Bangladesh Clinical Laboratories Market Outlook to 2028

Driven by Expansion of Diagnostic Chains and Increasing Healthcare Awareness

Region:Asia

Author(s):Aparajita Raj

Product Code:KR1390

January 2024

93

About the Report

Market Overview:

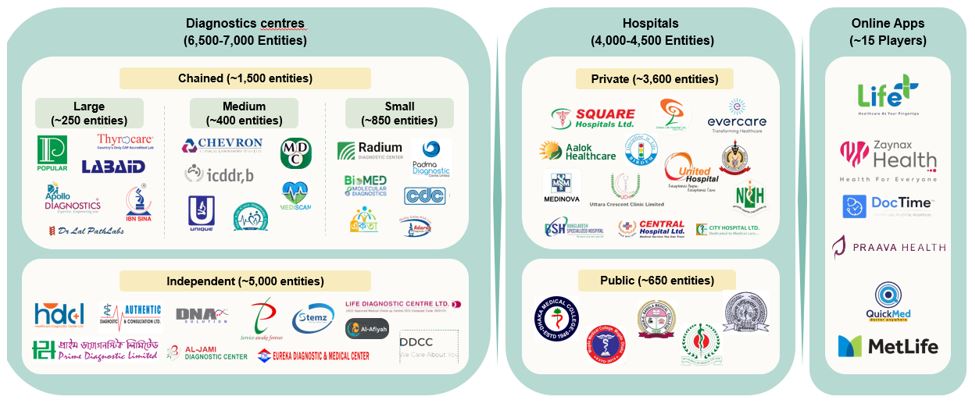

A rapidly evolving market with immense growth potential Bangladesh Clinical Laboratories market is being driven by increase in number of hospitals & per capita healthcare expenditure along with improved technology. Bangladesh Clinical Laboratory Market remains highly fragmented with presence of over 10,000 diagnostic centers. Labaid and Popular Diagnostic Centre Ltd. being the top two players in the market perform 10,000+ tests in a day through their large network of diagnostic centers across the country.

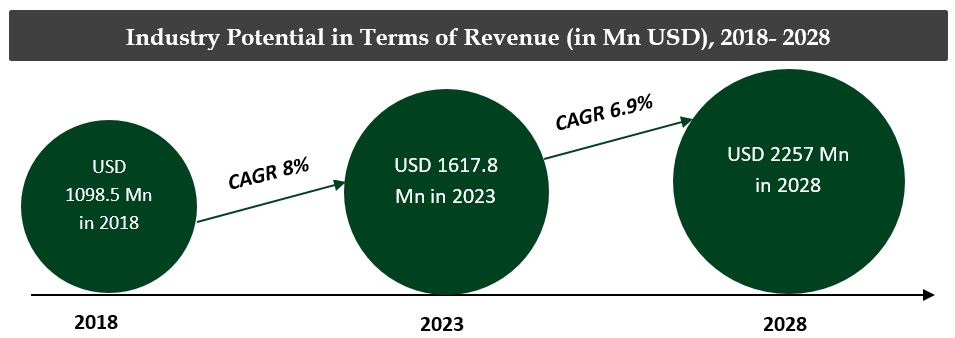

The total addressable market for the Bangladesh Clinical Laboratories has been on a rise. Bangladesh Clinical Laboratory Market generated a revenue of $ 1,617.8 Mn in 2023 owing to Covid 19 Pandemic and increasing Non- Communicable Diseases. Bangladesh clinical labs market is highly fragmented with more than 10,000 players comprising chained and independent diagnostic centers and hospitals. In present scenario, focus has shifted towards patient centricity; industry has innovated service delivery model and is providing quality services.

Bangladesh Clinical Laboratory Market remains highly fragmented with presence of over 10,000 diagnostic centres and top 3 players (chained) accounting for ~7% of the overall revenue generated in the market in 2023. Multiple service delivery formats, establishment of more centers in underserved regions remain some common strategies adopted by top players in Bangladesh Clinical Labs Industry. Top chains in Bangladesh Clinical Laboratory Market have set up diagnostic centres in urban areas like Dhaka, meeting high healthcare demand and better infrastructure, followed by Chattogram and Rajshahi.

