Canada Essential Oil Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD10118

November 2024

89

About the Report

Canada Essential Oil Market Overview

- The Canada essential oil market is valued at USD 450 million, driven by increasing consumer awareness of natural products and the rise of aromatherapy. The market's growth is also attributed to its applications in health and wellness, personal care, and alternative medicine. Increasing demand for organic products and the expansion of online retail channels have further propelled this growth. A solid five-year historical analysis reveals a consistent upward trend in consumer preferences for natural remedies and organic essential oils, driven by a focus on sustainability and holistic health solutions.

- Cities such as Toronto, Vancouver, and Montreal dominate the essential oil market in Canada due to their large, health-conscious populations and higher disposable incomes. These cities host a growing number of wellness centers, spas, and retailers that emphasize organic and sustainable products. Torontos prominence stems from its role as a cultural and commercial hub with significant demand for essential oils in personal care products.

- The Canadian Food Inspection Agency (CFIA) has set rigorous standards for essential oils, ensuring product safety and quality. These standards regulate everything from the purity of the oils to labeling requirements. In 2023, CFIA introduced new labeling guidelines that require essential oil products to clearly state their organic or synthetic origins, botanical name, and extraction method. These regulations help protect consumers from misleading claims and ensure that Canadian products meet high safety and quality standards

Canada Essential Oil Market Segmentation

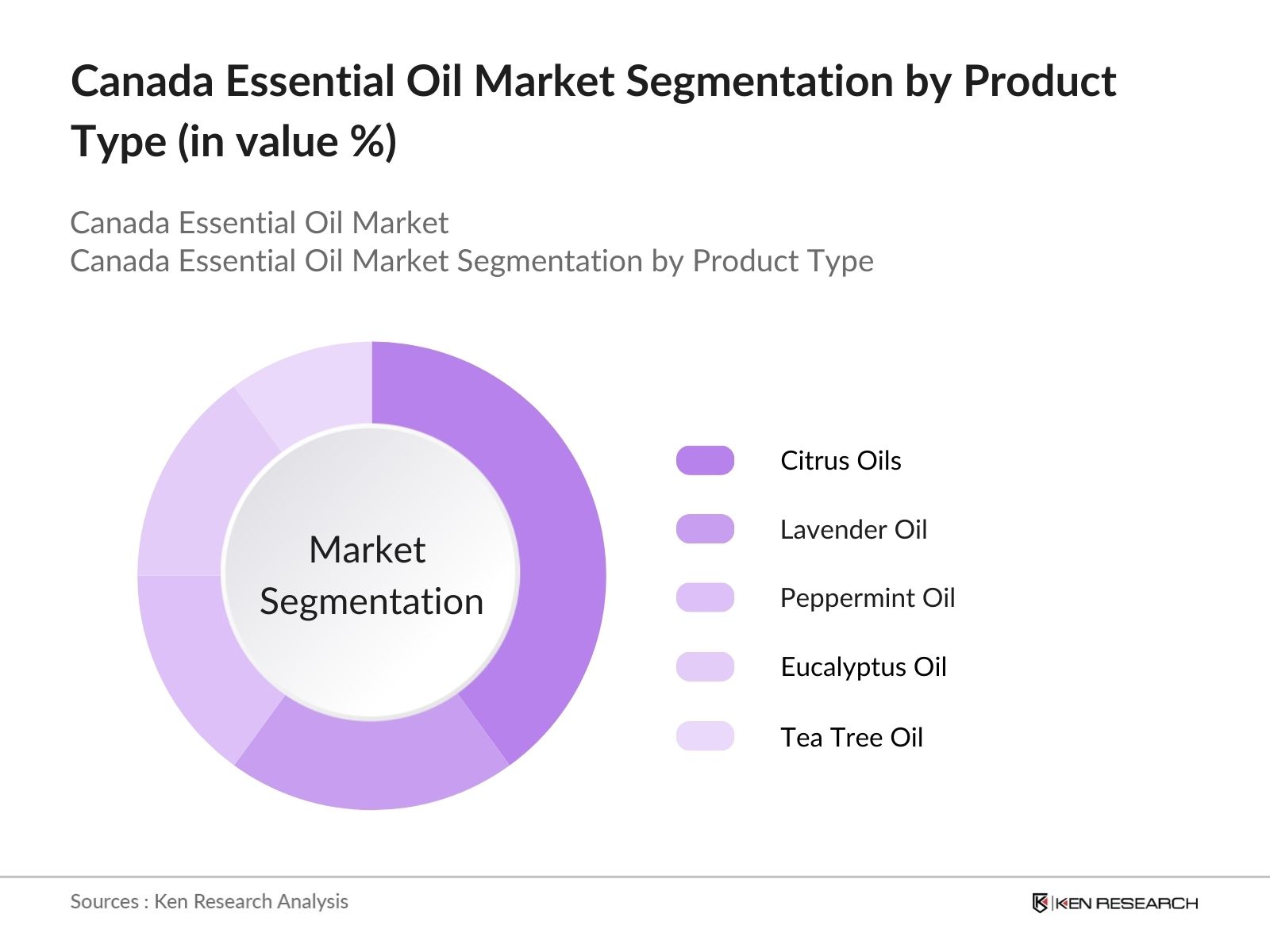

By Product Type: The Canada essential oil market is segmented by product type into citrus oils, lavender oil, peppermint oil, eucalyptus oil, and tea tree oil. Among these, citrus oils have maintained a dominant market share due to their extensive use in aromatherapy, household care, and personal care products. The uplifting and refreshing properties of citrus oils, such as lemon and orange oils, make them popular for consumers seeking natural alternatives to chemical-based cleaning agents and skincare products.

