Asia Pacific Water Enhancer Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5964

December 2024

81

About the Report

Asia Pacific Water Enhancer Market Overview

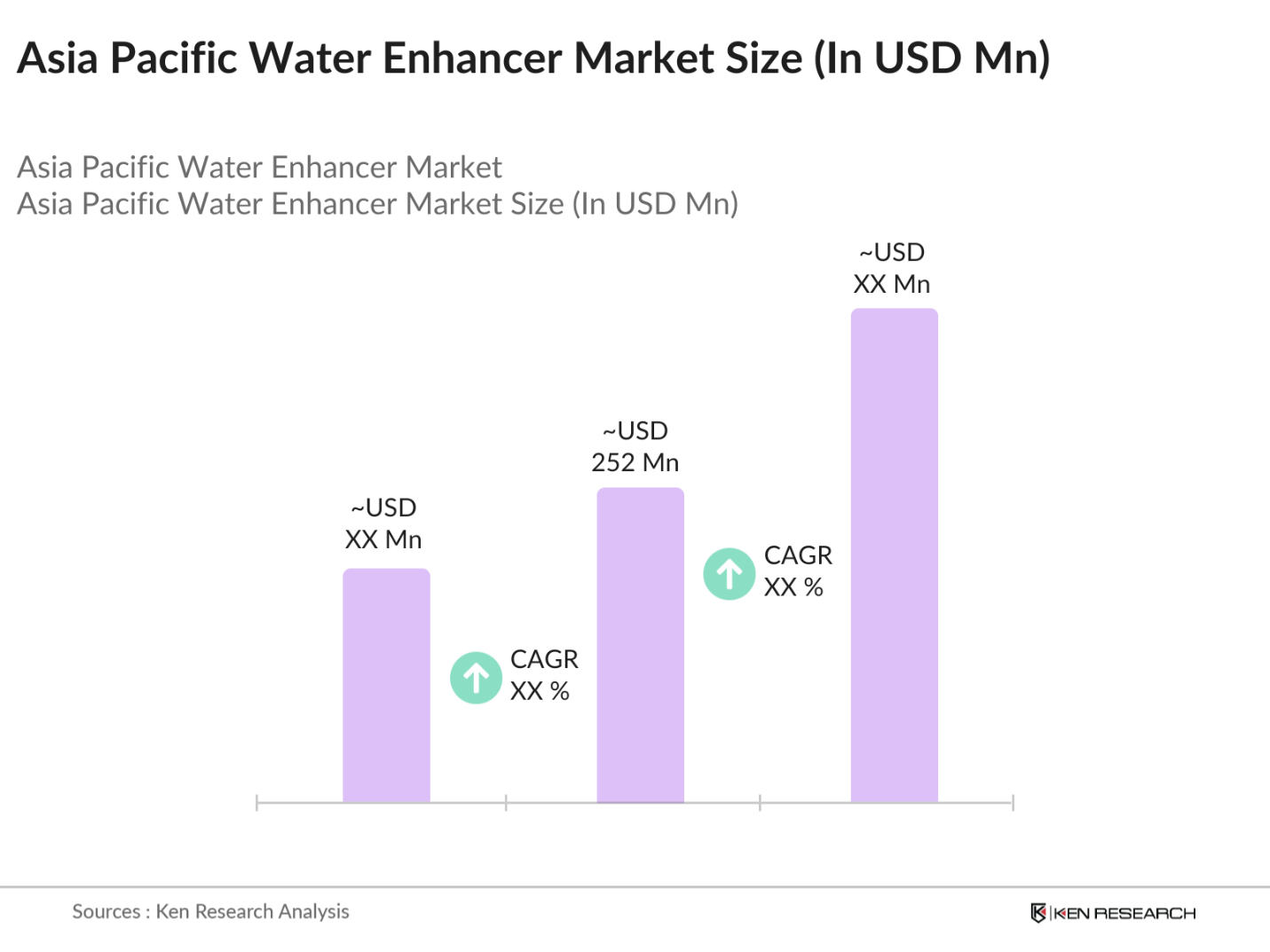

- The Asia Pacific Water Enhancer market is valued at USD 252 million, based on a five-year historical analysis. This market is primarily driven by a rising trend towards health-conscious consumption and a shift from sugary drinks to low-calorie hydration options. With increasing urbanization and lifestyle changes, consumers in the region are seeking convenient and functional beverage choices that provide flavor without added sugars, boosting demand for water enhancers, especially in the fitness and wellness segments.

