Asia Pacific Wine Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD8691

December 2024

88

About the Report

Asia Pacific Wine Market Overview

- The Asia Pacific Wine Market is valued at USD 58 billion, driven by the region's rising disposable income and growing cultural inclination towards premium beverages. Urbanization and increased consumer spending on luxury items have further fueled wine demand. Expansions in local vineyards and investments by multinational brands also contribute to the robust market landscape.

- China, Japan, and Australia lead the Asia Pacific Wine Market, primarily due to their established wine industries, strong consumer base, and supportive government policies. In China, a surge in wine tourism and growing middle-class interest in Western culture bolster market prominence. Japan and Australia benefit from sophisticated distribution networks and a longstanding wine culture that appeals to local consumers.

- Wine labeling standards across Asia Pacific are increasingly regulated to ensure consumer safety transparency. Japan's alcohol labeling requirements, updated in 2023, mandate detailed ingredient and origin labeling on imported wines (Japanese Ministry of Health, Labour, and Welfare) . Similarly, Australia has enforced stringent labeling regulations requiring detailed information on allergens and preservatives, allowing consumers to make informed choices. These changes shape the market, compelling wineries to comply with labeling standards, especially for health-related disclosures.

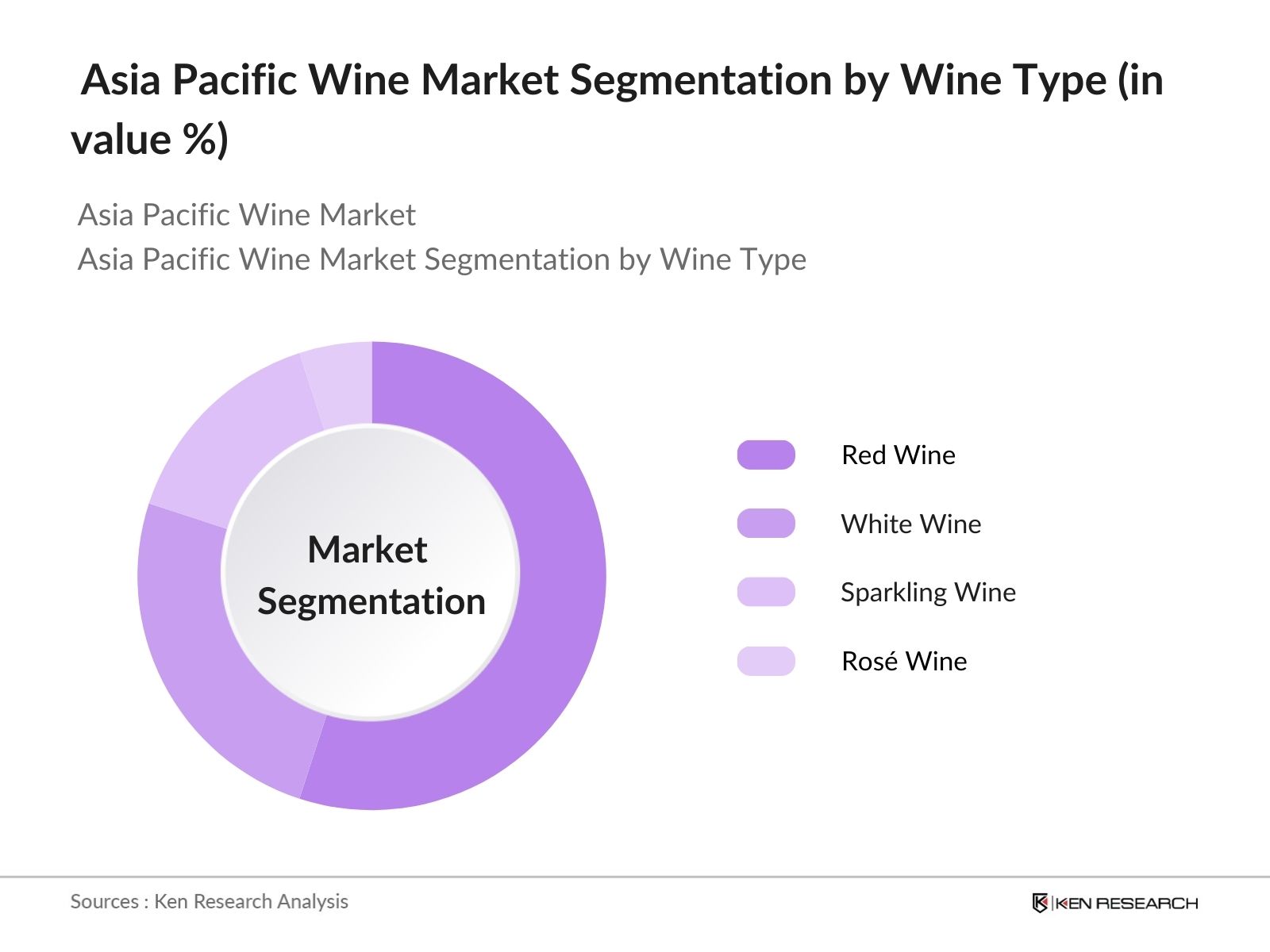

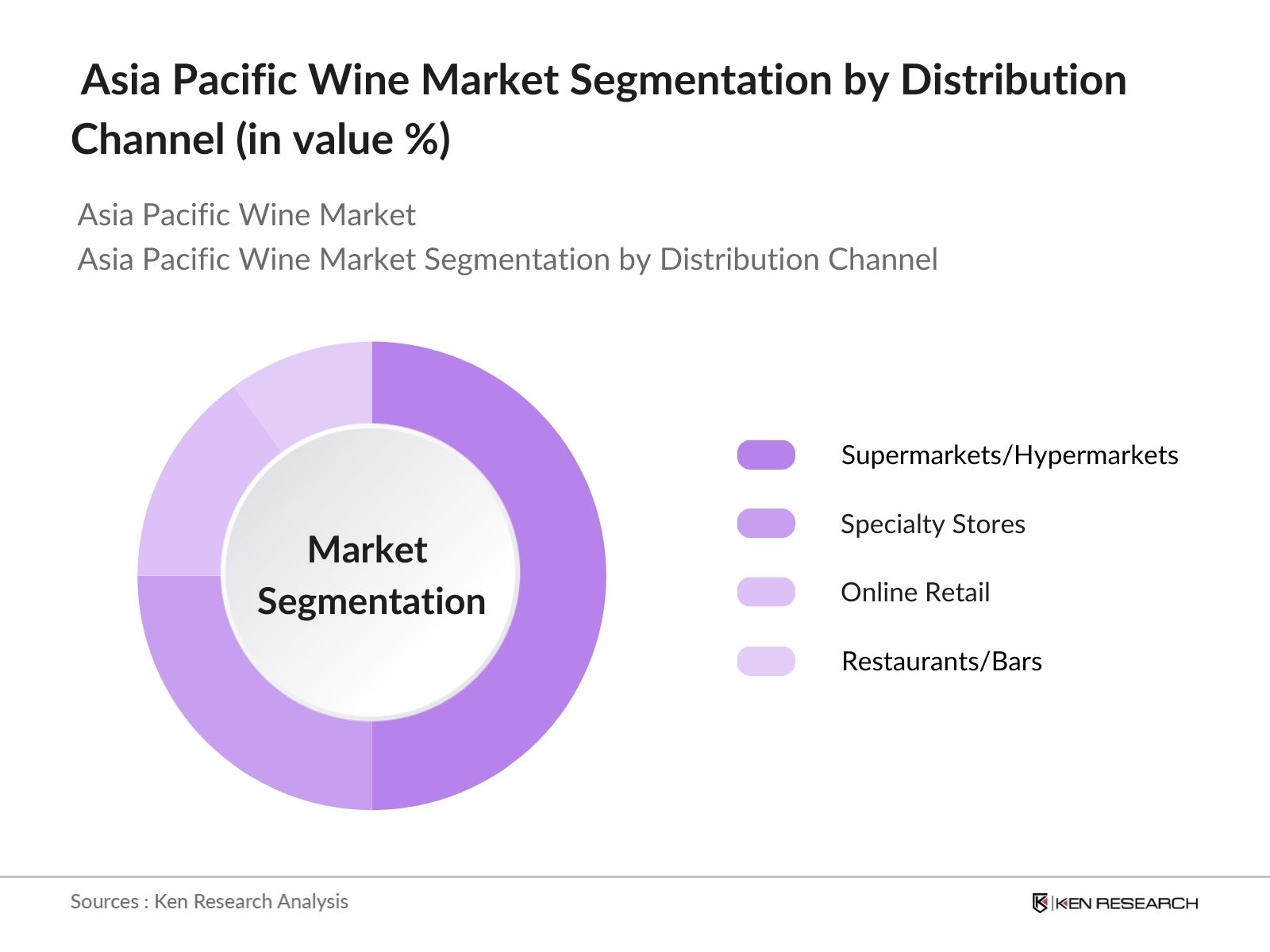

Asia Pacific Wine Market Segmentation

- By Wine Type: The market is segmented by wine type into red wine, white wine, sparkling wine, and ros wine. Red wine holds a dominant share due to its cultural acceptance and health benefits recognized by consumers across the region. With a higher preference for red wine varieties, brands are also increasingly focusing on introducing aged and premium options to cater to the luxury segment.

