China Buy Now Pay Later Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD9768

November 2024

100

About the Report

China Buy Now Pay Later Market Overview

- The China Buy Now Pay Later (BNPL) market is valued at USD 2.5 billion, driven by the rapid expansion of e-commerce, consumer demand for flexible payment options, and the technological advancements in digital finance platforms. BNPL services have gained widespread popularity, particularly among younger consumers and online shoppers, providing short-term financing solutions with zero or minimal interest rates.

- Major cities such as Shanghai, Beijing, and Shenzhen dominate the BNPL market in China due to their high population density, advanced digital infrastructure, and significant concentration of retail and e-commerce businesses. These cities are not only the financial hubs of the country but also the leading centers for technology and innovation, making them the primary regions where BNPL solutions are widely adopted.

- To encourage innovation in the BNPL and broader fintech sector, the Chinese government has introduced regulatory sandboxes where BNPL providers can test new products under limited regulations. As of 2024, these sandboxes have been instrumental in enabling BNPL companies to experiment with new financial models and payment schemes. This regulatory flexibility encourages innovation while ensuring that consumer protection mechanisms are in place. The success of these sandboxes allows China to remain at the forefront of fintech innovation while balancing risk with regulatory oversight.

China Buy Now Pay Later Market Segmentation

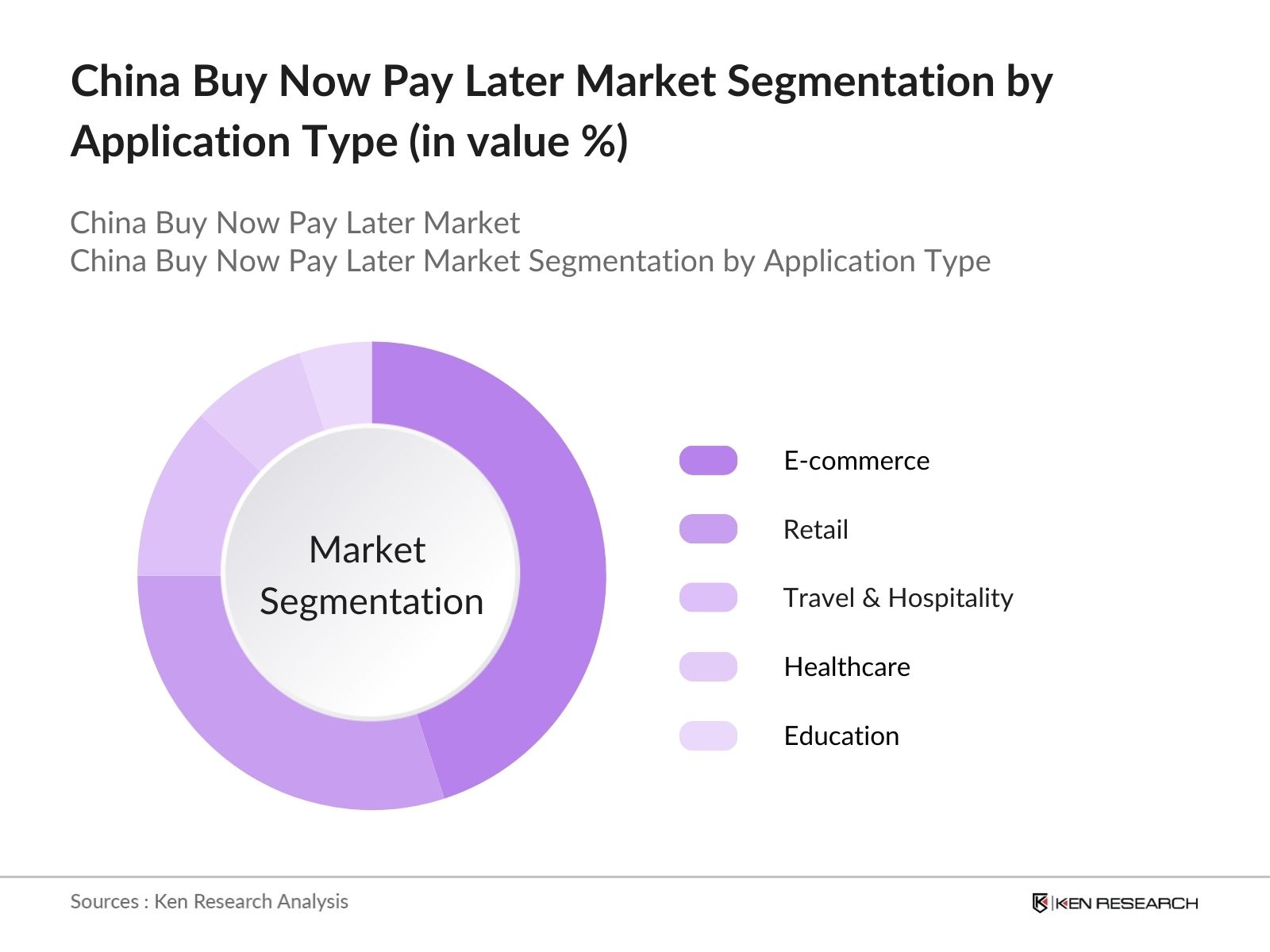

By Application Type: China's BNPL market is segmented by application type into e-commerce, retail, travel & hospitality, healthcare, and education. Among these, e-commerce holds a dominant market share due to the ever-growing online shopping culture and partnerships between BNPL service providers and e-commerce platforms such as Alibaba and JD.com. Consumers in China prefer BNPL solutions as they offer flexibility in payments without incurring high interest, which aligns well with the booming e-commerce sector.

