China Cold Storage Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9889

November 2024

99

About the Report

China Cold Storage Market Overview

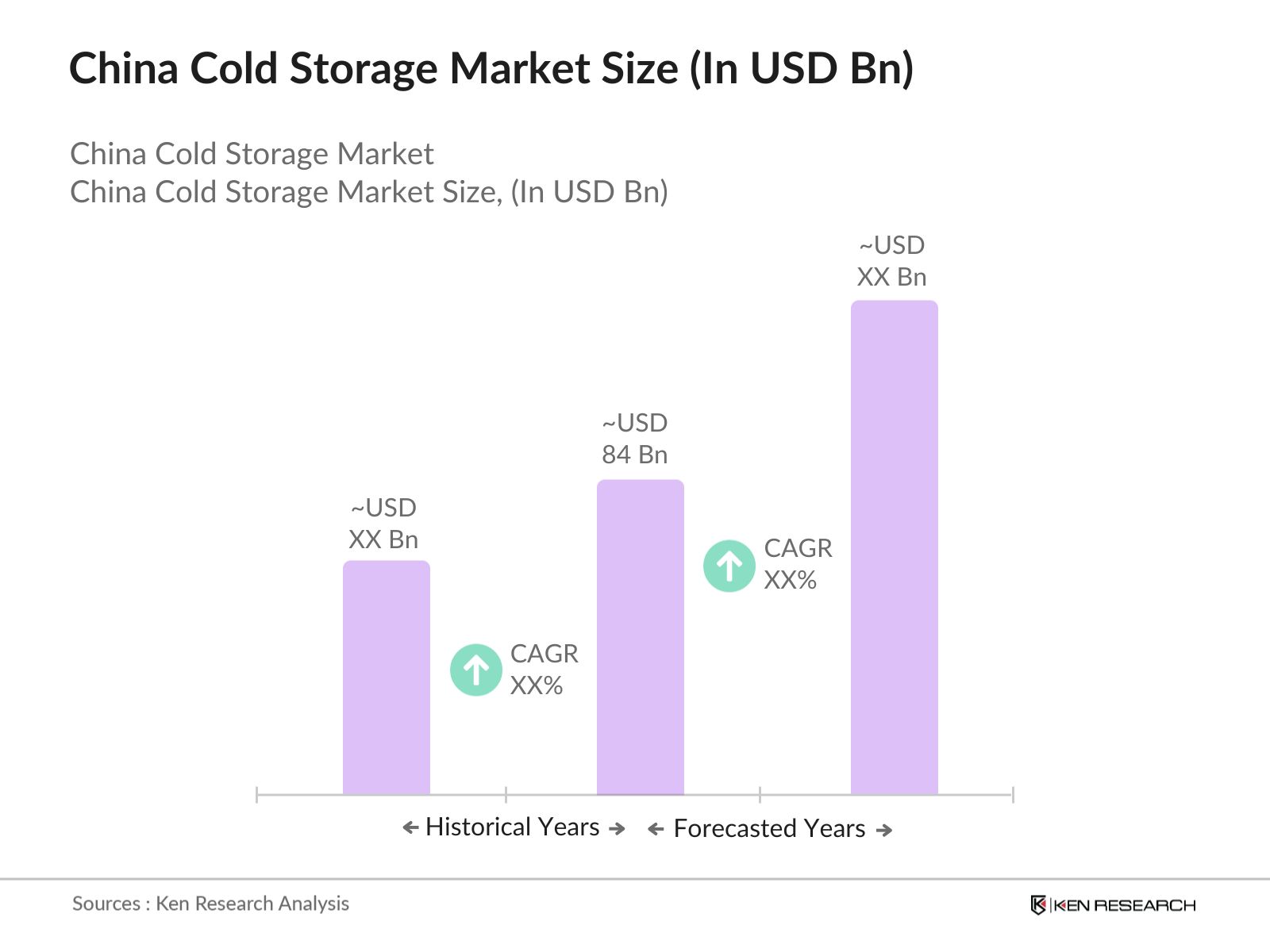

- The China Cold Storage Market is valued at USD 84 billion, based on a five-year historical analysis. The market is driven by the surge in demand for efficient food preservation systems and the increasing penetration of e-commerce in the fresh food and pharmaceutical sectors. The booming online grocery market and the growing middle-class population's demand for high-quality perishables are key factors contributing to the markets growth. Government investments in infrastructure, aimed at boosting domestic cold chain capabilities, are also pivotal in driving the market.

