China Mobile Phone Insurance Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD11151

December 2024

86

About the Report

China Mobile Phone Insurance Market Overview

- The China Mobile Phone Insurance Market is valued at USD 3 billion, based on a comprehensive five-year historical analysis. This valuation is primarily driven by the countrys high smartphone penetration, which reached over 1 billion mobile users, and the rapid adoption of 5G technology. The growing awareness among consumers regarding device protection and the increasing collaboration between insurance providers and telecom companies have also contributed significantly to the market's expansion.

- Eastern China, including cities like Shanghai, Beijing, and Shenzhen, dominates the China Mobile Phone Insurance Market. This dominance is due to higher income levels, greater smartphone ownership rates, and a concentration of technological infrastructure and high-end retail markets. These areas have well-established service ecosystems, which cater to premium customers who prioritize comprehensive insurance coverage for their devices.

- In 2024, the Chinese government allocated 10 billion in funding to promote digital platforms across the insurance sector, aiming to enhance access to mobile insurance policies for the digitally savvy population. This funding is expected to assist companies in establishing more efficient digital channels, making mobile phone insurance more accessible to users across urban and rural areas.

China Mobile Phone Insurance Market Segmentation

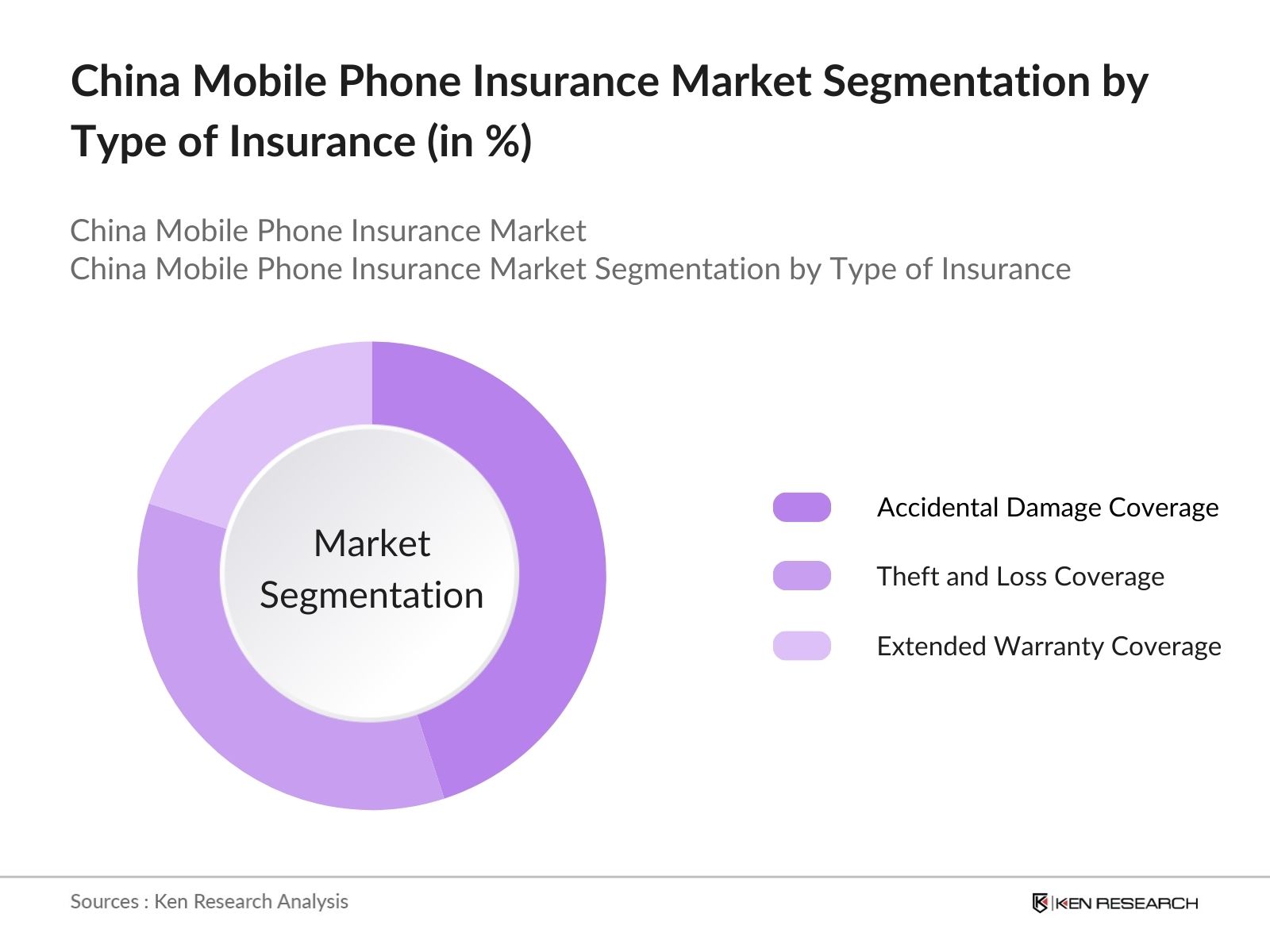

By Type of Insurance: The market is segmented by type of insurance into Theft and Loss Coverage, Accidental Damage Coverage, and Extended Warranty Coverage. Accidental Damage Coverage currently holds the largest share due to the high demand for comprehensive protection plans that cover screen damage, water exposure, and other unforeseen incidents. This trend is fueled by a consumer preference for safeguarding expensive smartphones, particularly in urban regions where the cost of repair is higher.