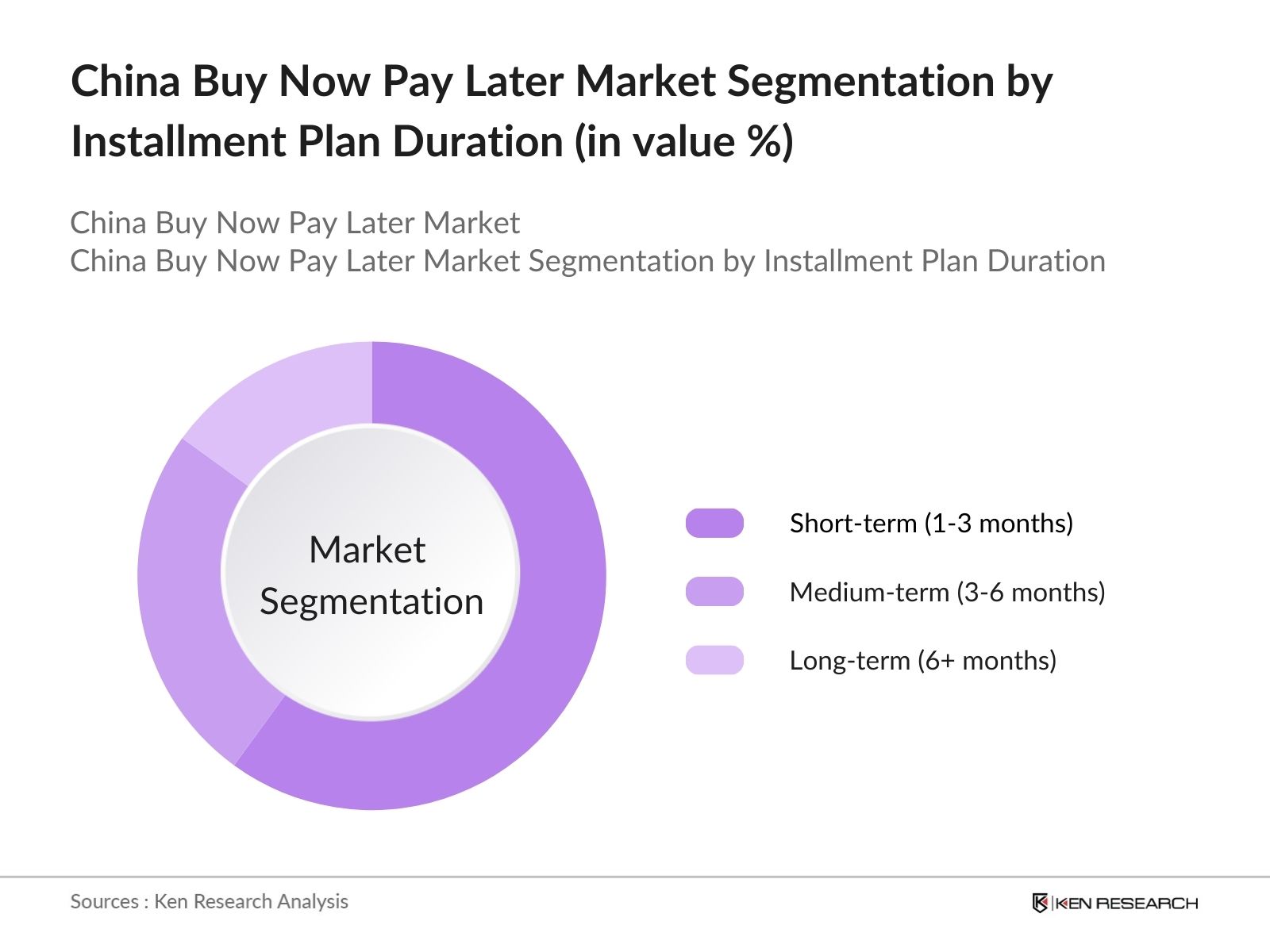

By Installment Plan Duration: The market is also segmented by the duration of installment plans into short-term (1-3 months), medium-term (3-6 months), and long-term (6+ months). Short-term installment plans dominate the market as they are favored by consumers who prefer to avoid long-term debt obligations. The popularity of short-term plans is largely driven by their simplicity and lower financial risk for consumers. Additionally, these plans often come with little to no interest, making them highly attractive for small to medium-sized purchases, particularly in sectors like fashion and electronics.

By Installment Plan Duration: The market is also segmented by the duration of installment plans into short-term (1-3 months), medium-term (3-6 months), and long-term (6+ months). Short-term installment plans dominate the market as they are favored by consumers who prefer to avoid long-term debt obligations. The popularity of short-term plans is largely driven by their simplicity and lower financial risk for consumers. Additionally, these plans often come with little to no interest, making them highly attractive for small to medium-sized purchases, particularly in sectors like fashion and electronics.

China Buy Now Pay Later Market Competitive Landscape

The China BNPL market is dominated by both local and global players, with companies like Ant Financial, JD Finance, and Tencent leading the charge. These companies have leveraged their established digital ecosystems to expand their BNPL offerings, collaborating with e-commerce platforms and retailers to integrate seamless payment solutions. Foreign companies like Klarna and PayPal have also entered the market, although local companies hold a stronger market presence due to their deep understanding of the domestic market and consumer preferences.

