China Ceramic Coating Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD6687

December 2024

96

About the Report

China Ceramic Coating Market Overview

- The China ceramic coating market is valued at USD 2.6 billion, driven by rapid industrialization across key sectors like automotive, aerospace, and manufacturing. The country's dominance in automotive production significantly boosts demand, as ceramic coatings offer superior protection for vehicle exteriors, increasing longevity and reducing maintenance costs. This demand is further reinforced by the government's push toward high-value manufacturing under initiatives such as "Made in China 2025," which supports advanced material applications in industry.

- Chinas ceramic coating market is concentrated in industrial hubs like Guangdong, Shanghai, and Jiangsu. These regions dominate due to their robust automotive, aerospace, and electronics industries, which require high-performance coatings. Guangdong, in particular, benefits from investments in the automotive refinish market, where companies like BASF SE have expanded production capacities. The presence of key manufacturing centers and access to advanced research facilities in these cities have further solidified their leadership.

- The Chinese government has introduced subsidies and tax incentives to promote sustainable manufacturing practices within the ceramic coating industry. In 2024, the government is allocating over 10 billion towards the development of eco-friendly coating technologies, focusing on reducing VOC emissions. These incentives are aimed at encouraging manufacturers to adopt low-emission technologies in production, such as water-based ceramic coatings, which can reduce environmental impact while maintaining product quality.

