Asia Pacific Whipped Cream Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5973

December 2024

96

About the Report

Asia Pacific Whipped Cream Market Overview

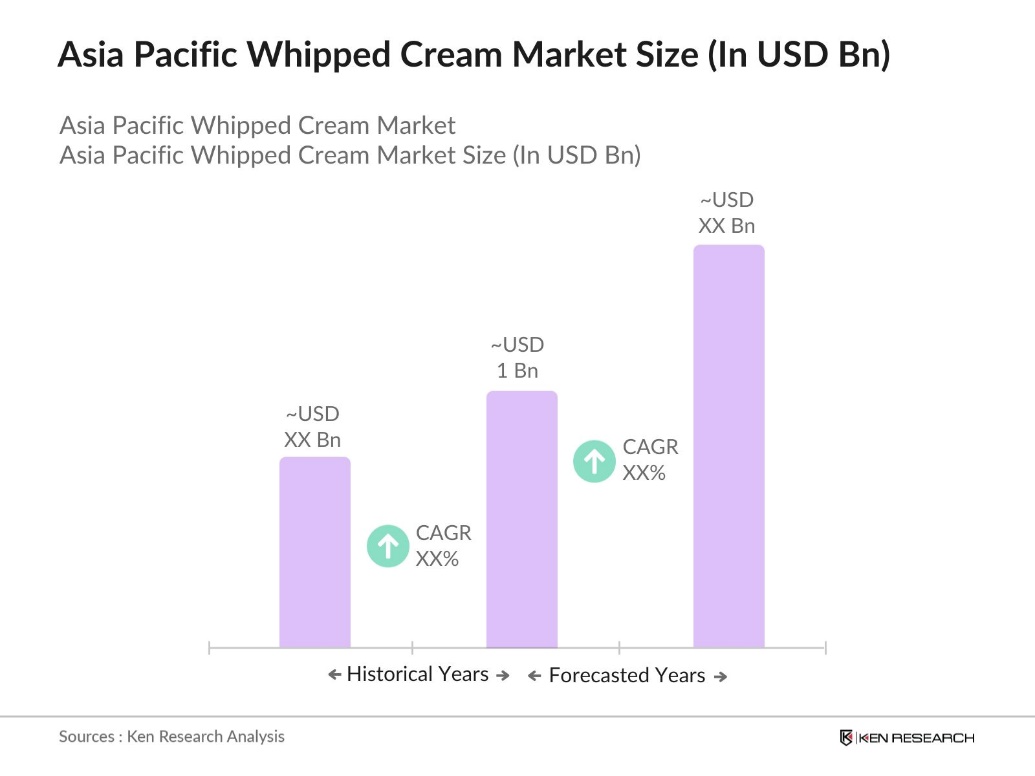

- The Asia Pacific Whipped Cream Market is valued at USD 1 billion, driven by a surge in demand across foodservice and bakery sectors, as well as increased consumer interest in ready-to-use dessert toppings. This growth is rooted in the diverse applications of whipped cream products in food preparation and decoration, especially within the retail and foodservice sectors.

- Dominant markets within this region include Japan, South Korea, and China, where whipped cream is extensively used in bakery and confectionery items. These countries have a robust foodservice industry, which has long embraced whipped cream as a core product for desserts, pastries, and drinks. Additionally, Japan and South Korea have seen rising consumer interest in vegan and plant-based whipped cream alternatives, further driving growth in these territories.

- Food safety standards are critical in the Asia Pacific whipped cream market, with agencies like Indias FSSAI enforcing strict dairy and plant-based product regulations in 2024. These standards ensure that manufacturers meet minimum safety and quality benchmarks, which has impacted the industrys operational protocols and slowed new product entries. Companies must comply with regulations for safe consumption, necessitating investments in quality control systems.

