China CMM Measurement Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD9880

December 2024

89

About the Report

China CMM Measurement Market Overview

- China CMM Measurement Market is valued at USD 420 million, driven by rapid industrialization, increasing demand for precision engineering in manufacturing, and technological advancements in automation and metrology. CMM (Coordinate Measuring Machines) have become essential tools in industries such as automotive, aerospace, and electronics due to their ability to offer highly accurate measurements of physical geometries, enhancing product quality and reducing operational errors.

- Dominant cities in this market include Shanghai, Beijing, and Guangzhou, driven by their strong industrial bases, advanced manufacturing infrastructure, and concentration of automotive, aerospace, and electronics companies. These regions have benefitted from government investments, a skilled workforce, and proximity to research hubs, making them central to Chinas precision engineering and metrology sector.

- Chinas National Measurement Standards are continuously evolving to maintain global competitiveness. As of 2024, Chinas National Institute of Metrology has updated precision measurement standards to accommodate advancements in metrology technologies. These standards ensure that CMM systems used across industries comply with stringent quality and accuracy requirements. This regulatory push has resulted in a 10% increase in CMM installations in sectors like aerospace and automotive, ensuring that products meet international precision and safety standards

China CMM Measurement Market Segmentation

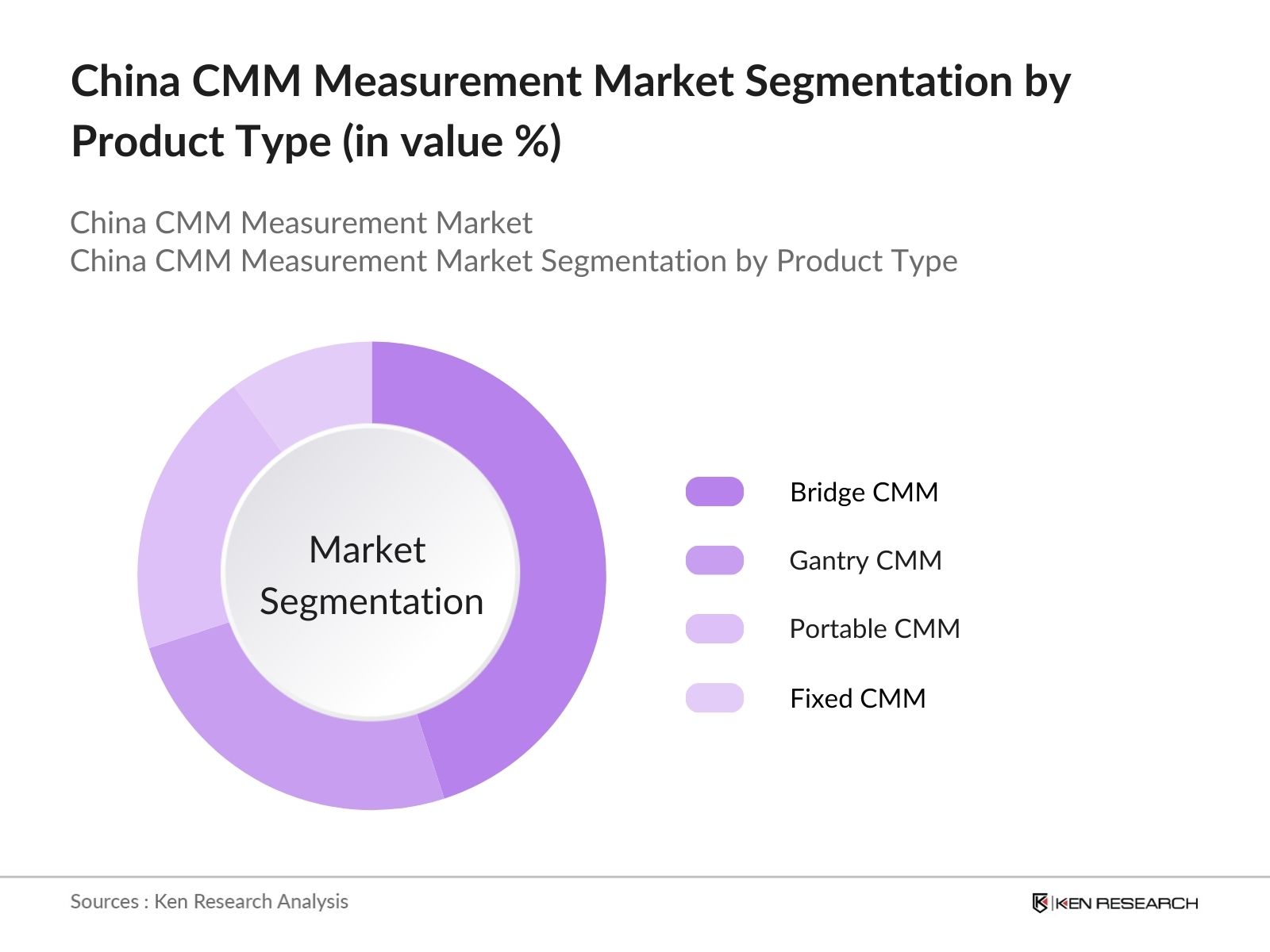

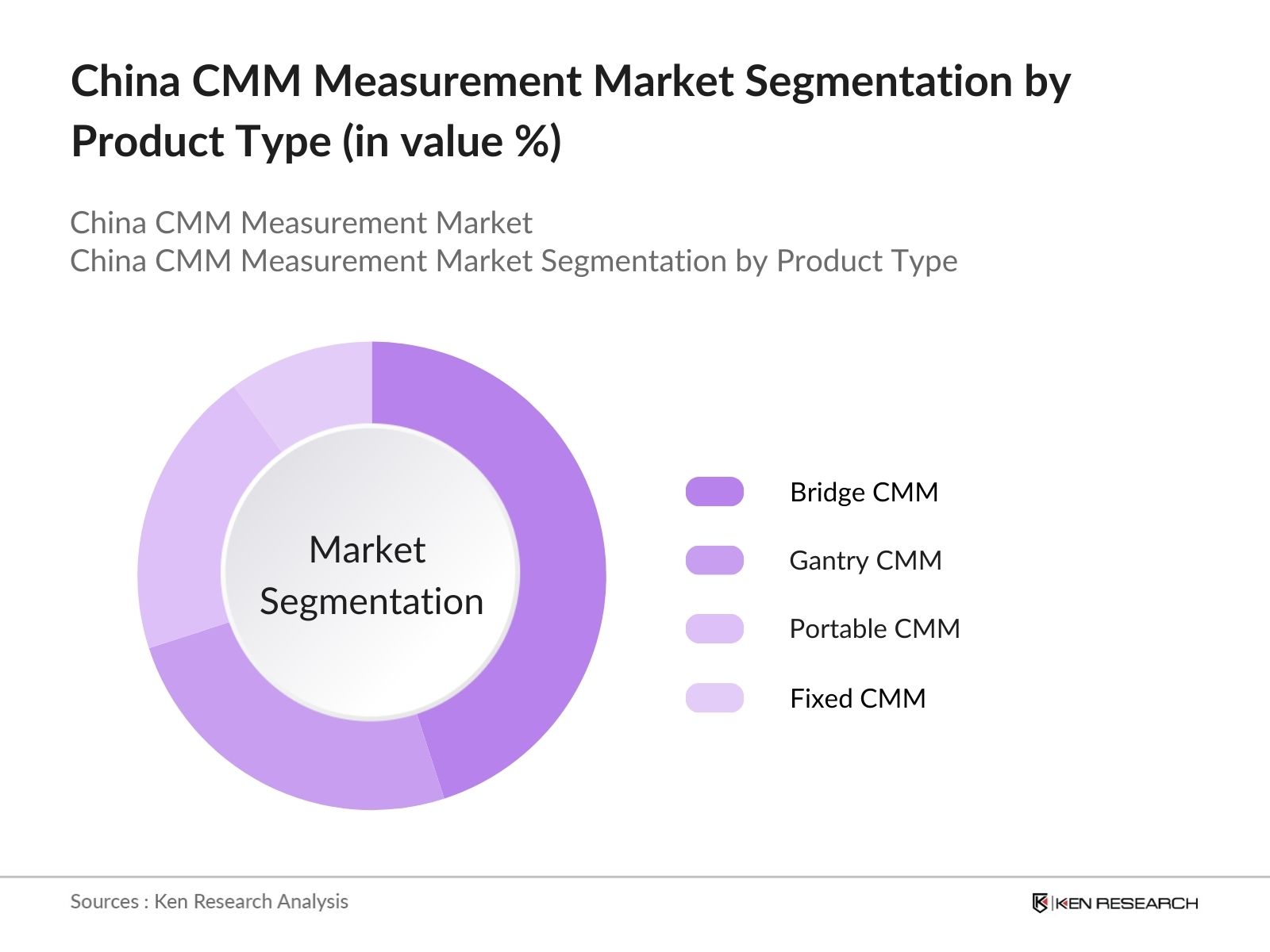

By Product Type: China's CMM Measurement market is segmented by product type into Fixed CMM, Portable CMM, Gantry CMM, and Bridge CMM. Bridge CMMs hold the dominant market share due to their widespread usage in industries such as automotive and aerospace for quality assurance in large-scale manufacturing. Their ability to provide precise measurements and durability in industrial settings makes them a preferred choice for high-volume applications.

