Belgium Wealth Management Market Outlook To 2030

Future-Ready & Wealth Steady

Region:Europe

Author(s):Rebecca Mary Reji

Product Code:KROD1200

June 2025

90

About the Report

Belgium Wealth Management Market Overview

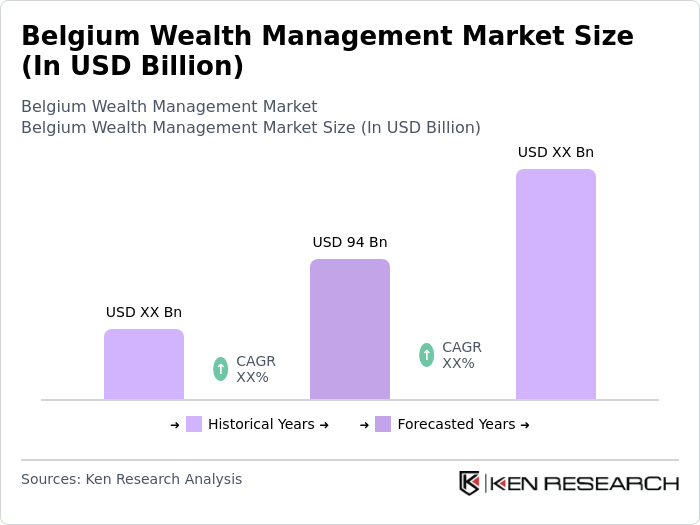

- The Belgium Wealth Management Market was valued at USD 94 billion, based on a five-year historical analysis. This growth is primarily driven by increasing high-net-worth individuals (HNWIs) and the rising demand for personalized financial services. The market is also supported by a robust regulatory framework and a growing emphasis on sustainable investment strategies, which have attracted more investors seeking tailored wealth management solutions.

- Brussels, Antwerp, and Ghent are the dominant cities in the Belgium Wealth Management Market. Brussels, as the capital, hosts numerous financial institutions and international organizations, making it a hub for wealth management services. Antwerp is known for its diamond trade, attracting affluent clients, while Ghent's growing tech scene has led to an increase in young entrepreneurs seeking wealth management services.

- Recent industry developments focus on cybersecurity enhancements and ethical investing frameworks, with 77% of wealth managers now integrating AI tools to expand service capabilities while maintaining compliance with EU financial regulations.

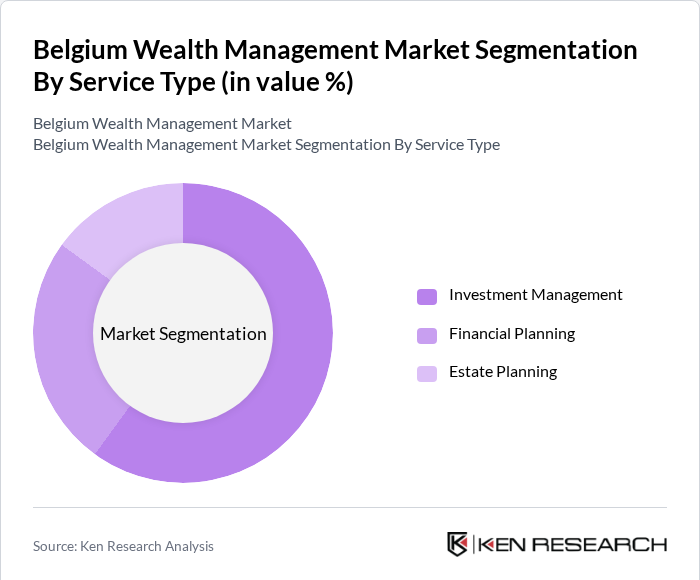

Belgium Wealth Management Market Segmentation

By Service Type: The wealth management market is segmented into investment management, financial planning, and estate planning. Among these, investment management is the dominant sub-segment, driven by the increasing complexity of investment products and the growing need for professional management of assets. Clients are increasingly seeking expert advice to navigate market volatility and optimize their portfolios, leading to a surge in demand for investment management services.

