Cambodia Industrial and Chemical Materials Market Outlook to 2029

Cambodia Industrial and Chemical Materials Market: Trends & Forecast 2019–2030

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1528

August 2025

90

About the Report

Cambodia Industrial and Chemical Materials Market Overview

- The Cambodia industrial and chemical materials market is experiencing rapid growth, driven by increasing demand for construction materials, agricultural inputs, and industrial chemicals. This expansion is fueled by fast-paced urbanization and extensive infrastructure development across the country.

- Key cities such as Phnom Penh, Siem Reap, and Sihanoukville dominate the market due to strategic locations, robust infrastructure, and expanding industrial activities. Phnom Penh is Cambodia’s main commercial center, while Sihanoukville Autonomous Port serves as the country’s principal deep-sea port, supporting large-scale import and export of chemicals and industrial materials. Siem Reap is also rapidly emerging as an industrial hub, fueled by ongoing infrastructure and business development.

- In 2023, the Cambodian government strengthened regulations on the production, import, and use of chemicals with updated sub-decrees and marking requirements aligned with international safety and environmental standards. These measures enhance control over hazardous substances, promote sustainable practices, and ensure chemical products meet strict health and safety criteria throughout the country.

Cambodia Industrial and Chemical Materials Market Segmentation

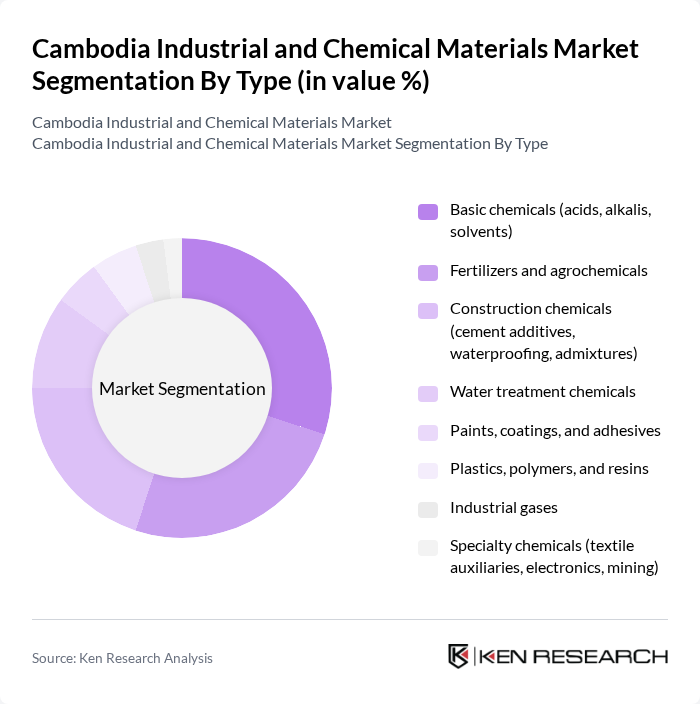

By Type: The market is segmented into various types, including basic chemicals, fertilizers and agrochemicals, construction chemicals, water treatment chemicals, paints, coatings, and adhesives, plastics, polymers, and resins, industrial gases, and specialty chemicals. Among these, basic chemicals hold a significant share due to their essential role in various industries, including manufacturing and agriculture. The demand for fertilizers and agrochemicals is also rising, driven by the need for increased agricultural productivity. The construction chemicals segment is gaining traction as infrastructure projects expand, reflecting a growing trend towards sustainable building practices.

