Asia Pacific Welding Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD9052

December 2024

96

About the Report

Asia Pacific Welding Market Overview

- The Asia Pacific welding market is valued at USD 2 billion, driven primarily by strong growth in industries like automotive, aerospace, and construction. The demand for welding equipment and consumables is pushed by rapid industrialization across key countries such as China and India. The expansion of infrastructure projects and manufacturing facilities plays a crucial role in maintaining market momentum.

- China, Japan, and South Korea dominate the Asia Pacific welding market due to their robust manufacturing and industrial sectors. Chinas massive construction and automotive industries contribute to its leadership, while Japans advanced technological capabilities in automation and robotics strengthen its foothold. South Korea, known for its shipbuilding and electronics industries, is also a key player.

- Emerging economies like Vietnam, Indonesia, and India present significant opportunities for the welding market due to their growing industrial base. : In 2023, India's manufacturing sector contributed approximately 33.92 lakh crore (or about $408 billion) to its GDP. Vietnam and Indonesia also saw substantial foreign direct investment (FDI) inflows, bolstering their industrial capacities. These expanding economies create a fertile market for welding equipment and technologies, particularly in construction and automotive sectors.

Asia Pacific Welding Market Segmentation

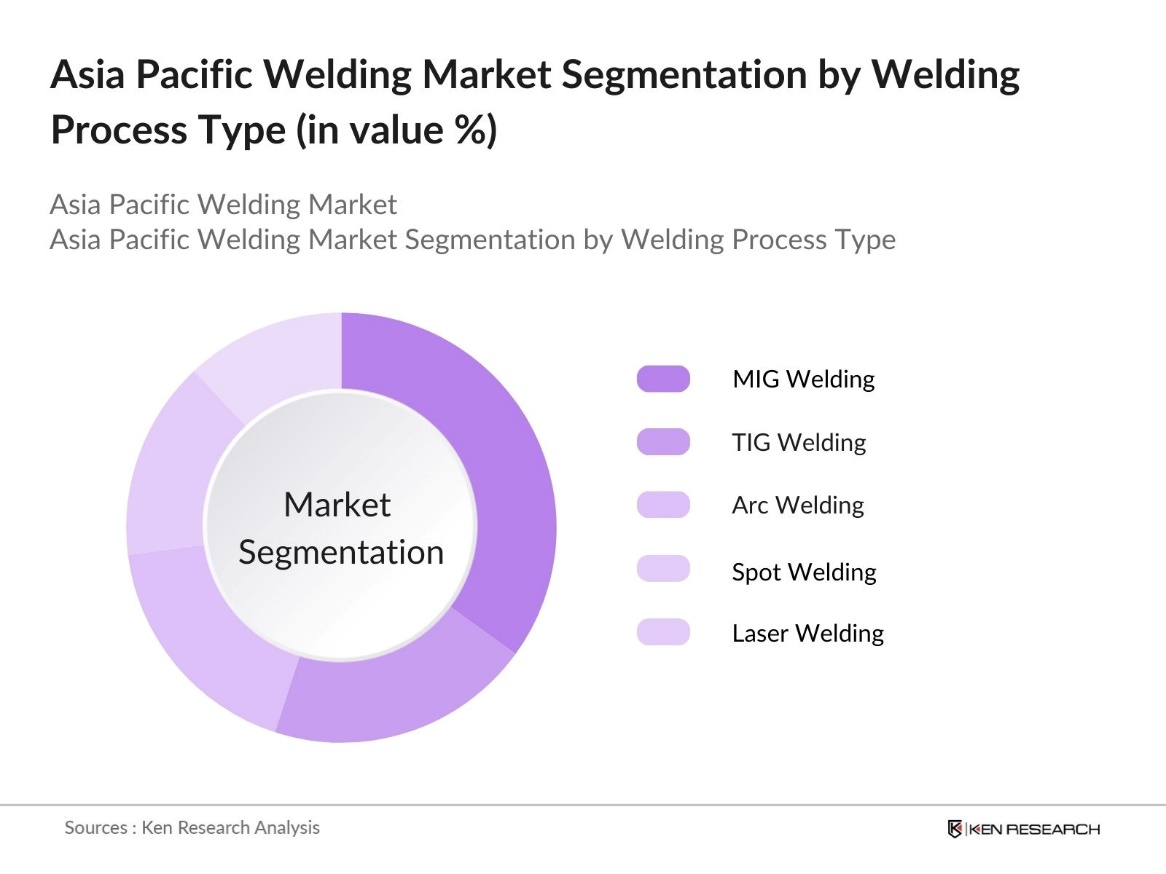