By Application: The CMM Measurement market is also segmented by application into Automotive, Aerospace & Defense, Electronics & Semiconductors, Heavy Machinery, and Medical Devices. Automotive leads the application segment, driven by the need for high-precision measurement in manufacturing components such as engines, gearboxes, and body panels. Chinas status as a global automotive manufacturing hub ensures consistent demand for CMM technology.

China CMM Measurement Market Competitive Landscape

The China CMM Measurement Market is characterized by the presence of both domestic and international players. The market is competitive, with significant investments in R&D and technological advancements to maintain leadership. The competitive landscape is shaped by innovation in metrology technologies and a focus on customer-specific solutions. Major players continue to expand their market presence through strategic collaborations, investments in automation technologies, and global partnerships.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

R&D Investment (RMB) |

Revenue (RMB) |

Geographical Reach |

Technological Capabilities |

Strategic Partnerships |

|

Hexagon AB |

1992 |

Sweden |

- |

- |

- |

- |

- |

- |

|

Mitutoyo Corporation |

1934 |

Japan |

- |

- |

- |

- |

- |

- |

|

ZEISS Group |

1846 |

Germany |

- |

- |

- |

- |

- |

- |

|

Nikon Metrology NV |

1917 |

Belgium |

- |

- |

- |

- |

- |

- |

|

Wenzel Group GmbH & Co. |

1968 |

Germany |

- |

- |

- |

- |

- |

- |

China CMM Measurement Market Analysis

Growth Drivers

- Precision Engineering in Automotive Sector: The Chinese automotive industry remains one of the largest globally, producing over 26 million vehicles annually as of 2023. Coordinate Measuring Machines (CMM) play a vital role in ensuring component accuracy in automotive manufacturing. Chinas focus on electric vehicle (EV) production has further heightened the need for precision engineering. The countrys annual EV production reached over 7.8 million units by mid-2024, emphasizing the demand for high-precision measurement systems in the manufacturing process.

