Australia Aluminum Facade Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2619

November 2024

83

About the Report

Australia Aluminum Facade Market Overview

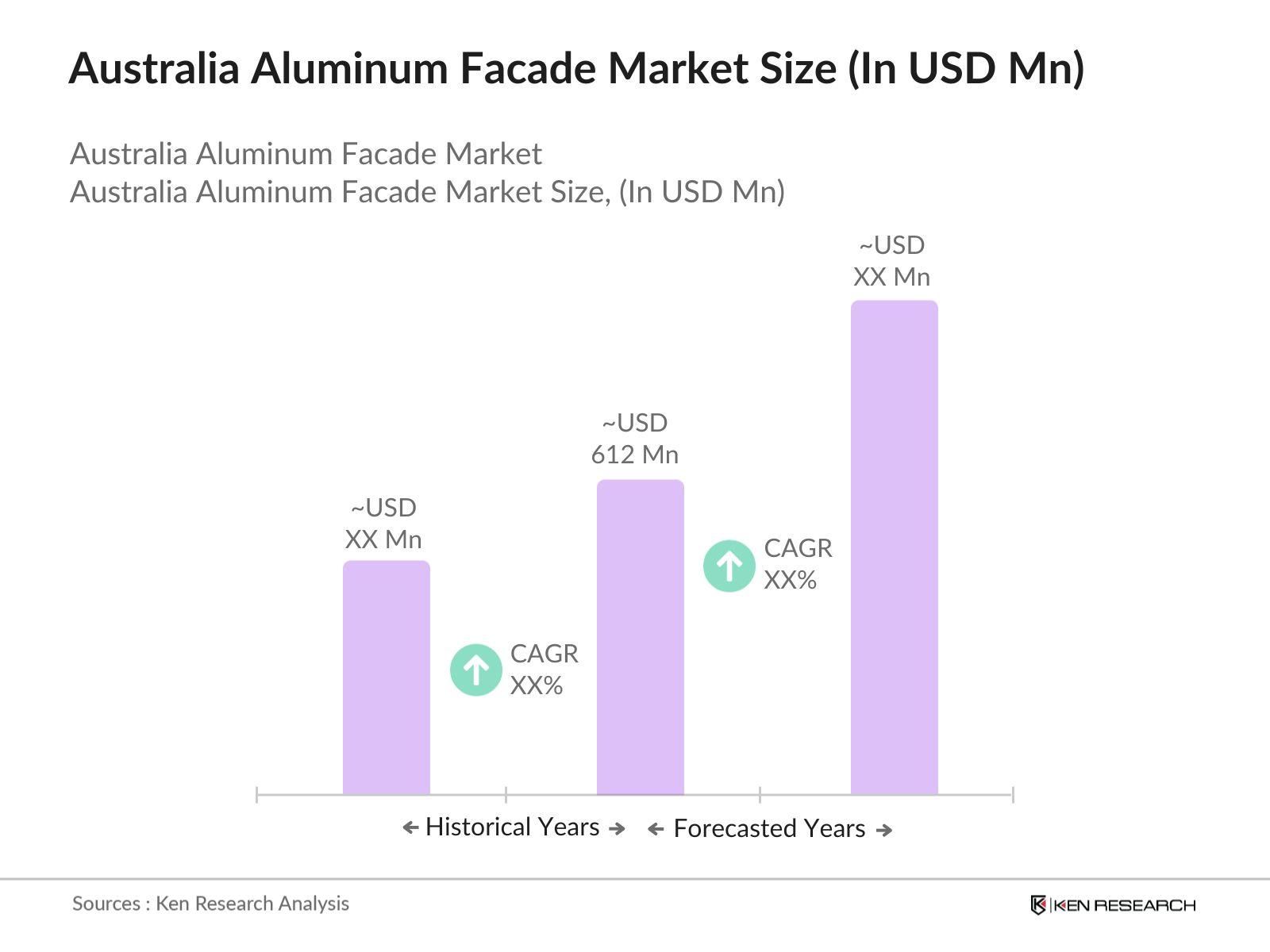

- The Australia Aluminum Facade Market is valued at approximately USD 612 million, primarily driven by the surge in sustainable architecture and increased demand for energy-efficient building materials. The market has been influenced by the strong adoption of aluminum facades in commercial and residential buildings due to their durability, aesthetic appeal, and contribution to energy savings. This emphasis on eco-friendly construction aligns with Australias commitment to sustainable development, adding further momentum to the demand for aluminum facades.

