Europe Agriculture Drone Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD3505

October 2024

83

About the Report

Europe Agriculture Drone Market Overview

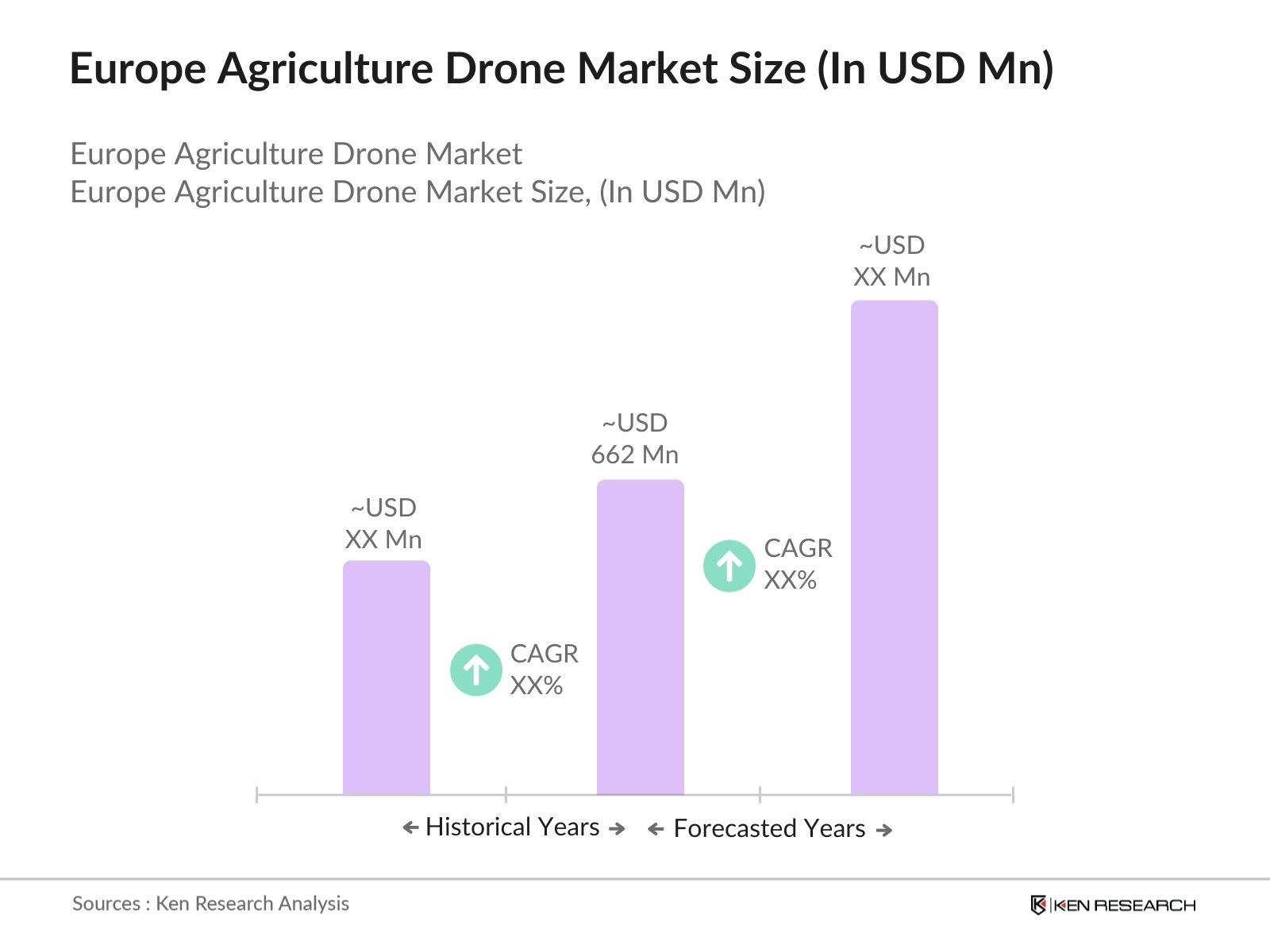

- The Europe agriculture drone market is valued at on a five-year historical analysis. The market is driven by the growing adoption of precision agriculture, where drones play a crucial role in optimizing crop management. Increased government support, technological advancements, and the rising demand for sustainable farming practices contribute to the expansion of the agriculture drone sector. The market has witnessed rapid integration of technologies like GPS, AI, and IoT, making drones an essential tool for European farmers to enhance yield and monitor crop health

- Germany, France, and the Netherlands dominate the European agriculture drone market due to their advanced agricultural practices, heavy investments in precision farming, and supportive government policies promoting smart farming technologies. Germany, in particular, benefits from its robust research and development initiatives in agriculture technology, while France's vast agricultural land and government incentives for sustainable practices have boosted drone usage. The Netherlands is a key player due to its technological expertise and focus on greenhouse farming.