- By Distribution Channel: Distribution channels in the Asia Pacific Wine Market include supermarkets/hypermarkets, specialty stores, online retail, and restaurants/bars. Supermarkets and hypermarkets dominate, owing to their accessibility and high consumer footfall. Large retail chains have established extensive supply chains, allowing consumers convenient access to a wide variety of wine brands and types, which is crucial for market growth.

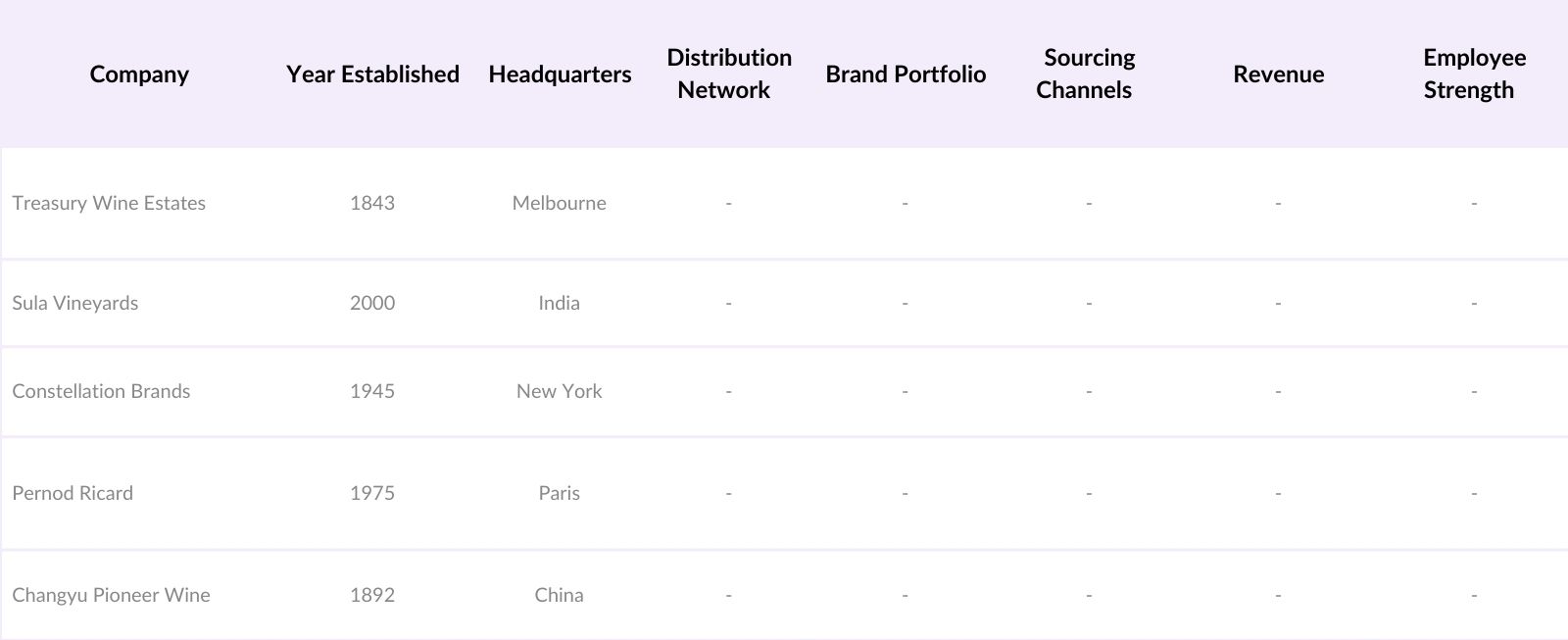

Asia Pacific Wine Market Competitive Landscape

The Asia Pacific Wine Market is dominated by prominent companies, each leveraging a mix of local market knowledge and international standards to gain a competitive edge. The following table provides insights into five major players, their establishment year, headquarters, and market-specific parameters.

