Australia Outplacement Services Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10294

November 2024

100

About the Report

Australia Outplacement Services Market Overview

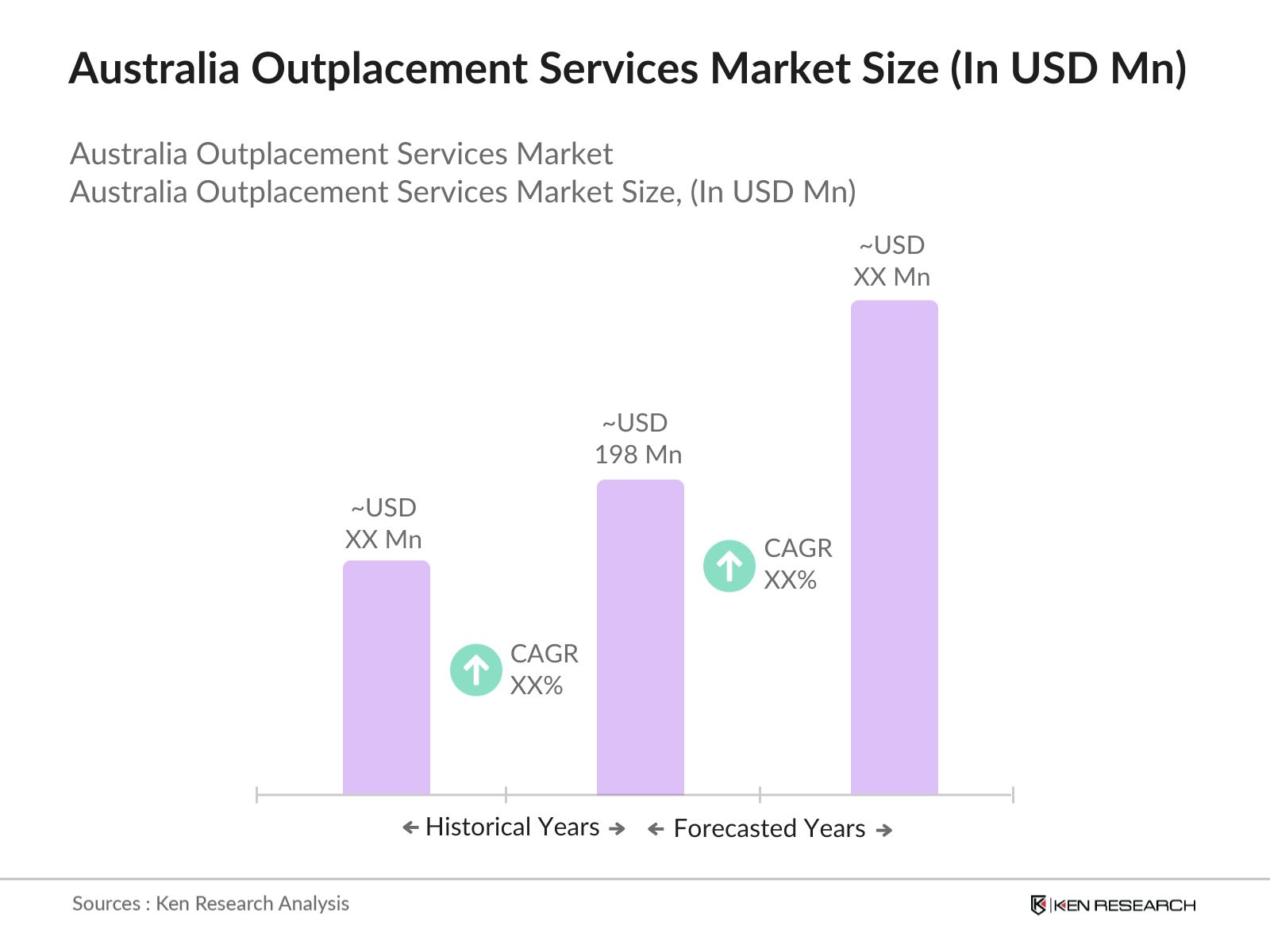

- The Australia outplacement services market is valued at USD198 million, based on a five-year historical analysis. This valuation is driven by economic fluctuations leading to corporate restructuring and layoffs, which have increased the demand for outplacement services. Additionally, organizations are increasingly recognizing the importance of supporting departing employees to maintain their corporate reputation and comply with employment regulations.

