Asia Pacific Wi-Fi Chipset Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10876

November 2024

88

About the Report

Asia Pacific Wi-Fi Chipset Market Overview

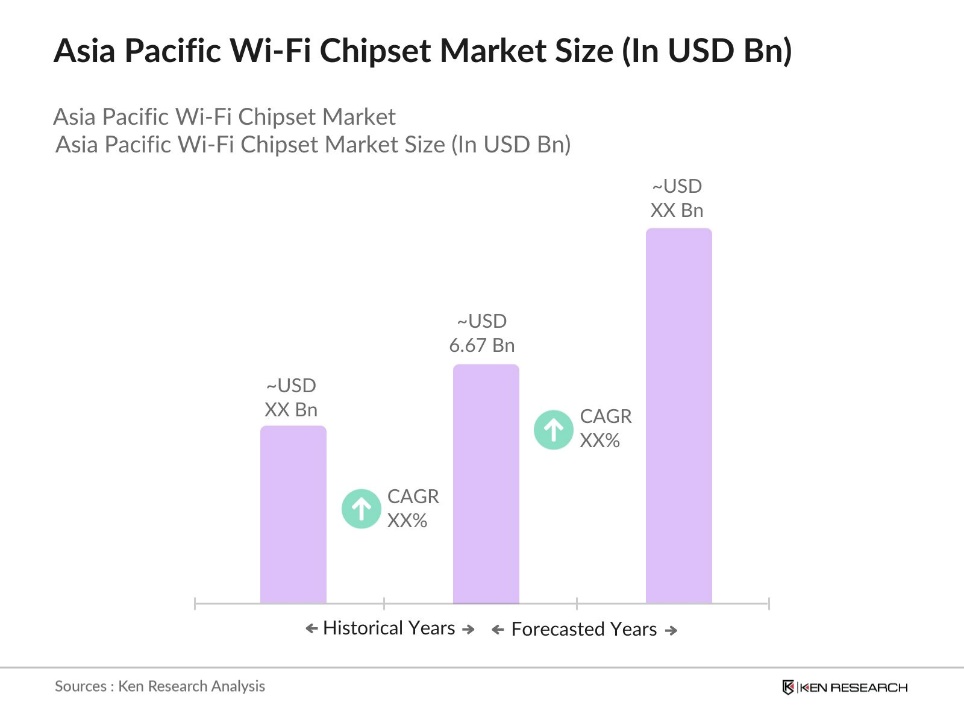

- The Asia Pacific Wi-Fi Chipset market is valued at USD 6.67 billion, driven by rapid technological advancements, increasing demand for smart devices, and expansion of digital infrastructure. Key factors propelling the growth include the proliferation of IoT devices, integration of 5G technology, and demand for high-speed connectivity in residential and commercial applications.

- China and India lead the Wi-Fi Chipset market in Asia Pacific due to their large consumer base, fast-paced industrial growth, and active digital transformation initiatives. Chinas robust manufacturing capabilities, coupled with high adoption of smart city initiatives, position it as a significant contributor. Meanwhile, Indias rapid digitization, supported by government-driven projects like Digital India, has bolstered Wi-Fi infrastructure development, solidifying the countrys dominance in the market.

- The Wi-Fi chipset market must comply with various standards, such as those established by the International Telecommunication Union (ITU) and local regulatory bodies. In 2024, Asia Pacifics chipset manufacturers faced an average of three compliance checks per chipset model due to stringent safety and interference regulations. This adherence ensures that chipsets meet safety and reliability standards, adding a layer of complexity but also enhancing chipset reliability and market credibility.

