Region:Europe

Author(s):Geetanshi

Product Code:KRAA0111

Pages:86

Published On:August 2025

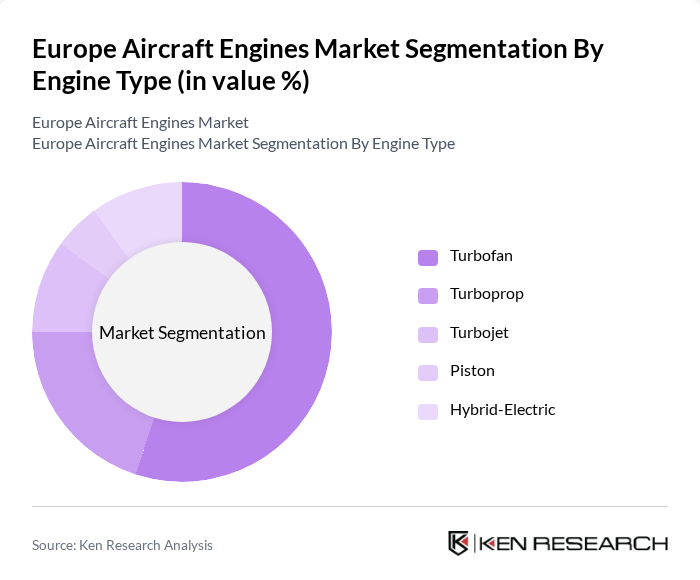

By Engine Type:The engine type segmentation includes various categories such as turbofan, turboprop, turbojet, piston, and hybrid-electric engines. Among these, turbofan engines dominate the market due to their widespread use in commercial aviation, offering high efficiency and lower noise levels. Turboprop engines are also significant, particularly in regional aviation, while hybrid-electric engines are gaining traction as the industry moves towards sustainable solutions .

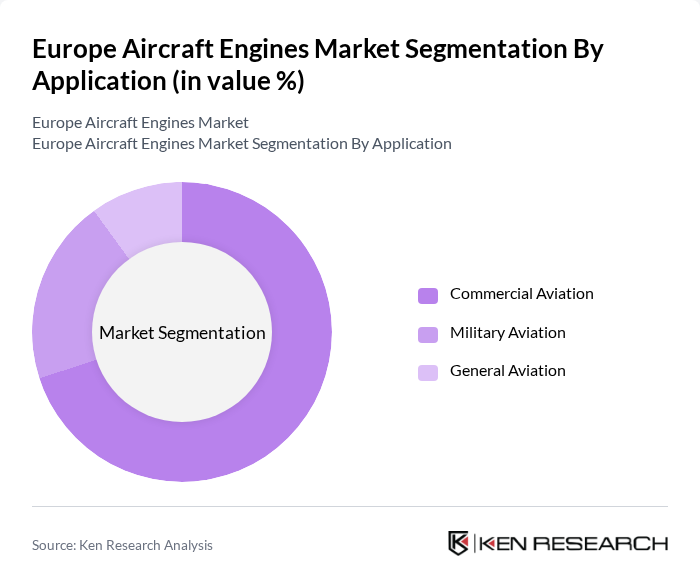

By Application:The application segmentation encompasses commercial aviation, military aviation, and general aviation. Commercial aviation is the leading segment, driven by the increasing demand for passenger and cargo transport. Military aviation follows, supported by defense budgets and modernization programs. General aviation, while smaller, is also growing due to rising interest in private flying and business jets .

The Europe Aircraft Engines Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolls-Royce Holdings plc, Safran S.A., General Electric Company, Pratt & Whitney (RTX Corporation), MTU Aero Engines AG, CFM International (Safran/GE JV), ITP Aero, Leonardo S.p.A., Avio Aero (GE Aerospace), Honeywell International Inc., IAE International Aero Engines AG, Rostec (United Engine Corporation) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the European aircraft engines market is poised for transformation, driven by a shift towards sustainable aviation technologies and digitalization. As airlines increasingly prioritize fuel efficiency and emissions reduction, investments in hybrid and electric engines are expected to rise significantly. Additionally, the integration of digital technologies in manufacturing processes will enhance operational efficiency and reduce costs. These trends indicate a dynamic market landscape that will adapt to evolving consumer and regulatory demands, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Engine Type | Turbofan Turboprop Turbojet Piston Hybrid-Electric |

| By Application | Commercial Aviation Military Aviation General Aviation |

| By Fuel Type | Jet A Sustainable Aviation Fuel (SAF) Biofuels Others |

| By Country | United Kingdom France Germany Spain Poland Russia Rest of Europe |

| By Manufacturer Type | OEMs Aftermarket/MRO Providers |

| By Maintenance Type | Line Maintenance Base Maintenance Overhaul Services |

| By Market Channel | Direct Sales Distributors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Engines | 100 | Chief Engineers, Procurement Managers |

| Military Aircraft Engines | 60 | Defense Procurement Officers, Technical Directors |

| Business Jet Engines | 40 | Fleet Managers, Aviation Consultants |

| Engine Maintenance Services | 50 | MRO Managers, Operations Supervisors |

| Emerging Technologies in Engine Design | 45 | R&D Engineers, Innovation Managers |

The Europe Aircraft Engines Market is valued at approximately USD 21.5 billion, driven by increasing air travel demand, advancements in engine technology, and a focus on fuel efficiency and sustainability.