China Buy Now Pay Later Market Analysis

Growth Drivers

- Increased Digital Adoption: China's rapid digital transformation has significantly bolstered the Buy Now, Pay Later (BNPL) market. As of 2024, Chinas internet users exceed 1.07 billion, with mobile internet penetration at 99%, enabling a strong foundation for digital financial solutions like BNPL. The shift toward digital platforms, including mobile banking and e-commerce, has driven demand for flexible payment options. Government-backed initiatives, such as China's 14th Five-Year Plan, have emphasized the need for digital economy development, further pushing BNPL adoption across urban and rural areas.

- Rising E-commerce Penetration: With China maintaining its position as the world's largest e-commerce market, the rise of online shopping has driven BNPL growth. As of 2024, China's e-commerce transactions reached $981 billion, reflecting the expanding digital retail ecosystem. Major e-commerce platforms like Alibaba and JD.com have integrated BNPL services, increasing its penetration in the retail sector. The expanding middle class and urbanization have contributed to the rise of online purchases, where consumers prefer installment-based solutions for more expensive goods.

- Supportive Government Initiatives: Regulatory frameworks like the Peoples Bank of Chinas (PBOC) fintech policies aim to improve the oversight of BNPL providers while ensuring a safe financial ecosystem. In 2024, Chinas digital financial inclusion efforts have expanded, offering greater financial services to underserved populations, especially in rural areas. The governments focus on digital finance and support for fintech innovation enhances BNPL market growth, as these initiatives foster a regulatory environment conducive to market expansion.

