Australia Electric Automation Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2632

November 2024

84

About the Report

Australia Electric Automation Market Overview

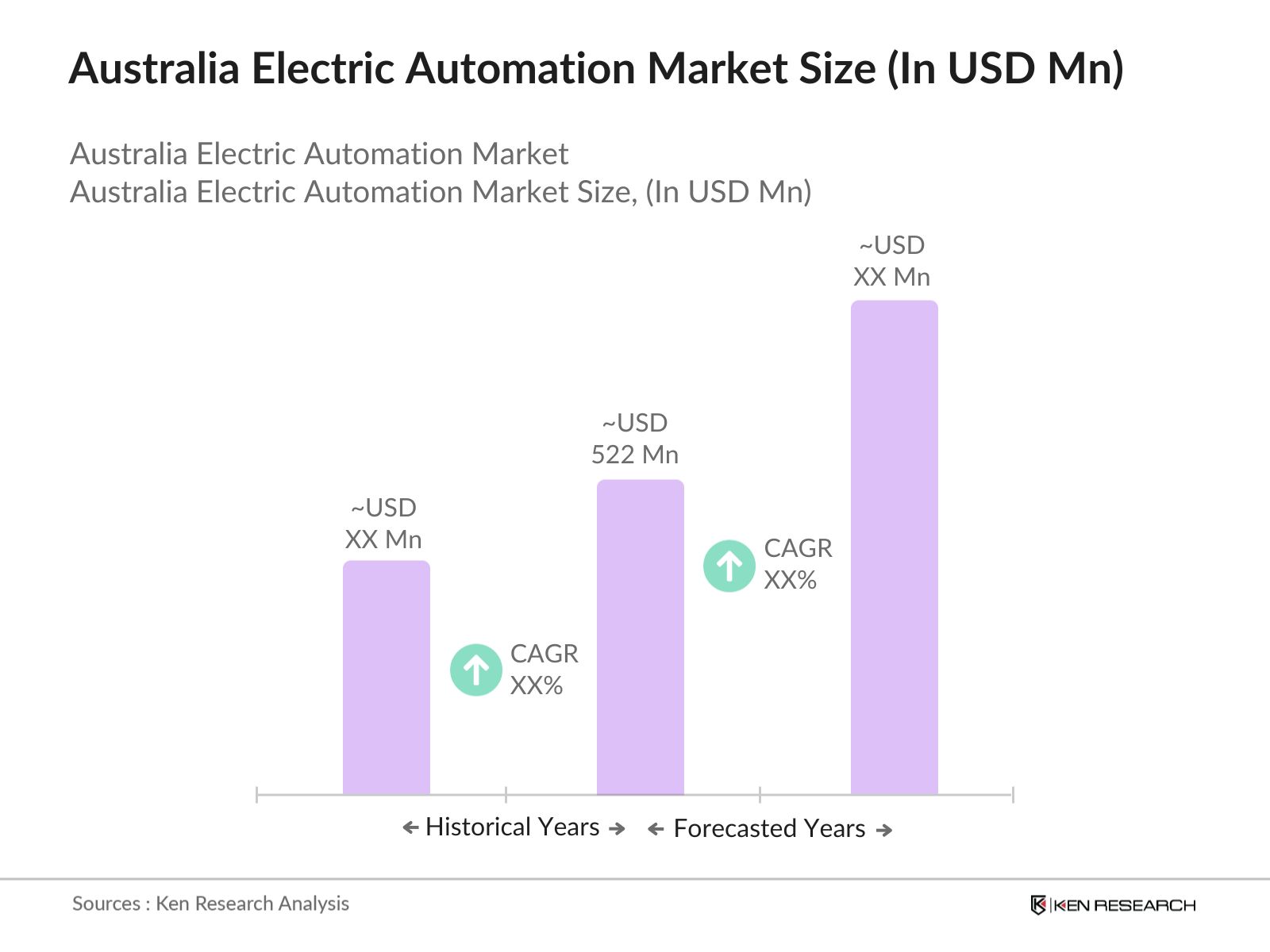

- The Australia Electric Automation Market is valued at USD 522 million, driven by rapid adoption across manufacturing sectors focused on enhancing productivity and efficiency. Increasing industrialization, government support for modernization, and rising demand for automated solutions in diverse industries have contributed to this growth. Data from the Australian Department of Industry highlights automation initiatives as a significant growth driver, particularly in energy and mining sectors.

