Australia Airlines Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD1587

November 2024

81

About the Report

Australia Airlines Market Overview

- The Australia Airlines Market is valued at USD 3.1 billion, driven by robust domestic and international travel demand. Growth is largely propelled by an expanding tourism sector, increased business travel, and the significant presence of low-cost carriers that cater to budget-conscious consumers. High air traffic volumes, especially between major Australian cities, have underscored the need for expanded service routes and additional flight frequencies, contributing to consistent market expansion.

Major cities such as Sydney, Melbourne, and Brisbane dominate the Australian airlines market due to their status as primary hubs for both international and domestic flights. Sydney and Melbourne's proximity to high-traffic Asia-Pacific routes and Brisbane's tourism appeal make these cities critical for air travel demand. Their developed airport infrastructure and connectivity to regional areas also enable these cities to serve as essential nodes in Australias aviation network.

- CASA enforces stringent safety standards, mandating regular maintenance checks and audits. In 2024, Australian airlines invested over AUD 500 million in meeting CASA regulations, supporting safety through compliance with operational protocols. These standards are crucial for maintaining passenger safety and bolstering public confidence in airline services.

Australia Airlines Market Segmentation

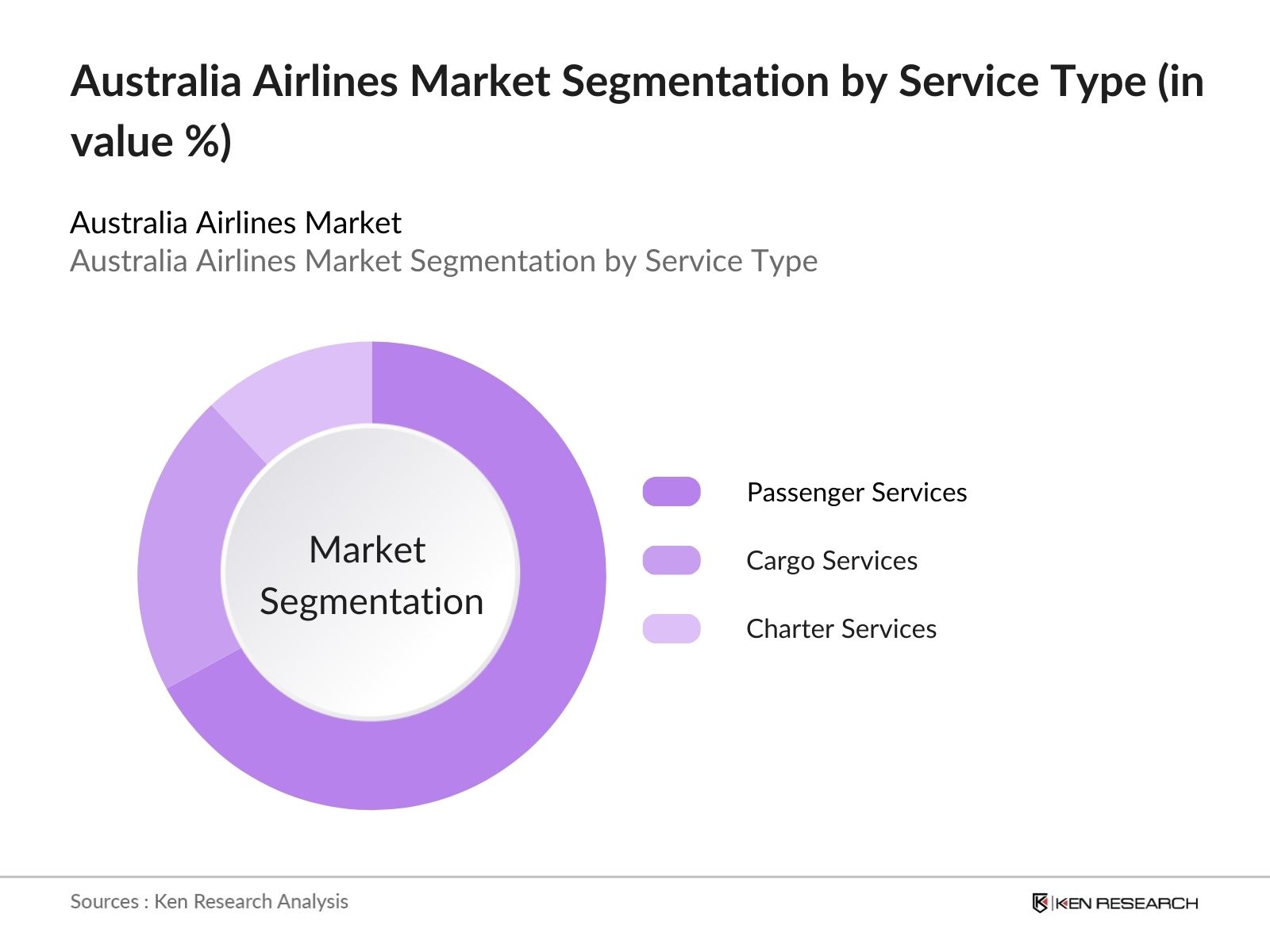

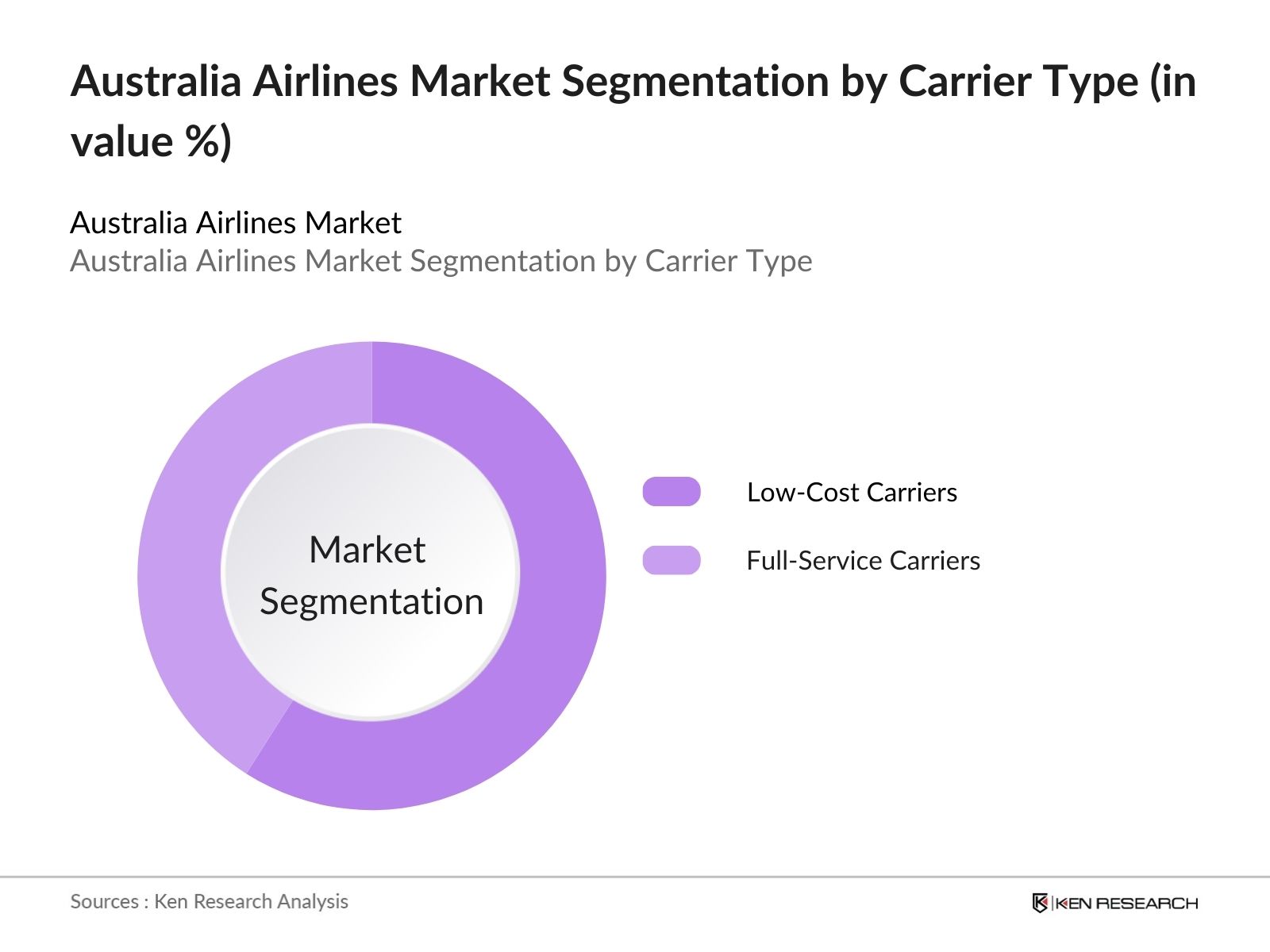

The Australia Airlines market is segmented by service type and by carrier type.

- By Service Type: The market is segmented by service type into passenger services, cargo services, and charter services. Recently, passenger services have dominated the market share due to heightened travel demand for both leisure and business. The large volume of domestic and international travel, coupled with a significant tourism sector, fuels the dominance of passenger services. Low-cost carriers and increasing flight frequency among major cities have amplified accessibility and affordability, further strengthening this segment's prominence.

- By Carrier Type: The market is further segmented by carrier type into full-service carriers and low-cost carriers. Low-cost carriers hold a larger market share due to the growing demand for affordable air travel options. These carriers attract price-sensitive customers by offering no-frills services, especially for domestic and short-haul international routes. The popularity of low-cost travel among Australian travelers and tourists has enabled these airlines to secure a leading position within this segment.