- Sydney and Melbourne lead the Australia Aluminum Facade Market, largely due to extensive urban development and a high concentration of commercial projects. These cities have seen significant investment in high-rise buildings and urban renewal initiatives, which has elevated the demand for durable and lightweight facade materials. Their dominance is further supported by local government incentives promoting sustainable construction practices and innovation in facade technologies.

- Australias Building Code requires that facades meet stringent safety and environmental standards. Aluminum facades, which comply with fire safety and thermal efficiency requirements, are preferred choices for many builders. The Australian government recently updated the BCA in 2023, emphasizing materials that reduce heat transmission. Compliance with the BCA is essential for new constructions, positioning aluminum facades as compliant solutions for energy-efficient, safe buildings in the country.

Australia Aluminum Facade Market Segmentation

The Australia Aluminum Facade Market is segmented by product type and by application.

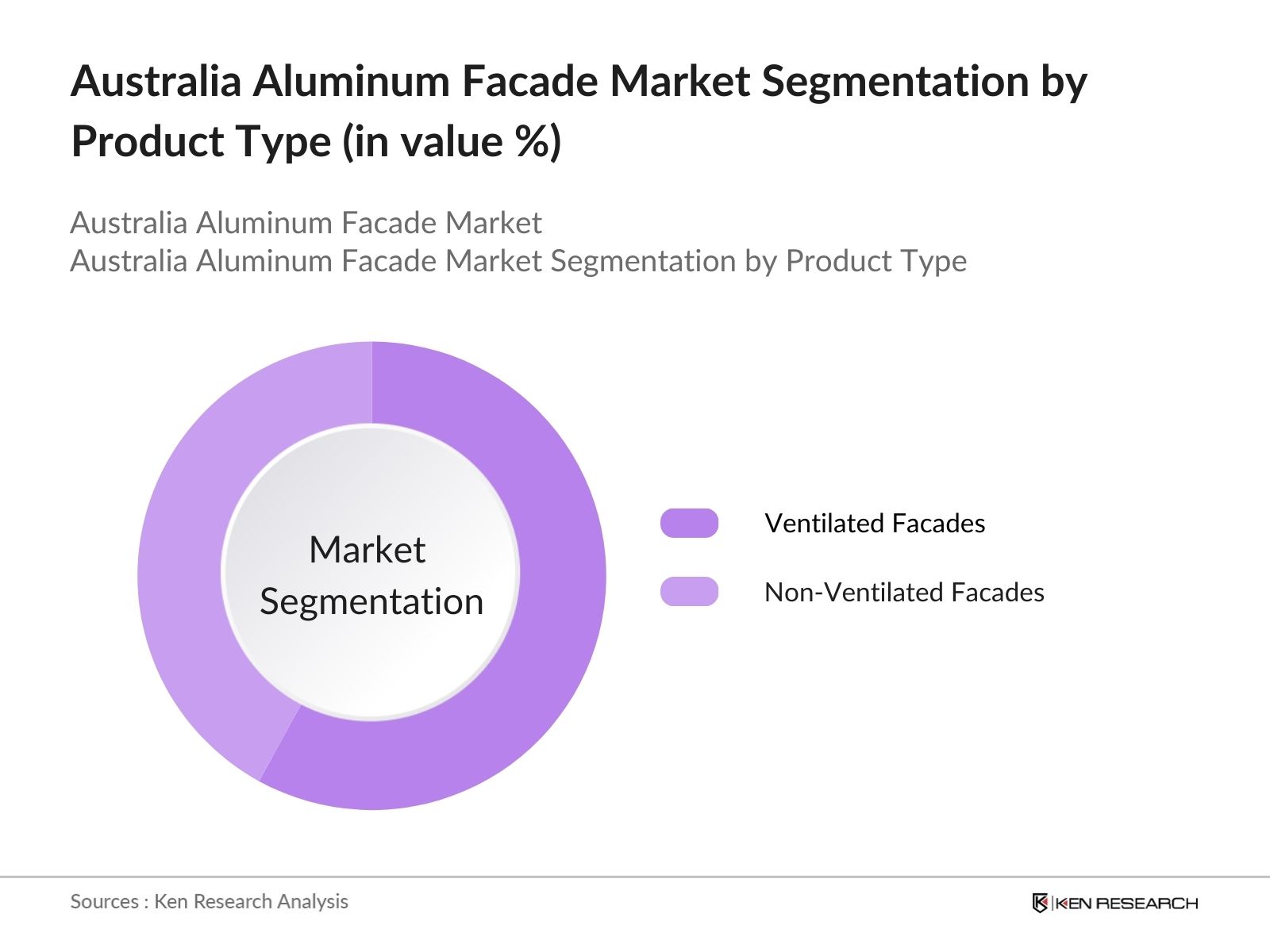

- By Product Type: The Australia Aluminum Facade Market is segmented by product type into ventilated facades and non-ventilated facades. Ventilated facades hold a dominant position within this segmentation, favored for their ability to provide effective thermal insulation and reduce energy costs. Additionally, the adoption of ventilated facades aligns with sustainability goals, as they contribute to indoor comfort without excessive reliance on artificial climate control.