- Key cities like Sydney and Melbourne dominate the electric automation market due to their robust industrial infrastructure, availability of skilled labor, and investment in technological innovation. Sydneys position as a financial and industrial hub, combined with Melbournes extensive manufacturing facilities, places them at the forefront of automation adoption, reflecting the concentration of advanced manufacturing and industrial operations in these regions.

- Australias manufacturing policy emphasizes increased automation adoption to enhance competitiveness. In 2023, the government allocated AUD 1 billion towards initiatives promoting automated solutions in manufacturing, highlighting the policys focus on modernizing industrial processes. The Department of Industry states that this policy has led to a 15% increase in automation adoption among mid-sized manufacturers, further reinforcing the role of government support in driving automation within the industry.

Australia Electric Automation Market Segmentation

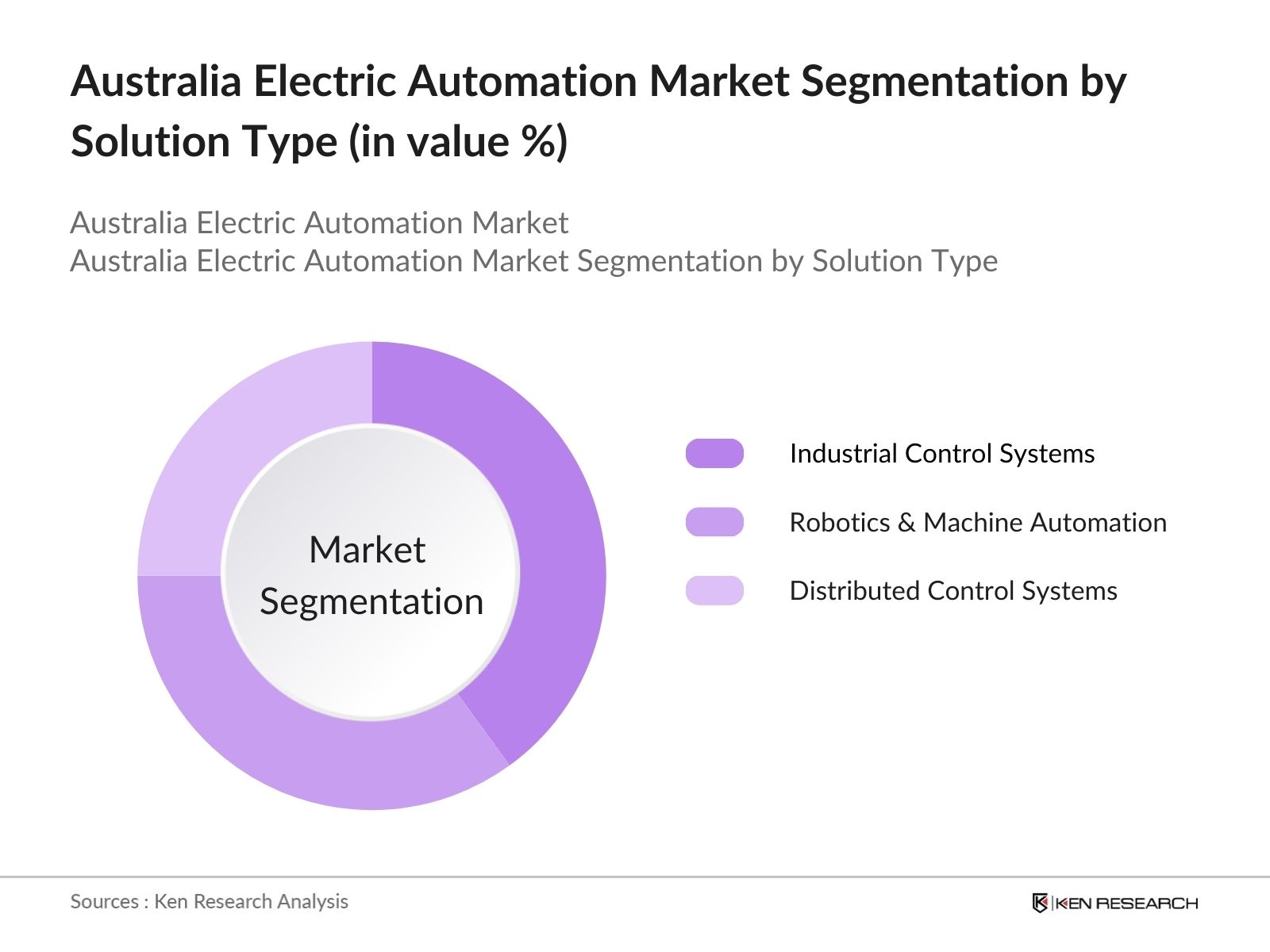

- By Solution Type: The market is segmented into Industrial Control Systems, Robotics & Machine Automation, and Distributed Control Systems. Industrial Control Systems hold a dominant market share within solution type due to their critical role in managing complex manufacturing processes across multiple sectors. The rise in automation for efficiency and precision, particularly in large-scale operations, has elevated demand for these systems, making them central to Australia's automation infrastructure.

