Region:Central and South America

Author(s):Shubham

Product Code:KRAA1754

Pages:95

Published On:August 2025

By Type:The airbag systems market can be segmented into various types, including Driver/Frontal Airbags, Passenger Frontal Airbags, Side (Thorax) Airbags, Curtain (Side-Curtain) Airbags, Knee Airbags, Pedestrian Protection Airbags, and Other Airbags (Center, Rear-Seat). Among these, Driver/Frontal Airbags and Passenger Frontal Airbags are the most widely used due to their essential role in protecting occupants during frontal collisions, and because they are the primary configurations regulated and factory-fitted by OEMs across mass-market models in Brazil. Growing adoption of side and curtain airbags is supported by OEM safety packages and consumer demand for higher safety ratings .

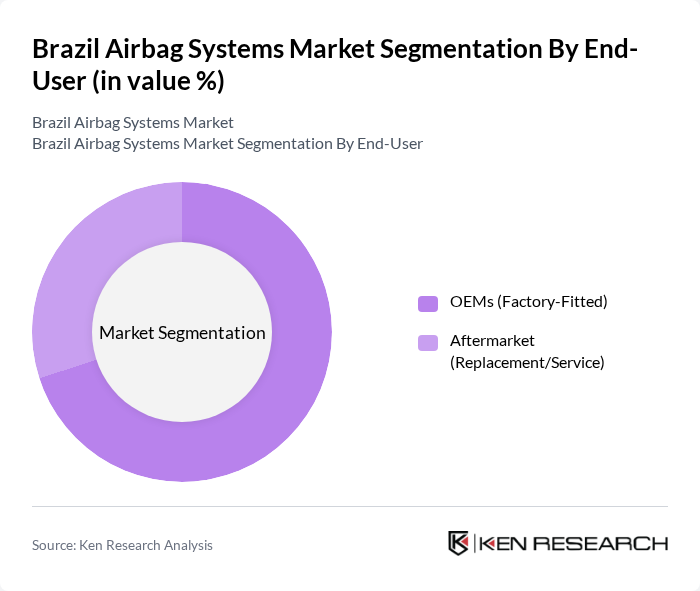

By End-User:The market is segmented into OEMs (Factory-Fitted) and Aftermarket (Replacement/Service). The OEM segment dominates as automakers integrate multi-airbag systems to meet safety standards and consumer expectations, with aftermarket demand driven by replacements and service following deployments or recalls .

The Brazil Airbag Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autoliv Inc., Joyson Safety Systems (including legacy Takata assets), ZF Friedrichshafen AG (ZF Passive Safety Systems), Continental AG, DENSO Corporation, Hyundai Mobis Co., Ltd., Toyoda Gosei Co., Ltd., Nihon Plast Co., Ltd., Daicel Corporation (Daicel Pyrotech/Inflator business), Ashimori Industry Co., Ltd., Toyota Boshoku Corporation, Bosch (Robert Bosch GmbH), Aptiv PLC, Mando Corporation, Aisin Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The Brazil airbag systems market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As the automotive industry increasingly embraces electric vehicles, the demand for innovative airbag solutions tailored to these new models will rise. Additionally, the integration of artificial intelligence in airbag systems is expected to enhance safety features, making vehicles smarter and more responsive. These trends indicate a dynamic market landscape, with opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Driver/Frontal Airbags Passenger Frontal Airbags Side (Thorax) Airbags Curtain (Side-Curtain) Airbags Knee Airbags Pedestrian Protection Airbags Other Airbags (Center, Rear-Seat) |

| By End-User | OEMs (Factory-Fitted) Aftermarket (Replacement/Service) |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Medium & Heavy Trucks Buses & Coaches |

| By Distribution Channel | OEM Supply Independent Aftermarket Authorized Service Networks |

| By Region | Southeast (São Paulo, Minas Gerais, Rio de Janeiro, Espírito Santo) South (Paraná, Santa Catarina, Rio Grande do Sul) Midwest/Central-West (Goiás, Mato Grosso, Mato Grosso do Sul, DF) Northeast North |

| By Price Range | Economy Mid-Range Premium |

| By Application | Passenger Safety Compliance (Regulatory) Occupant Protection Enhancement (Multi-stage/Smart Airbags) Fleet Safety and TCO Optimization Pedestrian Safety |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 90 | Product Development Managers, Safety Compliance Officers |

| Commercial Vehicle Manufacturers | 70 | Engineering Managers, Procurement Specialists |

| Airbag System Suppliers | 60 | Sales Directors, Technical Support Engineers |

| Automotive Safety Regulators | 40 | Policy Makers, Regulatory Affairs Managers |

| Automotive Aftermarket Retailers | 50 | Store Managers, Product Line Managers |

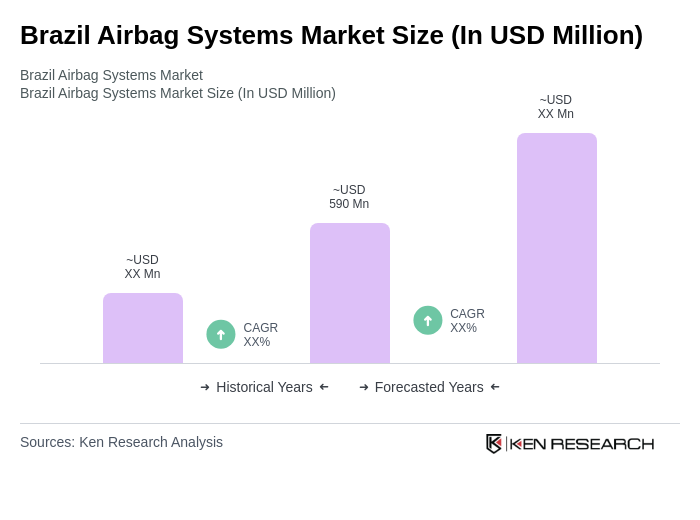

The Brazil Airbag Systems Market is valued at approximately USD 590 million, reflecting a significant growth trend driven by increased vehicle production, stringent safety regulations, and heightened consumer awareness regarding vehicle safety features.