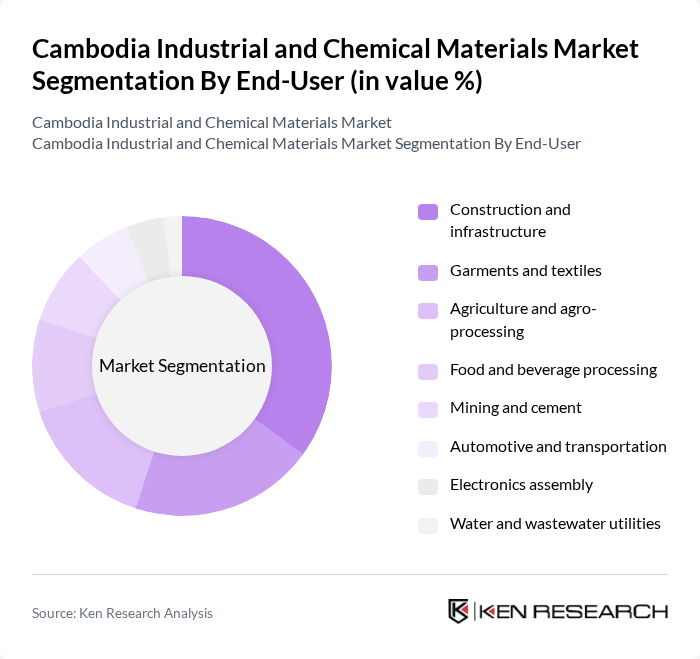

By End-User: The end-user segmentation includes construction and infrastructure, garments and textiles, agriculture and agro-processing, food and beverage processing, mining and cement, automotive and transportation, electronics assembly, and water and wastewater utilities. The construction and infrastructure sector is the largest consumer of industrial and chemical materials, driven by ongoing urban development and infrastructure projects. The agriculture sector is also significant, as the demand for fertilizers and agrochemicals continues to rise, reflecting a trend towards modern farming practices. The automotive and transportation sector is emerging as a key user of specialty chemicals, particularly in manufacturing and maintenance.

Cambodia Industrial and Chemical Materials Market Competitive Landscape

The Cambodia Industrial and Chemical Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCG Chemicals Public Company Limited (SCGC), PTT Global Chemical Public Company Limited (PTTGC), The Siam Cement Public Company Limited (Cement and Building Materials; chemicals via SCGC), Mitsubishi Chemical Group Corporation, BASF SE, contribute to innovation, geographic expansion, and service delivery in this space.

| SCG Chemicals Public Company Limited | 1913 | Bangkok, Thailand | – | – | – | – | – | – |

| PTT Global Chemical Public Company Limited | 2007 | Bangkok, Thailand | – | – | – | – | – | – |

| The Siam Cement Public Company Limited | 1913 | Bangkok, Thailand | – | – | – | – | – | – |

| Mitsubishi Chemical Group Corporation | 1933 | Tokyo, Japan | – | – | – | – | – | – |

| BASF SE | 1865 | Ludwigshafen, Germany | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Local presence (years in Cambodia, number of branches/depots) | Revenue in Cambodia (USD) and 3-year CAGR | Import volume/throughput (tons per year) | Market coverage (provinces served, key sectors) | Contract portfolio (number of key industrial accounts) | Pricing position vs. regional benchmarks |

|---|

Cambodia Industrial and Chemical Materials Market Industry Analysis

Growth Drivers

- Increasing Industrialization: Cambodia’s industrial sector continues to expand rapidly, with recent forecasts projecting annual growth near 8.6%. The government aims to boost the manufacturing sector’s share of GDP from about 28%. This industrialization is driven by the establishment of special economic zones, which have attracted sustained foreign investment—totaling hundreds of millions of dollars annually—fostering demand for industrial and chemical materials.

- Government Initiatives for Manufacturing: The Cambodian government has implemented various initiatives to boost the manufacturing sector, including tax incentives and wide-scale infrastructure development. Substantial funding has been approved for industrial and logistics projects, enhancing the country’s supply chains. These measures are expected to create hundreds of thousands of new jobs over the coming years, further increasing demand for chemical materials used in manufacturing processes.

- Rising Demand for Chemical Products: The demand for chemical products in Cambodia is expected to increase substantially, driven by growth in key sectors such as agriculture and construction. The chemical industry is expected to generate substantial revenue growth, around $1.5 billion. This expansion is driven by the increasing demand for fertilizers and construction materials, which are essential for sustaining Cambodia's ongoing economic growth.