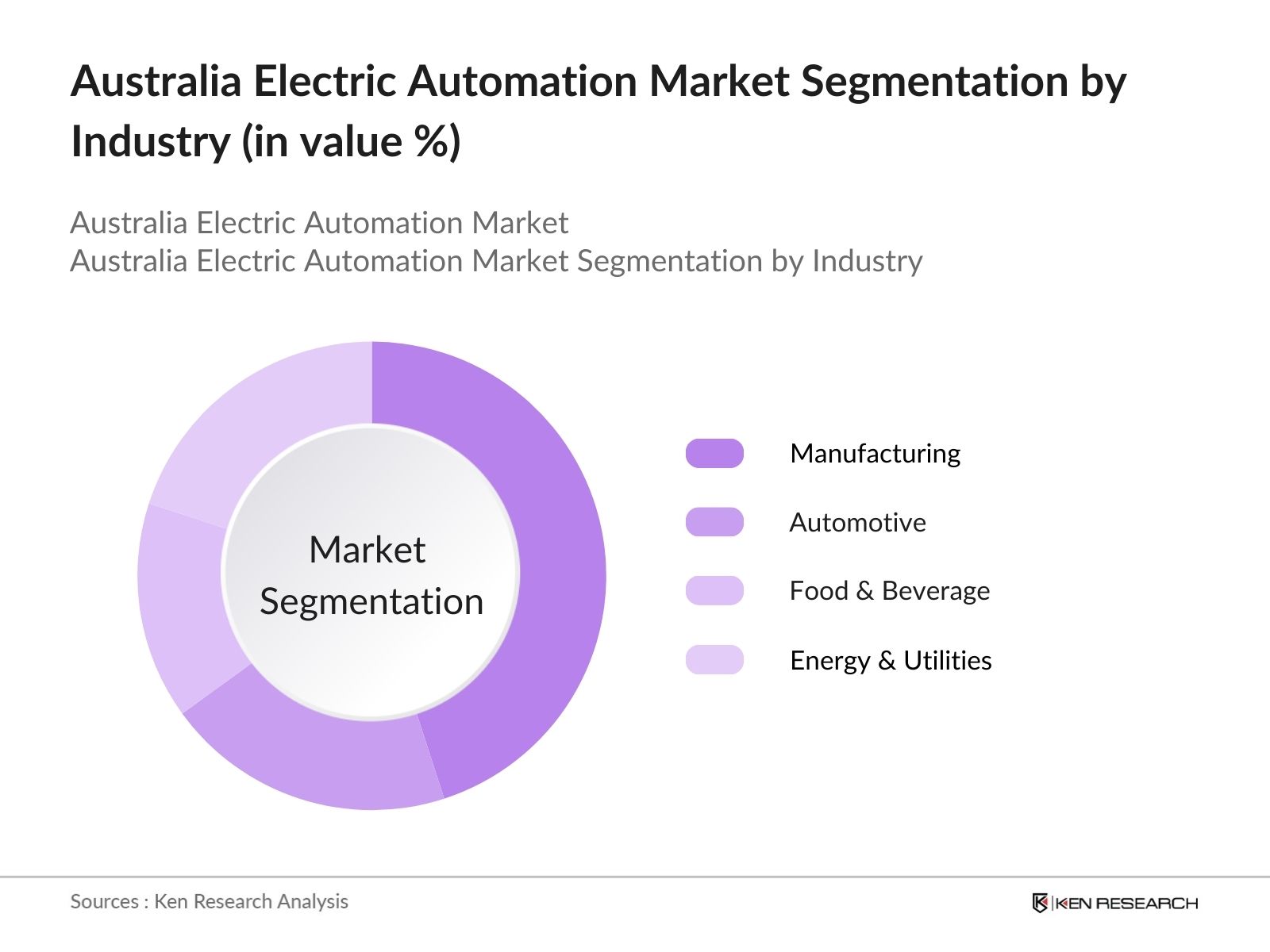

- By Industry: The industry segments include Manufacturing, Automotive, Food & Beverage, and Energy & Utilities. Manufacturing dominates due to high adoption of automated systems to enhance productivity and reduce operational costs. With investments from both private entities and government programs aimed at strengthening Australias manufacturing sector, automation within manufacturing remains at the core of market growth.

Australia Electric Automation Market Competitive Landscape

The Australia Electric Automation Market is led by a mix of multinational giants and strong local players, showcasing a consolidated market structure. Key companies such as Schneider Electric, Siemens Australia, and ABB have maintained market leadership through innovation, extensive product portfolios, and strong customer networks.

Australia Electric Automation Industry Analysis

Growth Drivers

- Industry 4.0 Adoption: Australias adoption of Industry 4.0 practices has been accelerated by strategic initiatives to increase automation, especially in manufacturing. According to the Australian Department of Industry, Science, Energy, and Resources, Industry 4.0 technologies were increasingly deployed across key industrial sectors, leading to enhanced productivity and output. In 2024, manufacturing accounts for approximately 6% of Australias GDP, valued at AUD 156 billion, with Industry 4.0 automation significantly boosting operational efficiency across this segment. Further, data from the Australian Bureau of Statistics highlights a 9% increase in automation-related investments by Australian manufacturers in 2023, underscoring the role of Industry 4.0 in driving automation uptake.

- Advanced Manufacturing: The rise of advanced manufacturing in Australia is further propelling the demand for electric automation solutions. Australian government reports show that advanced manufacturing contributed approximately AUD 90 billion to the national economy in 2023, with notable advancements in sectors like mining, defense, and healthcare. Data indicates a sharp 8% year-on-year increase in advanced manufacturing equipment imports in 20222023, reflecting a growing emphasis on automation-driven manufacturing systems. The increase in investment is bolstered by strong government support aimed at creating highly efficient, technology-driven production facilities that reduce dependency on labor-intensive operations.

- Government Investments (Manufacturing Modernization Fund): The Australian Governments Manufacturing Modernization Fund (MMF) allocated AUD 50 million in 2022 to support manufacturing businesses in integrating automation and digital technology. The MMF primarily aims to assist small and medium-sized enterprises in acquiring automation systems, thereby fostering broader industry adoption of electric automation. In 2023, MMF funding directly supported over 200 Australian firms, according to data from the Department of Industry, Science, Energy, and Resources, promoting a tech-driven manufacturing landscape. This investment contributes to reducing operational costs and promoting sustainable manufacturing practices in Australias key industrial sectors.

