Go To Market Strategy for IRU (Australian Based University) in Select Indian Cities

Detecting Potential For Foreign Owned Universities via Face to Face Interviews with Prospective Undergraduate Students

Region:Asia

Author(s):Aastha Garg, Aditya Konnur and Smridhi

Product Code:KR1426

February 2024

102

About the Report

Market Overview:

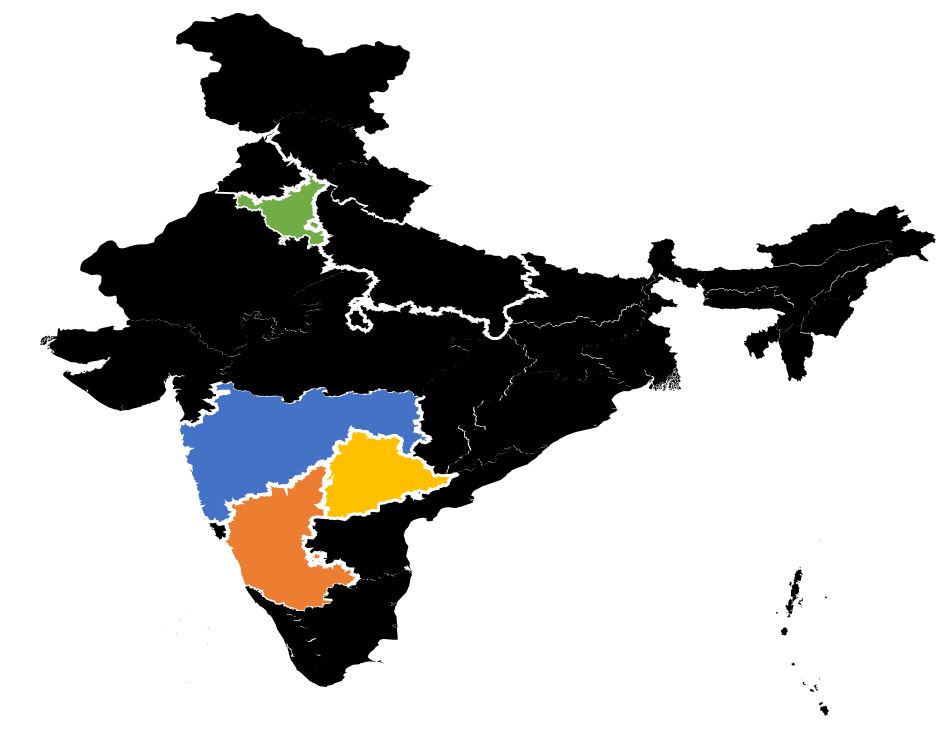

India has caught the attention of the world’s top universities in recent years owing to its developing infrastructure and education-friendly institution. t would be beneficial for a university to enter the Indian market, with Delhi offering multiple promising locations with reasonably priced land and significant infrastructure projects nearby. When it comes to how much the Australian University can charge for specific courses, Delhi NCR, Bangalore, and Hyderabad stand out relatively well.

Australian universities should begin with the most popular programs, such as BBA and B Tech, and then introduce new, exciting courses in areas like graphic design and entrepreneurship. The two most crucial factors that international students consider while choosing a place to continue tertiary education are university fees and worldwide rankings. Modern innovations like SEZs and vertical campuses, together with smart faculty and successful PR campaigns, will undoubtedly make the Australian institution stand out.

There are a total of 41 universities available in Australia out of which 37 are public Australian, three private Australian and one private international university. Among all, Monash University is the biggest Australian university followed by the University of Melbourne, the University of Technology Sydney, and the Australian National University.

Market Analysis

- India is the most populated country, with almost 20% of its total population being between the ages of 18 and 23. About 25% of the overall population is enrolled in undergraduate courses, meaning that the GER (Gross Enrollment Ratio) is about 27.

- The top 6 States in terms of highest total student enrolment are Uttar Pradesh, Maharashtra, Tamil Nadu, Madhya Pradesh, Karnataka and Rajasthan. The said States constitute more than half of the total Student enrolment in India.

- Mumbai neighborhoods Dadar, Andheri, and Chembur are home to several university clusters. There are numerous higher education institutions in Mumbai located in Ville Parle, Kurla, Ghatkopar, and Santa Cruz, all of which have sizable student populations.

- There is a significant concentration of universities in Hyderabad's Panjagutta, Chanchalguda, and Chintal neighborhoods. In Western Hyderabad, Panjagutta is a business and residential neighborhoods. Next Galleria Mall and PVR Panjagutta are two neighboring attractions which make it an advantageous location for universities.

