Asia Pacific Water Treatment Chemicals Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD7095

November 2024

95

About the Report

Asia Pacific Water Treatment Chemicals Market Overview

- The Asia Pacific Water Treatment Chemicals market is valued at USD 6.4 billion based on a five-year historical analysis. This market is driven by growing urbanization, industrialization, and the increasing demand for clean water across industrial and municipal sectors. Governments across the region are prioritizing the development of water treatment facilities to cope with rising water demand and pollution.

- Countries like China, India, and Japan dominate the Asia Pacific Water Treatment Chemicals market. China's large industrial base, coupled with rapid urbanization, makes it the leading country in terms of demand for these chemicals. India follows closely due to its growing infrastructure and increasing focus on municipal water treatment.

- Governments in Asia Pacific have implemented Clean Water Acts to safeguard water quality and public health. In 2023, India strengthened its Clean Water Act, mandating stricter discharge limits for industrial effluents, which has increased the demand for advanced water treatment chemicals. Similarly, Vietnams revised National Water Protection Law has intensified enforcement against non-compliance, further boosting the market for water treatment agents such as coagulants, flocculants, and disinfectants.

Asia Pacific Water Treatment Chemicals Market Segmentation

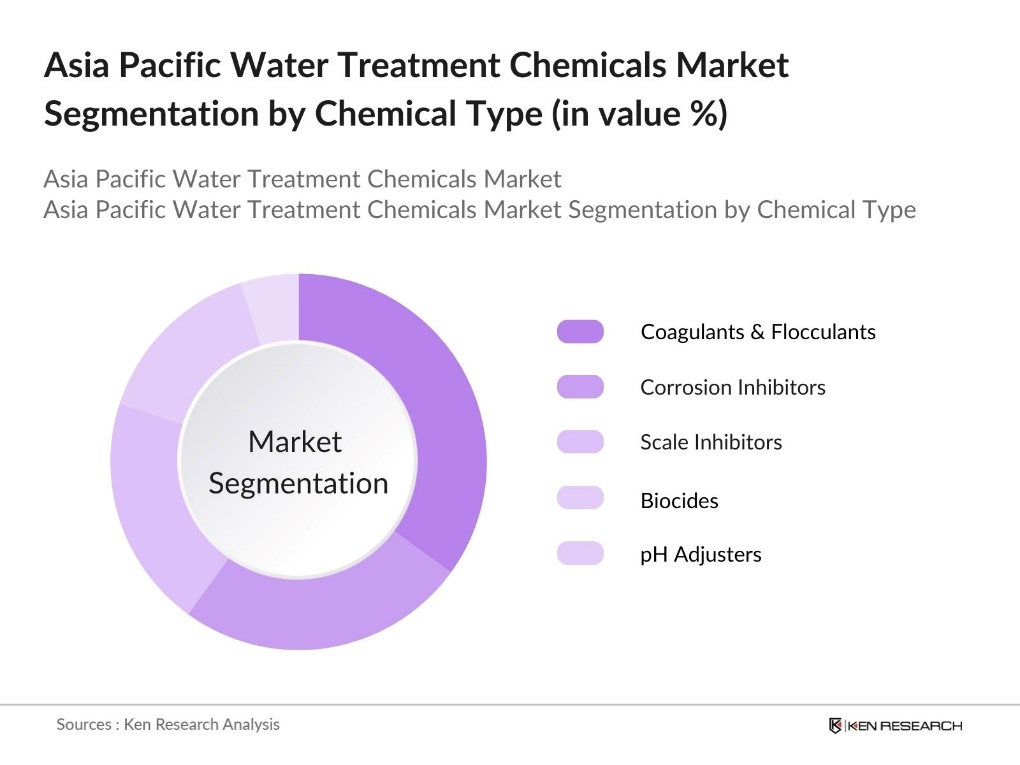

By Chemical Type: The market is segmented by chemical type into coagulants & flocculants, corrosion inhibitors, scale inhibitors, biocides, and pH adjusters. Recently, coagulants and flocculants have a dominant market share in the Asia Pacific under the segmentation by chemical type. This is largely due to their widespread use in wastewater treatment, where they help in the removal of suspended solids from water. The extensive industrial activity in the region, especially in manufacturing and processing, further boosts the demand for these chemicals, driving their market dominance.

