Australia Corporate Training Market Outlook to 2028

Driven by technological advancements, changing workforce needs, and demand for soft skills

Region:Asia

Author(s):Smridhi and Faqiha

Product Code:KR1454

October 2024

37

About the Report

Australia Corporate Training Market Overview

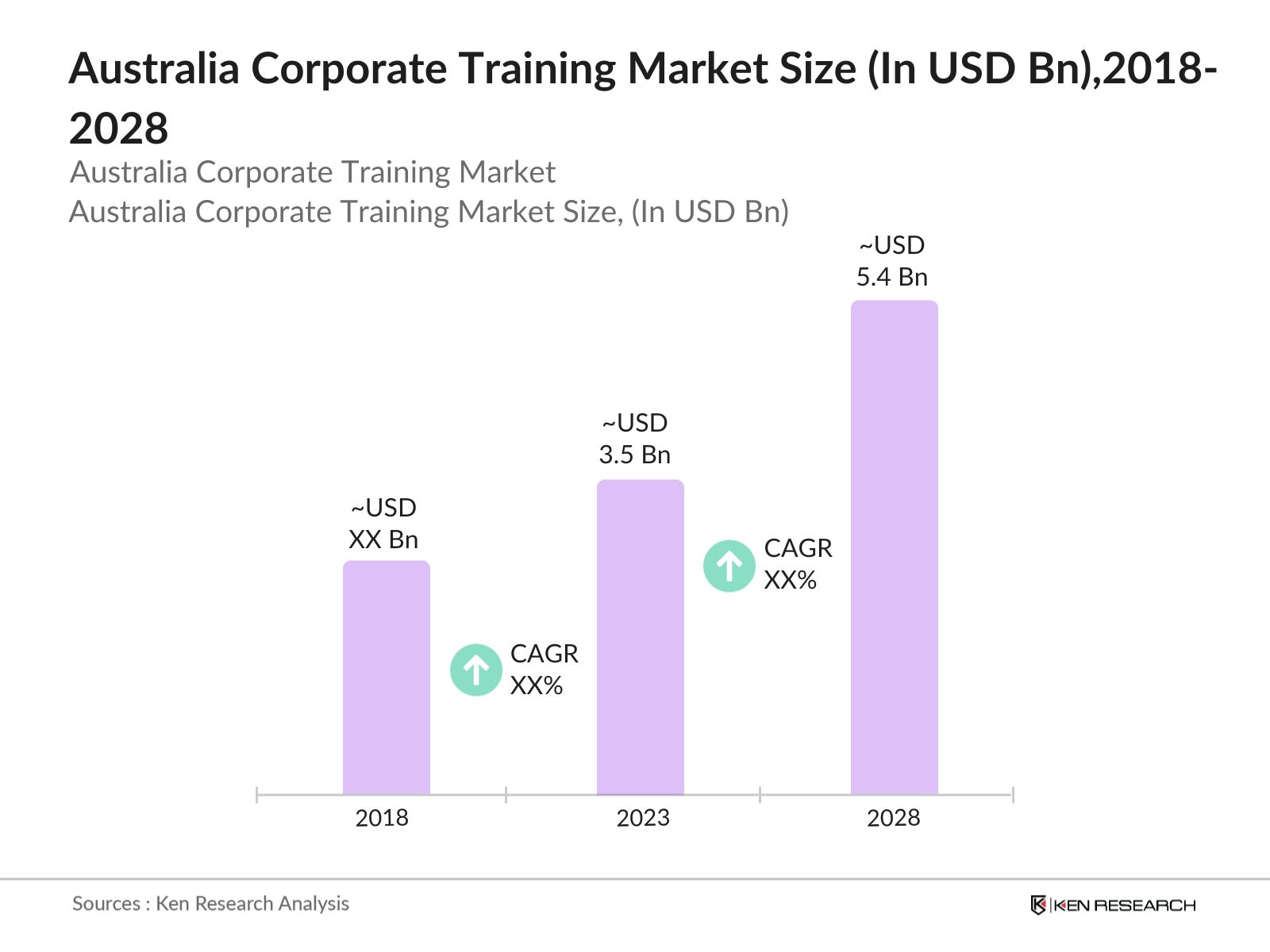

- The Australia Corporate Training Market was valued at USD 3.5 billion in 2023, driven by the increasing demand for cost-effective e-learning training solutions and the emergence of IoT along with supportive government initiatives. The growth is driven by the increasing adoption of digital learning platforms, the need for upskilling due to technological advancements, and the rising demand for customized training programs tailored to specific industries.

- The Australian corporate training landscape is dominated by major players such as Dale Carnegie Training, Skillsoft, Australian Institute of Management (AIM), BSI Learning and Franklin Covey. These companies offer a wide range of training solutions, from leadership development to compliance training, catering to various industries across the country.

- In 2023, Skillsoft announced a strategic partnership with Microsoft to integrate their learning platform with Microsoft Teams, enabling seamless access to training modules within the workplace. This integration aims to enhance employee engagement in training programs by making learning resources more accessible, a move that is expected to drive further growth in the market.

- Sydney dominates the Australia Corporate Training Market in 2023. This dominance is due to the high concentration of corporate headquarters and large businesses in Sydney, coupled with the city's status as a major financial hub in the Asia-Pacific region. The demand for leadership and compliance training in this region is particularly high, driving the market growth.