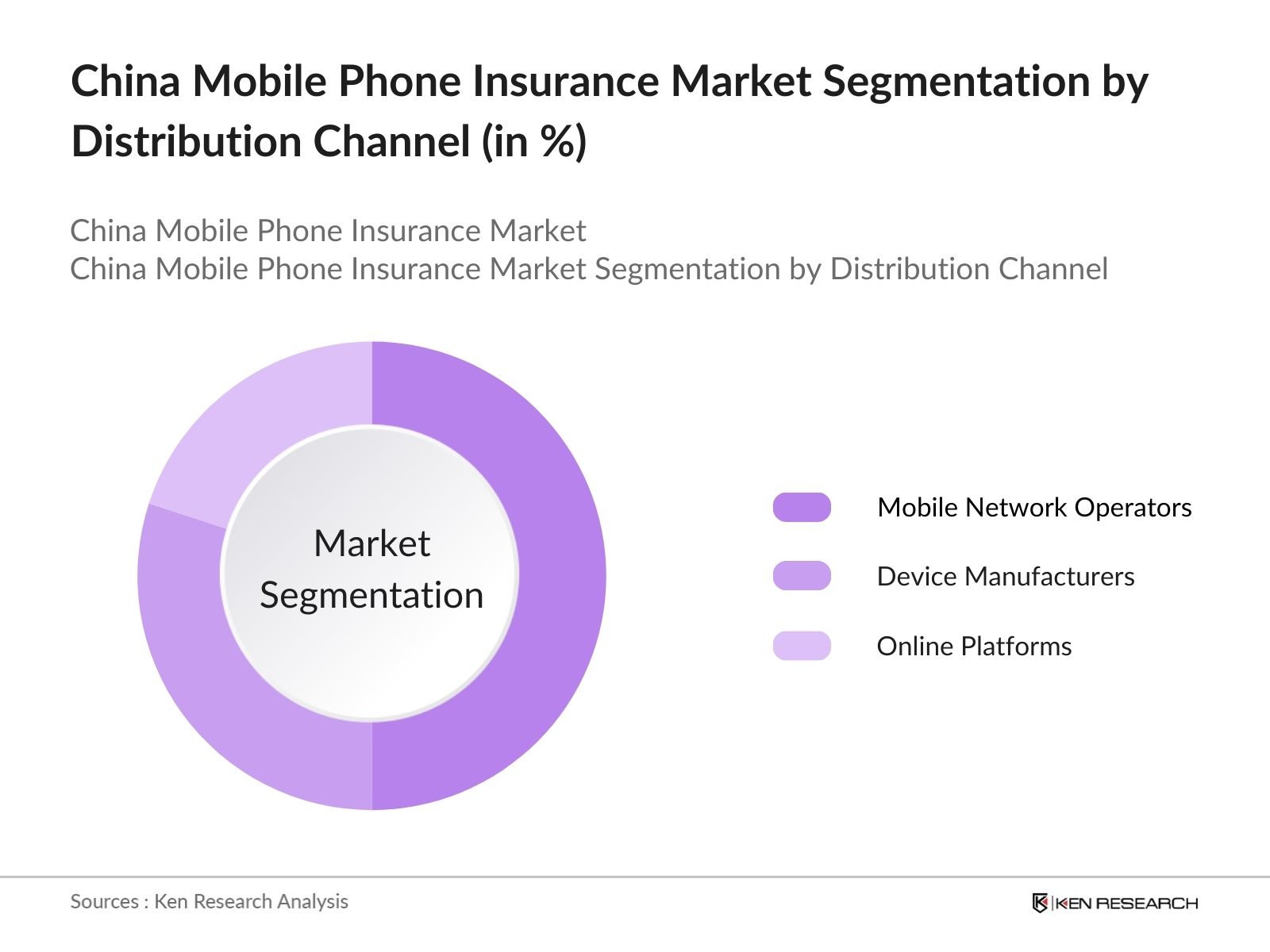

By Distribution Channel: The market is further segmented by distribution channels, including Mobile Network Operators (MNOs), Device Manufacturers, and Online Platforms. Mobile Network Operators dominate this segment, attributed to their established customer relationships and ease of bundling insurance with mobile service plans. MNOs such as China Mobile and China Telecom are preferred due to the convenience of monthly billing, along with partnerships that offer discounts on premiums and additional service features.

China Mobile Phone Insurance Market Competitive Landscape

The market is concentrated among a few dominant players, including Xiaomi Insurance, China Telecom, and JD Insurance. These companies leverage strong brand loyalty and advanced technology integration to offer comprehensive insurance solutions.

China Mobile Phone Insurance Market Analysis

Market Growth Drivers

- Rising Smartphone Penetration: In 2024, China had over 1.5 billion smartphone users, driven by a rapid increase in consumer spending on high-end models. This expanding user base fuels demand for mobile phone insurance as consumers seek to protect their valuable devices from potential damage or theft. Industry data shows that premium smartphones, particularly those priced over 5,000, are now a significant portion of the market, making insurance policies an attractive option for device protection.

- Growing Adoption of 5G Technology: With China achieving over 2 million active 5G base stations in 2024, 5G adoption has surged, leading to a significant increase in new device purchases. The high cost of 5G-enabled smartphones, which often exceed 8,000, has driven more consumers toward purchasing insurance to safeguard these investments. This growth in 5G technology is expected to support the expansion of the mobile phone insurance market as more users seek coverage for their upgraded devices.

- Increasing Incidents of Device Damage and Theft: In 2024, reports indicate that nearly 200 million smartphones in China experienced damage or theft, highlighting the need for insurance coverage. This rise in incidents, coupled with high repair costs for premium models, has made mobile insurance a practical choice for consumers. With replacement costs often exceeding 3,000 for high-end devices, the value proposition of insurance has strengthened, contributing to increased adoption.

Market Challenges

- Low Consumer Awareness in Rural Areas: Despite the urban demand for mobile phone insurance, rural areas, which house nearly 500 million people, still show low adoption rates due to limited awareness and accessibility. In 2024, rural consumers accounted for less than 10 million policies, reflecting a gap in outreach and education. This lack of awareness remains a challenge for insurers aiming to expand their customer base beyond metropolitan areas.