- Major metropolitan areas such as Sydney, Melbourne, and Brisbane dominate the market. These cities are home to a high concentration of corporate headquarters and large enterprises, resulting in a greater need for outplacement services during organizational changes. The presence of diverse industries and a dynamic job market in these regions further contributes to their dominance in the outplacement services sector.

- The Fair Work Act 2009 outlines employer obligations during redundancies, including consultation requirements and redundancy pay. In 2023, compliance with these provisions remained essential for employers, influencing the utilization of outplacement services to ensure adherence to legal standards.

Australia Outplacement Services Market Segmentation

The Australia outplacement services market is segmented by service type and by industry vertical.

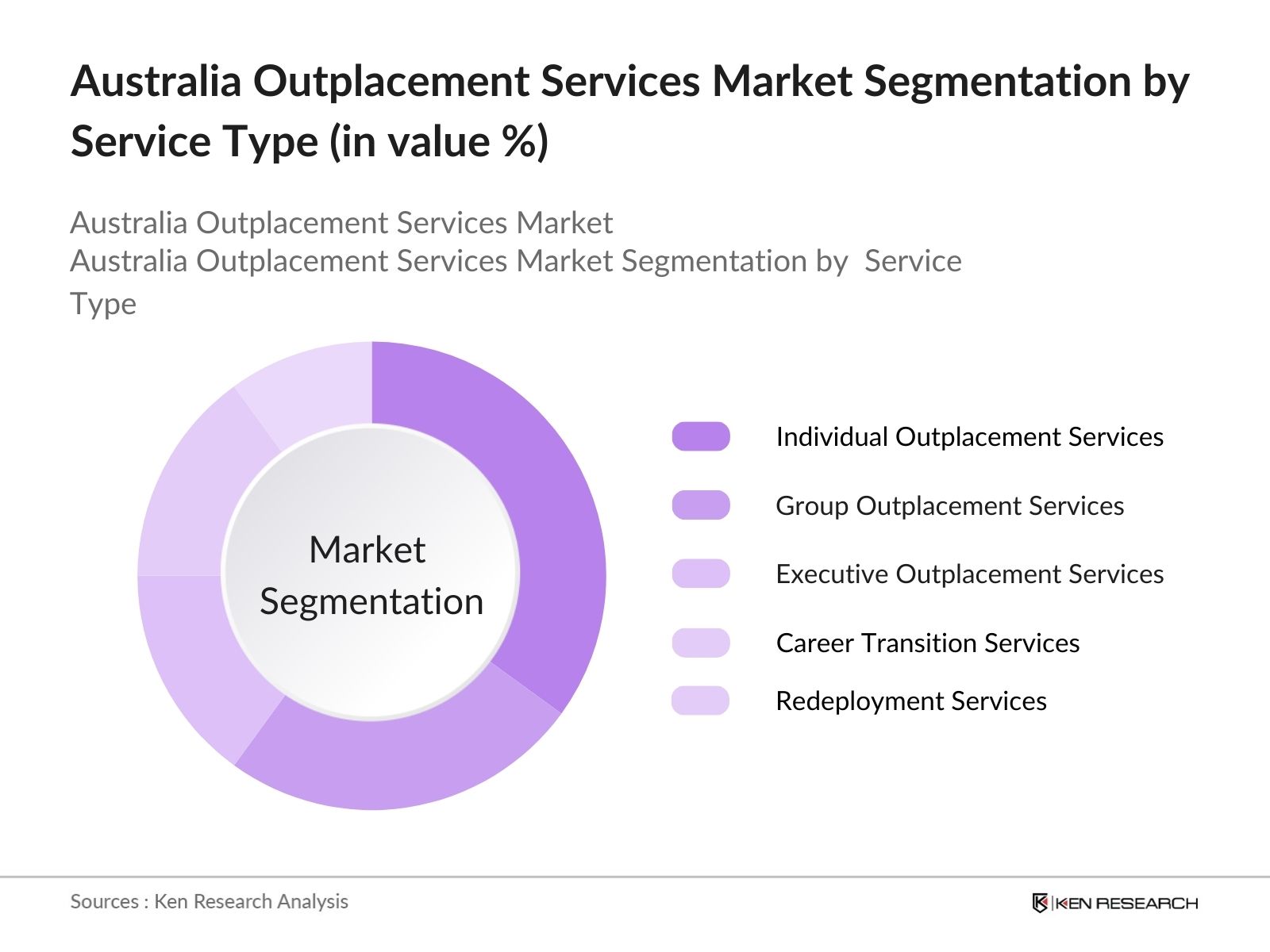

- By Service Type: The Australia outplacement services market is segmented by service type into individual outplacement services, group outplacement services, executive outplacement services, career transition services, and redeployment services. Individual outplacement services hold a dominant market share due to their personalized approach, which addresses the specific needs of each employee. This customization enhances the effectiveness of the transition process, making it a preferred choice among organizations aiming to provide tailored support to their departing staff.