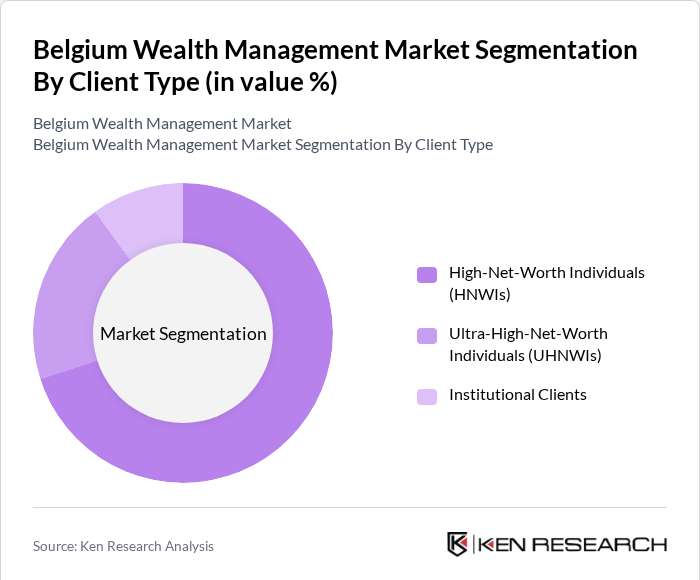

By Client Type: The market is segmented into high-net-worth individuals (HNWIs), ultra-high-net-worth individuals (UHNWIs), and institutional clients. HNWIs represent the largest client segment, as they account for a significant portion of the wealth in Belgium. This demographic is increasingly looking for personalized services and tailored investment strategies, which has led to a robust demand for wealth management services catering specifically to their needs.

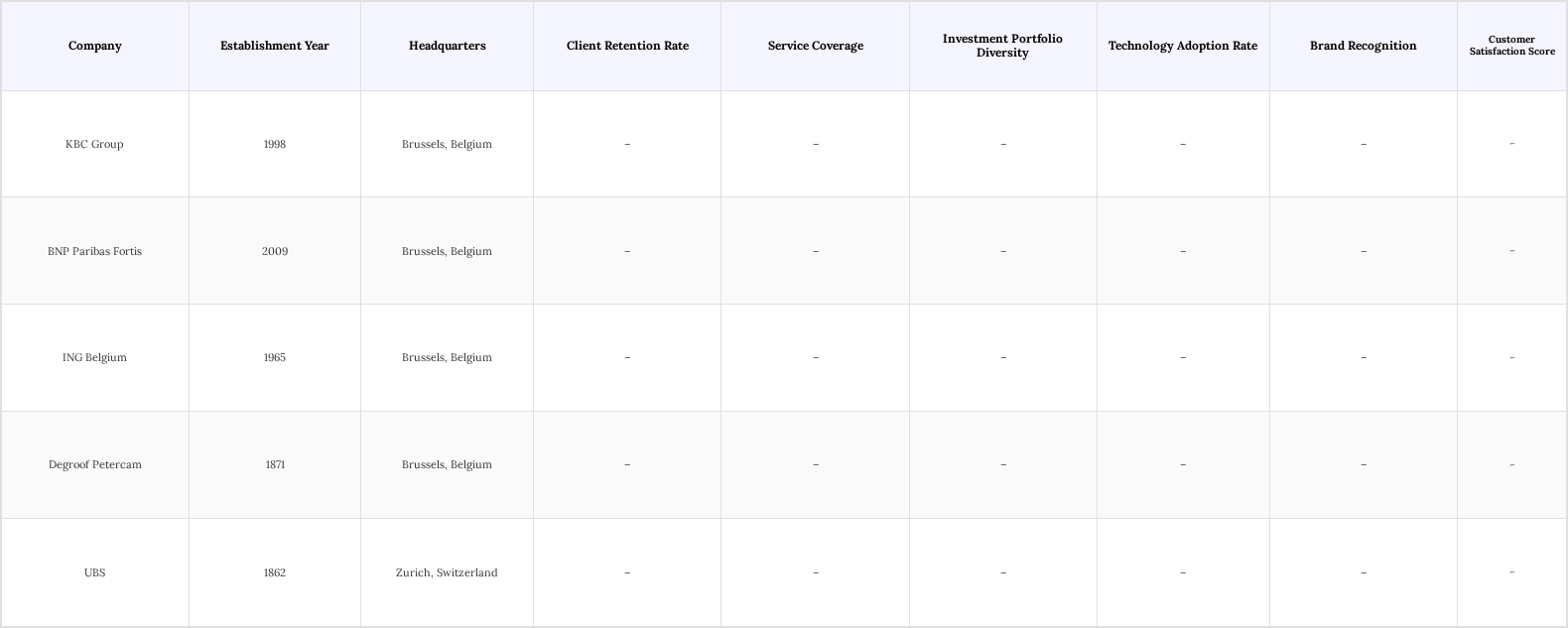

Belgium Wealth Management Market Competitive Landscape

The Belgium Wealth Management Market is characterized by a competitive landscape with several key players, including KBC Group, BNP Paribas Fortis, ING Belgium, Degroof Petercam, and UBS. These companies are known for their comprehensive service offerings and strong client relationships, which are crucial in a market that values personalized wealth management solutions.