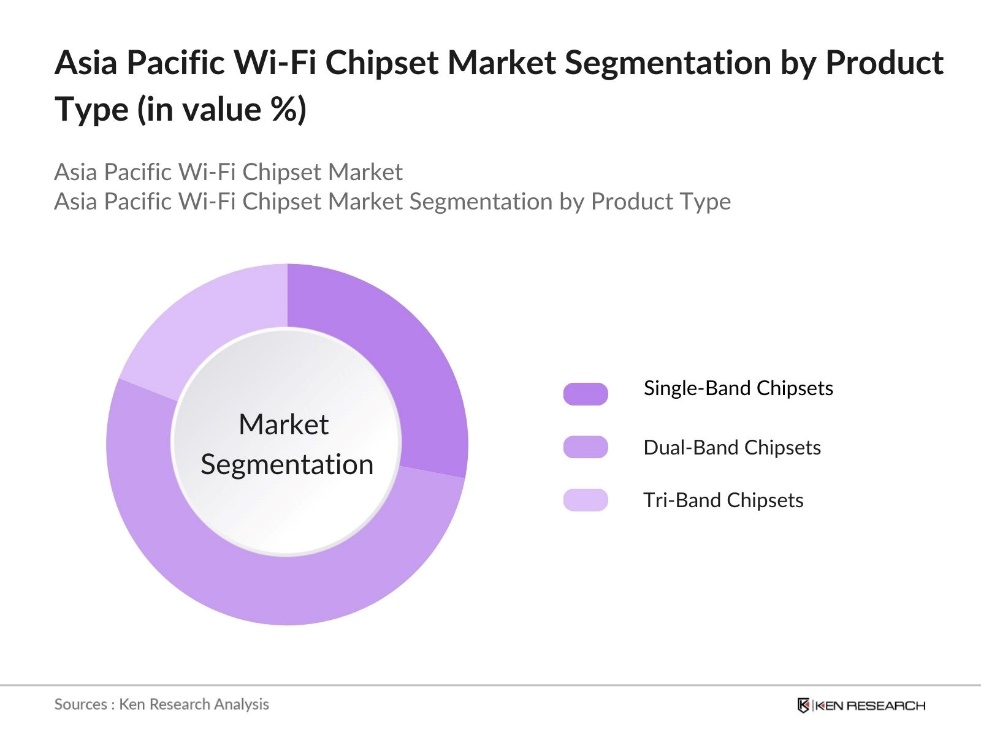

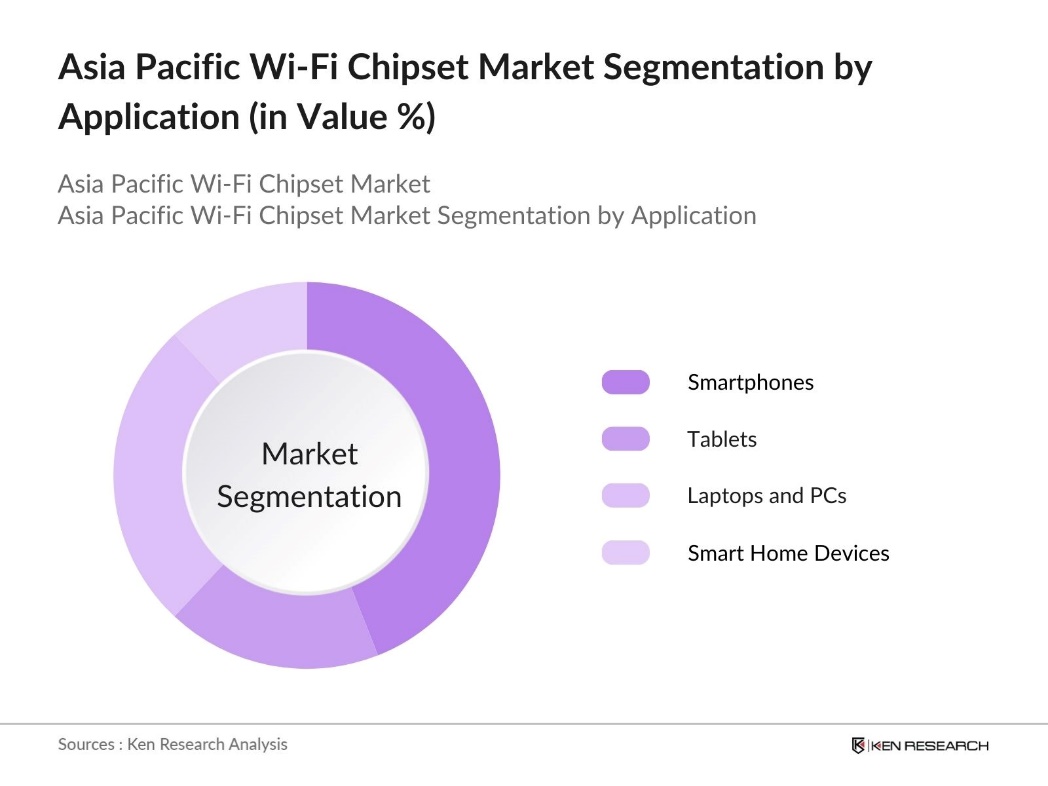

Asia Pacific Wi-Fi Chipset Market Segmentation

By Product Type: The market is segmented by product type into Single-Band, Dual-Band, and Tri-Band chipsets. Dual-Band chipsets currently dominate due to their balanced performance and compatibility with diverse applications. Dual-Band chipsets are highly preferred in residential and commercial applications because they offer an optimized balance between speed and range, which caters well to high-bandwidth applications, including streaming and gaming. This versatility makes them popular across various sectors.

By Application: The market segmentation by application includes Smartphones, Tablets, Laptops and PCs, and Smart Home Devices. Smartphones have a dominant market share within this segment, primarily due to the continuous rise in smartphone penetration in Asia Pacific, driven by an expanding middle class and demand for high-speed mobile internet. Leading smartphone manufacturers integrating advanced Wi-Fi chipsets into their products further fuel this segments growth.

Asia Pacific Wi-Fi Chipset Market Competitive Landscape

The Asia Pacific Wi-Fi Chipset market is dominated by major global players, including Qualcomm, Broadcom, and MediaTek, who lead the market through innovations and strategic partnerships with device manufacturers. Additionally, regional companies, including China-based companies, hold substantial market power, contributing to a competitive ecosystem driven by technological advancements and the need for high-performing chipsets.

Asia Pacific Wi-Fi Chipset Industry Analysis

Growth Drivers

- Rising Demand for IoT Devices: The Asia Pacific region has witnessed significant growth in IoT device adoption, driven by increasing digital transformation and government initiatives promoting smart infrastructure According to IDC, IoT spending in the Asia Pacific is expected to reach $435 billion by 2027, growing at a compound annual growth rate (CAGR) of 11.7% from 2023. Nations such as China and India are leading with substantial IoT deployments in sectors like manufacturing, healthcare, and smart cities. This rise in IoT connections underlines the crucial role of high-performance Wi-Fi chipsets in meeting connectivity demands and maintaining network stability in the Asia Pacific region.