- Rising Aerospace Investments: Chinas aerospace industry has seen remarkable growth, supported by substantial government investment in both commercial and defense aviation. By 2024, Chinas aerospace and defense sector has been allocated over $230 billion, with part of this investment directed toward enhancing metrology equipment, including CMM systems, for quality control and precision measurements. The rapid development of new aircraft models, including those by state-owned Commercial Aircraft Corporation of China (COMAC), has created a surge in demand for advanced metrology systems.

- Expansion in the Electronics and Semiconductor Industry: Chinas electronics and semiconductor sector is experiencing significant expansion, driven by the country's dominance in global electronics manufacturing. By 2023, China accounted for more than 25% of global electronics exports. The increased complexity of electronic components, particularly in semiconductor manufacturing, has raised the need for precise metrology systems. CMM machines are essential for ensuring the accuracy of intricate semiconductor components, critical for products like smartphones and microchips.

Challenges

- High Initial Costs for CMM Systems: CMM systems require a significant initial investment, with prices for advanced systems reaching hundreds of thousands of dollars. In China, this remains a barrier for small and medium-sized enterprises (SMEs) that seek to adopt these systems. This capital constraint affects the widespread adoption of CMM technology, particularly for smaller businesses. Despite available funding opportunities, many SMEs face challenges in accessing these resources due to bureaucratic hurdles and a lack of awareness about available schemes.

