in fast-paced markets such as China and Singapore.

Market Challenges

- High Initial Investment: Warehouse automation requires substantial upfront investments in robotics, software, and infrastructure, which can deter small and medium enterprises (SMEs). For instance, a fully automated warehouse system can cost between $10 million and $30 million, depending on the level of automation. In developing Asia-Pacific countries such as Indonesia and Vietnam, these costs can represent a significant financial barrier for companies with limited capital, despite the potential long-term savings and efficiency gains.

- Skill Gap in Advanced Technologies: The shift toward automation has highlighted a skill gap in advanced technologies across Asia-Pacific. The need for technically trained professionals to operate and maintain automated systems has surged. In India, only about 12% of the workforce in logistics possesses the necessary skills for operating advanced automated solutions, which poses a challenge to rapid automation. Similar trends are noted in other emerging economies in the region, where training initiatives lag behind technological advancement.

Asia Pacific Warehouse Automation Future Outlook

Over the next five years, the Asia Pacific Warehouse Automation Market is expected to grow significantly due to the continuous expansion of e-commerce, government support for industrial automation, and a rising demand for faster, more efficient logistics solutions. Advancements in AI and machine learning, as well as developments in robotics, are anticipated to enhance the capabilities of automated systems, allowing for improved flexibility and scalability in warehouse operations.

Opportunities

- Expansion of Micro-Fulfillment Centers: Micro-fulfillment centers (MFCs) are emerging as a popular solution to meet the demand for rapid delivery in urban areas across Asia-Pacific. Retail giants in the region are investing in smaller, automated warehouses that can be placed closer to consumers. By 2024, Japan alone has over 200 MFCs in operation, each strategically located to enable same-day delivery in major cities. This trend represents an opportunity for warehouse automation providers to deliver compact and flexible automation solutions tailored to MFC needs.

- Integration with Internet of Things (IoT): IoT integration within warehouse automation allows for real-time monitoring of inventory, equipment, and warehouse conditions. In 2024, over 45% of warehouses in Singapore and South Korea have adopted IoT-enabled solutions for better asset tracking and maintenance. This expansion allows facilities to reduce downtime, improve energy efficiency, and optimize inventory management, further driving demand for IoT-compatible automation systems across Asia-Pacific.

Scope of the Report

|

Technology |

Automated Guided Vehicles Sorting Systems Pick & Place Robots Conveyors & Sortation Systems Warehouse Management Software |

|

Function |

Sorting Picking Storing Packaging Shipping |

|

Deployment Type |

On-Premise Cloud-Based |

|

End-User Industry |

E-commerce Automotive Food & Beverage Pharmaceuticals Retail |

|

Region |

China Japan India Australia Southeast Asia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Warehouse and Logistics Companies

Technology Provider Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, Industrial Development Agencies)

E-commerce Companies

Pharmaceutical Distribution Companies

Automotive Supply Chain Companies

Companies

Players Mentioned in the Report

Daifuku Co., Ltd.

Honeywell International Inc.

Dematic

Murata Machinery, Ltd.

Vanderlande

Swisslog Holding AG

SSI SCHAEFER

TGW Logistics Group

Knapp AG

Zebra Technologies

Table of Contents

- Asia Pacific Warehouse Automation Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics (Automation Demand, Logistics Integration)

1.4 Market Growth Rate (Expansion in E-commerce, Smart Warehousing Trends)

1.5 Market Segmentation Overview - Asia Pacific Warehouse Automation Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Developments and Technological Advancements - Asia Pacific Warehouse Automation Market Analysis