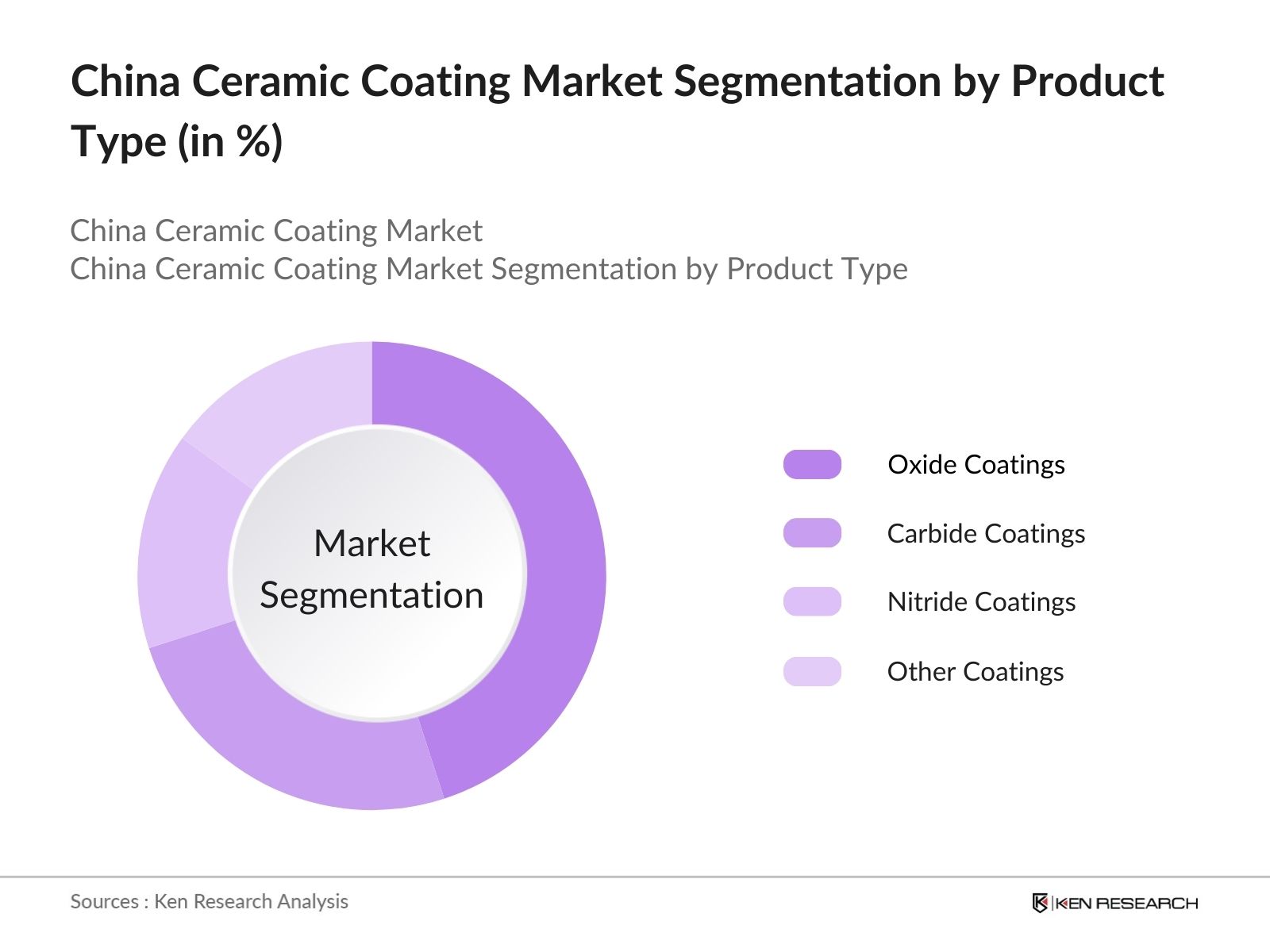

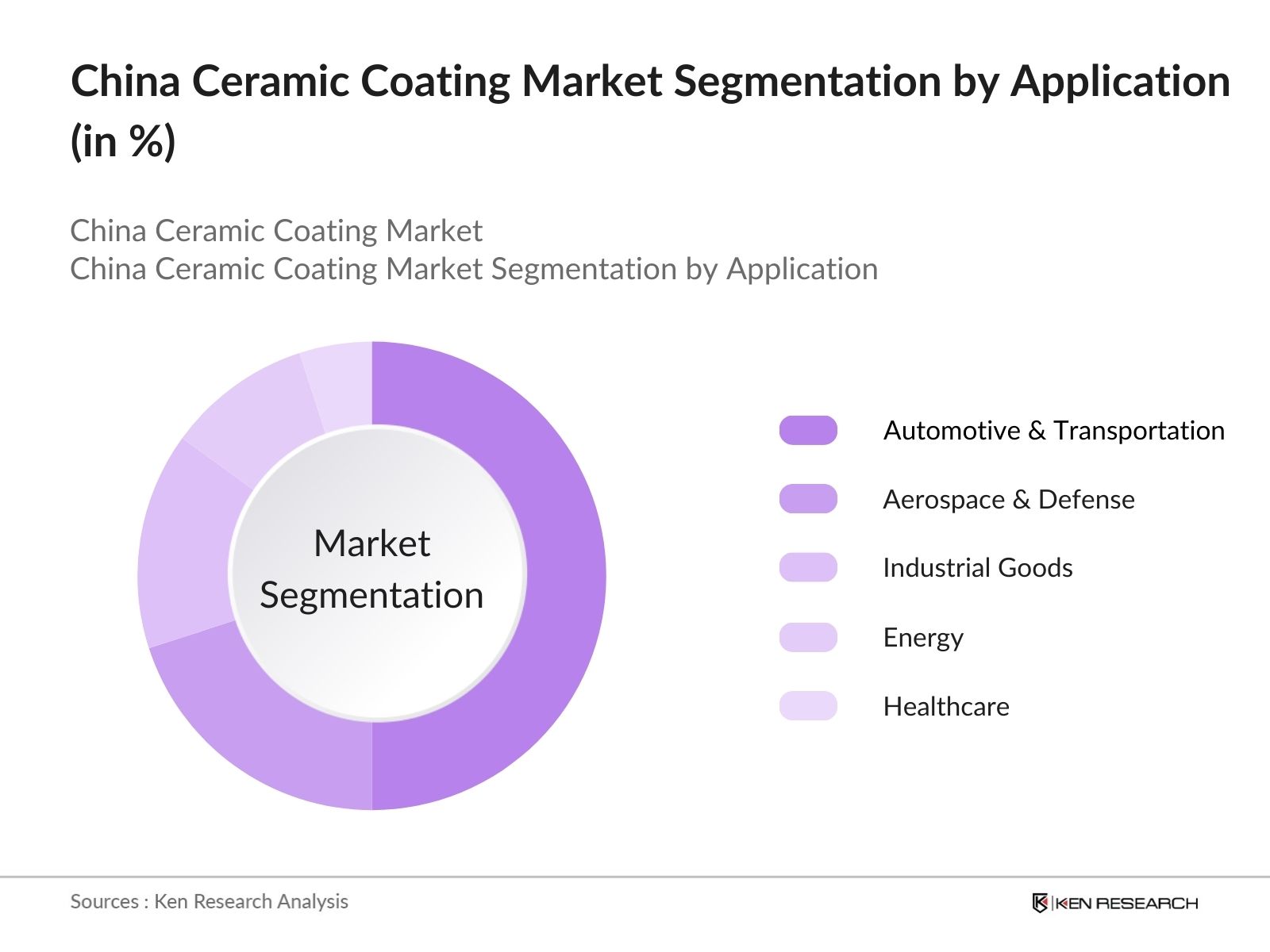

China Ceramic Coating Market Segmentation

By Product Type: The market is segmented by product type into oxide coatings, carbide coatings, nitride coatings, and other specialized coatings. Oxide coatings hold a dominant market share due to their widespread application in the automotive and aerospace industries. The high resistance of oxide coatings to wear, corrosion, and heat makes them the preferred choice for high-performance applications, especially in sectors like transportation and energy. The growing demand for durable coatings in these sectors has reinforced the popularity of oxide coatings across the market.

By Application: The market in China is also segmented by application into automotive & transportation, aerospace & defense, industrial goods, energy, and healthcare. The automotive & transportation segment leads the market due to the country's massive automotive manufacturing base. Ceramic coatings are widely used to protect vehicle surfaces from environmental damage, including UV exposure, chemicals, and scratches. The expansion of the electric vehicle (EV) sector in China further amplifies this segment, as EV manufacturers require durable coatings that ensure longevity and minimal maintenance.

China Ceramic Coating Market Competitive Landscape

The market is highly competitive, with both local and international players vying for market share. Major players have solidified their presence through partnerships, product innovations, and capacity expansions.

China Ceramic Coating Market Analysis

Market Growth Drivers

- Rising Demand in the Automotive Industry: The increasing use of ceramic coatings in the automotive sector is driving market growth. In 2024, the Chinese automotive industry is expected to produce over 26 million vehicles, creating a substantial demand for ceramic coatings. These coatings are used to enhance the durability, aesthetic appeal, and protection of vehicles against environmental damage.

- Booming Construction and Infrastructure Projects: Chinas rapid urbanization, coupled with large-scale government-led infrastructure projects, is creating a surge in the use of ceramic coatings for building materials. By 2024, over 1.4 billion square meters of new construction is projected to be completed in China, with ceramic coatings being widely used for their anti-corrosive and heat-resistant properties.

- Rising Adoption in the Aerospace Industry: The aerospace sector in China is seeing significant growth, particularly with the development of indigenous aircraft such as the COMAC C919. The aerospace industry is projected to see investments of around 100 billion by 2024, providing a major growth opportunity for ceramic coatings used in aerospace components to enhance durability, thermal resistance, and wear protection.