- Complexities in Calibration and Maintenance: CMM systems require regular calibration and maintenance to function accurately, but the complexity of these processes can be a challenge for many users. A study by the Chinese Academy of Metrology in 2023 highlighted that over 30% of manufacturing firms reported calibration difficulties, leading to inaccuracies in their measurements. Furthermore, calibration and maintenance costs are significant, adding to the operational burden for companies that rely on these systems. This technical barrier can hinder companies from fully realizing the potential benefits of CMM systems.

China CMM Measurement Market Future Outlook

China CMM Measurement Market is expected to experience substantial growth due to increased industrial automation, demand for precision in advanced manufacturing, and adoption of new metrology technologies. Government initiatives aimed at upgrading Chinas manufacturing capabilities will further drive the market. Additionally, rising demand from sectors such as medical devices, electronics, and aerospace is anticipated to fuel growth.

The continuous evolution of multi-sensor CMM systems, integration with Industry 4.0 technologies, and expansion of portable CMM solutions are likely to emerge as key trends. Furthermore, regional expansion beyond the major industrial hubs into developing areas will offer new growth opportunities for both domestic and international players.

Future Market Opportunities

- Increased Adoption in Small and Medium Enterprises (SMEs): SMEs in China are increasingly adopting automation technologies to enhance production efficiency and accuracy. By 2023, over 50% of SMEs in Chinas manufacturing sector had integrated some form of automation, according to the National Bureau of Statistics. This trend presents an opportunity for the adoption of CMM systems as part of their automation strategies. Government initiatives such as tax incentives for technology adoption have made it more financially feasible for SMEs to invest in CMM systems, driving growth in this segment of the market.

- Technological Innovations in Multi-Sensor CMM Systems: Advances in multi-sensor CMM systems offer a significant opportunity for market growth. These systems, which integrate tactile, optical, and laser sensors, provide greater flexibility and accuracy for complex measurements. As of 2024, Chinas manufacturing sector has increasingly adopted multi-sensor CMM systems in high-tech industries like aerospace and electronics. The multi-sensor technology allows for a broader range of applications, enabling manufacturers to meet strict quality control standards while improving operational efficiency.

Scope of the Report

|

By Product Type |

Fixed CMM Portable CMM Gantry CMM Bridge CMM |

|

By Application |

Automotive Aerospace and Defense Electronics and Semiconductors Heavy Machinery, Medical Devices |

|

By Technology |

Touch Trigger Probing Laser Probing White Light Scanning Optical Scanning |

|

By End-User |

OEMs Third-Party Service Providers R&D Institutions |

|

By Region |

East China North China South Central China Southwest China |

Products

Key Target Audience

Automotive Manufacturers

Aerospace and Defense Companies

Electronics & Semiconductor Manufacturers

Heavy Machinery Manufacturers

Medical Device Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Information Technology)

OEMs and Service Providers in Precision Engineering

Companies

Players Mentioned in the Report

Hexagon AB

Mitutoyo Corporation

ZEISS Group

Nikon Metrology NV

Wenzel Group GmbH & Co.

FARO Technologies, Inc.

Keyence Corporation

Aberlink Ltd.

Dukin Co., Ltd.