- In March 2020, the BMEL confirmed million euros for these trial fields, which are intended to promote digitalization in agriculture. The program facilitates collaboration among various stakeholders, including farmers and startups, to explore how digital technologies can enhance agricultural practices while addressing environmental concerns and improving productivity.

Europe Agriculture Drone Market Segmentation

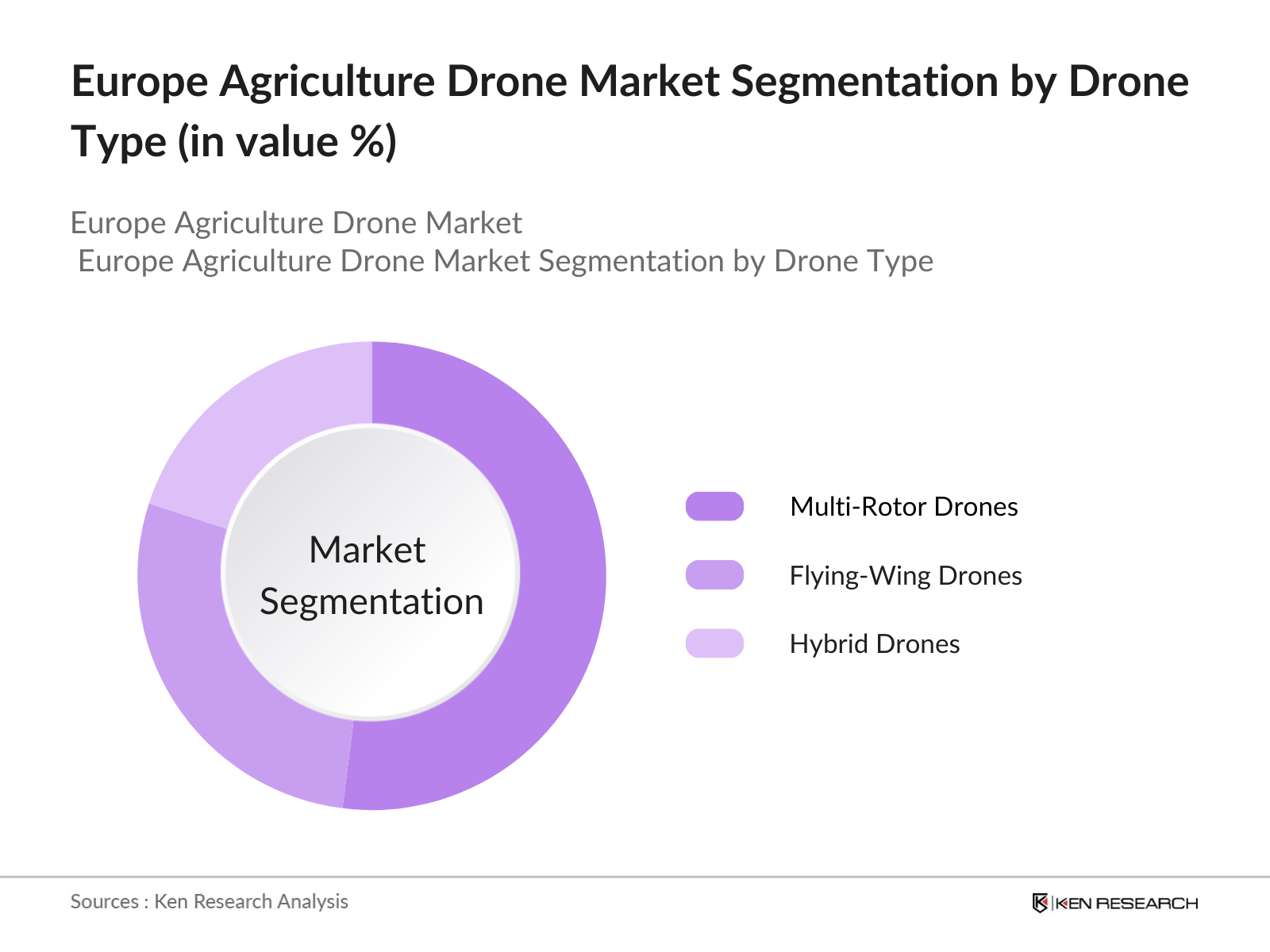

By Drone Type: The Europe agriculture drone market is segmented by drone type into fixed-wing drones, multi-rotor drones, and hybrid drones. Multi-rotor drones have a dominant market share in this segment due to their versatility, ease of use, and capability to hover in one place, making them ideal for precision farming applications like crop spraying and monitoring. Their popularity also stems from their lower cost compared to fixed-wing drones, and their ability to navigate complex terrains, which is a common feature of European farms.

