China Contrast Media Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD5153

December 2024

100

About the Report

China Contrast Media Market Overview

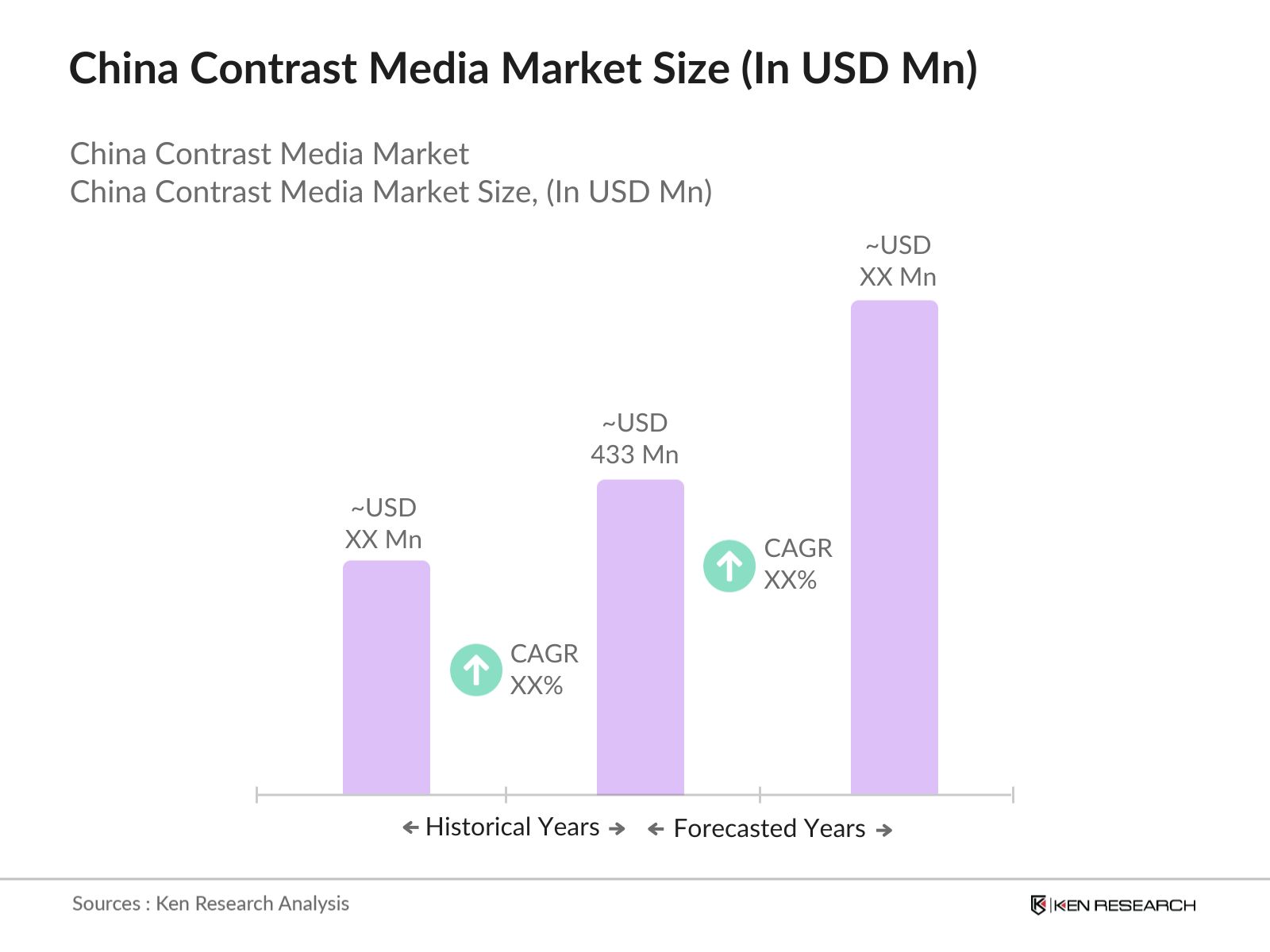

- The China Contrast Media Market holds significant value, driven by advancements in diagnostic imaging technologies and the increase in chronic disease prevalence. Valued at USD 433 million, the market benefits from substantial investment in healthcare infrastructure, supported by the governments initiative to modernize healthcare facilities. Urbanization and an aging population further contribute to the increased demand for contrast media in medical imaging applications, where contrast agents play a vital role in diagnosing cardiovascular, neurological, and gastrointestinal conditions.