- Complex Regulatory Environment: The Chinese insurance market is heavily regulated, with policies often requiring strict compliance. In 2024, over 50 regulatory changes were introduced in the insurance sector, complicating the operational landscape for mobile insurance providers. Compliance costs can reach 2 million annually for larger firms, adding to operational expenses and making it challenging to streamline offerings.

China Mobile Phone Insurance Market Future Outlook

Over the next five years, the China Mobile Phone Insurance industry is expected to experience sustained growth driven by increasing smartphone sales, rising disposable incomes, and advanced insurance technology integration.

Future Market Opportunities

- Increased Adoption of Blockchain for Enhanced Transparency: Over the next five years, mobile insurance providers are expected to integrate blockchain technology to improve transparency in claims processing and policy management. This integration will enable over 10 million policies to benefit from faster, more secure transactions by 2029, reducing fraud and increasing trust among policyholders.

- Expansion of AI in Fraud Detection and Policy Personalization: By 2029, AI is projected to play a crucial role in fraud detection, reducing false claims by nearly 30 million cases annually. Additionally, AI-driven personalization will allow insurers to offer highly tailored policies to 15 million policyholders, improving customer satisfaction and adoption rates.

Scope of the Report

|

Type of Insurance |

Theft and Loss Coverage |

|

Accidental Damage Coverage |

|

|

Extended Warranty Coverage |

|

|

Distribution Channel |

Mobile Network Operators (MNOs) |

|

Device Manufacturers |

|

|

Online Platforms |

|

|

Customer Type |

Individual Consumers |

|

Corporate Customers |

|

|

Device Type |

Smartphones |

|

Tablets |

|

|

Other Connected Devices |

|

|

Region |

Eastern China |

|

Northern China |

|

|

Southern China |

|

|

Western China |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecom Service Providers

Mobile Device Manufacturers

Online Retail Platforms

Consumer Electronics Insurance Providers

Repair Service Chains

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (China Banking and Insurance Regulatory Commission, State Administration for Market Regulation)

Technology and IT Infrastructure Providers

Companies

Xiaomi Insurance

China Telecom

JD Insurance

Huawei Care

OPPO Insurance Services

Baidu Insurance

China Life Insurance

Ping An Insurance

AppleCare China

Vivo Care

Table of Contents

1. China Mobile Phone Insurance Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics (Growth Rate, Competitive Structure, Key Influencing Factors)