Market Challenges

- Regulatory Compliance Issues: The Cambodian industrial sector, particularly the chemical industry, faces significant challenges in adhering to environmental regulations. The majority of local manufacturers report difficulties with compliance due to unclear guidelines and inconsistent enforcement, which can result in fines and operational delays. These regulatory hurdles complicate growth and investment in the sector, highlighting the need for clearer policies and stronger enforcement mechanisms.

- Limited Infrastructure Development: Despite government efforts, Cambodia's infrastructure remains underdeveloped, with only about 30% of roads paved. This situation increases transportation costs and causes delays, posing challenges for manufacturers relying on the timely delivery of raw materials and finished products. The infrastructure gap ultimately affects the industrial sector's competitiveness in the regional market.

Cambodia Industrial and Chemical Materials Market Future Outlook

The future of Cambodia's industrial and chemical materials market appears promising, driven by ongoing industrialization and government support. As the country continues to enhance its manufacturing capabilities, the demand for chemical products is expected to rise significantly. Additionally, the focus on sustainable practices and eco-friendly products will likely shape the market landscape, encouraging innovation and attracting foreign investment. Strategic partnerships with global players will further bolster the sector's growth, positioning Cambodia as a competitive player in the regional market.

Market Opportunities

- Expansion of Export Markets: Cambodia's strategic location in Southeast Asia offers significant opportunities for expanding chemical product exports. Current exports are valued in the hundreds of millions of dollars, with potential growth supported by rising demand from neighboring countries. This expansion provides local manufacturers with a broader customer base and enhances revenue prospects.

- Development of Eco-friendly Products: The global shift towards sustainability presents significant opportunities for Cambodian manufacturers to develop eco-friendly chemical products. Driven by growing environmental awareness and government support, the market for green specialty chemicals in Cambodia is steadily expanding. Local companies can capitalize on this trend by investing in sustainable production methods, attracting environmentally conscious consumers, and enhancing their market position in a growing niche estimated to reach substantial value in the coming years.

Scope of the Report

| By Type |

Basic chemicals (acids, alkalis, solvents) Fertilizers and agrochemicals Construction chemicals (cement additives, waterproofing, admixtures) Water treatment chemicals Paints, coatings, and adhesives Plastics, polymers, and resins Industrial gases Specialty chemicals (textile auxiliaries, electronics, mining) |

| By End-User |

Construction and infrastructure Garments and textiles Agriculture and agro-processing Food and beverage processing Mining and cement Automotive and transportation Electronics assembly Water and wastewater utilities |

| By Application |

Coatings and protective finishes Adhesives and sealants Plastics conversion (packaging, pipes, films) Textile processing (dyes, auxiliaries, washing chemicals) Fertilization and crop protection Water purification and wastewater treatment Concrete admixtures and asphalt modifiers Lubricants and metalworking fluids |

| By Distribution Channel |

Direct imports by end users Local distributors and agents Regional hubs (Thailand, Vietnam, Singapore re-exports) Online B2B platforms Retail/wholesale outlets |

| By Pricing Strategy |

Cost-plus on imported lots Volume-based discounts Contract pricing for industrial buyers Spot pricing for commodities |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry, Science, Technology & Innovation)

Manufacturers and Producers

Distributors and Retailers

Importers and Exporters

Industry Associations (e.g., Cambodia Chamber of Commerce)

Financial Institutions (e.g., National Bank of Cambodia)

Environmental Agencies (e.g., Ministry of Environment)

Companies

Players Mentioned in the Report:

SCG Chemicals Public Company Limited (SCGC)

PTT Global Chemical Public Company Limited (PTTGC)

The Siam Cement Public Company Limited (Cement and Building Materials; chemicals via SCGC)

Mitsubishi Chemical Group Corporation

BASF SE

Dow Inc.

