China Animal Healthcare Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD1853

October 2024

83

About the Report

China Animal Healthcare Market Overview

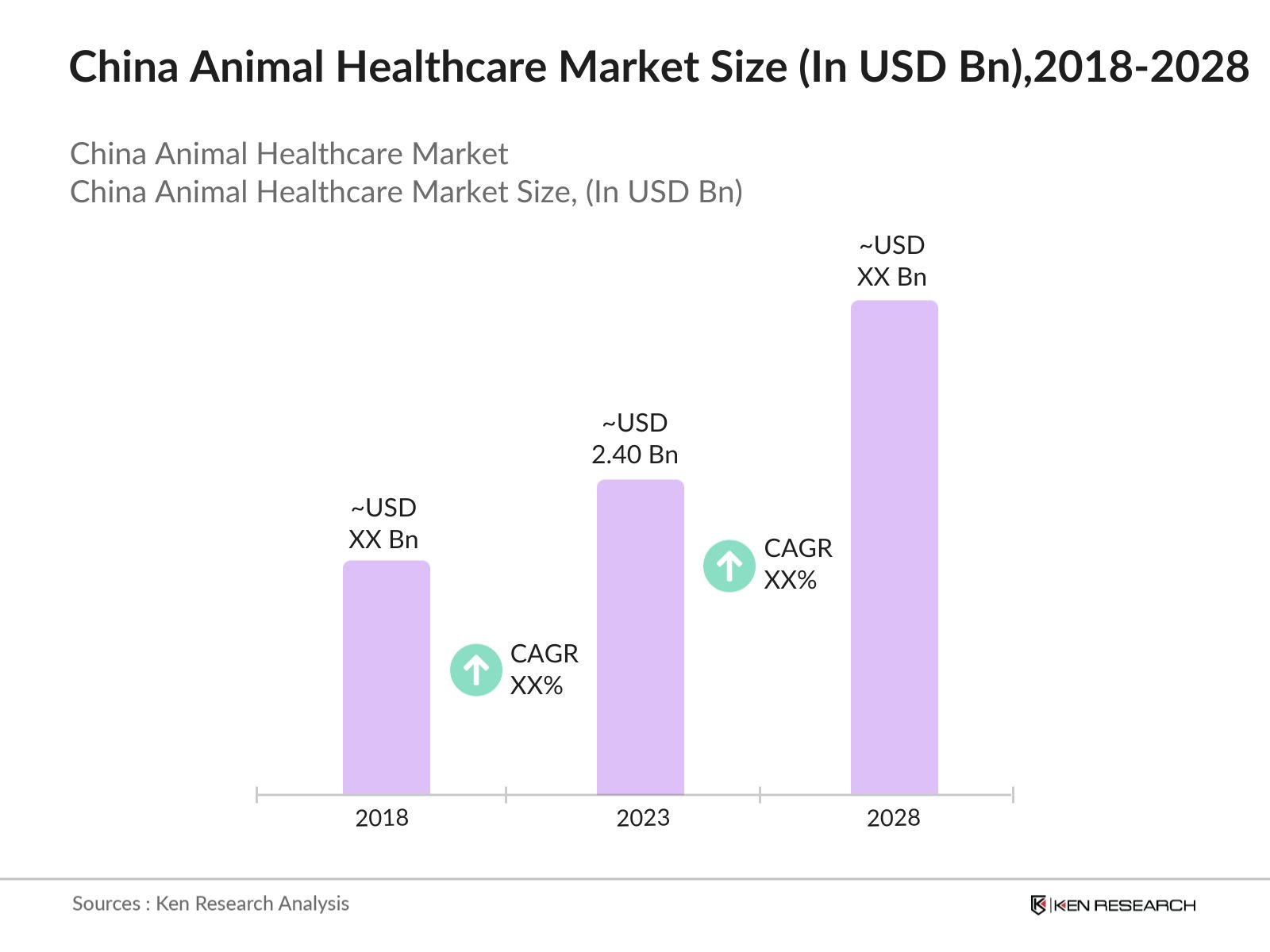

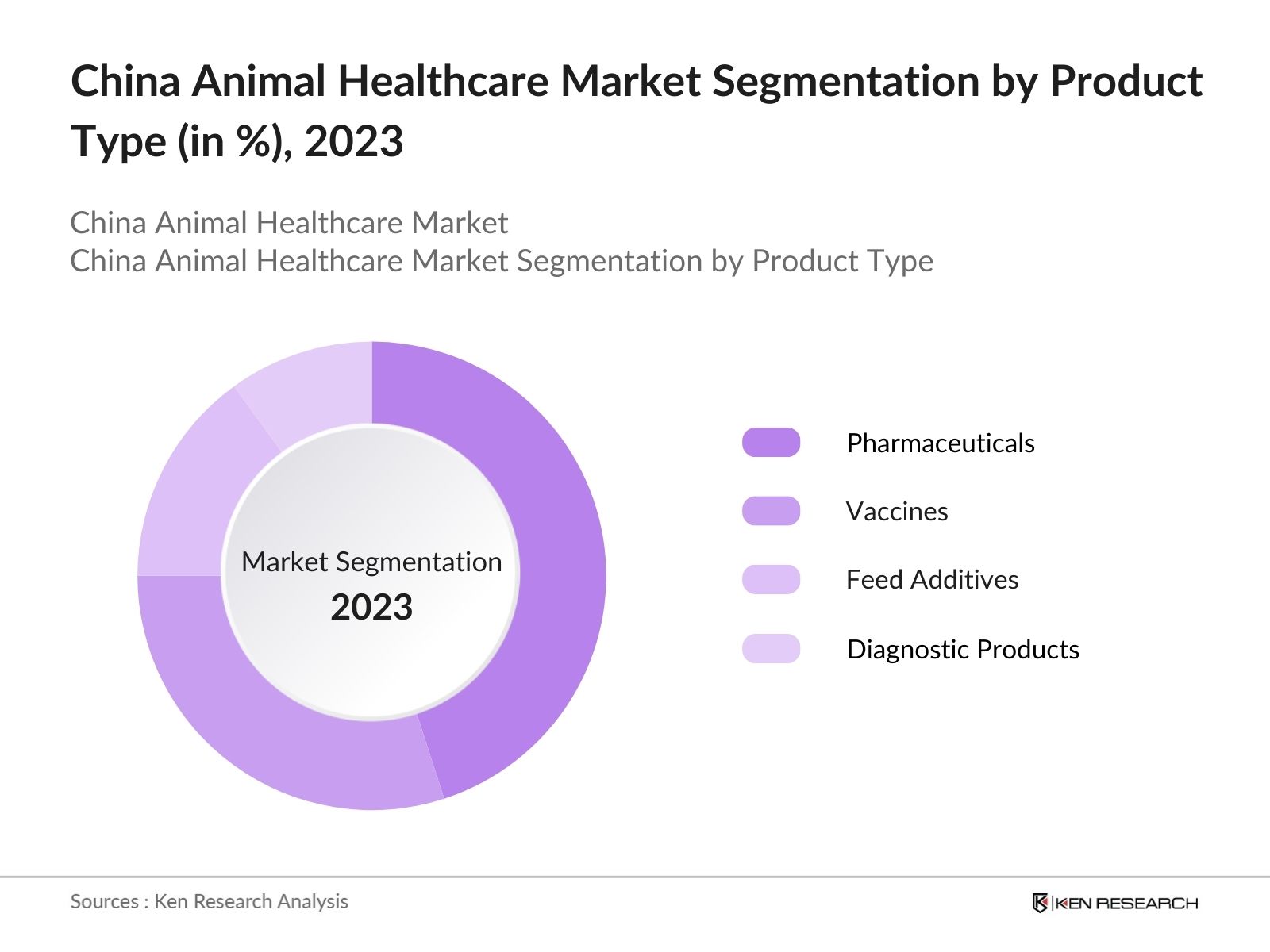

- In 2023, The China Animal Healthcare Market was valued at USD 2.40 billion in 2023, driven by increasing pet ownership, a growing livestock population, rising awareness about animal health, and advancements in veterinary services. The market includes segments such as pharmaceuticals, vaccines, feed additives, and diagnostic products, with pharmaceuticals being the most dominant due to the high prevalence of diseases and infections among animals.