- China and Australia are leading markets in the region. China's dominance is attributed to its large population and growing middle class, which is increasingly health-conscious. Australia's market is bolstered by a strong presence of soft drinks and non-alcoholic beverages, with water enhancers offering a unique point of difference within the industry.

- Governments worldwide are implementing stringent food safety standards to protect public health. In December 2022, the U.S. Food and Drug Administration released the 2022 Food Code, providing guidance to mitigate foodborne illness risks at retail and establish uniform national standards for food safety. Similarly, the European Food Safety Authority's 2022 report on pesticide residues in food indicated that 96.3% of samples analyzed fell below the maximum residue level, reflecting effective regulatory measures.

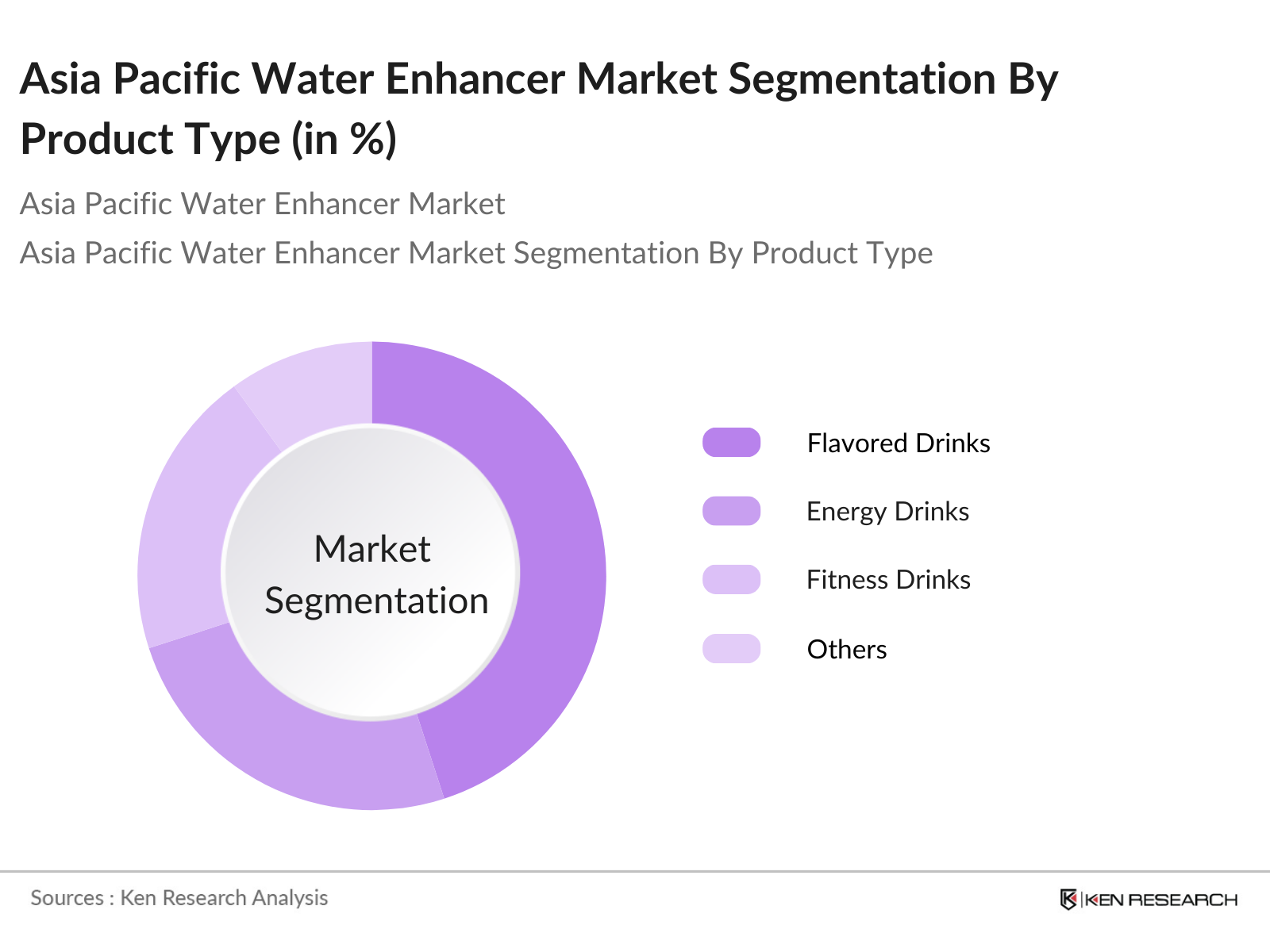

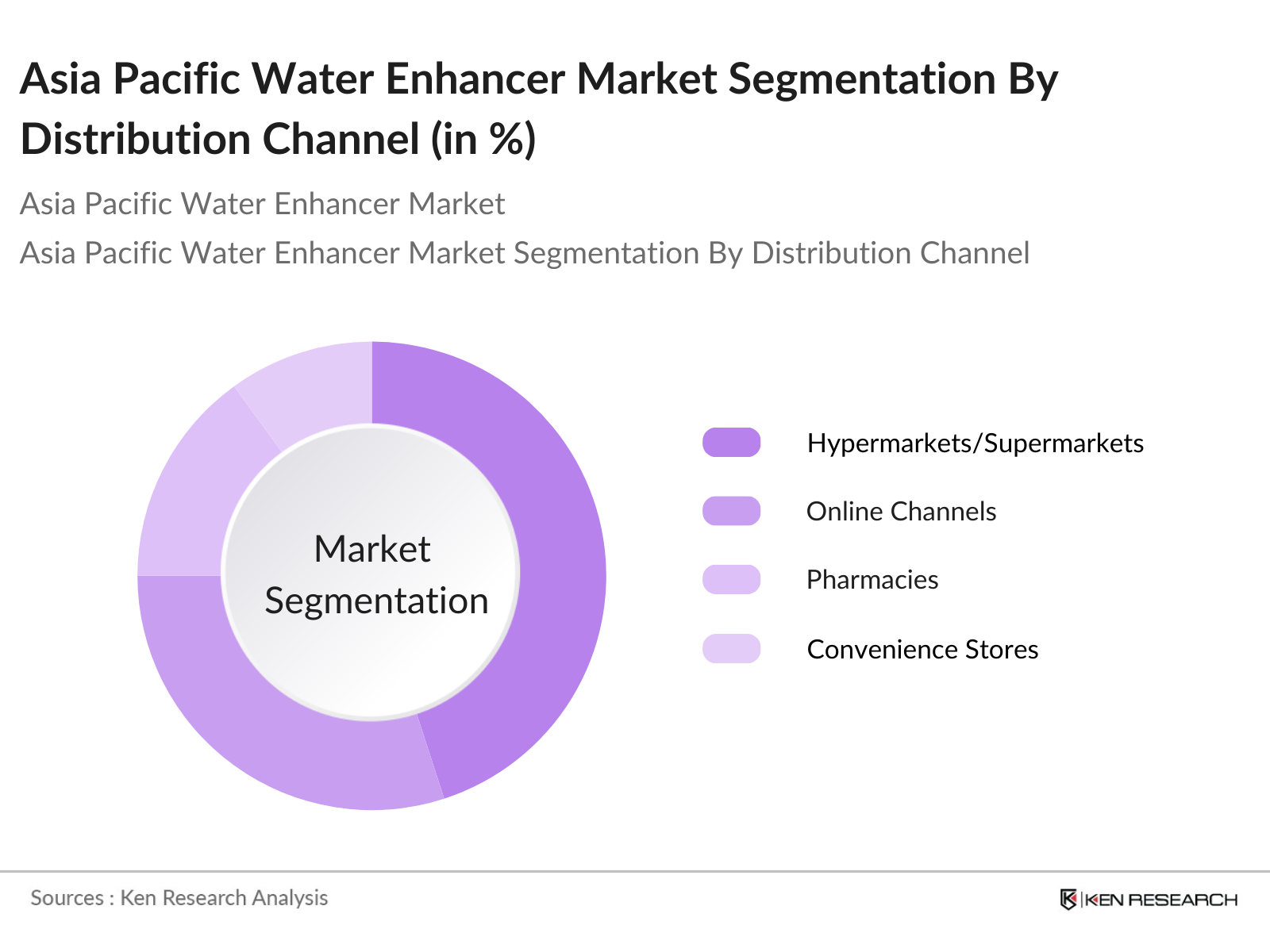

Asia Pacific Water Enhancer Market Segmentation

By Product Type: The market is segmented by product type into flavored drinks, energy drinks, fitness drinks, and others. Flavored drinks hold a dominant market share due to their wide appeal and variety of taste options, catering to consumers seeking healthier alternatives to traditional sugary beverages. The availability of diverse flavors encourages regular consumption, contributing to the segment's prominence.