Market Challenges

- Stringent Environmental Regulations: China has tightened its environmental regulations on the coating industry, specifically targeting volatile organic compounds (VOCs) emissions. In 2024, over 60% of ceramic coating manufacturers are expected to comply with the newly introduced National Standard for Hazardous Air Pollutants (GB 37824-2024), which restricts emissions from the production and application of coatings.

- Technical Complexity and Skilled Workforce Shortages: Ceramic coatings require highly specialized application processes, including plasma spray and thermal barrier technologies, which demand a skilled workforce. However, in 2024, China faces a shortage of technicians trained in these advanced techniques, with industry experts estimating a shortfall of around 10,000 skilled workers nationwide.

China Ceramic Coating Market Future Outlook

Over the next five years, the China ceramic coating industry is expected to experience growth driven by increased adoption in the automotive and energy sectors. Growing demand for electric vehicles and energy-efficient infrastructure will propel the use of high-performance coatings.

Future Market Opportunities

- Growth in Aerospace and Defense Applications: In the coming years, ceramic coatings will see growing applications in the aerospace and defense sectors as China ramps up its production of military and civilian aircraft. The projected increase in domestic aircraft production, with over 1,000 new planes expected by 2029, will necessitate advanced ceramic coatings for thermal, wear, and corrosion resistance.

- Rise of Anti-Corrosive Ceramic Coatings in Marine Applications: The marine industry will increasingly adopt ceramic coatings to protect vessels from harsh seawater conditions. With Chinas shipbuilding industry expected to grow further, producing over 60 million deadweight tons by 2028, ceramic coatings will be critical for improving ship durability and reducing maintenance costs.

Scope of the Report

|

By Product Type |

Oxide Carbide Nitride Anti-microbial |

|

By Technology |

CVD PVD Thermal Spray Electrophoretic |

|

By Application |

Automotive Aerospace Energy Healthcare |

|

By Region |

East North South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Aerospace and Defense Companies

Industrial Goods Manufacturers

Energy Companies

Healthcare Equipment Manufacturers

Government and Regulatory Bodies (Ministry of Industry and Information Technology, China Automotive Technology and Research Center)

Investor and Venture Capitalist Firms

Transportation and Logistics Firms

Companies

Players Mentioned in the Report:

BASF SE

AkzoNobel N.V.