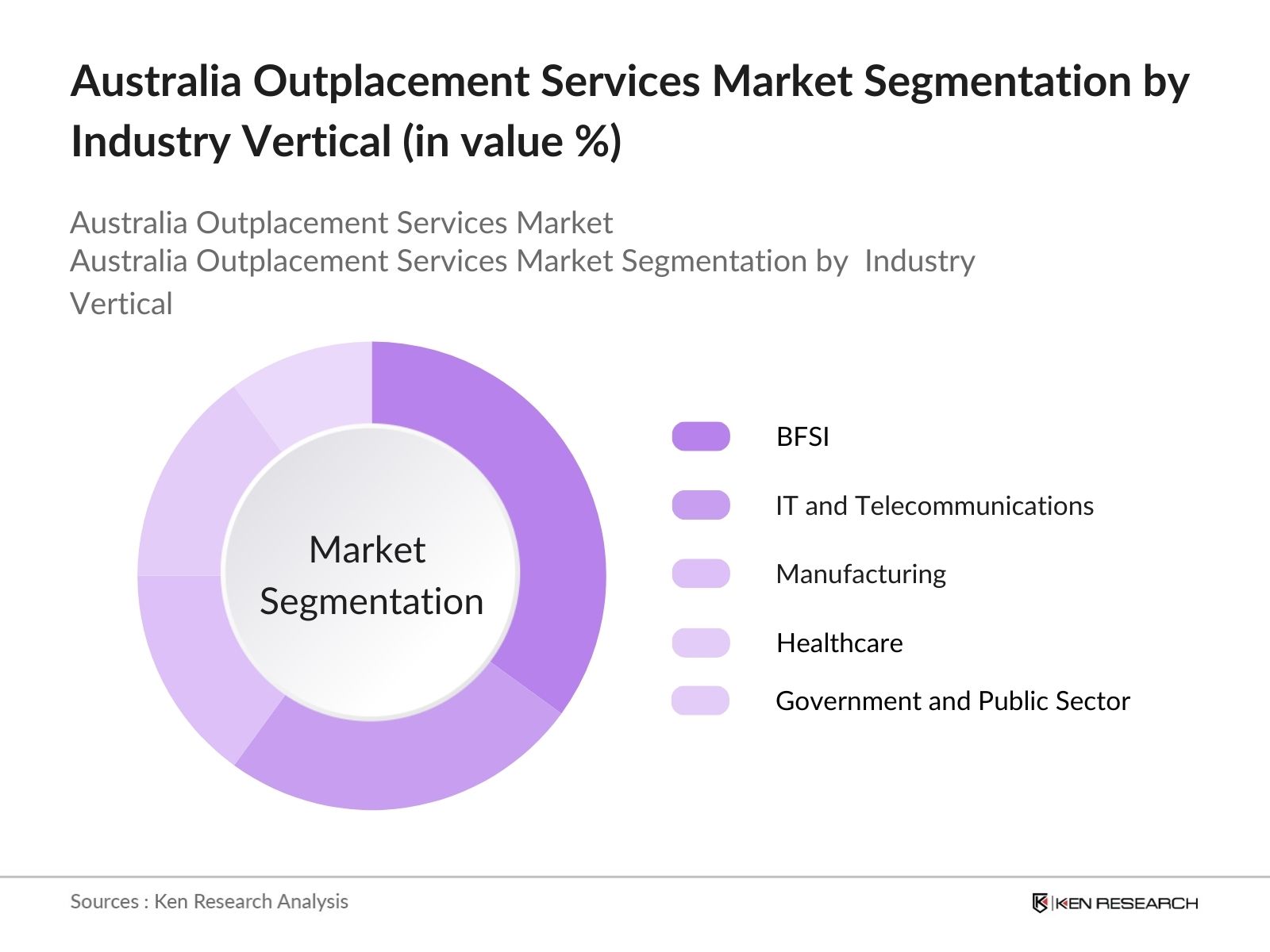

- By Industry Vertical: The market is also segmented by industry vertical into banking, financial services, and insurance (BFSI); information technology and telecommunications; manufacturing; healthcare; and government and public sector. The BFSI sector leads in market share, primarily due to the frequent restructuring and mergers within the industry. Such activities often result in workforce reductions, thereby increasing the demand for outplacement services to assist affected employees in transitioning to new roles.