By Welding Process Type: The market is segmented by process type into MIG (Metal Inert Gas) welding, TIG (Tungsten Inert Gas) welding, arc welding, spot welding, and laser welding. MIG welding holds a dominant market share under the welding process segmentation due to its high efficiency and wide range of applications. This process is particularly favored in the automotive and construction industries for its ability to weld various materials like steel and aluminum, ensuring high-quality joints. Moreover, its ease of automation makes it ideal for large-scale manufacturing operations, contributing to its market dominance.

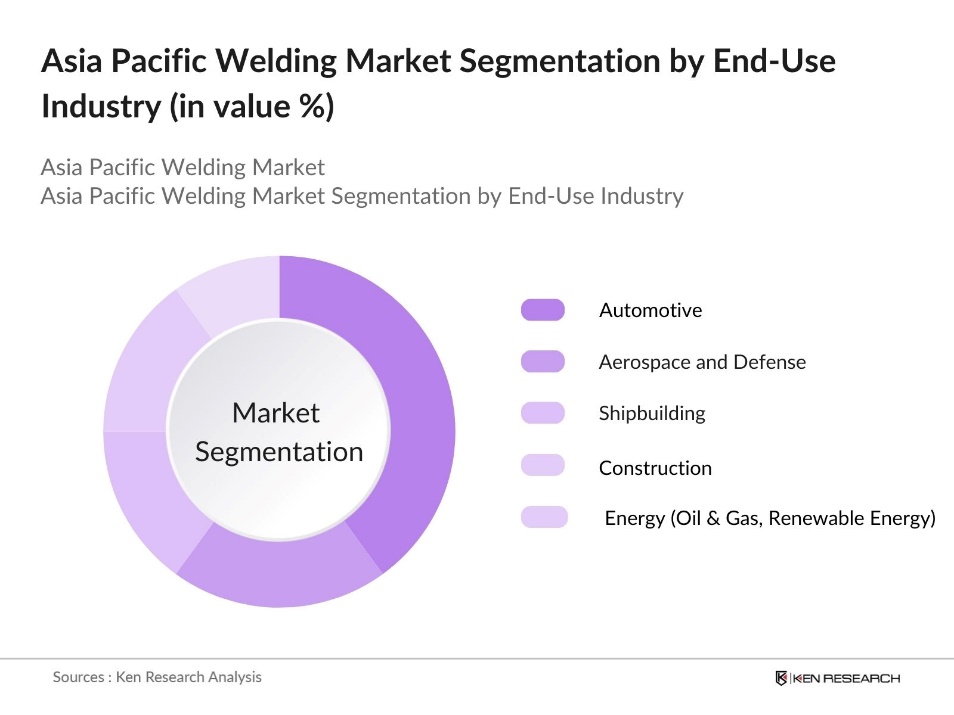

By End-Use Industry: The market is segmented by end-use industry, with automotive, aerospace and defense, shipbuilding, construction, and energy (oil & gas, renewable energy) being the primary segments. The automotive industry leads the market in this segmentation, supported by the region's massive vehicle production capacities. As governments push for more electric vehicles and sustainable transportation solutions, automotive manufacturers are heavily investing in new welding technologies that allow for the use of lighter materials such as aluminum, contributing to this segment's market share dominance.

Asia Pacific Welding Market Competitive Landscape

The Asia Pacific welding market is characterized by a mixture of global giants and local players. Companies such as Lincoln Electric and ESAB dominate, but there is significant competition from regional manufacturers who offer cost-effective and tailored solutions. The market is heavily consolidated, with the top players controlling a large portion of the market due to their strong distribution networks, advanced product portfolios, and high R&D investments in automation and sustainable technologies.