Asia Pacific Whipped Cream Market Segmentation

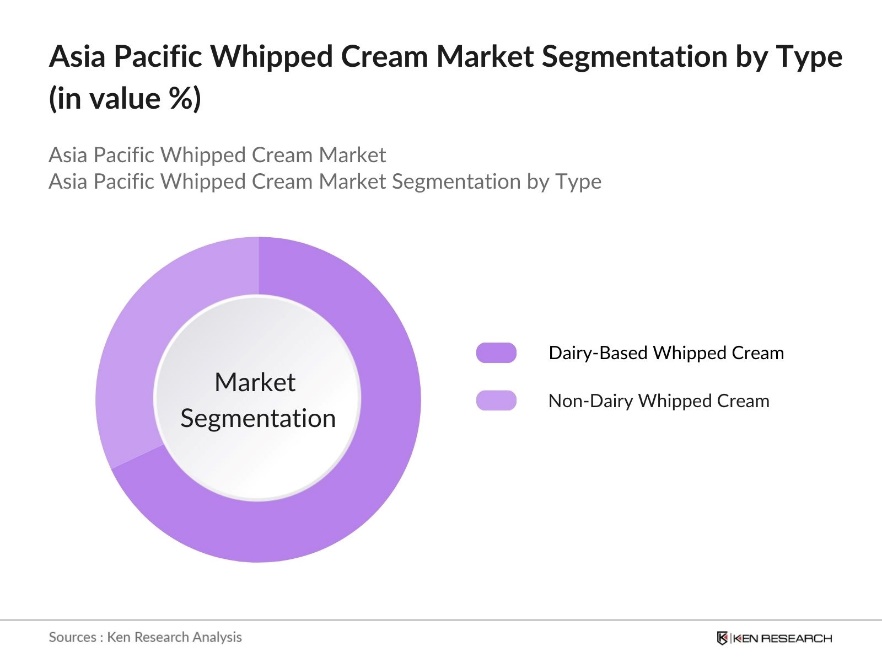

By Type: The market is segmented by type into dairy-based whipped cream and non-dairy whipped cream. Dairy-based whipped cream holds a dominant market share within this segmentation. Its extensive use in traditional recipes and beverages, coupled with a well-established dairy industry in the region, reinforces its popularity. This segment is particularly prevalent in countries like Australia and India, where dairy products enjoy strong cultural and culinary roots. The consistent demand for dairy-based whipped cream in retail and commercial kitchens underscores its leading market share.

