China Premium Motorcycle Helmet Market Overview

- The China Premium Motorcycle Helmet Market is valued at USD 110 million, based on a five-year historical analysis. This growth is primarily driven by increasing motorcycle ownership, rising disposable incomes, heightened safety awareness among riders, and the growing trend of premium and high-quality helmets that offer enhanced protection and comfort. The market has seen a significant shift towards premium products as consumers prioritize safety, style, and advanced features such as lightweight materials and improved ventilation systems .

- Key cities dominating the market includeBeijing, Shanghai, and Guangzhou, where the concentration of motorcycle users is high. These urban centers have robust infrastructure for motorcycle use and a growing population of motorcycle enthusiasts, contributing to the demand for premium helmets. Additionally, the presence of major retailers, brand showrooms, and expanding online sales channels in these cities enhances market accessibility .

- In recent years, the Chinese government has implemented stricter regulations regarding helmet safety standards, mandating that all motorcycle helmets sold in the market must comply with theGB 811-2010standard. This regulation aims to improve rider safety and reduce accidents, thereby increasing the demand for compliant premium helmets that meet these enhanced safety criteria .

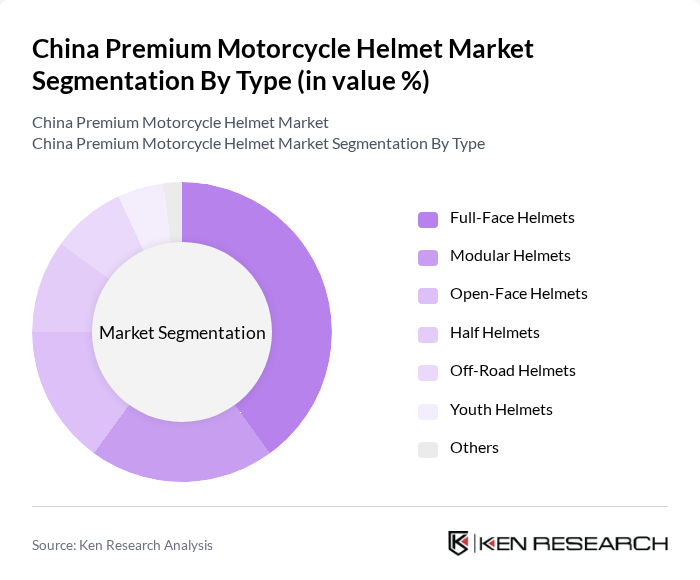

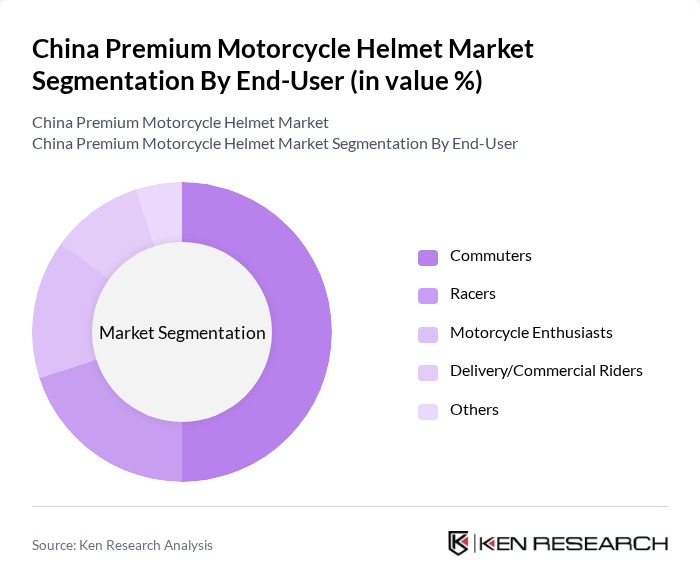

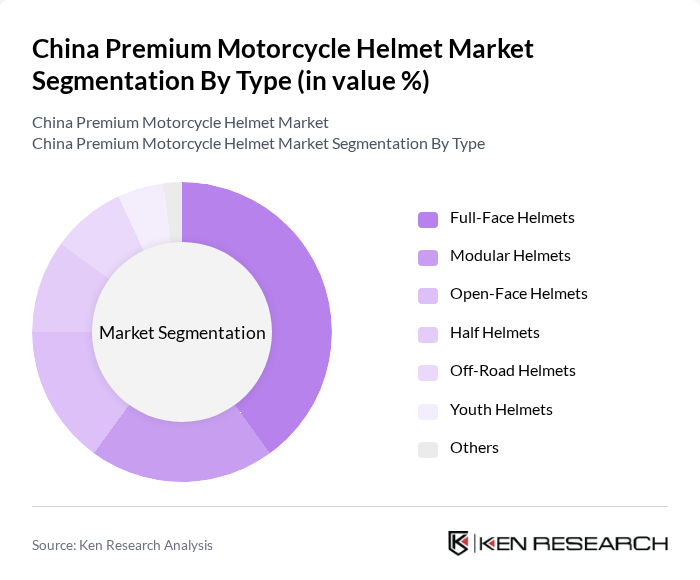

China Premium Motorcycle Helmet Market Segmentation

By Type:The market is segmented into various types of helmets, includingFull-Face Helmets, Modular Helmets, Open-Face Helmets, Half Helmets, Off-Road Helmets, Youth Helmets, and Others. Among these,Full-Face Helmetsdominate the market due to their comprehensive protection and popularity among both commuters and racers. The trend toward safety, the increasing number of motorcycle accidents, and consumer preference for helmets that offer maximum coverage and advanced features such as anti-fog visors and aerodynamic designs have led to greater demand for full-face models .