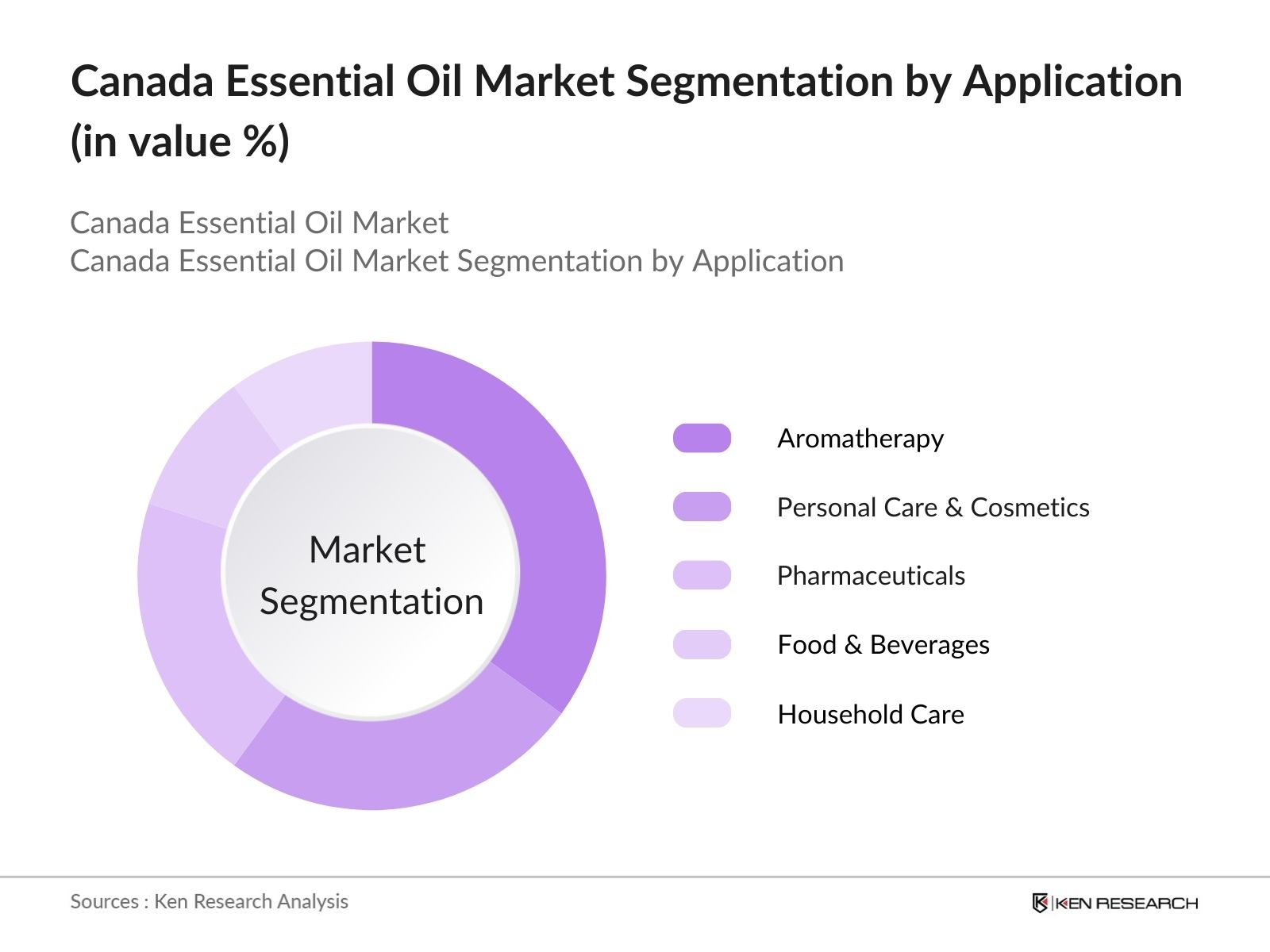

By Application: The essential oil market is further segmented by application into aromatherapy, personal care & cosmetics, pharmaceuticals, food & beverages, and household care. The aromatherapy segment leads the market due to growing consumer interest in stress relief and mental well-being. Essential oils like lavender, eucalyptus, and chamomile are integral to aromatherapy practices, which have gained popularity for their ability to promote relaxation and improve sleep quality.

By Application: The essential oil market is further segmented by application into aromatherapy, personal care & cosmetics, pharmaceuticals, food & beverages, and household care. The aromatherapy segment leads the market due to growing consumer interest in stress relief and mental well-being. Essential oils like lavender, eucalyptus, and chamomile are integral to aromatherapy practices, which have gained popularity for their ability to promote relaxation and improve sleep quality.

Canada Essential Oil Market Competitive Landscape

The Canada essential oil market is dominated by a mix of domestic and international players. Companies such as doTERRA, Young Living, and Saje Natural Wellness lead the market due to their strong brand presence, extensive product offerings, and commitment to sustainability. These companies emphasize organic certifications and responsible sourcing practices, which resonate with health-conscious consumers. The competitive landscape also highlights significant investment in research and development, with companies focusing on expanding their product lines to cater to diverse consumer needs.

Canada Essential Oil Market Analysis

Growth Drivers