Asia Pacific Wine Market Analysis

Market Growth Drivers

- Consumer Preferences: In the Asia Pacific wine market, premium wine consumption has gained traction, driven by changing consumer preferences and increased focus on quality. Japan reported an import increase in premium wines, valued at over 15 billion yen in 2023, reflecting a shift toward quality over quantity in consumer spending habits, Australia's wine import market has shown a preference for premium wines from Europe, indicating demand aligned with higher-quality offerings. As consumer preferences evolve, Asia Pacific's upper-middle-class households are anticipated to account for more discretionary spending, driven by lifestyle changes and a greater emphasis on refined alcoholic beverages.

- Increasing Disposable Income: Increased disposable income across Asia Pacific countries is a primary driver of wine demand, as higher income levels allow consumers to spend on premium products. According to the World Bank, the regions gross national income per capita saw an upward trend, with Australia reaching $61,160 and Singapore $66,250 in 2023. Countries like India, experiencing growth in disposable income, have seen rising demand for wine among middle-income households who now consider wine a part of leisure spending. Enhanced economic growth and stable inflation rates support this income boost, translating directly into increased wine consumption.

- Influence of culture: The increasing influence of Western culture has also fueled the demand for wine in Asia Pacific, with younger generations driving this trend. For example, China reported over 45% of its urban population consuming Western-style alcoholic beverages regularly in 2023. Furthermore, Australia's wine shown growth with an influx of Western brands, highlighting changing consumer preferences aligned with Western culture. The regions exposure to international media, tourism, and Western dining customs is pushing wine to become a staple in social and casual settings across Asia Pacific countries.

Market Challenges

- Alcohol Distribution Laws: Alcohol distribution laws remain a major hurdle for wine markets in Asia Pacific, with each country enforcing strict regulations. Such as, India's Goods and Services Tax (GST) on imported wines stands at a high rate of 150%, which impacts pricing and distribution substantially. Similarly, China imposes stringent import duties, the administrative costs and paperwork for wine imports, posing challenges for foreign brands. These regulatory barriers impact market access, particularly for smaller producers, adding layers of cost and compliance requirements.

- Competitive Pressure from Imported Brands: Important brands exert competitive pressure on domestic wine producers in Asia Pacific. In 2023, imported wine volumes in Japan reached over 280 million liters, showcasing an inclination toward established international brands. Similarly, Chinas imported wine share accounts for a substantial total wine consumption. These imports, especially from Europe, are widely perceived as superior in quality, challenging local brands to match consumer expectations and meet global quality standards.

Asia Pacific Wine Market Future Outlook

Over the next five years, the Asia Pacific Wine Market is expected to see considerable advancements, fueled by growing consumer interest in premium alcoholic beverages, the rise of e-commerce platforms, and evolving taste preferences. Investments in sustainable wine production and innovation across wine varieties will further shape the market, especially as brands expand their footprint in emerging regional markets.

Market Opportunities

- Expansion into Emerging Markets: The Asia Pacific market sees opportunities in emerging economies such as Vietnam and the Philippines, where urbanization rates exceeded 40% in 2023, fostering a conducive environment for wine consumption. The Philippines recorded an uptick in wine imports, valued at approximately $45 million dictating growing demand for wine among the urban population. Wine companies have room to expand distribution networks in these emerging markets, capitalizing tastes and increasing disposable income.

- Organic and Biodynamic Wine Production: Organic and biodynamic wines are gaining traction in Asia consumers seek environmentally responsible options. In Australia, organic wine exports grew substantial, reaching an estimated export volume of 10 million liters in 2023, driven by demand in Japan and South Korea. Biodynamic practices in wine production align with rising consumer awareness around sustainability, presenting an oppo producers to market eco-friendly products that appeal to the health-conscious demographic.

Scope of the Report

|

Type |

Still Wines Sparkling Wines |

|

Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail |

|

Packaging |

Glass Bottles Bag-in-Box Tetra Packs |

|

Price Segment |

Premium Economy |

|

Country |

China Japan Australia India South Korea |

Products

Key Target Audience

Wine Distributors and Retail Chains

Specialty Wine Shops and Wine Cellars

High-Net-Worth Individuals and Luxury Consumers

Wine Tourism Operators

Banks and Financial Institutions

Food and Beverage Industry Corporations

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., China Wine Association, Food Standards Australia)