- Key cities, such as Beijing, Shanghai, and Guangzhou, dominate the contrast media market due to their highly developed healthcare infrastructure, concentration of top-tier hospitals, and access to advanced imaging technologies. These regions also benefit from a higher awareness of preventive healthcare among the population, driving demand for imaging procedures and associated contrast media products.

- The China Food and Drug Administration (CFDA), renamed the National Medical Products Administration (NMPA), mandates strict guidelines for contrast media approval to ensure patient safety. In 2023, the NMPA evaluated over 4,200 new applications for medical products, with 15% dedicated to imaging-related agents, including contrast media. Compliance with the NMPA involves comprehensive clinical trials and quality assurance protocols, emphasizing patient safety and efficacy. These stringent standards are integral to preventing adverse reactions associated with contrast agents.

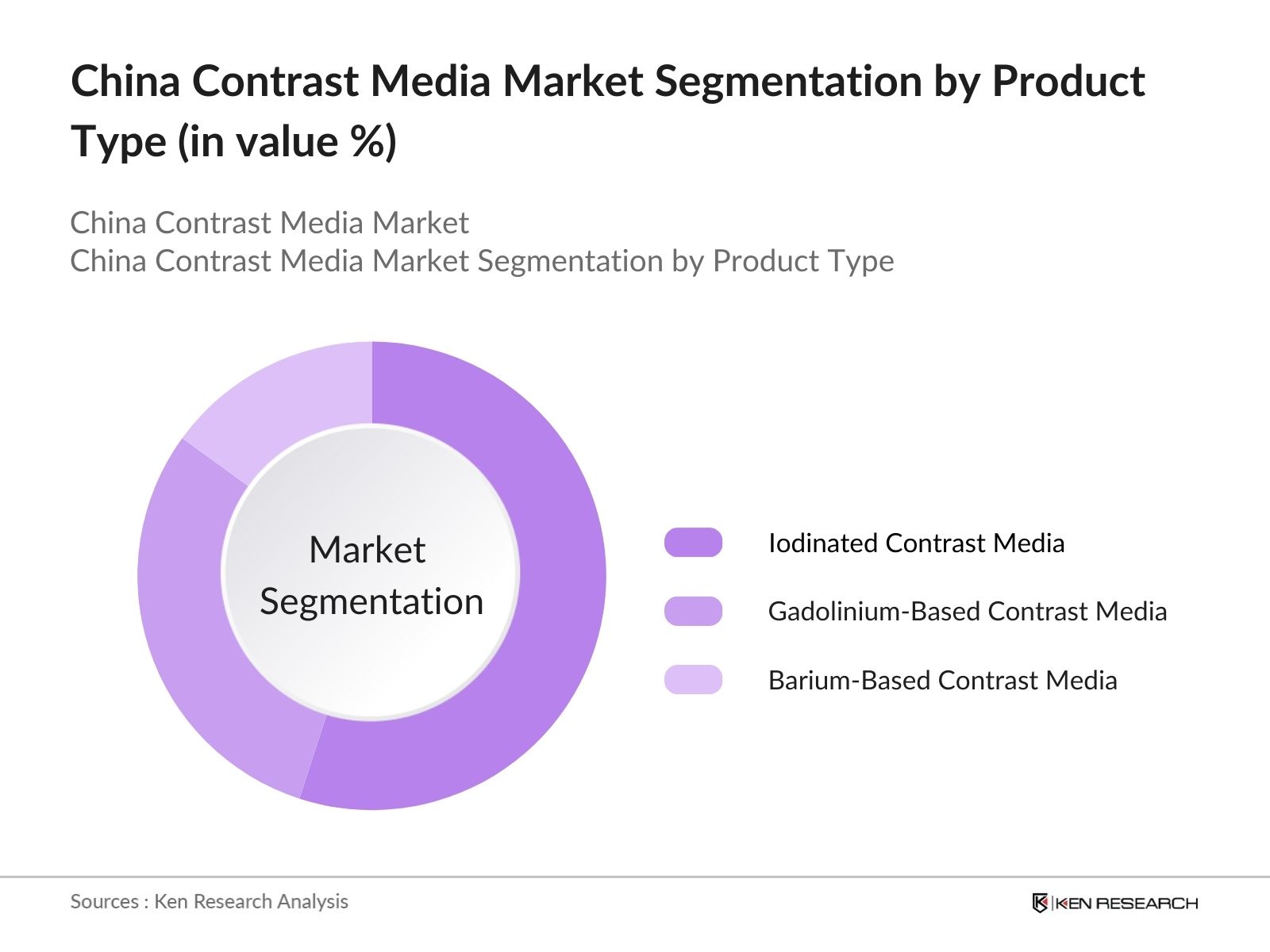

China Contrast Media Market Segmentation

By Product Type: The China Contrast Media Market is segmented by product type into iodinated contrast media, gadolinium-based contrast media, and barium-based contrast media. Iodinated contrast media leads in market share due to its wide application across X-ray and computed tomography (CT) procedures, commonly employed in cardiovascular and gastrointestinal diagnostics. Its widespread use is attributed to the affordability, compatibility with various imaging systems, and reliability in enhancing image clarity for specific diagnoses, further supported by robust supply chains and partnerships with hospitals.