Asia Pacific Welding Industry Analysis

Growth Drivers

- Industrialization and Infrastructure Development: The Asia Pacific region is experiencing rapid industrialization, particularly in emerging economies like India, Vietnam, and Indonesia. For instance, Indias government has allocated $134 billion (11.11 lakh crore) in its 2024 infrastructure budget for developing roads, bridges, and industrial parks, driving demand for welding equipment across construction and manufacturing sectors. These industrialization efforts are creating a surge in demand for welding technologies to support large-scale construction and development projects.

- Growth of Automotive and Aerospace Industries: The Asia Pacific region is a hub for automotive manufacturing, with countries like Japan, China, and South Korea leading the sector. Japan produced 7.8 million vehicles in 2023, while China exceeded 25 million vehicles in the same year. These industries rely heavily on welding technologies for production processes, including the growing use of lightweight materials such as aluminum. Aerospace is also expanding, with China, driving substantial welding demand for fabrication and assembly processes.

- Rising Demand for Energy (Oil & Gas, Renewables): Energy demand in Asia Pacific is rapidly increasing, with China and India driving growth in both traditional and renewable sectors. The construction of essential infrastructure like oil pipelines, wind turbines, and solar farms is boosting the need for advanced welding technologies. This surge in renewable energy projects, particularly in wind and solar, is creating strong demand for specialized welding solutions to support the region's expanding energy needs.

Market Challenges

- High Equipment Costs (For Automation and Robotic Welding): The high cost of automation and robotic welding systems poses a significant challenge, particularly for smaller businesses. While these systems offer numerous benefits in terms of precision and efficiency, their high upfront costs make them less accessible to companies in developing regions. The financial burden of investing in these technologies can hinder the widespread adoption of automation in industries that are looking to modernize their manufacturing processes but face budgetary constraints.

- Shortage of Skilled Welders: A critical shortage of skilled welders is affecting the Asia Pacific region, as rapid industrial growth outpaces the availability of trained professionals. The shortage leads to operational inefficiencies and increased costs, as businesses struggle to fill welding positions and maintain production quality. Despite efforts by governments to implement training programs, the demand for skilled welders continues to exceed supply, particularly in countries experiencing fast-paced development.

Asia Pacific Welding Market Future Outlook

Over the next few years, the Asia Pacific welding market is poised for continued growth, driven by rapid industrialization and technological advancements. The automotive sector, in particular, will play a significant role as governments push for electric vehicles and lightweight manufacturing processes. Additionally, the construction and energy industries will remain critical as countries invest in large-scale infrastructure projects and renewable energy initiatives. As automation continues to gain traction, the demand for robotic welding solutions will rise, further transforming the industry landscape.

Market Opportunities

- Adoption of Welding Robots (Industries: Automotive, Aerospace): The use of welding robots is increasing, particularly in sectors like automotive and aerospace. These robots offer enhanced precision and efficiency, making them highly valuable for large-scale manufacturing processes. Industries that require high production volumes, such as car manufacturing and aircraft assembly, are increasingly adopting robotic welding systems. This trend is creating new opportunities for the welding market, especially in regions with established automotive and aerospace industries, where automation is becoming a key driver of productivity.

- Growing Focus on Sustainable Welding Technologies: There is a growing emphasis on adopting sustainable welding technologies in the Asia Pacific region. Techniques like friction stir welding (FSW) and laser welding are gaining popularity due to their ability to reduce energy consumption and emissions. These methods align with stricter environmental regulations, as they help industries meet sustainability goals. The shift toward more energy-efficient and environmentally friendly welding practices reflects the increasing importance of reducing the environmental impact of industrial operations across various sectors.