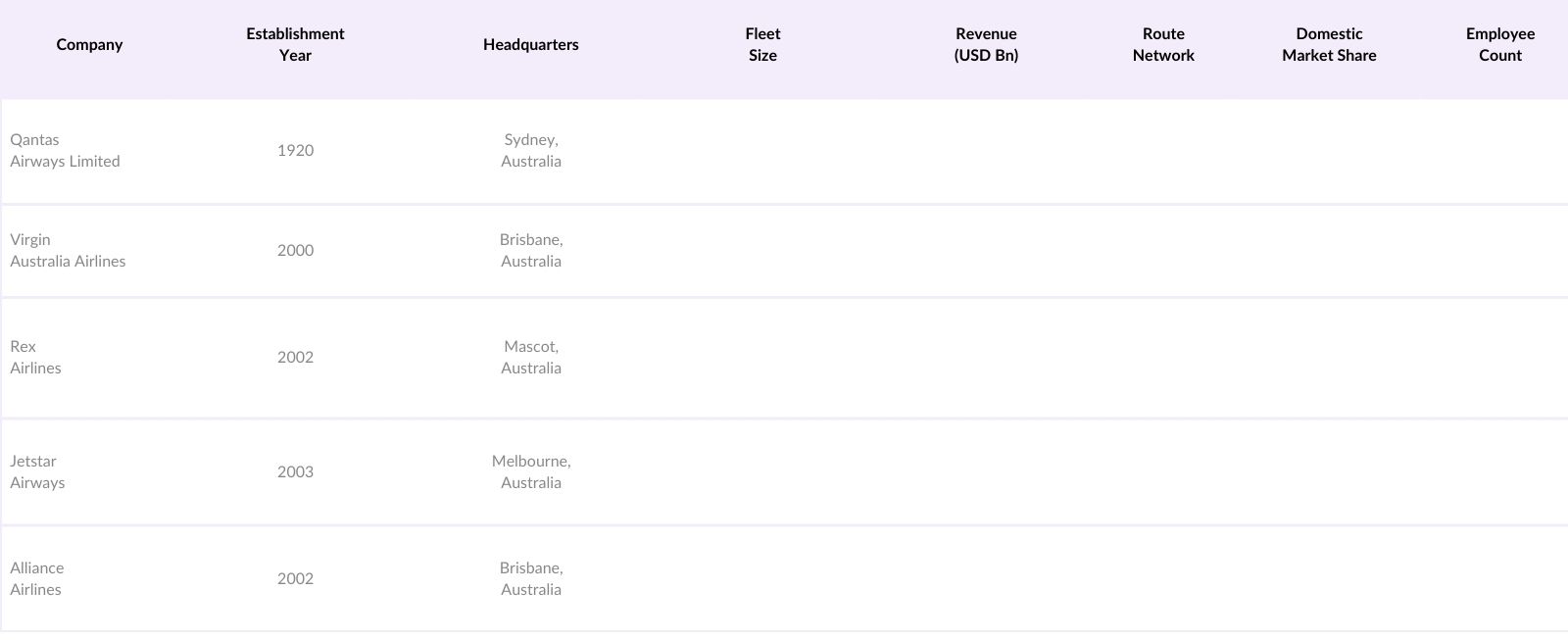

Australia Airlines Market Competitive Landscape

The Australian airline market is dominated by a few key players, with a competitive landscape marked by both local and international brands. Leading airlines such as Qantas and Virgin Australia, along with low-cost carriers like Jetstar, represent the key industry stakeholders, capturing significant market share. This consolidation underscores the competitive influence of these companies.

Australia Airlines Market Analysis

Growth Drivers

- Increase in Domestic Tourism: Australia's domestic tourism has surged, with over 120 million overnight trips recorded in 2024, largely driven by government initiatives to boost local travel following international restrictions. This growth has significantly benefited domestic airlines as tourism-related air travel demand increases, particularly on major routes like Sydney-Melbourne and Brisbane-Perth. The Australian Bureau of Statistics (ABS) highlighted a 15% increase in regional tourism spending, further bolstering the demand for flights within Australia. This trend underlines the pivotal role of domestic tourism in sustaining and expanding the Australian airline market through 2024.

- Rise in Low-Cost Carrier Popularity: The popularity of low-cost carriers (LCCs) in Australia continues to grow, with over 40% of domestic flights now served by budget airlines. Australian consumers are increasingly price-sensitive, with recent surveys showing a 25% increase in preference for LCCs due to affordability and value-driven services. This trend is especially prominent among younger travelers, supporting the LCC segments significant role in Australias airline industry. The move towards budget-friendly travel options aligns with a robust shift in airline service demand, which has been mirrored in ABS consumer price index findings.