3.1 Growth Drivers

3.1.1 Increasing E-commerce Demand

3.1.2 Labor Shortage Solutions

3.1.3 Advancements in AI and Robotics

3.1.4 Government Initiatives for Industrial Automation

3.2 Market Challenges

3.2.1 High Initial Investment

3.2.2 Skill Gap in Advanced Technologies

3.2.3 Regulatory Compliance

3.3 Opportunities

3.3.1 Expansion of Micro-Fulfillment Centers

3.3.2 Integration with Internet of Things (IoT)

3.3.3 Data Analytics and Predictive Maintenance

3.4 Trends

3.4.1 Collaborative Robots

3.4.2 Mobile and Automated Guided Vehicles (AGVs)

3.4.3 Cloud-Based Warehouse Management Systems

3.5 Government Regulations and Policies

3.5.1 Automation Subsidies

3.5.2 Compliance Standards

3.5.3 Safety Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Warehouse Providers, Logistics Firms)

3.8 Porters Five Forces

3.9 Competition Ecosystem - Asia Pacific Warehouse Automation Market Segmentation

4.1 By Technology (in Value %)

4.1.1 Automated Guided Vehicles (AGVs)

4.1.2 Sorting Systems

4.1.3 Pick & Place Robots

4.1.4 Conveyors & Sortation Systems

4.1.5 Warehouse Management Software (WMS)

4.2 By Function (in Value %)

4.2.1 Sorting

4.2.2 Picking

4.2.3 Storing

4.2.4 Packaging

4.2.5 Shipping

4.3 By Deployment Type (in Value %)

4.3.1 On-Premise

4.3.2 Cloud-Based

4.4 By End-User Industry (in Value %)

4.4.1 E-commerce

4.4.2 Automotive

4.4.3 Food & Beverage

4.4.4 Pharmaceuticals

4.4.5 Retail

4.5 By Region (in Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 Southeast Asia - Asia Pacific Warehouse Automation Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Daifuku Co., Ltd.

5.1.2 Honeywell International Inc.

5.1.3 Dematic

5.1.4 Murata Machinery, Ltd.

5.1.5 Vanderlande

5.1.6 Swisslog Holding AG

5.1.7 SSI SCHAEFER

5.1.8 TGW Logistics Group

5.1.9 Knapp AG

5.1.10 Kion Group AG

5.1.11 Zebra Technologies

5.1.12 Hikvision Robotics

5.1.13 Fetch Robotics

5.1.14 Inther Group

5.1.15 GreyOrange

5.2 Cross Comparison Parameters (Revenue, Automation Capabilities, Key Technologies, Geographic Reach, Innovation Index, Customer Base, Strategic Alliances, R&D Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, New Product Launches)

5.5 Mergers and Acquisitions

5.6 Investment Analysis - Asia Pacific Warehouse Automation Market Regulatory Framework

6.1 Automation and Safety Standards

6.2 Industry Compliance Requirements

6.3 Certification and Safety Guidelines - Asia Pacific Warehouse Automation Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth - Asia Pacific Warehouse Automation Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Target Market Assessment

8.3 Strategic Expansion Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves developing an ecosystem map that includes all major stakeholders in the Asia Pacific Warehouse Automation Market. This step utilizes extensive desk research, relying on both secondary and proprietary databases to gather comprehensive industry data, allowing us to define the essential variables driving market dynamics.

Step 2: Market Analysis and Construction

Historical data on market trends, warehousing solutions adoption, and regional distribution were analyzed to construct an accurate market landscape. We assessed industry growth drivers, competitive dynamics, and geographical spread to provide reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through direct consultation with industry experts. Interviews with warehouse operators, technology providers, and logistics firms provided insights into automation adoption, operational efficiency, and ROI, enriching the reliability of our findings.

Step 4: Research Synthesis and Final Output

The final phase engaged multiple warehouse automation companies to acquire insights into market-specific metrics, implementation challenges, and future potential. This phase ensured a holistic and verified analysis, forming the basis for a robust market report.

Frequently Asked Questions

01. How big is the Asia Pacific Warehouse Automation Market?

The Asia Pacific Warehouse Automation Market is valued at USD 12.6 billion, driven by increasing demand from e-commerce, logistics, and industrial sectors that prioritize operational efficiency and technology-driven solutions.

02. What are the challenges in the Asia Pacific Warehouse Automation Market?

Challenges include high initial investment costs, a shortage of skilled labor, and complex regulatory compliance. Additionally, integration challenges with legacy systems pose operational hurdles.

03. Who are the major players in the Asia Pacific Warehouse Automation Market?

Key players include Daifuku Co., Ltd., Honeywell International Inc., Dematic, Murata Machinery, Ltd., and Vanderlande, each known for their advanced automation solutions and extensive market reach.

04. What factors are driving growth in the Asia Pacific Warehouse Automation Market?

The market's growth is propelled by the rapid expansion of e-commerce, government support for industrial automation, and the rising need for efficient logistics solutions in densely populated cities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.