- Major cities such as Shanghai, Beijing, and Guangdong dominate the China cold storage market due to their strategic locations as logistics and trade hubs. These cities benefit from well-established transport networks and government initiatives to improve cold chain infrastructure. The growing presence of multinational food and pharmaceutical companies in these regions, coupled with strong import-export activities, reinforces their dominance in the market.

- The Chinese governments 14th Five-Year Plan (2021-2025) includes significant investments in cold chain logistics infrastructure. In 2024, the government committed CNY 100 billion towards the construction of new refrigerated storage facilities and transport routes to reduce food spoilage and ensure food safety. These projects are expected to add 700,000 tons of cold storage capacity by 2025, with priority given to the agricultural and seafood sectors.

China Cold Storage Market Segmentation

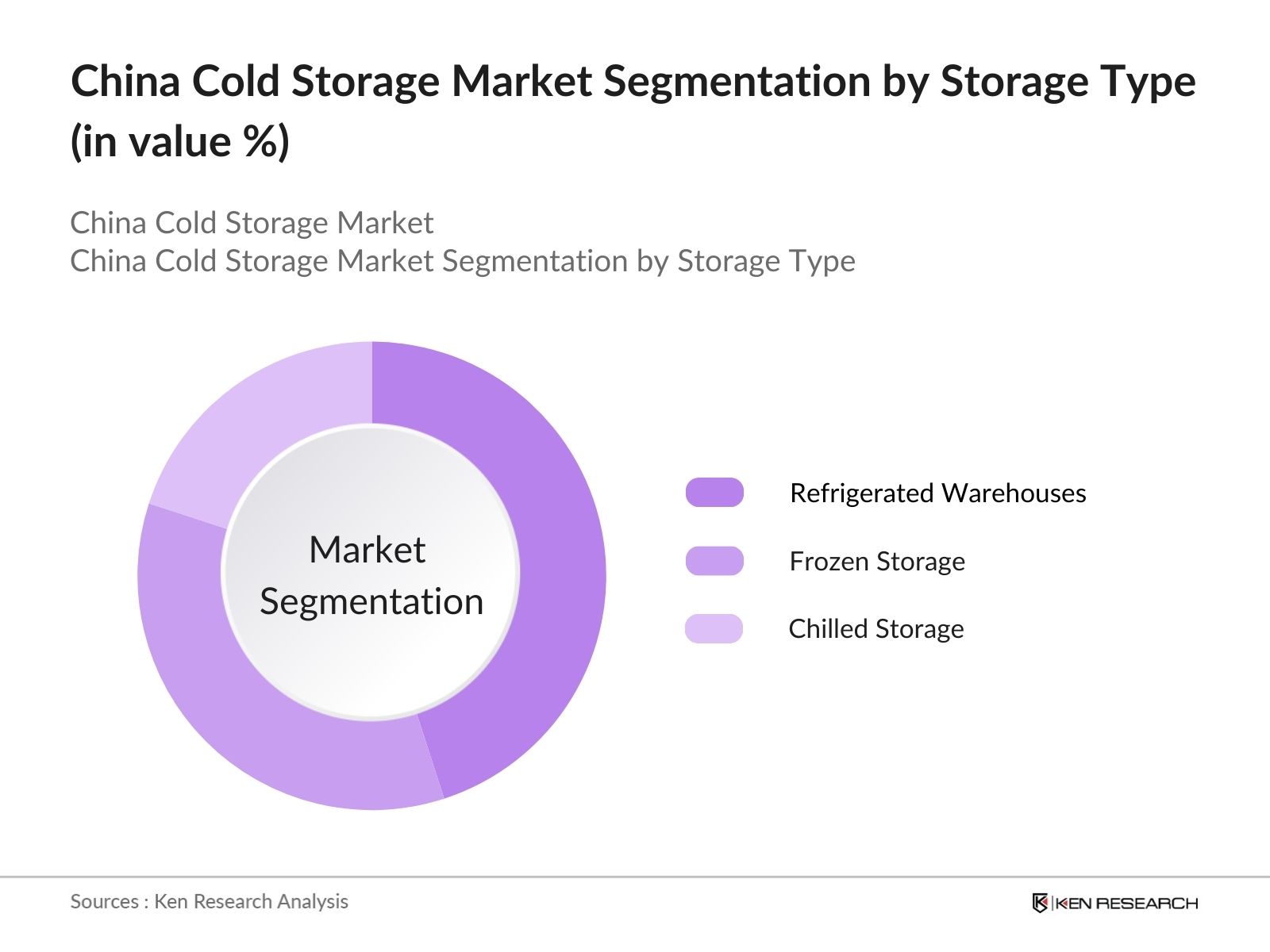

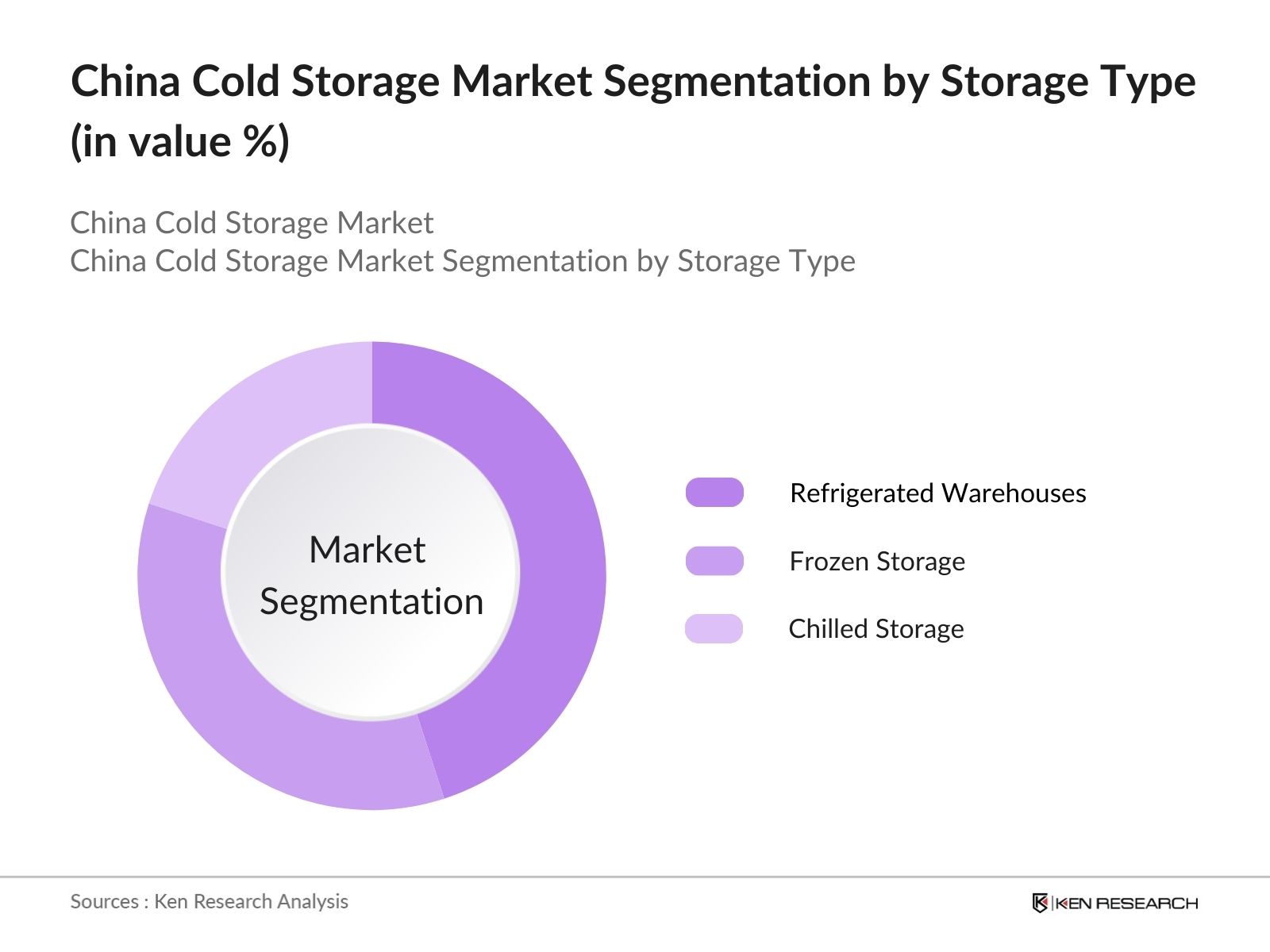

By Storage Type: China's cold storage market is segmented by storage type into refrigerated warehouses, frozen storage, and chilled storage. Recently, refrigerated warehouses have a dominant market share due to their widespread use in preserving both food products and pharmaceuticals. Their flexible temperature control systems and suitability for various goods, from dairy to meat and fish, make them a preferred choice. This demand is further driven by the increased need for safe storage during the logistics processes of e-commerce grocery sales.