Australia Corporate Training Market Segmentation

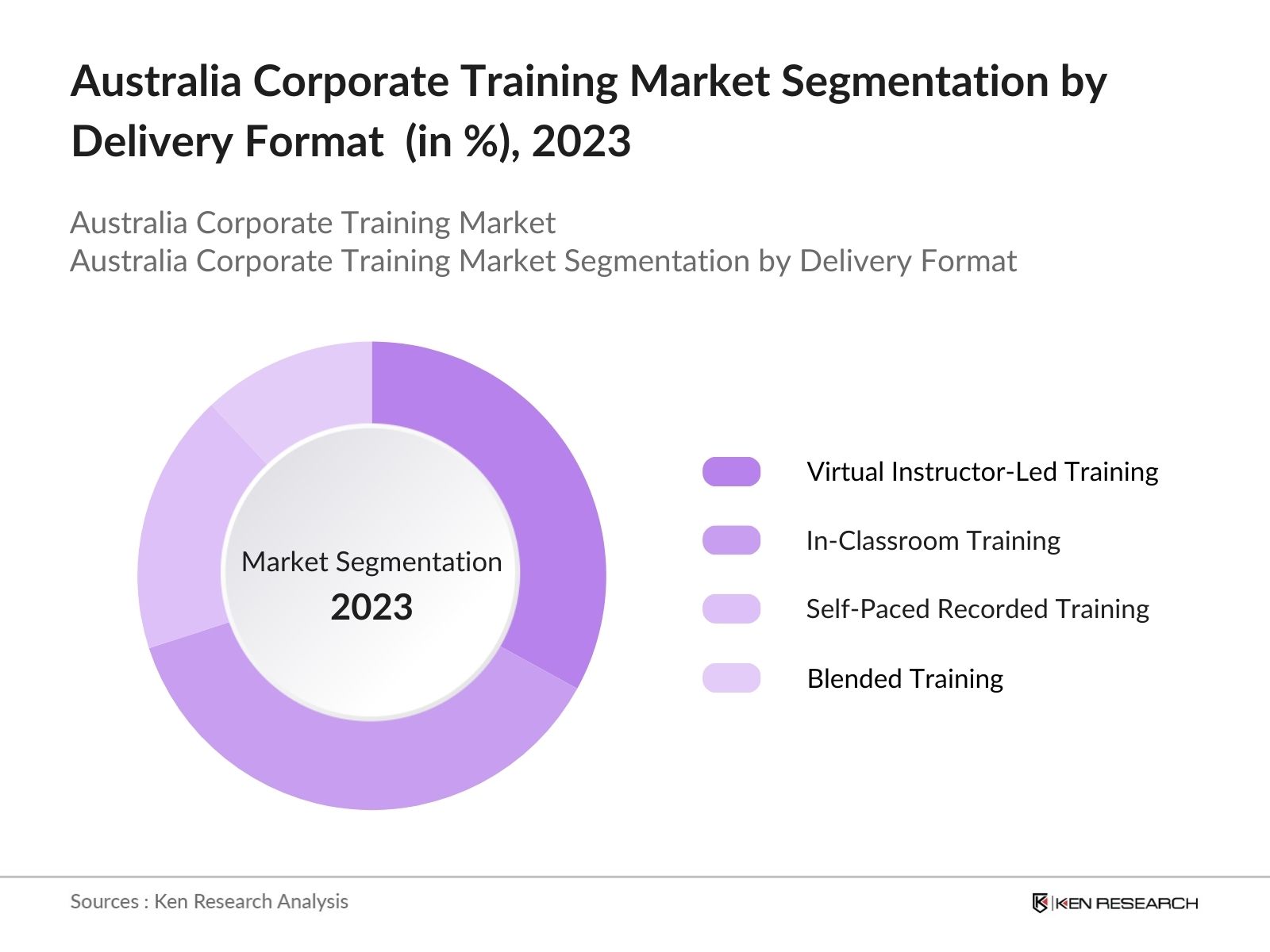

By Delivery Format: The Australia corporate training market is segmented by delivery format into virtual Instructor-led Training, In-classroom Training, Self-Paced Recorded Training. Virtual Instructor-Led Training (VILT) has gained prominence due to its flexibility, real-time engagement, and ability to cater to the remote work trend, making it a popular choice for organizations across various sectors.