Challenges

- Regulatory Uncertainty: Although the Chinese government supports fintech growth, regulatory uncertainty remains a significant challenge for the BNPL sector. In 2024, the Peoples Bank of China (PBOC) implemented new fintech regulations that require BNPL providers to meet stricter compliance and licensing standards. These evolving policies increase operational costs and legal risks for BNPL companies. Compliance with these regulations is crucial to avoid penalties or potential business disruptions.

- High Risk of Defaults: One of the primary risks in Chinas BNPL market is the high potential for defaults, particularly as the sector targets younger consumers with lower creditworthiness. As of 2024, Chinas household debt has risen to $10 trillion, signaling increased financial vulnerability. BNPL providers face elevated risks when extending credit to users without traditional credit scores or formal credit histories. This situation exposes BNPL companies to significant losses due to non-repayment.

China BNPL Market Future Outlook

China BNPL market is expected to see significant growth driven by increasing consumer preference for cashless transactions, the expansion of e-commerce, and ongoing technological innovations in digital finance. Government support for digital finance and the rising penetration of mobile payment systems are also expected to propel the market forward. The adoption of AI-driven credit scoring models and the expansion into underserved rural areas are additional factors that will likely contribute to the market's growth.

Market Opportunities

- Expansion into Rural Areas: Chinas rural areas, home to over 500 million people, represent a significant growth opportunity for BNPL services. Financial inclusion remains a government priority, and by 2024, nearly 225 million rural residents have gained access to digital financial services, but many remain unbanked. BNPL providers can cater to this untapped market, offering installment-based credit solutions where traditional financial institutions may not operate.

- Integration with AI and Big Data: The integration of artificial intelligence (AI) and big data in credit risk assessment offers BNPL providers the chance to reduce default rates and optimize their offerings. BNPL companies are leveraging AI to assess borrowers creditworthiness more effectively, reducing risks associated with extending credit to high-risk consumers. By utilizing big data from multiple sources, including social media and payment histories, BNPL providers can enhance their risk management capabilities and improve loan performance.

Scope of the Report

|

Segment |

Sub-segments |

|

By Application Type |

E-commerce Retail Travel & Hospitality Healthcare Education |

|

By Business Model |

B2C B2B |

|

By Platform |

Online Platforms Offline Platforms |

|

By Installment Plan Duration |

Short-term (1-3 months) Medium-term (3-6 months) Long-term (6+ months) |

|

By Region |

East South North Central West |

Products

Key Target Audience

BNPL Providers and Fintech Companies

E-commerce and Retail Platforms

Mobile Payment Service Providers

Consumer Credit Rating Agencies

Technology and Payment Gateway Providers

BNPL Solution Integrators

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (People's Bank of China, China Banking Regulatory Commission)

Companies

Players Mentioned in the Report

Ant Financial

JD Finance

Tencent

Klarna

PayPal

Afterpay (Block, Inc.)

Huabei

Affirm

Zip Co.

Sezzle

Table of Contents

1. China BNPL Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. China BNPL Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Key Market Developments and Milestones

2.3 Year-on-Year Growth Analysis

3. China BNPL Market Analysis

3.1 Growth Drivers

3.1.1 Increased Digital Adoption

3.1.2 Rising E-commerce Penetration

3.1.3 Supportive Government Initiatives

3.1.4 Consumer Demand for Flexible Payment Solutions

3.2 Market Challenges

3.2.1 Regulatory Uncertainty (Licensing, Compliance)

3.2.2 High Risk of Defaults (Credit and Payment Risks)

3.2.3 Competition from Traditional Financial Services

3.3 Opportunities

3.3.1 Expansion into Rural Areas (Inclusion of Unbanked Population)

3.3.2 Integration with AI and Big Data (Enhanced Credit Risk Assessment)

3.3.3 Partnerships with E-commerce Platforms (Retail Expansion)

3.4 Trends

3.4.1 Adoption of Artificial Intelligence in Credit Scoring

3.4.2 Rising Collaboration between BNPL and Banks

3.4.3 Growth of BNPL Super-apps

3.5 Government Regulation

3.5.1 Peoples Bank of China BNPL Guidelines

3.5.2 Regulatory Sandboxes for Fintech Solutions

3.5.3 Consumer Protection Measures (Interest Rate Caps, Payment Schedules)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. China BNPL Market Segmentation