- Major players in the China Animal Healthcare Market include Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, China Animal Husbandry Industry Co., Ltd., and Jinyu Bio-technology Co., Ltd. These companies are recognized for their extensive product portfolios and their focus on innovative animal health solutions. Zoetis Inc. leads the market with a wide range of veterinary products and strong distribution networks across China.

- In Eastern China, cities like Shanghai and Beijing are prominent markets due to the high concentration of pet owners and advanced veterinary facilities. In Northern China, provinces such as Heilongjiang and Inner Mongolia drive the livestock segment, fueled by extensive cattle and swine farming activities. Western China, including provinces like Sichuan and Yunnan, is witnessing growth in animal healthcare due to increased investment in veterinary infrastructure.

- Boehringer Ingelheim partnered with the University of Pennsylvania School of Veterinary Medicine to host the 2023 Rabies Symposium on September 30, 2023. The symposium, held virtually and in-person, aimed to educate veterinary students about rabies prevalence and prevention strategies from world-class experts in the field.

China Animal Healthcare Market Segmentation

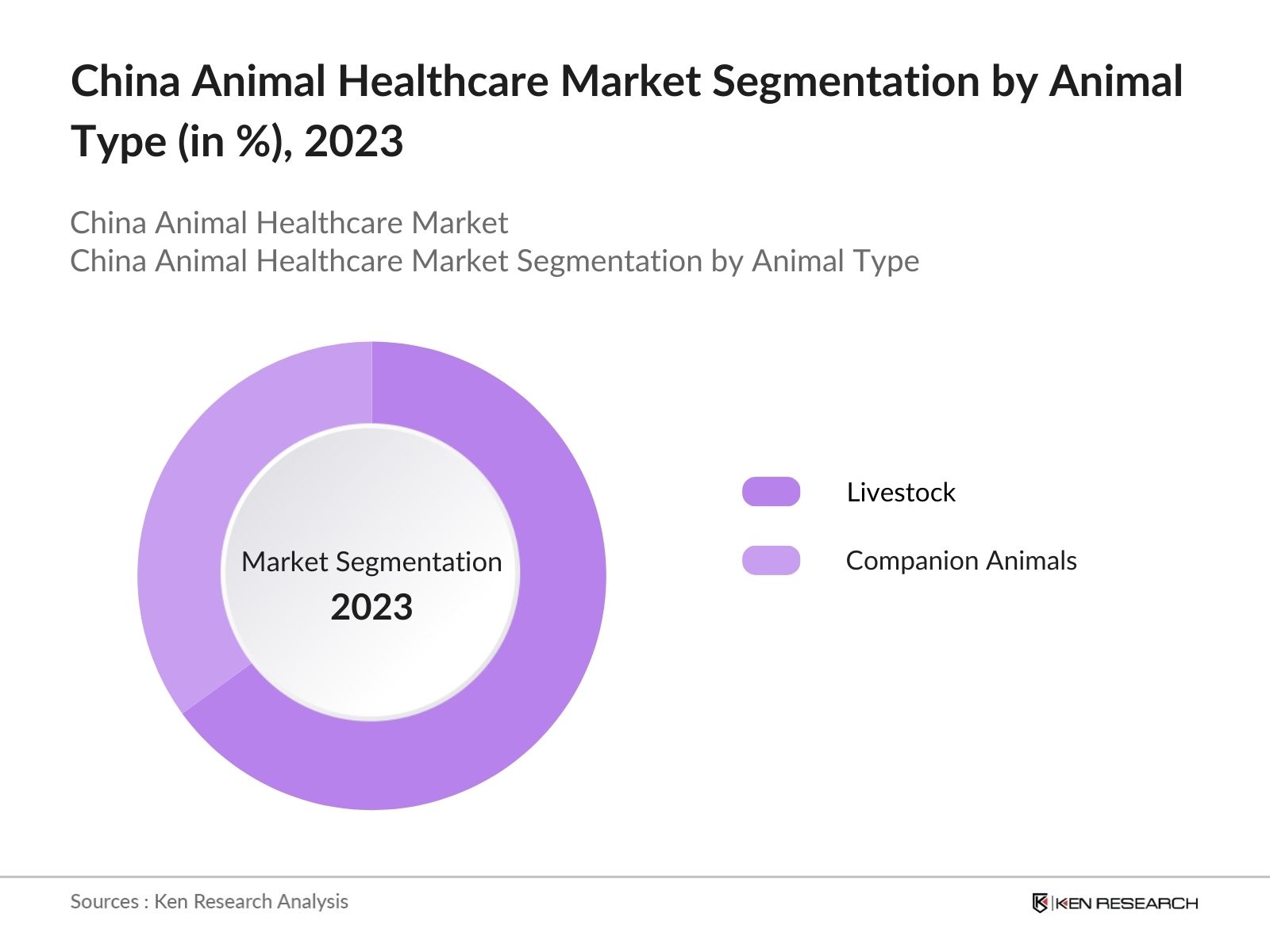

The China Animal Healthcare Market can be segmented by product type, animal type, and region:

- By Product Type: The market is segmented into pharmaceuticals, vaccines, feed additives, and diagnostic products. In 2023, pharmaceuticals remained the most dominant product type due to the necessity for treating various animal diseases and infections. However, vaccines are gaining popularity, especially in livestock management, for preventing common diseases. The demand for feed additives is also rising, driven by the need to enhance animal growth and productivity.

- By Animal Type: The market is segmented by animal type into companion animals and livestock. In 2023, livestock dominated the market due to the large population of cattle, pigs, and poultry in China. Companion animals, such as dogs and cats, are also a significant segment, driven by increasing pet ownership and spending on pet healthcare.

- By Region: The market is segmented regionally into East, North, West, and South. In 2023, Eastern China led the market due to the high density of pet owners and advanced veterinary infrastructure. Northern China is also a market, driven by large-scale livestock farming. Western and Southern China are emerging markets with increasing investment in animal healthcare facilities.