Market Challenges

- High Initial Capital Costs: Implementing electric automation in Australian industries comes with significant upfront costs. According to the Australian Bureau of Statistics, automation equipment imports required an average investment of AUD 30 million per major facility in 2023. Additionally, the Department of Industry highlights that about 40% of small and medium-sized enterprises in the manufacturing sector struggle with these high costs, which impacts their capacity to invest in automation. This challenge is exacerbated by the limited financing options available, hindering the widespread adoption of automation among smaller businesses.

- Skills Shortage (Workforce Adaptability): The demand for skilled automation technicians is outpacing supply, with the Department of Employment reporting a 12% increase in unfilled automation-related positions in 2023. This shortage is largely due to a lag in training programs relative to the rapid pace of automation adoption. Australias education sector has been expanding vocational training programs for automation, yet current statistics show a gap, as approximately 35% of automation roles remain unfilled, affecting industries reliant on these technologies for efficient operations.

Australia Electric Automation Market Future Outlook

Over the next five years, the Australia Electric Automation Market is expected to experience notable expansion due to continued government support for manufacturing innovation, increased adoption of Industry 4.0 technologies, and a shift toward energy-efficient solutions. Automation is set to become a crucial enabler for productivity, cost-effectiveness, and sustainability within Australia's primary industries.

Market Opportunities

- IoT and AI Integration: Australias automation sector stands to benefit from integrating IoT and AI into electric automation solutions. The Department of Industry, Science, Energy, and Resources estimates that IoT-enabled automation systems could reduce operational costs by up to AUD 20 million annually for large-scale facilities. In 2023, data showed that industries such as mining and agriculture increasingly adopted IoT-integrated automation systems to enhance productivity and streamline remote monitoring, creating substantial growth opportunities in the electric automation market.

- Cross-Sector Collaboration: The Australian government encourages collaboration across sectors to boost automation capabilities. In 2023, cross-sector partnerships accounted for AUD 500 million in collaborative projects focused on automation technologies in the manufacturing, agriculture, and resources sectors. This collaboration enables knowledge sharing and resource pooling, reducing the financial burden on individual sectors and accelerating the adoption of electric automation solutions. The impact is particularly visible in the mining sector, where such collaborations have contributed to reducing operational inefficiencies and expanding the automation ecosystem.

Scope of the Report

|

Industrial Control Systems Robotics & Machine Automation Distributed Control Systems |

|

|

By Industry |

Manufacturing Automotive Food and Beverage Energy & Utilities |

|

By Technology |

IoT-Enabled Automation AI-Powered Automation Machine Learning Algorithms |

|

By Component Type |

Sensors Controllers Actuators Drives |

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (Australian Department of Industry, Science, and Resources)

Manufacturing Companies

Energy and Utility Providers

Automotive Companies

Food & Beverage Manufacturers

Investment and Venture Capital Firms

Technology Solution Providers

Automation Equipment Distributors

Companies

Major Players in the Australia Electric Automation Market

Schneider Electric

Siemens Australia

ABB

Honeywell International

Rockwell Automation

Emerson Electric Co.

Bosch Rexroth

Mitsubishi Electric Australia

Yokogawa Electric Corporation

Beckhoff Automation

SICK AG

Endress+Hauser

NHP Electrical Engineering

Omron Corporation

Schneider Electric Australia

Table of Contents

1. Australia Electric Automation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Australia Electric Automation Market Size (In AUD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Australia Electric Automation Market Analysis

3.1. Growth Drivers

3.1.1. Industry 4.0 Adoption

3.1.2. Advanced Manufacturing

3.1.3. Government Investments (Manufacturing Modernization Fund)

3.1.4. Demand for Energy Efficiency

3.2. Market Challenges

3.2.1. High Initial Capital Costs

3.2.2. Skills Shortage (Workforce Adaptability)

3.2.3. Technology Integration Complexity

3.3. Opportunities

3.3.1. IoT and AI Integration

3.3.2. Cross-Sector Collaboration

3.3.3. SME Adoption

3.4. Trends

3.4.1. Increased Use of Robotics

3.4.2. Cloud-Based Automation Solutions

3.4.3. Real-Time Monitoring and Control

3.5. Government Regulations

3.5.1. Australian Manufacturing Policy

3.5.2. Automation and Cybersecurity Standards

3.5.3. Carbon Emission Reduction Targets

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Australia Electric Automation Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Industrial Control Systems