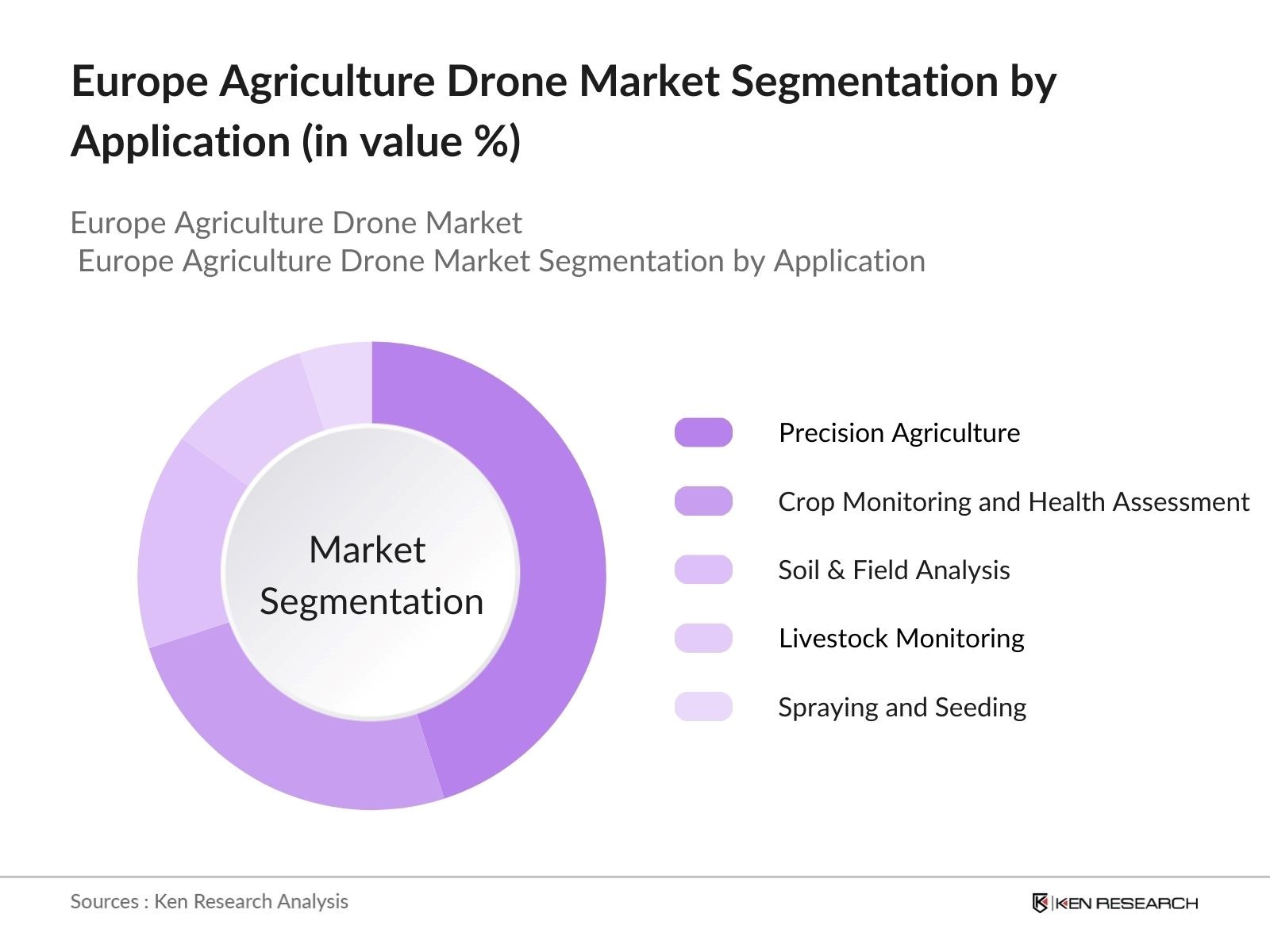

By Application: The market is also segmented by application into precision agriculture, crop monitoring and health assessment, soil and field analysis, livestock monitoring, and spraying and seeding. Precision agriculture has the largest market share in this segment due to the increasing need for optimizing farming efficiency and reducing input costs. Drones are widely used in this application for tasks like field mapping, monitoring crop conditions, and assessing irrigation needs, all of which contribute to improving crop yield and reducing operational expenses.

Europe Agriculture Drone Market Competitive Landscape

The Europe agriculture drone market is dominated by a few major players, including global leaders in drone technology and regional players specializing in agriculture solutions. These companies have strengthened their market position through continuous innovation, strategic collaborations, and expansion into new geographical markets.

|

Company Name |

Established |

Headquarters |

Product Portfolio |

Global Presence |

Revenue (USD) |

R&D Investments |

Market Penetration |

Strategic Collaborations |

Software Integration |

|

DJI Innovations |

2006 |

China |

- |

- |

- |

- |

- |

- |

- |

|

Parrot Drones |

1994 |

France |

- |

- |

- |

- |

- |

- |

- |

|

senseFly (Parrot) |

2009 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

AgEagle Aerial Systems |

2010 |

|

- |

- |

- |

- |

- |

- |

- |

|

Delair |

2011 |

France |

- |

- |

- |

- |

- |

- |

|

Europe Agriculture Drone Market Analysis

Growth Drivers

- Rising Adoption of Precision Agriculture: Precision agriculture is rapidly gaining traction in Europe, driven by the need to waste on the continent's 174 million hectares of arable land. European farms are increasingly leveraging drones for crop health monitoring, irrigation management, and data-driven decision-making. Countries like Germany, France, and Italy have seen significant adoption of these technologies, where agriculture contributes over $290 billion to GDP. The drones provide real-time, high-resolution data on soil conditions, crop growth, and pest infestations, improving yield and resource management, aligning with sustainable agricultural goals set by the EU.