- Expansion of Public Wi-Fi Networks: The expansion of public Wi-Fi networks across urban and rural areas in the Asia Pacific region is a significant growth driver for Wi-Fi chipsets. The State government plans to establish public Wi-Fi hotspots at a minimum of 5,000 locations throughout the city. Once completed, Indias Silicon City will lead the nation in public Wi-Fi hotspot density among cities. Such expansions demand robust Wi-Fi chipset infrastructure to ensure seamless connectivity across densely populated regions.

- Increased Mobile Penetration: Asia Pacifics high mobile penetration, especially in countries like Indonesia, the Philippines, and Vietnam, has led to an increased demand for robust Wi-Fi chipset solutions. Government initiatives to enhance digital access in remote areas further support this trend. Rising mobile data consumption across the region drives the need for advanced Wi-Fi chipsets to manage heavier network traffic and ensure reliable connectivity in a mobile-driven digital economy.

Market Challenges

- High Costs of High-Performance Chipsets: High-performance Wi-Fi chipsets, essential for stable and high-speed connectivity, often come with elevated production costs, making them less accessible for budget-constrained sectors. This price disparity limits adoption among smaller enterprises and residential users, particularly in cost-sensitive markets. For countries like India and Thailand, where affordability is a key consideration, these costs present a notable barrier to broader market penetration.

- Complex Regulatory Landscape: The Asia Pacific Wi-Fi chipset market faces a complex regulatory landscape, with each country enforcing unique compliance standards for frequency use and data protection. Countries such as Japan and Australia require strict spectrum compliance, while China has rigorous data security regulations impacting chipset design. This regulatory diversity adds operational challenges for chipset manufacturers, necessitating adaptive strategies to navigate varying compliance requirements.

