China Mutton Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD953

July 2024

80

About the Report

China Mutton Market Overview

- China Mutton Market has experienced significant growth over the past few years. This is reflected in the market size of Asia Mutton Market which reached a valuation of $525 million driven by increasing consumer demand for high-protein diets, rising disposable incomes, and a growing preference for mutton over other meats due to its perceived health benefits.

- Key players in the China Mutton Market include Inner Mongolia Yili Industrial Group Co., Ltd., Beijing Sanyuan Foods Co., Ltd., Heilongjiang Agriculture Company, and China National Agricultural Development Group Co., Ltd. These companies dominate the market due to their extensive supply chains, advanced production techniques, and strong distribution networks.

- In the first three quarters of 2023 supported by global partnerships, Yili Group’s performance was a resounding success. Revenue soared to $13.32 billion, accompanied by a notable 16.36% increase in net profit. Yili Group has cemented its all-around leadership in the industry.

China Mutton Current Market Analysis

- China Mutton market’s growth has led to increased employment opportunities and income for farmers. Additionally, the rising demand for mutton has increased investments in meat processing and distribution infrastructure, further boosting economic development.

- One of the primary challenges facing the China mutton market is the fluctuating cost of feed, which directly affects production costs. Feed prices increased due to supply chain disruptions and rising global commodity prices. This has put pressure on mutton producers, particularly small-scale farmers, who struggle to maintain profitability amidst rising operational costs.

- Inner Mongolia is the leading region in the China Mutton Market. The region's dominance is attributed to its favorable climate for sheep farming, extensive grazing lands, and well-established sheep farming practices.

China Mutton Market Segmentation

The China Mutton Market can be segmented based on several factors:

By Product Type: China Mutton Market is segmented by Product Type into Fresh Mutton, Frozen Mutton & Processed Mutton. In 2023, Fresh Mutton reign as the most dominant sub-segment, holding a substantial market share. Fresh mutton's dominance is driven by consumer preference for its superior taste and texture compared to frozen or processed alternatives.

By Distribution Channel: China Mutton Market is segmented by Distribution Channel into Supermarkets/Hypermarkets, Specialty Stores and Online Retail. In 2023, Supermarkets/Hypermarkets emerges as the most dominant sub-segment, commanding a significant percentage of the market share, driven by increasing number of urban consumers who prefer one-stop shopping experiences.

By Region: China Mutton Market is segmented by region into North, South, East & West. In 2023, North region dominates due to its extensive sheep farming practices and favorable climatic conditions for livestock rearing. The region's robust supply chain and high-quality mutton production contribute to its dominance.

China Mutton Market Competitive Landscape

- Shandong Delisi Food Co., Ltd. recently released its financial report for the first quarter of 2024. Revenue was $122.4 million, when compared to $123.06 million that year. The company attributed the slight decrease in revenue to fluctuations in market demand and increased operational costs.

- In 2024, the revenue of China Yurun Food Group Ltd. reached $180.7 million to date. Despite facing challenges in the competitive market, Yurun Food has managed to maintain its strong market presence through continuous innovation and quality improvements.

- In 2021, Hormel Foods has partnered with Better Meat Co. to launch a new plant-based meat alternative called Rhiza. Rhiza aims to provide a sustainable and nutritious alternative to traditional meat products, catering to the growing demand for plant-based diets.

China Mutton Industry Analysis

China Mutton Market Growth Drivers:

- Rising Meat Consumption: Meat consumption in China is steadily increasing, with mutton being a significant part of this trend. China consumed the largest meat in the world. In 2021, China consumed 100 million tons, which was 27% of the world’s total. The cultural preference for mutton in various traditional Chinese dishes contributes to its growing consumption, driving the market forward.

- Increasing Health Awareness: There is a rising demand for high-protein diets in China, with mutton being a preferred source due to its rich protein content. The growing awareness of mutton's health benefits, such as its high protein and vitamin content, drives this demand.

- Expansion of the Cold Chain Logistics: In July 2022, Yum China Holdings, Inc. announced the construction of a 61,000 square meter facility which serves as an integrated cold chain transit hub for the entire region. This expansion ensures the quality and safety of mutton during transportation, making it more accessible to consumers across the country and boosting market growth.

China Mutton Market Challenges:

- High Production Costs: The cost of sheep farming is relatively high, impacting the profitability of mutton producers. High costs pose a challenge for small-scale farmers, limiting their ability to compete with larger producers. Additionally, fluctuations in feed prices and veterinary expenses further strain the financial viability of smaller operations.