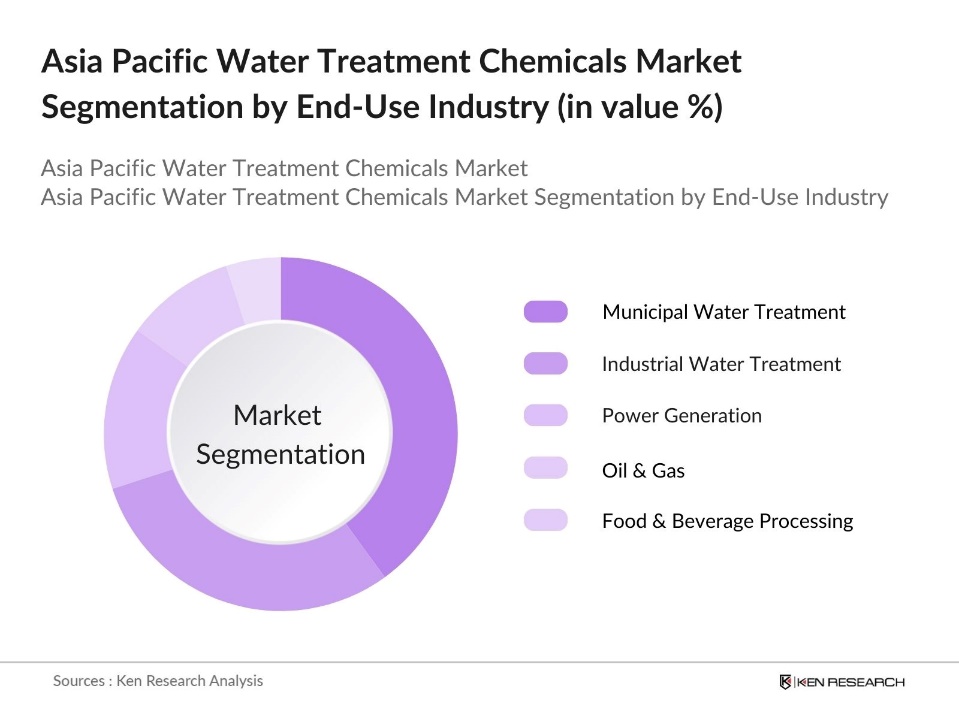

By End-Use Industry: The market is segmented by end-use industry into municipal water treatment, industrial water treatment, power generation, oil & gas, and food & beverage processing. The municipal water treatment segment has emerged as the leading end-use industry due to increasing investments by governments to improve water infrastructure. Rising urban populations and the need to provide clean water for public consumption have driven the growth of this segment. Industrial water treatment is also witnessing significant growth, fueled by stringent environmental regulations and the need for industries to treat their effluents before discharge.

Asia Pacific Water Treatment Chemicals Market Competitive Landscape

The Asia Pacific Water Treatment Chemicals market is dominated by major global companies like Ecolab and Kemira, along with regional players such as Kurita Water Industries. The consolidation within the industry highlights the significant influence these key players exert on the market, driving innovations and product developments. Several companies have also expanded their product portfolios by integrating eco-friendly and technologically advanced solutions in response to increasing environmental concerns.

Asia Pacific Water Treatment Chemicals Industry Analysis

Growth Drivers

- Industrial Water Usage (Industrial sector water consumption): In the Asia Pacific region, industrial water consumption is a critical driver for water treatment chemicals. Countries like China and India are among the highest industrial water users globally, by 2030, projections indicate that China's water demand could surpass 800 billion cubic meters. Water-intensive industries such as textiles, food processing, and chemicals contribute significantly to the demand for treatment chemicals, given the large volumes of wastewater they generate.

- Urbanization and Infrastructure Development (Urban water systems): Urbanization in Asia Pacific is growing at an unprecedented rate, with over 2.3 billion people residing in urban areas as of 2024. This rapid growth drives significant expansion of water treatment infrastructure, particularly in cities across China, India, and Indonesia. The chemicals used in these treatment systems are crucial for maintaining water quality, contributing to the market's growth as cities seek to meet rising demand for potable water and sanitation.

- Technological Advancements in Water Treatment (Innovations in chemical treatment): Technological advancements in Asia Pacifics water treatment sector are enhancing efficiency and sustainability. Innovations like nanotechnology-enhanced coagulants and biodegradable chemicals are minimizing environmental impacts, while advanced oxidation processes (AOP) offer chemical-free disinfection methods. These advancements are driving demand for modern, eco-friendly water treatment chemicals in industrial and municipal applications, improving water quality and meeting stricter regulatory requirements.

Market Challenges

- High Operational Costs (Raw material cost fluctuations): Fluctuations in raw material costs pose a significant challenge for the water treatment chemicals market in Asia Pacific. The region's reliance on imports of specialty chemicals, particularly from key global suppliers, has resulted in price volatility. This affects the overall operational expenses of water treatment facilities. Companies are forced to optimize the usage of chemicals or seek alternative treatment technologies to mitigate the financial impact of rising costs.