LG Chem Ltd.

Eastman Chemical Company

Formosa Plastics Corporation

Indorama Ventures Public Company Limited

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. Cambodia Industrial and Chemical Materials Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 Cambodia Industrial and Chemical Materials Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. Cambodia Industrial and Chemical Materials Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Industrialization

3.1.2 Government Initiatives for Manufacturing

3.1.3 Rising Demand for Chemical Products

3.1.4 Foreign Direct Investment in the Sector

3.2 Market Challenges

3.2.1 Regulatory Compliance Issues

3.2.2 Limited Infrastructure Development

3.2.3 Competition from Imported Products

3.2.4 Environmental Concerns and Sustainability

3.3 Market Opportunities

3.3.1 Expansion of Export Markets

3.3.2 Development of Eco-friendly Products

3.3.3 Technological Advancements in Production

3.3.4 Strategic Partnerships with Global Players

3.4 Market Trends

3.4.1 Shift Towards Sustainable Practices

3.4.2 Increasing Automation in Manufacturing

3.4.3 Growth of E-commerce in Industrial Supplies

3.4.4 Focus on Local Sourcing of Raw Materials

3.5 Government Regulation

3.5.1 Environmental Protection Laws

3.5.2 Import Tariffs on Chemical Products

3.5.3 Safety Standards for Industrial Chemicals

3.5.4 Incentives for Green Manufacturing

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. Cambodia Industrial and Chemical Materials Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. Cambodia Industrial and Chemical Materials Market Segmentation

8.1 By Type

8.1.1 Basic chemicals (acids, alkalis, solvents)

8.1.2 Fertilizers and agrochemicals

8.1.3 Construction chemicals (cement additives, waterproofing, admixtures)

8.1.4 Water treatment chemicals

8.1.5 Paints, coatings, and adhesives

8.1.6 Plastics, polymers, and resins

8.1.7 Industrial gases

8.1.8 Specialty chemicals (textile auxiliaries, electronics, mining)

8.2 By End-User

8.2.1 Construction and infrastructure

8.2.2 Garments and textiles

8.2.3 Agriculture and agro-processing

8.2.4 Food and beverage processing

8.2.5 Mining and cement

8.2.6 Automotive and transportation

8.2.7 Electronics assembly

8.2.8 Water and wastewater utilities

8.3 By Application

8.3.1 Coatings and protective finishes

8.3.2 Adhesives and sealants

8.3.3 Plastics conversion (packaging, pipes, films)

8.3.4 Textile processing (dyes, auxiliaries, washing chemicals)

8.3.5 Fertilization and crop protection

8.3.6 Water purification and wastewater treatment

8.3.7 Concrete admixtures and asphalt modifiers

8.3.8 Lubricants and metalworking fluids

8.4 By Distribution Channel

8.4.1 Direct imports by end users

8.4.2 Local distributors and agents

8.4.3 Regional hubs (Thailand, Vietnam, Singapore re-exports)

8.4.4 Online B2B platforms

8.4.5 Retail/wholesale outlets

8.5 By Pricing Strategy

8.5.1 Cost-plus on imported lots

8.5.2 Volume-based discounts

8.5.3 Contract pricing for industrial buyers

8.5.4 Spot pricing for commodities

9. Cambodia Industrial and Chemical Materials Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Company name

9.2.2 Local presence (years in Cambodia, number of branches/depots)

9.2.3 Revenue in Cambodia (USD) and 3-year CAGR

9.2.4 Import volume/throughput (tons per year)

9.2.5 Market coverage (provinces served, key sectors)

9.2.6 Contract portfolio (number of key industrial accounts)

9.2.7 Pricing position vs. regional benchmarks

9.2.8 Product breadth (SKUs across categories)

9.2.9 Supply reliability (on-time delivery rate, lead time)

9.2.10 Compliance and certifications (GHS/SDS, ISO, EIA permits)

9.2.11 After-sales technical support (field engineers, lab capability)

9.2.12 Local sourcing vs. imports ratio

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 SCG Chemicals Public Company Limited (SCGC)