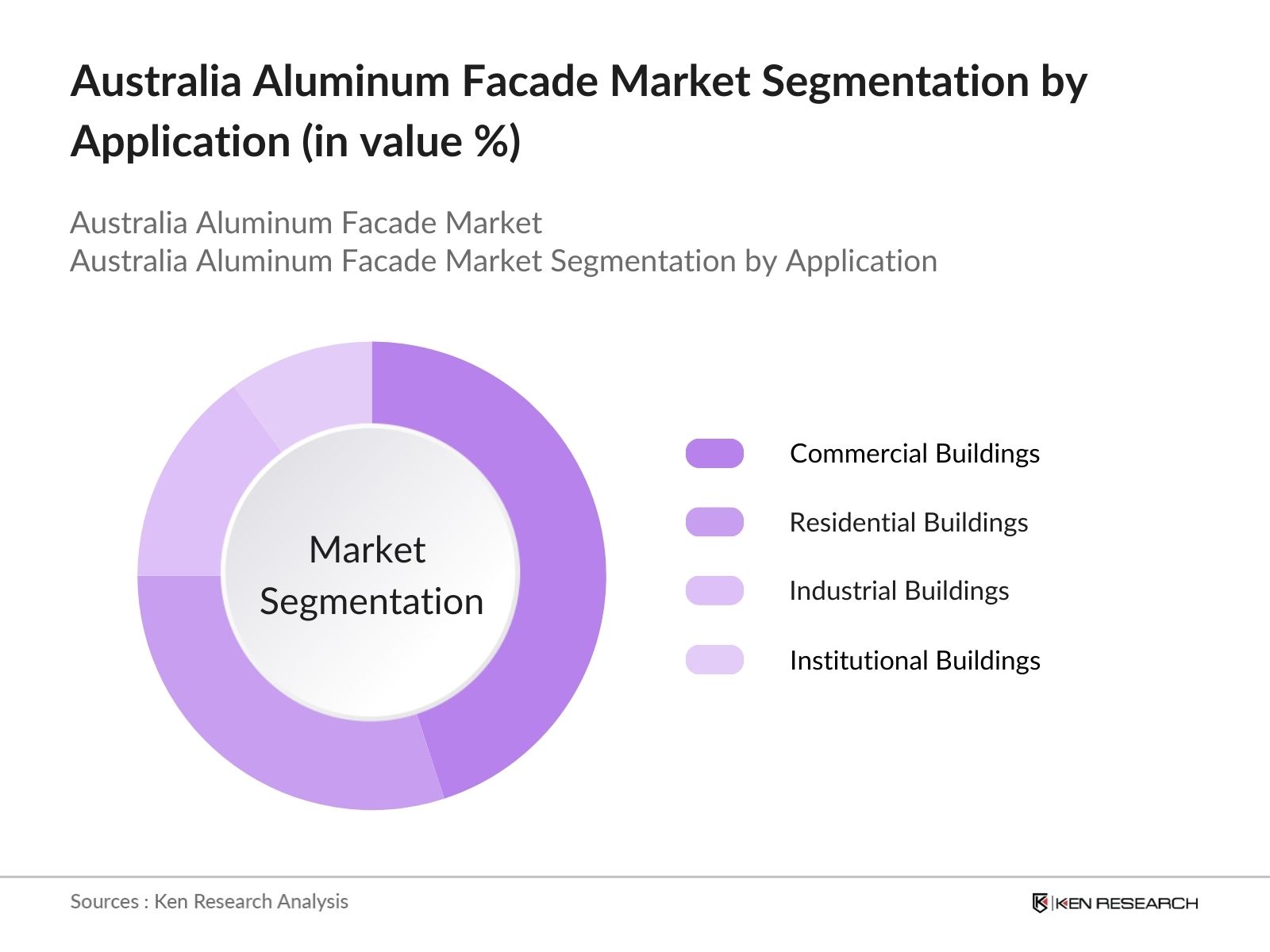

- By Application: The market is further segmented by application into commercial buildings, residential buildings, industrial buildings, and institutional buildings. Among these, commercial buildings have the largest market share, driven by extensive urban development and the need for aesthetically pleasing yet functional facade solutions in high-rise offices and retail complexes.

Australia Aluminum Facade Market Competitive Landscape

The Australia Aluminum Facade Market is dominated by several key players, both local and global, which highlights the competitive landscape within this market. The consolidation of these companies underscores their market influence through innovation, extensive product portfolios, and robust supply chains.

Australia Aluminum Facade Industry Analysis

Growth Drivers

- Urbanization and Infrastructure Development: Australia has seen substantial urbanization, with approximately 90% of its population residing in urban areas as of 2023. The Australian government allocated $120 billion in 2022 for infrastructure projects over the next decade, fueling demand for advanced building materials, including aluminum facades, which are valued for their durability and versatility. Urban areas like Sydney and Melbourne lead in new construction projects, intensifying the need for resilient facade solutions. Additionally, regional governments have increased spending on mixed-use urban developments, amplifying the potential for aluminum facades in modern urban infrastructure.

- Advancements in Aluminum Facade Technologies: Technological innovations in aluminum facades, such as pre-assembled modules and energy-efficient finishes, are transforming the construction sector in Australia. In 2024, new building regulations introduced mandates on facade performance, promoting tech-driven materials that provide insulation and reduce energy consumption. The Department of Industry, Science, Energy and Resources estimates a 20% improvement in energy efficiency in new facade installations due to these advancements. This shift aligns with Australias goal of achieving net-zero emissions by 2050, boosting demand for innovative facade systems that meet regulatory standards.