- Rise in Consumer Preference for Natural Products: The demand for natural products in Canada has seen significant growth due to an increased focus on health and wellness. According to Agriculture and Agri-Food Canada, the organic sector contributes over USD 3.62 billion annually to the economy. Consumers are increasingly shifting towards products free from synthetic chemicals, driving the demand for essential oils. This shift is fueled by increasing awareness of health benefits and a growing preference for natural ingredients in beauty and personal care.

Source: Agriculture and Agri-Food Canada - Growth of Aromatherapy Industry: Canada's aromatherapy sector has been growing rapidly, with more than 4,000 registered aromatherapy practitioners as of 2023, according to Statistics Canada. Essential oils, used extensively in aromatherapy, benefit from this growth, as the industry expands into wellness tourism and holistic health care. The ongoing wellness movement and health-conscious consumer behavior support the long-term demand for essential oils in this sector.

- Government Support and Incentives for Organic Farming: The Canadian government offers strong support for organic farming, with essential oils directly benefiting from these initiatives. Organic farming subsidies reached USD 292 million in 2023 under the Canadian Agricultural Partnership. Essential oil producers that engage in organic farming benefit from tax breaks, grants, and research investments aimed at promoting sustainable agricultural practices.

Challenges

- Volatility in Raw Material Prices: The essential oils market in Canada faces challenges due to fluctuating prices of raw materials. The agriculture sector in Canada has shown significant growth, with farm market receipts reaching a record high of $93.0 billion in 2023, reflecting a 5.8% average annual growth from 2013 to 2023 in various commodities, particularly grains and oilseeds. This price volatility is often due to changing weather patterns and global supply chain disruptions.