Scope of the Report

|

By Welding Process Type |

MIG Welding TIG Welding Arc Welding Spot Welding Laser Welding |

|

By Equipment Type |

Welding Machines Welding Consumables Welding Automation & Robotics PPE |

|

By Material Type |

Steel Aluminum Copper Plastics and Composites |

|

By End-Use Industry |

Automotive Aerospace and Defense Shipbuilding Construction Energy (Oil & Gas, Renewable Energy) |

|

By Region |

China Japan India South Korea Southeast Asia |

Products

Key Target Audience

Automotive Manufacturers

Shipbuilding Companies

Construction Firms

Welding Equipment Manufacturers

Government and Regulatory Bodies (Ministries of Industry, Energy Commissions)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Lincoln Electric

ESAB

Panasonic Welding Systems

Fronius International GmbH

Miller Electric Manufacturing

Voestalpine Bhler Welding

Kemppi Oy

Hyundai Welding Co., Ltd.

Denyo Co., Ltd.

Kobe Steel, Ltd. (Kobelco Welding)

Table of Contents

1. Asia Pacific Welding Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Welding Process Types, End-Use Industries, Material Types, Technologies, Region)

1.3. Market Growth Rate

1.4. Market Segmentation Overview (Welding Equipment, Consumables, Automation, Welding Services, Regions)

2. Asia Pacific Welding Market Size (In USD Mn)

2.1. Historical Market Size (By Process Types - MIG, TIG, Arc, Spot Welding, etc.)

2.2. Year-On-Year Growth Analysis (By End-Use Industries Automotive, Aerospace, Shipbuilding, Construction, Energy)

2.3. Key Market Developments and Milestones (Innovations in Welding Automation, Adoption of Green Welding Technologies)

3. Asia Pacific Welding Market Analysis

3.1. Growth Drivers

3.1.1. Industrialization and Infrastructure Development

3.1.2. Growth of Automotive and Aerospace Industries

3.1.3. Rising Demand for Energy (Oil & Gas, Renewables)

3.1.4. Technological Advancements in Welding Equipment

3.2. Market Challenges

3.2.1. High Equipment Costs (For Automation and Robotic Welding)

3.2.2. Shortage of Skilled Welders

3.2.3. Stringent Environmental Regulations (On Welding Fumes and Emissions)

3.2.4. Variability in Material Welding Capabilities

3.3. Opportunities

3.3.1. Adoption of Welding Robots (Industries: Automotive, Aerospace)

3.3.2. Growing Focus on Sustainable Welding Technologies

3.3.3. Expansion into Emerging Economies (Vietnam, Indonesia, India)

3.3.4. Government Infrastructure Investments (Japan, China, India)

3.4. Trends

3.4.1. Increasing Use of Laser Welding and Friction Stir Welding (FSW)

3.4.2. Integration of IoT and AI in Welding Equipment

3.4.3. Rising Demand for Lightweight Materials (Aluminum, Composites)

3.4.4. Shift Toward Energy-Efficient Welding Solutions

3.5. Government Regulation

3.5.1. Occupational Safety Regulations (Workplace Safety, Emission Standards)

3.5.2. Environmental Compliance (Welding Fumes, Green Welding Policies)

3.5.3. Import and Export Tariffs (On Welding Machinery and Materials)

3.5.4. Certification and Accreditation Standards (ISO, ASME)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Welding Equipment Manufacturers, Consumable Suppliers, Service Providers, End-User Industries)

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Threat of Substitutes, Threat of New Entrants, Competitive Rivalry)

3.9. Competition Ecosystem

4. Asia Pacific Welding Market Segmentation

4.1. By Welding Process Type (In Value %)

4.1.1. MIG (Metal Inert Gas) Welding

4.1.2. TIG (Tungsten Inert Gas) Welding

4.1.3. Arc Welding

4.1.4. Spot Welding

4.1.5. Laser Welding

4.2. By Equipment Type (In Value %)

4.2.1. Welding Machines

4.2.2. Welding Consumables (Electrodes, Wires, Flux)

4.2.3. Welding Automation & Robotics

4.2.4. Personal Protective Equipment (PPE)

4.3. By Material Type (In Value %)

4.3.1. Steel

4.3.2. Aluminum

4.3.3. Copper

4.3.4. Plastics and Composites

4.4. By End-Use Industry (In Value %)

4.4.1. Automotive

4.4.2. Aerospace and Defense

4.4.3. Shipbuilding

4.4.4. Construction

4.4.5. Energy (Oil & Gas, Renewable Energy)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Southeast Asia (Indonesia, Malaysia, Vietnam)