- Emphasis on Energy Efficiency and Sustainability: Australia has prioritized energy efficiency, aligning with the Paris Agreement, aiming to reduce building emissions by up to 43% by 2030. Aluminum facades, known for their sustainability and recyclability, fit within this framework. According to Clean Energy Australia, implementing energy-efficient facades can lower a building's energy consumption by up to 30%, creating significant energy savings. Government incentives, including tax breaks for sustainable building materials, have further bolstered this market, attracting environmentally-conscious builders toward aluminum facades.

Market Challenges

- High Initial Investment Costs: Aluminum facade systems involve higher initial costs than traditional materials, a challenge for widespread adoption. The Australian construction sector has recorded a 15% increase in aluminum costs due to global supply chain disruptions. Moreover, facade installation requires skilled labor and precise engineering, adding to project costs. This challenge is evident in residential projects, where developers often opt for less costly materials. However, large-scale commercial projects are more likely to absorb these expenses for long-term benefits.

Fluctuations in Aluminum Prices: Aluminum prices have shown volatility due to factors like supply chain issues and global demand fluctuations, with a 10% increase in price observed over the last year, according to the World Banks 2023 commodities report. Such price instability impacts construction costs, making budgeting challenging for facade projects. The Australian construction industry has been particularly affected, leading to potential delays in projects dependent on aluminum facade materials, which could hinder market growth unless more stable pricing emerges.