- Environmental Concerns: Sheep farming can have a significant environmental impact, particularly concerning land degradation and greenhouse gas emissions. Implementing sustainable farming practices and exploring alternative feed sources are essential steps towards reducing the industry's ecological footprint.

- Market Competition: The mutton market faces competition from other meats, such as pork and chicken, which are more affordable and widely available. Price difference deters cost-sensitive consumers from purchasing mutton, affecting market growth.

China Mutton Market Government Initiatives:

- Import Tariffs Adjustment: To protect domestic producers, the Chinese government adjusted import tariffs on mutton. Since 2020, China has imposed sanctions and tariffs on Australian trade, including barley and red meat. This policy aims to reduce dependence on imported mutton, supporting the growth of domestic production.

- Sustainable Farming Practices: In 2021, China Meat Association (CMA) collaborated with the World-Wide Fund for Nature (WWF) to issue its “Specifications for Meat Industry Green Trade” to promote the sustainable development of China’s meat industry. With the associations’ reach, the Specifications constitute an important milestone toward responsible meat and animal feed supply chains in China.

China Mutton Future Market Outlook

China Mutton Market is expected to grow significantly by 2028 along with a respectable CAGR during the period of 2023-2028, driven by increasing technological advancements & expansion of online retail.

Future Trends

-

- Technological Advancements in Farming: Over the next five years, advancements in farming technologies, such as precision agriculture and automated feeding systems, are expected to improve sheep farming efficiency. The adoption of these technologies will enhance productivity and reduce operational costs, contributing to the growth of the mutton market.

- Growing Demand for Organic Mutton: The demand for organic and sustainably produced mutton is expected to rise significantly in the coming years. By 2028, the market for organic mutton is projected to grow significantly driven by increasing consumer awareness of environmental and health issues. Producers are likely to invest in organic farming practices to cater to this growing segment.

- Expansion of Online Retail: The online retail segment for mutton is anticipated to expand rapidly over the next five years. With the growing popularity of e-commerce platforms and consumer preference for online shopping, the sale of mutton through online channels is expected to increase. Companies will focus on enhancing their online presence and logistics to tap into this expanding market

Scope of the Report

|

By Product Type |

Fresh Mutton Frozen Mutton Processed Mutton |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Meat Processing Companies

Retailers (Supermarkets/Hypermarkets)

Online Retailers

Packaging Companies

Cold Chain Logistics Providers

Health and Nutrition Organizations

Banks & Financial Institutions

Government & Regulatory Bodies (Ministry of Commerce, China Food & Drug Administration etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

