Europe 3PL Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD10043

December 2024

83

About the Report

Europe Third-Party Logistics Market Overview

- The Europe Third-Party Logistics (3PL) market, valued at USD 210 billion, is driven by the expansion of international trade and the complexities of managing global supply chains. Many companies find it challenging to handle logistics in-house, leading them to outsource to 3PL providers who offer expertise in transportation management and value-added services.

- Germany and the United Kingdom are dominant players in the European 3PL market. Germany's dominance stems from its strategic central location, advanced infrastructure, and strong manufacturing base. The UK's prominence is due to its significant retail and e-commerce sectors, which demand efficient logistics solutions.

- Companies are investing in cold chain logistics due to rising demand for temperature-sensitive products, with $20 billion invested globally in 2024. This expansion supports industries such as pharmaceuticals and food, where precise temperature control is essential for product safety and quality.

Europe Third-Party Logistics Market Segmentation

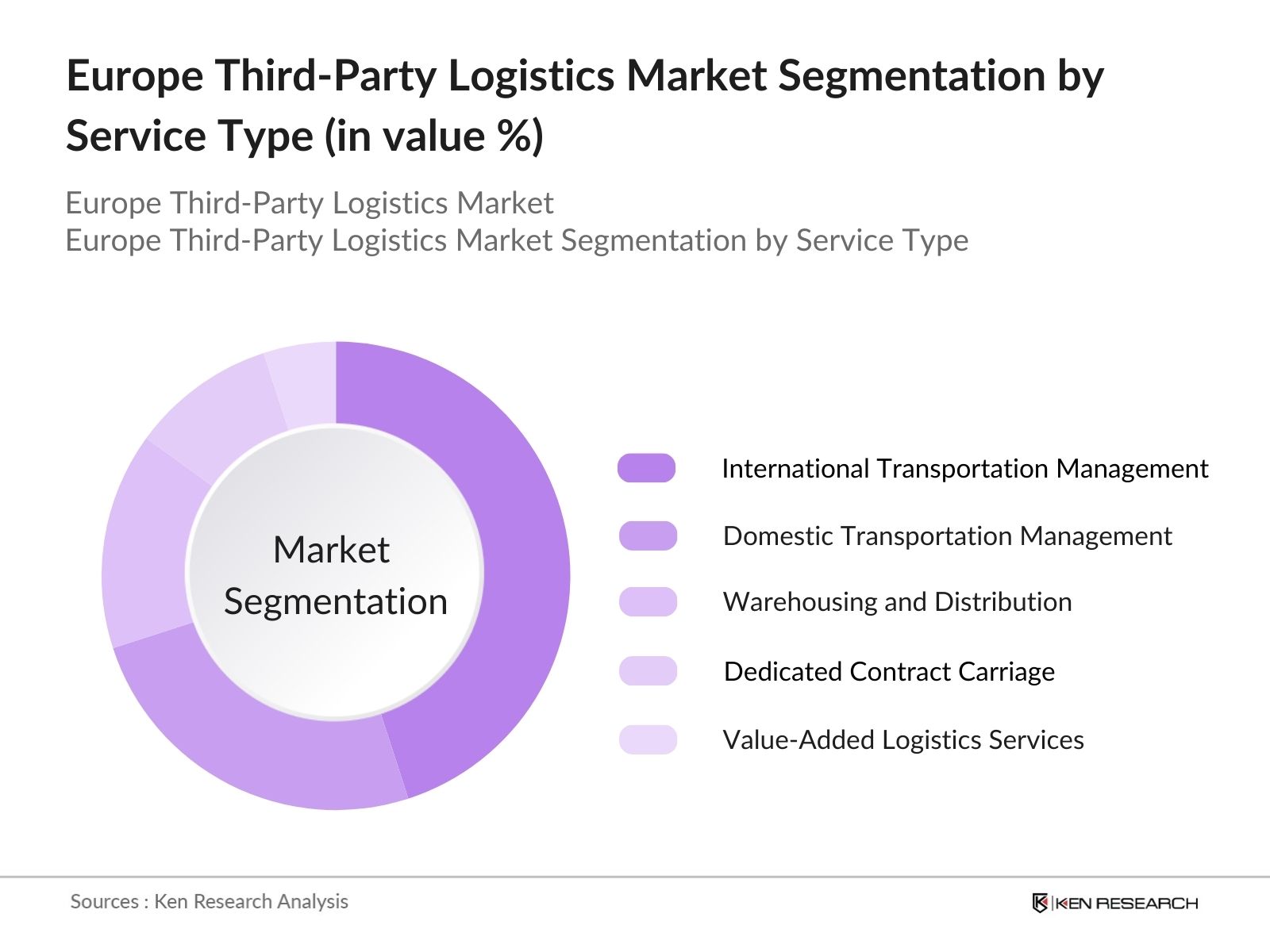

By Service Type: The Europe 3PL market is segmented by service type into Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing and Distribution, Dedicated Contract Carriage (DCC), and Value-Added Logistics Services (VALs). Among these, International Transportation Management holds a dominant market share due to the high volume of cross-border trade within Europe and between Europe and other continents. The need for efficient management of international shipments, customs clearance, and compliance with varying regulations makes ITM services indispensable for businesses engaged in global trade.