1.4 Market Segmentation Overview

2. China Mobile Phone Insurance Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Product Launches, Partnerships)

3. China Mobile Phone Insurance Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Smartphone Penetration

3.1.2 Rising Awareness of Mobile Device Protection

3.1.3 Partnerships with Telecom Providers

3.2 Market Challenges

3.2.1 High Insurance Premiums

3.2.2 Limited Coverage Options

3.2.3 Regulatory Barriers

3.3 Opportunities

3.3.1 Expansion of Online Sales Channels

3.3.2 Integration of AI in Claims Management

3.3.3 Growth in Premium Insurance Plans

3.4 Trends

3.4.1 Use of Telematics for Premium Calculation

3.4.2 Embedded Insurance with Mobile Devices

3.4.3 Integration of Smart Contracts for Claims Processing

3.5 Regulatory Framework

3.5.1 Compliance Standards for Insurance Providers

3.5.2 Consumer Protection Laws

3.5.3 Data Privacy Regulations in Mobile Insurance

3.6 Competitive Landscape (Porters Five Forces Analysis, Stakeholder Ecosystem)

4. China Mobile Phone Insurance Market Segmentation

4.1 By Type of Insurance (In Value %)

4.1.1 Theft and Loss Coverage

4.1.2 Accidental Damage Coverage

4.1.3 Extended Warranty Coverage

4.2 By Distribution Channel (In Value %)

4.2.1 Mobile Network Operators (MNOs)

4.2.2 Device Manufacturers

4.2.3 Online Platforms

4.3 By Customer Type (In Value %)

4.3.1 Individual Consumers

4.3.2 Corporate Customers

4.4 By Device Type (In Value %)

4.4.1 Smartphones

4.4.2 Tablets

4.4.3 Other Connected Devices

4.5 By Region (In Value %)

4.5.1 Eastern China

4.5.2 Northern China

4.5.3 Southern China

4.5.4 Western China

5. China Mobile Phone Insurance Market Competitive Analysis

5.1 Profiles of Key Competitors

5.1.1 Xiaomi Insurance

5.1.2 China Telecom

5.1.3 JD Insurance

5.1.4 Huawei Care

5.1.5 OPPO Insurance Services

5.1.6 Baidu Insurance

5.1.7 China Life Insurance

5.1.8 Ping An Insurance

5.1.9 AppleCare China

5.1.10 Vivo Care

5.1.11 Tencent Insurance

5.1.12 Alibaba Insurance

5.1.13 ZhongAn Insurance

5.1.14 Sunshine Insurance

5.1.15 Samsung Care+ China

5.2 Cross-Comparison Parameters (Customer Base, Premium Plans, Claim Processing Time, Regional Presence, Product Diversification, Revenue, Market Share, Customer Satisfaction)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, New Product Launches)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Venture Capital Funding, Government Grants)

6. China Mobile Phone Insurance Market Regulatory Framework

6.1 Insurance Licensing Requirements

6.2 Consumer Protection Compliance

6.3 Data Security and Privacy Protocols

7. China Mobile Phone Insurance Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. China Mobile Phone Insurance Future Market Segmentation

8.1 By Type of Insurance (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Customer Type (In Value %)

8.4 By Device Type (In Value %)

8.5 By Region (In Value %)

9. China Mobile Phone Insurance Market Analysts Recommendations

9.1 Customer Segmentation Strategies

9.2 Product Development Opportunities

9.3 Digital Transformation in Claims Management

9.4 Potential Market Expansion Areas

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping the key stakeholders and variables impacting the China Mobile Phone Insurance Market. This includes identifying industry participants such as telecom providers, insurance companies, and repair services to define the major forces driving market dynamics.

Step 2: Market Analysis and Construction

This stage focuses on collecting and analyzing historical data related to the market size, growth trends, and customer demographics. We assess penetration rates, consumer adoption patterns, and policy characteristics to provide an accurate portrayal of market behavior.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses are validated through in-depth interviews with industry experts and company representatives. These insights help refine market forecasts, align with operational data, and corroborate the competitive landscape.

Step 4: Research Synthesis and Final Output

In the final stage, the gathered data is synthesized to ensure a holistic and accurate analysis of the China Mobile Phone Insurance Market. This process includes cross-verifying insights from industry experts with secondary data sources, ensuring high reliability and precision.

Frequently Asked Questions

01. How big is the China Mobile Phone Insurance Market?

The China Mobile Phone Insurance Market is valued at USD 3 billion, driven by increasing smartphone ownership and strategic partnerships between telecom companies and insurance providers.

02. What are the challenges in the China Mobile Phone Insurance Market?

Challenges in the China Mobile Phone Insurance Market include high premiums, limited coverage options, and regulatory barriers that can affect customer acquisition and the overall market growth trajectory.

03. Who are the major players in the China Mobile Phone Insurance Market?

Key players in the China Mobile Phone Insurance Market include Xiaomi Insurance, China Telecom, JD Insurance, and Ping An Insurance, all of whom lead due to their robust service networks and strong brand presence.

04. What are the growth drivers of the China Mobile Phone Insurance Market?

The China Mobile Phone Insurance Market is propelled by rising smartphone penetration, increased awareness of device protection, and the growing convenience of bundled insurance plans offered by telecom providers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.