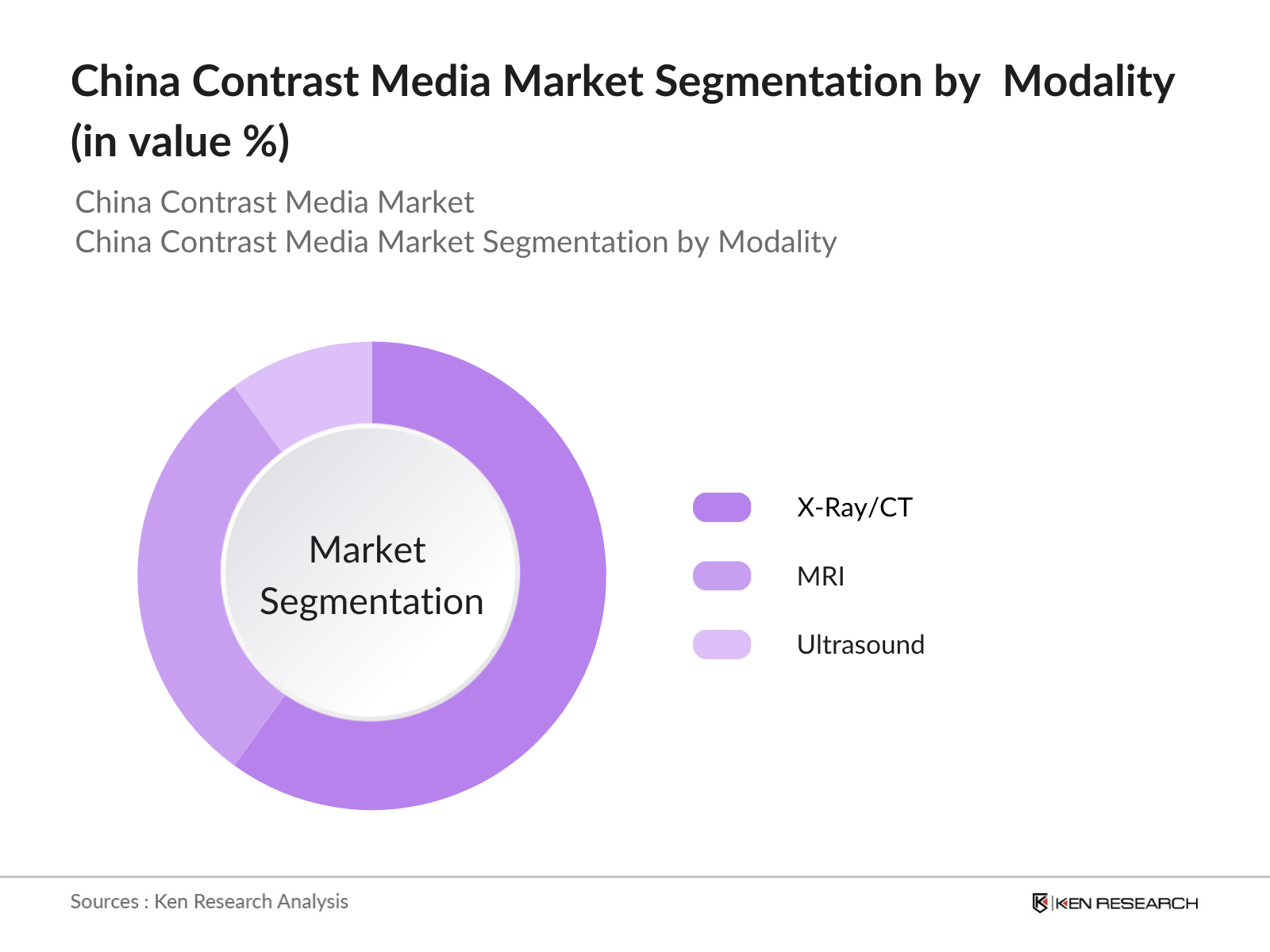

By Modality: The market is also segmented by modality into X-ray/CT, MRI, and ultrasound imaging. X-ray/CT imaging holds a dominant share in this segment due to the high demand for contrast agents in cardiovascular and neurological diagnostics. The ability of X-ray and CT modalities to provide detailed cross-sectional imaging supports early diagnosis and treatment planning, particularly in regions with high incidences of heart disease and cancer. This segment's dominance is reinforced by significant investments in radiology infrastructure and the availability of skilled radiologists in major hospitals.

China Contrast Media Competitive Landscape

The China Contrast Media Market is marked by a blend of established international players and emerging domestic companies. This consolidation allows these key players to dominate through technology integration, R&D investments, and alliances with medical institutions for exclusive supply contracts.

China Contrast Media Market Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases: The rising incidence of chronic conditions, such as cardiovascular diseases, cancers, and neurological disorders, has significantly amplified the demand for diagnostic imaging and, consequently, contrast media in China. According to the World Health Organization, China recorded over 4.8 million new cancer cases in 2022, with cardiovascular diseases remaining a leading cause of mortality in the region. The increased need for detailed diagnostic imaging has driven demand for high-quality contrast media to enhance imaging outcomes for precise disease management. Chronic diseases now account for around 89% of all deaths in China, underscoring the role of diagnostic support.

- Advancements in Imaging Technology: By 2024, over 25,000 MRI and CT units are operational across China, according to the National Health Commission, with public hospitals in urban centers showing the highest adoption rates. This widespread implementation of high-end imaging modalities elevates the demand for contrast media, which is integral for accuracy in complex imaging procedures, particularly for soft tissue and vascular assessments.

- Rising Geriatric Population: Chinas rapidly aging population, which now exceeds 230 million individuals aged 60 and above, fuels the demand for contrast media as older individuals are more susceptible to chronic diseases requiring imaging diagnostics. By 2023, nearly 17% of Chinas population was aged 65 or older, per the National Bureau of Statistics, creating an increased demand for age-specific healthcare services, including diagnostic imaging. Geriatric care has become a significant focus in healthcare policy, leading to sustained demand for diagnostic tools like contrast media.