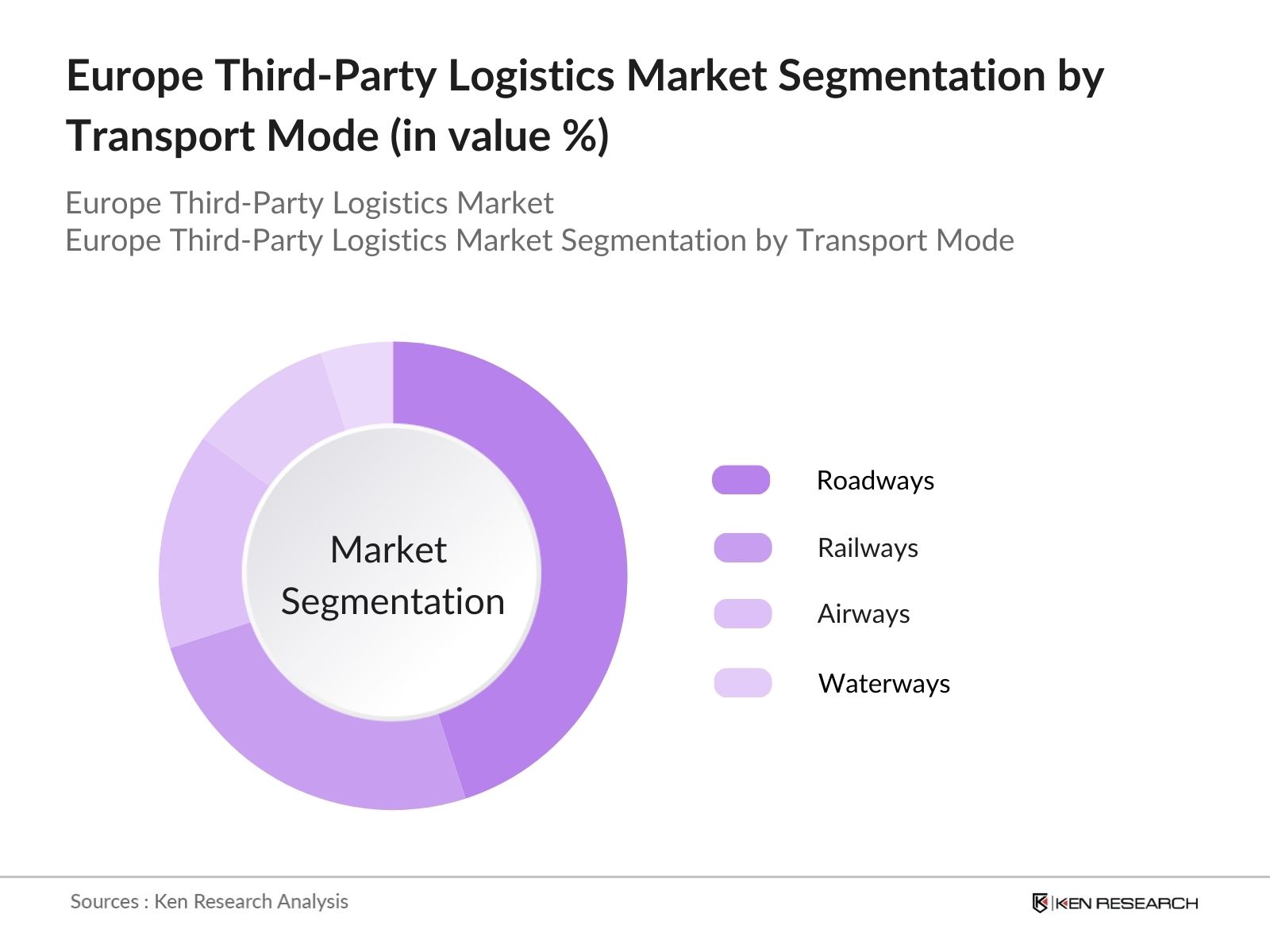

By Transport Mode: The market is also segmented by transport mode into Roadways, Railways, Waterways, and Airways. Roadways dominate the market share, primarily because of Europe's extensive and well-developed road network, which facilitates efficient door-to-door delivery services. The flexibility and cost-effectiveness of road transport make it the preferred choice for both domestic and international logistics within the continent.

Europe Third-Party Logistics Market Competitive Landscape

The European 3PL market is characterized by the presence of several key players who offer a wide range of logistics services. These companies leverage advanced technologies and extensive networks to provide efficient and reliable logistics solutions.

Europe Third-Party Logistics Market Analysis

Growth Drivers

- Expansion of E-commerce Sector: The e-commerce sector is witnessing robust growth, with over 2 billion consumers globally expected to shop online in 2024, contributing significantly to logistics demands. The surge in online retailing, particularly in Asia and North America, has increased logistics needs, where orders reached 100 million daily deliveries in major markets. This growth drives a higher volume of shipments, warehousing, and last-mile delivery solutions, bolstering the logistics market.

- Globalization and International Trade: The international trade volume has increased, with the World Trade Organization recording trade growth surpassing 40 billion tons of goods traded in 2024 alone. Rising cross-border e-commerce and trade agreements have led to an increase in the demand for efficient global logistics networks, creating substantial opportunities for market players involved in international shipping, customs brokerage, and global freight management.

- Technological Advancements in Logistics: Automation and IoT integration in logistics have optimized supply chain efficiency, with an estimated 300 million devices used in logistics by 2024. Technologies such as real-time tracking, autonomous vehicles, and robotic warehousing systems are helping companies manage operational costs, enhance delivery accuracy, and reduce delays, propelling the sector's growth.

Market Challenges

- Regulatory Compliance and Trade Barriers: Stringent regulations on customs, tariffs, and cross-border trade affect logistics, with an average cost of regulatory compliance reaching $3 billion annually in major trading nations. The complexity of managing compliance across different countries poses a significant challenge for logistics firms, impacting cross-border operations and contributing to delays.

