Asia Pacific Water Dispenser Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD6078

November 2024

91

About the Report

Asia Pacific Water Dispenser Market Overview

- The Asia Pacific water dispenser market is valued at USD 725 million based on a detailed historical analysis. The market is primarily driven by the increasing demand for clean drinking water in residential, commercial, and industrial sectors. The growing awareness about water contamination and the push toward eco-friendly, energy-efficient products have been significant drivers. Moreover, innovations in water purification technologies like UV and RO filters have also played a role in boosting product adoption across multiple segments of society.

- Countries like China, India, and Japan dominate the Asia Pacific water dispenser market due to their large population base, rapid urbanization, and the expanding commercial sector. The urban centers of these countries have seen a rise in demand for convenient and hygienic water solutions, especially in office spaces, hospitals, and public institutions. This demand is further supported by government initiatives focused on clean drinking water access and reducing plastic waste.

- In 2024, the governments of India and China continued their national clean water campaigns aimed at improving water quality and accessibility in both urban and rural areas. These initiatives included subsidies for water dispensers in government buildings and public institutions, resulting in increased market demand.

Asia Pacific Water Dispenser Market Segmentation

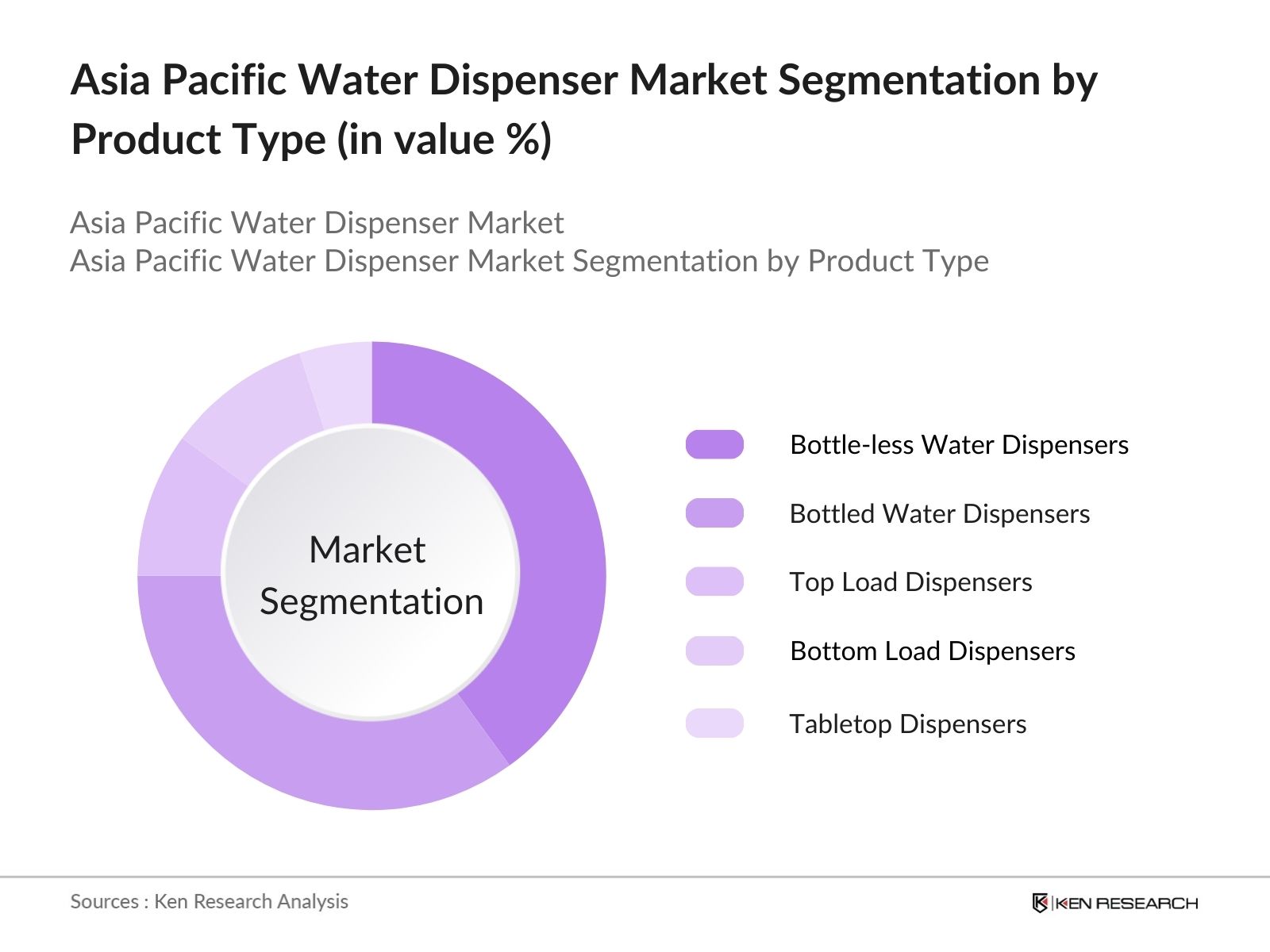

By Product Type: The Asia Pacific Water Dispenser market is segmented by product type into bottled water dispensers, bottle-less water dispensers, top load dispensers, bottom load dispensers, and tabletop dispensers. Recently, bottle-less water dispensers have gained a dominant share due to their sustainability benefits and reduced operational costs. The growing awareness of environmental issues, such as plastic waste from bottled water, has encouraged both consumers and businesses to opt for bottle-less systems, which offer long-term cost savings and a continuous supply of purified water.