- Advances in Sustainable Aviation Fuel Adoption: Australia has committed to sustainable aviation advancements, with the government allocating AUD 30 million to support Sustainable Aviation Fuel (SAF) initiatives in 2024. The countrys three largest airlines have announced collaborations with SAF producers, aiming to reduce carbon emissions by 10,000 tons annually through SAF integration. As part of the countrys 2030 net-zero goals, this commitment reflects the alignment of Australian airlines with global environmental standards, enhancing the market's growth through eco-conscious initiatives.

Market Challenges

- High Operating Costs: Australian airlines face substantial operating expenses, with fuel accounting for nearly 35% of total airline operating costs. Additionally, labor expenses are high, with the minimum wage rising by 5.75% in 2024, impacting staffing costs. Rising inflation, reported at 4.2% in early 2024 by the Reserve Bank of Australia, has further escalated operational challenges. This cost-intensive environment adds significant pressure on Australian airlines to optimize operations while maintaining competitive pricing.

- Intense Regulatory Compliance: Australias stringent aviation regulations require compliance with numerous standards set by the Civil Aviation Safety Authority (CASA). Australian airlines collectively spend an estimated AUD 500 million annually on regulatory compliance and safety protocols. With a 5% increase in CASA audits in 2024, airlines must continuously invest in compliance to meet safety and environmental standards, adding to the cost burden on the industry.