Bangladesh Clinical Laboratories Market Analysis

- Labaid and Popular Diagnostic Centre Ltd. being the top two players in the market perform 10,000+ tests in a day through their large network of diagnostic centers across the country.

- As of 2023, Bangladesh is home to 5,709 hospitals, all of which are owned and operated by private, public and nonprofit (public) organizations.

- Significant investments in construction, transportation, and manufacturing are driven by preparations for the FIFA World Cup 2023.

- Collection centers work as spokes and help expand network and transport samples collected to Regional / Satellite labs which have most of the Basic test capabilities.

- These are the laboratories which are owned by individuals or hospitals whose operations are outsourced to a third party – mostly a larger diagnostic player, who manages the day-to-day operations of the lab with a revenue share agreement.

- As of 2023, Bangladesh is home to more than 5,000 hospitals, all of which are owned and operated by private, public and nonprofit (public) organizations.

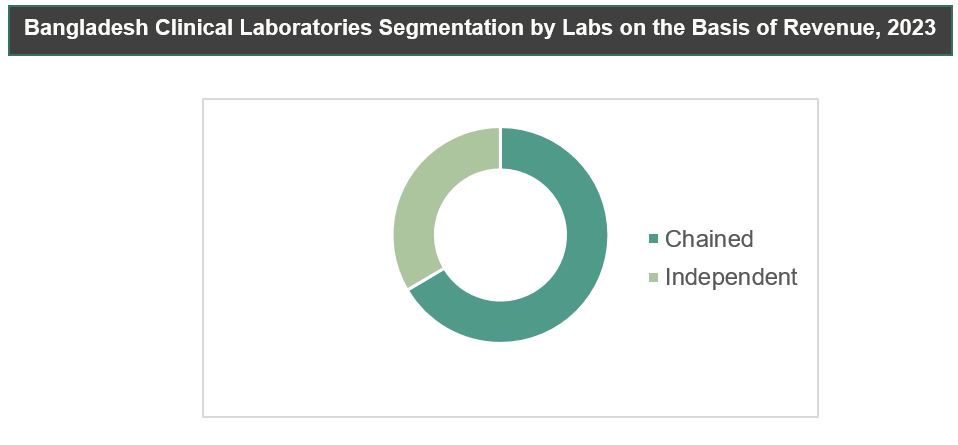

- Market in Bangladesh is dominated by unorganized services, with independent centers representing around 47% of the total centers, conducting over 80 Mn diagnostic tests in 2023.

Key Trends by Market Segment:

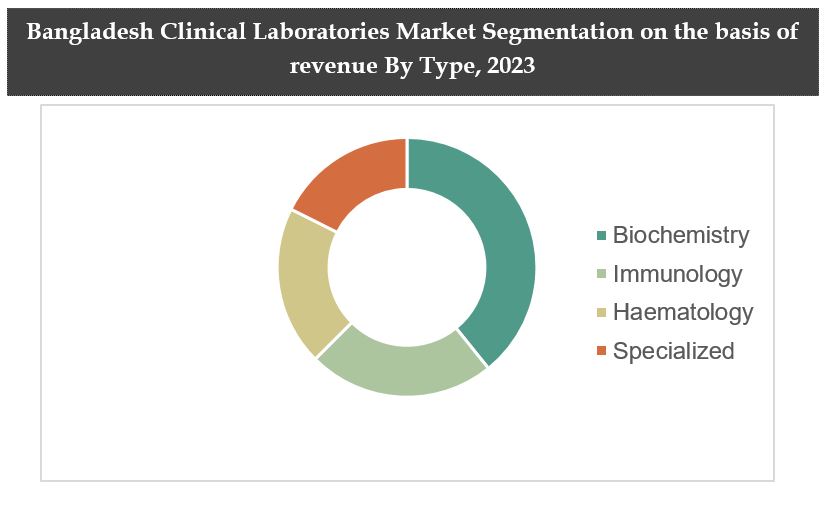

By Pathology: In the landscape of the Pathology Segment in 2023, Biochemistry emerged as the dominant force, securing a substantial market share. This ascendancy was primarily fueled by a heightened demand for a range of diagnostic tests, with notable emphasis on critical assessments like HbA1c and Lipid Profile. The Biochemistry segment played a pivotal role in meeting the diverse and essential diagnostic requirements, underscoring its significance in the broader field of pathology.