China Animal Healthcare Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Zoetis Inc. |

1952 |

Parsippany, USA |

|

Merck Animal Health |

1891 |

Kenilworth, USA |

|

Boehringer Ingelheim |

1885 |

Ingelheim, Germany |

|

China Animal Husbandry Industry Co., Ltd. |

1984 |

Beijing, China |

|

Jinyu Bio-technology Co., Ltd. |

1953 |

Inner Mongolia, China |

- Zoetis Inc.: In 2023, Zoetis Inc. introduced a new range of parasiticides for pets under its Revolution Plus brand, addressing the growing demand for comprehensive parasite protection. This launch aims to strengthen the company's position in the premium pet healthcare segment, where there is increasing consumer interest in holistic and preventive healthcare solutions.

- Merck Animal Health: In 2024, Merck Animal Health expanded its product line with the launch of a new range of poultry vaccines designed to combat avian influenza and Newcastle disease. This expansion reflects Merck's commitment to enhancing animal health and food safety in China's large poultry sector.

China Animal Healthcare Market Analysis

Market Growth Drivers

- Increasing Pet Ownership: The growing number of pet owners in China is significantly driving the demand for veterinary pharmaceuticals, vaccines, and pet healthcare products. A 2023 survey by the China Pet Industry Association indicated that pet ownership in China has seen a steady increase, with over 100 million pet dogs and cats now part of households across the country.

- Growing Livestock Population: The expansion of the livestock industry in China, particularly in swine and poultry farming, is boosting the demand for animal healthcare products. According to the Ministry of Agriculture and Rural Affairs of China, the livestock population in 2023 included 435 million pigs and 14 billion chickens, marking a increase from previous years. In 2023, China reported over 100 outbreaks of ASF, which prompted a substantial investment in veterinary healthcare products, including vaccines, antibiotics, and biosecurity measures.

- Advancements in Veterinary Services: The growing number of pet owners in China, with over 121.5 million pets as of 2023, is significantly driving the demand for veterinary pharmaceuticals, vaccines, and pet healthcare products. The pet industry in China is expanding rapidly, with spending on pet-related products and services increasing as pets are increasingly viewed as family members.