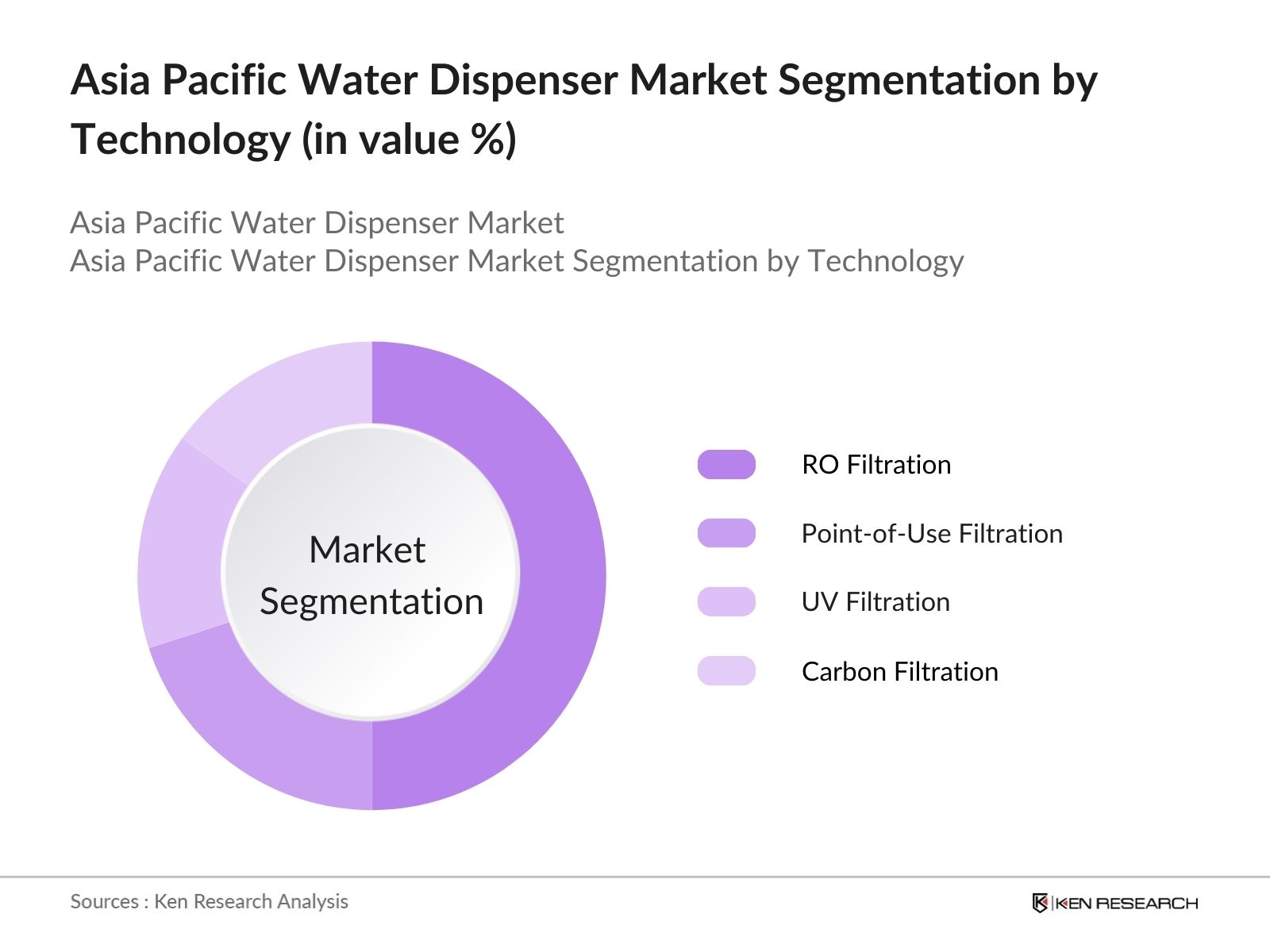

By Technology: The market is further segmented by technology into point-of-use filtration, UV filtration, RO filtration, and carbon filtration. RO filtration systems dominate the market because of their ability to effectively remove impurities and contaminants from water, making them popular in areas where water quality is a concern. As water quality deteriorates in many urban areas, RO systems provide a reliable method for ensuring safe and clean drinking water.

Asia Pacific Water Dispenser Market Competitive Landscape

The Asia Pacific Water Dispenser market is competitive, dominated by global and regional players offering a wide range of products. Companies such as Haier, Whirlpool, and Blue Star lead the market with their extensive distribution networks, strong brand presence, and focus on innovation. The growing emphasis on environmental sustainability has pushed these companies to invest in eco-friendly and energy-efficient water dispensers.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Product Range |

Geographical Reach |

Sustainability Initiatives |

Technological Innovations |

Distribution Channels |

|---|---|---|---|---|---|---|---|---|

|

Haier Group Corporation |

1984 |

Qingdao, China |

- | - | - | - | - | - |

|

Whirlpool Corporation |

1911 |

Michigan, USA |

- | - | - | - | - | - |

|

Blue Star Limited |

1943 |

Mumbai, India |

- | - | - | - | - | - |

|

Midea Group Co., Ltd. |

1968 |

Guangdong, China |

- | - | - | - | - | - |

|

Culligan International |

1936 |

Rosemont, USA |

- | - | - | - | - | - |

Asia Pacific Water Dispenser Market Analysis

Growth Drivers

- Increasing Demand for Clean Drinking Water: The rising awareness about waterborne diseases has led to a significant demand for clean drinking water in the Asia Pacific region. In 2024, approximately 2.5 billion people in the region have limited access to clean water, prompting both residential and commercial sectors to invest in water dispensers as a solution. Governments in countries like India and China have implemented water safety regulations, driving the market's growth as businesses comply with these standards.

- Expansion of Commercial Spaces: The rapid development of commercial spaces, such as offices, shopping centers, and hospitality venues, is fueling the demand for water dispensers. In 2024, the number of new commercial projects in the Asia Pacific region reached over 15,000, especially in cities like Shanghai, Mumbai, and Sydney. Water dispensers have become a standard feature in such establishments to ensure access to safe drinking water, driving market growth.

- Health-Conscious Consumers: There is a growing shift toward healthier lifestyles in the Asia Pacific region, with consumers prioritizing clean and filtered water over bottled alternatives. This trend has led to a surge in demand for water dispensers. By 2024, over 800 million individuals in urban areas across the region have adopted healthier practices, further driving the adoption of water dispensers in households, offices, and public spaces.