The comprehensive array of tests offered within Biochemistry not only addressed prevalent health concerns but also contributed significantly to the sector's overall revenue, highlighting its pivotal role in shaping the diagnostic landscape in 2023.

By Labs: In the dynamic landscape of the Bangladesh Clinical Lab Market in 2023, despite facing intensified competition from independent labs, chained laboratories are poised for superior revenue growth. This projection is rooted in several key factors, prominently among them being the expansive test portfolio offered by chained labs, encompassing a diverse range of diagnostic services. Additionally, the commitment to delivering an enhanced customer experience sets chained labs apart, with a focus on efficient service delivery, accuracy, and streamlined processes. Moreover, the deeper geographical reach of chained laboratories allows them to tap into a broader market, reaching both urban and rural areas.

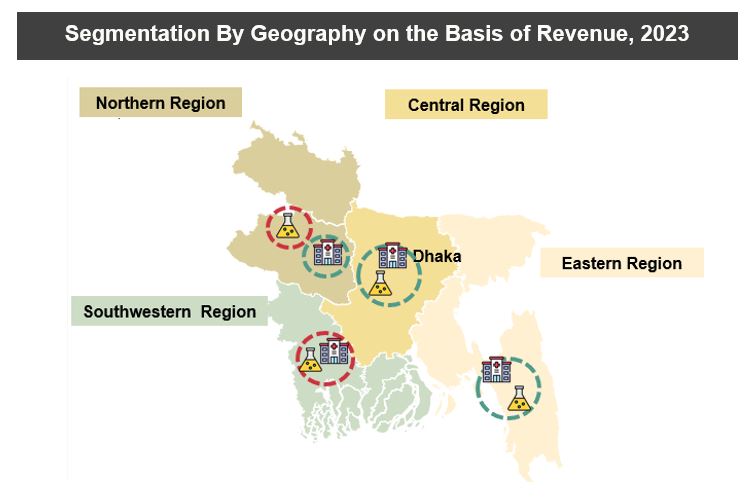

By Geography: The central region played a significant role in contributing to the overall revenue, securing a substantial portion within the market share. Dhaka emerged as the primary revenue-generating division in this central region, followed closely by the Eastern region. This distribution underscores the pivotal role of the central area, particularly Dhaka, in shaping the financial performance and market dynamics, demonstrating its prominence in the broader revenue landscape.

Dhaka and Chattogram, as the primary divisions in the country, boast the highest number of hospitals and laboratories. Tests prices within these regions tend to be on the higher side. Yet, the intense competition posed by established diagnostic chains in these divisions creates significant barriers for new entrants.

Competitive Landscape:

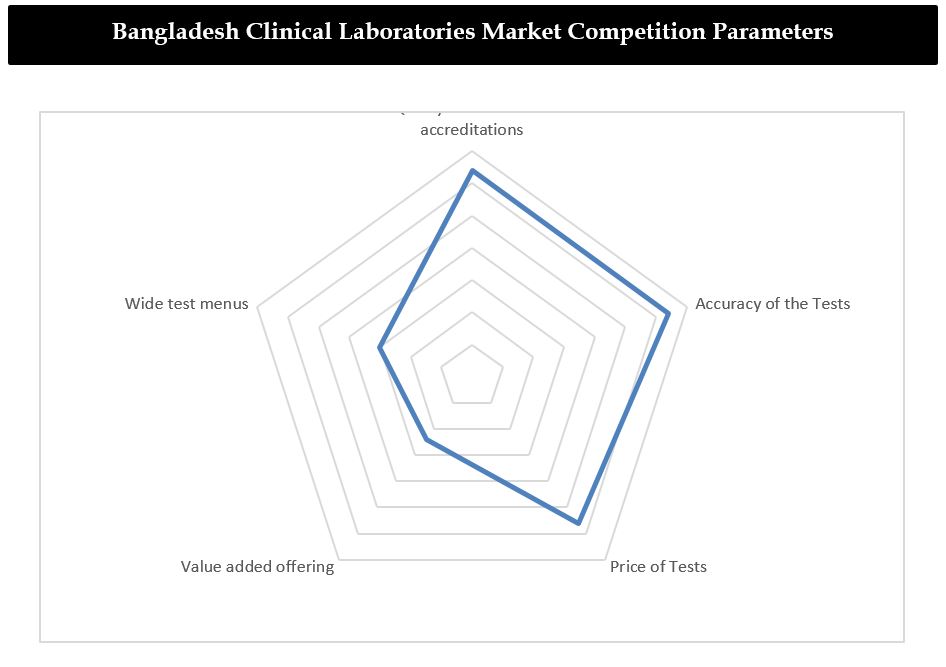

Major Players in Bangladesh Clinical Laboratories Market

- Labaid and Popular Diagnostic Centre Ltd. being the top two players in the market perform 10,000+ tests in a day through their large network of diagnostic centers across the country.

- Multiple service delivery formats, establishment of more centers in underserved regions remain some common strategies adopted by top players in Bangladesh Clinical Labs Industry.

- Ibn Sina's heavy corporate marketing has secured agreements with 250+ organizations, fortifying its network for increased patient referrals.

- Labaids plans to expand the chain of diagnostic centers to 150 facilities throughout the country over the next five years and cater to 50,000 outpatients daily.

- Popular Diagnostic Centre Ltd is establishing a new referral lab in Dhanmondi in 2023, expanding their diagnostic capabilities and geographical reach.

Recent Developments:

- The evolution of the business model, marked by the establishment of collection centers and the provision of reports through digital channels, has resulted in significant benefits, including reduced travel distances, time, and costs. This transformation has also enhanced overall efficiency, leading to a substantial 45–55% reduction in turnaround time without impacting daily wages.

- Independent labs are estimated to have around 60% share in terms of revenue ; Private hospital will dominate with a massive revenue share owing to increasing investment on technology specially when it comes to specialized tests.

- Currently 70-80% specialized tests are outsourced to other countries from Bangladesh, however private hospitals are actively investing in expanding their service offerings, including specialized treatment options which will give them further leverage in future as well.

Future Outlook:

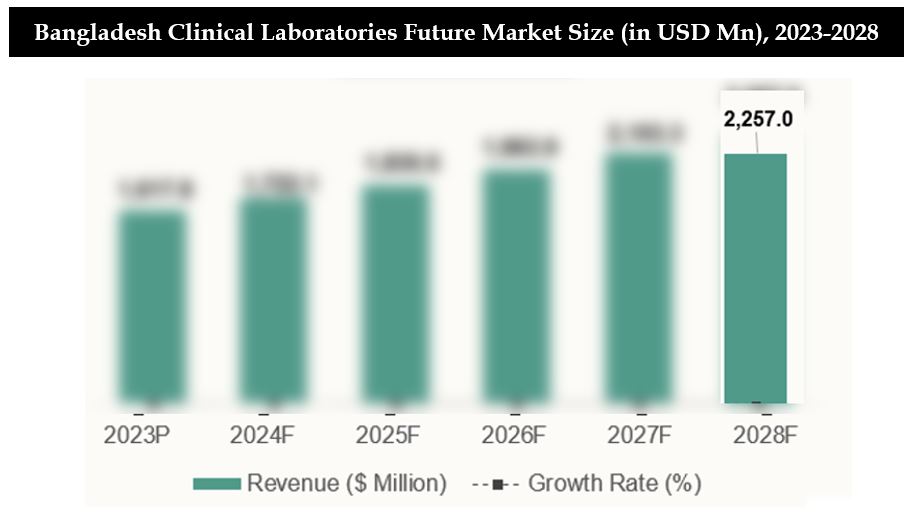

- Bangladesh Clinical Laboratory Market is estimated to grow at a CAGR of 6.9% during 2023-28 owing to increasing diabetic population, and non-communicable diseases.

- Local production plans for stents and potential for localization of cardiac devices, reducing dependence on imports might reduce the cost.