By Application: The market is also segmented by application into food & beverages, pharmaceuticals, chemicals, and agriculture. The food & beverages segment holds the dominant share due to the growing consumption of processed and frozen food in urban areas. With the rise of online food delivery services and heightened awareness of food safety, the need for reliable cold storage solutions in this sector has increased significantly.

China Cold Storage Market Competitive Landscape

The China cold storage market is dominated by a few key players, including China International Marine Containers (CIMC), JD Logistics, and Lineage Logistics. These companies benefit from strong technological integration, extensive supply chains, and government backing, which gives them an edge in this rapidly evolving market. The landscape is characterized by both domestic and international players, and competition is intensifying as more companies invest in automation and smart cold storage solutions.

China Cold Storage Market Analysis

Growth Drivers

- Energy Efficiency Standards: China's cold storage market is being driven by the implementation of stringent energy efficiency standards. In 2024, the Chinese government has introduced advanced energy-saving protocols in cold chain logistics, particularly targeting warehouses and storage facilities. For instance, the Dual Control energy system promotes efficient usage, demanding cold storage facilities to adopt greener technologies. As a result, newer facilities are integrating high-efficiency refrigeration systems, lowering operational energy consumption by over 1.2 million kilowatt-hours annually across facilities.

- E-commerce Integration: The rapid rise of e-commerce in China has created strong demand for cold storage infrastructure. As of 2024, online fresh food sales have grown to 4.6 billion units of delivery, necessitating robust cold chain solutions. Large-scale e-commerce platforms like JD.com and Alibaba are expanding their cold storage capacity to meet consumer demands, with investments of over CNY 10 billion dedicated to modernizing their cold chain infrastructure.

- Logistics Expansion: Logistics networks in China are expanding rapidly, supported by government initiatives to improve national transportation infrastructure. In 2024, the Belt and Road Initiative (BRI) continues to play a critical role in cold chain logistics by facilitating the construction of over 5,000 kilometers of new refrigerated transportation routes. This logistical expansion is enhancing the connectivity of cold storage facilities with major ports and inland cities, driving demand for advanced refrigerated storage solutions.

Market Challenges

- High Capital Investments: The construction and maintenance of cold storage facilities require substantial financial investments. In 2024, the cost of building an average-sized cold storage facility in China is estimated to be CNY 35 million, a significant barrier for small and medium-sized enterprises (SMEs) seeking to enter the market. Additionally, ongoing operational costs, particularly for electricity and specialized refrigeration equipment, further elevate the investment burden.