Market Challenges

- Rising Raw Material Costs: The rising costs of raw materials, especially proteins, grains, and packaging, pose challenges to manufacturers, leading to increased product prices. This could impact consumer purchasing power, particularly in the mid-range product segment.

- Regulatory Constraints: The market is subject to stringent regulations regarding product safety, quality, and efficacy. Compliance with these regulations can be challenging for manufacturers, particularly smaller players who may lack the resources for extensive testing and certification.

Government Initiatives:

- ???????China's National Animal Disease Control Program: The Chinese government has implemented the National Animal Disease Control Program, aimed at preventing and controlling major animal diseases and improving animal health management practices across the country. This initiative focuses on the surveillance, prevention, and control of diseases like African swine fever (ASF), avian influenza, and foot-and-mouth disease. In 2023, the government allocated RMB 5 billion to support this program, which includes funding for research and development of vaccines and diagnostics, as well as training for veterinary professionals and the implementation of biosecurity measures on farms.

- Promotion of Veterinary Biotechnology and Innovation: As part of its broader innovation-driven development strategy, the Chinese government has been supporting the veterinary biotechnology sector through subsidies and grants. In 2021, the Ministry of Science and Technology allocated RMB 1.5 billion for research and development in animal vaccines and diagnostics as part of the National Key R&D Program. This funding aims to promote the development of new veterinary products and enhance China's capacity to respond to emerging animal diseases.

China Animal Healthcare Market Future Market Outlook

The China Animal Healthcare Market is expected to continue its steady growth, driven by the increasing pet ownership, expansion of the livestock industry, and advancements in veterinary technologies.

Future Market Trends

- Growth of Telemedicine in Veterinary Services: Telemedicine for veterinary services is expected to grow in popularity, offering convenience and access to veterinary care for pet owners and livestock farmers in remote areas. This model ensures timely diagnosis and treatment, contributing to better animal health outcomes.

- Increased Focus on Preventive Healthcare: There will likely be a growing emphasis on preventive healthcare products such as vaccines and nutritional supplements, designed to maintain animal health and prevent diseases. Advances in veterinary science and biotechnology will drive the development of these products.

Scope of the Report

|

By Region |

West East North South |

|

By Sales Channel |

Veterinary Clinics Online Retailers Veterinary Pharmacies |

|

By Product Type |

Pharmaceuticals Vaccines Feed Additives Diagnostic Products |

|

By Animal Type |

Companion Animals Livestock |

|

By End User |

Pet Owners Livestock Farmers Veterinary Hospitals and Clinics |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing to This Report:

- Banks and Financial Institutions

- Venture Capitalists

- Government and Regulatory Bodies (MOA, AQSIQ, CFDA)

- Veterinary Product Manufacturers

- Veterinary Clinics and Animal Hospitals

- E-commerce Companies

- Veterinary Product Development Firms

- Livestock Farmers

- Pet Owners

- Animal Nutrition Companies

- Animal Welfare Organizations

- Agricultural Cooperatives

- Research and Development Institutes

- Universities and Veterinary Colleges

- Consulting Firms in Animal Healthcare

- Veterinary Associations and Societies

- Pet Food Manufacturers

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

- Zoetis Inc.

- Merck Animal Health

- Boehringer Ingelheim

- China Animal Husbandry Industry Co., Ltd.

- Jinyu Bio-technology Co., Ltd.

- Elanco Animal Health

- Vetoquinol S.A.

- Virbac

- Ceva Animal Health

- Phibro Animal Health Corporation

- China National Pharmaceutical Group Corporation (Sinopharm)

- Shandong Luxi Animal Medicine Share Co., Ltd.