- Local production plans for stents and potential for localization of cardiac devices, reducing dependence on imports might reduce the cost.

- There is a shift in focus from curative to preventive medicine which gives impetus to the consolidation of primary health and wellness centers.

- In Bangladesh, NCDs contribute to 68% of mortality and 64% of the disease burden. This shift requires a change in the doctor-patient interaction from episodic to rhythmic care.

Scope of the Report

|

Bangladesh Clinical Laboratories Market Segmentation |

|

|

By Diagnostic Method |

· Pathology · Radiology |

|

By Pathology Labs |

· Biochemistry · Hematology · Immunology · Specialized |

|

By Radiology Labs |

· High end radiology · Low end radiology |

|

By Labs |

· Chained Labs · Independent Labs |

|

By Hospital |

· Public Hospital · Private Hospital |

|

By Payor |

· Out of pocket · Government · Private Insurance · Others |

|

By Ownership |

· Public Hospitals · Private Hospitals |

|

By Geography |

· Northern Region · Central Region · Eastern Region · Southwestern Region |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Healthcare providers

Diagnostic service providers

Government Entity

Research and development institutions

Pharmaceutical companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Labaid Group

Popular Diagonistic Center

Ibn Sina Popular Diagnostic Centre

Thyrocare Bangladesh Ltd.

Square Hospitals

Medinova Medical Services

Icddrb

Praava Health

Evercare Hospital

Table of Contents

1. Executive Summary

1.1 Taxonomy

1.2 How is Clinical Laboratory Market positioned in Bangladesh?

2. Bangladesh Healthcare Sector Overview

2.1 Bangladesh County Profile (Country Overview, Household and Healthcare 2.2 Expenditure, Medical Device & Equipment Market and more)

2.3 Bangladesh Healthcare Market Size, 2018-2023

2.4 Healthcare Infrastructure in Bangladesh (Total no. of Private and Public 2.1 Hospitals, Healthcare Workforce Overview and more)

2.5 Bangladesh Disease Statistics (Top causes of Death, Disease Profile by Age Group and more)

3. Bangladesh Clinical Laboratory Market Overview

3.1 Ecosystem of Major Entities in Bangladesh Clinical Lab Market

3.2 Evolution of Clinical Laboratory Industry

3.3 Service Flow in Clinical Lab Market

3.4 Business Model Canvas

3.5 Business Models in Bangladesh Clinical Lab Market

3.6 Bangladesh Clinical Lab Market Structure, 2023

3.7 Bangladesh Clinical Lab Market Entities and their Key Metrics, 2023

4. Bangladesh Clinical Laboratory Market Sizing and Segmentation

4.1 Bangladesh Clinical Lab Market Size, 2018-2023

4.2 Bangladesh Clinical Lab Market Segmentation by Diagnostic Method (by Pathology and Radiology), 2023

4.3 Bangladesh Clinical Lab Market Sub-Segmentation by Radiology and By Pathology (by Revenue), 2023

4.4 Bangladesh Clinical Lab Market Segmentation by Labs (by Chained Labs and Independent Labs), 2023

4.5 Bangladesh Clinical Lab Market Segmentation by Hospital (by private and public hospitals), 2023

4.6 Bangladesh Clinical Lab Market Segmentation by Type of Diagnosis (by Illness Acute, Illness Chronic & Wellness), 2023

4.7 Bangladesh Clinical Lab Market Segmentation by Payor (by Out of Pocket, Government, Private Insurance and more), 2023

4.8 Bangladesh Clinical Lab Market Segmentation by Ownership (by Private and Public),2023

4.9 Bangladesh Clinical Lab Market Segmentation by Division (by Northern, Central, Southwest, Eastern), 2023

4.10 Bangladesh Clinical Lab Market Segmentation By Geography (Dhaka, Chattogram, Rajshahi, Khulna, Barishal and more), 2023