- Regulatory Compliance: Cold storage operators in China must comply with strict regulatory standards set by the government. For instance, in 2024, new laws under the Cold Chain Logistics Development Plan have increased the complexity of adhering to safety and hygiene regulations, particularly for food storage. Compliance with these regulations necessitates investment in advanced temperature monitoring systems and regular audits, which can add significant operational costs and challenges.

China Cold Storage Market Future Outlook

The China cold storage market is expected to witness significant growth over the next five years, driven by increasing demand for fresh and frozen food products and a growing pharmaceutical industry. Government support through various infrastructure initiatives and the continued expansion of e-commerce will further accelerate market development. Automation and smart cold storage technologies, such as Internet of Things (IoT)-enabled warehouses, are likely to enhance operational efficiency, catering to the rising demand for seamless cold chain logistics.

Market Opportunities

- Integration with Smart Technology: There is a growing opportunity for the integration of smart technology in cold storage facilities. As of 2024, companies are increasingly deploying IoT-enabled sensors and AI-driven analytics to monitor temperature and humidity in real-time. Smart cold storage solutions are expected to improve operational efficiency by over 20%, reducing spoilage and lowering energy consumption by over 1.5 million kilowatt-hours annually across integrated facilities.

- Expansion into Rural Areas: Rural areas in China remain largely underserved by cold storage infrastructure. In 2024, the Chinese government launched initiatives to expand cold chain networks to rural provinces, aiming to increase storage capacity by 450,000 metric tons by 2026. This presents a significant opportunity for investors and logistics companies to develop facilities in less saturated regions, thereby tapping into the growing demand for fresh food storage in rural markets.

Scope of the Report

|

By Storage Type |

Refrigerated Warehouses Frozen Storage Chilled Storage |

|

By Construction Type |

Private Cold Storage Public Cold Storage Custom-Built Cold Storage |

|

By Application |

Food & Beverages Pharmaceuticals Chemicals Agriculture |

|

By Temperature Type |

Frozen Chilled |

|

By Region |

North East South Central West |

Products

Key Target Audience

Cold Chain Logistics Providers

Food & Beverage Manufacturers

Pharmaceutical Companies

Agricultural Cooperatives

Technology Integration Firms (for IoT and Automation in Cold Storage)

Government and Regulatory Bodies (e.g., National Development and Reform Commission, China Food and Drug Administration)

Investors and Venture Capitalist Firms

Import-Export Agencies

Companies

Players Mentioned in the Report:

China International Marine Containers (CIMC)

JD Logistics

Lineage Logistics

Swire Cold Storage

Sinotrans Limited

Alibaba Cainiao Logistics

Shanghai Electric Group

China Merchants Group

YTO Express Group Co., Ltd.

SF Express

Zhuhai Port Holdings Group

Table of Contents

1. China Cold Storage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. China Cold Storage Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. China Cold Storage Market Analysis

3.1. Growth Drivers (Energy Efficiency Standards, E-commerce Integration, Logistics Expansion, Food Security Initiatives)

3.2. Market Challenges (High Capital Investments, Regulatory Compliance, Temperature Control Complexity, Technological Integration)

3.3. Opportunities (Integration with Smart Technology, Expansion into Rural Areas, Government Infrastructure Projects, Increasing Export Demand)

3.4. Trends (Automation in Cold Storage, Sustainable Cooling Systems, IoT Adoption, Cold Chain Traceability)

3.5. Government Regulations (China Cold Chain Logistics Plan, Food Safety Regulations, National Refrigeration Efficiency Standards, Import-Export Regulations)