Online Retail and E-commerce Platforms

Companies

Players Mentioned in the Report

Treasury Wine Estates

Accolade Wines

Casella Wines

Changyu Pioneer Wine

Sula Vineyards

Pernod Ricard

Diageo

Constellation Brands

Yantai North Andre Juice

Great Wall Wine

Table of Contents

1. Asia Pacific Wine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Wine Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Wine Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Preferences (Shift toward Premium Wines)

3.1.2 Increasing Disposable Income

3.1.3 Influence of Western Culture

3.1.4 Demand for Low-ABV (Alcohol by Volume) Products

3.2 Market Challenges

3.2.1 Regulatory Constraints (Alcohol Distribution Laws)

3.2.2 Competitive Pressure from Imported Brands

3.2.3 High Cost of Imported Wines

3.3 Opportunities

3.3.1 Expansion into Emerging Markets

3.3.2 Organic and Biodynamic Wine Production

3.3.3 Potential in Online Wine Sales

3.4 Trends

3.4.1 Rise of E-commerce in Wine Sales

3.4.2 Growing Wine Tourism

3.4.3 Increased Adoption of Wine Subscriptions

3.5 Government Regulations

3.5.1 Wine Labeling Standards

3.5.2 Import-Export Regulations

3.5.3 Health and Safety Guidelines

3.5.4 Promotional and Advertising Restrictions

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Wine Market Segmentation

4.1 By Type (In Value %)

4.1.1 Still Wines

4.1.2 Sparkling Wines

4.1.3 Fortified Wines

4.1.4 Dessert Wines

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Specialty Stores

4.2.3 Online Retail

4.2.4 Hotels, Restaurants, and Cafs (HoReCa)

4.3 By Packaging (In Value %)

4.3.1 Glass Bottles

4.3.2 Bag-in-Box

4.3.3 Tetra Packs

4.3.4 Cans

4.4 By Price Segment (In Value %)

4.4.1 Premium

4.4.2 Mid-Range

4.4.3 Economy

4.5 By Country (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 Australia

4.5.4 India

4.5.5 South Korea

5. Asia Pacific Wine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Treasury Wine Estates

5.1.2 Accolade Wines

5.1.3 Casella Wines

5.1.4 Changyu Pioneer Wine

5.1.5 Sula Vineyards

5.1.6 Pernod Ricard

5.1.7 Diageo

5.1.8 Constellation Brands

5.1.9 Yantai North Andre Juice

5.1.10 Great Wall Wine

5.1.11 Thai Beverage

5.1.12 Yanghe Brewery

5.1.13 Kingfisher Boissons

5.1.14 Kweichow Moutai

5.1.15 Asahi Group

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters

5.2.3 Inception Year

5.2.4 Revenue

5.2.5 Market Share

5.2.6 Annual Growth Rate

5.2.7 Distribution Network

5.2.8 Product Portfolio

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Wine Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Wine Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Wine Market Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Packaging (In Value %)

8.4 By Price Segment (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific Wine Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with the development of a comprehensive ecosystem model covering all stakeholders in the Asia Pacific Wine Market. This step involves gathering primary data from industry sources and building a database to identify the most influential variables in the market.

Step 2: Market Analysis and Construction

Next, historical data is analyzed, focusing on consumer patterns, retail channel distribution, and wine consumption trends. Additional assessments are conducted on distribution efficiency and market penetration to ensure robust analysis.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert consultations are conducted with industry veterans and wine market analysts. These interactions help confirm key insights and fill gaps in data collected, leading to a refined and comprehensive understanding.

Step 4: Research Synthesis and Final Output

The synthesis phase consolidates findings from primary research, statistical analyses, and expert input to produce a final report. This output includes segmented insights, detailed market metrics, and validated data covering the Asia Pacific Wine Market.

Frequently Asked Questions

01. How big is the Asia Pacific Wine Market?

The Asia Pacific Wine Market is valued at USD 58 billion, supported by increasing demand for premium wines and expanded distribution networks across major countries.

02. What are the key challenges in the Asia Pacific Wine Market?

Challenges include complex regulatory frameworks, high import tariffs in some countries, and logistical hurdles due to the fragmented nature of the region's distribution systems.

03. Who are the major players in the Asia Pacific Wine Market?

Leading players include Treasury Wine Estates, Sula Vineyards, Pernod Ricard, Constellation Brands, and Changyu Pioneer Wine, known for their extensive reach and diverse portfolios.

04. What drives growth in the Asia Pacific Wine Market?

Growth is primarily driven by increasing consumer interest in wine culture, rising disposable income, and the popularity of wine tourism, especially in China, Japan, and Australia.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.