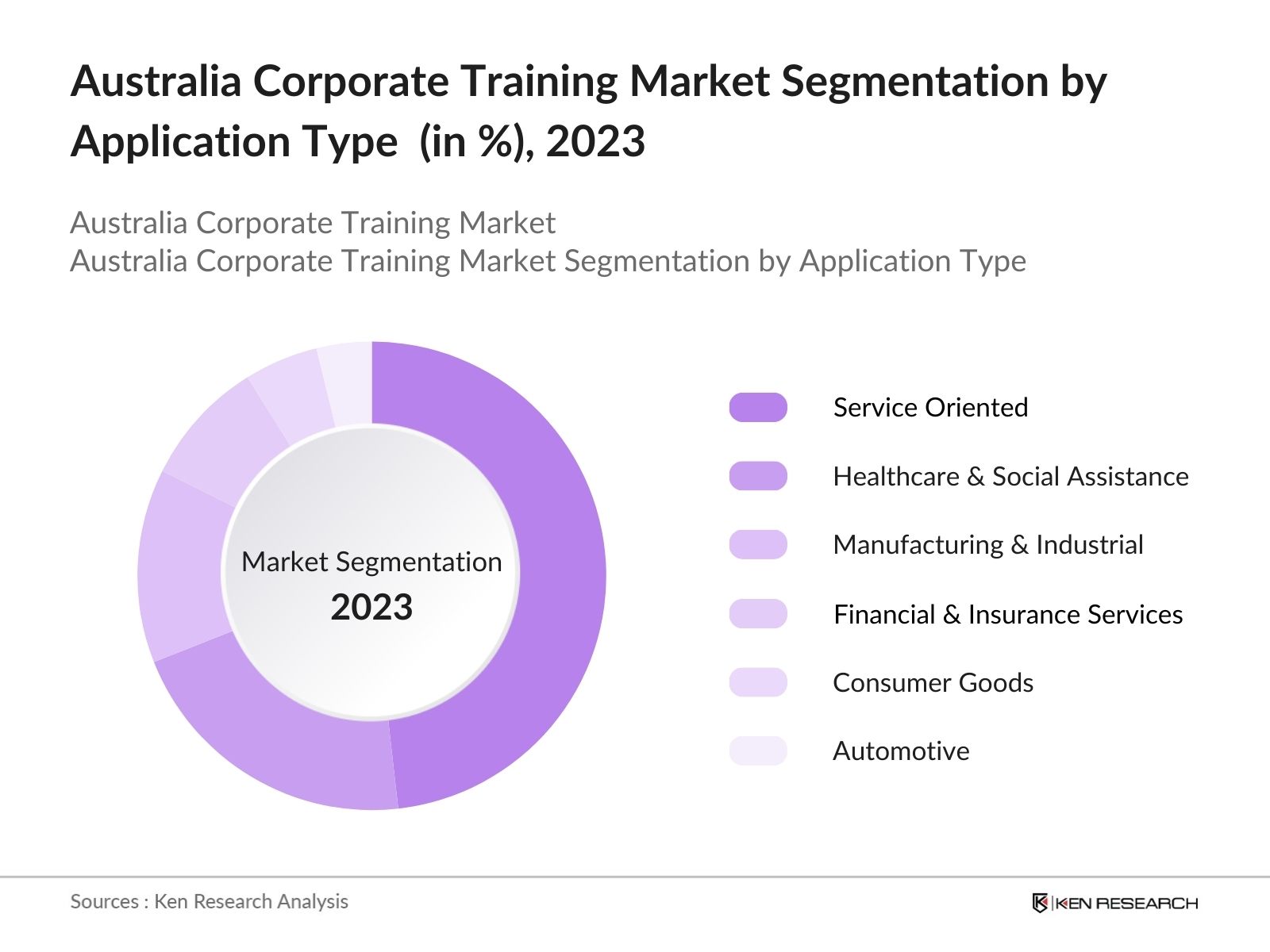

By Application Type: The Australia corporate training market is segmented by application type into service oriented, healthcare & social assistance, manufacturing & industrial, financial & insurance services, consumer goods and automotive. The service-oriented segment dominates the market due to the increasing demand for customer service excellence and interpersonal skills training, which are critical in service-driven industries.

By Region: The Australia corporate training market is segmented by region into New South Wales, Queensland, Victoria, South Australia, Western Australia and others. New South Wales leads the market due to its status as a major economic hub with a diverse industry base, driving a significant demand for corporate training programs.

Australia Corporate Training Market Competitive Analysis

|

Company Name |

Establishment Year |

Headquarters Location |

|

Maximus |

2001 |

Sydney, NSW |

|

The Dream Collective |

2012 |

Sydney, NSW |

|

Grey Matta Solutions |

2028 |

Spring Hill, QLD |

|

WeTrain |

2010 |

Melbourne, VIC |

|

Wizard Corporate Training |

1992 |

Sydney, NSW |

- The Dream Collective: By partnering with Sonder, The Dream Collective emphasizes a holistic approach to leadership and corporate training. This partnership enables the development of programs that not only enhance professional skills but also prioritize mental health and emotional resilience, aligning with modern workplace needs for comprehensive employee care.

- Maximus: In line with the growing demand for digitalization in corporate training, Maximus has begun integrating advanced digital learning technologies into its programs. Launched in September 2023, the EDP is a cornerstone initiative for senior leaders. It offers a personalized learning experience that combines in-person and virtual training elements, along with developmental tools such as personalized learning plans and professional coaching.

Australia Corporate Training Industry Analysis

Australia Corporate Training Market Growth Drivers

- Increasing Flexibility by Introduction of E-Learning: With the integration of geo-fencing, training materials can be distributed to employees instantly. This is particularly beneficial for companies utilizing a hub and spoke office model, allowing for immediate and tailored training delivery across diverse locations.

- Micro-learning Increasing Efficiency: Bite-sized training courses that are rich in content allow employees to enhance their skills without disrupting their work schedules. This approach maximizes productivity by enabling ongoing learning in short, manageable sessions.