- High Operational Costs: Operational expenses in logistics, including fuel, labor, and warehousing costs, have risen. In 2024, global transportation costs averaged $7,000 per container, marking a significant increase. These high operational costs strain logistics firms, particularly those with large fleets and extensive delivery networks, creating a barrier to profitability.

Europe Third-Party Logistics Market Future Outlook

Over the next five years, the Europe 3PL market is expected to experience significant growth, driven by the continuous expansion of e-commerce, advancements in logistics technology, and increasing demand for efficient supply chain solutions. The integration of technologies such as the Internet of Things (IoT), blockchain, and artificial intelligence is anticipated to enhance operational efficiency and transparency in logistics operations.

Market Opportunities

- Adoption of Green Logistics Solutions: With environmental concerns rising, logistics providers are increasingly adopting green solutions. In 2024, over 500,000 electric vehicles were used globally in last-mile delivery operations. The trend toward eco-friendly logistics, including alternative fuels and carbon-neutral strategies, aligns with global environmental goals and presents a growth opportunity.

- Integration of Big Data and Analytics: Big Data usage in logistics has enabled enhanced route optimization, inventory forecasting, and demand prediction. By 2024, over 70% of large logistics firms implemented data analytics solutions. These tools allow for real-time decision-making, reducing operational costs and improving delivery accuracy, providing a competitive edge to early adopters.

Scope of the Report

|

By Service |

Domestic Transportation Management (DTM) |

|

By Transport Mode |

Roadways |

|

By End-Use Industry |

Retail |

|

By Country |

Germany |

Products

Key Target Audience

Logistics Service Providers

Manufacturing Companies

Retail and E-commerce Businesses

Automotive Industry Players

Healthcare and Pharmaceutical Companies

Food and Beverage Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, National Transport Authorities)

Companies

Players Mentioned in the Report:

Deutsche Post AG (DHL)

Kuehne + Nagel International AG

DB Schenker

DSV A/S

CEVA Logistics

FedEx Corporation

UPS Supply Chain Solutions

Geodis

Panalpina World Transport (Holding) Ltd.