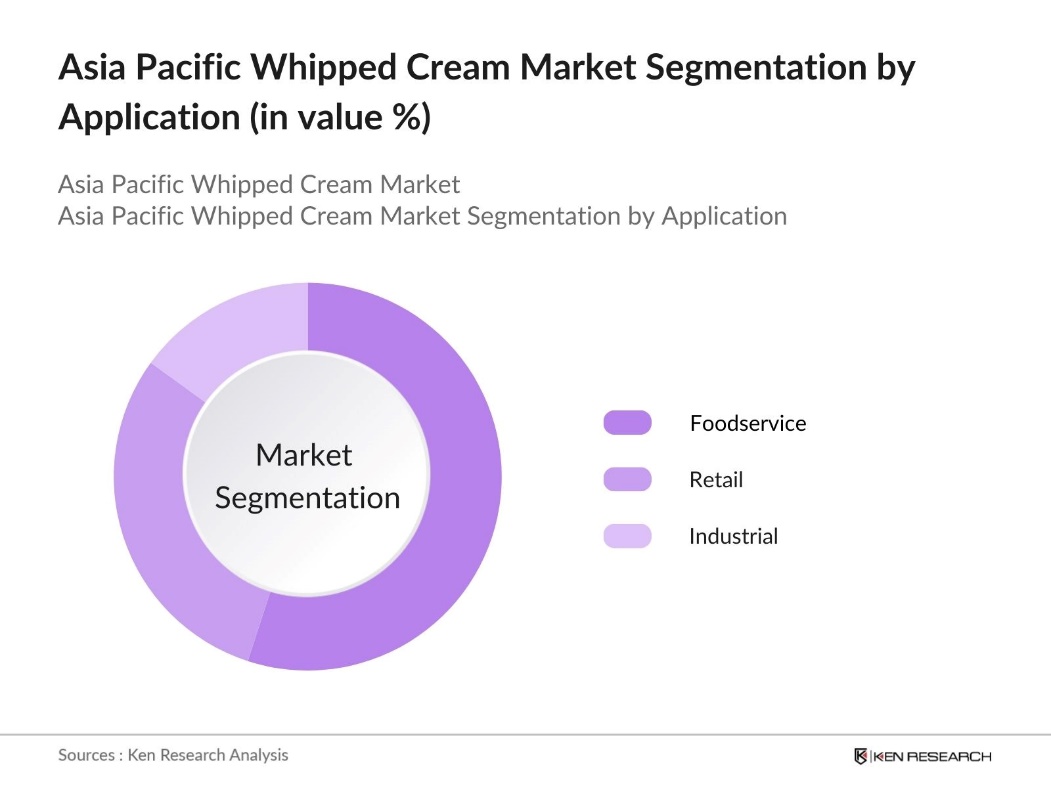

By Application: The market is segmented by application into foodservice (bakeries, cafs, restaurants), retail (household use, ready-to-eat products), and industrial (desserts, pastries, toppings). Foodservice dominates the market due to the high frequency of whipped cream use in commercial kitchens and bakeries. Establishments in countries like Japan and South Korea integrate whipped cream in various dessert and coffee offerings, driving its consistent demand. Retail is also significant, particularly with the rise in home baking trends, but foodservice remains at the forefront of this segmentation due to its scale and frequent usage.