Challenges

- High Cost of Contrast Media Procedures: Although Chinas healthcare infrastructure has expanded, the high cost of contrast-enhanced imaging procedures remains a challenge, with MRI and CT scans with contrast media costing an average of $300 per session. The cost factor has restrained access to contrast-enhanced imaging for many middle- and low-income individuals. This disparity has been highlighted in health surveys conducted by Chinas National Health Commission, underscoring the financial barrier in accessing diagnostic imaging and resulting in limited procedural uptake in economically disadvantaged areas.

- Stringent Regulatory Approvals: Stringent regulatory requirements in China for the approval of contrast media impact market availability and innovation. Regulatory delays can extend approval timelines by up to three years, according to the National Medical Products Administration. The approval process includes thorough assessments to ensure patient safety, which impacts the speed at which new products enter the market. These strict regulations, while safeguarding quality, can slow down the introduction of advanced contrast agents.

China Contrast Media Market Future Outlook

The China Contrast Media Market is expected to witness robust growth over the next five years. Factors contributing to this expansion include continued modernization of healthcare facilities, advancements in AI-based imaging solutions, and increased healthcare expenditure by the government. Additionally, the rising prevalence of chronic illnesses and a focus on early diagnosis and intervention are expected to drive greater demand for contrast media across imaging modalities.

Future Market Opportunities

- Growth in Emerging Regions: Chinas western and rural regions represent untapped markets for contrast media, with healthcare access initiatives driving diagnostic capacity in these areas. The government has allocated over $35 billion in healthcare development funds for rural areas in 2024, aiming to bridge the healthcare access gap between urban and rural areas. As healthcare facilities grow in these regions, the demand for contrast-enhanced imaging is set to rise, presenting an opportunity for market expansion.

- Development of Non-Ionic and Low-Osmolality Agents: Non-ionic and low-osmolality contrast agents are increasingly preferred due to their reduced risk of side effects, especially in renal-impaired patients. The National Medical Products Administration reported that in 2023, nearly 60% of new contrast media formulations approved were low-osmolality variants, which have shown improved safety profiles. These advanced agents are expected to gain popularity in China, especially in higher-risk populations, driving growth in this specific segment of contrast media.

Scope of the Report

|

Product Type |

Iodinated Contrast Media Gadolinium-Based Contrast Media Microbubble Contrast Media Barium-Based Contrast Media |

|

Modality |

X-Ray/CT MRI Ultrasound |

|

Application |

Cardiovascular Disorders Oncology Gastrointestinal Disorders Neurological Disorders |

|

End User |

Hospitals Diagnostic Imaging Centers Ambulatory Surgical Centers |

|

Region |

East North South Central |

Products

Key Target Audience

Radiology and Diagnostic Imaging Centers

Pharmaceutical Companies (Contrast Media Manufacturers)

Healthcare Infrastructure Investors

Medical Imaging Equipment Manufacturers

Hospitals and Ambulatory Surgical Centers

Research Institutions Focused on Medical Imaging

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (National Medical Products Administration, Ministry of Health)

Companies

Players Mentioned in the Report

Bayer AG

GE Healthcare

Bracco Imaging S.p.A.

Guerbet Group

Lantheus Holdings

Daiichi Sankyo Company

Trivitron Healthcare

J.B. Chemicals and Pharmaceuticals

Unijules Life Sciences

Zydus Cadila

Table of Contents

China Contrast Media Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Growth Rate Analysis

1.4 Segmentation Overview

China Contrast Media Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones

China Contrast Media Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Chronic Diseases