- Shift Towards Experimental Training: The adoption of experimental training methods, including simulations, sensitivity training, and case studies, is gaining traction. These methods are proven to improve focus and deliver better results, motivating other organizations to incorporate similar training strategies.

Australia Corporate Training Market Challenges

- Resistance to Change Among Traditional Industries: Certain traditional industries in Australia, such as manufacturing and construction, have shown resistance to adopting new training methodologies, particularly digital and experimental training approaches. This resistance is expected to persist in 2024, posing a challenge for training providers looking to introduce innovative solutions in these industries.

- Resistance to Change Among Traditional Industries: Certain traditional industries in Australia, such as manufacturing and construction, have shown resistance to adopting new training methodologies, particularly digital and experimental training approaches. In 2023, approximately 800 companies in manufacturing and construction sectors reported reluctance among their workforce to embrace new training formats, citing concerns over the effectiveness and relevance of these methods.

Australia Corporate Training Market Government Initiatives

- Vocational Education and Training (VET) Reform: There is an Increased fundingfor 180,000 Fee-Free TAFE and vocational education places in 2023, with a further 300,000 places to be made fee-free from January 2024 under the 5-year National Skills Agreement. Establishmentof the independent Training Package Assurance function to ensure training products meet national standards and drive continuous improvement.

- Future Skills Initiative: In 2023, the Australian government launched the "Future Skills" initiative, allocating AUD 500 million to subsidize corporate training programs focused on emerging technologies and critical skills. This initiative is aimed at bridging the skills gap in sectors such as technology and healthcare. In 2024, it is anticipated that the initiative will support over 1,000 companies in accessing affordable training solutions.