9.5.2 PTT Global Chemical Public Company Limited (PTTGC)

9.5.3 The Siam Cement Public Company Limited (Cement and Building Materials; chemicals via SCGC)

9.5.4 Mitsubishi Chemical Group Corporation

9.5.5 BASF SE

9.5.6 Dow Inc.

9.5.7 LG Chem Ltd.

9.5.8 Eastman Chemical Company

9.5.9 Formosa Plastics Corporation

9.5.10 Indorama Ventures Public Company Limited

10. Cambodia Industrial and Chemical Materials Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Ministry of Industry, Science, Technology, and Innovation

10.1.2 Ministry of Commerce

10.1.3 Ministry of Environment

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in Chemical Manufacturing Facilities

10.2.2 Expenditure on Sustainable Practices

10.2.3 Budget Allocation for R&D

10.3 Pain Point Analysis by End-User Category

10.3.1 Manufacturing Sector Challenges

10.3.2 Regulatory Compliance Issues

10.3.3 Supply Chain Disruptions

10.4 User Readiness for Adoption

10.4.1 Awareness of New Technologies

10.4.2 Training and Skill Development Needs

10.4.3 Financial Readiness for Investment

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Measurement of ROI in Chemical Projects

10.5.2 Case Studies of Successful Implementations

10.5.3 Future Expansion Plans

11. Cambodia Industrial and Chemical Materials Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Business Model Development

1.3 Value Proposition Analysis

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

3. Distribution Plan

3.1 Urban Retail Strategies

3.2 Rural NGO Tie-ups

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands Analysis

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

7. Value Proposition

7.1 Sustainability Initiatives

7.2 Integrated Supply Chains

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding Efforts

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix Considerations

9.1.2 Pricing Band Strategy

9.1.3 Packaging Solutions

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield Investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines for Implementation

12. Control vs Risk Trade-Off

12.1 Ownership Considerations

12.2 Partnerships Evaluation

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability Strategies

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone Planning

15.2.2 Activity Tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of government publications and reports on industrial growth in Cambodia

- Review of trade statistics from the Ministry of Commerce and relevant industry associations

- Examination of market reports and white papers from international trade organizations

Primary Research

- Interviews with industry experts and stakeholders in the chemical materials sector

- Surveys conducted with manufacturers and distributors of industrial chemicals

- Field visits to production facilities to gather firsthand insights on operations

Validation & Triangulation

- Cross-verification of data from multiple sources to ensure accuracy

- Engagement with a panel of experts for qualitative insights and feedback

- Sanity checks against historical market trends and growth patterns

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of market size based on national economic indicators and industrial output

- Segmentation of the market by product type and end-user industries

- Incorporation of government initiatives promoting industrial growth and sustainability

Bottom-up Modeling

- Collection of sales data from key players in the industrial and chemical materials market

- Estimation of production capacities and output levels of local manufacturers

- Analysis of pricing strategies and cost structures across different segments

Forecasting & Scenario Analysis

- Development of predictive models based on historical growth rates and market dynamics

- Scenario planning considering economic fluctuations and regulatory changes

- Projections of market growth under various conditions through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Sector | 120 | Production Managers, Quality Control Supervisors |

| Industrial Supply Chain Management | 90 | Logistics Coordinators, Procurement Managers |

| Construction Materials Sector | 80 | Project Managers, Material Suppliers |

| Pharmaceutical Raw Materials | 70 | Regulatory Affairs Specialists, R&D Managers |

| Environmental Compliance in Chemical Production | 60 | Sustainability Officers, Compliance Managers |

Frequently Asked Questions

What is the current value of the Cambodia Industrial and Chemical Materials Market?