Asia Pacific Whipped Cream Market Competitive Landscape

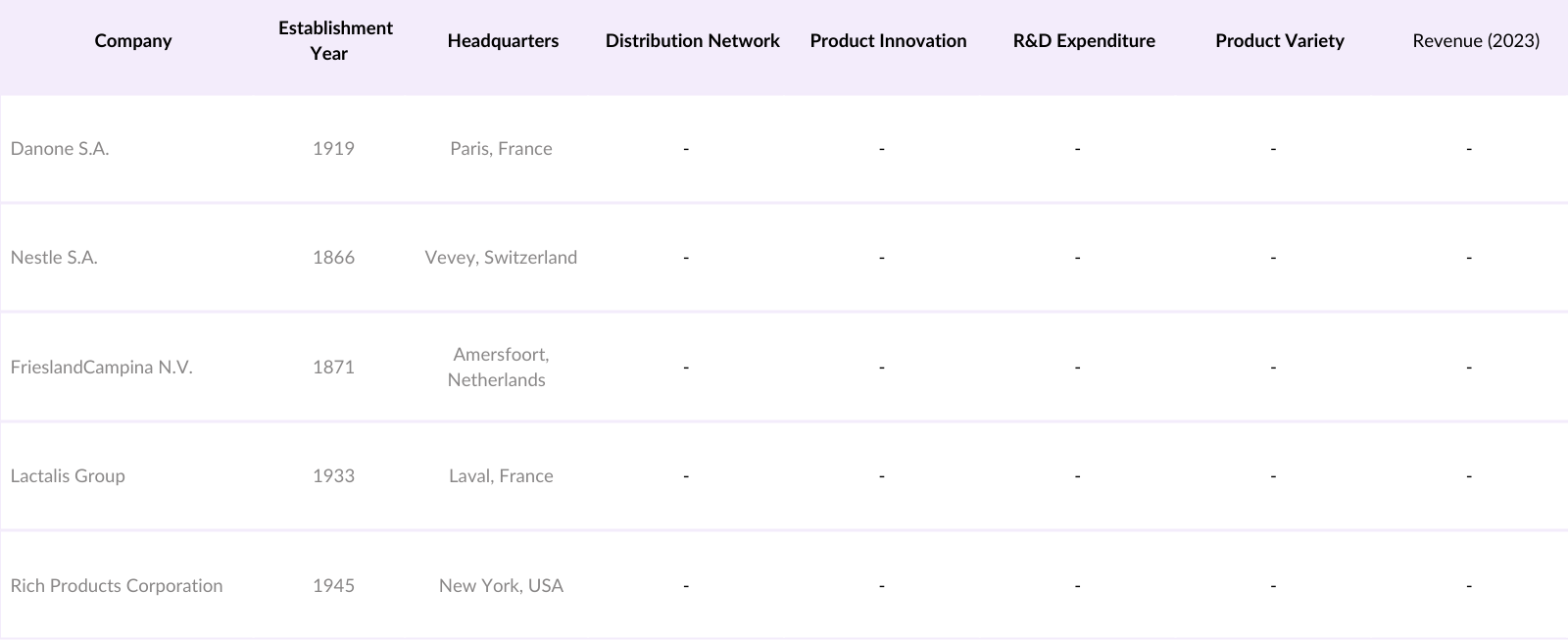

The Asia Pacific Whipped Cream Market is dominated by a select group of key players, whose influence is bolstered by extensive distribution networks, strong brand recognition, and ongoing product innovation. This consolidation highlights the central role of established companies in shaping market dynamics and responding to consumer demand for varied whipped cream offerings.

Asia Pacific Whipped Cream Industry Analysis

Growth Drivers

- Growing Demand for Convenient Dessert Toppings: The Asia Pacific market has seen an increase in demand for convenient dessert toppings like whipped cream, aligning with the region's growing quick-service restaurant (QSR) sector. Urban consumers, especially in countries like Japan and Singapore, increasingly prefer convenient ready-to-serve products, which includes whipped cream for home use and dessert customization. In Singapore, a notable trend is the shift towards healthier food options. Approximately 60% of Singaporeans are actively choosing healthier meals, with younger consumers particularly inclined toward nutritious dining options.

- Rise in Demand for Dairy Alternatives (Plant-Based Whipped Cream): In 2024, the Asia Pacific region sees increasing consumer interest in plant-based whipped cream, driven by a shift toward dairy-free and vegan options. According to recent studies by the Food and Agriculture Organization (FAO), plant-based food consumption in Asia Pacific has increased in 2023, with a noticeable rise in dairy alternative products. This trend is significant, especially in countries like China and Japan, where lactose intolerance is prevalent, thus driving demand for dairy-free whipped cream.

- Expanding E-Commerce Channels for Distribution: The rapid growth of e-commerce in Asia Pacific enhances whipped cream distribution, reaching a wider consumer base through online grocery platforms, especially in digitally advanced countries like China, South Korea, and Japan. This shift allows consumers in areas with limited retail access to conveniently purchase whipped cream, supporting market expansion and offering diverse product options directly to their doorsteps.

Market Challenges

- Volatile Raw Material Prices (Dairy and Non-Dairy Ingredients): Fluctuating prices of dairy and plant-based ingredients present a significant challenge to the Asia Pacific whipped cream market. Price volatility impacts production costs, especially in regions where dairy supply is seasonal. Similarly, demand for non-dairy ingredients, such as coconut and almond milk, often exceeds supply, adding further instability and affecting product affordability for both manufacturers and consumers.

- Regulatory Standards for Food Safety and Quality: Strict food safety and quality regulations in Asia Pacific impact the whipped cream market, requiring producers to meet rigorous standards for both dairy and non-dairy products. These regulatory demands can slow the introduction of new products, particularly plant-based options, as manufacturers must comply with detailed safety protocols. This regulatory environment often limits operational flexibility and increases production costs.