Australia Aluminum Facade Market Future Outlook

Over the next several years, the Australia Aluminum Facade Market is anticipated to experience substantial growth. This outlook is driven by factors such as government incentives for sustainable building materials, advances in facade technology, and a heightened awareness of environmental impact in construction. The ongoing urban expansion, particularly in Australias major cities, will likely sustain the demand for durable and energy-efficient aluminum facade systems.

Market Opportunities

- Technological Innovations in Facade Systems: Australia's focus on high-performance building materials opens opportunities for advanced facade systems with embedded energy-efficient features. In 2023, Australias Smart Cities Program allocated $50 million toward innovations in building technology, including facade systems that can interact with smart building management systems. This move supports the integration of responsive facades that adjust to environmental conditions, enhancing energy efficiency and aligning with Australias carbon reduction targets.

- Expansion into Emerging Urban Areas: As Australias urban population continues to grow, cities beyond Sydney and Melbourne, such as Brisbane and Perth, are expanding rapidly, creating demand for modern construction materials. The governments Regional Growth Fund, which allocated $272 million in 2023 for infrastructure development in emerging cities, supports aluminum facade adoption for new builds that prioritize sustainable, energy-efficient materials. This shift toward urban expansion offers growth potential in regions previously underserved by high-performance facade solutions.

Scope of the Report

|

Ventilated Facades Non-Ventilated Facades |

|

|

By Material |

Aluminum Composite Panels |

|

By Application |

Commercial Buildings |

|

By Installation Type |

New Construction |

|

By Region |

North East West South |

Products

Key Target Audience

Aluminum Facade Manufacturers

Building and Construction Companies

Architects and Design Studios

Real Estate Developers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Building Code of Australia, Australian Building and Construction Commission)

Energy Efficiency Organizations

Facade Installation and Maintenance Service Providers

Companies

Major Players in the Market

Alucobond Australia

Fairview Architectural

Ullrich Aluminium

Alspec

Hunter Douglas

Kingspan Insulated Panels

BlueScope Steel Limited

Capral Aluminium

CSR Limited

JWI Aluminum

G.James Glass & Aluminium

Viridian Glass

Austral Wright Metals

Locker Group

Revolution Roofing

Table of Contents

1. Australia Aluminum Facade Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Australia Aluminum Facade Market Size (In AUD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Australia Aluminum Facade Market Analysis

3.1 Growth Drivers

3.1.1 Urbanization and Infrastructure Development

3.1.2 Advancements in Aluminum Facade Technologies

3.1.3 Emphasis on Energy Efficiency and Sustainability

3.1.4 Government Initiatives and Regulations

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Fluctuations in Aluminum Prices

3.2.3 Technical Challenges in Installation and Maintenance

3.3 Opportunities

3.3.1 Technological Innovations in Facade Systems

3.3.2 Expansion into Emerging Urban Areas

3.3.3 Integration with Smart Building Technologies

3.4 Trends

3.4.1 Adoption of Modular Facade Systems

3.4.2 Use of Recyclable and Eco-Friendly Materials

3.4.3 Increased Demand for Customizable Facade Designs

3.5 Government Regulations

3.5.1 Building Code of Australia (BCA) Compliance

3.5.2 Energy Efficiency Standards

3.5.3 Fire Safety Regulations

3.5.4 Environmental Sustainability Guidelines

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Australia Aluminum Facade Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Ventilated Facades