The Cambodia Industrial and Chemical Materials Market is valued at approximately USD XX billion, reflecting significant growth driven by increasing demand for construction materials, agricultural inputs, and industrial chemicals, particularly due to rapid urbanization and infrastructure development.

Which cities are key players in the Cambodia Industrial and Chemical Materials Market?

Key cities in the Cambodia Industrial and Chemical Materials Market include Phnom Penh, Siem Reap, and Sihanoukville. Phnom Penh serves as the commercial hub, while Sihanoukville is crucial for bulk import/export activities due to its deep-sea port.

What recent regulations have been implemented in Cambodia's chemical sector?

In 2023, the Cambodian government enacted the Sub-Decree on Chemical Management and Hazardous Substances. This regulation aims to ensure safety and environmental protection in the production, import, and use of chemicals, aligning with international standards.

What are the main types of chemicals in the Cambodia market?

The Cambodia Industrial and Chemical Materials Market is segmented into various types, including basic chemicals, fertilizers and agrochemicals, construction chemicals, water treatment chemicals, paints, coatings, adhesives, plastics, polymers, industrial gases, and specialty chemicals.

Which sectors are the largest consumers of industrial and chemical materials in Cambodia?

The largest consumers of industrial and chemical materials in Cambodia include the construction and infrastructure sector, followed by agriculture, garments and textiles, food and beverage processing, and automotive and transportation sectors, reflecting diverse industrial needs.

What are the growth drivers for the Cambodia Industrial and Chemical Materials Market?

Key growth drivers include increasing industrialization, government initiatives to boost manufacturing, and rising demand for chemical products, particularly in agriculture and construction, which are essential for supporting Cambodia's economic development.

What challenges does the Cambodia Industrial and Chemical Materials Market face?

The market faces challenges such as regulatory compliance issues, limited infrastructure development, and competition from imported products. These factors can hinder growth and investment in the local chemical industry.

How is the Cambodian government supporting the manufacturing sector?

The Cambodian government supports the manufacturing sector through initiatives like tax incentives, infrastructure development, and allocating funds for industrial projects. These efforts aim to enhance logistics, create jobs, and stimulate demand for chemical materials.

What opportunities exist for eco-friendly products in Cambodia's chemical market?

There is a growing market for eco-friendly products in Cambodia, driven by global sustainability trends. Local manufacturers can capitalize on this by developing green chemical products, which are projected to reach a market size of approximately USD 300 million.

What is the projected future growth of the Cambodia Industrial and Chemical Materials Market?

The future of the Cambodia Industrial and Chemical Materials Market looks promising, with ongoing industrialization and government support expected to drive significant demand for chemical products, particularly as the focus on sustainable practices increases.

Which companies are leading in the Cambodia Industrial and Chemical Materials Market?

Leading companies in the Cambodia Industrial and Chemical Materials Market include SCG Chemicals, PTT Global Chemical, BASF, Dow, and Mitsubishi Chemical. These firms contribute to innovation and service delivery in the sector.

What are the main applications of chemicals in Cambodia?

Main applications of chemicals in Cambodia include coatings and protective finishes, adhesives, plastics conversion, textile processing, fertilization, water purification, concrete admixtures, and lubricants, reflecting the diverse industrial landscape.

How does the Cambodian market handle chemical distribution?

Chemical distribution in Cambodia occurs through various channels, including direct imports by end users, local distributors, regional hubs, online B2B platforms, and retail/wholesale outlets, ensuring accessibility across different sectors.

What is the significance of the Sihanoukville Autonomous Port for the chemical market?

The Sihanoukville Autonomous Port is crucial for the Cambodia Industrial and Chemical Materials Market as it serves as the primary deep-sea port for bulk import and export of chemicals and materials, facilitating trade and logistics.

What role does foreign investment play in Cambodia's industrial sector?

Foreign investment plays a significant role in Cambodia's industrial sector, with over $1.5 billion attracted to special economic zones. This investment fosters demand for industrial and chemical materials, supporting overall economic growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.