- High Cost of Organic Certification: Organic certification remains a significant financial burden for small and medium-sized essential oil producers in Canada. The average cost of organic certification for essential oil producers was USD 22,250 in 2023, as reported by the Organic Council of Ontario. These high costs can hinder smaller companies from entering the market or expanding their operations, especially as they navigate stringent Canadian Organic Standards (COS) and regular audits.

Canada Essential Oil Market Future Outlook

Canada essential oil market is expected to experience significant growth driven by the increasing popularity of natural and organic products, advancements in essential oil extraction technologies, and rising awareness about the benefits of essential oils in health and wellness. Additionally, the expansion of e-commerce platforms will continue to drive sales, providing consumers with greater access to diverse essential oil products. The wellness trend and focus on natural ingredients are likely to sustain growth momentum in both urban and suburban regions.

Market Opportunities

- Expansion in Health and Wellness Industry: The health and wellness industry in Canada has grown by over USD 8.68 billion in 2023, offering significant opportunities for the essential oils market, according to Statistics Canada. Essential oils are increasingly incorporated into products ranging from skincare to dietary supplements. The focus on mental health and holistic well-being further drives the demand for oils used in aromatherapy, stress relief, and skin care. The integration of essential oils into a broader range of wellness products supports sustained market growth.

- Innovations in Product Development: Product innovation remains a key opportunity, with custom essential oil blends gaining popularity for their functional benefits. Canadian companies introduced over 150 new essential oil-based products in 2023, focusing on sleep aids, immune support, and mood enhancement, according to Innovation, Science and Economic Development Canada. Innovations like multi-purpose blends tailored to individual needs (e.g., stress relief, skincare) continue to attract consumers seeking personalized wellness solutions.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Product Type |

Citrus Oils Lavender Oil Peppermint Oil Eucalyptus Oil Tea Tree Oil |

|

By Application |

Aromatherapy Personal Care & Cosmetics Pharmaceuticals Food & Beverages Household Care |

|

By Extraction Method |

Steam Distillation Cold Press Extraction Solvent Extraction CO2 Extraction Water Distillation |

|

By Source |

Fruit Flowers Leaves Roots Seeds |

|

By Region |

Ontario British Columbia Quebec Alberta Others |

Products

Key Target Audience

Essential Oil Manufacturers

Aromatherapy Service Providers

Wellness Centers and Spas

Personal Care Product Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Canadian Food Inspection Agency, Health Canada)

Companies

Players Mentioned in the Report

doTERRA

Young Living

Saje Natural Wellness

Rocky Mountain Oils

Plant Therapy

Now Foods

Aura Cacia

Edens Garden

Vitruvi

Neals Yard Remedies

Table of Contents

1. Canada Essential Oil Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Canada Essential Oil Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Canada Essential Oil Market Analysis

3.1. Growth Drivers (Government Incentives, Consumer Preferences, Natural Product Demand, Export Demand)

3.1.1. Rise in Consumer Preference for Natural Products

3.1.2. Growth of Aromatherapy Industry

3.1.3. Government Support and Incentives for Organic Farming

3.1.4. Increasing Export Demand for Essential Oils

3.2. Market Challenges (Supply Chain, Cost of Organic Certification, Market Volatility, Technological Advancements)

3.2.1. Volatility in Raw Material Prices

3.2.2. High Cost of Organic Certification

3.2.3. Limited Access to Advanced Extraction Technologies

3.2.4. Complex Supply Chain Issues

3.3. Opportunities (New Product Development, Health & Wellness Industry Growth, Technological Advancements, Export Opportunities)

3.3.1. Expansion in Health and Wellness Industry

3.3.2. Innovations in Product Development (Custom Blends, Functional Benefits)

3.3.3. Technological Innovations in Distillation and Extraction

3.3.4. Increasing Export Opportunities

3.4. Trends (Organic Certification, Sustainable Sourcing, Premiumization, Integration into Wellness Products)

3.4.1. Rising Demand for Organic-Certified Oils

3.4.2. Emphasis on Sustainable Sourcing Practices

3.4.3. Premiumization of Essential Oils

3.4.4. Integration into Wellness Products and Cosmetics

3.5. Government Regulation (Canadian Food Inspection Agency, Essential Oils Safety Standards, Import-Export Regulations, Organic Certification Guidelines)