- Water Scarcity (Limited availability of freshwater resources): Water scarcity is a pressing issue across Asia Pacific, with several countries facing a shortage of freshwater resources. This scarcity increases the need for effective water treatment chemicals, particularly for recycling wastewater in industrial and municipal sectors. Limited freshwater availability places pressure on water supply systems and necessitates advanced treatment methods to ensure efficient reuse of available water, highlighting the growing importance of water conservation efforts in the region.

Asia Pacific Water Treatment Chemicals Market Future Outlook

Over the next few years, the Asia Pacific Water Treatment Chemicals market is expected to experience continuous growth. Factors driving this growth include increasing government regulations, rapid urbanization, and the need to address water pollution challenges. Additionally, the rising industrial demand for effective wastewater treatment solutions, particularly in countries like China and India, is likely to contribute to the market's growth trajectory.

Market Opportunities

- Expansion of Municipal Water Treatment Systems (Government investments in water infrastructure): Government investments in municipal water treatment infrastructure are providing significant growth opportunities for the water treatment chemicals market. Many countries in Asia Pacific are prioritizing the improvement and expansion of their water treatment facilities to meet increasing demand for clean water. These investments are boosting the demand for essential water treatment chemicals like coagulants and flocculants, which are crucial for maintaining water quality in rapidly urbanizing regions.

- Emerging Market Demand (Increased need for wastewater recycling): The growing emphasis on wastewater recycling across industries and municipalities in Asia Pacific is driving demand for water treatment chemicals. As water shortages and environmental regulations become more prominent, industries are increasingly adopting wastewater recycling to conserve resources. This has led to a greater need for chemicals such as flocculants and disinfectants, which are essential for treating wastewater and ensuring its safe reuse, aligning with sustainability goals in the region.

Scope of the Report

|

Chemical Type |

Coagulants & Flocculants Corrosion Inhibitors Scale Inhibitors Biocides pH Adjusters |

|

End-Use Industry |

Municipal Water Treatment Industrial Water Treatment Power Generation Oil & Gas Food & Beverage Processing |

|

Application |

Wastewater Treatment Raw Water Treatment Cooling Water Treatment Boiler Water Treatment |

|

Region |

China India Japan South Korea Southeast Asia |

|

Source of Supply |

Domestic Producers International Importers |

Products

Key Target Audience

Municipal Water Utilities

Industrial Manufacturers (Chemical, Petrochemical, Food & Beverage)

Power Generation Companies

Oil & Gas Companies

Government and Regulatory Bodies (EPA, China Ministry of Environmental Protection)

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Ecolab

Kemira

BASF

Dow Chemical Company

SUEZ Water Technologies

Solenis

Lonza Group

Kurita Water Industries

SNF Group

Veolia Water

Table of Contents

1. Asia Pacific Water Treatment Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Water Treatment Chemicals Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Water Treatment Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Water Usage (Industrial sector water consumption)

3.1.2. Urbanization and Infrastructure Development (Urban water systems)

3.1.3. Environmental Regulations (Government pollution controls)

3.1.4. Technological Advancements in Water Treatment (Innovations in chemical treatment)

3.2. Market Challenges

3.2.1. High Operational Costs (Raw material cost fluctuations)

3.2.2. Water Scarcity (Limited availability of freshwater resources)

3.2.3. Lack of Skilled Workforce (Technical expertise in chemical treatment)

3.3. Opportunities

3.3.1. Expansion of Municipal Water Treatment Systems (Government investments in water infrastructure)

3.3.2. Emerging Market Demand (Increased need for wastewater recycling)

3.3.3. Smart Water Solutions (Integration of digital monitoring and control)

3.4. Trends

3.4.1. Shift Toward Green Chemicals (Environmentally sustainable treatment agents)

3.4.2. Increased Use of Biocides (Enhanced pathogen control in treatment processes)

3.4.3. Rise in Customized Treatment Solutions (Tailored chemical formulations)

3.5. Government Regulations

3.5.1. Clean Water Acts (Local water quality regulations)

3.5.2. Environmental Protection Protocols (Discharge control standards)

3.5.3. Public-Private Partnerships (Infrastructure development collaborations)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats in the Asia Pacific region)