Asia Pacific Wi-Fi Chipset Market Future Outlook

The Asia Pacific Wi-Fi Chipset market is anticipated to evolve rapidly with advancements in Wi-Fi 6E and the integration of 5G networks, catering to the growing demand for high-speed internet. Expansion of smart city initiatives and increased penetration of IoT applications will further amplify the markets trajectory. Regional governments' commitment to advancing digital infrastructure will continue to drive the adoption of Wi-Fi chipsets, especially in emerging markets within the region.

Market Opportunities

- Integration with 5G Networks: The integration of Wi-Fi chipsets with 5G infrastructure presents significant growth potential, particularly in enhancing connectivity across urban and industrial areas. As more cities adopt 5G, hybrid Wi-Fi-5G networks emerge, requiring advanced chipsets that can support smooth transitions between Wi-Fi and cellular networks. This integration creates new opportunities for chipset providers, particularly for applications relying on robust, high-speed connectivity.

- Smart City Implementations: Smart city initiatives in Asia Pacific are driving demand for high-capacity Wi-Fi chipsets to enable seamless connectivity across urban infrastructure. Projects in cities across the region require reliable Wi-Fi networks to support connected public spaces, transportation systems, and healthcare facilities. These smart city projects open up opportunities for chipset manufacturers to deliver solutions that can handle large-scale, data-intensive applications essential for urban digital transformation.

Scope of the Report

|

Product Type |

Single-Band Wi-Fi Chipsets |

|

Application |

Smartphones |

|

Technology |

Wi-Fi 4 |

|

Frequency Band |

2.4 GHz |

|

Country |

China |

Products

Key Target Audience

Consumer Electronics Manufacturers

Network Infrastructure Manufactures

Telecommunication Companies

IoT Device Manufacturers

Government and Regulatory Bodies (e.g., Telecommunications Regulatory Authority)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Qualcomm Technologies

Broadcom Inc.

MediaTek Inc.

Intel Corporation

Realtek Semiconductor

Cypress Semiconductor

Texas Instruments

NXP Semiconductors

STMicroelectronics

Synaptics Incorporated

Table of Contents

1. Asia Pacific Wi-Fi Chipset Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate Analysis

1.4. Market Segmentation Overview

2. Asia Pacific Wi-Fi Chipset Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Major Market Developments and Milestones

3. Asia Pacific Wi-Fi Chipset Market Dynamics

3.1. Growth Drivers (Adoption Rate, Infrastructure Expansion, Increased Connectivity Demand)

3.1.1. Rising Demand for IoT Devices

3.1.2. Expansion of Public Wi-Fi Networks

3.1.3. Increased Mobile Penetration

3.1.4. Government Digital Initiatives

3.2. Market Challenges (Interference Issues, Power Consumption, Compatibility Challenges)

3.2.1. High Costs of High-Performance Chipsets

3.2.2. Complex Regulatory Landscape

3.2.3. Limited Spectrum Availability

3.3. Opportunities (5G Integration, Smart City Projects, Emerging Markets)

3.3.1. Integration with 5G Networks

3.3.2. Smart City Implementations

3.3.3. Expansion in Rural and Underdeveloped Areas

3.4. Trends (Wi-Fi 6 Adoption, Low-Power Consumption Designs, Security Enhancements)

3.4.1. Increase in Wi-Fi 6 and 6E Adoption

3.4.2. Emphasis on Low-Power Consumption Chipsets

3.4.3. Focus on Enhanced Security Protocols

3.5. Regulatory Framework (Spectrum Allocation, Licensing, Compliance Standards)

3.5.1. Regional Spectrum Allocation Policies

3.5.2. Compliance with Local and International Standards

3.5.3. Licensing Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Wi-Fi Chipset Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Single-Band Wi-Fi Chipsets