3.5.1. Canadian Food Inspection Agency Standards for Essential Oils

3.5.2. Essential Oils Safety Standards and Labeling Requirements

3.5.3. Import and Export Regulations for Essential Oils

3.5.4. Organic Certification Guidelines for Essential Oil Producers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Farmers, Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces (Bargaining Power, Competitive Rivalry, Threat of Substitutes)

3.9. Competitive Landscape

4. Canada Essential Oil Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Citrus Oils (Lemon, Orange, Grapefruit)

4.1.2. Lavender Oil

4.1.3. Peppermint Oil

4.1.4. Eucalyptus Oil

4.1.5. Tea Tree Oil

4.2. By Application (In Value %)

4.2.1. Aromatherapy

4.2.2. Personal Care & Cosmetics

4.2.3. Pharmaceuticals

4.2.4. Food & Beverages

4.2.5. Household Care

4.3. By Extraction Method (In Value %)

4.3.1. Steam Distillation

4.3.2. Cold Press Extraction

4.3.3. Solvent Extraction

4.3.4. CO2 Extraction

4.3.5. Water Distillation

4.4. By Source (In Value %)

4.4.1. Fruits

4.4.2. Flowers

4.4.3. Leaves

4.4.4. Roots

4.4.5. Seeds

4.5. By Region (In Value %)

4.5.1. Ontario

4.5.2. British Columbia

4.5.3. Quebec

4.5.4. Alberta

4.5.5. Others

5. Canada Essential Oil Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. doTERRA

5.1.2. Young Living

5.1.3. Plant Therapy

5.1.4. Now Foods

5.1.5. Rocky Mountain Oils

5.1.6. Aura Cacia

5.1.7. Vitruvi

5.1.8. Saje Natural Wellness

5.1.9. Edens Garden

5.1.10. Neals Yard Remedies

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Portfolio, Revenue, Regional Presence, Market Share, Distribution Network, Certification Status)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Canada Essential Oil Market Regulatory Framework

6.1. Essential Oils Regulation by Health Canada

6.2. Compliance and Certification Requirements

6.3. Certification Processes (Organic, Non-GMO, Sustainable)

7. Canada Essential Oil Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Canada Essential Oil Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Extraction Method (In Value %)

8.4. By Source (In Value %)

8.5. By Region (In Value %)

9. Canada Essential Oil Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the Canada essential oil market, incorporating all major stakeholders. Extensive desk research is conducted to gather industry-level information on key variables, including production methods, product applications, and distribution channels.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data on essential oil production, demand, and usage across different applications. Data from reliable government sources and proprietary databases are used to evaluate market growth and trends. A focus is placed on revenue generation from primary and secondary markets.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations with industry experts are conducted through surveys and interviews. These experts represent a range of companies across the essential oil value chain, providing insights into product development and consumer preferences.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing research findings into actionable insights for stakeholders. This includes data validation from essential oil manufacturers and distributors, ensuring the accuracy and reliability of the market forecast and recommendations.

Frequently Asked Questions

01. How big is the Canada Essential Oil Market?

The Canada essential oil market was valued at USD 450 million, driven by increasing consumer demand for natural and organic products across the health and wellness industry.

02. What are the challenges in the Canada Essential Oil Market?

Challenges in the Canada essential oil market include fluctuating raw material prices, the high cost of organic certification, and complexities in maintaining a sustainable supply chain for organic essential oils.

03. Who are the major players in the Canada Essential Oil Market?

Key players in Canada essential oil market include doTERRA, Young Living, Saje Natural Wellness, Rocky Mountain Oils, and Plant Therapy, which lead due to their focus on organic products and strong distribution networks.

04. What are the growth drivers of the Canada Essential Oil Market?

Canada essential oil market is driven by the increasing use of essential oils in aromatherapy, personal care, and wellness products, alongside rising consumer awareness of sustainable and organic product offerings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.