3M Co.

DuPont de Nemours, Inc.

Saint-Gobain

Praxair Surface Technologies

A&A Coatings

Morgan Advanced Materials

Zircotec

Bodycote

Table of Contents

China Ceramic Coating Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

China Ceramic Coating Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

China Ceramic Coating Market Analysis

3.1 Growth Drivers

Government initiatives (e.g., Made in China 2025)

Increased demand in automotive and industrial sectors

Rapid industrialization (e.g., infrastructure projects)

Application across multiple sectors (e.g., aerospace, defense)

3.2 Market Challenges

Raw material price fluctuations

Intense competition

Quality standardization issues

High production costs

3.3 Opportunities

Rising demand for corrosion-resistant coatings

Expansion in aerospace and defense industries

Technological advancements in coating methods

Strategic partnerships for product innovations

3.4 Trends

Adoption of advanced deposition technologies (e.g., CVD, PVD)

Increasing use in public transportation (e.g., metro, bus fleets)

Integration with automotive and industrial automation

Development of sustainable coating materials

3.5 Government Regulations

Compliance with environmental standards

Policies supporting automotive sector growth

Subsidies for green and sustainable technologies

Regulations in industrial goods applications

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

China Ceramic Coating Market Segmentation

4.1 By Product Type (In Value %)

Oxide Coatings

Carbide Coatings

Nitride Coatings

Others (Anti-microbial, carbon coatings)

4.2 By Technology (In Value %)

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Thermal Spray

Electrophoretic Deposition

4.3 By Application (In Value %)

Automotive & Transportation

Aerospace & Defense

Energy

Industrial Goods

Healthcare

4.4 By Region (In Value %)

East

North

South

West

China Ceramic Coating Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

3M Co.

AkzoNobel N.V.

BASF SE

DuPont de Nemours, Inc.

Saint-Gobain

A & A Coatings

Praxair Surface Technologies

Morgan Advanced Materials

Zircotec

Bodycote

IGL Coatings

Oerlikon Metco

CoorsTek, Inc.

CeramTec

Keronite Group

5.2 Cross Comparison Parameters (Headquarters, Revenue, No. of Employees, Technology Focus)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

China Ceramic Coating Market Regulatory Framework

6.1 Environmental Standards

6.2 Certification Processes

6.3 Compliance Requirements

China Ceramic Coating Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

China Ceramic Coating Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By Region (In Value %)

China Ceramic Coating Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involved mapping all stakeholders in the China ceramic coating market. Extensive desk research was conducted using proprietary databases and secondary resources to identify key market variables, including technological advancements, industry trends, and competitive dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market revenue, penetration, and competitive landscape was compiled. A bottom-up approach was used to derive accurate market size estimates. Key factors like automotive and aerospace penetration were carefully analyzed to ensure data precision.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, interviews with industry experts and key players were conducted. These insights helped refine projections and confirmed the accuracy of revenue forecasts. Expert consultations also provided insights into future market trends and growth drivers.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the findings through interaction with manufacturers and industry professionals. This enabled the creation of a robust market forecast, providing clear insights into market dynamics, opportunities, and future growth.

Frequently Asked Questions

How big is the China Ceramic Coating Market?

The China ceramic coating market is valued at USD 2.6 billion, driven by strong demand in automotive, aerospace, and industrial applications. The market's size reflects China's leadership in manufacturing and industrial growth.

What are the key growth drivers in the China Ceramic Coating Market?

Key drivers in the China ceramic coating market include the booming automotive industry, government initiatives promoting advanced manufacturing, and increased demand for high-performance coatings in industrial goods. The expansion of electric vehicles also fuels demand.

Which are the major cities leading the market?

Cities like Guangdong, Shanghai, and Jiangsu dominate due to their strong automotive and industrial bases. Guangdong, in particular, benefits from the concentration of manufacturing hubs and R&D centers.

What challenges face the China Ceramic Coating Market?

Challenges in the China ceramic coating market include fluctuations in raw material prices, maintaining consistent product quality, and intense competition among domestic and international players. These issues can impact profitability and market growth.

Who are the major players in the China Ceramic Coating Market?

Key players in the China ceramic coating market include BASF SE, AkzoNobel N.V., 3M Co., DuPont de Nemours, and Saint-Gobain. These companies dominate through their strong presence in automotive and industrial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.