Australia Airlines Market Future Outlook

Over the next five years, the Australia Airlines Market is expected to experience steady growth driven by enhanced tourism, government investment in aviation infrastructure, and growing regional connectivity. With increasing emphasis on sustainable aviation solutions, airlines are adopting new technologies and green fuel alternatives. Expansion of low-cost carrier networks and the introduction of more flexible travel options will further boost market growth, reinforcing Australias position as a key aviation hub in the Asia-Pacific region.

Market Opportunities

- Expansion into Regional Routes: With around 45% of Australias population residing outside major cities, expanding air services to regional areas represents a lucrative growth opportunity for airlines. Government subsidies, such as the AUD 50 million Regional Airline Network Assistance Program, further incentivize airlines to develop these underserved routes. This expansion is essential to connect regional populations with urban centers, facilitating economic and tourism growth in regional Australia.

- Partnerships with International Airlines: Strategic alliances with international carriers offer Australian airlines expanded network reach and operational synergies. Partnerships with major players, like recent agreements with Asian and North American airlines, allow better access to high-traffic international routes, significantly enhancing passenger volume. This strategic alignment strengthens Australias position as a key hub for Asia-Pacific travel.

Scope of the Report

Products

Key Target Audience

Aviation Service Providers

Government and Regulatory Bodies (Australian Civil Aviation Safety Authority, Department of Infrastructure, Transport, Regional Development, and Communications)

Airport Operators

Tourism Boards and Travel Agencies

Environmental Advocacy Groups

Investors and Venture Capitalist Firms

Banks and Financial Institutes

Aircraft Maintenance and Repair Service Providers

Technology and Digital Solution Providers for Airlines

Companies

Players Mention in the Report:

Qantas Airways Limited

Virgin Australia Airlines

Rex Airlines

Jetstar Airways

Alliance Airlines

Airnorth

FlyPelican Pty Ltd

Bonza Aviation Pty Ltd

Qlink (QantasLink)

Hevilift Australia Pty Ltd

Skippers Aviation

Sharp Airlines

Skytrans Pty Ltd

Tigerair Australia

AirAsia X Australia

Table of Contents

1. Australia Airlines Market Overview

1.1 Definition and Scope

1.2 Market Structure

1.3 Market Dynamics

1.4 Industry Taxonomy

1.5 Economic and Regulatory Environment

2. Australia Airlines Market Size (in AUD Mn)

2.1 Historical Market Size (2018 - present)

2.2 Year-On-Year Growth Rate

2.3 Revenue Contribution by Key Segments

2.4 Market Milestones and Events

3. Australia Airlines Market Analysis

3.1 Growth Drivers

- Increase in Domestic Tourism

- Rise in Low-Cost Carrier Popularity

- Advances in Sustainable Aviation Fuel Adoption

3.2 Market Challenges

- High Operating Costs

- Intense Regulatory Compliance

- Geographical and Weather Challenges

3.3 Opportunities

- Expansion into Regional Routes

- Partnerships with International Airlines

- Technology-Driven Efficiencies

3.4 Key Trends

- Adoption of Digital Check-In and Baggage Solutions

- Increased Focus on In-Flight Experience

- Growing Demand for Charter Services

3.5 Regulatory Landscape

- Civil Aviation Safety Authority Standards

- Environmental Compliance Policies

- Passenger Rights Legislation

3.6 Stakeholder Ecosystem

3.7 Porters Five Forces Analysis

3.8 Competition Landscape

4. Australia Airlines Market Segmentation

4.1 By Service Type (in Value %)

- Full-Service Airlines

- Low-Cost Carriers

- Regional Airlines

4.2 By Fleet Type (in Value %)

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets

4.3 By Route Type (in Value %)

- Domestic Routes

- International Routes

- Charter and Special Routes

4.4 By Customer Segment (in Value %)

- Business Travelers

- Leisure Travelers

- Government/Corporate Travelers

4.5 By Region (in Value %)

- North

- South

- East

- West

5. Australia Airlines Market Competitive Analysis

5.1 Profiles of Key Competitors

- Qantas Airways

- Virgin Australia

- Jetstar Airways

- Regional Express (Rex)

