Region:Asia

Author(s):Geetanshi

Product Code:KRAB4578

Pages:94

Published On:October 2025

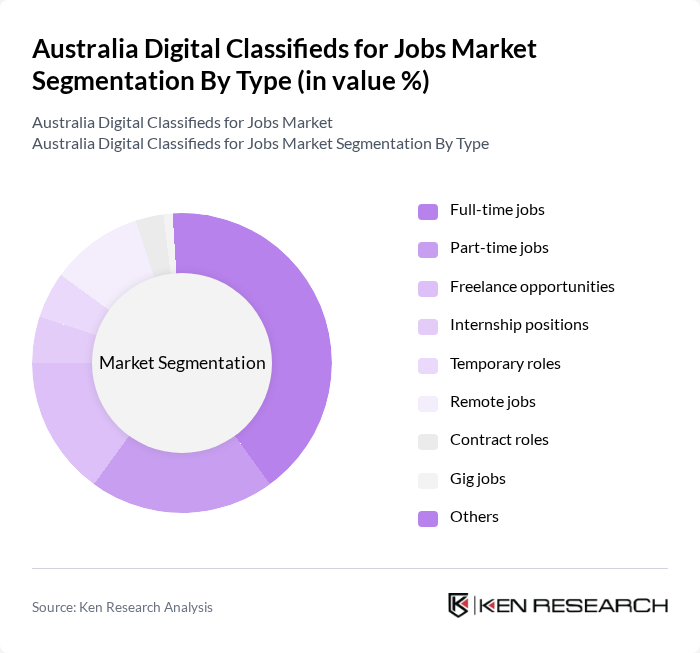

By Type:The market is segmented into various job types, including full-time jobs, part-time jobs, freelance opportunities, internship positions, temporary roles, remote jobs, contract roles, gig jobs, and others. Among these, full-time jobs dominate the market due to the stability and benefits they offer, appealing to a significant portion of job seekers. The trend towards remote work has become the new norm, with hybrid or fully remote digital roles now standard across the industry, leading to increased demand for flexible job types such as freelance and gig roles.

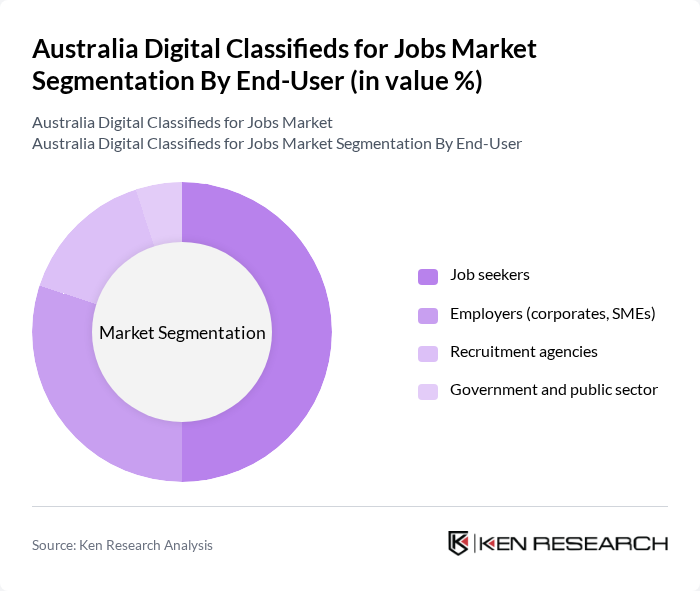

By End-User:The end-user segmentation includes job seekers, employers (corporates, SMEs), recruitment agencies, and government/public sector entities. Job seekers represent the largest segment, driven by the increasing number of individuals seeking employment through digital platforms. Employers are also significant players, as they leverage these platforms to attract talent efficiently and cost-effectively. The growing emphasis on digital transformation across all sectors has intensified demand for specialized digital talent, with companies investing heavily in performance marketing, AI automation, and customer experience roles.

The Australia Digital Classifieds for Jobs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seek Limited, Indeed Australia, Jora, Adzuna Australia, JobActive (Australian Government), LinkedIn Australia, CareerOne, Glassdoor Australia, Gumtree Jobs, FlexCareers, Talent.com Australia, Hired Australia, JobSeeker (Australian Government), GradConnection, EthicalJobs.com.au contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia digital classifieds for jobs market appears promising, driven by technological advancements and evolving workforce dynamics. As remote work continues to gain traction, platforms that adapt to these changes will likely thrive. Additionally, the integration of AI for personalized job matching is expected to enhance user experience significantly. Companies that prioritize user trust and data security will also be better positioned to capture market share, ensuring sustainable growth in this competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-time jobs Part-time jobs Freelance opportunities Internship positions Temporary roles Remote jobs Contract roles Gig jobs Others |

| By End-User | Job seekers Employers (corporates, SMEs) Recruitment agencies Government and public sector |

| By Industry | Information Technology Healthcare Education Retail Construction Finance Hospitality & Tourism Logistics & Transport Others |

| By Job Level | Entry-level Mid-level Senior-level Executive-level |

| By Recruitment Method | Direct applications Referrals Job fairs Online platforms Social media recruitment |

| By Geographic Focus | Urban areas Suburban areas Rural areas |

| By Pricing Model | Subscription-based Pay-per-click Pay-per-post Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate HR Departments | 100 | HR Managers, Talent Acquisition Specialists |

| Job Seekers Across Industries | 120 | Recent Graduates, Mid-Career Professionals |

| Recruitment Agencies | 80 | Agency Owners, Senior Recruiters |

| Industry Experts and Analysts | 50 | Labor Market Analysts, Economic Researchers |

| Digital Platform Providers | 60 | Product Managers, Marketing Directors |

The Australia Digital Classifieds for Jobs Market is valued at approximately USD 3.8 billion, reflecting significant growth driven by the increasing adoption of digital platforms for job searching and recruitment, as well as the rise of remote work and the gig economy.