Australia Outplacement Services Market Competitive Landscape

The Australia outplacement services market is characterized by the presence of both global and local players, offering a range of services tailored to various industries and organizational needs. Key companies include Adecco Australia, Hays plc, Hudson Global Inc., ManpowerGroup, and Mercer. These organizations have established strong market positions through extensive service portfolios, strategic partnerships, and a focus on delivering customized outplacement solutions.

Australia Outplacement Services Industry Analysis

Australia Outplacement Services Industry Analysis

Growth Drivers

- Economic Fluctuations: Economic fluctuations significantly influence the demand for outplacement services in Australia. During periods of economic downturn, companies often resort to workforce reductions to maintain financial stability. For instance, in 202021, the COVID-19 pandemic led to a surge in the national unemployment rate, prompting many companies to lay off employees and increasing the need for outplacement services to support displaced workers.

- Corporate Restructuring Trends: Corporate restructuring, including mergers, acquisitions, and organizational realignments, often results in workforce redundancies. In 2023, several Australian companies underwent significant restructuring, leading to job losses and a subsequent rise in demand for outplacement services to assist affected employees in transitioning to new employment opportunities.

- Technological Advancements: The rapid adoption of automation and digital technologies has transformed various industries, leading to shifts in workforce requirements. In 2023, the Australian government reported that technological advancements contributed to changes in employment patterns, necessitating outplacement services to help workers adapt to new roles or industries.

Market Challenges

- High Service Costs: The cost of outplacement services can be a barrier for some organizations, particularly small and medium-sized enterprises (SMEs). In 2023, industry reports indicated that the pricing of outplacement services remained a concern for cost-sensitive businesses, potentially limiting their adoption.

- Limited Awareness Among SMEs: Many SMEs may lack awareness of the benefits and availability of outplacement services. In 2023, surveys revealed that a significant portion of SMEs were unfamiliar with outplacement options, highlighting a need for increased education and outreach by service providers.

Australia Outplacement Services Market Future Outlook

Over the next five years, the Australia outplacement services market is expected to show significant growth driven by continuous corporate restructuring, technological advancements in service delivery, and increasing awareness of the benefits of outplacement support. Organizations are anticipated to invest more in comprehensive outplacement programs to enhance their employer brand and comply with evolving employment regulations.

Market Opportunities

- Expansion into Emerging Industries: Emerging industries, such as renewable energy and technology sectors, are experiencing growth and transformation. In 2023, the Australian government reported increased investment in renewable energy projects, creating opportunities for outplacement service providers to assist workers transitioning into these expanding fields.

- Integration of Digital Platforms: The adoption of digital platforms enhances the accessibility and efficiency of outplacement services. In 2023, industry trends indicated a shift towards virtual outplacement solutions, enabling providers to offer remote support and reach a broader client base.

Scope of the Report

|

Individual Outplacement Services Group Outplacement Services Executive Outplacement Services Career Transition Services Redeployment Services |

|

|

By Industry Vertical |

Banking, Financial Services, and Insurance (BFSI) Information Technology and Telecommunications Manufacturing Healthcare Government and Public Sector |

|

By Organization Size |

Large Enterprises Small and Medium Enterprises (SMEs) |

|

By Delivery Mode |

In-person Services |

|

By Region |

North East West South |

Products

Key Target Audience

Human Resource Departments

Corporate Training and Development Managers

Organizational Development Consultants

Employee Assistance Program Providers

Career Transition Coaches

Government and Regulatory Bodies (e.g., Fair Work Commission)

Investment and Venture Capitalist Firms

Large Enterprises and SMEs undergoing restructuring

Companies

Players Mention in the Report:

Adecco Australia

Hays plc

Hudson Global Inc.

ManpowerGroup

Mercer

Prima Careers

Randstad Pty Limited

Career Insight Group Pty Ltd.