Nippon Express Co., Ltd.

Table of Contents

1. Europe Third-Party Logistics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Third-Party Logistics Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Third-Party Logistics Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of E-commerce Sector

3.1.2 Globalization and International Trade

3.1.3 Technological Advancements in Logistics

3.1.4 Focus on Core Competencies by Businesses

3.2 Market Challenges

3.2.1 Regulatory Compliance and Trade Barriers

3.2.2 High Operational Costs

3.2.3 Limited Use of Information Technology

3.2.4 Geopolitical Instabilities

3.3 Opportunities

3.3.1 Adoption of Green Logistics Solutions

3.3.2 Integration of Big Data and Analytics

3.3.3 Growth in Emerging Markets

3.3.4 Development of Multi-modal Transportation Networks

3.4 Trends

3.4.1 Emergence of Big Data in Logistics

3.4.2 Growth in Online Retailing

3.4.3 Increase in Mergers and Acquisitions

3.4.4 Shift Towards Omni-channel Distribution

3.5 Government Regulations

3.5.1 EU Logistics Policies

3.5.2 Environmental Regulations

3.5.3 Trade Agreements and Tariffs

3.5.4 Customs and Border Control Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe Third-Party Logistics Market Segmentation

4.1 By Service (In Value %)

4.1.1 Domestic Transportation Management (DTM)

4.1.2 International Transportation Management (ITM)

4.1.3 Warehousing and Distribution

4.1.4 Dedicated Contract Carriage (DCC)

4.1.5 Value-Added Logistics Services (VALs)

4.2 By Transport Mode (In Value %)

4.2.1 Roadways

4.2.2 Railways

4.2.3 Waterways

4.2.4 Airways

4.3 By End-Use Industry (In Value %)

4.3.1 Retail

4.3.2 Manufacturing

4.3.3 Healthcare

4.3.4 Automotive

4.3.5 Consumer Goods

4.4 By Country (In Value %)

4.4.1 Germany

4.4.2 United Kingdom

4.4.3 France

4.4.4 Italy

4.4.5 Spain

4.4.6 Rest of Europe

5. Europe Third-Party Logistics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Deutsche Post AG (DHL)

5.1.2 DB Schenker

5.1.3 Kuehne + Nagel International AG

5.1.4 DSV A/S

5.1.5 XPO Logistics, Inc.

5.1.6 CEVA Logistics

5.1.7 FedEx Corporation

5.1.8 UPS Supply Chain Solutions

5.1.9 Geodis

5.1.10 Panalpina World Transport (Holding) Ltd.

5.1.11 Nippon Express Co., Ltd.

5.1.12 Yusen Logistics Co., Ltd.

5.1.13 Agility Logistics

5.1.14 Bollor Logistics

5.1.15 Expeditors International of Washington, Inc.

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters Location

5.2.3 Year of Establishment

5.2.4 Annual Revenue

5.2.5 Service Portfolio

5.2.6 Geographic Presence

5.2.7 Technological Capabilities

5.2.8 Strategic Partnerships

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Third-Party Logistics Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Third-Party Logistics Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Third-Party Logistics Future Market Segmentation

8.1 By Service (In Value %)

8.2 By Transport Mode (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Country (In Value %)

9. Europe Third-Party Logistics Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe Third-Party Logistics (3PL) Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Europe 3PL Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple logistics service providers to acquire detailed insights into service segments, operational performance, customer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe 3PL market.

Frequently Asked Questions

01. How big is the Europe Third-Party Logistics (3PL) Market?

The Europe Third-Party Logistics (3PL) market is valued at USD 210 billion, based on a five-year historical analysis.

02. What are the challenges in the Europe 3PL Market?

Challenges in the Europe 3PL Market include regulatory compliance complexities, high operational costs, limited adoption of advanced information technology, and geopolitical instabilities affecting cross-border logistics.

03. Who are the major players in the Europe 3PL Market?

Key players in the Europe 3PL Market include Deutsche Post AG (DHL), Kuehne + Nagel International AG, DB Schenker, DSV A/S, and CEVA Logistics. These companies dominate due to their extensive service portfolios, technological integration, and expansive regional networks.

04. What are the growth drivers of the Europe 3PL Market?

The Europe 3PL Market is propelled by factors such as the expansion of international trade, growth in e-commerce activities, technological advancements in logistics, and businesses' focus on core competencies leading to increased outsourcing of logistics functions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.