4.1 By Application Type (In Value %)

4.1.1 E-commerce

4.1.2 Retail

4.1.3 Travel & Hospitality

4.1.4 Healthcare

4.1.5 Education

4.2 By Business Model (In Value %)

4.2.1 Business-to-Consumer (B2C)

4.2.2 Business-to-Business (B2B)

4.3 By Platform (In Value %)

4.3.1 Online Platforms

4.3.2 Offline Platforms

4.4 By Installment Plan Duration (In Value %)

4.4.1 Short-term (1-3 months)

4.4.2 Medium-term (3-6 months)

4.4.3 Long-term (6+ months)

4.5 By Region (In Value %)

4.5.1 East China

4.5.2 South China

4.5.3 North China

4.5.4 Central China

4.5.5 West China

5. China BNPL Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Ant Financial

5.1.2 JD Finance

5.1.3 Tencent

5.1.4 Klarna

5.1.5 Afterpay (Acquired by Block, Inc.)

5.1.6 PayPal (BNPL Segment)

5.1.7 Zip Co.

5.1.8 Sezzle

5.1.9 Affirm

5.1.10 Huabei

5.2 Cross Comparison Parameters (Market Share, Revenue, Strategic Partnerships, Technology Adoption, Consumer Base, Payment Solutions, Credit Risk Assessment Models, Geographical Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

5.9 Government Grants and Support

6. China BNPL Market Regulatory Framework

6.1 Peoples Bank of China Regulations

6.2 Compliance and Certification Processes

6.3 Consumer Data Protection Laws

6.4 Cross-border BNPL Regulations

7. China BNPL Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

7.3 Emerging Consumer Segments

8. China BNPL Future Market Segmentation

8.1 By Application Type (In Value %)

8.2 By Business Model (In Value %)

8.3 By Platform (In Value %)

8.4 By Installment Plan Duration (In Value %)

8.5 By Region (In Value %)

9. China BNPL Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Segmentation and Targeting

9.3 Competitive Strategy Recommendations

9.4 White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped the entire BNPL ecosystem in China, identifying key variables such as market penetration, payment preferences, and the regulatory landscape. This stage involved extensive desk research and analysis of secondary data from proprietary sources.

Step 2: Market Analysis and Construction

Historical data was analyzed to assess the growth trajectory of the China BNPL market. Factors such as consumer behavior, transaction volumes, and regional preferences were evaluated to form a robust understanding of market trends and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To validate the hypotheses formed during the analysis phase, we conducted interviews with industry experts and key stakeholders. These consultations provided insights into market drivers, barriers, and competitive strategies.

Step 4: Research Synthesis and Final Output

The final stage involved compiling the insights gained from desk research, data analysis, and expert consultation to produce a comprehensive market report. The synthesis of these data points ensured a validated and accurate representation of the China BNPL market.

Frequently Asked Questions

1. How big is the China BNPL Market?

The China Buy Now Pay Later market is valued at USD 2.5 billion, driven by rising digital payments, the growth of e-commerce, and consumer preference for flexible payment options.

2. What are the challenges in the China BNPL Market?

Challenges in China Buy Now Pay Later market include regulatory uncertainties regarding consumer protection and credit risks, the high potential for default due to unsecured lending, and increased competition from traditional financial institutions.

3. Who are the major players in the China BNPL Market?

Key players on China Buy Now Pay Later market include Ant Financial, JD Finance, Tencent, Klarna, PayPal, and Afterpay. These companies dominate due to their technological capabilities, strong digital ecosystems, and partnerships with retailers.

4. What are the growth drivers of the China BNPL Market?

Growth in China Buy Now Pay Later market is driven by factors such as increasing digital adoption, the rise of mobile payment platforms, and consumer demand for flexible, interest-free payment options, especially in the e-commerce sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.