Australia Corporate Training Market Future Outlook

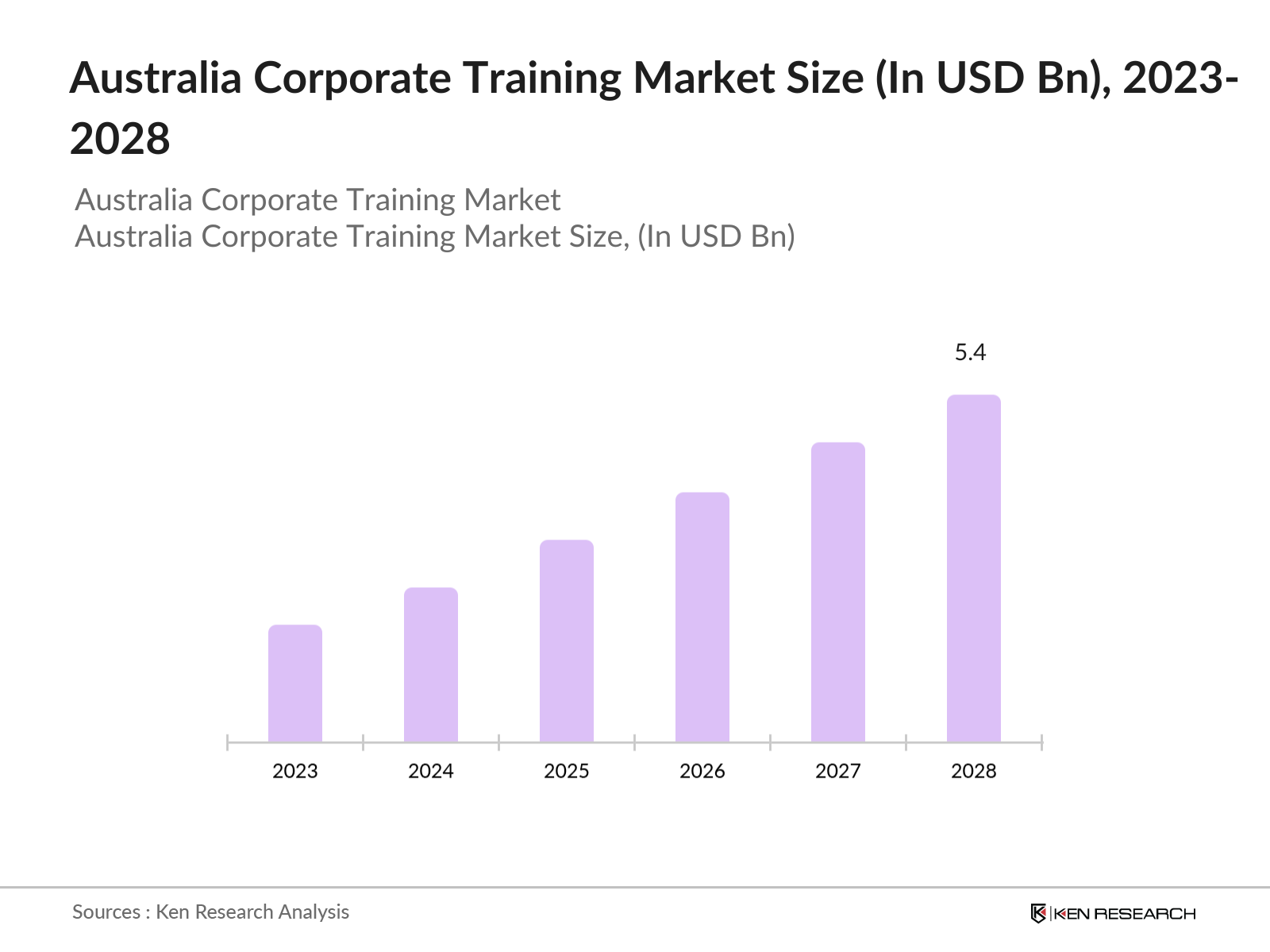

The Australia corporate training market is valued at 5.4 billion by 2028. The future of the market will be shaped by advancements in AI-driven personalized learning, the rise of hybrid work environments, and the growing importance of soft skills training to complement technical knowledge.

Future Trends

- Increased Adoption of AI-Driven Personalized Learning: Over the next five years, AI-driven personalized learning solutions are expected to gain significant traction in the Australia Corporate Training Market. These systems will analyze individual learning behaviors and performance data to customize training content, thereby enhancing learning outcomes, particularly in sectors like IT, finance, and healthcare, where continuous upskilling is critical.

- Expansion of Micro-Learning Modules for Continuous Skill Development: Micro-learning, which delivers training content in short, focused bursts, will become increasingly popular in the corporate training landscape. This format is especially suited for a workforce that is time-constrained but needs to stay updated with the latest industry trends and skills, particularly in fast-paced industries like technology, finance, and retail, where rapid skill acquisition is essential.

Scope of the Report

|

By Delivery Format |

Virtual Instructor led Training In Classroom Training Self-Paced Recorded Training Blended Training |

|

By Application Type |

Service Oriented Healthcare & Social Assistance Financial & Insurance Services Consumer Goods Automotive |

|

By Region |

New South Wales Queensland Victoria South Australia Western Australia |

Products

Key Target Audience:

Corporate HR Departments

Banks and Financial Institutions

Government Agencies (Australian Skills Quality Authority)

Multinational Corporations

Public Sector Organizations

Non-Governmental Organizations (NGOs)

Technology Firms

Healthcare Providers

Retail Chains

Professional Services Firms

Manufacturing Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Dale Carnegie Training

Skillsoft

Australian Institute of Management (AIM)

BSI Learning

FranklinCovey

LinkedIn Learning

MCI Solutions

Learning Seat

PD Training

The Learning Factor

Corporate Edge

Leadership Management Australia (LMA)

