Region:Central and South America

Author(s):Dev

Product Code:KRAA0475

Pages:98

Published On:August 2025

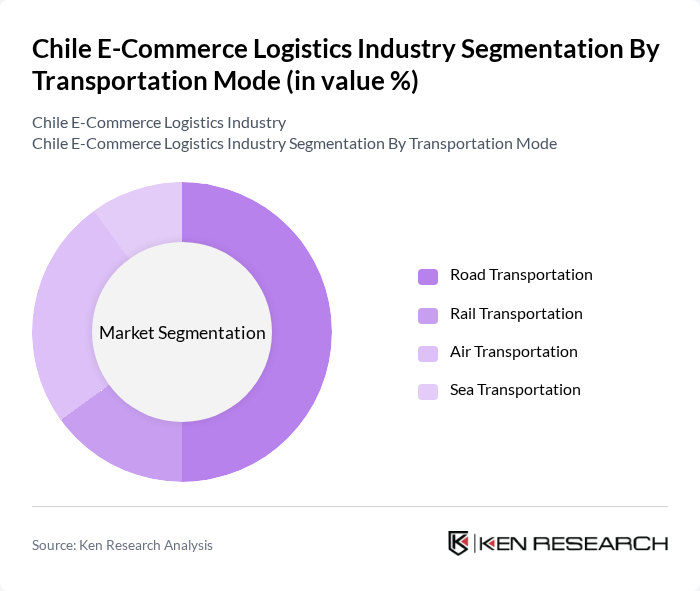

By Transportation Mode:The transportation mode segment includes various methods used for the movement of goods within the e-commerce logistics framework. The primary modes are road, rail, air, and sea transportation. Road transportation is the most utilized due to its flexibility and extensive network, supporting both urban and rural deliveries. Air transportation is increasingly preferred for urgent and high-value deliveries, especially with the surge in air cargo capacity and sustainable aviation fuel adoption. Rail and sea transportation are vital for bulk shipments and international trade, with ports such as Valparaíso and San Antonio serving as key logistics hubs .

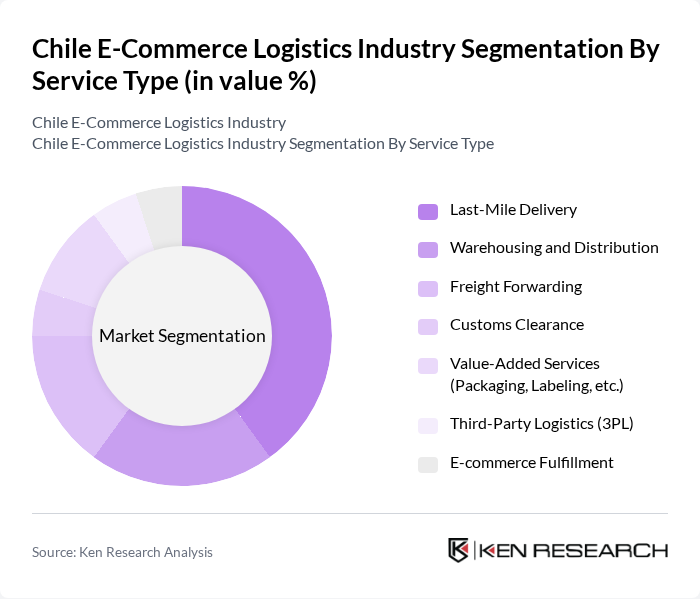

By Service Type:The service type segment encompasses various logistics services offered to e-commerce businesses. Key services include last-mile delivery, warehousing and distribution, freight forwarding, customs clearance, value-added services, third-party logistics (3PL), and e-commerce fulfillment. Last-mile delivery is critical for customer satisfaction, with increasing demand for faster and more flexible delivery options. Warehousing and distribution support efficient inventory management and rapid order processing, while freight forwarding and customs clearance are essential for cross-border e-commerce. Value-added services such as packaging and labeling, as well as the growing reliance on third-party logistics providers and specialized e-commerce fulfillment solutions, are shaping the competitive landscape .

The Chile E-Commerce Logistics Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as CorreosChile, Chilexpress, DHL Express Chile, FedEx Chile, UPS Chile, Starken, Blue Express, Mercado Libre (Mercado Envíos), Falabella (Sodimac Logística), Cencosud (Easy, Paris), Amazon Logistics (Chile), Linio, Rappi, PedidosYa, AliExpress contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean e-commerce logistics industry is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As digital payment systems become more prevalent, logistics providers will need to adapt to ensure seamless integration with e-commerce platforms. Additionally, sustainability initiatives are likely to gain traction, prompting logistics companies to adopt eco-friendly practices. The focus on enhancing last-mile delivery solutions will also be critical, as consumers increasingly demand faster and more reliable shipping options in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation |

| By Service Type | Last-Mile Delivery Warehousing and Distribution Freight Forwarding Customs Clearance Value-Added Services (Packaging, Labeling, etc.) Third-Party Logistics (3PL) E-commerce Fulfillment |

| By Industry Vertical | Retail and Consumer Goods Consumer Electronics Fashion and Apparel Food and Beverage Pharmaceuticals and Healthcare Automotive Parts Others |

| By Delivery Speed | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cash on Delivery Others |

| By Geographic Coverage | Metropolitan Region (Santiago) Other Urban Areas Rural Areas International Markets Others |

| By Technology Utilization | Automated Warehousing Real-Time Tracking Systems AI and Machine Learning Blockchain for Transparency Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Providers | 60 | Logistics Directors, Operations Managers |

| Last-Mile Delivery Services | 50 | Delivery Managers, Fleet Coordinators |

| Warehousing Solutions | 40 | Warehouse Managers, Inventory Control Specialists |

| Consumer Insights on Delivery Preferences | 100 | Online Shoppers, Customer Experience Managers |

| Returns Management Practices | 45 | Returns Managers, Customer Service Representatives |

The Chile E-Commerce Logistics Industry is valued at approximately USD 2.1 billion, reflecting significant growth driven by increased online shopping and digital transformation, particularly accelerated by the COVID-19 pandemic.