4.1.2. Robotics & Machine Automation

4.1.3. Distributed Control Systems

4.2. By Industry (In Value %)

4.2.1. Manufacturing

4.2.2. Automotive

4.2.3. Food and Beverage

4.2.4. Energy & Utilities

4.3. By Technology (In Value %)

4.3.1. IoT-Enabled Automation

4.3.2. AI-Powered Automation

4.3.3. Machine Learning Algorithms

4.4. By Component Type (In Value %)

4.4.1. Sensors

4.4.2. Controllers

4.4.3. Actuators

4.4.4. Drives

4.5. By Region (In Value %)

4.5.1. New South Wales

4.5.2. Victoria

4.5.3. Queensland

4.5.4. South Australia

4.5.5. Western Australia

5. Australia Electric Automation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Schneider Electric

5.1.2. Siemens Australia

5.1.3. ABB Australia

5.1.4. Rockwell Automation

5.1.5. Honeywell International Inc.

5.1.6. Emerson Electric Co.

5.1.7. Bosch Rexroth

5.1.8. Mitsubishi Electric Australia

5.1.9. Omron Corporation

5.1.10. Yokogawa Electric Corporation

5.1.11. Beckhoff Automation

5.1.12. SICK AG

5.1.13. Endress+Hauser

5.1.14. NHP Electrical Engineering

5.1.15. Schneider Electric Australia

5.2. Cross Comparison Parameters (Revenue, Market Presence, Product Range, Innovation Investment, Partnerships, R&D Expenditure, Regional Offices, No. of Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Australia Electric Automation Market Regulatory Framework

6.1. Industrial Automation Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Australia Electric Automation Future Market Size (In AUD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Australia Electric Automation Future Market Segmentation

8.1. By Solution Type (In Value %)

8.2. By Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Component Type (In Value %)

8.5. By Region (In Value %)

9. Australia Electric Automation Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, a comprehensive mapping of the Australia Electric Automation Market ecosystem was undertaken, covering all critical stakeholders. This stage relies on extensive secondary research using industry databases to capture all influential market variables.

Step 2: Market Analysis and Construction

Historical market data were assessed to analyze industry penetration, and relationships between solution providers and end-users. Quality standards and industry benchmarks were also evaluated to ensure the reliability of market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were refined and validated through direct interviews with industry experts, gathering operational and financial insights from seasoned professionals, which enhanced the accuracy of the data.

Step 4: Research Synthesis and Final Output

Engagement with manufacturers and distributors in the electric automation market provided additional insights into product performance, sales trends, and market preferences. This step ensured a validated, comprehensive view of the market landscape.

Frequently Asked Questions

01. How big is the Australia Electric Automation Market?

The Australia Electric Automation Market is valued at USD 522 million, driven by strong adoption across industries and supportive government policies aimed at enhancing automation.

02. What are the challenges in the Australia Electric Automation Market?

Key challenges in Australia Electric Automation Market include high initial costs of automation systems, technology integration complexities, and a shortage of skilled labor, which can limit the rapid adoption of advanced automation solutions.

03. Who are the major players in the Australia Electric Automation Market?

Leading players in Australia Electric Automation Market include Schneider Electric, Siemens Australia, ABB, Honeywell International, and Rockwell Automation, which dominate due to their extensive product offerings, market reach, and technical expertise.

04. What are the growth drivers of the Australia Electric Automation Market?

Australia Electric Automation Market Growth is fueled by government support for industrial modernization, rising adoption of Industry 4.0, and the increasing demand for efficiency and energy savings within manufacturing and utility sectors.

05. Which sectors are driving the demand in the Australia Electric Automation Market?

Manufacturing and energy sectors are major drivers, adopting automation to enhance productivity and operational efficiency while reducing costs and environmental impact.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.