Open Learning

GO1

The Training Room Online

Table of Contents

1. Executive Summary

1.1 Executive Summary Australia Corporate Training Market

2. Market Overview

2.1 Australia Corporate Training Market Overview

2.2 Supply and Demand Side Ecosystem of Australia Corporate Training Market, 2022

2.3 Timeline of Corporate Training in Australia

3. Australia Corporate Training Market Sizing Analysis and Segmentations, 2018-2023

3.1 Market Landscape of Australia Corporate Training Market

3.2 Share of In-House and Outsource Corporate Training in Australia

3.3 Market Sizing of Australia Corporate Training Market, 2018 - 2023

3.4 Australia Corporate Training Market (Outsourced) Segmentation by Delivery Format, 2018-2023

3.5 Australia Corporate Training Market (In-House) Segmentation by Delivery Format, 2018-2023

3.6 Cross Comparison of Different Delivery Formats in Australia Corporate Training Market

3.7 Australia Corporate Training Market (Outsourced) Segmentation by Application Types, 2018-2023

3.8 Cross Comparison of Different Application Types in Australia Corporate Training Market

3.9 Australia Corporate Training Market (Outsourced) Segmentation by Regions, 208-2023

3.10 Cross Comparison of Different Regions in Australia Corporate Training Market

4. Future Outlook of Australia Corporate Training Market, 2023-2028

4.1 Market Sizing of Australia Corporate Training Market, 2023-2028

4.2 Australia Corporate Training Market (Outsourced) Segmentation by Delivery Format, 2023-2028

4.3 Australia Corporate Training Market (In-House) Segmentation by Delivery Format, 2023-2028

4.4 Australia Corporate Training Market (Outsourced) Segmentation by Application Types, 2023-2028

4.5 Australia Corporate Training Market (Outsourced) Segmentation by Regions, 2023-2028

5. Research Methodology

5.1 Market Definitions and Assumptions

5.2 Abbreviations

5.3 Market Sizing Approach

5.4 Consolidated Research Approach

5.5 Sample Size Inclusion

5.6 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Market Definitions and Assumptions:

The research defines the Australia Corporate Training Market, encompassing revenue from various training methods, including in-house and outsourced corporate training. It also specifies the inclusion of both white-collar and blue-collar job training, ensuring a comprehensive overview of the market dynamics.

Step 2: Abbreviations and Data Conversion:

Essential abbreviations and conversion rates are outlined to maintain consistency and clarity throughout the report. This includes currency conversion rates and key terms like CAGR, VILT, and more, facilitating accurate financial analysis and understanding of market trends.

Step 3: Market Sizing Approach:

A bottom-to-top approach is utilized, gathering data from industry experts and company interviews to estimate market size. This involves calculating revenue streams, the number of trainings, and the value of courses, ensuring a detailed assessment of the market landscape and future growth projections.

Step 4: Consolidated Research Approach:

A blend of primary and secondary research methods is employed. Primary research includes telephonic interviews with industry professionals, while secondary research draws on company reports, government publications, and online articles. This dual approach ensures a comprehensive and validated dataset.

Step 5: Sample Size Inclusion:

The report includes a varied sample size of respondents from different industry roles, such as Directors, Zonal Heads, and Operations Managers, to ensure diverse perspectives. Each interview is structured with a mix of subjective and objective questions to gather in-depth insights.

Frequently Asked Questions

01 How big is Australia Corporate Training Market?

The Australia corporate training market, valued at USD 3.5 billion in 2023, is driven by the increasing adoption of digital learning platforms, the rise of customized training programs, and the growing demand for leadership development initiatives.

02 What are the challenges in Australia Corporate Training Market?

Challenges include the high cost of developing customized training programs, limited access to digital infrastructure in remote areas, a talent shortage in training and development, and resistance to change among traditional industries.

03 Who are the major players in the Australia Corporate Training Market?

Key players in the market include Dale Carnegie Training, Skillsoft, Australian Institute of Management (AIM), BSI Learning, and Franklin Covey. These companies lead the market due to their wide range of training solutions, strong brand presence, and innovative approaches.

04 What are the growth drivers of Australia Corporate Training Market?

The market is driven by the growing demand for digital learning solutions, the expansion of customized training programs, increased investment in leadership development, and the rise of compliance training due to regulatory pressures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.