Leitz Metrology

Table of Contents

China CMM Measurement Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

China CMM Measurement Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

China CMM Measurement Market Analysis

3.1 Growth Drivers

3.1.1 Precision Engineering in Automotive Sector

3.1.2 Rising Aerospace Investments

3.1.3 Expansion in the Electronics and Semiconductor Industry

3.1.4 Government Policies Supporting Manufacturing and Quality Control (Made in China 2025)

3.2 Market Challenges

3.2.1 High Initial Costs for CMM Systems (Capital Investment Constraints)

3.2.2 Limited Skilled Workforce in Metrology (Training and Expertise Gaps)

3.2.3 Complexities in Calibration and Maintenance (Technical Barriers)

3.2.4 Competition from Emerging Non-Contact Measurement Technologies

3.3 Opportunities

3.3.1 Increased Adoption in Small and Medium Enterprises (SMEs) (Automation Growth)

3.3.2 Technological Innovations in Multi-Sensor CMM Systems

3.3.3 Integration of CMM with Smart Factories and IoT (Industry 4.0 Adoption)

3.3.4 Strategic Alliances and International Collaborations

3.4 Trends

3.4.1 Miniaturization of CMM for Compact Use in Electronics Industry

3.4.2 Increasing Use of Portable CMM in Field Applications

3.4.3 Growing Demand for 3D CMM Systems (Technological Trends)

3.4.4 Focus on Environmental Sustainability in CMM Design and Usage

3.5 Government Regulations

3.5.1 Regulations for Precision Measurement Standards (National Measurement Standards)

3.5.2 Government Funding for Technological Upgradation in Manufacturing

3.5.3 Subsidies for Advanced Metrology Systems in Key Sectors (Automotive, Aerospace)

3.5.4 Implementation of ISO Standards in Metrology

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

China CMM Measurement Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fixed CMM

4.1.2 Portable CMM

4.1.3 Gantry CMM

4.1.4 Bridge CMM

4.2 By Application (In Value %)

4.2.1 Automotive Industry

4.2.2 Aerospace and Defense

4.2.3 Electronics and Semiconductors

4.2.4 Heavy Machinery

4.2.5 Medical Devices

4.3 By Technology (In Value %)

4.3.1 Touch Trigger Probing

4.3.2 Laser Probing

4.3.3 White Light Scanning

4.3.4 Optical Scanning

4.4 By End-User (In Value %)

4.4.1 OEMs

4.4.2 Third-Party Service Providers

4.4.3 Research & Development Institutions

4.5 By Region (In Value %)

4.5.1 East China

4.5.2 North China

4.5.3 South Central China

4.5.4 Southwest China

China CMM Measurement Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hexagon AB

5.1.2 Mitutoyo Corporation

5.1.3 ZEISS Group

5.1.4 Nikon Metrology NV

5.1.5 Wenzel Group GmbH & Co. KG

5.1.6 FARO Technologies, Inc.

5.1.7 Keyence Corporation

5.1.8 Aberlink Ltd.

5.1.9 Dukin Co., Ltd.

5.1.10 Leitz Metrology

5.2 Cross Comparison Parameters (Market Share, Product Portfolio, Technological Capabilities, R&D Spending, Market Reach, Employee Strength, Geographic Presence, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

China CMM Measurement Market Regulatory Framework

6.1 Precision Measurement Legislation

6.2 Compliance with National Measurement Standards

6.3 Certification Processes and Approvals

China CMM Measurement Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

China CMM Measurement Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

China CMM Measurement Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all relevant stakeholders and key factors that influence the China CMM Measurement Market. This is accomplished through comprehensive desk research, leveraging a mix of proprietary databases, industry publications, and governmental sources to gather crucial market data and insights.

Step 2: Market Analysis and Construction

We compile and analyze historical data to understand market trends, revenue patterns, and growth drivers. By assessing CMM adoption rates, product utilization, and service quality, we generate precise estimates of current and future market size. The analysis also factors in the revenue generated from key segments and regions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the preliminary findings and validated through consultations with industry experts. These consultations help to verify the data and refine our market analysis, offering valuable insights from professionals directly engaged in the CMM measurement market.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesize all the data gathered and integrate findings from industry consultations to produce a comprehensive report. This stage involves engaging directly with CMM manufacturers and end-users to ensure accurate representation of market dynamics and to validate the accuracy of our forecasts.

Frequently Asked Questions

01 How big is Chinas CMM Measurement Market?

The China CMM Measurement Market is valued at USD 420 million, primarily driven by the demand for high-precision measurement tools in the automotive, aerospace, and electronics industries.

02 What are the challenges in Chinas CMM Measurement Market?

Challenges in China CMM Measurement Market include the high initial cost of CMM systems, the shortage of skilled metrology professionals, and the rising competition from non-contact measurement technologies.

03 Who are the major players in Chinas CMM Measurement Market?

Key players in China CMM Measurement Market include Hexagon AB, Mitutoyo Corporation, ZEISS Group, Nikon Metrology NV, and Wenzel Group GmbH & Co., with these companies dominating through innovation and strategic partnerships.

04 What are the growth drivers of Chinas CMM Measurement Market?

China CMM Measurement Market is driven by the rising demand for precision in manufacturing, government policies promoting advanced metrology, and the growing integration of Industry 4.0 technologies in production lines.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.