3.1.2 Advancements in Imaging Technology

3.1.3 Rising Geriatric Population

3.1.4 Expansion of Healthcare Infrastructure

3.2 Market Challenges

3.2.1 High Cost of Contrast Media Procedures

3.2.2 Stringent Regulatory Approvals

3.2.3 Potential Side Effects of Contrast Media

3.3 Opportunities

3.3.1 Growth in Emerging Regions

3.3.2 Development of Non-Ionic and Low-Osmolality Agents

3.3.3 Increasing Adoption of Digital Health Solutions

3.4 Trends

3.4.1 Integration of AI in Imaging Modalities

3.4.2 Preference for Injectable Contrast Media

3.4.3 Growth of Personalized Medicine

China Contrast Media Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Iodinated Contrast Media

4.1.2 Gadolinium-Based Contrast Media

4.1.3 Microbubble Contrast Media

4.1.4 Barium-Based Contrast Media

4.2 By Modality (In Value %)

4.2.1 X-Ray/CT

4.2.2 MRI

4.2.3 Ultrasound

4.3 By Application (In Value %)

4.3.1 Cardiovascular Disorders

4.3.2 Oncology

4.3.3 Gastrointestinal Disorders

4.3.4 Neurological Disorders

4.4 By End User (In Value %)

4.4.1 Hospitals

4.4.2 Diagnostic Imaging Centers

4.4.3 Ambulatory Surgical Centers

4.5 By Region (In Value %)

4.5.1 East China

4.5.2 North China

4.5.3 South China

4.5.4 Central China

China Contrast Media Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Bayer AG

5.1.2 GE Healthcare

5.1.3 Bracco Imaging S.p.A.

5.1.4 Guerbet Group

5.1.5 Lantheus Holdings

5.1.6 Daiichi Sankyo Company

5.1.7 Trivitron Healthcare

5.1.8 J.B. Chemicals and Pharmaceuticals

5.1.9 Unijules Life Sciences

5.1.10 Zydus Cadila

5.2 Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Product Innovation, Market Presence, Strategic Partnerships, Number of Employees, Clinical Trial Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

China Contrast Media Market Regulatory Landscape

6.1 China Food and Drug Administration (CFDA) Compliance

6.2 Medical Device Regulation Standards

6.3 Contrast Media Safety and Quality Standards

6.4 Certification Processes

China Contrast Media Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

China Contrast Media Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Modality (In Value %)

8.3 By Application (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

China Contrast Media Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Serviceable Available Market (SAM) Analysis

9.3 Serviceable Obtainable Market (SOM) Analysis

9.4 White Space Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the ecosystem of the China Contrast Media Market, identifying stakeholders such as manufacturers, healthcare providers, and regulatory bodies. This phase incorporates a combination of secondary data from proprietary databases to define the variables influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data on contrast media adoption is collected and analyzed. Insights into product type penetration and imaging modality use across healthcare facilities form the basis for revenue estimations, verified through a comparative analysis of industry reports.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and tested through expert consultations with healthcare professionals and industry leaders. Telephone interviews provide direct insights, refining data on market drivers, adoption rates, and future demand trends in key regions.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing collected data and insights to construct a comprehensive and validated market report. In-depth engagement with imaging centers and contrast media suppliers further enhances the accuracy of segment-specific analysis.

Frequently Asked Questions

01. How big is the China Contrast Media Market?

The China Contrast Media Market is valued at USD 433 million, supported by investments in diagnostic imaging infrastructure and the rising demand for advanced medical imaging.

02. What are the primary drivers of the China Contrast Media Market?

China Contrast Media Market is driven by advancements in imaging technology, a growing elderly population, and an increase in chronic disease diagnoses, which necessitate accurate imaging solutions.

03. Which are the major companies in the China Contrast Media Market?

Key companies in China Contrast Media Market include Bayer AG, GE Healthcare, Bracco Imaging, Guerbet Group, and Lantheus Holdings, all of which have established strong market positions through technology advancements and strategic partnerships.

04. What are the key challenges facing the China Contrast Media Market?

Challenges in China Contrast Media Market include high costs associated with contrast media procedures and stringent regulatory requirements for approval pose challenges for market growth, particularly for new market entrants.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.