- Chongqing Taiji Group

- Huvepharma

- Hipra

Table of Contents

1. China Animal Healthcare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. China Animal Healthcare Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. China Animal Healthcare Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Pet Ownership

3.1.2. Growing Livestock Population

3.1.3. Advancements in Veterinary Services

3.2. Restraints

3.2.1. Rising Raw Material Costs

3.2.2. Regulatory Constraints

3.2.3. Increasing Competition

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion into Emerging Markets

3.3.3. Growing Demand for Preventive Healthcare Products

3.4. Trends

3.4.1. Growth of Telemedicine in Veterinary Services

3.4.2. Increased Focus on Preventive Healthcare

3.4.3. Integration of Veterinary Biotechnology

3.5. Government Regulation

3.5.1. China’s National Animal Disease Control Program

3.5.2. Promotion of Veterinary Biotechnology and Innovation

3.5.3. Implementation of Healthy Livestock Action Plan

3.5.4. National Plan for Antimicrobial Resistance Control

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. China Animal Healthcare Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Pharmaceuticals

4.1.2. Vaccines

4.1.3. Feed Additives

4.1.4. Diagnostic Products

4.2. By Animal Type (in Value %)

4.2.1. Companion Animals

4.2.2. Livestock

4.3. By Sales Channel (in Value %)

4.3.1. Veterinary Clinics

4.3.2. Online Retailers

4.3.3. Veterinary Pharmacies

4.4. By Region (in Value %)

4.4.1. East

4.4.2. North

4.4.3. West

4.4.4. South

4.5. By End User (in Value %)

4.5.1. Pet Owners

4.5.2. Livestock Farmers

4.5.3. Veterinary Hospitals and Clinics

5. China Animal Healthcare Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Zoetis Inc.

5.1.2. Merck Animal Health

5.1.3. Boehringer Ingelheim

5.1.4. China Animal Husbandry Industry Co., Ltd.

5.1.5. Jinyu Bio-technology Co., Ltd.

5.1.6. Elanco Animal Health

5.1.7. Vetoquinol S.A.

5.1.8. Virbac

5.1.9. Ceva Animal Health

5.1.10. Phibro Animal Health Corporation

5.1.11. China National Pharmaceutical Group Corporation (Sinopharm)

5.1.12. Shandong Luxi Animal Medicine Share Co., Ltd.

5.1.13. Chongqing Taiji Group

5.1.14. Huvepharma

5.1.15. Hipra

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. China Animal Healthcare Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. China Animal Healthcare Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. China Animal Healthcare Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. China Animal Healthcare Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Animal Type (in Value %)

9.3. By Sales Channel (in Value %)

9.4. By Region (in Value %)

9.5. By End User (in Value %)

10. China Animal Healthcare Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and nutritional trends. We also assess regulatory impacts and market dynamics specific to the Chinese market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (pharmaceuticals, vaccines, feed additives, and diagnostic products), and the distribution of sales channels (veterinary clinics, online retailers, veterinary pharmacies). We also analyze market share and revenue generated by leading brands, emerging trends in animal healthcare, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading veterinary product manufacturers, distributors, and retailers. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and consumer buying patterns.

Step 4: Research Output

Our team interacts with veterinary product manufacturers, veterinarians, livestock farmers, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and sales trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

1. How large is the China Animal Healthcare Market?

In 2023, the China Animal Healthcare Market was valued at approximately USD 2.40 billion. The market's growth is driven by the increasing number of pet ownership, rising awareness of animal health, and advancements in veterinary services.

2. What are the challenges in the China Animal Healthcare Market?

Challenges in the China Animal Healthcare Market include rising raw material costs, which affect pricing and profit margins for manufacturers, as well as stringent regulatory requirements for product safety and labeling. Additionally, competition among established brands and new entrants, along with the increasing demand for preventive healthcare products, poses significant challenges.

3. Who are the major players in the China Animal Healthcare Market?

Major players in the China Animal Healthcare Market include Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, China Animal Husbandry Industry Co., Ltd., and Jinyu Bio-technology Co., Ltd. These companies lead the market with extensive product portfolios, strong brand recognition, and continuous innovation in veterinary products.

4. What are the growth drivers of the China Animal Healthcare Market?

Key growth drivers include the growing trend of pet ownership, which leads to increased spending on veterinary healthcare products. The expansion of the livestock industry and the rising prevalence of animal diseases also contribute to market growth. Additionally, advancements in veterinary diagnostic technologies and services are fueling demand for innovative animal healthcare products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.