- Government Subsidies for Smart Farming: In 2023, the European Union earmarked more than €387 million for smart through its Common Agricultural Policy (CAP), which promotes drone technology in agriculture to enhance operational efficiency. Governments in countries like France, Germany, and Spain have been providing financial support to farmers for integrating innovative tools like drones, thus reducing the technological entry barrier. These incentives are essential to making precision agriculture technologies more accessible to smaller farms. The EU's ongoing reforms in agricultural policies are also focusing on integrating digital technologies to address labor shortages and meet sustainability targets.

- Advancements in Drone Technologies (Payload capacity, AI-driven analytics): Drone technology for agriculture has advanced significantly, with newer models offering improved payload capacity AI-driven analytics. In 2024, drones with payload capacities of 10-15 kg are being commonly deployed in European fields, allowing for more efficient crop spraying and seed planting. Integration of AI-powered analytics has further improved precision in monitoring crop health, pest control, and soil conditions. This level of automation and precision helps farms optimize their resources, cutting costs and increasing efficiency. European countries like the Netherlands are leading in testing and adopting these high-tech drone systems in large-scale farming operations.

Market Challenges

- Regulatory Challenges (EU drone laws, flight restrictions): Regulatory frameworks remain one of the significant hurdles in the widespread use of agricultural drones across Europe. EU regulations, such as the U-Space framework, impose stringent flight restrictions for drones, especially over populated areas and near critical infrastructure. These regulations require agricultural drones to follow strict certification processes, making it difficult for smaller farms to comply.

- High Initial Investment and Maintenance Costs: Despite the long-term benefits, high upfront costs for purchasing and maintaining agricultural drones pose challenges for small and medium-sized farmers across Europe. On average, professional-grade agricultural drones used for seeding, fertilizing, or surveying can cost between €10,000 to €50,000 depending on specifications. In addition to the initial investment, maintenance costs, which include battery replacement and software updates, can further burden farmers.