Market Challenges

- High Initial Investment in Premium Models: One of the major challenges in the Asia Pacific water dispenser market is the high initial investment required for premium models that offer advanced filtration and cooling features. The average price for such dispensers in 2024 ranged between $200 and $500, making it difficult for small businesses and households to afford them. This limits market penetration in developing regions within Asia.

- Inconsistent Infrastructure in Developing Areas: The market faces challenges in rural and semi-urban regions where access to electricity and piped water supply remains inconsistent. In 2024, nearly 600 million people in the region still lacked reliable access to electricity, limiting the installation of electric water dispensers. This challenge affects market growth in countries like Indonesia, Vietnam, and the Philippines.

Asia Pacific Water Dispenser Market Future Outlook

Over the next five years, the Asia Pacific Water Dispenser market is expected to witness significant growth, driven by rising environmental awareness, technological advancements in water purification, and increasing demand from commercial sectors. Governments are expected to introduce stricter water quality regulations, and consumers will continue to seek solutions that reduce plastic waste, leading to a greater adoption of bottle-less water dispensers. Energy-efficient and smart water dispensers are likely to dominate the market, particularly in urban and densely populated areas.

Market Opportunities

- Adoption in Healthcare Facilities: Hospitals and healthcare centers in the Asia Pacific region are increasingly adopting water dispensers as a safe and efficient source of drinking water for patients and staff. In 2024, the number of hospitals and clinics equipped with water dispensers in major cities like Beijing, Tokyo, and New Delhi exceeded 4,500, reflecting a growing opportunity for manufacturers to target the healthcare segment.

- Eco-Friendly Initiatives in Water Dispenser Manufacturing: Manufacturers are responding to rising environmental concerns by producing eco-friendly water dispensers with recyclable materials and energy-saving technology. By 2024, over 60% of newly launched water dispenser models in the Asia Pacific region included eco-friendly features, such as energy-efficient compressors and non-toxic materials, creating an opportunity for market growth driven by sustainability.

Scope of the Report

|

By Product Type |

Bottled Water Dispensers Bottle-less Water Dispensers Top Load Dispensers Bottom Load Dispensers, Tabletop Dispensers |

|

By Application |

Residential Commercial Industrial |

|

By Technology |

Point-of-Use Filtration UV Filtration RO Filtration Carbon Filtration |

|

By Water Source |

Tap Water Bottled Water |

|

By Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Asia-Pacific Water Forum, Environmental Protection Agencies)

Hospitality and Commercial Establishments

Healthcare Institutions

Retailers and Distributors

Manufacturers and Suppliers of Water Purification Systems

Construction Companies

Environmental and Sustainability Organizations

Companies

Players Mentioned in the Report:

Haier Group Corporation

Whirlpool Corporation

Blue Star Limited

Midea Group Co., Ltd.

Culligan International

Panasonic Corporation

Honeywell International Inc.