3.6. SWOT Analysis

3.7. Supply Chain Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. China Cold Storage Market Segmentation

4.1. By Storage Type (In Value %)

4.1.1. Refrigerated Warehouses

4.1.2. Frozen Storage

4.1.3. Chilled Storage

4.2. By Construction Type (In Value %)

4.2.1. Private Cold Storage

4.2.2. Public Cold Storage

4.2.3. Custom-Built Cold Storage

4.3. By Application (In Value %)

4.3.1. Food & Beverages

4.3.2. Pharmaceuticals

4.3.3. Chemicals

4.3.4. Agriculture

4.4. By Temperature Type (In Value %)

4.4.1. Frozen

4.4.2. Chilled

4.5. By Region (In Value %)

4.5.1. North China

4.5.2. East China

4.5.3. South China

4.5.4. Central China

4.5.5. West China

5. China Cold Storage Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. China International Marine Containers (Group) Ltd. (CIMC)

5.1.2. Xiamen Xiangyu Group

5.1.3. Lineage Logistics

5.1.4. Swire Cold Storage

5.1.5. JD Logistics

5.1.6. China Merchants Group

5.1.7. Shanghai Electric Group

5.1.8. Sinotrans Limited

5.1.9. SF Express

5.1.10. YTO Express Group Co., Ltd.

5.1.11. China National Offshore Oil Corporation (CNOOC)

5.1.12. Guangdong Cold Chain Industry Association

5.1.13. Zhuhai Port Holdings Group

5.1.14. Shuanghui Logistics

5.1.15. Alibaba Cainiao Logistics

5.2. Cross Comparison Parameters (Warehouse Capacity, Automation Level, Temperature Range, Investment in Sustainability, Supply Chain Network, Location Coverage, Technology Integration, Revenue from Cold Storage Operations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. China Cold Storage Market Regulatory Framework

6.1. Cold Chain Logistics Guidelines

6.2. Food Safety Law of the PRC (Cold Storage Specifics)

6.3. Energy Conservation Law for Cold Storage Facilities

6.4. Compliance and Certification for Cold Storage

7. China Cold Storage Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. China Cold Storage Market Future Segmentation

8.1. By Storage Type (In Value %)

8.2. By Construction Type (In Value %)

8.3. By Application (In Value %)

8.4. By Temperature Type (In Value %)

8.5. By Region (In Value %)

9. China Cold Storage Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Expansion Strategy

9.3. Cold Chain Infrastructure Investments

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage focuses on identifying all stakeholders involved in the China cold storage ecosystem, with particular emphasis on logistics providers and cold chain solution manufacturers. Through extensive desk research, key variables like storage capacity, technological integration, and regional focus are analyzed.

Step 2: Market Analysis and Construction

This phase involves the examination of historical market data, with attention to storage types and their respective market shares. Data on logistics networks, cold chain infrastructure, and regulatory developments will be compiled to create a robust market overview.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with key stakeholders such as cold storage operators and logistics companies will provide firsthand insights into the markets challenges and opportunities. These expert inputs help in refining market hypotheses and validating market dynamics.

Step 4: Research Synthesis and Final Output

The final output integrates both primary and secondary research findings to deliver an in-depth analysis of the China cold storage market. Detailed insights into market size, segmentation, and future outlook are provided, offering actionable intelligence for stakeholders.

Frequently Asked Questions

01. How big is the China Cold Storage Market?

The China cold storage market is valued at USD 84 billion, driven by a combination of rising e-commerce demand for fresh and frozen food products, as well as increased pharmaceutical storage requirements.

02. What are the challenges in the China Cold Storage Market?

Challenges in the China cold storage market include the high costs associated with building and maintaining cold storage facilities, regulatory compliance issues, and the technological integration needed for modernized operations.

03. Who are the major players in the China Cold Storage Market?

Key players in the China cold storage market include China International Marine Containers (CIMC), JD Logistics, Lineage Logistics, Swire Cold Storage, and Sinotrans Limited. These companies lead the market due to their extensive networks and technological innovations.

04. What are the growth drivers of the China Cold Storage Market?

The China cold storage market is driven by the surge in online food delivery services, increased demand for pharmaceuticals, and government investments in enhancing cold chain logistics infrastructure across major cities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.