Europe Agriculture Drone Market Future Outlook

Over the next five years, the Europe agriculture drone market is expected to exhibit robust growth, driven by the increasing adoption of smart farming technologies, government initiatives supporting sustainable agriculture, and technological advancements in drone hardware and software. The demand for real-time data collection and analytics will fuel the growth of drone usage, as farmers seek to optimize yield, reduce operational costs, and implement environmentally friendly farming practices. Additionally, the integration of AI, IoT, and machine learning in drones will play a crucial role in automating complex agricultural tasks, further boosting market growth.

Market Opportunities

- Emerging Markets in Eastern Europe: Countries in Eastern Europe, such as Poland, Romania, and Hungary, are emerging as potential growth regions for agricultural drone adoption. In 2024, agricultural land in Eastern Europe accounted for over 40% of the total agricultural area in the EU, representing a vast untapped market for drone technologies. Governments in these countries are increasingly supporting the digitalization of agriculture, with plans to modernize farming practices to boost productivity. With relatively lower levels of technological integration, these regions present significant growth opportunities for drone manufacturers and service providers to introduce affordable and scalable drone solutions.

- Drone-as-a-Service (DaaS) Models: The Drone-as-a-Service (DaaS) business model is gaining traction in Europe, providing an affordable alternative to owning drones. This model enables farmers to rent drones and access real-time data without the burden of high capital investments. In 2024, service providers are increasingly targeting small and medium-sized farms that lack the financial capacity to purchase their own equipment. Companies offering DaaS manage all aspects, from operation to data processing, allowing farmers to access state-of-the-art drone technology at a fraction of the cost. This trend is expected to grow, especially in regions like Southern and Eastern Europe, where cost constraints are prominent.

Scope of the Report

Segment |

Sub-segments |

|

Drone Type |

Fixed-Wing Drones Multi-Rotor Drones Hybrid Drones |

|

Application |

Precision Agriculture Crop Monitoring Soil Analysis Livestock Monitoring Spraying and Seeding |

|

Technology |

GPS-enabled Drones Thermal Imaging LIDAR Multi-spectral |

|

Offering |

Hardware Software Services |

|

Region |

Germany France United Kingdom Sweden Italy Rest of Europe |

Products

Key Target Audience

Agriculture Technology Providers

Precision Farming Companies

Drone Manufacturers

Government and Regulatory Bodies (European Union, European Commission)

Investments and Venture Capitalist Firms

Agriculture Cooperatives and Associations

Farm Management Service Providers

Agricultural Equipment Distributors

Companies

DJI Innovations

Parrot Drones

senseFly (A Parrot Company)

AgEagle Aerial Systems Inc.

Delair

AeroVironment, Inc.

Trimble Inc.

DroneDeploy

Yamaha Motor Co., Ltd.

HEMAV Technology

PrecisionHawk

John Deere

Sentera

Kespry

Wingtra

Table of Contents

1. Europe Agriculture Drone Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Absolute Growth %)

1.4. Market Segmentation Overview

2. Europe Agriculture Drone Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (YOY %)

2.3. Key Market Developments and Milestones

3. Europe Agriculture Drone Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption of Precision Agriculture

3.1.2. Government Subsidies for Smart Farming

3.1.3. Advancements in Drone Technologies (Payload capacity, AI-driven analytics)

3.1.4. Increasing Focus on Sustainability (Pesticide reduction, Soil health management)

3.2. Market Challenges

3.2.1. Regulatory Challenges (EU drone laws, flight restrictions)

3.2.2. High Initial Investment and Maintenance Costs

3.2.3. Lack of Technical Expertise Among Farmers

3.2.4. Concerns About Data Privacy

3.3. Opportunities

3.3.1. Emerging Markets in Eastern Europe

3.3.2. Drone-as-a-Service (DaaS) Models

3.3.3. Technological Partnerships and Collaborations (Drone analytics, AI-integrated software)

3.3.4. Expansion into Livestock Monitoring

3.4. Trends

3.4.1. Increasing Adoption of AI and Machine Learning in Drones

3.4.2. Integration with IoT-based Smart Farming Systems

3.4.3. Autonomous Drone Swarming

3.4.4. Expansion of Real-Time Data Analysis Platforms

3.5. Government Regulation

3.5.1. EU Drone Regulations (EASA, GDPR compliance)

3.5.2. CAP (Common Agricultural Policy) Directives

3.5.3. National-level Drone Flight Permissions

3.5.4. Subsidies and Grants for Sustainable Farming

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Agricultural Cooperatives, Drone Manufacturers, Software Providers, Farmers)