By Distribution Channel: Distribution channels for water enhancers include hypermarkets/supermarkets, online channels, pharmacies, convenience stores, and others. Hypermarkets and supermarkets lead the market share, offering consumers the advantage of a wide selection and the convenience of one-stop shopping. Their extensive reach and ability to stock various brands and flavors make them a preferred choice for purchasing water enhancers.

Asia Pacific Water Enhancer Market Competitive Landscape

The Asia Pacific water enhancer market is characterized by the presence of both global and regional players, leading to a competitive environment. Companies are focusing on product innovation, flavor diversification, and strategic partnerships to strengthen their market position. The introduction of natural and organic ingredients is a notable trend among key players.

Asia Pacific Water Enhancer Industry Analysis

Growth Drivers

- Health Consciousness and Demand for Low-Calorie Beverages: The global shift towards healthier lifestyles has significantly influenced beverage consumption patterns. In 2023, the World Health Organization reported that non-communicable diseases, often linked to dietary habits, accounted for 41 million deaths annually. This alarming statistic has prompted consumers to seek low-calorie beverage options to mitigate health risks. For instance, the U.S. Department of Agriculture noted a 15% increase in the consumption of low-calorie drinks in 2022, reflecting a growing preference for healthier alternatives.

- Rise in Consumption of Functional Beverages: Functional beverages, designed to offer health benefits beyond basic nutrition, have seen a surge in popularity. The International Food Information Council's 2023 survey revealed that 60% of consumers are interested in beverages that provide additional health benefits, such as enhanced immunity or improved digestion. This interest is reflected in market data; for example, the U.S. Food and Drug Administration reported a 20% increase in the approval of functional beverage products in 2022, indicating a robust pipeline of new offerings to meet consumer demand.

- Growth of Online Retail Channels: The expansion of e-commerce has transformed beverage distribution. According to the United Nations Conference on Trade and Development, global e-commerce sales reached $26.7 trillion in 2022, with a significant portion attributed to food and beverage products. In the same year, the U.S. Census Bureau reported that online beverage sales increased by 30%, highlighting the growing consumer preference for purchasing beverages through digital platforms.

Market Challenges

- High Competition from Substitutes: The beverage industry faces intense competition from alternative products. For example, the U.S. Department of Agriculture reported a 5% decline in carbonated soft drink consumption in 2022, as consumers shifted towards bottled water and flavored seltzers. Similarly, the European Food Safety Authority observed a 7% increase in tea and coffee consumption in 2023, indicating a preference for these beverages over traditional sodas. This competitive landscape requires beverage companies to innovate continually to maintain market share.

- Limited Consumer Awareness in Developing Areas: In developing regions, consumer awareness about diverse beverage options remains limited. The World Bank's 2022 report highlighted that 40% of the population in low-income countries lacks access to information about fortified or functional beverages. Additionally, the United Nations Educational, Scientific and Cultural Organization noted that literacy rates in these areas are below 70%, hindering effective marketing communication. This lack of awareness poses a challenge for beverage companies aiming to penetrate these markets.

Asia Pacific Water Enhancer Market Future Outlook

Over the next five years, the Asia Pacific water enhancer market is expected to experience significant growth, driven by continuous product innovation, increasing consumer health awareness, and the expansion of distribution channels. The incorporation of functional ingredients and the development of personalized nutrition products are anticipated to further propel market expansion.

Market Opportunities

- Product Innovation in Flavor and Ingredients: Innovating with new flavors and ingredients presents a significant growth opportunity. The U.S. Department of Agriculture reported a 10% increase in consumer interest in exotic fruit flavors in 2023. Additionally, the Food and Agriculture Organization noted a 15% rise in the use of plant-based ingredients in beverage formulations in 2022, catering to the growing vegan and vegetarian populations. By developing unique and health-oriented products, companies can attract a broader consumer base and differentiate themselves in a crowded market.

- Expansion into Rural and Semi-urban Markets: Rural and semi-urban areas offer untapped potential for beverage companies. The World Bank's 2023 data indicates that 45% of the global population resides in rural areas, with increasing disposable incomes. The International Labour Organization reported a 5% rise in employment rates in these regions in 2022, leading to higher spending power. By tailoring distribution strategies and product offerings to meet the preferences of these consumers, companies can expand their market reach and drive sales growth.