- The outskirts of Greater Noida and Manesar Gurgaon offer cheap real estate prices for retrofitting university buildings. In addition, there is potential to utilize Ghaziabad and Faridabad as future locations for educational hubs.

Key Trends by Market Segment:

By Type of Cities: Delhi-NCR, Mumbai, Bangalore, and Hyderabadaresome of the major friendly cities for university infrastructure development in the country. Australian universities can target these cities to start their trials in India. Most of the top universities/colleges in Mumbai have their present for a long time with good NAAC accreditation and NIRF ranking including IIT Bombay and the University of Bombay. Additionally, Bangalore has several private and public colleges that are well-established and reputed such as the National Institution of Technology Karnataka and Malnad College of Engineering.

Scope of the Report

|

Go To Market Strategy for IRU (Australian Based University) in Select Indian Cities |

|

|

By Type of Cities |

· Delhi-NCR · Mumbai · Bangalore · Hyderabad

|

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Educational Institutions

Government Entities

Alumni Networks

Corporate Partnerships

Research and Academic Community

Time Period Captured in the Report:

Time Period: 2023

Companies

Major Universities Mentioned in the Report:

Monash University

The University of Melbourne

The University of Technology Sydney

The Australian National University

UNSW University

Table of Contents

1. Executive Summary

1.1 Market Entry Analysis on the Basis of Location

1.2 Fee & Price Analysis by City/Course

1.3 Recommended Courses – Present & Future

1.4 Student Decision Making Parameters

1.5 Key Differentiators

2. Country Overview

2.1 Demographic Overview of India

2.2 Market Potential of India Under-graduate Market

3. Location & WhiteSpace Analysis

3.1 Location Analysis of Mumbai

3.2 Location Analysis of Hyderabad

3.3 Location Analysis of Delhi-NCR

3.4 Location Analysis of Bangalore

4. Retro Fitting & Land Pricing Analysis

4.1 Cost of Constructing a University

4.2 Registration Charges

4.3 Definition of Parameters Used

4.4 Retro Fitting Analysis – Delhi NCR

4.5 Retro Fitting Analysis – Navi Mumbai & Bangalore

4.6 Retro Fitting Analysis – Hyderabad

5. Demand Analysis

5.1 Mumbai Tertiary Education

5.2 Hyderabad Tertiary Education

5.3 Delhi Tertiary Education

5.4 Bangalore Tertiary Education

5.5 Employment Prospects & Industry Demand

5.6 Emerging Fields

6. Course Pricing & Competition Analysis

6.1 Mumbai

6.2 Bangalore

6.3 Hyderabad

6.4 Delhi

6.5 Colleges Offering SDG Courses India

6.6 Most Expensive Colleges of India

7. Local Government Support

8. UGC Guidelines

8.1 Application Process

8.2 Autonomy in Operations

9. Student Interview Analysis

9.1 Education Background

9.2 Budget Preferences

9.3 Willingness to Travel

9.4 Perception on Decision Making Parameters

9.5 University Preferences between Public & Private

9.6 University Preferences between Private & Australia Based Indian University

9.7 Current Awareness Path

9.8 Academic Preferences

10. Analyst Recommendations

10.1 Country Level Tertiary Education

10.2 City Level Tertiary Education

10.3 WhiteSpace Recommendations

10.4 Recommended Course Offerings – Present & Future

10.5 Challenges & Bottle Necks

10.6 Special Education Zones

10.7 University Faculty Hiring Strategies

10.8 Positioning Strategies

11. Research Methodology

11.1 Abbreviations

11.2 Survey Process (Sample Size, Questionnaire & Data Analysis)

Disclaimer Contact UsResearch Methodology

Step1: Identifying Key Variables: Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step2: Market Building: Collating statistics on the Indian cities over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the Go to market strategy for IRU Universities. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step3: Validating and Finalizing: Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step4: Research output: Our team will approach multiple India-Based Australian Universities providing courses and understand the nature of product segments and courses, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from courses providers.

Frequently Asked Questions

Who are the Top Universities in Australia?

Monash University, The University of Melbourne, The University of Technology Sydney, The Australian National University, and UNSW University are some of the Top Universities in Australia.

Which Australian universities are opening campuses in India?

In GIFT City in Gandhinagar, Gujarat, two Australian universities, Deakin and Wollongong, will open the following academic year, according to an announcement made by Union Education and Skill Development Minister Dharmendra Pradhan in 2023.

How Many total Universities are there in Australia?

There are a total of 41 universities available in Australia out of which 37 are public Australian, three private Australian and one private international university.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.