Outplacement Australia

Katie Roberts Career Consulting

Lee Hecht Harrison

Chandler Macleod Group

Right Management

Talent2 International

Directioneering

Table of Contents

1. Australia Outplacement Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Australia Outplacement Services Market Size (In AUD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Australia Outplacement Services Market Analysis

3.1. Growth Drivers

3.1.1. Economic Fluctuations

3.1.2. Corporate Restructuring Trends

3.1.3. Technological Advancements

3.1.4. Government Policies and Regulations

3.2. Market Challenges

3.2.1. High Service Costs

3.2.2. Limited Awareness Among SMEs

3.2.3. Market Fragmentation

3.3. Opportunities

3.3.1. Expansion into Emerging Industries

3.3.2. Integration of Digital Platforms

3.3.3. Strategic Partnerships and Collaborations

3.4. Trends

3.4.1. Adoption of Virtual Outplacement Services

3.4.2. Emphasis on Employee Well-being Programs

3.4.3. Customization of Outplacement Packages

3.5. Government Regulation

3.5.1. Fair Work Act Provisions

3.5.2. Employment Transition Support Initiatives

3.5.3. Compliance Requirements for Employers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Australia Outplacement Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Individual Outplacement Services

4.1.2. Group Outplacement Services

4.1.3. Executive Outplacement Services

4.1.4. Career Transition Services

4.1.5. Redeployment Services

4.2. By Industry Vertical (In Value %)

4.2.1. Banking, Financial Services, and Insurance (BFSI)

4.2.2. Information Technology and Telecommunications

4.2.3. Manufacturing

4.2.4. Healthcare

4.2.5. Government and Public Sector

4.3. By Organization Size (In Value %)

4.3.1. Large Enterprises

4.3.2. Small and Medium Enterprises (SMEs)

4.4. By Delivery Mode (In Value %)

4.4.1. In-person Services

4.4.2. Virtual/Online Services

4.4.3. Hybrid Services

4.5. By Region (In Value %)

4.5.1. New South Wales

4.5.2. Victoria

4.5.3. Queensland

4.5.4. Western Australia

4.5.5. South Australia

5. Australia Outplacement Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Adecco Australia

5.1.2. Hays plc

5.1.3. Hudson Global Inc.

5.1.4. ManpowerGroup

5.1.5. Mercer

5.1.6. Prima Careers

5.1.7. Randstad Pty Limited

5.1.8. Career Insight Group Pty Ltd.

5.1.9. Outplacement Australia

5.1.10. Katie Roberts Career Consulting

5.1.11. Lee Hecht Harrison

5.1.12. Chandler Macleod Group

5.1.13. Right Management

5.1.14. Talent2 International

5.1.15. Directioneering

5.2. Cross Comparison Parameters (Number of Employees, Headquarters Location, Year of Establishment, Revenue, Service Portfolio, Client Base, Geographic Presence, Recent Developments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Australia Outplacement Services Market Regulatory Framework

6.1. Employment Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Australia Outplacement Services Future Market Size (In AUD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Australia Outplacement Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Organization Size (In Value %)

8.4. By Delivery Mode (In Value %)

8.5. By Region (In Value %)

9. Australia Outplacement Services Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Outplacement Services Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Australia Outplacement Services Market. This includes assessing market penetration, the ratio of service providers to client organizations, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple outplacement service providers to acquire detailed insights into service offerings, client feedback, and service effectiveness. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Australia Outplacement Services market.

Frequently Asked Questions

01. How big is the Australia Outplacement Services Market?

The Australia outplacement services market was valued at USD 198 million, driven by economic fluctuations and increased demand for restructuring support across various industries.

02. What are the main challenges in the Australia Outplacement Services Market?

Australia outplacement services market Challenges include high service costs, limited awareness of outplacement benefits among small and medium enterprises, and market fragmentation, which creates inconsistencies in service quality across providers.

03. Who are the major players in the Australia Outplacement Services Market?

Key players in the Australia outplacement services market include Adecco Australia, Hays plc, Hudson Global Inc., ManpowerGroup, and Mercer. These companies dominate due to their extensive service portfolios, strategic partnerships, and reputation for tailored outplacement solutions.

04. What factors are driving growth in the Australia Outplacement Services Market?

The Australia outplacement services market is propelled by ongoing corporate restructuring, technological advancements in service delivery, and a growing recognition of the importance of outplacement services for corporate reputation and employee welfare.

05. Which industry vertical holds the largest market share in the Australia Outplacement Services Market?

The banking, financial services, and insurance (BFSI) sector leads in market share due to frequent mergers, acquisitions, and restructuring within the industry, which increases the demand for outplacement support services.

06. How is technology impacting the Australia Outplacement Services Market?

Technology is enabling virtual and hybrid service delivery models, making outplacement services more accessible and personalized. Advancements in digital platforms and AI-driven tools are enhancing service efficiency and engagement.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.