AO Smith Corporation

Waterlogic Plc

Electrolux AB

Table of Contents

1. Asia Pacific Water Dispenser Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Value Chain Analysis

2. Asia Pacific Water Dispenser Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Market Growth Milestones

2.4 Key Market Developments

3. Asia Pacific Water Dispenser Market Analysis

3.1 Growth Drivers (e.g., rising urbanization, increasing demand for clean drinking water, commercial space expansion)

3.2 Market Challenges (e.g., high initial investment, infrastructure limitations, energy consumption concerns)

3.3 Opportunities (e.g., adoption in healthcare facilities, eco-friendly initiatives, expanding product range)

3.4 Trends (e.g., smart dispensers, touchless solutions, integration of IoT for real-time monitoring)

3.5 Government Regulations (e.g., water safety standards, energy efficiency regulations, plastic reduction policies)

4. Asia Pacific Water Dispenser Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Bottled Water Dispensers

4.1.2 Bottle-less Water Dispensers

4.1.3 Top Load Dispensers

4.1.4 Bottom Load Dispensers

4.1.5 Tabletop Dispensers

4.2 By Application (In Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Industrial

4.3 By Technology (In Value %)

4.3.1 Point-of-Use Filtration

4.3.2 UV Filtration

4.3.3 RO Filtration

4.3.4 Carbon Filtration

4.4 By Water Source (In Value %)

4.4.1 Tap Water

4.4.2 Bottled Water

4.5 By Region (In Value %)

4.5.1 East Asia

4.5.2 Southeast Asia

4.5.3 South Asia

4.5.4 Oceania

5. Asia Pacific Water Dispenser Market Competitive Analysis

5.1 Competitor Profiles (15 competitors)

5.1.1 Haier Group Corporation

5.1.2 Whirlpool Corporation

5.1.3 Blue Star Limited

5.1.4 Midea Group Co., Ltd.

5.1.5 AO Smith Corporation

5.1.6 Panasonic Corporation

5.1.7 Culligan International

5.1.8 Honeywell International Inc.

5.1.9 Elkay Manufacturing Company

5.1.10 Primo Water Corporation

5.1.11 Oasis International

5.1.12 Waterlogic Plc

5.1.13 Clover Co., Ltd.

5.1.14 Electrolux AB

5.1.15 Aqua Clara, Inc.

5.2 Cross Comparison Parameters (Product Portfolio, Revenue, Distribution Network, Market Share, R&D Spending, Brand Presence, Regional Focus, Environmental Initiatives)

5.3 Market Share Analysis (Competitive Market Positioning)

5.4 Strategic Initiatives (Key business strategies like mergers, acquisitions, partnerships, and product innovations)

5.5 Investment Analysis (Venture Capital, Private Equity, and Corporate Investments)

6. Asia Pacific Water Dispenser Market Regulatory Framework

6.1 Water Quality Standards

6.2 Compliance and Certification (e.g., Energy Star, NSF Certification)

6.3 Regulatory Guidelines for Materials

6.4 Recycling and Waste Management Regulations

7. Asia Pacific Water Dispenser Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Asia Pacific Water Dispenser Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By Water Source (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Water Dispenser Market Analysts Recommendations

9.1 Total Addressable Market (TAM)/Serviceable Addressable Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2 Consumer Demographics and Preferences

9.3 Marketing and Distribution Strategies

9.4 Innovation and White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the Asia Pacific Water Dispenser Market ecosystem by identifying the key stakeholders, including manufacturers, distributors, retailers, and consumers. Extensive desk research is used to compile data from government reports, industry publications, and proprietary databases to define the key market drivers and constraints.

Step 2: Market Analysis and Construction

In this phase, historical data is gathered and analyzed to understand the market dynamics and segment performance. Market penetration, pricing strategies, and the balance between supply and demand are studied to estimate overall revenue and market growth. The impact of government regulations and technological advancements is also evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews are conducted to validate the findings and hypotheses developed during the research. Industry experts from leading water dispenser companies provide insights into current trends, emerging opportunities, and potential market disruptions.

Step 4: Research Synthesis and Final Output

Finally, a synthesis of all the data collected is undertaken, combining quantitative and qualitative insights to form the final market report. Cross-referencing findings with real-world market performance ensures accuracy and relevance in the final analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Water Dispenser Market?

The Asia Pacific Water Dispenser Market was valued at USD 725 million, driven by the rising demand for clean drinking water solutions and innovations in filtration technologies like RO and UV systems.

02. What are the challenges in the Asia Pacific Water Dispenser Market?

Challenges in the Asia Pacific Water Dispenser Market include high initial investment costs for advanced water filtration systems and the need for reliable water infrastructure, particularly in developing regions of Asia Pacific.

03. Who are the major players in the Asia Pacific Water Dispenser Market?

Major players in the Asia Pacific Water Dispenser Market include Haier Group Corporation, Whirlpool Corporation, Blue Star Limited, Midea Group Co., Ltd., and Culligan International. These companies dominate through strong distribution networks and innovative product offerings.

04. What are the growth drivers of the Asia Pacific Water Dispenser Market?

The Asia Pacific Water Dispenser market is driven by increasing urbanization, environmental awareness, and technological advancements in water purification systems. Rising disposable incomes and growing demand in commercial sectors also contribute to growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.