3.8. Porter’s Five Forces

3.9. Competitive Ecosystem

4. Europe Agriculture Drone Market Segmentation

4.1. By Drone Type (In Value %)

4.1.1. Fixed-Wing Drones

4.1.2. Multi-Rotor Drones

4.1.3. Hybrid Drones

4.2. By Application (In Value %)

4.2.1. Precision Agriculture

4.2.2. Crop Monitoring and Health Assessment

4.2.3. Soil & Field Analysis

4.2.4. Livestock Monitoring

4.2.5. Spraying and Seeding

4.3. By Technology (In Value %)

4.3.1. GPS-enabled Drones

4.3.2. Thermal Imaging Drones

4.3.3. LIDAR-equipped Drones

4.3.4. Multi-spectral Drones

4.4. By Offering (In Value %)

4.4.1. Hardware (Drones, Sensors, Cameras)

4.4.2. Software (Analytics, Cloud-based Platforms)

4.4.3. Services (Drone-as-a-Service, Consulting)

4.5. By Region (In Value %)

4.5.1. Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Sweden

4.5.5 Italy

Rest of Europe

5. Europe Agriculture Drone Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DJI Innovations

5.1.2. Parrot Drones

5.1.3. senseFly (A Parrot Company)

5.1.4. AeroVironment, Inc.

5.1.5. PrecisionHawk

5.1.6. Delair

5.1.7. AgEagle Aerial Systems Inc.

5.1.8. Trimble Inc.

5.1.9. Yamaha Motor Co., Ltd.

5.1.10. DroneDeploy

5.1.11. Sentera

5.1.12. John Deere

5.1.13. Kespry

5.1.14. Wingtra

5.1.15. HEMAV Technology

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Presence (Global, Regional)

5.2.6. Drone Portfolio Range

5.2.7. Software & Analytics Capabilities

5.2.8. Strategic Partnerships & Collaborations

5.3. Market Share Analysis

5.4. Strategic Initiatives (R&D Investments, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Europe Agriculture Drone Market Regulatory Framework

6.1. Environmental Standards for Agricultural Drones

6.2. Compliance Requirements (Data Privacy, Safety Standards)

6.3. Certification Processes (CE Marking, EASA Certification)

7. Europe Agriculture Drone Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Agriculture Drone Future Market Segmentation

8.1. By Drone Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Offering (In Value %)

8.5. By Region (In Value %)

9. Europe Agriculture Drone Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategies

9.3. Strategic Positioning for European Expansion

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on mapping out the ecosystem of the Europe agriculture drone market, identifying stakeholders like drone manufacturers, agriculture cooperatives, and government bodies. Secondary research from industry reports and proprietary databases is utilized to identify key market drivers, challenges, and growth opportunities.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data to understand market growth trends, penetration rates of agriculture drones, and technological advancements. Data is gathered from government publications, industry reports, and company financials to ensure accurate estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through in-depth interviews with industry experts from major agriculture drone manufacturers, farming cooperatives, and drone software providers. These consultations help refine the market projections and provide insights into operational dynamics.

Step 4: Research Synthesis and Final Output

The final phase integrates inputs from the interviews and secondary research, synthesizing them into a comprehensive report. Market forecasts are further refined through a bottom-up approach, ensuring the highest level of accuracy and reliability for stakeholders in the Europe agriculture drone market.

Frequently Asked Questions

01. How big is the Europe agriculture drone market?

The Europe agriculture drone market was valued at USD 662 million, driven by the increased adoption of precision farming, government support, and technological advancements in drone technology.

02. What are the challenges in the Europe agriculture drone market?

Challenges include high initial investment costs, regulatory hurdles related to drone flight and data privacy, and a lack of technical expertise among farmers.

03. Who are the major players in the Europe agriculture drone market?

Key players include DJI Innovations, Parrot Drones, senseFly, AgEagle Aerial Systems, and Delair, all of which have a strong market presence and a wide portfolio of drone solutions.

04. What drives the growth of the Europe agriculture drone market?

Growth is driven by technological advancements in drone capabilities, government subsidies for precision farming, and the increasing need for sustainable farming practices across Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.