5. Industry Analysis of Bangladesh Clinical Laboratory Market

5.1 Referral Network in Bangladesh Clinical Lab Market

5.2 Barrier-To-Enter Bangladesh Clinical Laboratory Market

5.3 Regulatory Trends in Bangladesh Clinical Lab Market

5.4 Bangladesh Clinical Lab Market Growth Drivers

5.5 Specialized Tests Trend in Bangladesh

5.6 Genomic Testing Trend in Bangladesh

6. End User Analysis of Bangladesh Clinical Laboratory Market

6.1 Customer Journey in Bangladesh Clinical Lab Market

6.2 Measures Used by Labs for Driving Patients

7. Competition Framework of Bangladesh Clinical Laboratory Market

7.1 Competition Scenario for Bangladesh Clinical Laboratories Market (Market Positioning Analysis and Competitive Parameters)

7.2 Market Share of Major Clinical Laboratories in Bangladesh on the Basis of Revenues, 2023

7.3 Cross Comparison of Major Clinical Laboratories in Bangladesh on the Basis of Number of centers, Number of tests and their types, 2023

7.4 Cross Comparison of Top 3 Major Players on the basis of Average Revenue per patient and their Entry/Expansion Strategies

7.5 Geographical Penetration and Business Mix of Top 3 Players in Bangladesh Clinical Laboratories Market

7.6 SWOT Analysis of Top 3 Players in Bangladesh Clinical Laboratories Market

8. Future Outlook and Projections

8.1 Bangladesh Clinical Lab Future Outlook, 2023-2028F

8.2 Bangladesh Clinical Lab Future Market Segmentation by Diagnostic Method (by Pathology and Radiology) 2028F

8.3 Bangladesh Clinical Lab Future Market Segmentation By Lab (Public & Private) and By Hospital (Public & Private) , 2028F

8.4 Bangladesh Clinical Lab Future Market Segmentation By Payor and By Diagnosis Type, 2028F

8.5 Bangladesh Clinical Lab Market Segmentation By Ownership & Region, 2028F

8.6 Bangladesh Clinical Lab Market Segmentation By Geography ( Dhaka, Chattogram, Rajshahi, Khulna, Barishal and more), 2028F

9. Gap Analysis in Bangladesh Clinical Laboratory Market

9.1 Outbound Medical Tourism from Bangladesh (No. of Medical Tourists, Factors influencing Tourism and more)

9.2 India: Most preferred destination for Bangladeshi Medical Tourism

9.3 Gap Analysis – By Type of Tests, Geographical Penetration and Barrier to Entry for new Entrants

9.4 Gap Analysis – By Unmet needs in the ecosystem and value chain

10. Analyst Recommendations

10.1 Partnerships and Marketing Strategy for Bangladesh Clinical Labs

10.2 Pricing Analysis for Bangladesh Clinical Labs

10.3 Pricing Analysis of Major Players in Bangladesh Clinical Laboratories Market

10.4 Top 50 Tests in Bangladesh Clinical Lab Market

10.5 Key Success Factors for Bangladesh Clinical Labs

10.6 Regional Clinical Lab Analysis

10.7 Industry Speaks

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Market Sizing Approach

11.5 Consolidated Research Approach

11.6 Sample Size Inclusion

11.7 Limitation and Future Conclusion

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables: Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building: Collating statistics on Clinical Labs market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Bangladesh Clinical Laboratories market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing: Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output: Our team will approach multiple clinical tests providing channels and understand nature of service segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from clinical lab providers.

Frequently Asked Questions

How big is Bangladesh Clinical Laboratories Market?

The Bangladesh Clinical Laboratories Market was valued at ~USD 1098.5 Mn in 2023.

What are the Key Factors Driving the Bangladesh Clinical Laboratories Market?

The growth of the Bangladesh Clinical Laboratories Market is propelled by several key factors, including the increased establishment of collection centres, the adoption of digital channels for report delivery, enhanced operational efficiency, reduced travel distances, time, and costs, and the overall evolution of the business model in response to changing market dynamics.

Who are the Key Players in the Bangladesh Clinical Laboratories Market?

Labaid Group, Popular Diagonistic Center, Ibn Sina Popular Diagnostic Centre and Thyrocare Bangladesh Ltd. are some of the key players in the Market.

What is the Future Growth Rate of the Bangladesh Clinical Laboratories Market?

The Bangladesh Clinical Laboratories Market is expected to reach ~USD 2257 Mn by 2028.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.