Asia Pacific Whipped Cream Market Future Outlook

The Asia Pacific Whipped Cream Market is expected to experience steady growth over the next five years, propelled by evolving consumer preferences, increased adoption of vegan and non-dairy products, and innovations in packaging. Rising demand for convenience foods and a preference for aesthetically pleasing desserts and beverages will further stimulate growth in the regions whipped cream market.

Market Opportunities

- Innovations in Low-Fat and Sugar-Free Variants: As health-conscious consumers increasingly seek lighter, healthier products, manufacturers in Asia Pacific are responding with low-fat and sugar-free whipped cream options. These innovations align with regional health trends and dietary preferences, catering to urban populations that prioritize reduced sugar and lower-fat alternatives. Such offerings tap into a growing market segment that values both taste and health benefits.

- Expansion of Plant-Based and Organic Whipped Cream Lines: The Asia Pacific market shows strong potential for plant-based and organic whipped cream, with increasing consumer interest in natural and environmentally friendly options. Supported by regional initiatives promoting organic practices, and rising interest in plant-based foods, these products attract consumers looking for ethical and healthier choices. Brands investing in plant-based and organic lines can benefit from this evolving demand.

Scope of the Report

|

Type |

Dairy-Based Whipped Cream Non-Dairy Whipped Cream (Soy, Coconut, Almond) |

|

Application |

Foodservice (Bakeries, Cafs, Restaurants) Retail (Household Use, Ready-to-Eat Products) Industrial (Desserts, Pastries, Toppings) |

|

Distribution Channel |

Supermarkets/Hypermarkets Online Stores Specialty Food Stores Convenience Stores |

|

Flavor |

Plain Flavored (Vanilla, Chocolate, Strawberry) |

|

Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience

Whipped Cream Manufacturers

Dairy and Non-Dairy Industry

Foodservice Industry

Bakeries and Confectioneries Industry

Government and Regulatory Bodies (FSSAI, FDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Danone S.A.

Nestle S.A.

FrieslandCampina N.V.

Lactalis Group

Rich Products Corporation

Arla Foods

Dean Foods

Fonterra Co-operative Group

Hanan Products Co., Inc.

Glenisk Ltd.

Table of Contents

1. Asia Pacific Whipped Cream Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. Asia Pacific Whipped Cream Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Developments and Milestones

3. Asia Pacific Whipped Cream Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Demand for Dairy Alternatives (Plant-Based Whipped Cream)