4.1.2 Non-Ventilated Facades

4.1.3 Others

4.2 By Material (In Value %)

4.2.1 Aluminum Composite Panels

4.2.2 Solid Aluminum Panels

4.2.3 Aluminum Mesh Panels

4.2.4 Others

4.3 By Application (In Value %)

4.3.1 Commercial Buildings

4.3.2 Residential Buildings

4.3.3 Industrial Buildings

4.3.4 Institutional Buildings

4.4 By Installation Type (In Value %)

4.4.1 New Construction

4.4.2 Renovation and Retrofit

4.5 By Region (In Value %)

4.5.1 New South Wales

4.5.2 Victoria

4.5.3 Queensland

4.5.4 Western Australia

4.5.5 South Australia

4.5.6 Tasmania

4.5.7 Australian Capital Territory

4.5.8 Northern Territory

6. Australia Aluminum Facade Market Competitive Analysis

6.1 Detailed Profiles of Major Companies

6.1.1 Alucobond Australia

6.1.2 Fairview Architectural

6.1.3 Ullrich Aluminium

6.1.4 Alspec

6.1.5 JWI Aluminum

6.1.6 Hunter Douglas

6.1.7 Kingspan Insulated Panels

6.1.8 BlueScope Steel Limited

6.1.9 CSR Limited

6.1.10 Capral Aluminium

6.1.11 G.James Glass & Aluminium

6.1.12 Viridian Glass

6.1.13 Austral Wright Metals

6.1.14 Locker Group

6.1.15 Revolution Roofing

6.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Regional Presence, Strategic Initiatives)

6.3 Market Share Analysis

6.4 Strategic Initiatives

6.5 Mergers and Acquisitions

6.6 Investment Analysis

6.7 Venture Capital Funding

6.8 Government Grants

6.9 Private Equity Investments

7. Australia Aluminum Facade Market Regulatory Framework

7.1 Building Code of Australia (BCA) Standards

7.2 Compliance Requirements

7.3 Certification Processes

8. Australia Aluminum Facade Future Market Size (In AUD Billion)

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. Australia Aluminum Facade Future Market Segmentation

9.1 By Product Type (In Value %)

9.2 By Material (In Value %)

9.3 By Application (In Value %)

9.4 By Installation Type (In Value %)

9.5 By Region (In Value %)

10. Australia Aluminum Facade Market Analysts Recommendations

10.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the major stakeholders within the Australia Aluminum Facade Market. This stage entails comprehensive desk research using trusted secondary and proprietary databases to map market influencers, focusing on sustainable construction and facade innovations.

Step 2: Market Analysis and Data Collection

This step incorporates collecting historical data on aluminum facade demand, application distribution, and regional uptake. By evaluating market penetration and facade adoption trends, this phase ensures the accuracy and relevance of revenue estimates for the market.

Step 3: Hypothesis Validation and Industry Consultation

Market hypotheses are formulated based on the data collected and validated through expert interviews with aluminum facade manufacturers and construction industry specialists. This process gathers insights on operational trends and market challenges from industry practitioners.

Step 4: Final Data Synthesis and Reporting

The final phase involves integrating findings from multiple data sources to develop a cohesive market report. This includes direct engagement with facade solution providers to refine segmentation and validate the analysis, ensuring a comprehensive view of the Australia Aluminum Facade Market.

Frequently Asked Questions

01. How big is the Australia Aluminum Facade Market?

The Australia Aluminum Facade Market was valued at approximately USD 612 million, largely propelled by urban development projects and a focus on sustainability within the construction sector.

02. What are the key challenges in the Australia Aluminum Facade Market?

Challenges include in Australia Aluminum Facade Market are fluctuating aluminum prices, high initial costs associated with facade installations, and the need for skilled installation professionals to maintain technical standards in large projects.

03. Who are the major players in the Australia Aluminum Facade Market?

Key players in Australia Aluminum Facade Market include Alucobond Australia, Fairview Architectural, Ullrich Aluminium, Alspec, and Hunter Douglas, with these companies leveraging product innovation and strong distribution networks.

04. What drives growth in the Australia Aluminum Facade Market?

Australia Aluminum Facade Market Growth is driven by urban expansion, government incentives for sustainable materials, and advances in facade technologies that support energy efficiency in construction.

05. What are the primary applications of aluminum facades in Australia?

Aluminum facades are primarily used in commercial and residential buildings, with a growing presence in industrial and institutional buildings due to their durability and design flexibility.

06. Are there environmental benefits associated with aluminum facades?

Yes, aluminum facades contribute to sustainable construction by providing energy-efficient insulation and enabling the use of recyclable materials, aligning with environmental goals in Australia.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.