Belgium Wealth Management Market Industry Analysis

Belgium Wealth Management Market Industry Analysis

Growth Drivers

- Increasing Affluence of the Population: The wealth management sector in Belgium is significantly driven by the increasing affluence of its population. According to the National Bank of Belgium, the number of High-Net-Worth Individuals (HNWIs) in Belgium rose to approximately 536,000 in 2023, representing a 5% increase from the previous year. This growth in wealth is primarily attributed to rising disposable incomes and favorable economic conditions, including a GDP growth rate of 1.5% in 2024, as projected by the International Monetary Fund (IMF). The increase in disposable income has led to a greater demand for wealth management services, as affluent individuals seek to optimize their investments and secure their financial futures.

- Rising Demand for Personalized Financial Services: The shift towards personalized financial services is another critical growth driver in the Belgium wealth management market. A report by Deloitte indicates that 77% of wealth managers believe AI will enable broader service integration. This trend is particularly pronounced among younger investors, who are increasingly seeking advice that reflects their values, such as sustainability and social responsibility. The wealth management industry is responding by enhancing their service offerings, with firms investing in advanced analytics and client relationship management tools to provide tailored advice.

- Technological Advancements in Wealth Management Solutions: The integration of technology in wealth management is revolutionizing the industry in Belgium. The adoption of fintech solutions, such as robo-advisors and AI-driven investment platforms, is on the rise, with a projected market penetration of 13.7% by the end of 2024. According to a government report , 77% of wealth management firms in Belgium are investing in digital transformation initiatives to enhance operational efficiency and client experience. These technological advancements enable firms to offer more efficient services, reduce costs, and improve decision-making processes.

Market Challenges

- Regulatory Compliance and Changes: One of the significant challenges facing the Belgium wealth management market is the complex regulatory environment. The implementation of the Markets in Financial Instruments Directive II (MiFID II) has introduced stringent requirements for transparency and client protection, impacting how wealth management firms operate. Compliance with these regulations requires substantial investment in compliance infrastructure and training, which can strain resources, particularly for smaller firms.

- Market Volatility and Economic Uncertainty: Economic uncertainty and market volatility pose significant challenges to the Belgium wealth management market. The ongoing geopolitical tensions and inflationary pressures have led to fluctuations in financial markets, impacting investor confidence. In 2024, the inflation rate in Belgium is projected to remain around 3.2%, according to the National Bank of Belgium, which can erode real returns on investments. This volatility can lead to increased client anxiety and a reluctance to invest, as individuals may prefer to hold cash or low-risk assets rather than engage in wealth management services.

Belgium Wealth Management Market Future Outlook

The Belgium wealth management market is poised for continued evolution, driven by technological advancements and changing client preferences. Firms that leverage digital tools and focus on personalized services will likely thrive in this dynamic environment, adapting to the needs of a diverse client base.

Market Opportunities

- Expansion of Digital Wealth Management Platforms: The rise of digital wealth management platforms presents a significant opportunity for growth in the Belgium market. As more clients seek convenient and accessible investment solutions, firms that develop user-friendly digital platforms can capture a larger share of the market. According to a report by Accenture, the digital wealth management market in Belgium is expected to grow by 40% over the next five years. This growth is driven by the increasing adoption of mobile banking and investment apps, which allow clients to manage their portfolios on-the-go.

- Growing Interest in Sustainable Investment Options: The increasing focus on sustainable and responsible investing presents a unique opportunity for wealth management firms in Belgium. A survey conducted by the Belgian Asset Managers Association revealed that 73% of investors are interested in sustainable investment options, indicating a strong demand for ESG (Environmental, Social, and Governance) compliant portfolios. As more clients prioritize sustainability in their investment decisions, wealth management firms that offer tailored sustainable investment strategies can differentiate themselves in a competitive market.