Scope of the Report

|

Product Type |

Flavored Water Enhancers |

|

Form |

Liquid |

|

Ingredient Type |

Vitamins and Minerals |

|

Distribution Channel |

Supermarkets/Hypermarkets |

|

Country |

China |

Products

Key Target Audience

Beverage Manufacturers

Health and Wellness Product Companies

Retail Chains and Supermarkets

Online Retailers

Ingredient Suppliers

Packaging Companies

Investment and Venture Capital Firms

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India)

Companies

Players Mentioned in the Report

The Coca-Cola Company

PepsiCo, Inc.

Nestl S.A.

Keurig Dr Pepper Inc.

Britvic PLC

Arizona Beverages

Dyla LLC (Stur)

Heartland Food Products Group

Wisdom Natural Brands

The Jel Sert Company

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Health Consciousness and Demand for Low-Calorie Beverages

3.1.2 Rise in Consumption of Functional Beverages

3.1.3 Growth of Online Retail Channels

3.1.4 Increasing Urbanization and Lifestyle Changes

3.2 Market Challenges

3.2.1 High Competition from Substitutes

3.2.2 Limited Consumer Awareness in Developing Areas

3.2.3 Regulatory Challenges

3.3 Opportunities

3.3.1 Product Innovation in Flavor and Ingredients

3.3.2 Expansion into Rural and Semi-urban Markets

3.3.3 Strategic Alliances and Partnerships

3.4 Trends

3.4.1 Demand for Natural and Organic Ingredients

3.4.2 Growth of Sustainable Packaging

3.4.3 Personalized Beverage Solutions

3.5 Government Regulations

3.5.1 Food Safety Standards

3.5.2 Labeling Requirements

3.5.3 Import/Export Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Flavored Water Enhancers

4.1.2 Energy and Sports Drink Enhancers

4.1.3 Health and Wellness Enhancers

4.1.4 Functional/Targeted Nutrient Enhancers

4.2 By Form (In Value %)

4.2.1 Liquid

4.2.2 Powder

4.3 By Ingredient Type (In Value %)

4.3.1 Vitamins and Minerals

4.3.2 Electrolytes

4.3.3 Antioxidants

4.3.4 Sweeteners

4.3.5 Other Functional Additives

4.4 By Distribution Channel (In Value %)

4.4.1 Supermarkets/Hypermarkets

4.4.2 Convenience Stores

4.4.3 Pharmacies/Drug Stores

4.4.4 Online Retail

4.4.5 Specialty Stores

4.5 By Country (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 Rest of Asia Pacific

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 The Coca-Cola Company

5.1.2 PepsiCo, Inc.

5.1.3 Nestl S.A.

5.1.4 Keurig Dr Pepper Inc.

5.1.5 Britvic PLC

5.1.6 Arizona Beverages

5.1.7 Dyla LLC (Stur)

5.1.8 Heartland Food Products Group

5.1.9 Wisdom Natural Brands

5.1.10 The Jel Sert Company

5.1.11 4C Foods Corp.

5.1.12 Mondelez International Inc.

5.1.13 Refresco

5.1.14 FLAVR Group

5.1.15 Pure Leaf

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Regional Presence, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Regulatory Framework

6.1 Food and Beverage Safety Regulations

6.2 Advertising and Labeling Standards

6.3 Import/Export Regulations

7. Future Market Size (In USD Million)

7.1 Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Form (In Value %)

8.3 By Ingredient Type (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Country (In Value %)

9. Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Water Enhancer Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Water Enhancer Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple water enhancer manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Water Enhancer market.

Frequently Asked Questions

01. How big is the Asia Pacific Water Enhancer Market?

The Asia Pacific Water Enhancer market is valued at USD 252 million, based on a five-year historical analysis. This market is primarily driven by a rising trend towards health-conscious consumption and a shift from sugary drinks to low-calorie hydration options.

02. What are the challenges in the Asia Pacific Water Enhancer Market?

Challenges include high competition from alternative beverages, regulatory compliance, and the need to increase consumer awareness in certain emerging markets. These obstacles impact product penetration, especially among price-sensitive customers.

03. Who are the major players in the Asia Pacific Water Enhancer Market?

Key players in the market include The Coca-Cola Company, PepsiCo Inc., Nestl S.A., Keurig Dr Pepper Inc., and Britvic PLC. These companies leverage strong brand recognition and distribution networks to maintain their competitive edge.

04. What are the growth drivers of the Asia Pacific Water Enhancer Market?

The market is propelled by rising health awareness, urbanization, and innovations in product flavors and ingredients. The demand for natural, organic, and functional additives such as vitamins and electrolytes is also a significant driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.