5. Asia Pacific Welding Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lincoln Electric

5.1.2. ESAB (A Colfax Company)

5.1.3. Panasonic Welding Systems

5.1.4. Fronius International GmbH

5.1.5. Miller Electric Manufacturing

5.1.6. Voestalpine Bhler Welding

5.1.7. Kemppi Oy

5.1.8. Hyundai Welding Co., Ltd.

5.1.9. Denyo Co., Ltd.

5.1.10. Kobe Steel, Ltd. (Kobelco Welding)

5.1.11. Hitachi High-Tech Corporation

5.1.12. Air Liquide Welding

5.1.13. Iwatani Corporation

5.1.14. Obara Group Inc.

5.1.15. DAIHEN Corporation

5.2. Cross Comparison Parameters (Revenue, Market Share, No. of Employees, Product Portfolio, Global Presence, R&D Investments, Certification Standards, Key Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Joint Ventures, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Capital Expenditure, Facility Expansions)

5.7. Venture Capital Funding (Startups in Welding Automation and Robotics)

5.8. Government Grants for Innovation and Sustainability

5.9. Private Equity Investments

6. Asia Pacific Welding Market Regulatory Framework

6.1. Safety and Emission Standards (OSHA, ISO, ANSI, ASME)

6.2. Compliance and Certification Processes (ISO 9001, ASME Section IX)

6.3. Import and Export Regulations (Welding Equipment and Materials)

7. Asia Pacific Welding Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Automation, Green Welding, Advanced Materials)

8. Asia Pacific Welding Market Future Market Segmentation

8.1. By Process Type (In Value %)

8.2. By Equipment Type (In Value %)

8.3. By Material Type (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Welding Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (End-Use Industry Segmentation)

9.3. Marketing Initiatives (Digital Marketing, Industry Events, White Papers)

9.4. White Space Opportunity Analysis (Emerging Markets, Niche Applications

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step in our research involved identifying key variables that drive the Asia Pacific welding market, including technological advancements, raw material availability, and industrial demand. Desk research was employed to create an initial framework based on credible sources, including government reports and proprietary databases.

Step 2: Market Analysis and Construction

We utilized historical data to construct an analytical model for market segmentation, revenue generation, and market penetration. The analysis covered welding equipment, consumables, and end-use industries such as automotive and construction, ensuring an accurate portrayal of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formed based on the gathered data, which were then validated through interviews with industry experts. These consultations provided valuable insights into operational and financial aspects of the market, helping refine our findings and revenue estimates.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from key manufacturers and industry players to cross-verify market trends and forecasts. This step ensured that the data derived from both top-down and bottom-up approaches were accurate and credible.

Frequently Asked Questions

01. How big is the Asia Pacific Welding Market?

The Asia Pacific welding market is valued at USD 2 billion, driven by strong industrialization and rising demand in automotive and construction sectors. The markets growth is underpinned by technological advancements and the adoption of automation in key industries.

02. What are the challenges in the Asia Pacific Welding Market?

Challenges in Asia Pacific welding market include high equipment costs, a shortage of skilled welders, and stringent environmental regulations regarding welding emissions. Additionally, market players must adapt to the rapid pace of technological changes, especially in automation.

03. Who are the major players in the Asia Pacific Welding Market?

Major players in Asia Pacific welding market include Lincoln Electric, ESAB, Panasonic Welding Systems, Fronius International, and Miller Electric. These companies dominate due to their advanced technologies, strong global presence, and extensive product portfolios.

04. What are the growth drivers of the Asia Pacific Welding Market?

Key drivers in Asia Pacific welding market include the rapid expansion of the automotive industry, rising infrastructure development projects, and the adoption of advanced welding technologies, such as robotic and laser welding. Government initiatives in renewable energy also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.