By End-User:The end-user segmentation includesCommuters, Racers, Motorcycle Enthusiasts, Delivery/Commercial Riders, and Others.Commutersrepresent the largest segment, driven by the increasing number of individuals using motorcycles for daily transportation. The rise in urban traffic congestion and the growth of the delivery sector have made motorcycles a preferred choice, leading to higher demand for premium helmets that ensure safety, comfort, and compliance with regulatory standards during commutes .

China Premium Motorcycle Helmet Market Competitive Landscape

The China Premium Motorcycle Helmet Market is characterized by a dynamic mix of regional and international players. Leading participants such asShoei Co., Ltd., Arai Helmet Ltd., HJC Helmets, AGV (Dainese Group), Schuberth GmbH, Nolan Group, LS2 Helmets (Jiangmen Pengcheng Helmet Manufacturing Co., Ltd.), Shark Helmets, KYT Helmets, YOHE Helmets (Guangzhou YOHE Helmet Manufacturing Co., Ltd.), YEMA Helmet (Yongkang Yema Helmet Co., Ltd.), Bilmola, X-Lite (Nolan Group), Origine Helmets, and Masei Helmetscontribute to innovation, geographic expansion, and service delivery in this space.

China Premium Motorcycle Helmet Market Industry Analysis

Growth Drivers

- Increasing Safety Awareness Among Riders:The rising number of motorcycle accidents in China has heightened safety awareness among riders. In future, the country reported over 48,000 motorcycle-related fatalities, prompting a shift towards premium helmets that offer better protection. Government campaigns and educational programs have also contributed to this trend, with a reported 30% increase in helmet sales attributed to heightened safety consciousness. This growing awareness is expected to drive demand for high-quality helmets significantly.

- Rising Disposable Income in Urban Areas:Urban disposable income in China reached approximately CNY 43,000 per capita, reflecting a 6% increase from the previous period. This economic growth has enabled consumers to invest in premium motorcycle helmets, which are often priced higher than standard options. As urbanization continues, more individuals are willing to spend on safety and quality, leading to a projected increase in premium helmet purchases, particularly in metropolitan areas where motorcycle ownership is prevalent.

- Growth in Motorcycle Ownership:The number of registered motorcycles in China surpassed 48 million, marking a 5% increase from the previous period. This surge in ownership is driven by urban commuting needs and the popularity of motorcycles as a cost-effective transportation option. As more individuals acquire motorcycles, the demand for premium helmets is expected to rise correspondingly, as new riders prioritize safety and quality in their purchases, further bolstering the market.

Market Challenges

- Intense Competition from Low-Cost Alternatives:The Chinese market is flooded with low-cost helmet options, with prices often under CNY 200. This intense competition poses a significant challenge for premium helmet manufacturers, as budget-conscious consumers may opt for cheaper alternatives despite the safety benefits of premium products. In future, low-cost helmets accounted for approximately 60% of total helmet sales, making it difficult for premium brands to capture market share and maintain profitability.

- Regulatory Compliance Complexities:The regulatory landscape for motorcycle helmets in China is intricate, with multiple safety standards enforced by the government. Manufacturers must navigate these regulations, which can vary by region, leading to increased compliance costs. In future, approximately 25% of manufacturers reported challenges in meeting these standards, which can hinder product launches and limit market entry for new premium helmet brands, ultimately affecting overall market growth.

China Premium Motorcycle Helmet Market Future Outlook

The future of the China premium motorcycle helmet market appears promising, driven by technological advancements and evolving consumer preferences. As smart helmets equipped with communication and navigation features gain traction, manufacturers are likely to invest in innovative designs. Additionally, the trend towards eco-friendly materials is expected to shape product offerings, appealing to environmentally conscious consumers. With the expansion of online sales channels, premium brands can reach a broader audience, enhancing market penetration and growth potential in future.

Market Opportunities

- Technological Advancements in Helmet Safety:The integration of advanced safety technologies, such as impact sensors and Bluetooth connectivity, presents a significant opportunity for premium helmet manufacturers. As consumer demand for innovative features increases, brands that invest in research and development can differentiate themselves, potentially capturing a larger market share and enhancing brand loyalty among tech-savvy riders.

- Expansion into Rural Markets:With rural motorcycle ownership on the rise, targeting these markets offers a lucrative opportunity for premium helmet brands. In future, rural areas accounted for approximately 30% of new motorcycle registrations. By educating consumers on the benefits of premium helmets and establishing distribution channels, manufacturers can tap into this growing segment, driving sales and brand recognition in previously underserved regions.