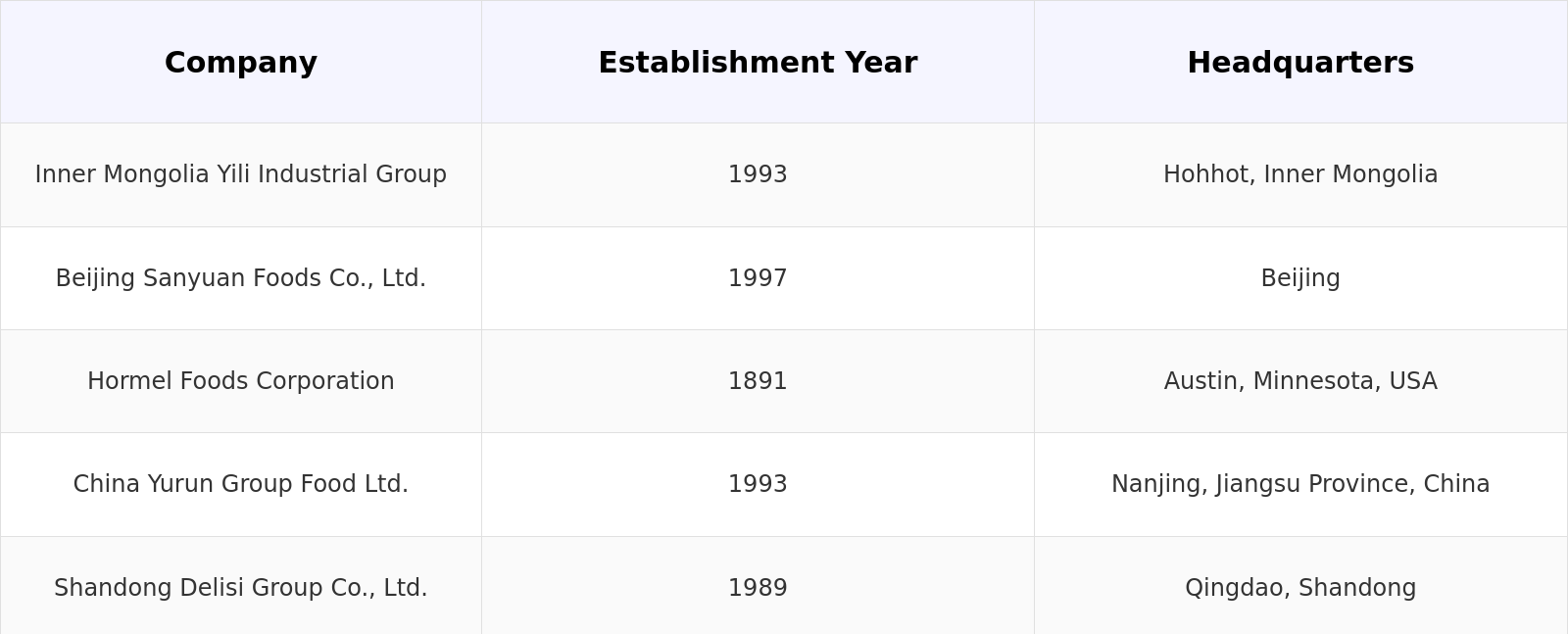

Inner Mongolia Yili Industrial Group Co., Ltd.

Beijing Sanyuan Foods Co., Ltd.

Hormel Foods Corporation

China Yurun Group Food Ltd.

Shandong Delisi Group Co., Ltd.

Henan Zhongpin Food Share Co., Ltd.

Hebei Yangyuan Zhihui Beverage Co., Ltd.

COFCO Meat Holdings Limited

Fujian Sunner Development Co., Ltd.

Inner Mongolia Mengniu Dairy Co., Ltd.

Tangrenshen Group Co., Ltd.

Anhui Gujing Distillery Company Limited

Wens Foodstuff Group Co., Ltd.

Chuying Agro-Pastoral Group Co., Ltd.

Qingdao Fusheng Food Co., Ltd.

Table of Contents

1. China Mutton Market Overview

1.1 China Mutton Market Taxonomy

2. China Mutton Market Size (in USD Mn), 2018-2023

3. China Mutton Market Analysis

3.1 China Mutton Market Growth Drivers

3.2 China Mutton Market Challenges and Issues

3.3 China Mutton Market Trends and Development

3.4 China Mutton Market Government Regulation

3.5 China Mutton Market SWOT Analysis

3.6 China Mutton Market Stake Ecosystem

3.7 China Mutton Market Competition Ecosystem

4. China Mutton Market Segmentation, 2023

4.1 China Mutton Market Segmentation by Product Type (in value %), 2023

4.2 China Mutton Market Segmentation by Distribution Channel (in value %), 2023

4.3 China Mutton Market Segmentation by Region (in value %), 2023

5. China Mutton Market Competition Benchmarking

5.1 China Mutton Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. China Mutton Future Market Size (in USD Mn), 2023-2028

7. China Mutton Future Market Segmentation, 2028

7.1 China Mutton Market Segmentation by Product Type (in value %), 2028

7.2 China Mutton Market Segmentation by Distribution Channel (in value %), 2028

7.3 China Mutton Market Segmentation by Region (in value %), 2028

8. China Mutton Market Analysts’ Recommendations

8.1 China Mutton Market TAM/SAM/SOM Analysis

8.2 China Mutton Market Customer Cohort Analysis

8.3 China Mutton Market Marketing Initiatives

8.4 China Mutton Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on China Mutton Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for China Mutton Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple mutton suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from mutton suppliers and distributors companies

Frequently Asked Questions

01 How big is China Mutton Market?

China Mutton Market has experienced significant growth over the past few years. This is reflected in the market size of Asia Mutton Market which reached a valuation of $525 billion driven by increasing consumer demand for high-protein diets

02 What are the growth drivers of the China Mutton Market?

The China Mutton market is propelled by increasing health awareness about the nutritional benefits of mutton, the expansion of cold chain logistics, government support for domestic production, and the rising overall meat consumption in China.

03 What are challenges faced by China Mutton Market?

Challenges in China Mutton market include high production costs, environmental concerns related to sheep farming, market competition from other meats, and fluctuating feed prices. These factors impact the profitability and sustainability of the market.

04 Who are the major players in the China Mutton Market?

Key players in the China Mutton market include Inner Mongolia Yili Industrial Group Co., Ltd., Beijing Sanyuan Foods Co., Ltd. and Shandong Delisi Group Co., Ltd. These companies lead due to their extensive supply chains, advanced production techniques, and strong distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.