Scope of the Report

| By Service Type |

Investment Management Financial Planning Estate Planning |

| By Client Type |

High-Net-Worth Individuals (HNWIs) Ultra-High-Net-Worth Individuals (UHNWIs) Institutional Clients |

| By Investment Strategy |

Active Management Passive Management Alternative Investments |

| By Geographic Region |

Flanders Wallonia Brussels-Capital Region |

| By Asset Class |

Equities Fixed Income Real Estate Commodities |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Financial Services and Markets Authority)

Private Banking Institutions

Wealth Management Firms

Insurance Companies

Pension Funds

Family Offices

Financial Technology Providers

Companies

Players Mentioned in the Report:

KBC Group

BNP Paribas Fortis

ING Belgium

Degroof Petercam

UBS

WealthBridge Belgium

EuroCapital Advisors

Prosperity Partners Belgium

Antwerp Asset Management

Brussels Wealth Solutions

Table of Contents

1. Belgium Wealth Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Belgium Wealth Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Belgium Wealth Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Affluence of the Population

3.1.2. Rising Demand for Personalized Financial Services

3.1.3. Technological Advancements in Wealth Management Solutions

3.2. Market Challenges

3.2.1. Regulatory Compliance and Changes

3.2.2. Market Volatility and Economic Uncertainty

3.2.3. Competition from Fintech Companies

3.3. Opportunities

3.3.1. Expansion of Digital Wealth Management Platforms

3.3.2. Growing Interest in Sustainable Investment Options

3.3.3. Increasing Cross-Border Wealth Management Services

3.4. Trends

3.4.1. Shift Towards Robo-Advisory Services

3.4.2. Integration of Artificial Intelligence in Wealth Management

3.4.3. Focus on Client Experience and Engagement

3.5. Government Regulation

3.5.1. Overview of Financial Regulatory Bodies

3.5.2. Impact of MiFID II on Wealth Management Practices

3.5.3. Anti-Money Laundering (AML) Regulations

3.5.4. Data Protection and GDPR Compliance

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Belgium Wealth Management Market Segmentation

4.1. By Service Type

4.1.1. Investment Management

4.1.2. Financial Planning

4.1.3. Estate Planning

4.2. By Client Type

4.2.1. High-Net-Worth Individuals (HNWIs)

4.2.2. Ultra-High-Net-Worth Individuals (UHNWIs)

4.2.3. Institutional Clients

4.3. By Investment Strategy

4.3.1. Active Management

4.3.2. Passive Management

4.3.3. Alternative Investments

4.4. By Geographic Region

4.4.1. Flanders

4.4.2. Wallonia

4.4.3. Brussels-Capital Region

4.5. By Asset Class

4.5.1. Equities

4.5.2. Fixed Income

4.5.3. Real Estate

4.5.4. Commodities

5. Belgium Wealth Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. KBC Group

5.1.2. BNP Paribas Fortis

5.1.3. ING Belgium

5.1.4. Degroof Petercam

5.1.5. UBS

5.1.6. WealthBridge Belgium

5.1.7. EuroCapital Advisors

5.1.8. Prosperity Partners Belgium

5.1.9. Antwerp Asset Management

5.1.10. Brussels Wealth Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Revenue Growth Rate

5.2.3. Client Retention Rates

5.2.4. Average Assets Under Management (AUM)

5.2.5. Service Offerings Diversity

5.2.6. Digital Adoption Rate

5.2.7. Customer Satisfaction Scores

5.2.8. Regulatory Compliance Ratings

6. Belgium Wealth Management Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Belgium Wealth Management Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Belgium Wealth Management Market Future Market Segmentation

8.1. By Service Type

8.1.1. Investment Management

8.1.2. Financial Planning

8.1.3. Estate Planning

8.2. By Client Type

8.2.1. High-Net-Worth Individuals (HNWIs)

8.2.2. Ultra-High-Net-Worth Individuals (UHNWIs)

8.2.3. Institutional Clients

8.3. By Investment Strategy

8.3.1. Active Management

8.3.2. Passive Management

8.3.3. Alternative Investments

8.4. By Geographic Region

8.4.1. Flanders

8.4.2. Wallonia

8.4.3. Brussels-Capital Region

8.5. By Asset Class

8.5.1. Equities

8.5.2. Fixed Income

8.5.3. Real Estate

8.5.4. Commodities

9. Belgium Wealth Management Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Belgium Wealth Management Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Belgium Wealth Management Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Belgium Wealth Management Market.

Frequently Asked Questions

01. How big is the Belgium Wealth Management Market?

The Belgium Wealth Management Market is valued at USD 94 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Belgium Wealth Management Market?

Key challenges in the Belgium Wealth Management Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Belgium Wealth Management Market?

Major players in the Belgium Wealth Management Market include KBC Group, BNP Paribas Fortis, ING Belgium, Degroof Petercam, UBS, among others.

04. What are the growth drivers for the Belgium Wealth Management Market?

The primary growth drivers for the Belgium Wealth Management Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.