3.7. Stakeholder Ecosystem (Key participants in the value chain, including suppliers and end-users)

3.8. Porters Five Forces Analysis (Analysis of competitive forces affecting the market)

3.9. Competition Ecosystem (Overview of key competitors and market position)

4. Asia Pacific Water Treatment Chemicals Market Segmentation

4.1. By Chemical Type (In Value %)

4.1.1. Coagulants & Flocculants

4.1.2. Corrosion Inhibitors

4.1.3. Scale Inhibitors

4.1.4. Biocides

4.1.5. pH Adjusters

4.2. By End-Use Industry (In Value %)

4.2.1. Municipal Water Treatment

4.2.2. Industrial Water Treatment

4.2.3. Power Generation

4.2.4. Oil & Gas

4.2.5. Food & Beverage Processing

4.3. By Application (In Value %)

4.3.1. Wastewater Treatment

4.3.2. Raw Water Treatment

4.3.3. Cooling Water Treatment

4.3.4. Boiler Water Treatment

4.4. By Region (In Value %)

4.4.1. China

4.4.2. India

4.4.3. Japan

4.4.4. South Korea

4.4.5. Southeast Asia

4.5. By Source of Supply (In Value %)

4.5.1. Domestic Producers

4.5.2. International Importers

5. Asia Pacific Water Treatment Chemicals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Ecolab

5.1.2. Kemira

5.1.3. BASF

5.1.4. SUEZ Water Technologies

5.1.5. Dow Chemical Company

5.1.6. Solenis

5.1.7. Lonza Group

5.1.8. Kurita Water Industries

5.1.9. SNF Group

5.1.10. Veolia Water

5.1.11. Thermax Ltd.

5.1.12. Italmatch Chemicals

5.1.13. Akzo Nobel

5.1.14. ICL Group

5.1.15. Buckman Laboratories

5.2 Cross Comparison Parameters (Revenue, Headquarters, No. of Empoyees, Product Portfolio, Market Share, Strategic Initiatives, Mergers & Acquisitions, Sustainability Focus)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Joint ventures, partnerships, R&D investments)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Market trends in investment by private equity and institutional investors)

5.7 Venture Capital Funding (Key players and trends in water treatment chemicals sector)

5.8 Government Grants (Subsidies for water treatment innovations)

5.9 Private Equity Investments (Notable acquisitions and investments in the sector)

6. Asia Pacific Water Treatment Chemicals Market Regulatory Framework

6.1 Environmental Standards (Specific standards in water treatment for each country)

6.2 Compliance Requirements (Mandates from environmental agencies)

6.3 Certification Processes (Required certifications for chemicals and treatment processes)

7. Asia Pacific Water Treatment Chemicals Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Infrastructure development, regulatory drivers, industry-specific needs)

8. Asia Pacific Water Treatment Chemicals Future Market Segmentation

8.1. By Chemical Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Application (In Value %)

8.4. By Region (In Value %)

8.5. By Source of Supply (In Value %)

9. Asia Pacific Water Treatment Chemicals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with the identification of key variables in the Asia Pacific Water Treatment Chemicals market. These variables include factors such as market drivers, growth constraints, technological advancements, and regulatory frameworks. Data is gathered using both secondary and proprietary sources to map out the market landscape.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical market data is conducted to identify market trends and shifts. This phase also involves assessing the adoption of water treatment chemicals across different sectors, evaluating the penetration rates, and studying the market's competitive landscape. The goal is to construct a reliable market model that reflects past and present market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts. These interviews provide insights from professionals across the water treatment chemicals industry, including key companies, regulatory bodies, and end-users. The feedback is crucial for ensuring the accuracy and reliability of market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data and presenting it in a structured and comprehensive report. The output includes validated data, market insights, competitive analysis, and future outlooks to provide a complete overview of the Asia Pacific Water Treatment Chemicals market.

Frequently Asked Questions

01. How big is the Asia Pacific Water Treatment Chemicals Market?

The Asia Pacific Water Treatment Chemicals market is valued at USD 6.4 billion, driven by increased demand for wastewater treatment in both industrial and municipal sectors.

02. What are the challenges in the Asia Pacific Water Treatment Chemicals Market?

Key challenges in Asia Pacific Water Treatment Chemicals market include fluctuating raw material costs and stringent environmental regulations that increase the operational costs for manufacturers.

03. Who are the major players in the Asia Pacific Water Treatment Chemicals Market?

Major players in Asia Pacific Water Treatment Chemicals market include Ecolab, Kemira, BASF, Dow Chemical Company, and SUEZ Water Technologies. These companies dominate due to their extensive distribution networks and investment in sustainable solutions.

04. What are the growth drivers of the Asia Pacific Water Treatment Chemicals Market?

The Asia Pacific Water Treatment Chemicals market is driven by rapid urbanization, increasing industrialization, and the growing need for water treatment solutions in emerging economies like China and India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.