4.1.2. Dual-Band Wi-Fi Chipsets

4.1.3. Tri-Band Wi-Fi Chipsets

4.2. By Application (In Value %)

4.2.1. Smartphones

4.2.2. Tablets

4.2.3. Laptops and PCs

4.2.4. Smart Home Devices

4.3. By Technology (In Value %)

4.3.1. Wi-Fi 4

4.3.2. Wi-Fi 5

4.3.3. Wi-Fi 6 and 6E

4.4. By Frequency Band (In Value %)

4.4.1. 2.4 GHz

4.4.2. 5 GHz

4.4.3. 6 GHz

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Wi-Fi Chipset Market Competitive Landscape

5.1. Detailed Profiles of Major Competitors

5.1.1. Qualcomm Technologies

5.1.2. Broadcom Inc.

5.1.3. MediaTek Inc.

5.1.4. Intel Corporation

5.1.5. Cypress Semiconductor

5.1.6. Marvell Technology Group

5.1.7. Texas Instruments

5.1.8. Realtek Semiconductor Corp.

5.1.9. NXP Semiconductors

5.1.10. STMicroelectronics

5.1.11. Synaptics Incorporated

5.1.12. Infineon Technologies

5.1.13. Renesas Electronics

5.1.14. Samsung Electronics Co., Ltd.

5.1.15. Skyworks Solutions, Inc.

5.2. Cross Comparison Parameters (R&D Investments, Headquarters, Revenue, Workforce Size, Innovation Rate, Global Presence, Product Range, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Acquisitions, Partnerships, R&D)

5.5. Mergers and Acquisitions

5.6. Investment Landscape

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Asia Pacific Wi-Fi Chipset Market Regulatory Overview

6.1. Spectrum Regulations and Standards

6.2. Compliance Requirements and Certifications

6.3. Environmental Standards for Chipset Manufacturing

7. Asia Pacific Wi-Fi Chipset Market Future Size (In USD Mn)

7.1. Market Size Projections

7.2. Key Drivers of Future Market Growth

8. Asia Pacific Wi-Fi Chipset Future Segmentation

8.1. By Product Type

8.2. By Application

8.3. By Technology

8.4. By Frequency Band

8.5. By Country

9. Asia Pacific Wi-Fi Chipset Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Marketing Initiatives

9.3. White Space and Niche Opportunities

9.4. Customer Cohort and Demographic Analysi

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by defining key market variables and constructing an ecosystem map, which includes major stakeholders in the Wi-Fi Chipset Market. Secondary research from industry databases and publications is utilized to build a foundational understanding of the market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the Asia Pacific Wi-Fi Chipset Market is compiled and analyzed. This includes market penetration, revenue breakdown, and product segmentation. Service quality and consumer adoption rates are also assessed to validate revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on initial findings and validated through consultations with industry experts. Interviews with representatives from leading companies provide insights into operational and market trends, enhancing data reliability.

Step 4: Research Synthesis and Final Output

The final phase includes interactions with chipset manufacturers and distributors to gather detailed information on product segments, sales trends, and market challenges. This process ensures a comprehensive and accurate analysis, producing a validated report on the Asia Pacific Wi-Fi Chipset market.

Frequently Asked Questions

01. How big is the Asia Pacific Wi-Fi Chipset Market?

The Asia Pacific Wi-Fi Chipset market is valued at USD 6.67 billion, supported by increasing digital transformation initiatives and consumer demand for high-speed connectivity.

02. What are the challenges in the Asia Pacific Wi-Fi Chipset Market?

Challenges in Asia Pacific Wi-Fi Chipset market include spectrum availability, high initial costs, and regulatory compliance complexities. Power consumption and compatibility issues in high-frequency bands also impact the market.

03. Who are the major players in the Asia Pacific Wi-Fi Chipset Market?

Key players in Asia Pacific Wi-Fi Chipset market include Qualcomm, Broadcom, MediaTek, Intel, and Realtek Semiconductor, known for their extensive R&D and robust product portfolios.

04. What drives the growth of the Asia Pacific Wi-Fi Chipset Market?

The Asia Pacific Wi-Fi Chipset market is driven by increased smartphone adoption, IoT integration, and government initiatives supporting digital infrastructure. The rise of 5G and Wi-Fi 6E technologies also fuels growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.