- Alliance Airlines

- Bonza Airline

- Airnorth

- Skytrans Airlines

- Sharp Airlines

- FlyPelican

- Cobham Aviation Services

- Aviair

- Viva Energy Aviation

- QantasLink

- Virgin Australia Regional

5.2 Cross-Comparison Parameters (Fleet Size, Revenue, Headquarters, Passenger Load Factor, On-Time Performance, Market Share, Fleet Age, Environmental Initiatives)

5.3 Market Share Distribution

5.4 Strategic Initiatives and Mergers

5.5 Venture Capital and Funding Overview

5.6 Investments in Infrastructure and Technology

5.7 Government and Private Sector Grants

6. Australia Airlines Market Regulatory Framework

6.1 Safety and Security Standards

6.2 Environmental Impact Regulations

6.3 Passenger Service Regulations

6.4 Compliance with International Aviation Standards

7. Australia Airlines Future Market Size (in AUD Mn)

7.1 Projected Market Size

7.2 Key Factors Influencing Growth

8. Australia Airlines Market Segmentation (Future)

8.1 By Service Type (in Value %)

8.2 By Fleet Type (in Value %)

8.3 By Route Type (in Value %)

8.4 By Customer Segment (in Value %)

8.5 By Region (in Value %)

9. Australia Airlines Market Analyst Recommendations

9.1 Total Addressable Market (TAM) and Serviceable Market (SAM) Analysis

9.2 Key Customer Cohorts

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focused on defining key stakeholders within the Australia Airlines Market, utilizing comprehensive desk research and reviewing databases. This step aimed to identify critical factors influencing market trends, regulatory requirements, and competitive dynamics.

Step 2: Market Analysis and Construction

This phase involved compiling and analyzing historical data on the Australia Airlines Market. The research incorporated fleet sizes, routes, service offerings, and revenue data to ensure accuracy. Evaluating these elements allowed for a reliable assessment of revenue trends and service penetration across the country.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and validated through consultations with industry experts. Through computer-assisted telephone interviews (CATIs), insights on market structure, operational challenges, and regulatory impacts were gathered to enhance the reliability of the market data.

Step 4: Research Synthesis and Final Output

The final phase included direct engagement with airline operators and related stakeholders to validate insights on segment performance, passenger volumes, and market trends. This step ensured a robust and credible analysis of the Australia Airlines Market, providing a comprehensive outlook for industry stakeholders.

Frequently Asked Questions

01. How big is the Australia Airlines Market?

The Australia Airlines Market is valued at USD 3.1 billion, driven by high demand for both domestic and international air travel. The market benefits from increased tourism, expanding route networks, and competitive pricing.

02. What challenges does the Australia Airlines Market face?

Key challenges in Australia Airlines Market include fuel price volatility, skilled labor shortages, and regulatory compliance costs. Environmental impact pressures also demand airlines to innovate and adapt sustainable practices to meet emission standards.

03. Who are the major players in the Australia Airlines Market?

Major players in Australia Airlines Market include Qantas Airways, Virgin Australia, Rex Airlines, Jetstar Airways, and Alliance Airlines. These companies leverage extensive networks, strong brand loyalty, and competitive pricing.

04. What drives the Australia Airlines Market?

The Australia Airlines Market is primarily driven by tourism growth, increased business travel, and the rise of budget-friendly low-cost carriers. Government investment in airport infrastructure also supports the expansion of regional connectivity.

05. How is the Australia Airlines Market evolving?

The Australia Airlines Market is increasingly adopting sustainable aviation practices and digital solutions. Low-cost carriers continue to expand, and full-service airlines are focusing on premium travel services to attract diverse customer segments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.