3.1.2 Increasing Adoption in Foodservice and Bakery Industries

3.1.3 Growing Demand for Convenient Dessert Toppings

3.1.4 Expanding E-Commerce Channels for Distribution

3.2 Market Challenges

3.2.1 Volatile Raw Material Prices (Dairy and Non-Dairy Ingredients)

3.2.2 Regulatory Standards for Food Safety and Quality

3.2.3 Limited Cold Chain Infrastructure in Developing Markets

3.3 Opportunities

3.3.1 Innovations in Low-Fat and Sugar-Free Variants

3.3.2 Expansion of Plant-Based and Organic Whipped Cream Lines

3.3.3 Development of Ready-to-Serve Packaging Solutions

3.4 Trends

3.4.1 Increasing Preference for Vegan and Dairy-Free Whipped Cream

3.4.2 Growth in Premium and Specialty Cream Products

3.4.3 Technological Advancements in Production Techniques

3.5 Regulatory Landscape

3.5.1 Food and Safety Standards (FDA, FSSAI)

3.5.2 Labeling Requirements (Nutritional and Allergen Information)

3.5.3 Import and Export Tariff Regulations

4. Asia Pacific Whipped Cream Market Segmentation

4.1 By Type (In Value %)

4.1.1 Dairy-Based Whipped Cream

4.1.2 Non-Dairy Whipped Cream (Soy, Coconut, Almond)

4.2 By Application (In Value %)

4.2.1 Foodservice (Bakeries, Cafs, Restaurants)

4.2.2 Retail (Household Use, Ready-to-Eat Products)

4.2.3 Industrial (Desserts, Pastries, Toppings)

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets/Hypermarkets

4.3.2 Online Stores

4.3.3 Specialty Food Stores

4.3.4 Convenience Stores

4.4 By Flavor (In Value %)

4.4.1 Plain

4.4.2 Flavored (Vanilla, Chocolate, Strawberry)

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 South Korea

4.5.4 India

4.5.5. Rest of APAC

4.5.6. Australia

5. Asia Pacific Whipped Cream Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Danone S.A.

5.1.2 Nestle S.A.

5.1.3 FrieslandCampina N.V.

5.1.4 Lactalis Group

5.1.5 Dean Foods

5.1.6 Arla Foods

5.1.7 Fonterra Co-operative Group

5.1.8 Rich Products Corporation

5.1.9 Hanan Products Co., Inc.

5.1.10 Hanan Distribution Inc.

5.1.11 Glenisk Ltd.

5.1.12 Great Lakes Whip

5.1.13 Old World Creamery

5.1.14 Palsgaard

5.1.15 Great American Whipped Toppings

5.2 Cross Comparison Parameters (Production Capacity, Distribution Network, Flavor Offerings, Manufacturing Technology, R&D Focus, Product Innovation, Geographic Reach, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 R&D Expenditure Analysis

5.8 Partnership and Collaboration Analysis

5.9 Sustainability and Environmental Initiatives

6. Asia Pacific Whipped Cream Market Regulatory Framework

6.1 Compliance Standards for Dairy and Non-Dairy Products

6.2 Nutritional Labeling Regulations

6.3 Allergen and Ingredient Disclosure Requirements

7. Asia Pacific Whipped Cream Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Asia Pacific Whipped Cream Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Flavor (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Whipped Cream Market Analysts Recommendations

9.1 Target Audience Segmentation

9.2 Strategic Marketing Insights

9.3 White Space Opportunity Analysis

9.4 Innovative Product Development Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive map of stakeholders in the Asia Pacific Whipped Cream Market, utilizing desk research and proprietary databases to gather industry-level data. The primary objective is to identify the critical variables influencing market trends.

Step 2: Market Analysis and Construction

This step includes compiling and analyzing historical data relevant to the whipped cream market in Asia Pacific, covering penetration rates and revenue generation. Service quality metrics and reliability measures are evaluated to refine revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through interviews with industry experts from major companies, using CATIs to obtain insights on market dynamics. These consultations provide operational and financial data from key industry players.

Step 4: Research Synthesis and Final Output

The final stage involves detailed interactions with whipped cream manufacturers to verify data and gain insights into product segments, sales performance, and consumer preferences. This information ensures a validated and comprehensive analysis of the Asia Pacific Whipped Cream Market.

Frequently Asked Questions

01. How big is the Asia Pacific Whipped Cream Market?

The Asia Pacific Whipped Cream Market is valued at USD 1 billion, supported by steady growth in demand across retail and foodservice sectors, particularly in countries with established culinary traditions involving whipped cream.

02. What are the challenges in the Asia Pacific Whipped Cream Market?

Challenges in Asia Pacific Whipped Cream Market include fluctuating raw material prices, regulatory standards for food safety, and limitations in cold storage infrastructure in certain developing regions, which can affect distribution.

03. Who are the major players in the Asia Pacific Whipped Cream Market?

Key players in Asia Pacific Whipped Cream Market include Danone S.A., Nestle S.A., FrieslandCampina N.V., Lactalis Group, and Rich Products Corporation. These companies lead due to their extensive distribution networks, product variety, and ongoing innovation.

04. What are the growth drivers of the Asia Pacific Whipped Cream Market?

Key growth in Asia Pacific Whipped Cream Market drivers include the expanding foodservice industry, rising consumer preference for convenient dessert toppings, and increasing demand for non-dairy and vegan whipped cream options, reflecting dietary trends in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.